- Home

- »

- Animal Health

- »

-

Veterinary Parasiticides Market Size And Share Report, 2030GVR Report cover

![Veterinary Parasiticides Market Size, Share & Trends Report]()

Veterinary Parasiticides Market (2024 - 2030) Size, Share & Trends Analysis Report By Animal Type (Production, Companion) By Product, By Route of Administration, Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-328-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Parasiticides Market Summary

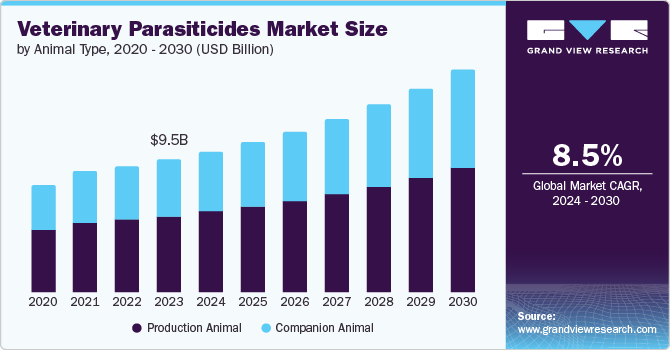

The global veterinary parasiticides market size is estimated to be at USD 9.54 billion in 2023 and is expected to reach USD 16.63 billion by 2030, growing at a CAGR of 8.50% from 2024 to 2030. Key market growth drivers include the rise in animal parasitic infections, the need for a regulated approach towards parasiticide use, the rise in the animal medicalization rate, and the demand for pathogen-free meat products.

Key Market Trends & Insights

- North America veterinary parasiticides market accounted for the largest revenue share in 2023.

- The veterinary parasiticides market in the U.S. is driven by the constantly evolving regulatory guidelines in the country.

- By animal type, the production animal segment held the dominant revenue share of 58.21 in 2023.

- By product, the ectoparasiticides segment dominated the market with a revenue share of 48.81% in 2023.

- By route of administration, topical segment dominated the market with a share of over 40% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.54 Billion

- 2030 Projected Market Size: USD 16.63 Billion

- CAGR (2024-2030): 8.50%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In veterinary medicine, parasiticide medications are frequently used to prevent and cure many parasites, such as worms, fleas, and ticks. Utilizing them on animals demonstrates benefits for human health by addressing diseases with zoonotic origins. The industry is witnessing high adoption of parasiticides among various species like cattle, poultry, swine, dogs, cats, and horses due to the increasing prevalence of parasitic infections among pets. This rise is leading to an increase in demand for parasiticides like ectoparasiticides, endoparasiticides, and endectocides.For instance, as per a January 2023 study published by the National Center for Biotechnology Information (NCBI), gastrointestinal parasites are commonly found globally in the cattle population. Out of the total analyzed cattle fecal samples, more than half, i.e., 67.2%, were infected with parasites like Strongyle, Fasciola, and Paramphistomum. Most of the cattle in the study were infected with Strongyle parasites, with a prevalence rate of 18.25%. This high occurrence of parasites in the gastrointestinal tract (GIT) of important livestock animals like cattle underscores the significance of strategically using parasiticides for deworming and effective management programs to eradicate these infections.

Furthermore, another study was conducted in the ASEAN country of Indonesia, exploring the prevalence of ectoparasites in small ruminants. This study was published in the Veterinary Sciences Journal in April 2024 and inferred that over 97.85% of the small ruminants like sheep & goats were infected with external parasites. This alarming number also points to a need for farmer education concerning appropriate medications and timely control measures to combat these infections. If left untreated, these infections are at threat of being transmitted to humans, causing public health risks on a much larger scale.

Additionally, globally, a high rate of adoption of pets can be seen. These pets carry a variety of internal as well as external parasites. These parasites pose a threat to the pet’s health as well as to the owner’s health. For example, an April 2024 MDPI study estimated that among the dog population in Serbia, over 62.6% suffer from endoparasites like intestinal parasites. The most prevalent species of these parasites are Cystoisospora spp. (9.2%), Giardia intestinalis (11.8%), Toxocara canis (11.5%), etc. Dogs being the most popular pets globally, such infections pose a threat of infection spreading to the human owner. Moreover, among cats, ectoparasites are very common globally; prevalence estimated suggests that over 63% of the cats are infected with these parasites, inferred from the March 2023 study from Psyche Journal of Entomology.

There are three types of parasiticides currently used in animals: ectoparasiticides (external parasites), endoparasiticides (internal parasites), and endectocides (external and internal parasites). Endoparasiticides, endectocides, and ectoparasiticides are becoming progressively more common due to the rising incidence of parasitic infections in various animal species. Thus, the market for veterinary parasiticides will be driven by the rising need for efficient as well as strategies for management treatments for eliminating these infections.

Market Concentration & Characteristics

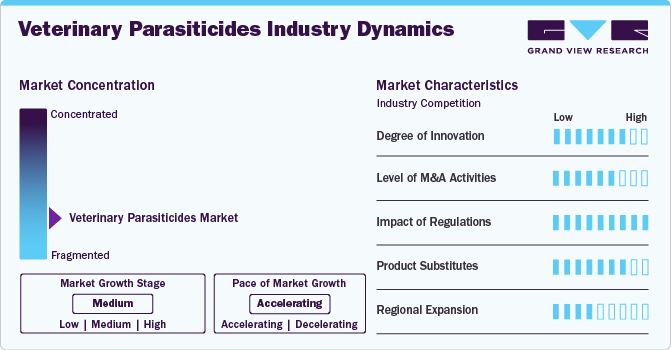

A high level of product innovation can be seen in this industry, with researchers worldwide developing novel solutions to combat parasitic infections in animals. For instance, researchers from Embrapa Goats and Sheep, a veterinary research organization from Brazil, developed a novel vaccine to combat H.contortus worms that cause verminosis in sheep & goats. The Moredun Research Institute of the UK has manufactured this product.

The market has a moderate to high level of mergers and acquisitions. This indicates that market players are attempting to consolidate the industry by acquiring companies or their business units.

The industry is currently experiencing high volatility regarding regulations. Despite the long-term use of parasiticides, experts are now reassessing their use for the treatment of parasitic infections in animals. Prominent regulatory bodies across the globe (US, UK, etc.) are reanalyzing the use of these products owing to their evident negative impact on the environment and reports of antiparasitic resistance among the animals. Hence, the impact of regulations in the upcoming years is expected to be high.

The market is currently dominated by a few leaders, such as Zoetis, Boehringer Ingelheim, Dechra Pharmaceuticals plc, and Merck & Co. Inc. However, many smaller companies are emerging with their products to challenge these established players. Moreover, when it comes to countries, alternative forms of medicines are often also employed to treat animal diseases.

The market is experiencing low to moderate regional expansion. Manufacturers are focusing on expanding their regional presence by introducing their product portfolios in previously untapped countries, allowing them to establish a monopoly in that region’s market.

Animal Type Insights

The production animal segment held the dominant revenue share of 58.21 in 2023. The use of veterinary parasiticides in the production of animals has attracted more attention owing to the increased focus on food safety and sustainability on a global scale. This is because meeting the dietary needs of the growing human population, which mainly relies on animal products for protein, necessitates proper healthcare and prevention of diseases like parasitic infestations. The use of parasiticides to prevent and treat parasite infections and adopting production animals have been influenced by higher spending on animal healthcare, especially in developed countries.

The companion segment is anticipated to grow at the fastest CAGR from 2024 to 2030. This can be driven by increased companion animal ownership, awareness, and demand for efficient animal care due to associated health benefits. Consequently, pets like dogs & cats are increasingly being humanized and considered part of a family, increasing spending on their health. To maintain the well-being of companion animals, the adoption of pharmaceuticals like parasiticides is increasing, thereby serving as a driver for the segment.

Product Insights

The ectoparasiticides segment dominated the market with a revenue share of 48.81% in 2023. Ectoparasiticides are preferred over endectocides for treating external parasites like ticks, fleas, and lice due to their targeted action and cost-effectiveness. These products come in various formulations like sprays, powders, ointments, creams, and spot-on treatments. These multiple formulations give these products the advantage over others, as animal owners and veterinary professionals can easily choose the best formulation to target animal disease. Additionally, ectoparasiticides reduce the risk of adverse effects on non-target organisms and also animals as they are used externally and do not enter directly into their body. Another factor driving this segment is the high occurrence of external parasites compared to internal parasites among both livestock and companion animals.

Route of Administration Insights

Topical segment dominated the market with a share of over 40% in 2023. This can be attributable to the fact that this route of administration is primarily used to treat external parasites like ticks, fleas, and worms in animals through ectoparasiticides. The external application ensures that they deal only with the external parasites on the animal's skin and fur and do not directly interact with other essential animal organisms, minimizing the possible side effects. Also, as opposed to other delivery modes, topical products come in various formulations like creams, ointments, sprays, shampoos, and powders, increasing the versatility of their use.

The injectable segment is expected to grow the fastest from 2024 to 2030. This delivery mode sends the medicine directly into the body of the animals to the target site, ensuring quicker drug action and higher drug bioavailability. This route of administration is primarily used to treat internal parasites.

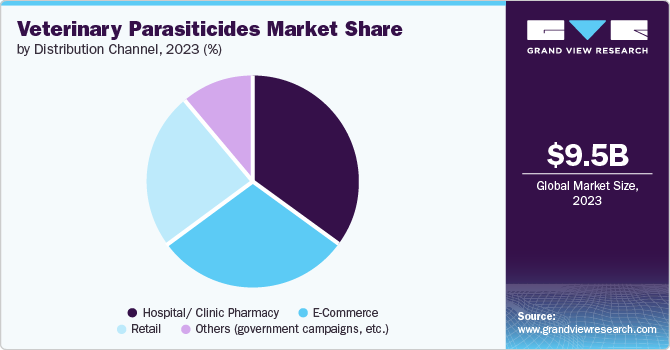

Distribution Channel

The hospital/clinic pharmacy segment dominated the market with revenue highest share in 2023. This can be attributable to the availability of many parasiticides in these settings. Many animals like horses, dogs, cats, and livestock visit these hospitals/clinics to treat various diseases. After the consultation and diagnosis, the veterinarian can prescribe the required medications to the animal's owners, which they can easily procure from the pharmacy at the hospital or clinic. With increasing animal patient volume, these pharmacies are always stocked with many medications and other products that the animals might need. This makes it convenient for the animal owners to procure the required drugs immediately.

The e-commerce segment expected to grow at the highest CAGR from 2024 to 2030. Many advantages, including more accessibility for patients unwilling to buy pharmaceuticals from retail or hospital pharmacies, can be attributed to this. Since medications can be ordered in advance, these channels additionally make it simpler to maintain a constant supply of drugs. It is expected that factors like these will boost demand for e-commerce throughout the span of the forecast period. Growing pet adoption rates and technological developments are the primary growth factors. The worldwide smartphone consumer base continues to increase due to rising internet usage since it improves client satisfaction. Therefore, the acceptance of e-commerce websites has increased due to the growing integration of instant purchasing alternatives, growing smartphone adaptability, and user-friendly web pages.

Regional Insights

In 2023, North America veterinary parasiticides market accounted for the largest revenue share in 2023 and is expected to grow at a significant CAGR from 2023 to 2030. This is attributed to the fact that the region is among the top meat-producing countries and has the highest pet adoption rate in the world. These factors contribute to the region's rise in demand for parasiticide products.

U.S. Veterinary Parasiticides Market Trends

The veterinary parasiticides market in the U.S. is driven by the constantly evolving regulatory guidelines in the country. Authorities in the country are actively involved in tackling constantly evolving issues in animal health. For instance, the American Veterinary Medical Association (AVMA), in June 2022, developed guidelines & education programs for veterinary professionals amidst the growing antiparasitic resistance among livestock populations like sheep, goats, cattle, & pigs and also companion animals like dogs, cats, and horses. These guidelines highlight the measures to prevent antiparasitic resistance in animals.

Europe Veterinary Parasiticides Market Trends

The Europe veterinary parasiticides market is anticipated to expand rapidly due to researchers promoting the controlled use of parasiticides among animals owing to their environmental impact. They are actively promoting a proper Environmental Risk Assessment (ERA) of veterinary parasiticides during product authorization to minimize the damage to the environment. This will drive the market in the region by promoting the use of sustainable and eco-friendly parasiticide products.

The veterinary parasiticides market in Germany is expected to grow owing to the increasing spread of animal parasitic infections in the country. Until 2011, parasitic infections like heartworm disease were absent in Europe, particularly Germany. But in the last decade, diseases like this have rapidly spread among animals across the country and the European region. This has boosted the demand for antiparasitic medications in the country, driving the market.

Asia Pacific Veterinary Parasiticides Market Trends

The Asia Pacific (APAC) veterinary parasiticides market is growing fastest due to growing initiatives to spread awareness about the diagnosis and treatment of veterinary parasitic infections. Recognizing the growing disease burden of parasitic infections and their zoonoses, the World Organization of Animal Health (WOAH) is actively arranging awareness initiatives to prevent and control parasitic infection zoonoses. The organization conducted two consecutive Tripartite seminars in 2018 and 2023. The discussion in these seminars is useful for regional countries to tackle the disease burden of parasitic infections among animals.

The veterinary parasiticides market in India is expected to grow at a CAGR of over 10% from 2024 to 2030. This is owed to the country's active involvement in solving animal health issues globally by promoting research and development into avenues like veterinary parasitology. For instance, in August 2023, the Tamil Nadu Veterinary & Animal Sciences University (TANUVAS) and the Indian Association for Advancement of Veterinary Parasitology (IAAVP) collaborated with World Association for Advancement of Veterinary Parasitology to conduct the first in any South Asian city the conference on veterinary parasitology. Over 400 delegates from 50 countries attended this conference.

Latin America Veterinary Parasiticides Market Trends

Latin America veterinary parasiticides market growth is driven by an increase in the prevalence of chronic livestock diseases. Another contributing aspect is the rising government funding for support in countries like Brazil. Some factors responsible for this region's rapid growth are untapped prospects, economic development, and increasing levels of awareness. Given that agriculture is a major industry in the area, animal husbandry techniques are becoming increasingly widespread, which promotes market development.

The veterinary parasiticides market in Brazil is expected to witness growth at a notable CAGR from 2024 to 2030. Growing research activities in the country drive the Brazilian market. For instance, in the January 2024 study by Oswaldo Cruz Institute (Fiocruz) and the State University of Maranhão (UEMA), seven new harmful parasites were discovered in aquaculture. The finding adds to the understanding of the biodiversity of these species and is therefore considered valuable to the study of parasitology. Furthermore, since these parasite infestations may prove lethal to livestock fish, the discovery has practical implications for the aquaculture industry in the region.

Middle East & Africa Veterinary Parasiticides Market Trends

The MEA veterinary parasiticides market is primarily driven by initiatives by global organizations to combat the parasitic infections and other veterinary that are plaguing the animals in the region. For instance, in September 2023, The Bill & Melinda Gates Foundation, Boehringer Ingelheim, GalvMed, and the UK Government Foreign Commonwealth jointly launched a partnership to combat the African animal trypanosomiasis (AAT) or Nagana. This is a highly prevalent parasitic infection in sub-Saharan Africa that affects millions of cattle every year. The joint venture aims to find a novel medical therapy to treat this parasite.

The veterinary parasiticides market in South Africa held a significant revenue share in 2023. Disease outbreaks among animals have continuously plagued the country in recent years. After the avian influenza outbreak in 2023, dogs in South Africa risk being exposed to Giardia parasites. According to April 2024 reports by News24, the Tokai region of the country has seen a rise in Giardiasis infection among pet dogs. The rise in disease outbreaks boosts the demand for veterinary medicines, driving the market to lucrative growth.

Key Veterinary Parasiticides Companies:

The following are the leading companies in the veterinary parasiticides market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Boehringer Ingelheim

- Merck & Co. Inc.

- Dechra Pharmaceuticals Plc.

- Elanco Animal Health

- Ceva Sante Animale

- Virbac

- Biogénesis Bagó

- Vetoquinol

- Himalaya Wellness

Recent Developments

-

In May 2024, Petmedica launched a new antiparasitic chewable tablets for dogs, Atrevia 360. These tablets protect the dogs against fleas, ticks, & mites (3 month protection; roundworms, lungworms, and heartworms (1 month protection).

-

In March 2024, a new type of flatworm has been discovered in California, U.S. which has the potential to be fatal for dogs. The flatworm parasite Heterobilharzia americana is frequently referred to as the liver fluke. It hadn't been documented further west earlier and had been primarily found in Texas and other Gulf Coast states. Canine schistosomiasis, a disease that affects the intestines and liver of dogs, is frequently caused due to this worm.

-

In September 2023, Dechra expanded its chicken & pigs product range by adding a new parasite medication, Fluboral. This product specifically targets GIT parasites like nematodes.

-

In July 2023, the US FDA approved Boehringer Ingelheim's NexGard PLUS chewable tablets. These tablets are applicable in dogs for combating parasites such as fleas, heartworm disease, ticks, etc. These are endectocides that have beef flavoring to enhance dog compliance and improve palatability.

-

In July 2023, Zoetis launched an endectocide known as Valcor. This injectable is used in cattle to combat over 35 different types of internal as well as external parasites.

Veterinary Parasiticides Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.19 billion

Revenue forecast in 2030

USD 16.63 billion

Growth rate

CAGR of 8.50% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zoetis; Boehringer Ingelheim; Merck & Co. Inc.; Dechra Pharmaceuticals Plc.; Elanco Animal Health; Ceva Sante Animale; Virbac; Biogénesis Bagó; Vetoquinol, Himalaya Wellness

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Parasiticides Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary parasiticides market report based on animal type, product, route of administration, distribution channel, and region.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animal

-

Cattle

-

Swine

-

Poultry

-

Others (sheep, goats, aquaculture, etc.)

-

-

Companion Animal

-

Canine

-

Feline

-

Equine

-

Others (turtles, fish, rabbit, etc.)

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ectoparasiticides

-

Endoparasiticides

-

Endectocides

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

Others (government campaigns, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the telemedicine market include Zoetis, Boehringer Ingelheim, Merck & Co. Inc., Dechra Pharmaceuticals Plc., Elanco Animal Health, Ceva Sante Animale, Virbac, Biogénesis Bagó, Vetoquinol and Himalaya Wellness.

b. Key factors that are driving the market growth include rise in parasitic infections among animals, need for regulated approach towards parasiticide use, rise in medicalization rate among animals, and rising demand for pathogen-free meat products.

b. The global veterinary parasiticides market size was estimated at USD 9.54 billion in 2023 and is expected to reach USD 10.19 billion in 2024.

b. The global veterinary parasiticides market is expected to grow at a compound annual growth rate of 8.50% from 2024 to 2030 to reach USD 16.63 billion by 2030.

b. In 2023, North America accounted for the largest veterinary parasiticides market share of 35.53% and is expected to grow at a significant CAGR over the forecast period. This is attributed to the fact that the region is among the top meat-producing countries and has the highest pet adoption rate in the world. These factors contribute to the region's rise in demand for parasiticide products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.