- Home

- »

- Animal Health

- »

-

Veterinary Services Market Size, Industry Report, 2033GVR Report cover

![Veterinary Services Market Size, Share & Trends Report]()

Veterinary Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal Type (Companion Animals, Production Animals), By Service Type (Medical Services, Non-Medical Services), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-551-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Services Market Summary

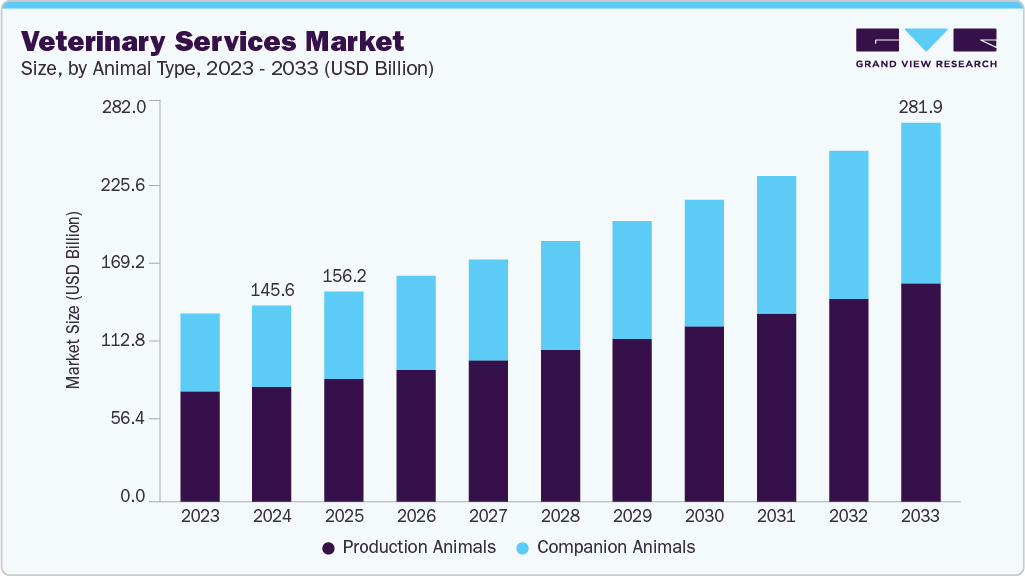

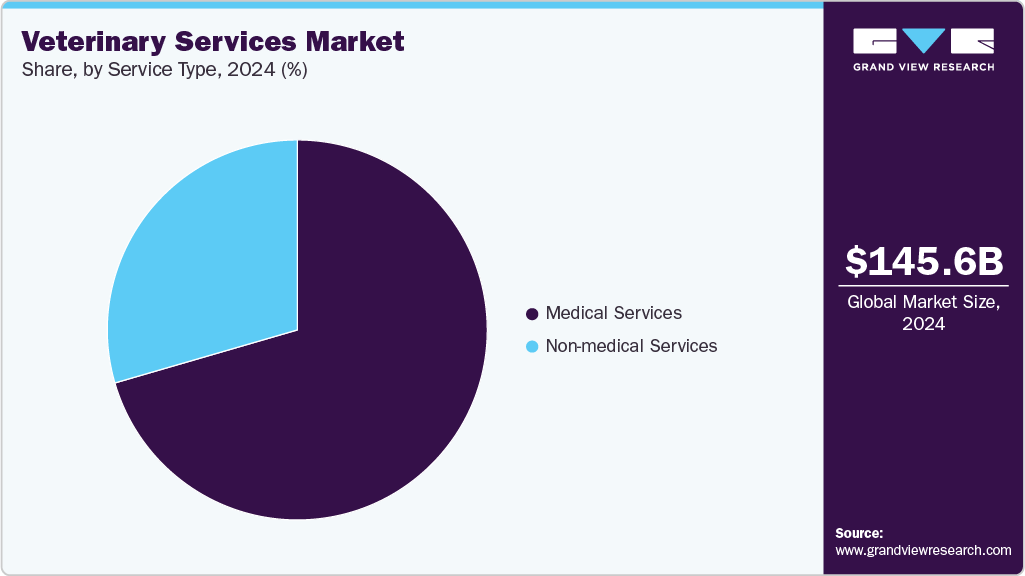

The global veterinary services market size was estimated at USD 145.65 billion in 2024 and is projected to reach USD 281.93 billion by 2033, growing at a CAGR of 7.66% from 2025 to 2033. The veterinary services industry is advancing, driven by rising pet ownership and spending on animal healthcare, rising prevalence of chronic and infectious diseases in pets and livestock, and advancements in diagnostics and treatment technologies.

Key Market Trends & Insights

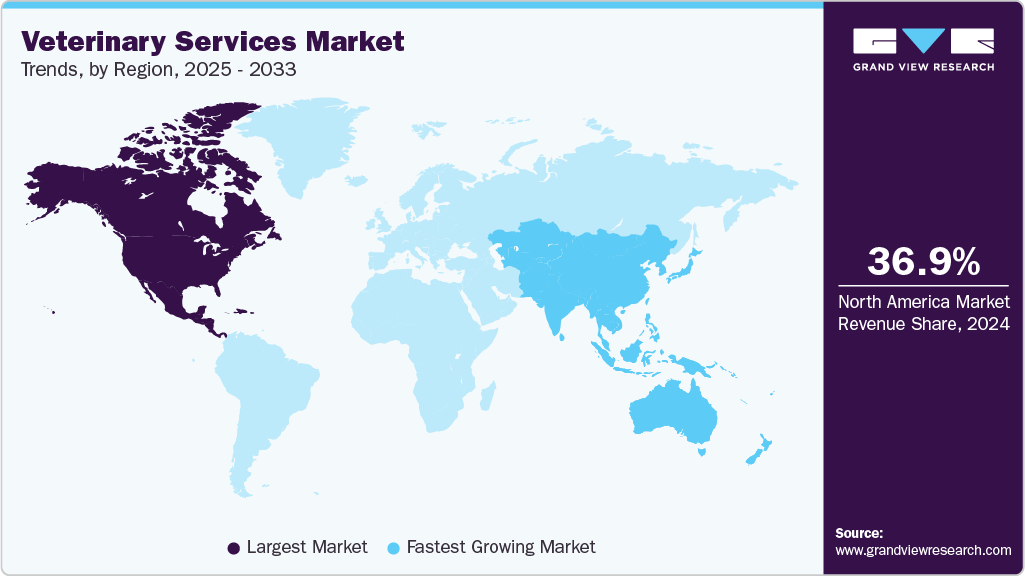

- North America dominated the veterinary services market with the largest revenue share of 36.95% in 2024.

- By animal, the production animals segment led the market with the largest revenue share of 58.57% in 2024

- By service type, the medical services segment led the market with the largest revenue share of 70.50% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 145.65 Billion

- 2033 Projected Market Size: USD 281.93 Billion

- CAGR (2025-2033): 7.66%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing demand for preventive care, wellness services, and specialized veterinary expertise further accelerates market growth. For instance, in September 2025, SignalPET introduced SignalPET 360°, a comprehensive radiology solution designed to streamline veterinary diagnostics. The platform integrates AI-powered immediate triage, a Complete AI Report modeled after radiologist reports, and 24/7 access to board-certified radiologists, all in one system. By merging AI technology with radiologist expertise, the platform enables clinics to work faster, make confident decisions, and provide better patient care.

The veterinary services industry is witnessing strong growth, primarily fueled by the rapid rise in pet ownership and increasing emphasis on preventive healthcare. In 2024, 66% of U.S. households (86.9 million homes) owned a pet, with dogs and cats making up the majority. This surge in pet adoption has driven demand for routine veterinary checkups, diagnostics, and preventive services, as pet owners increasingly view animals as family members. Spending reflects this trend-pet-related expenditures reached USD 150.6 billion in 2024, up from USD 147.0 billion in 2023, with diagnostics gaining a growing share. For example, IDEXX's 2024 survey revealed that 73% of Millennials and 71% of Gen Z pet parents support annual wellness diagnostics, underscoring a generational shift toward proactive health management.

Generation

% of Dog Parents

% Owning Dogs <2 Years Old

% Supporting Annual Diagnostics

Gen Z (≤27 yrs)

24%

48%

71%

Millennials (28-43 yrs)

33%

37%

73%

Gen X (44-59 yrs)

28%

27%

63%

Baby Boomers (60-78 yrs)

15%

15%

57%

Source: IDEXX’s U.S. Pet Owner survey fielded in June 2024

The market is further supported by increasing pet lifespans and senior animals' healthcare needs. IDEXX reported that the average lifespan of dogs rose from 11.6 years in 2010 to 13.4 years in 2024, while cats now live up to 14.4 years on average. With age, diagnostic demand rises significantly-per-patient diagnostic revenue grows from USD 50 in puppies and kittens to USD 170 in geriatric pets, reaching as high as USD 395 in wellness-focused practices. This trend highlights diagnostics' central role in managing chronic and age-related conditions such as kidney disease, cancer, and orthopedic disorders, fueling steady revenue growth for veterinary providers.

Another key driver is expanding pet insurance, which lowers financial barriers to diagnostics. In August 2024, APOLLO Insurance partnered with Petsecure to launch digital pet insurance plans covering lab tests, imaging, and hospitalization. Similarly, the North American Pet Health Insurance Association (NAPHIA) reported that pet insurance premiums surpassed USD 4.27 billion in 2023, reflecting rising demand for comprehensive coverage. Insurance-driven affordability increases uptake of advanced diagnostic tools and strengthens early disease detection and preventive care adoption. Beyond companion animals, equine insurance plans also expand diagnostic coverage for conditions like lameness and metabolic issues, broadening opportunities within the broader veterinary services industry.

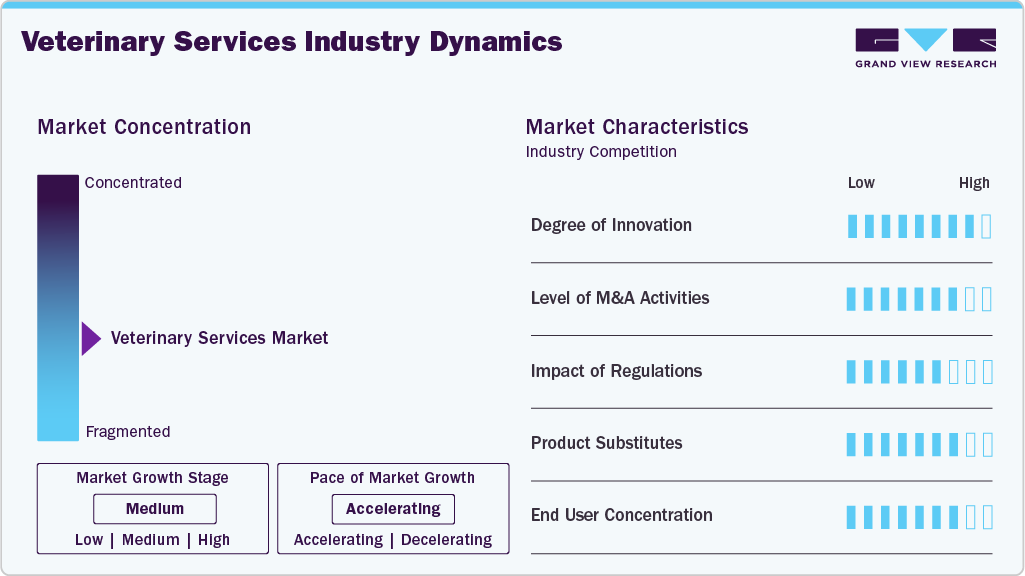

Market Concentration & Characteristics

The veterinary services industry is moderately fragmented, with pockets of consolidation, as large corporate groups expand their footprint through acquisitions. At the same time, independent clinics and regional practices still hold significant market share. Major players such as Mars Inc. (VCA, Banfield, BluePearl) and CVS Group in the UK have built extensive networks of veterinary hospitals and specialty centers, leveraging scale to invest in advanced diagnostics, technology, and workforce training.

For example, Mars Inc.’s investment in India’s Crown Veterinary Services in 2024 highlights the trend of multinational consolidation in emerging markets. However, independent and mid-sized practices continue to dominate rural and local markets, especially in developing regions, sustaining a diverse competitive landscape. This balance between corporate consolidation and independent presence underscores a market structure where industry concentration is growing but far from monopolized.

The degree of innovation in the veterinary services industry is high, driven by rapid advancements in diagnostics, therapeutics, and digital health solutions, transforming animal care. Precision medicine and advanced technologies, such as 3D printing for custom implants and surgical guides (launched by VCA Animal Hospitals in October 2024), enable more accurate and minimally invasive treatments. Similarly, companies like Zomedica are expanding access to advanced point-of-care diagnostic tools such as Truforma and VETGuardian, improving clinical efficiency and early disease detection. The adoption of AI-powered telemedicine platforms, wearable monitoring devices, and genetic testing for companion animals is also expanding, aligning with the rising trend of pet humanization. These innovations enhance treatment outcomes and client education and increase operational efficiency for veterinary practices, reflecting a strong focus on continuous R&D and integration of cutting-edge technologies across the sector.

The level of M&A activity in the veterinary services industry is robust, as companies pursue consolidation, geographic expansion, and access to advanced technologies. Large corporate and private equity firms actively acquire veterinary chains, specialty practices, and pet service providers to strengthen market positioning. For instance, in December 2024, Mars Inc. invested in Crown Veterinary Services in India, marking a major foreign entry into the country's veterinary practice market, while local players like Vetic and Max Vets are also expanding through acquisitions and partnerships. Similarly, in the U.S., Harbour Group’s 2025 acquisition of Senproco and Groomer’s Choice highlights growing interest in complementary non-medical services such as grooming. These deals reflect the industry’s trend toward consolidation, integrated service offerings, and cross-border expansion, driving growth and competitiveness across both companion and production animal segments.

Regulations significantly affect the veterinary services industry, shaping standards for animal health, food safety, and service delivery. Governments and international bodies enforce strict frameworks to control zoonotic diseases, enhance biosecurity, and improve animal welfare, directly influencing demand for veterinary diagnostics, preventive care, and workforce expansion. For instance, in February 2025, India's Union Animal Husbandry and Dairying Ministry, in collaboration with WOAH, launched a public-private partnership initiative to strengthen veterinary services through FMD-free zones, vaccine platform development, and NABL-accredited district labs. Similarly, in Brazil, Ibama mandated Petrobras to establish a veterinary center in Amapá as a condition for offshore drilling approval, reflecting how environmental and animal welfare regulations drive investment in veterinary infrastructure. Such policies safeguard public health and create opportunities for innovation and service expansion within the sector.

The threat of product substitutes in the veterinary services industry is moderate, as alternatives such as over-the-counter (OTC) pet medications, telemedicine apps, and nutraceuticals can partially replace traditional in-clinic services. Pet owners increasingly turn to digital health platforms and home diagnostic kits for basic consultations or preventive care, reducing dependency on routine veterinary visits. For instance, the rise of AI-driven telehealth apps like Pawly and Fuzzy Pet Health allows owners to access remote consultations, while advanced nutraceuticals and functional foods by companies like Royal Canin and Hill’s Pet Nutrition support preventive health without clinical intervention. However, complex procedures such as surgeries, advanced diagnostics, and regulatory requirements for livestock health cannot be substituted, keeping veterinary services essential and limiting the overall substitution threat.

End-user concentration in the veterinary services industry is moderate to high, driven by the dominance of companion animal owners and livestock producers, who collectively account for the bulk of service demand. Companion animal services are concentrated among urban pet owners, where rising pet humanization and higher disposable incomes drive uptake of advanced care, diagnostics, and wellness services.

For instance, Walmart's expansion of veterinary and grooming centers in the U.S. in 2024 reflects growing demand for accessible pet healthcare among mass-market consumers. On the production side, livestock veterinary services remain concentrated among large-scale cattle, poultry, and swine producers, particularly in regions like Brazil and the U.S., where high protein demand necessitates continuous veterinary oversight. This concentration amplifies the bargaining power of large clients while pushing service providers to scale offerings, adopt innovation, and tailor solutions to meet high-volume livestock producers and increasingly health-conscious pet owners.

Animal Type Insights

The production animals segment led the market with the largest revenue share of 58.57% in 2024, due to the essential role of veterinary services in ensuring the health, productivity, and biosecurity of livestock such as cattle, poultry, swine, sheep, goats, and aquaculture. Rising global demand for animal protein, coupled with the FAO’s projection that food demand will increase by 70% by 2050, has intensified the need for veterinary interventions to secure high-quality and safe animal-derived products. Preventive care, disease surveillance, and advanced diagnostic services are becoming increasingly important as governments and producers work to mitigate zoonotic disease risks and ensure food safety.

Furthermore, strong institutional support is accelerating the segment’s dominance. For example, in October 2024, the USDA’s National Institute of Food and Agriculture (NIFA) invested $3.8 million across 25 grants to strengthen rural animal veterinary services, including training programs and equipment upgrades. Such initiatives expand veterinary capacity in shortage areas and enhance rural infrastructure, ensuring sustainable livestock production. With the global push toward sustainable agriculture and biosecurity, production animal services remain the backbone of the veterinary services industry, securing their leading revenue share.

The companion animals segment is projected to grow at the fastest CAGR during the forecast period, due to the sharp increase in global pet ownership and the rising emphasis on pet health, nutrition, and preventive care. Growing urbanization, smaller household sizes, and the emotional value placed on pets have fueled the trend of pet humanization, where owners treat pets as family members and invest in advanced veterinary treatments, diagnostics, and wellness services. In addition, expanding pet insurance, the availability of specialized services such as oncology, dentistry, and orthopedics, and the rising demand for non-medical services like grooming, daycare, and boarding are driving segment growth. Pet owners' increasing willingness to spend on medical and lifestyle care is positioning the companion animal segment as the key driver of long-term expansion in the veterinary services industry.

Service Type Insights

The medical services segment led the market with the largest revenue share of 70.50% in 2024, due to the rising prevalence of zoonotic diseases and the extensive measures taken worldwide to manage and control outbreaks. Growing pet ownership and heightened awareness of animal health have increased demand for diagnostics, surgeries, and preventive care. Moreover, expanding access to veterinary medical services in developing countries drives higher utilization of core treatments, vaccinations, and emergency interventions.

For instance, in October 2024, VCA Animal Hospitals launched a dedicated 3D Printing Lab at its Northwest Veterinary Specialists facility in Oregon to enhance orthopedic surgeries for pets. By producing customized implants and surgical guides tailored to each animal, the lab improves surgical precision, minimizes complications, and accelerates recovery times. Such innovations highlight the sector’s shift toward precision veterinary medicine, positioning advanced medical care as the backbone of veterinary services and reinforcing why medical services continue to dominate the market.

The non-medical services segment is anticipated to grow at the fastest CAGR during the forecast period, due to rising demand for pet-focused services such as boarding, grooming, sitting, travel, and funeral care, driven by increasing pet humanization and owner spending. On the livestock side, services like artificial insemination (AI) are expanding rapidly with strong government support for improving breeding efficiency and productivity. In addition, major industry players are undertaking strategic initiatives, such as acquisitions, partnerships, and service expansions, to capture this growing demand, further accelerating the segment’s growth trajectory.

For instance, in January 2025, Harbour Group, backed by Abacus Finance, acquired Senproco and its distribution arm Groomer's Choice, manufacturers of professional pet grooming products, including shampoos, conditioners, grooming tools, and pet accessories. With well-known brands like Bark2Basics, Green Groom, and Bather Box, Senproco serves thousands of groomers across the U.S., and Harbour Group aims to accelerate its growth through strategic and operational support. This acquisition strengthens the non-medical pet care segment, particularly grooming, which is increasingly integrated into veterinary practices to meet rising pet owner demand for holistic care.

Regional Insights

North America dominated the veterinary services market with the largest revenue share of 36.95% in 2024, driven by rising pet ownership, expanding service offerings, and strategic investments from industry players. For instance, in January 2025, Harbour Group acquired Senproco and Groomer’s Choice Pet Products, major suppliers of grooming products and accessories, with support from Abacus Finance. This acquisition strengthens Harbour’s foothold in the pet care ecosystem. It indirectly benefits the U.S. veterinary services industry by promoting pet wellness, hygiene, and preventive care, increasing cross-service demand, and supporting overall market expansion.

Government-backed initiatives and animal welfare organizations across the U.S. and Canada also contribute to this momentum by implementing programs that enhance access to veterinary services. Expanding new veterinary education programs, including non-traditional accredited training, is expected to reduce shortages and broaden service adoption. While North America continues to dominate the market, the Asia Pacific is projected to be the fastest-growing region, fueled by the rapid rise in pet ownership and livestock populations in developed and emerging economies.

U.S. Veterinary Services Market Trends

The veterinary services market in the U.S. is witnessing strong growth, fueled by rising pet ownership, higher spending on pet healthcare, and the entry of major retail players. For instance, in October 2024, Walmart expanded its pet services with five new centers offering veterinary care and grooming, following the success of its pilot location. This strategic move, after exiting human healthcare, intensifies competition with established players like Petco and Chewy, pushing veterinary care into mainstream retail. By increasing accessibility and affordability of routine vet services, Walmart’s entry is expected to reshape customer expectations and broaden the reach of veterinary care across the U.S.

Europe Veterinary Services Market Trends

The veterinary services market in Europe is expanding rapidly, driven by rising pet humanization, growing demand for advanced treatments, and strong innovation in companion animal healthcare. For instance, in February 2025, Ireland-based TriviumVet advanced first-to-market therapies for chronic conditions in pets, including feline hypertrophic cardiomyopathy (HCM), canine neuropathic pain, gastric ulcers, and chronic kidney disease. These breakthroughs address long-standing gaps in veterinary care, enabling earlier intervention and improving treatment outcomes for veterinarians across Europe.

Such innovations are raising the standard of care, particularly in specialty and chronic disease management, while also boosting the adoption of advanced veterinary pharmaceuticals in the region. As European pet owners increasingly seek high-quality, human-like healthcare for animals, the market is witnessing stronger demand for specialized diagnostic and therapeutic services, positioning Europe as a key hub for veterinary innovation and growth.

The UK veterinary services market is evolving with rising demand for advanced diagnostic and monitoring technologies, driven by strong industry partnerships and innovation. For instance, in September 2025, Zomedica partnered with Pioneer Veterinary Products to distribute its Truforma diagnostic platform and later VETGuardian remote monitoring technology across the UK. This collaboration expands access to cutting-edge tools for small animal and equine care, enhancing diagnostic precision, practice efficiency, and patient outcomes. The move also intensifies competition and innovation in the sector, aligning with the UK’s growing emphasis on point-of-care solutions and advanced veterinary care.

Asia Pacific Veterinary Services Market Trends

The veterinary services market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period, driven by the region's dependence on agriculture, rising livestock populations, and growing awareness of disease prevention. Increasing cases of zoonotic diseases drive demand for advanced veterinary care, while expanding companion animal ownership boosts the need for pet healthcare services. In Japan, the number of veterinarians focusing on small animals continues to rise, strengthening the companion services segment. Meanwhile, rapid population growth in India fuels demand for meat and milk, accelerating livestock rearing and creating higher demand for veterinary expertise in animal health and productivity.

The India veterinary services market is expanding rapidly, driven by government initiatives, rising livestock demand, and a booming companion animal sector. For instance, in February 2025, the Union Animal Husbandry and Dairying Ministry, in collaboration with the World Organization for Animal Health (WOAH), conducted a workshop to strengthen veterinary services through public-private partnerships (PPPs). The initiative emphasizes disease control, Foot-and-Mouth Disease (FMD)-free zones, advanced vaccine platforms, workforce training, and district-level NABL-accredited laboratories, which will significantly improve diagnostic capacity, disease management, and private sector participation.

At the same time, India’s growing pet ownership is fueling demand for advanced companion animal healthcare, attracting global and domestic players. For instance, in December 2024, Mars Inc. invested in Crown Veterinary Services, marking a major international entry into India’s veterinary practice market, while local players like Vetic and Max Vets continue to expand their chains. This dual growth is strengthening livestock healthcare infrastructure and expanding companion animal services, which positions India as a high-potential veterinary market in the Asia Pacific region.

Latin America Veterinary Services Market Trends

The veterinary services market in Latin America is experiencing robust growth, driven by the region's large livestock population, rising companion animal ownership, and increasing focus on sustainable animal health practices. Countries like Brazil, with the world's second-largest cattle population, invest heavily in pasture rehabilitation and livestock productivity. For instance, in July 2025, Sumitomo Corporation of America partnered with Grupo Papalotla to scale hybrid pasture seed adoption through its Brazilian subsidiary, Tropical Seeds do Brasil. These innovations improve forage quality, reduce greenhouse gas emissions, and enhance animal productivity, creating new opportunities for veterinary services tied to preventive health, nutrition, and disease management.

At the same time, the companion animal sector in markets such as Argentina and Chile is expanding rapidly, fueled by urbanization and a cultural shift toward treating pets as family. This trend boosts demand for advanced veterinary care, diagnostics, and specialty treatments. The combination of large-scale livestock initiatives and growing pet healthcare adoption positions Latin America as a dynamic market, with veterinary services playing a pivotal role in both agricultural sustainability and companion animal well-being.

The Brazil veterinary services market is expanding rapidly, driven by the country’s large livestock population and rising investments in animal health infrastructure. For instance, in February 2025, MSD Animal Health partnered with Union Agener Animal Health to co-distribute LACTOTROPIN in Brazil. This biotechnology solution boosts dairy cow productivity while lowering emissions per liter of milk. Similarly, in April 2025, Petrobras established a veterinary center in Oiapoque, Amapá, as part of its environmental licensing, strengthening capacity for wildlife care in sensitive ecosystems. These examples highlight how agribusiness and environmental initiatives fuel demand for advanced veterinary solutions, positioning Brazil as a key growth hub in Latin America's animal health sector.

Middle East & Africa Veterinary Services Market Trends

The veterinary services market in the Middle East & Africa is expanding due to increasing livestock production, growing awareness of zoonotic diseases, and rising demand for companion animal care. In South Africa, veterinary services are being strengthened by initiatives to improve surveillance and control of foot-and-mouth disease (FMD), supporting livestock exports and food security. Meanwhile, in markets like the UAE, pet ownership is surging, leading to higher demand for advanced veterinary clinics, grooming, and preventive care services. These trends highlight how both livestock health management and companion animal care are shaping the market growth trajectory across the region.

The South Africa veterinary services market is expanding, driven by rising companion animal ownership, government focus on livestock health, and the integration of advanced clinical standards. For instance, in July 2025, the University of Pretoria’s Onderstepoort Veterinary Academic Hospital, in partnership with Royal Canin, launched Gauteng’s first gold-status Cat-Friendly Clinic, setting international benchmarks in feline care, research, and veterinary education. On the livestock side, state initiatives targeting foot-and-mouth disease (FMD) control and improved biosecurity are strengthening the export competitiveness of South African cattle and sheep. Together, these advancements in both companion and production animal care highlight a dual growth trajectory, boosting clinical innovation, professional training, and preventive health services across the veterinary sector.

The veterinary services market in Saudi Arabia is expanding rapidly, driven by rising livestock populations, growing pet ownership, and government initiatives under Vision 2030. The Kingdom is home to more than 7.5 million livestock in the Northern Borders region alone, with sheep, goats, camels, and cattle forming the backbone of its food security strategy. This has led to significant investments in animal health infrastructure. For instance, in July 2025, Saudi Arabia began constructing its first National Excellence Center for Animal Research and Disease Control in Arar, with a SAR 29.6 million investment. The facility will span over 17,000 square meters and include veterinary laboratories, barns, refrigeration, and support infrastructure to strengthen diagnostics, disease prevention, and scientific research. Strategically located in the livestock-rich Northern Borders region-home to more than 7.5 million animals-the center will enhance veterinary services, food security, sustainability, and biosecurity, aligning with Vision 2030 goals. The new research hub will modernize veterinary infrastructure, enabling early detection and control of livestock diseases. This strengthens local veterinary capacity, reduces zoonotic risks, and positions Saudi Arabia as a regional leader in animal health innovation.

Key Veterinary Services Company Insights

The veterinary services industry is competitive and largely fragmented, with a significant number of small to large veterinary service providers. These companies are constantly involved in implementing strategic initiatives, such as collaborations, mergers and acquisitions, and service and regional expansions, among others.

Key Veterinary Services Companies:

The following are the leading companies in the global veterinary services market. These companies collectively hold the largest market share and dictate industry trends.

- CVS Group Plc

- Mars Incorporated

- National Veterinary Associates

- Pets at Home Group PLC

- Greencross Vets

- Fetch! Pet Care

- IVC Evidensia

- A Place for Rover, Inc.

- PetSmart LLC

- Airpets International

Recent Developments

-

In September 2025, SignalPET introduced SignalPET 360°, a comprehensive radiology solution designed to streamline veterinary diagnostics. The platform integrates AI-powered immediate triage, a Complete AI Report modeled after radiologist reports, and 24/7 access to board-certified radiologists, all in one system.

-

In May 2025, Vetanco, a global animal health company, partnered with Saudi Arabia’s Arasco via its veterinary division Al-Emar International, granting Al-Emar exclusive distribution rights for Vetanco’s portfolio in Saudi Arabia.

-

In March 2025, Pet Madness Inc. launched the world's first AI-driven pet ecosystem, integrating software, hardware, and partnerships to connect pet owners, veterinarians, brands, and service providers.

-

In February 2025, Ireland-based TriviumVet advanced first-to-market therapies for chronic conditions in pets, including feline hypertrophic cardiomyopathy (HCM), canine neuropathic pain, gastric ulcers, and chronic kidney disease.

-

In October 2024, VCA Animal Hospitals launched a dedicated 3D Printing Lab at its Northwest Veterinary Specialists facility in Oregon to enhance orthopedic surgeries for pets.

Veterinary Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 156.25 billion

Revenue forecast in 2033

USD 281.93 billion

Growth rate

CAGR of 7.66% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, service type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

CVS Group Plc; Mars Incorporated; National Veterinary Associates; Pets at Home Group PLC; Greencross Vets; Fetch! Pet Care; IVC Evidensia; A Place for Rover, Inc.; PetSmart LLC; Airpets International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary services market report based on animal, type, service type, and region:

-

Animal Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Production Animals

-

Cattle

-

Poultry

-

Swine

-

Others

-

-

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Medical Services

-

Diagnosis

-

In-Vitro Diagnosis

-

In-Vivo Diagnosis

-

-

Preventative Care

-

Treatment

-

Consultation

-

Surgery

-

Others

-

-

-

Non-Medical Services

-

Pet Services

-

Livestock Services

-

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary services market size was estimated at USD 145.65 billion in 2024 and is expected to reach USD 156.25 billion in 2025.

b. The global veterinary services market is expected to grow at a compound annual growth rate (CAGR) of 7.66% from 2025 to 2033 to reach USD 281.93 billion by 2033.

b. North America veterinary services market held the largest revenue share of 36.95% in 2024, driven by rising pet ownership, expanding service offerings, and strategic investments from industry players. In addition numerous measures undertaken by government & animal welfare organizations inclined towards improving veterinary services are further supporting the substantial share.

b. Some key players operating in the global veterinary services market include CVS Group Plc; Mars Incorporated; National Veterinary Associates; Pets at Home Group PLC; Greencross Vets; Fetch! Pet Care; IVC Evidensia; A Place for Rover, Inc.; PetSmart LLC; Airpets International, among others.

b. Some of the key factors propelling the market growth includes, increasing animal welfare activities, rising need to enhance food security, increasing pet populations, growing awareness about animal health coupled with growing timely diagnosis & treatments, and increasing expenditure on animal healthcare services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.