- Home

- »

- Animal Health

- »

-

Veterinary Pharmacovigilance Market, Industry Report, 2030GVR Report cover

![Veterinary Pharmacovigilance Market Size, Share & Trends Report]()

Veterinary Pharmacovigilance Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Software, Services), By Type (In-house), By Product (Anti-Infective) By Animal Type (Dogs, Cats), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-052-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Pharmacovigilance Market Trends

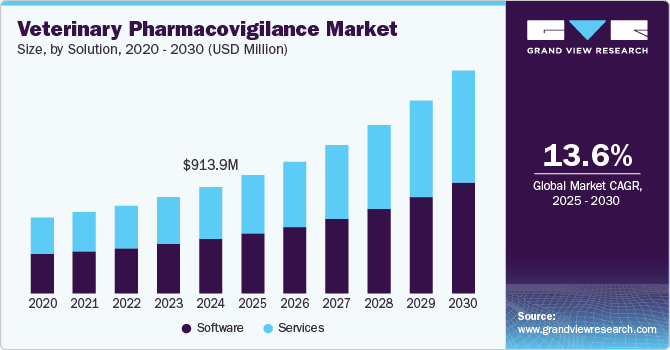

The global veterinary pharmacovigilance market size was valued at USD 913.9 million in 2024 and is expected to grow at a CAGR of 13.6% from 2025 to 2030. This growth is attributed to the increasing number of veterinary medicinal product approvals, awareness and demand for veterinary pharmacovigilance reporting, the need for regulatory compliance, and initiatives by public & private market participants. Furthermore, the focus on continuous signal management, maintenance of a pharmacovigilance master file by the marketing authorization holder, and pharmacovigilance inspections by regulators also contribute to the market growth.

Veterinary pharmacovigilance systematically monitors and analyzes adverse drug reactions and product defects related to veterinary medicines. This practice is crucial for ensuring the safety and efficacy of these drugs for both animals and humans. The veterinary pharmacovigilance market is witnessing substantial growth, driven by a growing demand for pet care and livestock health, largely due to increased pet ownership and heightened consumer awareness of animal health. There is a greater need for rigorous surveillance and assessment of veterinary pharmaceuticals, making veterinary pharmacovigilance indispensable in maintaining the safety of medications administered to animals.

In addition, regulatory bodies globally are imposing stricter guidelines for the authorization and post-market investigation of animal medications, which has led to a surge in demand for veterinary pharmacovigilance services to safeguard compliance with these developing regulations. This presents numerous business opportunities for companies in the animal health and pharmaceutical sectors. Investing in advanced data collection and analysis technologies can provide a competitive edge, while expanding service offerings to include consulting and regulatory compliance support can attract a wide-ranging customer base.

Furthermore, technological advancements are also driving demand for veterinary pharmacovigilance. The integration of AI, machine learning, and data analytics enhances efficiency and accuracy in adverse event monitoring, allowing for quicker identification of drug-related issues. Moreover, public awareness regarding the safety of veterinary pharmaceuticals has increased, prompting consumers to seek assurance through attentive monitoring and assessment. This growing consciousness has led regulatory bodies and industry companies to prioritize drug safety, further fueling the growth of the veterinary pharmacovigilance market. For instance, in 2024, World Health Organization (WHO) announced that the Programme for International Drug Monitoring expanded its network significantly, now comprising 159 full members and 22 associate members, demonstrating a worldwide commitment to improving pharmacovigilance methodologies. Furthermore, regulatory bodies in major regions, such as the European Union, have convened multiple meetings to assess and monitor medicinal product safety, reflecting ongoing efforts to enhance drug safety standards.

Solution Insights

The software segment dominated the global veterinary pharmacovigilance industry and accounted for the largest revenue share of 51.0% in 2024, primarily driven by technological advancements, such as AI and machine learning, which enhance efficiency and accuracy in monitoring adverse drug reactions. In addition, cloud-based solutions provide real-time data access and collaboration, improving pharmacovigilance operations. These technologies streamline data collection, analysis, and reporting, bolstering consumer and regulatory confidence.

The services segment is expected to grow at a CAGR of 14.1% over the forecast period, owing to the increasing demand for real-time monitoring and the broadening of service portfolios to cover various animal species. In addition, technological integration, such as AI and data analytics, enhances monitoring efficiency and accuracy. Furthermore, regulatory compliance and international standard alignment drive growth, as companies seek comprehensive services to ensure drug safety and maintain compliance with evolving regulations.

Type Insights

The in-house segment led the market with the largest revenue share of 54.4% in 2024. This growth is attributed to the increased investment in digitalization and data management systems. Furthermore, companies prioritize training and development of in-house teams to enhance expertise and ensure compliance with evolving regulations. Moreover, this approach allows for better control over pharmacovigilance processes, improving efficiency and accuracy in monitoring and reporting adverse drug reactions.

Contract outsourcing is expected to grow at a lucrative CAGR of 14.7% over the forecast period, owing to the increasing number of animal health companies and product approvals. Small and medium-sized companies outsource pharmacovigilance operations to save time and costs. In addition, this trend is also driven by the need for specialized services that can handle complex regulatory requirements, allowing companies to focus on core operations while ensuring compliance and safety standards.

Product Insights

The anti-infective segment held the highest market share of 45.4% in 2024, driven by increased scrutiny of antibiotic use due to antimicrobial resistance. In addition, stricter regulations on antibiotic prescriptions necessitate robust monitoring, enhancing pharmacovigilance demand. Furthermore, the prevalence of infectious diseases in livestock and pets also contributes to this growth, as ensuring safe drug use becomes a priority. This heightened focus on safety and compliance fuels the expansion of pharmacovigilance services for anti-infective.

Biologics are projected to grow at the fastest CAGR of 14.4% from 2025 to 2030, due to increased R&D activities and new veterinary vaccine launches. In addition, rising demand for advanced treatments and the trend of pet humanization drive investment in biologics. This fuels market expansion as pet owners increasingly invest in specific and accurate treatments, securing significant revenues. Moreover, the complexity of biologics also requires comprehensive pharmacovigilance, further driving the demand for specialized monitoring services in this segment.

Animal Type Insights

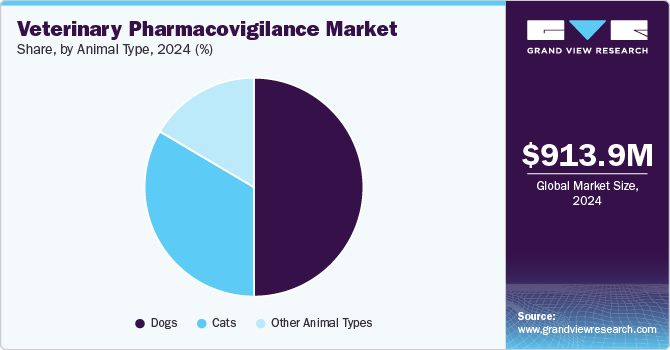

Dogs in veterinary pharmacovigilance industry held the dominant position with the highest revenue share of 50.0% in 2024, attributed to the increased pet ownership and the humanization of dogs. This trend leads to higher spending on dog health and wellness, including advanced treatments and monitoring. As a result, there is a greater need for pharmacovigilance services to ensure drug safety and compliance. Common canine health issues require robust monitoring, further fueling the demand for specialized pharmacovigilance services in this segment.

The cats segment is expected to grow at a significant CAGR over the forecast period, primarily driven by rising pet ownership and the demand for specialized feline care. In addition, advances in veterinary medicine drive investment in pharmacovigilance to ensure safer drug use and compliance with evolving regulations. This supports the overall well-being of cats and their owners. Furthermore, the increasing complexity of feline health treatments also necessitates comprehensive pharmacovigilance, contributing to market expansion and the need for precise monitoring services.

Regional Insights

North America veterinary pharmacovigilance market dominated the global market and accounted for the largest revenue share of 40.0% in 2024. One of the key drivers is the growing regulatory environment governing the use of veterinary drugs. For instance, in August 2024, Mexico launched a new veterinary-pharmacovigilance system to monitor and prevent adverse reactions from veterinary drugs, enhancing animal medication safety and food production. The system involves reporting adverse events and mandatory participation from the veterinary pharmaceutical industry. In addition, the FDA's Center for Veterinary Medicine (CVM) accepts electronic submission of adverse events for veterinary drugs through the Rational Questionnaire (RQ) in the Safety Reporting Portal (SRP) and the Electronic Submissions System (ESS). This continuous monitoring of approved NADAs and ANADAs enables the FDA to identify potential problems with the safety and efficacy of approved and marketed new animal drugs as well as potential product/manufacturing problems.

U.S. Veterinary Pharmacovigilance Market Trends

The U.S. veterinary pharmacovigilance market led the North American market and accounted for the largest revenue share in 2024, driven by a strong pet care infrastructure and evolving regulatory oversight. In addition, increased awareness of veterinary pharmacovigilance reporting and real-time monitoring of drug safety contribute to growth. Furthermore, high pet ownership and demand for advanced veterinary care fuel expansion. Moreover, the market benefits from technological advancements and specialized services, ensuring compliance and safety in veterinary drug use.

Asia Pacific Veterinary Pharmacovigilance Market Trends

Asia Pacific veterinary pharmacovigilance market is expected to grow at a lucrative CAGR of 15.4% over the forecast period, owing to the increasing awareness among animal owners about the importance of animal health and the potential risks associated with the use of veterinary drugs. In addition, as pet ownership rates continue to rise in the region, more and more people are seeking high-quality veterinary care for their animals, and are therefore more likely to report any adverse effects or reactions to medications.

The veterinary pharmacovigilance market in China dominated the Asia Pacific market and accounted for the highest revenue share in 2024, due to increasing awareness of animal health and potential risks associated with veterinary drugs. In addition, expanding pet ownership and demand for high-quality veterinary care drive demand for pharmacovigilance services. Furthermore, regulatory approvals and collaborations with international companies contribute to market expansion. Moreover, china's large animal population and increasing investment in veterinary infrastructure further fuel the growth of pharmacovigilance services.

Europe Veterinary Pharmacovigilance Market Trends

Europe veterinary pharmacovigilance market is expected to grow significantly over the forecast period, owing to robust regulatory guidelines and continuous signal management. In addition, the region's strong focus on animal health and increasing veterinary medicinal product approvals fuel market growth. Furthermore, European countries' emphasis on drug safety and pharmacovigilance best practices supports the expansion of specialized services, enhancing the overall quality of veterinary care. European Union's pharmacovigilance system for veterinary medicines lay emphasis on continuous monitoring of safety and efficacy, including signal management and maintaining a pharmacovigilance master file. Moreover, the EU has shifted towards continuous signal management, enhancing scientific rigor and reducing administrative burdens to ensure drug safety and best practices in pharmacovigilance.

The growth of the veterinary pharmacovigilance market in the UK is expected to be driven by the stringent regulatory frameworks and increased awareness of drug safety. The emphasis on compliance with European standards maintains high pharmacovigilance levels. Furthermore, growing pet ownership and demand for quality veterinary care drive the need for robust monitoring services. Moreover, the country’s strong veterinary industry and focus on animal health also contribute to market growth and the adoption of advanced pharmacovigilance practices.

Key Veterinary Pharmacovigilance Company Insights

The veterinary pharmacovigilance industry is a highly competitive and involves monitoring the safety and efficacy of veterinary drugs. The industry is driven by the need to ensure that animal health products are safe for consumption by animals and that they do not pose any risks to human health. Competition in the market is expected to remain intense as companies strive to gain a competitive advantage by offering innovative solutions and offering competitive prices. Other strategies deployed by market players include partnerships, expansions, mergers & acquisitions, among others.

-

Accenture provides comprehensive pharmacovigilance services to pharmaceutical companies, including those manufacturing veterinary medicines. The company deals in end-to-end safety solutions, offering consulting, technology, and operations support. Accenture operates in the services segment, delivering veterinary vigilance services that include case processing, signal detection, and regulatory intelligence.

-

Ennov specializes in software solutions for pharmacovigilance, including veterinary applications. It deals in electronic data capture and management systems, facilitating efficient monitoring and reporting of adverse drug reactions. Ennov operates in the software segment, providing tools that streamline pharmacovigilance processes, ensuring compliance with regulatory requirements and enhancing drug safety in veterinary care.

Key Veterinary Pharmacovigilance Companies:

The following are the leading companies in the veterinary pharmacovigilance market. These companies collectively hold the largest market share and dictate industry trends.

- ArisGlobal

- Accenture

- Ennov

- Sarjen Systems Pvt. Ltd.

- Pharsafer Associates Limited

- Knoell

- Biologit

- Indivirtus

- Azierta Contract Science Support Consulting

- Oy Medfiles Ltd.

Recent Developments

-

In February 2025, Merck Animal Health's injectable formulation of BRAVECTO (fluralaner) has been awarded the 2024 Best New Companion Animal Product by S&P Global Animal Health. This parasiticide offers year-long flea and tick protection for dogs with a single dose. Approved in over 30 countries (excluding the US as of February 2025), it ensures continuous protection, addressing potential compliance issues with monthly treatments. The development and monitoring of BRAVECTO also involves veterinary-pharmacovigilance to ensure the safety and efficacy of the product.

-

In July 2024, Dechra Pharmaceuticals PLC acquired Invetx, a biotech company specializing in protein-based therapeutics for companion animals, particularly monoclonal antibodies (mAbs). This acquisition provided Dechra with an innovative pipeline of products for dogs and cats, entry into the mAb market, and new technology capabilities. The goal was to create more effective, safe, and affordable treatments with fewer side effects.

-

In June 2024, The NOBIVAC NXT Canine Flu H3N2, the first RNA-particle technology vaccine for canine influenza by Merck Animal Health was approved by The USDA. This innovative vaccine protects dogs against the prevalent H3N2 strain, utilizing a nonadjuvanted, low-volume dose. As part of ongoing veterinary-pharmacovigilance efforts, Merck ensures the safety and efficacy of this groundbreaking vaccine.

Veterinary Pharmacovigilance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.01 billion

Revenue forecast in 2030

USD 1.91 billion

Growth rate

CAGR of 13.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Solution, type, product, animal type, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

ArisGlobal; Accenture; Ennov; Sarjen Systems Pvt. Ltd.; Pharsafer Associates Limited; Knoell; Biologit; Indivirtus; Azierta Contract Science Support Consulting; Oy Medfiles Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Pharmacovigilance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary pharmacovigilance market report based on solution, type, product, animal type, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Contract Outsourcing

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Anti-Infective

-

Other Product

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animal Types

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.