- Home

- »

- Animal Health

- »

-

Veterinary Stents Market Size, Share, Industry Report, 2030GVR Report cover

![Veterinary Stents Market Size, Share & Trends Report]()

Veterinary Stents Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Airway Stents, Vascular Stents), By Animal, By Application, Material (Nitinol, Biodegradable Polymer), End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-449-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Stents Market Size & Trends

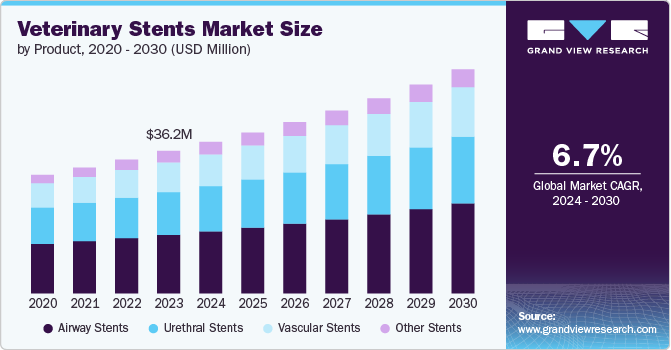

The global veterinary stents market size was estimated at USD 48.29 million in 2024 and is anticipated to grow at a CAGR of 6.84% from 2025 to 2030. The market is driven by quick R&D initiatives, an increase in pipeline products, increased adoption due to proven advantages over other minimally invasive treatments, and increased research into the application of existing technologies in veterinary use. Increasing research and development for innovative stents in veterinary science is a key driver of the veterinary stents market. Ongoing advancements are focused on developing stents with improved materials, designs, and biocompatibility, which enhance their effectiveness and safety for treating various conditions in animals.

Innovations such as customizable stents, biodegradable options, and advanced delivery systems are expanding treatment possibilities and driving market growth by meeting the evolving needs of veterinary care. For instance, in July 2024, At ABTVet, a team of veterinarians successfully treated Chiquis, a 9-year-old brachiocephalic dog with severe tracheal collapse, by placing a silicone tracheal stent. The procedure, involving meticulous placement and confirmation via X-ray, significantly improved Chiquis's respiratory function and recovery. This case highlights the effectiveness of silicone stents in managing severe respiratory conditions in pets and reflects the growing adoption of innovative stenting techniques in the veterinary market.

Stenting in veterinary medicine has gained popularity as an interventional procedure for maintaining the permeability of tubular structures in the respiratory, urinary, and gastrointestinal tracts. It is often used when traditional treatments fail or as a cost-effective alternative. The procedure is also employed palliatively, such as in easing colonic obstructions due to tumors. Stents are made from various materials, including nitinol, and can be coated with drugs to manage inflammation. The growing use of stents reflects their effectiveness and the increasing interest in advanced veterinary treatments.

Various companies across the globe are attempting to enter this niche market by developing novel stents. For instance, a veterinary medical device startup from New York, U.S., has multiple prosthetic devices like artificial valves and stents in the research & development phase. For example, UltraVet Medical Devices Llc. is developing a novel bifurcating bronchial stent. Animals with severe airway disease for whom a conventional straight stent would not be beneficial are the target audience for this Bifurcated Bronchial Stent. In complicated cases, the bifurcated design provides superior treatment than a straight stent, as it addresses both apical (LB1) and posterior (LB2) bronchial collapse and the left stem bronchus.

Furthermore, thorough clinical testing is underway in the animal medicine community for employing established stents for veterinary use. For example, in January 2024, AVMA published a clinical study to study the efficacy of Dumon silicone stents for improving respiratory function in dogs with grade IV tracheal collapse (TC). Dumon silicone stents are manufactured by Boston Medical Products Inc. and are used in human use for airway stenosis. This study by AVMA revealed that if employed in dogs, these stents prove to be an efficient treatment for TC when they are not responding to medical management.

Due to these developments, the market for veterinary stents is anticipated to grow. These innovative products tackle specific demands, and clinical testing of certain products' demonstrated use will expand veterinarians' treatment options. Because of these stents' efficacy in improving respiratory function, their use in veterinary medicine is anticipated to rise. The growing need for effective treatments for animal respiratory conditions is expected to drive this growth.

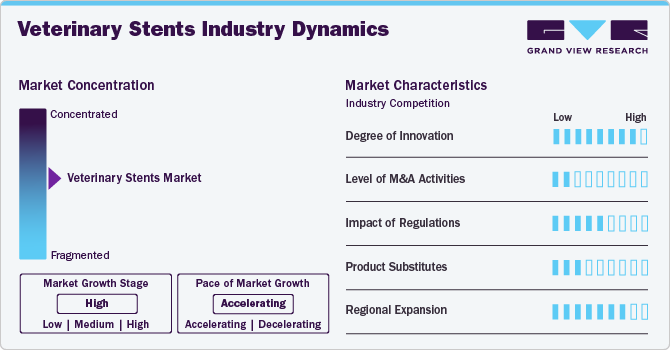

Market Concentration & Characteristics

The degree of innovation in the market is advancing through the development of customized, patient-specific solutions like 3D-printed stents and the adoption of new materials such as biocompatible silicone. Innovations also include the adaptation of stent technology from human medicine, improving minimally invasive procedures and long-term outcomes for conditions like tracheal collapse and heart defects in animals. These innovations are driving more effective and tailored treatments, reducing complications, and improving the quality of life for veterinary patients.

Regulations significantly impact the market by ensuring safety and efficacy through stringent approval processes and quality standards. Compliance with these regulations can drive innovation but may also increase costs and extend time-to-market for new stent technologies. Additionally, regulatory requirements can influence market dynamics by setting barriers for new entrants and ensuring that only high-quality, safe products reach the veterinary field.

In the market, product substitutes such as balloon dilation or surgical interventions can impact growth by offering alternative treatment options for conditions like airway collapse or urinary obstruction. These substitutes may be preferred due to lower costs or fewer complications in certain cases. As a result, the presence of viable alternatives can influence the adoption rates of stents and potentially slow market growth by reducing demand for stenting procedures.

Regional expansion in the market involves entering new geographical areas, particularly emerging markets with growing pet ownership and advanced veterinary care infrastructure. This expansion increases market opportunities by addressing diverse needs and preferences across different regions. It also requires adapting to varying regulatory standards and market conditions, which can influence product adoption and market dynamics.

Product Insights

The airway stents segment dominated the veterinary stents market with a market share of 38.94% in 2024 due to the increasing prevalence of airway conditions such as the tracheal collapse in small-breed dogs and advances in airway stent technology, such as the development of self-expanding stents and improved materials, enhance their effectiveness and safety, making them a preferred choice for veterinarians. Additionally, Veterinary airway stents offer significant advantages, including maintaining airway patency in conditions like tracheal collapse, thereby alleviating breathing difficulties and improving quality of life. For example, self-expanding nitinol stents provide effective support for collapsed tracheal rings and are less invasive compared to surgical alternatives, making them a preferred option for managing severe airway obstructions in dogs.

However, the vascular stents segment is estimated to grow rapidly with the highest CAGR of 7.82% from 2025 to 2030. Vascular stents are becoming more popular in the market because they offer effective solutions for managing vascular issues in pets. Innovations in stent design and materials have improved their safety and performance, making them a viable option for minimally invasive treatments. The growing need for advanced veterinary care and better outcomes for animals is driving their increased use and acceptance.

Animal Insights

The dogs segment had the largest revenue share of 59.01% in 2024. The adoption of veterinary stents is higher for dogs compared to other animals due to their more common and varied vascular conditions, such as congestive heart failure or certain types of tumors that require stenting. For instance, dogs with pulmonary artery stenosis often benefit from stenting, as it can significantly improve their quality of life and manage symptoms effectively. In contrast, stenting is less frequently needed in other animals like cats or small exotic pets, where such conditions are less prevalent or less severe.

Other animals such as pigs, rabbits, horses, etc. animals are estimated to grow at the highest CAGR from 2024 to 2030 due to increased awareness and advancements in veterinary care for exotic and large animals. Species such as horses, birds, and small mammals are now receiving more specialized treatments for vascular issues, driven by the need for effective management of conditions like arterial stenosis and tumors. This growth is also fueled by better diagnostic capabilities and a rising focus on improving the health and welfare of a broader range of animals.

Application Insights

The airway collapse segment dominated the market with a revenue share of 40.95% in 2024 due to the high prevalence of airway-related conditions in pets, particularly in breeds prone to tracheal collapse. Airway collapse stents provide effective management for these conditions by keeping the airway open and improving breathing. The segment's dominance is also driven by advancements in stent technology that enhance safety and efficacy, making them a preferred choice for treating airway collapse in veterinary medicine.

The vascular obstructions segment is estimated to grow at the highest CAGR from 2025 to 2030 due to the increasing prevalence of vascular diseases in animals and advancements in stent technology. The rising incidence of conditions such as arterial stenosis and tumors that cause vascular blockages drives demand for innovative treatments. Improved stent designs and enhanced procedural techniques are making vascular interventions more effective and accessible, contributing to the rapid growth in this segment.

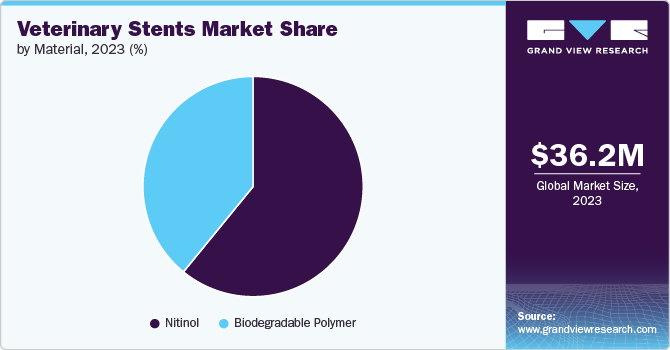

Material Insights

The nitinol segment dominated the market with a revenue share of 60.40% in 2024 due to nitinol's unique properties, such as superior flexibility, biocompatibility, and self-expanding capabilities. Nitinol stents provide excellent conformability and support, which enhances their effectiveness in treating various vascular and airway conditions in pets. These attributes make nitinol stents the preferred choice for veterinarians, contributing to their leading position in the market.

On the other hand, biodegradable polymer is estimated to grow with the highest CAGR of 7.47% from 2025 to 2030 due to increasing demand for eco-friendly and biocompatible materials in veterinary stents. Biodegradable polymers offer the advantage of gradual degradation within the body, reducing the need for surgical removal and minimizing long-term complications. Advances in polymer technology and a growing focus on sustainability are driving this segment's rapid expansion.

End-use Insights

The veterinary hospitals & clinics segment dominated the market in 2024 due to their central role in diagnosing and treating a wide range of conditions that require stenting. These facilities are equipped with advanced diagnostic tools and specialized staff, enabling them to handle complex procedures effectively. In addition, the high volume of cases and growing demand for specialized treatments in these settings drive their market dominance.

The other end-users like academic & research institutions, rescue centers, animal shelters, etc. are estimated to grow with the highest CAGR of 8.02% from 2025 to 2030 due to increased research and development activities, and a rising focus on improving animal welfare. These institutions are investing in advanced veterinary care technologies and conducting studies that drive innovation in stent applications. The growing need for specialized care in rescue centers and shelters also contributes to this segment's rapid expansion.

Regional Insights

North America veterinary stents market is one of the leading market in 2024. Some of the drivers for this region are high pet ownership, rising incidences of Airway Collapse and Urethral Obstructions in pets, growing pet health awareness, and an increase in awareness about advanced veterinary stenting procedures. Further factors supporting market expansion include improvements in veterinary care, the presence of specialty veterinary hospitals, and the use of advanced veterinary surgical solutions like veterinary stents. Another important factor is the focus on enhancing pet emergency care and the growing use of customized stents in veterinary clinical settings.

U.S. Veterinary Stents Market Trends

The increase in successful veterinary surgeries using stents in the U.S. is significantly driving market growth. Advanced stenting techniques, such as those used in minimally invasive procedures for tracheal and vascular issues, are improving surgical outcomes and patient recovery times. This trend is fueling demand for specialized stent devices, as veterinary practices adopt these innovative solutions to address complex conditions in pets.

As more successful cases are reported, veterinary stents are becoming a critical tool in modern veterinary care, contributing to market expansion and driving investment in new stent technologies. For instance, in March 2024, Loki, a 1-year-old golden retriever, underwent a groundbreaking procedure at the Virginia-Maryland College of Veterinary Medicine to correct a severe liver condition using a stent and coils. This minimally invasive surgery restored proper blood flow to Loki's liver to treat a rare condition that bypassed liver filtration. The success of this innovative treatment highlights the advancing field of veterinary stents, demonstrating their role in enhancing care and improving outcomes for complex health issues in pets.

Europe Veterinary Stents Market Trends

The Europe veterinary stent market is being driven by advancements in stent technology, such as Infiniti’s pulmonic valve stent (Vet Stent PV), which has enabled new treatment options for conditions like pulmonic stenosis. For instance, in September 2022, Dr. Jordi López-Alvarez from Memvet in Mallorca successfully performed Europe’s first pulmonic valve stent placement using Infiniti’s new Vet Stent PV on an English Bulldog with severe pulmonic stenosis. This advancement highlights the potential for improved treatment options for dogs with limited survival prospects, driving innovation and growth in the Europe veterinary stent market. Infiniti's commitment to cutting-edge research and technology is further advancing the adoption of stents in complex veterinary cases, boosting market demand and enhancing patient outcomes.

The veterinary stents market in the UK is driven by advancements in minimally invasive surgical techniques, increasing awareness of complex pet health conditions, and a growing demand for improved veterinary care. Additionally, the rising adoption of stent procedures for cardiac and respiratory conditions in pets contributes to market growth. For instance, in October 2023, Paragon Veterinary Referrals in Wakefield performed its first cardiovascular stent procedure on a French bulldog suffering from pulmonic stenosis, using a minimally invasive technique to improve blood flow and reduce heart strain. This pioneering multidisciplinary approach highlights advancements in stenting treatment options for pets, contributing to the growth of the UK's veterinary stent market as innovative techniques enhance pet care and recovery outcomes.

Asia Pacific Veterinary Stents Market Trends

The Asia Pacific region is anticipated to grow with a CAGR of 9.47% over the forecast period. This can be owed to rising pet ownership and increasing awareness of advanced veterinary care, which boost demand for innovative treatments like stenting. Regulatory improvements, such as China's new measures for standardizing veterinary institutions, enhance the quality of care and expand the scope for advanced procedures. Additionally, growing investments in veterinary healthcare infrastructure and technological advancements in stenting technologies contribute to market growth. Increasing pet health concerns and the need for specialized treatments also play a significant role in driving the market forward.

The veterinary stents market in India is driven by the rise in advanced small animal veterinary clinics in the country. For Instance, in March 2024, Tata Trusts launched India’s first state-of-the-art Small Animal Hospital in Mumbai, spanning 98,000 sq. ft. over five floors with over 200 beds. The facility offers advanced, round-the-clock care by specialized veterinarians, nurses, and technicians. Inspired by Ratan Tata's vision, the hospital will provide comprehensive pet healthcare, including emergency services, ICU, surgery, and diagnostics. This initiative is expected to enhance the veterinary care landscape in India and contribute to the growth of the country's veterinary stents market by setting new standards for pet healthcare infrastructure.

Latin America Veterinary Stents Market Trends

The Latin America veterinary stents market is expected to grow due to the increasing government initiatives to improve animal healthcare, the growing awareness of livestock and companion animal health, and the expansion of veterinary services into urban areas. The development of more sophisticated veterinary clinics and rising investments in veterinary infrastructure are also driving the market's expansion.

The veterinary stents market in Brazil is primarily driven by several initiatives taken by leading market players in the veterinary industry to enhance pet care in the country. For example, in September 2022, Vimian launched their VetFamily initiative in Brazil which is designed to encourage entrepreneurs to innovate within the veterinary industry.

Middle East & Africa Veterinary Stents Market Trends

The Middle East & Africa veterinary stents market is driven by increasing pet ownership, rising awareness of advanced veterinary care, and the growing prevalence of chronic conditions in animals. Additionally, improvements in veterinary infrastructure and higher investment in specialized animal healthcare are boosting the demand for advanced stenting solutions. The expansion of veterinary practices and the introduction of modern treatment techniques further contribute to market growth.

The veterinary stents market in South Africa is driven by increasing demand for advanced pet care and technological advancements. Key trends in the market include the rising adoption of minimally invasive procedures and the growing emphasis on specialized veterinary care. For example, the introduction of advanced stenting technologies by companies like Medtronic and local innovations in veterinary medicine are enhancing treatment options for pets with complex conditions, thereby expanding the market.

Key Veterinary Stents Company Insights

The market companies are actively involved in bringing novel technologies. The market is being significantly shaped by increased collaboration between key players and hospitals. These partnerships are facilitating the development and adoption of advanced stenting technologies and improving patient care. For instance, collaborations between stent manufacturers and veterinary hospitals enable the integration of cutting-edge stent designs and techniques into clinical practice, leading to enhanced treatment outcomes and driving market growth.

Key Veterinary Stents Companies:

The following are the leading companies in the veterinary stents market. These companies collectively hold the largest market share and dictate industry trends.

- Dextronix Animal Health

- Infiniti Medical

- TaeWoong Medical USA

- Create Medic Co. Ltd.

- AbtVet (Stening Group)

- M.I. Tech Co. Ltd

- UltraVet Medical Devices LLC.

Recent Developments

-

In October 2024, Infiniti Medical announced the expansion of their Vet Stent Cava portfolio by including two new product variants in 28 mm and 30 mm diameter.

-

In November 2024, veterinarians from Linnaeus Veterinary Limited, UK, collaborated with The British Veterinary Clinic, UAE, to perform the country's first veterinary interventional cardiology procedures, such as stenting and balloon valvuloplasty.

-

In December 2023, Neuromed, a division of Infiniti Medical in collaboration with a team of seven veterinary and human medicine experts recently performed a complex spine and pelvic surgery on Chelsea, a 9-month-old Great Pyrenees with severe back problems. The procedure, which included a bone graft infused with antibiotics, is expected to alleviate her pain and improve her chances of adoption. This case highlights the growing demand for advanced veterinary stent solutions, driven by the need for innovative treatments to address complex conditions in animals.

-

In March 2023, Jet, a 4-year-old labradoodle, underwent a life-saving transpulmonic stent procedure at UW Veterinary Care to address a severe heart defect. Supported by a donation from Jet’s owner, the UW School of Veterinary Medicine enhanced its capabilities by bringing in experts from the University of Georgia. This procedure, which has been used in humans but is new for dogs, significantly improved Jet’s blood flow and recovery prospects. The initiative also aims to advance the expertise of UW veterinarians in this specialized field, benefiting more pets in the future.

Veterinary Stents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 51.30 million

Revenue forecast in 2030

USD 71.43 million

Growth Rate

CAGR of 6.84% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, application, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dextronix Animal Health, Infiniti Medical, TaeWoong Medical USA, Create Medic Co. Ltd., AbtVet (Stening Group), M.I. Tech Co. Ltd, and UltraVet Medical Devices LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Stents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary stents market report based on the product, animal, application, material, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Airway Stents

-

Urethral Stents

-

Vascular Stents

-

Other Stents

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Airway Collapse

-

Urinary Tract Obstructions

-

Vascular Obstructions

-

Other Applications

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Nitinol

-

Biodegradable Polymer

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Other end-use (academic & research institutions, rescue centers, animal shelters, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary stents market size was estimated at USD 48.29 million in 2024 and is expected to reach USD 51.30 million in 2025.

b. The global veterinary stents market is expected to grow at a compound annual growth rate of 6.84% from 2025 to 2030 to reach USD 71.43 million by 2030.

b. By material, the nitinol segment dominated with a share of 60.40% in 2024 due to nitinol's unique properties, such as superior flexibility, biocompatibility, and self-expanding capabilities. Nitinol stents provide excellent conformability and support, which enhances their effectiveness in treating various vascular and airway conditions in pets. These attributes make nitinol stents the preferred choice for veterinarians, contributing to their leading position in the market.

b. Some key players operating in the veterinary stents market include Dextronix Animal Health, Infiniti Medical, TaeWoong Medical USA, Create Medic Co. Ltd., AbtVet (Stening Group), M.I. Tech Co. Ltd, and UltraVet Medical Devices LLC.

b. Key factors that are driving the market growth include rising R&D initiatives, an increase in pipeline products, increasing adoption due to proven advantages over other minimally invasive treatments, and increasing research into the application of existing technologies in veterinary use.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.