Veterinary Point Of Care Diagnostics Market Size, Share & Trends Analysis Report By Animal, By Product (Consumables, Reagents, & Kits, And Instruments & Devices), By Testing Category, By Indication, By Sample Type, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-824-2

- Number of Report Pages: 154

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

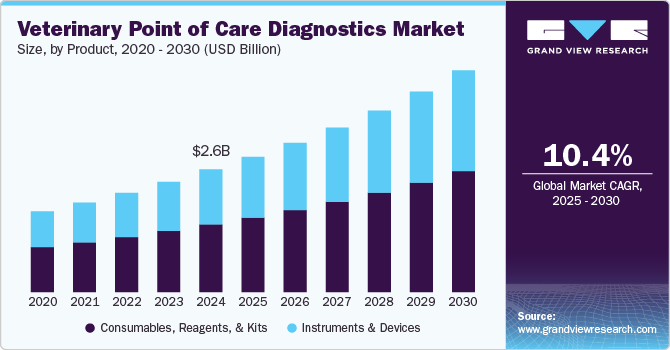

The global veterinary point of care diagnostics market size was estimated at USD 2.55 billion in 2024 and is projected to grow at a CAGR of 10.38% from 2025 to 2030. Increased pet expenditures, advances in test kits and equipment related to the rapid diagnosis of animal diseases, rise in overall zoonotic diseases, popularity of pet care, and a significant demand for point-of-care diagnostics are major factors driving this market.

For instance, businesses are investing in research and development to develop point-of-care diagnostic equipment. Overall, awareness about veterinary health is increasing globally, as it directly correlates with human health. For instance, dairy cattle struggling with an ailment will affect the yield and quality of the dairy products. This will further affect humans economically as well as their overall health.

Industry leaders such as IDEXX Laboratories, Inc., Zoetis, Heska Corporation (Antech), Mindray, and FUJIFILM Corporation are investing significantly in the research and development of unique products specialized in point-of-care diagnostics of companion and livestock animals for a variety of indications.

Increasing pet care expenditure on diagnostic services is a significant factor driving lucrative growth in the market. Point-of-care diagnostics help identify new risk factors for disease that allow veterinarians to take earlier preventative action. Globally, spending on health-related costs has been on the rise. According to January 2025 statistics published by Dogster, health-related costs amount to over 19% - 45.5% in overall dog-related costs and over 15% to 38.8% in overall cat-related costs. Furthermore, in the U.S. alone, pet owners are estimated to collectively spend over USD 136 billion annually on pets.

In addition, pet insurance ensures that diagnostic pet care expenses are reimbursed and that the pet owner is not responsible for the associated costs. Due to many factors, including the humanization of animals, increases in animal numbers, increased initiatives by major corporations, escalating veterinarian costs, and growing adoption among underprivileged communities, acceptance of pet insurance is on the rise. These pet insurances provide substantial coverage for Tests/diagnostics (such as x-rays, blood tests, MRIs, and more), Unexpected injuries/accidents, medications, etc.

In the United States, since 2018, as more and more owners look for ways to cope with increasing veterinary care costs, there has been an overall increase of 22.5% year over year in insured pets. According to the Consumer Price Index, between June 2022 and June 2023, veterinary service prices outpaced inflation by as much as 11.4% over the last decade. According to studies by Pawlicy Advisor, 2,438,795+ pets (dogs & cats) have pet insurance across the U.S.

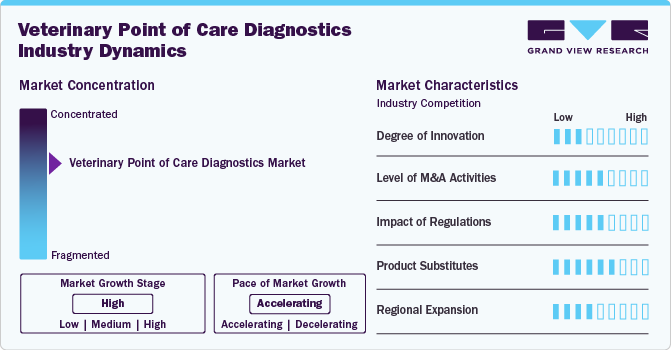

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market is characterized by a high degree of innovation owing to advancements such as the emergence of specialized products and initiatives from market players to increase productivity in veterinary diagnostics and veterinary practice as a whole.

The market is also characterized by a high level of merger and acquisition (M&A) activity by leading and emerging players. In April 2023, Mars Incorporated acquired Heska Corporation, making it part of Mars Petcare's Science & Diagnostics division. This enables Mars Incorporated to ensure broader coverage across diagnostics and technology while accelerating R&D and expanding access globally to pet healthcare solutions.

The market faces challenges in quality assurance and control of POCT products. As technology advances, there is a rapid influx of POCT methods and equipment on the market. POCTs are frequently not subjected to the same regulations as traditional laboratory diagnostic tests or assays. Regulations or standards for evaluation are inadequate. Consequently, appropriate approval processes to guarantee the caliber of outcomes are lacking. Animal diagnostic tests, including POCT, are officially validated and certified by the World Organization for Animal Health (WOAH). In addition, WOAH maintains a register to track veterinary diagnostic kits, but WOAH does not administer this and is not required in most countries. Due to worries about costs and marketability, most small-scale POCT producers do not consider registering their products.

The market is characterized by a dearth of submitted validation studies, a lack of uniformity and openness in POCT validation data, and challenges in fully validating POCTs for specific pathogens.

Even though quality control in veterinary POCTs is an issue, there is not much reference material available. In this regard, quality assurance guidelines for veterinary POCT were created by the American Society for Veterinary Clinical Pathology (ASVCP) and released in 2013. Their primary suggestions were to adopt a formalized approach to POCT, use written policies, SOPs, forms, and logs, train operators and periodically assess their skills, inquire about the instruments' analytical performance, use appropriately established or validated reference intervals, and guarantee accurate results reporting. These recommendations were intended to help veterinarians or technicians raise POCT standards in their clinical or research institutions; they were not intended to be all-inclusive.

Animal type Insights

The companion animals segment held the highest market share, 59.99%, in 2024. This is likely linked to a rise in pet adoption during the pandemic, which is anticipated to drive market expansion during the projected period. For example, after COVID-19, private breeders, nonprofit rescues, and shelters in the U.S. reported high consumer demand. Heska Corporation, Zoetis, and IDEXX are anticipated to have robust product pipelines to drive market expansion throughout the projection period.

The livestock animal segment is expected to grow most over the forecast period. This can be attributed to increasing livestock productivity. Livestock animals comprise cattle, swine, poultry, and others. The major drivers of the segment include the rising incidence of zoonotic diseases and the large livestock population. An increasing number of veterinary practitioners is a major driver fueling the growth of the livestock animal market. In addition, key market players are expanding their product portfolios of diagnostic kits & solutions and offering their services worldwide, which is expected to boost the market growth.

Product Insights

By product, consumables, reagents, and kits segment held the highest market share in 2024. This is because many products are available, the sales model for reagents and consumables is subscription-based or recurring payments, and other major corporations have taken these steps. Consumables are becoming an essential component of diagnostic procedures used in many. Rising demand for veterinary diagnostics is driving up the consumption and usage of consumables and reagents in diagnosis.

The instruments and devices segment is projected to expand at the fastest rate of over 10.68% in the forecast period, owing to growing product enhancements and demand for these products. Growing demand for animal-derived food is anticipated to increase the requirement for animal immunodiagnostic tests over the forecast period. Clinical chemistry and immunodiagnostic kits are significant products used in veterinary diagnostics. This is because of the increase in demand for detecting general health profiles of animals. On the other hand, advancements in immunodiagnostic kits for veterinary use are expected to drive their adoption over the forecast period.

Testing category Insights

By testing category, the parasitology segment held the highest market share in 2024. This is due to the high prevalence of parasitic infections, which is probing for the need for increased parasitological tests. A 2020 study from Veterinary Parasitology inferred that heartworm prevalence could be as high as 28% in dog populations, while testing in cats found 19% with evidence of an active or previous infection. Tests for internal parasites typically involve examination of feces for parasite eggs. Whipworm, roundworm, Giardia, hookworm, and coccidia are the most frequently diagnosed internal parasites per the Companion Animal Parasite Council (CAPC) and are most commonly diagnosed by fecal examination.

The hematology segment is estimated to grow at the highest rate over the forecast period. The Complete Blood Count (CBC) test is the most common among the various hematological tests. CBC is recommended for companion animals in case of symptoms such as fever, vomiting, diarrhea, weakness, or anorexia. CBC details the pet's infection, blood clotting ability, hydration status, anemia, and immune system response. With recent product advancements and increased use of in-clinic hematology tests, coagulopathy can be identified with simple activated clotting time, partial thromboplastin time, and prothrombin time tests. Thus, the rising adoption of these devices at vet clinics is expected to propel segment growth.

Indication Insights

By indication, the infectious disease segment held the highest market share in 2024. This can be attributed to the stark rise in contagious diseases among companions and livestock animals. For example, A devastating and highly transmissible viral disease affecting cattle, foot, and mouth (FMD) has a substantial financial impact. Cattle, pigs, sheep, goats, and other ruminants with cloven hooves are susceptible to the disease. The disease is thought to affect 77% of the world's livestock population and populations in Africa, the Middle East, Asia, and a small portion of South America, according to the World Organization of Animal Health (WOAH).

The general ailments segment is estimated to show the highest CAGR over 2025-2030. This can be attributed to an increase in diagnostic companies entering the market with innovative technologies to determine animal diseases. For instance, the Lab on a Chip technology analyzes electrolytic imbalance in the body fluids such as blood, urine, and milk. Similarly, IDEXX Laboratories offers a broad range of products integral to this market, widely used in key regions such as North America, Europe, Asia Pacific, Africa, and the Middle East.

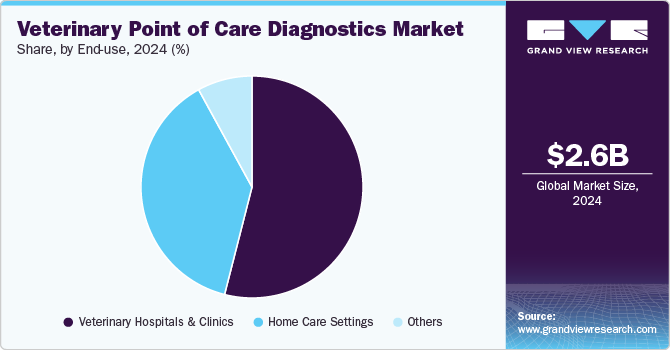

End-use Insights

Veterinary hospitals & clinics segment led the market in 2024. Because point-of-care diagnostics yield answers quickly and allow for prompt treatment decisions, they are extensively used in veterinary clinics and hospitals. Minimizing the requirement for independent laboratories shortens turnaround times and enables veterinarians to attend to patient needs quickly. On-site testing's speed and convenience increase workflow overall, resulting in faster diagnosis and better patient care. Furthermore, point-of-care diagnostics provide prompt interventions, which are essential in emergencies and tracking long-term medical issues in animals.

Point-of-care diagnostics' ease of use and comfort make them highly likely to be adopted in homecare settings and are estimated to register the highest CAGR. The development of portable testing instruments has made it possible for people to keep an eye on their health or the health of their pets from the comfort of their homes, negating the need for frequent trips to veterinary clinics or other healthcare facilities. Ease of use and promptness of the results enables pet owners to take charge of their animals' health, encouraging early detection and preventative therapy. This move toward home-based diagnostics fits into a larger pattern of decentralized healthcare, improving pets' general health by prompt and practical observation.

Sample type Insights

By sample type, the blood/plasma/serum segment held the highest market share in 2024. Because blood, plasma, and serum samples provide valuable information about an animal's health, they are commonly used in veterinary point-of-care diagnostics. These samples contain biomarkers that represent a variety of physiological factors, making it feasible to assess both overall health and the presence of specific illnesses minimally invasively and swiftly.

Urine segment is growing at the fastest rate over the forecast period. This sample type is used in the process of urinalysis, which is based on the evaluation of constituents of urine. It is an easy-to-use, cost-effective, and key initial diagnostic test. Complete urine analysis includes the examination of turbidity, volume, color, odor, pH, protein, glucose, specific gravity, ketones, blood, epithelial cells, casts, crystals, organisms, erythrocytes, and leukocytes.

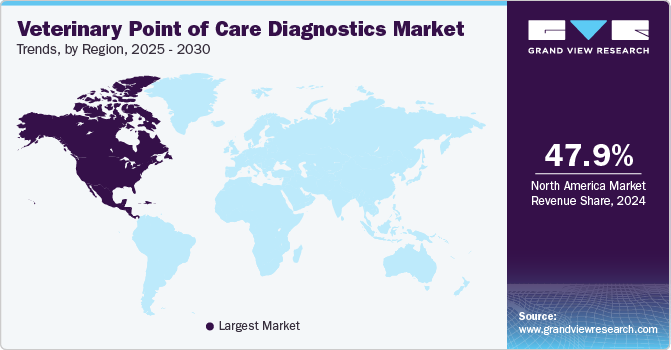

Regional Insights

North America's veterinary point-of-care diagnostics market held the largest share of 47.93% of the global market in 2024, attributed to the presence of significant animal healthcare companies locally. Real-time diagnosis is now possible due to improvements in the veterinary healthcare infrastructure in the U.S. and Canada. This is expected to stimulate R&D and facilitate the creation of new products. The region's growing veterinary clinic and veterinarian population is also fueling the market's expansion. For instance, the American Veterinary Medical Association (AVMA) estimates that there will be approximately 121,461 veterinarians in the United States in 2021. The market is highly competitive, with many large- and small-scale players. Most companies focus on R&D efforts. Mergers, acquisitions, collaborations, and partnerships to achieve a more significant market share

Rising awareness about animal hygiene & health, coupled with an increasing number of pet owners, is likely to accelerate the U.S. Humanization of pets can also drive market growth across the country. Government organizations, such as the UN Food and Agriculture Organization, are actively supporting training programs to create awareness among field practitioners. Increasing pet and livestock animal populations is expected to boost the demand for veterinary healthcare services, such as diagnostic kits, further propelling the overall expenditure on pets.

Europe Veterinary Point Of Care Diagnostics Market Trends

Europe accounted for the second-largest market share in 2024. The rapid adoption of advanced technologies in blood gas analyzers, growing ownership of companion animals, increasing expenditures on animal welfare, and raising awareness about animal health are some of the major drivers of the regional market. The European Medicines Agency (EMA) and its regulatory network partners have identified an action plan to improve the availability of animal medicines and diagnostics tools & kits in Europe. Some action plans are being executed in the interest of animal & public health and welfare. The EMA has undertaken several initiatives to encourage timely access to animal medicines and products in the European market and respective countries. The rising number of pets in the region is expected to boost market growth.

The continuous regulatory oversight over the country's veterinary sector primarily drives the UK market. This ensures the minimization of malpractices and the maximum benefit to animal owners. For instance, in March 2024, the Competition & Markets Authority of the UK launched a formal market investigation into the veterinary sector owing to rising concerns about weak competition, potential overcharging for veterinary medicines, and an outdated regulatory framework. The initial review included over 56,000 responses from the public and the industry, revealing that pet owners have incomplete information to make informed decisions and that large corporate groups might reduce choice and weaken competition.

The willingness of pet owners to opt for veterinary treatments, such as vaccinations, supplements, and diagnostic tests, for general ailments and diseases is improving the lives of pets and driving the market in Spain. Moreover, the increase in pet ownership has also fueled the growth of the veterinary POC diagnostic market. In addition, increasing initiatives undertaken by the Spanish government and non-government organizations in the field of veterinary health and increasing awareness among pet owners about animal health are driving the market in Spain.

Asia Pacific Veterinary Point Of Care Diagnostics Market Trends

The veterinary point-of-care diagnostics market is expected to register the highest growth rate in Asia Pacific due to several factors. Firstly, the region has a rising awareness and concern for animal health and well-being, leading to an increased demand for veterinary services. In addition, the growth of the pet population, urbanization, and a high livestock animal population in the region contribute to a higher willingness to invest in veterinary care. The need for rapid and on-the-spot diagnostics is emphasized in regions with large rural areas where access to centralized veterinary laboratories may be limited. As the veterinary industry evolves and technology becomes more accessible, Asia Pacific presents a significant market for adopting point-of-care diagnostics in veterinary care.

Advancements in technologies to improve animal care and medical care, along with the growing adoption of pets and demand for practical solutions to maintain their health, accelerate the market growth. Accordingly, the market is illustrated to observe a notable increase since veterinary point-of-care diagnostic tools help diagnose and detect any diseases or general ailments occurring in animals. Furthermore, the increasing number of veterinarians and rising income among people in developed countries will be commended for the market.

Latin America Veterinary Point Of Care Diagnostics Market Trends

The Latin America veterinary POC market includes the following countries: Brazil and Argentina. Technological developments are driving the market, the growing pet population and humanization, the need to reduce antimicrobial resistance, and the growth of service offerings by vet clinics. Furthermore, the market has been impacted by the global trend of digitalization in healthcare. Companies are investing in product development to improve testing accuracy, validate devices, broaden test menus, and automate as much of the process as feasible, lowering the difficulty of using these devices.

The increasing frequency of zoonotic illnesses among companion & livestock animals, growing demand for rapid diagnosis of these diseases, and advantages of POC tests over laboratory analysis will likely drive Brazil's market over the forecast period. Furthermore, the increasing pet population can further drive the market, as people are more aware of their pet conditions during these years. According to a Euromonitor survey, Brazilians own approximately 36 million puppies and small dogs, the most of any country in the world. On the other hand, the high cost of veterinary imaging tools is hampering the market growth.

MEA Veterinary Point Of Care Diagnostics Market Trends

Technological and medical developments are significantly impacting animal care in the MEA. The market is likely to be driven by the increasing adoption of pets and the demand for better healthcare solutions. As a result, the market is expected to increase significantly as veterinary POCs aid in detecting infections, which has been vital amid the pandemic. In addition, the market can benefit from an increase in the number of veterinary doctors and the average income of people in developed economies. Furthermore, as the number of zoonotic diseases in animals and their transmission to people grows, so does the requirement for better diagnostics.

The primary factor driving Saudi Arabia's veterinary POC diagnostics market is the increased demand for pet insurance amid growing pet adoption. Furthermore, rising disposable income, increasing demand for animal-derived foods, and growing investments in animal healthcare spending will likely drive the country's market over the forecast period. The market is also expected to grow due to an increase in the prevalence of foodborne diseases in animals and zoonotic infections.

Key Veterinary Point Of Care Diagnostics Company Insights

The market is relatively competitive owing to the presence of many key manufacturers. This is expected to intensify the competition in the coming years. Some of the key players in the market are Zoetis, IDEXX, Virbac, Heska Corporation, Thermo Fisher Scientific, Inc., FUJIFILM Corporation, and others. To strengthen their market presence, these players are undertaking various strategic initiatives, such as partnerships, sales & marketing activities, mergers & acquisitions, product expansion, and product launches.

Key Veterinary Point Of Care Diagnostics Companies:

The following are the leading companies in the veterinary point of care diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories, Inc.

- Zoetis

- Heska Corporation (Antech)

- Virbac

- Thermo Fisher Scientific, Inc.

- Mindray

- Woodley Equipment Company Ltd

- FUJIFILM Corporation

- Getein Biotech

Recent Developments

-

In December 2024, Zoetis announced the launch of Vetscan OptiCell, a point-of-care hematology analyzer, at the Veterinary Meeting & Expo (VMX).

-

In November 2023, Antech Diagnostics opened its brand-new reference laboratory in Warwick. The launch marks the arrival of Antech’s first complete and flexible portfolio in the UK, which includes the reference lab, in-house diagnostics, imaging, and software solutions.

-

In November 2023, Adopt a Pet and Zoetis partnered to improve access to care for shelter pets and deploy educational resources for shelter veterinary healthcare teams and pet owners nationwide.

-

In June 2023, IDEXX Laboratories, Inc. announced the launch of the first veterinary diagnostic test for detecting kidney injury in cats and dogs. The Test panels evaluating kidney health will incorporate the IDEXX Cystatin B Test, providing fresh clinical information for an anticipated two million patient visits yearly. Later in the year, these tests were conducted at IDEXX Reference Laboratories in the United States and Canada. The test is scheduled to be introduced in Europe in 2024.

Veterinary Point Of Care Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.82 billion |

|

Revenue forecast in 2030 |

USD 4.62 billion |

|

Growth rate |

CAGR of 10.38% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Animal type, product, testing category, indication, sample type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

US; Canada; UK; Germany; France; Italy; Spain ; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

IDEXX Laboratories, Inc.; Zoetis; Heska Corporation (Antech); Virbac; Thermo Fisher Scientific, Inc.; Mindray; Woodley Equipment Company Ltd; FUJIFILM Corporation; Getein Biotech |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Veterinary Point Of Care Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary point of care diagnostics market report based on animal type, product, testing category, indication, sample type, end-use, and region:

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Livestock Animals

-

Cattle

-

Swine

-

Poultry

-

Others

-

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumables, Reagents, & Kits

-

Instruments & Devices

-

-

Testing Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hematology

-

Diagnostic Imaging

-

Bacteriology

-

Virology

-

Cytology

-

Clinical Chemistry

-

Parasitology

-

Serology

-

Others

-

-

Sample Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infectious Disease

-

General Ailments

-

Others

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blood/Plasma/Serum

-

Urine

-

Fecal

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary point of care diagnostics market size was estimated at USD 2.55 billion in 2024 and is expected to reach USD 2.82 billion in 2025.

b. The global veterinary point of care diagnostics market is expected to grow at a compound annual growth rate of 10.38% from 2025 to 2030 to reach USD 4.62 billion by 2030.

b. North America dominated the veterinary PoC diagnostics market with a share of about 47.93% in 2024. This is attributable to the presence of key market players and advanced veterinary healthcare infrastructure in the U.S. and Canada.

b. Some key players operating in the veterinary PoC diagnostics market include IDEXX Laboratories, Inc., Zoetis, Heska Corporation (Antech), Virbac, Thermo Fisher Scientific, Inc., Mindray, Woodley Equipment Company Ltd, FUJIFILM Corporation, Getein Biotech

b. Key factors that are driving the veterinary point of care diagnostics market growth include technological advancements, rising pet population & humanization, the need to reduce antimicrobial resistance, and expansion of service offerings by vet clinics.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."