- Home

- »

- Animal Health

- »

-

Veterinary Rapid Test Market Size And Share Report, 2030GVR Report cover

![Veterinary Rapid Test Market Size, Share & Trends Report]()

Veterinary Rapid Test Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Test Kits, Readers), By Technology (Immunoassays, PCR), By Animal Type, By Testing Category, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-191-2

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Rapid Test Market Summary

The global veterinary rapid test market size was estimated at USD 820.8 million in 2023 and is projected to reach USD 1,847.7 million by 2030, growing at a CAGR of 12.3% from 2024 to 2030. The market is primarily driven by growing animal population & and ownership rates; rising expenditure on animals; growing focus on preventive healthcare for animals; technological advancements in veterinary diagnosis tests; and rising adoption of pet insurance.

Key Market Trends & Insights

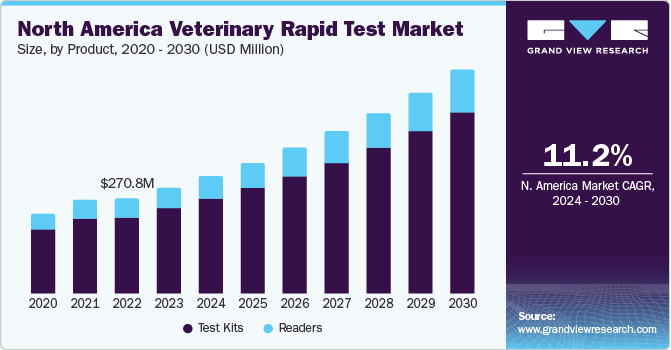

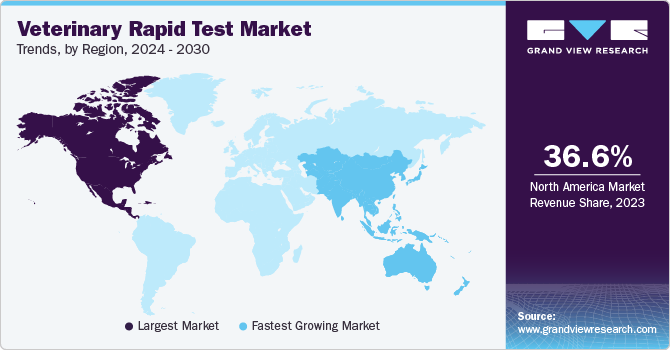

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, UK is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, test kits accounted for a revenue of USD 658.6 million in 2023.

- Test Kits is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 820.8 Million

- 2030 Projected Market Size: USD 1,847.7 Million

- CAGR (2024-2030): 12.3%

- North America: Largest market in 2023

One of the primary benefits of veterinary rapid test is the ability to provide quick results.

Rapid tests often yield results within minutes to a few hours, allowing veterinarians and animal owners to make timely decisions regarding treatment and management. Early diagnosis is crucial for effective treatment and preventing the spread of infectious diseases within animal populations. The quick turnaround time of rapid test results reduces the time between sample collection and diagnosis. This is essential for implementing timely interventions, preventing the spread of diseases, and improving overall animal health outcomes.

The diversity of animal species in veterinary healthcare provides opportunities for developing rapid test kits tailored to specific animals. Specialized kits for livestock, companion animals, and exotic species can meet unique diagnostic needs of each segment. The shift towards preventive healthcare for animals offers opportunities for use of rapid test kits in routine screenings. Early detection of diseases can lead to timely intervention, preventing spread of infections and improving overall animal health.

Industry leaders like Zoetis, IDEXX Laboratories, Inc., Heska Corporation (Mars Inc.), Thermo Fisher Scientific Inc, Neogen Corporation, etc. are adopting strategies, such as launch of new products, partnerships, and mergers and acquisitions to gain a greater share of market.

The market is influenced by various technological advancements that drive innovation, improve diagnostic accuracy, and enhance overall performance of these diagnostic tools. Ongoing advancements in biotechnology and diagnostic technologies contribute to development of more sophisticated & accurate rapid test kits. Developing more sensitive and specific rapid test kits can offer opportunities for market players to introduce innovative products. This includes the incorporation of advanced detection methods and integration of digital technologies for result interpretation.

Immunoassay techniques, such as Enzyme-linked Immunosorbent Assay (ELISA) and lateral flow immunoassay, are commonly used in rapid test kits. Ongoing advancements in these techniques contribute to increased sensitivity and specificity, allowing for more accurate detection of diseases in animals. Furthermore, increasing initiatives by key market players can contribute to market growth. For instance, in January 2023, Heska Corporation (Mars Inc.) completed acquisition of MBio Diagnostics, Inc. d/b/a LightDeck Diagnostics ("LightDeck"), a leader in the field of planar waveguide fluorescence immunoassay diagnostics with significant production and R&D capabilities. This has enabled the company to explore a novel area for developing immunoassays for veterinary diagnostic applications.

Molecular diagnostic techniques, such as Polymerase Chain Reaction (PCR), are increasingly incorporated into veterinary rapid test. These techniques offer high sensitivity and specificity for detecting nucleic acids, enabling the identification of specific pathogens. In October 2022, La Trobe University, Australia, developed a new rapid isothermal PCR test to detect liver fluke within an hour. The test is intended to help prevent the spread of the deadly parasite affecting cows, sheep, and other ruminants.

Furthermore, increasing trend of pet ownership and the humanization of pets result in greater attention to their health and wellbeing. Pet owners are more willing to invest in healthcare measures, including regular screenings using veterinary rapid test. There is a growing focus on preventive healthcare for animals, driven by recognition that early detection of diseases can lead to more effective and cost-efficient treatments. Veterinary rapid test play a critical role in preventive healthcare by providing quick and accessible diagnostic solutions. According to American Pet Products Association, Inc., pet parents spent an estimated USD 37 million on vet care and product sales in 2023. This number is notably greater than USD 35.9 million vet care & product sales estimated in 2022.

Veterinary clinics and healthcare providers are offering comprehensive wellness programs for companion animals. These programs often include periodic screenings and diagnostics using rapid test kits to assess overall health and detect potential issues before they become severe. For instance, the SNAP 4Dx Plus Test by IDEXX is recommended annually to help prevent spread of Lyme disease, heartworm disease, ehrlichiosis, and anaplasmosis. In 2022, IDEXX attributed increase in its rapid assay revenue to high clinic testing levels and higher price realizations, primarily from SNAP 4Dx Plus.

Market Concentration & Characteristics

Market participants are carrying out consolidation operations like mergers and acquisitions (M&A) to increase their regional and geographic reach while improving their existing resources and competencies in order to fulfill the growing need. This enables market participants to serve additional customers by utilizing labor, technology, and existing expertise on a larger scale.

The market is also characterized by a strategy to launch novel and innovative products addressing a variety of indications in this diagnosis industry to boost their market position & revenue. These types of initiatives could potentially be employed to reach more consumers by enhancing the global footprint or expanding regionally. For instance, in June 2023, Zoetis launched a new product called Vetscan Mastigram+, a rapid on-farm mastitis diagnostic test kit.

Furthermore, in November 2023, a comprehensive screening test for diseases transmitted by vectors, such as canine leishmaniasis, called as the SNAP Leish 4Dx Test was launched by IDEXX Laboratories, Inc. Moreover, in June 2023, Gold Standard Diagnostics launched 4 new diagnostic test kits Simplex DNAnimal kits for veterinary use.

Players in this market are constantly involved in strategic initiatives, such as regional expansion, mergers, acquisitions, and new product launches, to gain a higher market share. For instance, in June 2023, Mars, Inc. Mars, Incorporated declared that the acquisition of Heska by Mars had been completed successfully to expand diagnostic & technology coverage, expediting R&D, and increasing access to veterinary diagnostic care products globally.

Regulations have a big impact on the global market because they guarantee the efficacy, safety, and conformity of products to quality standards. Stringent regulations could increase consumer confidence and encourage the use of certified kits. Market dynamics can also be influenced by regulatory compliance, which benefits businesses that make R&D investments to adhere to norms. However, smaller firms may find it difficult to navigate complicated regulatory environments, which could restrict their ability to enter market. In global market, a well-regulated environment generally encourages product reliability and market sustainability.

The market landscape has been impacted by regional expansion, as companies aim to penetrate new markets to take advantage of new opportunities and satisfy increasing demand for veterinary rapid test kit solutions. The intricate interactions between innovation, M&A, legislation, replacements, and regional expansion shape the dynamic Veterinary rapid test industry, as these aspects collectively demonstrate. As companies recognize global potential of the veterinary rapid test market, they are expanding their presence to tap into diverse geographical markets with varying pet ownership and spending patterns. Key players adopting this expansion strategy include Zoetis Inc., IDEXX Laboratories, Inc., Virbac, and Boster Biological Technology

Market players are very actively launching new products to strengthen their portfolio and provide customers with various innovative and advanced products. Similarly, companies are launching initiatives to create awareness among pet parents about veterinary diagnostic kits solutions. Companies most commonly follow this strategy to attract more customers in market. Key players adopting this product launch strategy include Zoetis Inc., IDEXX Laboratories, Inc., Heska Corporation (Mars Inc.), Thermo Fisher Scientific and Neogen Corporation, Gold Standard Diagnostics, Biogal Galed Labs, Biostone Animal Health, and Genesystem.

Limited sensitivity may result in false negatives, meaning test may fail to detect true positive cases. Similarly, limited specificity can lead to false positives, indicating that the test may incorrectly identify a negative case as positive. Both scenarios can compromise accuracy of diagnosis and treatment decisions. The limited sensitivity and specificity of some Veterinary Rapid Test can pose significant challenges and restrain the market. If a rapid test kit has limited sensitivity or specificity, there is a reduced confidence in the accuracy of results. This can lead to hesitancy in relying on these tests for critical diagnostic determinations.

As per a thesis published in December 2020 by Graduate School at Tennessee Research and Creative Exchange, three rapid commercial ELISA test kits by IDEXX, Zoetis, and Abaxis for canine Parvovirus were compared with lab-based qPCR, known for its high sensitivity & specificity. The sensitivities of ELISA tests were estimated at 45.4%, compared to 100% for gold standard qPCR method. This indicated low sensitivity of ELISA tests. If rapid test kits have limited sensitivity, they may miss cases of infection, leading to inadequate disease surveillance. This can result in underestimating disease prevalence and hinder effective control measures.

Product Insights

Based on product, the test kits segment led the market with the largest revenue share of 80.24% in 2023. Technological advancements in veterinary diagnostics have led to the development of innovative & accurate diagnostic test kits that are more accurate, sensitive, and rapid, such as polymerase chain reaction (PCR), enzyme-linked immunosorbent assay (ELISA), and lateral flow assays. These innovations improve the efficiency and effectiveness of veterinary diagnostics, thereby stimulating market growth.

Furthermore, key players are continually introducing new veterinary rapid diagnostic test kits, offering a broader range of tests for various diseases and conditions affecting animals. These new products address emerging needs in veterinary medicine, such as the detection of novel pathogens or the monitoring of specific health parameters. As a result, the adoption of rapid diagnostic test kits is growing, contributing to overall market expansion. For instance, in June 2023, Gold Standard Diagnostics launched four new diagnostic test kits under Simplex DNAnimal kits for veterinary use.

Testing Category Insights

Based on testing category, the virology segment held the market in 2023 with the largest revenue share of 33.00% in 2023. Virology deals with identifying viral infections in animals by using techniques such as viral culture, antigen detection tests, serology, isolation of viruses, and detection of antibodies that are produced in response to infections, which, in turn, helps detect nucleic acids of viruses. This segment also includes monitoring vaccine response. The other tests that come under this category, along with antibody detection by different methods, are agar-gel immunodiffusion, complement fixation, latex agglutination, hemagglutination inhibition, ELISA, neutralization, and indirect immunofluorescence. Antigen detection tests are immunofluorescent antibody detection, immunohistochemistry tests, and antigen ELISA tests.

Governments are implementing preventive healthcare programs to reduce the spread of viral diseases among animals. These programs often include vaccination campaigns, biosecurity measures, and routine diagnostic screening. For instance, in February 2023, several Veterinary Rapid Test were launched for the detection of various diseases in animals. As per U.S. Department of Agriculture's (USDA) Animal and Plant Health Inspection Service (APHIS) declared the purchase of diagnostic test kits for the National Animal Vaccine and Veterinary Diagnostic Bank (NAV-VDB) to test livestock for African Swine Fever (ASF) and Foot and Mouth Disease (FMD).

Furthermore, an increase in competition among manufacturers to strengthen their product lines is contributing to the market growth. Companies are focused on differentiating their products by offering unique features, improved performance, and better value propositions, ultimately benefiting end users through a wider selection of high-quality diagnostic options. For example, in December 2023, BioStone Animal Health introduced the AsurDx Japanese Encephalitis (JEV) Antibody Test Kit, tailored for identifying pig antibodies targeted against the JEV.

Technology Insights

Based on technology, the immunoassays led the market with largest revenue share in 2023. The immunoassays segment includes ELISA/EIA, Lateral Flow Assays (LFAs), and Immunochromatographic Assays (ICA). ELISA rapid test kits are commonly used in veterinary medicine for the detection of antibodies or antigens associated with infectious diseases such as parvovirus infection, distemper, brucellosis, and leptospirosis. ELISA kits are available in various formats, including LFAs or Lateral Flow Immunoassays (LFIs), providing rapid and easy-to-interpret results.

The use of ELISA technology in veterinary rapid diagnostics is advantageous for its reliability, speed, and cost-effectiveness. These qualities make it an attractive choice for routine screening and monitoring in the veterinary field. For instance, in November 2023, BioStone Animal Health launched AsurDx Fowl Adenovirus Group I (FADV-4, FADV-8, and FADV-11) Antibody Test Kits, specifically engineered to detect chicken antibodies directed at fowl adenovirus group I in chicken serum/plasma. This innovative kit is based on a rapid, easy, highly sensitive, cost-efficient ELISA screening method. The introduction of specialized kits, such as the AsurDx Fowl Adenovirus Group I Antibody Test Kits, further enhances the capabilities of ELISA in addressing specific health concerns in poultry, contributing to the overall health and productivity of poultry farming operations.

ICAs are rapid tests based on the lateral flow principle, often used for the detection of specific antigens or antibodies in veterinary samples. ICA rapid test kits are available for the detection of various veterinary pathogens and conditions, such as infectious diseases in companion animals (e.g., canine parvovirus & feline leukemia virus) and livestock (e.g., bovine viral diarrhea virus & avian influenza virus).

Animal Type Insights

Based on animal type, the companion animals segment held the market with the largest revenue share of 55.80% in 2023. This can be attributed to the increasing pet population, growing pet expenditure, and rising awareness about early disease diagnosis & preventive care. Increasing product launches and strong service pipelines of IDEXX, Zoetis, and Heska Corporation (Mars Inc.) are expected to propel market growth over the forecast period. For instance, in June 2023, IDEXX launched the first animal diagnostic test to detect kidney damage in dogs & cats. The tests will be performed in IDEXX Reference Laboratories in 2023 in the U.S. & Canada, with a scheduled rollout across Europe in 2024.

The dogs segment accounted for the largest market share under companion animals’ segment in 2023 and is expected to the fastest CAGR during the forecast period. The rising awareness and popularity of canine rapid diagnostic test kits is propelling market growth. The growing demand for point-of-care treatments and improved diagnostic tests is also impelling market growth. These tests include ELISA, PCR, and dermatological tests for dermatophytes to detect parasites & viruses, such as coronavirus, parvovirus, hepatitis, & leishmania. To expand their market share, companies are continuously spending on R&D to provide innovative diagnostic tests for dogs.

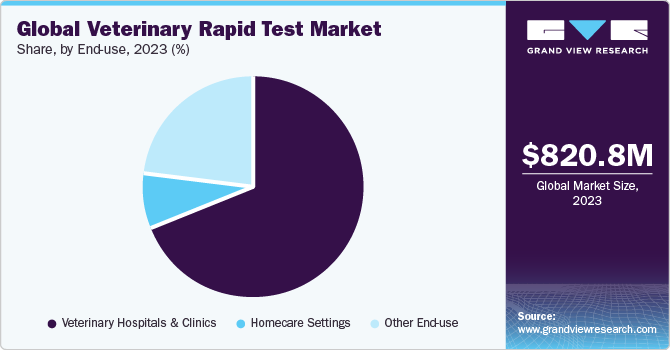

End-use Insights

Based on end-use, the veterinary hospitals & clinics segment led the market with a largest revenue share of 68.71% in 2023, owing to the increasing demand for diagnostics and readily accessible rapid diagnostic tools in hospitals. This segment represents the revenue generated by veterinary hospitals & clinics, which provide diagnostic test kits directly to pet owners and livestock farmers. Moreover, veterinary hospitals also play a role in educating pet owners about the importance of diagnostics in maintaining their pets' health. By raising awareness, they encourage more pet owners to seek diagnostic test kits when needed.

In addition, companies are continually developing and launching new products with improved accuracy, sensitivity, and ease of use to meet the growing needs of veterinary professionals. For instance, in March 2023, Zoetis introduced its multipurpose testing system, Vetscan Imagyst, with additional features to include two new applications for artificial intelligence (AI), one for dermatological applications and the other for AI equine Fecal Egg Count (FEC) assessment. These diagnostic enhancements bring more in-clinic testing to the Vetscan Imagyst diagnostic tools, which are fully connected with cloud-based AI capabilities of the company. These new tests complement the company's existing digital cytology tools, AI canine & feline fecal analysis, and AI blood smear analysis.

The utilization of rapid diagnostic tests in a home setting enhances accessibility and contributes to a more comprehensive and stress-free range of pet care. With a growing number of pets, there is a heightened concern among pet owners regarding the health and well-being of their animals. The growing preference for at-home and farm testing is increasing usage of rapid veterinary diagnostic tests, as they are easy to perform and quick. At-home veterinary rapid diagnostic test kits are commonly used to identify heartworm, feline leukemia, and Newcastle Disease Virus (NDV). Furthermore, the incorporation of at-home testing into veterinary care represents a novel strategic approach adopted by key industry players to expand their market presence.

The use of on-farm veterinary rapid test is more convenient and cost-effective for farmers, as it eliminates the need for veterinary visits and reduces the time & cost associated with disease diagnosis. These factors are expected to continue driving market growth, particularly for on-farm diagnostic test kits. Moreover, accurate & efficient diagnostic testing is crucial for livestock producers to optimize productivity and profitability. On-farm diagnostic test kits can help improve farm animal health management by providing accurate results, thus holding a significant share of the market.

Regional Insights

North America dominated the market with the revenue share of 36.60% in 2023. The growing use of diagnostic tests due to extensive pet insurance coverage in the U.S. is attributed to the region's market domination globally. Regular medical exams for pets are insured by pet owners, who are encouraged to do so by insurance policies covering various diagnostic tests. The demand for prompt and precise diagnoses has increased in Canada due to an increasing number of reportable diseases among livestock, including avian influenza, bovine tuberculosis, and chronic wasting disease. The market for veterinary diagnostic kits in North America is expected to develop at a positive rate owing in part to the need for early disease identification, particularly amid high disease prevalence.

The U.S. market is the increasing adoption of diagnostic testing due to coverage under pet insurance. Typically, in the U.S., health insurance for pets covers diagnostic testing such as X-rays, MRI, and blood work. Data by Forbes on January 3, 2024, covered the average pet insurance cost in the US and its coverage. With USD 5,000 in yearly coverage, a USD 250 deductible, and an 80% reimbursement level, the average monthly cost of pet insurance is USD 44 for a dog and USD 30 for a cat.

Europe market held the second-largest share of in 2023. Significant recent developments in diagnostic technology, including point-of-care testing and molecular diagnostics, have helped boost adoption of veterinary diagnostics. These technologies drive the overall demand for veterinary diagnostics by providing meticulous and productive diagnostic testing. Pet insurance is necessary because of several factors, such as the increased incidence of zoonotic diseases in animals & humans and the high treatment costs.

The Germany market will see a steady positive outlook due to the high prevalence of Urinary Tract Infections (UTIs) among companion animals. One of the most common diagnoses in companion animal illnesses is bacterial UTI, which is the main cause of antibiotic prescriptions. According to data on the prevalence of uropathogens in cats and dogs from Germany published in the Antibiotics Journal in 2022, uropathogenic growth was found in 38.5% of cat samples and 43.9% of dog samples. Furthermore, Escherichia coli (48.4%) was the most common pathogen recovered, followed by Coagulase-positive Staphylococci (CoPS; 11.5%) and Enterococcus spp. (11.9%).

Pets are commonly found in homes everywhere, including in the UK. A 2024 article published by Pet Keen stated that the pet population in the UK in 2021 was estimated to be 12.5 million dogs & 12.2 million cats. Due to the COVID-19 pandemic and the isolation that followed, there was a rise in pet ownership in recent years. In addition, people are adopting new pets for love, company, and fun. Currently, 62% of UK residents are pet owners.

The France market is expected to grow at the fastest CAGR during the forecast period, due to the advancements in diagnostic test kits driving industry expansion. The growth potential of industry participants has expanded due to technological advancements. The growing number of sheep and other animals, as well as the presence of internationally prominent market participants in France, are important market drivers.

The Asia Pacific market is expected to witness the fastest CAGR during the forecast period. The Asia Pacific market with diverse markets such as Thailand, South Korea, Australia, India, China, and Japan shows signs of growth. The acceptance of pets and the employment of breeding techniques in livestock production are the two main factors driving the market in Thailand. The need for Veterinary Rapid Test in South Korea is driven by the high emphasis on broiler farms, especially amid the fight against viral infections. Australia's thriving cattle business is reflected in the country's broad adoption of bovine artificial insemination procedures, which can drive market growth.

The India market is estimated to grow at the fastest CAGR over the forecast period. This growth is complemented by government initiatives to ensure OPTIMAL availability of diagnostic kits for required diagnostic test kits, rising artificial insemination in livestock animals and growing livestock population in the country.

In China market, due to a rise in middle-class families, disposable income, and the desire of more individuals spending on their pets, the market for Veterinary Rapid Test is expanding quickly. The majority of senior citizens in China possesses pets. A growing need for effective healthcare services has resulted from an increase in pet ownership. In urban China, there are as many as 51 million pet dogs and 65 million pet cats, according to data released by Acuity in 2023. Assuming an equal distribution across China's urban population, one in eight Chinese citizens own a dog or a cat.

Death due to infectious diseases in beef cattle in Brazil is the main factor that drives the market, highlighting the need for proper education about the importance of trained professionals to effectively manage diseases and contribute to market growth. Beef cattle mortality is a serious issue in Brazil as it causes large financial losses since the country is one of the largest producers of beef in the world.

The Saudi Arabia market is primarily driven by the country's rapidly increasing poultry production. As part of its Saudi Vision 2030 goal, the Saudi Ministry of Environment, Water and Agriculture (MEWA) appealed to local producers to significantly expand poultry production to reduce the country's reliance on oil and diversify its economy. With predictions of 1.55 MMT annually, the country produced 900,000 MT of chicken meat in 2020, which accounted for 60% of domestic consumption.

Key Veterinary Rapid Test Company Insights

Some of the key players operating in market include Zoetis, IDEXX Laboratories, Inc., Heska Corporation (Mars Inc.), Thermo Fisher Scientific Inc, Neogen Corporation, etc.

Prometheus Bio Inc., Fassisi GmbH, Biopanda Reagents Ltd, Boster Biological Technology, Biogal, Glod Standard Diagnostics, etc. are some of the emerging market participants in global market.

Market players are constantly engaging in an array of strategies to improve their presence in the competitive market. Companies frequently introducing new and innovative items to meet the evolving needs of veterinarians and pet owners. Examples of these products include improved diagnosis tools. Partnerships and collaborations with other businesses and academic institutions are common, promoting information sharing and accelerating the creation of original solutions. Ongoing expansion plans include branching out into other regions in order to capitalize on new prospects and grow the clientele.

The companies are seeking for collaborative strategies in order to broaden their market share, expand their current solutions, and acquire emerging technologies. There are many examples of merger and acquisition activity occurring. It is noteworthy that industry stakeholders are constantly working on improving veterinary diagnostics through research and development. When paired together, these various approaches heighten the competitive and dynamic atmosphere of the market.

Key Veterinary Rapid Test Companies:

The following are the leading companies in the veterinary rapid test market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these veterinary rapid test companies are analyzed to map the supply network.

- Zoetis

- IDEXX Laboratories, Inc.

- Virbac

- Heska Corporation (Mars Inc.)

- Thermo Fisher Scientific, Inc

- Neogen Corporation

- Prometheus Bio Inc.

- Fassisi GmbH

- Biopanda Reagents Ltd

- Boster Biological Technology

Recent Developments

-

In October 2023, with the release of a DNA test for dogs, Basepaws (Zoetis) hastened the field of health genetic testing. The Basepaws Breed + Health Dog DNA Test facilitates the transition for pet owners from reactive to proactive care through offering an easy swabbing procedure and results that are optimized for mobile devices

-

In June 2023, My CatScan 2.0, a highly improved and updated version of the test in cat genetic screening, was launched by Neogen Corporation

-

In August 2023, Biostone Animal Health lauched AsurDxTM Leptospira Antibodies Kits for use in Bovine/Ovine/Caprine/Swine

-

In December 2023, a partnership between Neogen Corporation and the Cat Fanciers' Association (CFA), a renowned voice for feline advocacy, was announced. The partnership is centered on Neogen's My CatScan DNA testing services, which are used to market, educate, and promote Neogen technology and products in order to expand the genomic products that CFA members can access

-

On November 30th 2022, Virbac inaugurated a new R&D center at Pingtung Agricultural Biotechnology Park (PABP) in Taiwan

Veterinary Rapid Test Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 919.66 million

Revenue forecast in 2030

USD 1.85 billion

Growth rate

CAGR of 12.33% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, testing category, animal type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

US; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zoetis; IDEXX Laboratories, Inc.; Virbac; Heska Corporation (Mars Inc.); Thermo Fisher Scientific, Inc; Neogen Corporation; Prometheus Bio Inc.; Fassisi GmbH; Biopanda Reagents Ltd; Boster Biological Technology

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Rapid Test Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary rapid test market report based on product, testing category, technology, animal type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Test Kits

-

Readers

-

-

Testing Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Virology

-

Parasitology

-

Bacteriology

-

Clinical Chemistry

-

Other Categories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

PCR

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Dogs

-

Cats

-

Horses

-

Other Companion Animals

-

-

Production Animal

-

Cattle

-

Poultry

-

Swine

-

Other Production Animals

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Homecare Settings

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

- Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary rapid test market is expected to grow at a compound annual growth rate of 12.33% from 2024 to 2030 to reach USD 1.85 billion by 2030.

b. Test kits segment by product dominated the veterinary rapid test market with a share of 80.24% in 2023. This is attributable to the development of innovative & accurate diagnostic test kits that are more accurate, sensitive, and rapid, such as Polymerase Chain Reaction (PCR), Enzyme-Linked Immunosorbent Assay (ELISA), and lateral flow assays.

b. The global veterinary rapid test market size was estimated at USD 820.83 million in 2023 and is expected to reach USD 919.66 million in 2024.

b. Some key players operating in the veterinary rapid test market include Zoetis, IDEXX Laboratories, Inc., Virbac, Heska Corporation (Mars Inc.), Thermo Fisher Scientific, Inc., Neogen Corporation, Prometheus Bio Inc., Fassisi GmbH, Biopanda Reagents Ltd, Boster Biological Technology, etc.

b. Key factors that are driving the market growth include growing animal population & and ownership rates; rising expenditure on animals; growing focus on preventive healthcare for animals; technological advancements in veterinary diagnosis tests; and rising adoption of pet insurance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.