- Home

- »

- Animal Health

- »

-

Veterinary Oxygen Therapy Market, Industry Report, 2033GVR Report cover

![Veterinary Oxygen Therapy Market Size, Share & Trends Report]()

Veterinary Oxygen Therapy Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Veterinary Oxygen Concentrator, Accessories), By Animal (Small Animal, Large Animal), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-278-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Oxygen Therapy Market Summary

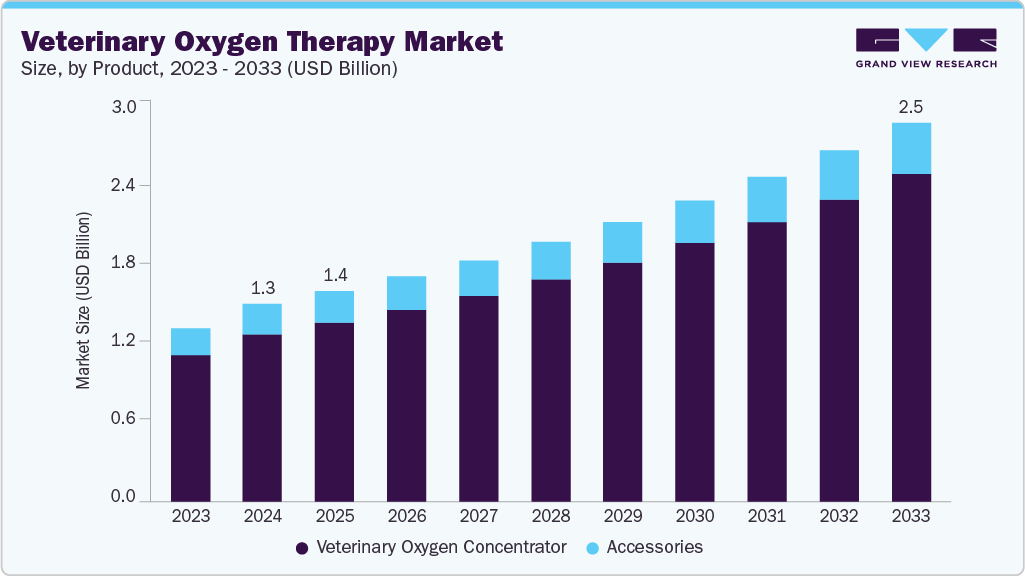

The global veterinary oxygen therapy market size was estimated at USD 1.29 billion in 2024 and is projected to reach USD 2.47 billion by 2033, growing at a CAGR of 7.63% from 2025 to 2033. The market is experiencing growth driven by the rising prevalence of respiratory and critical conditions in animals, the expansion of veterinary infrastructure and specialized clinics, and advancements in veterinary essential care technologies.

Key Market Trends & Insights

- North America veterinary oxygen therapy market held the largest revenue share of 38.48% in 2024.

- The U.S. veterinary oxygen therapy market dominated with largest revenue share in 2024.

- By product, veterinary oxygen concentrator segment held the largest share of 84.71% in the market in 2024.

- By animal, small animal segment held the largest in the market in 2024.

- Based on application, ICU segment held the largest market share in 2024.

- By end use, veterinary hospitals segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.29 Billion

- 2033 Projected Market Size: USD 2.47 Billion

- CAGR (2025-2033): 7.63%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing cases of pneumonia, asthma, cardiac failure, and trauma-induced hypoxemia in companion animals, along with better diagnostic tools, highlight the need for respiratory support. Rising prevalence of respiratory diseases in companion animals and increasing efforts to combat disease outbreaks are expected to fuel market growth rapidly. Veterinarians across the U.S. have reported outbreaks of a canine respiratory illness in August 2023, that do not respond to standard treatments and appears more severe and prolonged than typical canine infectious respiratory disease (CIRD). The exact cause remains unknown. In response, Cornell University’s College of Veterinary Medicine, through its Animal Health Diagnostic Center and Riney Canine Health Center, launched a rapid response research project to investigate this disease and develop effective therapeutics for its cure.

In addition, adopting oxygen therapy plays a vital role in stabilizing patients in emergencies and post-surgical care. Clinics and hospitals must invest in oxygen cages, masks, and concentrators. This demand increases veterinary oxygen equipment sales, increases adoption rates, and propels businesses to develop innovative, portable solutions. The market is growing because of the quick advancements in oxygen delivery and monitoring technologies in contemporary veterinary care, such as integrated anesthetic equipment, portable oxygen concentrators, and flow regulators.

Manufacturers are constantly developing small, cost-effective, and easy-to-use products that allow even mobile units and small clinics to offer top-notch care. For instance, in January 2025, Super Air Smart ICU was introduced by Bionet America, Inc., with effective oxygenation, CO2 removal without soda-lime, air purification, and sophisticated climate control that improves the dependability of critical care. These innovations reduce operational complexity and enhance treatment reliability, encouraging veterinarians to adopt oxygen therapy widely. Improved outcomes boost pet owner confidence, leading to greater acceptance of oxygen-based interventions. The availability of diverse, advanced solutions broadens usage across companion, equine, and livestock practices, fueling market expansion.

Furthermore, with the help of government programs and private investments, there is an increasing number of veterinary hospitals, referral centers, and specialist clinics. The services in rural regions are growing with portable oxygen equipment, and the urban cities have emergency rooms and veterinary intensive care units. The expansion of this infrastructure increases the accessibility of oxygen therapy for both livestock farmers and pet owners. Adoption of modern oxygen equipment is fueled by competition among clinics to provide advanced services. In addition, the proliferation of specialist institutions normalizes oxygen therapy as a component of routine veterinary care.

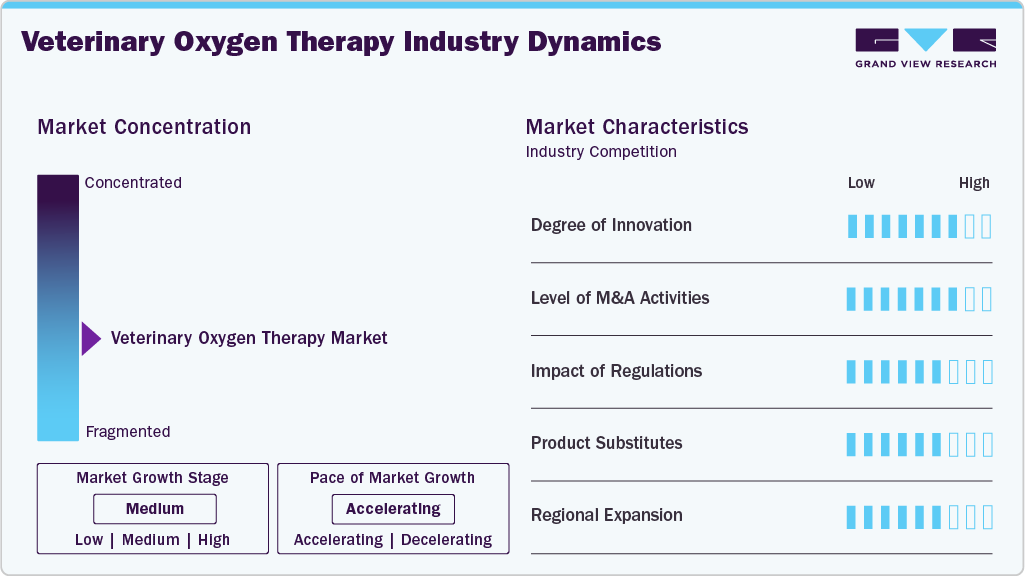

Market Concentration & Characteristics

The veterinary oxygen therapy industry is moderately concentrated, and the pace is accelerating. It includes a mix of global medical device leaders and specialized veterinary equipment manufacturers. Competition centers on innovation, quality, and service support. Key players continually introduce advanced oxygen delivery systems, ICU units, and portable concentrators, driving differentiation while fostering strategic collaborations and regional expansions.

Manufacturers are launching smart intensive care units, integrated monitoring systems, and portable concentrators; the market is witnessing consistent innovation. The innovations' emphasis on easy-to-use design, effective oxygenation, and low maintenance allows for wider application in hospitals and clinics. For instance, in April 2025, Virginia Tech's Veterinary Teaching Hospital ICU improved critical care safety and efficiency by upgrading to VetFlex ICU oxygen equipment, the first soda lime-free units in the world. Veterinarians can now prioritize patient outcomes because of this breakthrough.

Mergers and acquisitions remain moderate, with strategic partnerships focused on expanding product portfolios and geographic reach. Larger animal health companies are exploring acquisitions of niche device makers to strengthen ICU and respiratory care offerings. For instance, in January 2025, Infinium Medical’s veterinary division partnered exclusively with Vapotherm to distribute the Vapotherm VET 2.0 system, delivering advanced high-flow oxygen therapy technology to enhance respiratory support and critical care in veterinary medicine.

The market is directly impacted by laws pertaining to veterinary supplies and animal welfare. Adherence to safety, quality, and performance standards ensures trust between veterinarians and pet owners. Stricter welfare standards drive the need for oxygen support in emergency and surgical situations. On the other hand, protracted approval procedures and disparate local regulations delay product introductions, which affects expansion plans and market entry tactics.

In veterinary medicine, substitutes for oxygen therapy include manual ventilation, traditional ICU units, and basic airway management devices. However, these alternatives are less efficient, labor-intensive, and limited in sustaining oxygen levels for critical cases. Their shortcomings reinforce the importance of advanced oxygen therapy systems, positioning them as the preferred standard for respiratory support in veterinary critical and emergency care.

The market is propelled by regional expansion as the demand for veterinary oxygen therapy becomes more popular outside of developed nations. Opportunities abound throughout Asia Pacific and Latin America due to growing pet ownership, the need for livestock health care, and advancements in veterinary infrastructure. Global producers are expanding access to advanced care and hastening the global adoption of veterinary respiratory support systems by introducing portable, reasonably priced oxygen therapy options for emerging countries.

Product Insights

Based on products, veterinary oxygen concentrator segment held the largest revenue share of 84.71% in 2024 and is the fastest-growing segment over the forecast period. The market's expansion is attributed to their effectiveness, affordability, and simplicity of use. Veterinary oxygen concentrators, which eliminate the need for refills and save operating costs for veterinary clinics, are more widely used than traditional oxygen cylinders because they deliver a consistent oxygen supply from ambient air. These veterinary oxygen concentrators are suitable for small animal practices, emergency care, and mobile veterinary units due to their portability and versatility. Rising rates of respiratory diseases in companion animals and more knowledge of advanced critical care solutions have contributed to their growing appeal.

Accessories accounted for the second fastest-growing segment in the market, driven by the need for complementary tools that enhance treatment efficiency and patient safety. For precise oxygen administration, this segment comprises oxygen masks, nasal cannulas, flow meters, tubing, regulators, and monitoring equipment. The demand for these goods rises with the adoption of core equipment as clinics offer more critical care services. Growth is further supported by the trend toward specialized, animal-specific accessories made for various breeds and sizes.

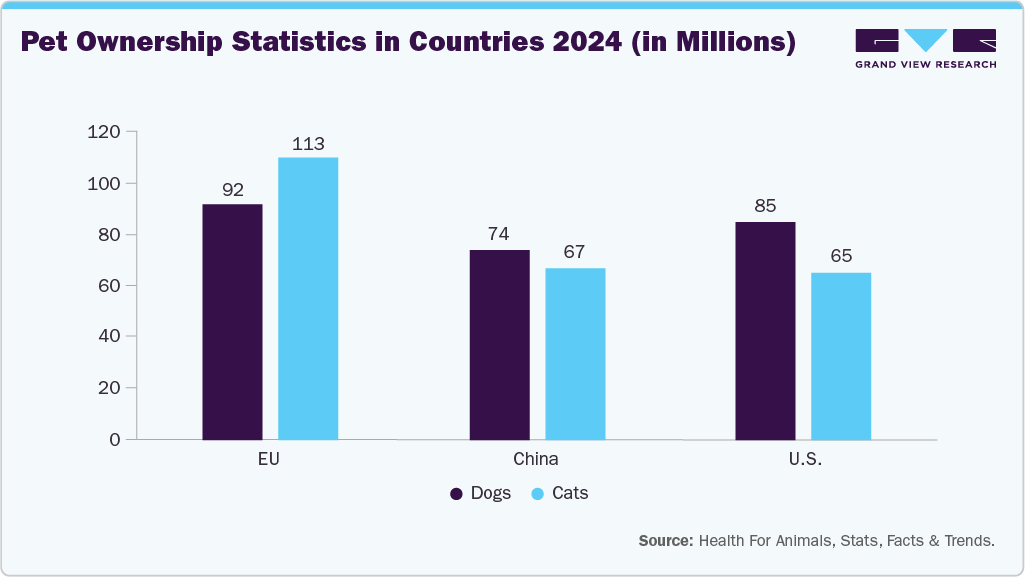

Animal Insights

Based on animal, small animal segment dominated the market with the largest revenue share in 2024 and is the fastest growing from 2025 to 2033, owing to the high prevalence of respiratory and critical care conditions in these animals. Rising pet ownership, increased spending on advanced veterinary treatments, and the humanization of pets drive demand for oxygen therapy solutions. Small animal clinics and hospitals prioritize emergency interventions, making oxygen therapy indispensable for emergencies, surgeries, and chronic respiratory care. Portable concentrators, masks, and ICU systems designed for smaller animals enhance adoption.

Large animal segments, including horses, cattle, and livestock, are the second fastest growing segment in the market due to increasing awareness of animal welfare and the economic importance of livestock health. Respiratory disorders, post-surgical recovery, and emergency care in large animals require specialized oxygen delivery systems. Equine hospitals, dairy farms, and veterinary practices increasingly adopt portable concentrators and high-flow oxygen devices designed for larger patients. Rising investments in veterinary infrastructure, combined with the need for advanced critical care in valuable livestock and performance animals, are driving rapid adoption, making large animals a key growth segment in the market.

Application Insights

On the basis of application, ICU segment held the largest revenue share in 2024, boosted by the increasing need for critical care facilities in veterinary hospitals and specialty clinics. Intensive care units are equipped with sophisticated oxygen delivery systems. Animals suffering from severe respiratory illnesses, trauma, or post-operative complications can get emergency care, precise oxygenation, and continuous monitoring. Growing pet ownership, more knowledge of advanced veterinary treatment, and the prevalence of acute and chronic illnesses in companion animals have all increased demand for ICU-based oxygen therapy. The ICU's standing as the market's favored category is strengthened by the combination of temperature control, high-flow oxygen systems, and monitoring apparatus.

The homecare setting/postoperative care segment is expanding fastest due to rising demand for ongoing, easy-to-access care for recuperating pets. Pet owners can safely provide oxygen therapy at home due to advancements in portable oxygen concentrators and small delivery systems, which lessen hospital stays and animal stress. Adoption is further accelerated by growing knowledge of chronic respiratory care and post-operative rehabilitation procedures. Furthermore, the humanization of dogs motivates owners to spend money on superior home care products.

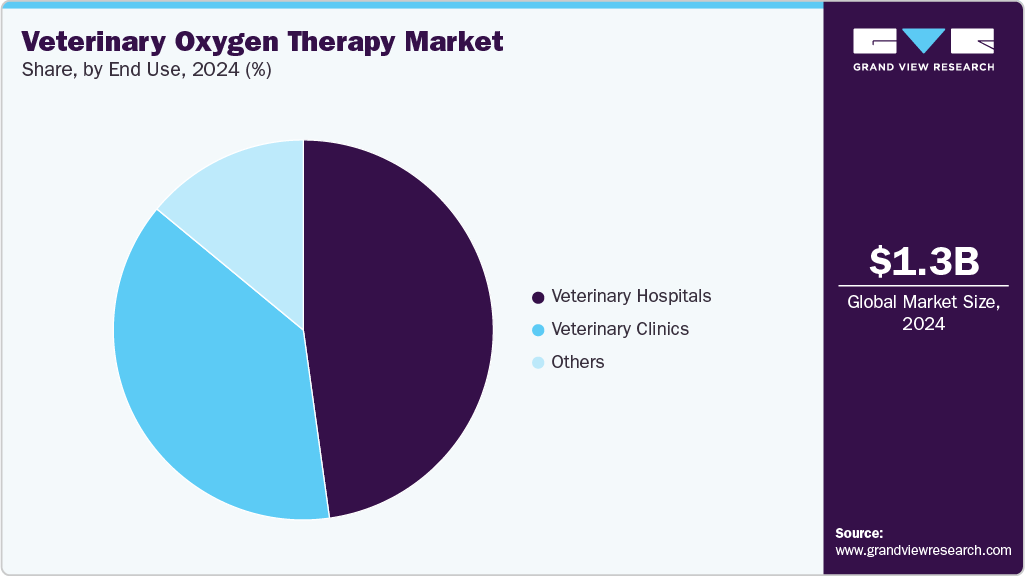

End Use Insights

Based on end use, veterinary hospitals accounted for the largest revenue share in 2024, driven by the concentration of specialist services, critical care units, and leading medical facilities. Numerous companion animals, livestock, and equine patients who need oxygen therapy for respiratory distress, surgical recuperation, or emergency care are served by hospitals. Hospitals offer accurate oxygen supply and continuous monitoring due to their ICU units, portable concentrators, and high-flow oxygen systems. Equipped with ICU units, portable concentrators, and high-flow oxygen systems, hospitals provide continuous monitoring and precise oxygen delivery.

Veterinary clinics held the highest CAGR as they are the fastest-growing market, driven by the increasing number of small and mid-sized clinics expanding critical care services. Awareness of advanced respiratory care has encouraged clinics to adopt portable oxygen concentrators, masks, and high-flow therapy systems. Clinics benefit from cost-effective, convenient solutions that enable timely intervention for emergencies, surgeries, and chronic respiratory conditions. The demand is further fueled by the humanization of pets and owners’ preference for local, accessible care.

Regional Insights

North America dominated the global veterinary oxygen therapy market in 2024, holding the largest revenue share of 38.48%. The market growth is attributed to increasing awareness of advanced veterinary care and growing adoption of pet insurance, enabling access to critical respiratory treatments. Some players, such as CAIRE Inc., Drive DeVilbiss Healthcare, Longfian Scitech, and Imex Medical Group, focus on innovations such as portable oxygen concentrators, high-flow therapy systems, and integrated ICU solutions. Technological advancements in mobile concentrators, air purification, and precise oxygen delivery enhance treatment outcomes, expanding adoption across clinics, hospitals, and homecare settings.

U.S. Veterinary Oxygen Therapy Market Trends

The veterinary oxygen therapy market in the U.S. accounted for the highest market share in the North America market, owing to rising pet ownership and demand for convenient, portable solutions. Technological advancements are boosting market growth with their new inventions. For instance, in 2024, Dynarex Corporation launched its expanded Resp-O2 line, offering portable oxygen delivery, suction care, and nebulization products, enabling flexible, high-performance therapy in clinics, homecare, and transport settings, supporting patient mobility and improved clinical outcomes.

Canada veterinary oxygen therapy market is expected to grow significantly during the forecast period. The market is driven by the expansion of veterinary clinics and hospitals and the shift towards home-care preferences. Besides, advancements in portable oxygen concentrators and high-flow therapy systems enhance animal treatment options in various settings. The regulatory landscape for veterinary oxygen therapy products is regulated to ensure safety, efficacy, and quality. Health Canada oversees medical devices used in veterinary care, requiring compliance with manufacturing, labeling, and performance standards. These regulations ensure reliable oxygen delivery, protect animal welfare, and guide veterinary practices adopting approved respiratory therapy equipment.

Europe Veterinary Oxygen Therapy Market Trends

The veterinary oxygen therapy market in Europe is driven by expanding veterinary facilities and regulatory support. Innovations such as developing hyperbaric oxygen therapy (HBOT) chambers provide high-pressure environments that accelerate healing and reduce inflammation in pets, along with portable oxygen concentrators. Key players in the European market include AEOLUS International Pet Products, Airnetic, BMV Animal Technology, CAIRE, Drive DeVilbiss International, Imex Medical Limited, Koninklijke Philips, and Longfian Scitech. These companies are investing in research and development to introduce advanced oxygen therapy solutions, catering to the growing demand for effective and efficient animal respiratory care.

Germany veterinary oxygen therapy market held the highest share in 2024. Animals with respiratory problems and technological developments like high-flow therapy devices and portable oxygen concentrators drive this expansion. In addition, the market is growing due to the increased demand for sophisticated veterinary treatment and the increasing prevalence of respiratory disorders in animals. Throughout Germany, these developments improve the standard of care and availability of respiratory therapies for animals.

The veterinary oxygen therapy market in the UK is expected to grow significantly over the forecast period. The country’s growth is influenced by the consolidation of veterinary practices as larger groups acquire smaller surgery centers. To ensure uniform care across all locations, this tendency increases demand for standardized equipment, such as oxygen concentrators. Reliable oxygen therapy systems are even more important because merger practices frequently expand their offerings to encompass sophisticated critical care and difficult surgeries. For instance, the acquisition of Ark Animal Services by CVS Group in February 2024 demonstrates the increasing demand for veterinary equipment, such as oxygen concentrators, to support expanding operations and improved treatment capacities.

Asia Pacific Veterinary Oxygen Therapy Market Trends

The veterinary oxygen therapy market in the Asia Pacific is expected to grow significantly over the forecast period. The growing emphasis on providing high-quality veterinary care and the growth of AAHA accreditation in the area are the main factors propelling the market. Advanced equipment will become more necessary as more veterinary clinics strive for accreditation and higher standards, which will assist the expansion of the industry. One notable instance of a rising dedication to strict veterinary care standards is the AAHA's accreditation of Daktari Animal Hospital Tokyo Medical Center, the first outside of the United States and Canada. The need for equipment will increase as more Asia-Pacific practices work toward AAHA accreditation, supporting industry expansion.

China veterinary oxygen therapy market is witnessing new growth opportunities due to urbanization, the aging pet population, and the expansion of veterinary networks. In April 2025, China’s customs authorities ceased supervising goods under drugs, veterinary drugs, and medical devices, potentially easing the import and distribution of veterinary oxygen therapy devices. Despite this, all devices must still comply with NMPA registration and quality standards, ensuring safety, efficacy, and regulatory adherence in the Chinese market.

The veterinary oxygen therapy market in Japan is driven by the increasing number of animal clinics and the rising lifespan of pets, which is expected to drive demand for veterinary oxygen therapy. According to data from the Agriculture, Forestry, and Fisheries Ministry published in April 2022, there were 12,435 animal facilities in Japan in 2021, an 18% growth over the previous ten years. Increased rates of age-related illnesses, including cancer and renal failure, are a result of pets living longer. The rising market for veterinary services is reflected in Tokyo University of Agriculture and Technology's new hospital, which has expanded its animal clinics and implemented 24-hour care. To promote high-quality care for elderly dogs and emergencies, this trend is anticipated to increase demand for veterinary oxygen concentrators.

India veterinary oxygen therapy marketis expanding significantly, which may be ascribed to increased livestock production, government initiatives, and animal welfare programs. Technological developments have created affordable portable oxygen concentrators, improving therapy effectiveness and accessibility. Major players in the market, such as Philips India Limited, BPL Medical Technologies, Nidek Medical India, and Imex Medical, are vital in transforming market growth. These companies are focusing on innovation and expanding their product offerings to meet the growing needs of the veterinary healthcare sector.

Latin America Veterinary Oxygen Therapy Market Trends

The veterinary oxygen therapy market in Latin America is expected to witness significant growth over the estimated time period. In Latin America, the market is developing steadily, supported by the integration of telemedicine in veterinary care and the expansion of veterinary education and training. In addition, growing pet humanization trends and an increasing emphasis on improving animal health outcomes drive higher demand for oxygen concentrators in veterinary facilities throughout Latin America.

Brazil veterinary oxygen therapy market is witnessing notable growth due to the expansion of veterinary service networks across the country. For example, in September 2022, VetFamily launched in Brazil with 25 clinics onboard, tapping into a vibrant pet population exceeding 149.6 million. Their innovative business model offers veterinarians solutions and tools to support their professional growth. As veterinary clinic networks like VetFamily expand, the demand for advanced medical equipment, including oxygen concentrators, rises, essential for animal respiratory care, surgical procedures, and post-operative recovery.

Middle East & Africa Veterinary Oxygen Therapy Market Trends

The veterinary oxygen therapy market in the MEA is expanding significantly due to improvements in veterinary procedures like those at Modern Vet in Dubai. Successfully correcting congenital heart abnormalities and intricate small animal surgeries are two innovative procedures driving demand for innovative veterinary equipment. The UAE's Ministry of Climate Change and Environment (MOCCAE) supports efforts to advance veterinary care, emphasizing the growing demand for high-quality oxygen concentrators in this growing industry.

South Africa veterinary oxygen therapy market is the fastest-growing over the forecast period, propelled by the rising number of veterinary clinics and hospitals. Increasing animal healthcare awareness and the expanding pet population drive demand for advanced veterinary services. In addition, technological innovations in veterinary medical devices and an emphasis on delivering high-quality care support the widespread adoption of oxygen concentrators in veterinary practices throughout the country.

The veterinary oxygen therapy market in the UAE is experiencing growth driven by increased pet ownership and improvements in veterinary care. Technological advancements, including stationary and portable oxygen concentrators, are providing more options for treating animal respiratory disorders. Among the major participants in the area are Drive Through product development and strategic alliances. DeVilbiss Healthcare, Imex Medical Limited, Longfian Scitech, and RWD Life Science are bolstering the market's expansion.

Key Veterinary Oxygen Therapy Company Insights

Major global market players include Drive DeVilbiss Healthcare, Imex Medical Limited, Longfian Scitech, Philips, CAIRE, and BMV Animal Technology. These companies lead through innovation, strategic collaborations, and expanding product portfolios, strengthening their market presence and shaping competitive dynamics across regions in the rapidly growing veterinary oxygen therapy sector. For instance, in July 2025, Penlon launched a new Veterinary Product Range featuring anesthesia systems, MRI-compatible devices, and patient monitoring solutions, with integrated oxygen therapy to enhance veterinary surgical safety and critical care outcomes.

Key Veterinary Oxygen Therapy Companies:

The following are the leading companies in the veterinary oxygen therapy market. These companies collectively hold the largest market share and dictate industry trends.

- VETLAND MEDICAL SALES & SERVICES. LLC

- Airnetic, LLC

- CAIRE Inc.

- Longfian Scitech Co., Ltd.

- IMEX MEDICAL LIMITED,

- RWD Life Science Co., Ltd.

- AEOLUS International Pet Products, LLC.

- Koninklijke Philips N.V.

- Drive DeVilbiss International

- Shinova Systems

Recent Developments

-

In February 2025, Bionet America unveiled its Super Air Smart ICU, a next-generation veterinary critical care unit featuring efficient oxygenation, CO₂ management without soda-lime, ionization-based air purification, and advanced climate control. Designed to reduce workload and costs while improving patient comfort and safety, the launch sets a new standard for veterinary ICUs, enhancing overall treatment efficiency.

-

In January 2025, Infinium Medical announced an exclusive partnership to distribute Vapotherm VET 2.0, an advanced high-flow oxygen therapy system for veterinary use. The system transforms respiratory care with enhanced mobility, user-friendly design, improved animal comfort, and advanced medication delivery. The launch strengthens Infinium’s portfolio while empowering veterinary clinics with innovative technology for better patient outcomes.

-

In February 2024, Tata Trusts opened India's first Small Animal Hospital in Mahalaxmi, Mumbai. It will provide round-the-clock services through pet-sensitized veterinarians, nurses, and technicians, focusing on emergency and critical care, surgery, and oxygen therapy. The hospital will feature advanced radiology, imaging, and laboratory equipment catering to a wide range of veterinary needs.

Veterinary Oxygen Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.37 billion

Revenue forecast in 2033

USD 2.47 billion

Growth rate

CAGR of 7.63% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, application, end use, regional

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Thailand, South Korea, Australia, Brazil, Argentina, South Africa, UAE, Saudi Arabia, Kuwait, Qatar, Oman

Key companies profiled

VETLAND MEDICAL SALES & SERVICES. LLC; Airnetic, LLC; CAIRE Inc.; Longfian Scitech Co., Ltd.; IMEX MEDICAL LIMITED; RWD Life Science Co., Ltd.; AEOLUS International Pet Products, LLC.; Koninklijke Philips N.V.; Drive DeVilbiss International; Shinova Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Oxygen Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary oxygen therapy market report based on product, animal, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Oxygen Concentrator

-

Portable Oxygen Concentrator

-

Stationary Oxygen Concentrator

-

-

Accessories

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Animal

-

Large Animal

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

ICU

-

Homecare setting/postoperative care

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary oxygen therapy market size was estimated at USD 1.29 billion in 2024 and is expected to reach USD 1.37 billion in 2025.

b. The global veterinary oxygen therapy market is expected to grow at a compound annual growth rate of 7.63% from 2025 to 2033 to reach USD 2.47 billion by 2033.

b. North America dominated the veterinary oxygen therapy market with a share of 38.48% in 2024. This is attributable to increase in pet insurance adoption is driving the growth of North American veterinary oxygen therapy market. Pet insurance provides financial security, encouraging pet owners to pursue necessary veterinary treatments without financial constraints. This leads to a higher demand for advanced veterinary care, including oxygen therapy, which is essential for various surgical and emergency procedures.

b. Some key players operating in the veterinary oxygen therapy market include VETLAND MEDICAL SALES & SERVICES. LLC, Airnetic, LLC, CAIRE Inc., Longfian Scitech Co., Ltd, IMEX MEDICAL LIMITED, RWD Life Science Co., LTD, AEOLUS International Pet Products, LLC., Koninklijke Philips N.V., Drive DeVilbiss International, Shinova Systems

b. Key factors that are driving the market growth include rising prevalence of respiratory diseases in animals, a growing number of pet owners, increasing adoption of pet insurance, and rapid technological advancements in veterinary oxygen therapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.