- Home

- »

- Animal Health

- »

-

Veterinary Reference Laboratory Market Size Report, 2030GVR Report cover

![Veterinary Reference Laboratory Market Size, Share & Trends Report]()

Veterinary Reference Laboratory Market Size, Share & Trends Analysis Report By Animal (Companion, Production), By Application (Clinical Pathology, Parasitology), By Technology, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-590-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

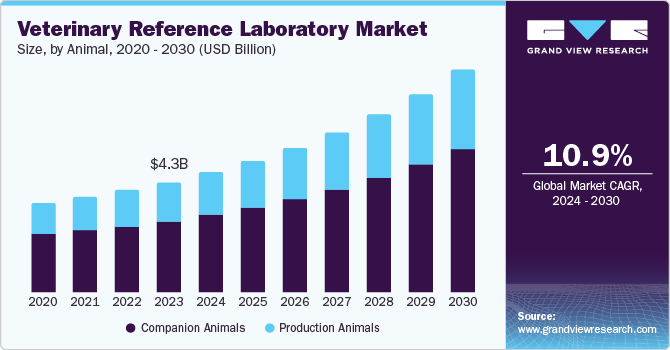

The global veterinary reference laboratory market size was valued at USD 4.33 billion in 2023 and is projected to grow at a CAGR of 10.9% from 2024 to 2030. This growth can be attributed to the rising pet ownership, an increase in pet insurance, an increase in the spending on animal health, development in veterinary medicine, and the need for specific procedures like PCR testing. Moreover, the increasing trends in companion animal adoption, including dogs and cats, have fueled the development of the veterinary reference laboratory market.

The industry is witnessing significant growth due to the increasing awareness of pet owners regarding health of their pets and the subsequent demand for diagnostic services. The growing trend of preventive medicine in animals has led to an increase in spending on animal health, resulting in a surge in demand for specialized testing services offered by veterinary reference laboratories. Furthermore, the need for accurate diagnostic tests has grown with the advancement of veterinary medicines, enabling veterinarians to develop more effective treatment plans.

The emergence of portable diagnostic devices and mobile applications has revolutionized the diagnostic process, enabling veterinarians to diagnose diseases more efficiently and effectively. Point-of-care equipment, such as small animal point of care equipment, offers convenient solutions for laboratory diagnosis, including blood biochemistry, hematology, and diagnosis of infections and diseases. This trend is expected to continue, driving the demand for specialized testing services and further consolidating the position of veterinary reference laboratories in the market.

The increasing demand for PCR testing, rapid testing, and other complex testing procedures is also driving the growth of the veterinary reference laboratory market. The need for early and accurate detection of diseases in animals is critical, and veterinary reference laboratories are well-positioned to meet this need. Consequently, the market is expected to continue its upward trajectory, driven by the increasing awareness of pet owners, advancements in veterinary medicine, and the development of innovative diagnostic technologies.

Animal Insights

Companion animals dominated the market with a revenue share of 64.3% in 2023. The companion animal segment, comprising dogs, cats, birds, and exotic animals, is a key driver of growth in veterinary diagnostics services. Pet owners are willing to invest in preventive care, early disease diagnosis, and sophisticated treatments, leading to increased demand for veterinary reference laboratory services.

The production animals segment is expected to register the fastest growth with a CAGR of 11.1% over the forecast period. The livestock industry, encompassing cattle, pigs, poultry, and sheep, is driven by the rising global population and demand for food products. Governments’ strict regulations on animal health and food hygiene have also contributed to the growth of the industry. As consumers increasingly recognize the importance of proper animal care and health, investments in this sector are increasing, propelling market growth.

Application Insights

Clinical pathology led the market in 2023, accounting for a revenue share of 30.5%. Clinical pathology diagnosis is a comprehensive evaluation of an animal’s health status through analysis of blood plasma, urine, and other bodily fluids. This process enables the identification of various diseases, including infections, metabolic disorders, anemia, and cancers. Trained clinical pathologists specialize in interpreting laboratory results, providing accurate diagnoses and detailed reports with treatment recommendations.

Parasitology application segment is expected to register the fastest growth with a CAGR of 11.7% over the forecast period. Parasitic diseases are a pervasive issue in both domestic and wild animals, affecting a wide range of species. Common parasites include worms, ticks, fleas, mites, and protozoa. The global prevalence of these infections necessitates the high-volume testing of samples at veterinary parasitology reference laboratories. Effective diagnosis and treatment by parasitology experts are crucial to mitigating the severe health impacts of parasites, which can lead to weight loss, anemia, organ damage, and even death.

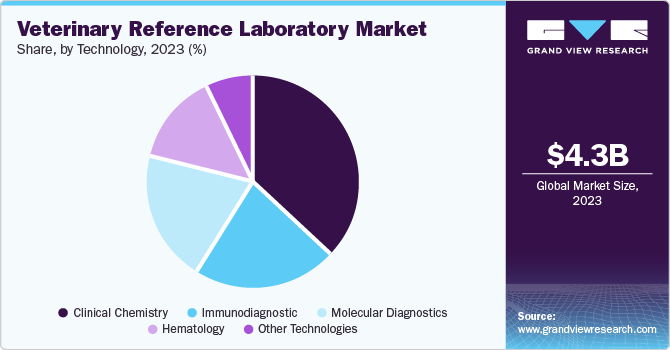

Technology Insights

Clinical chemistry held the largest market share of 36.7% in 2023, aided by its capabilities, accuracy, and precision, as well as its fast analyzers, cost-effectiveness, and focus on preventive care. The technology’s partnership agreements with clinics and adherence to regulations also contribute to its excellence. Its reliability is crucial in veterinary diagnostics, enabling informed treatment decisions and accurate measurement of intervention outcomes.

Immunodiagnostic technology is expected to grow at the fastest CAGR of 11.0% over the forecast period. Immunodiagnostics is a very important in veterinary medicine whereby diagnosis of infection, measurement of immune response, identification of antibodies/antigens and global wellbeing of animals is achieved. The global infection rate of pathogens in animals is on the rise, and hence, the need to develop efficient diagnostic tools. Immunodiagnostics stands out in this regard due to the technology’s ability to provide a rapid turnaround and high sensitivity.

Regional Insights

North America veterinary reference laboratory market dominated the global veterinary reference laboratory market with a revenue share of 44.4% in 2023. The dominance of veterinary diagnostics in the region can be attributed to a combination of factors, including the technological advancements in healthcare, high pet ownership rates, and favorable legislation. A well-established network of veterinary reference laboratories provides a range of specialized services, including molecular diagnostics, clinical chemistry, and pathology.

U.S. Veterinary Reference Laboratory Market Trends

The veterinary reference laboratory market in U.S. dominated the North America veterinary reference laboratory market with a revenue share of 85.6% in 2023. The country boasts a high rate of pet ownership, with Forbes reporting that 66% of households owning pets as of 2024. This demographic drives the growth of the pet care industry, with pet owners prioritizing the health of their animals. As a result, there is a growing demand for advanced veterinary diagnostic solutions, fueling innovation and investment in the industry.

Europe Veterinary Reference Laboratory Market Trends

Europe veterinary reference laboratory market held a significant market share in 2023. Europe considered to have keen interest in the research and development of diagnostics in veterinary medicine. It has been quick to adopt key solution technologies mainly PCR, ELISA, and point care testing devises. These advanced technologies help to diagnose several diseases in animals effectively and quickly, hence making Europe’s veterinary reference lab service market promising.

The veterinary reference laboratory market in Germany is expected to grow over the forecast period. Services offered by the laboratories include advance diagnostic equipment and facilities in German laboratories allows for accurate and efficient testing of various veterinary services. This turns out to be a technological strength for the German laboratories to produce credible results within the shortest time possible thus improving their market base both locally and internationally since they deliver the best veterinary diagnostic services.

Asia Pacific Veterinary Reference Laboratory Market Trends

Asia Pacific veterinary reference laboratory market is expected to register the fastest CAGR of 13.0% over the forecast period. The ownership of pets has been on the rise in the Asia Pacific. Such trend has created a need for veterinary services which include diagnostic testing done by the reference laboratories. Moreover, the Asia Pacific region is home to some of the largest livestock industries globally. With a focus on improving animal health and productivity, there is a high demand for diagnostic services in this sector, further driving the growth of veterinary reference laboratories.

The veterinary reference laboratory market in China has significant growth in 2023. Various factors contributing to the market share such as increasing pet ownership, growing consciousness approximately animal health, and advancements in veterinary healthcare services. This growth has caused a higher call for veterinary diagnostic services.

Key Veterinary Reference Laboratory Company Insights

Some key companies in the veterinary reference laboratory market include IDEXX; Mars, Incorporated; GD; Greencross Vets; Gribbles Veterinary Pathology; Zoetis; and Neogen Corporation; among others. Leading entities are implementing strategic initiatives, including mergers and acquisitions, as well as collaborations with prominent companies, to enhance their market presence and competitive advantage.

-

IDEXX offers a comprehensive range of products and services for companion animals, livestock, poultry, and dairy, including laboratory analyzers, diagnostic imaging, and software, as well as water quality testing and livestock disease diagnostics.

-

Mars, Incorporated’s veterinary division provides a range of laboratory tests and services to support the diagnosis and treatment of various animal diseases, aiming to enhance the health and well-being of animals.

Key Veterinary Reference Laboratory Companies:

The following are the leading companies in the veterinary reference laboratory market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX

- Mars, Incorporated

- GD

- Greencross Vets

- Gribbles Veterinary Pathology

- Zoetis

- Neogen Corporation

- ProtaTek International, Inc.

- Wisconsin Veterinary Diagnostic Laboratory

- Thermo Fisher Scientific Inc.

- Merck & Co., Inc. (MSD Animal Health)

Recent Developments

-

In June 2024, IDEXX launched the Catalyst Pancreatic Lipase Test, catering to the diagnosis of canine and feline pancreatitis. The test provides quantitative results in under 10 minutes, empowering veterinarians to confidently diagnose and treat pancreatitis.

-

In May 2024, Mars, Incorporated entered exclusive discussions to acquire Cerba HealthCare’s stake in Cerba Vet and ANTAGENE, enhancing its European veterinary diagnostics business through Mars Petcare’s Science & Diagnostics division.

-

In October 2023, Gribbles Veterinary Pathology and Vedi collaborated to digitize pathology ordering for vets in Victoria and South Australia, introducing a state-of-the-art digital platform that streamlined and improved the process.

Veterinary Reference Laboratory Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.72 billion

Revenue forecast in 2030

USD 8.80 billion

Growth rate

CAGR of 10.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, application, technology, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

IDEXX; Mars, Incorporated; GD; Greencross Vets; Gribbles Veterinary Pathology; Zoetis; Neogen Corporation; ProtaTek International, Inc.; Wisconsin Veterinary Diagnostic Laboratory; Thermo Fisher Scientific Inc.; Merck & Co., Inc. (MSD Animal Health)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Reference Laboratory Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary reference laboratory market report based on animal, application, technology, and region.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Other Companion Animals (Rabbits, Fish, Turtle, Frog)

-

-

Production Animals

-

Cattles

-

Pigs

-

Poultry

-

Sheep and Goats

-

Other Production Animals (Donkey, Camels)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Pathology

-

Virology

-

Bacteriology

-

Parasitology

-

Productivity Testing

-

Pregnancy Testing

-

Toxicology

-

Other Applications

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Chemistry

-

Hematology

-

Immunodiagnostic

-

ELISA Tests

-

Lateral Flow Rapid Tests

-

Others (Includes Allergen-specific Immunodiagnostic Tests, FAT, Agglutination Tests, Immunohisto-chemistry Tests, WB)

-

-

Molecular Diagnostics

-

PCR Tests

-

Microarrays

-

Others (Includes genetic tests and DNA sequencing reagents)

-

-

Other Technologies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."