Veterinary Orthopedic Medicines Market Size, Share & Trends Analysis Report By Product, By Animal Type, By Application, By Route Of Administration, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-167-6

- Number of Report Pages: 183

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

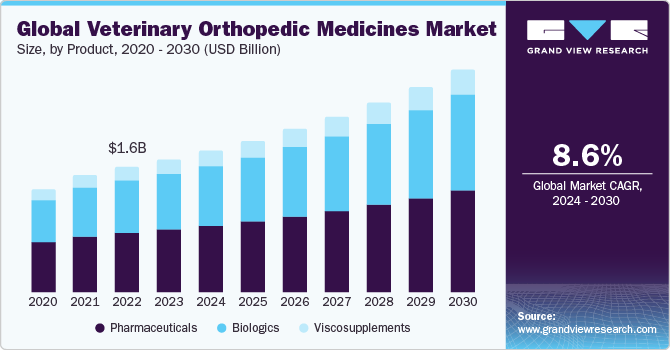

The global veterinary orthopedic medicines market size was estimated at USD 1.62 billion in 2023 and is expected to grow at a CAGR of 8.6% from 2024 to 2030. The growth can be attributed to rising prevalence of orthopedic disorders in animals, the growing uptake of pet insurance, an increase in the aging animal population, and advancements in veterinary orthopedic medicines. Orthopedic issues can negatively impact an animal's quality of life by affecting the bones, muscles, and joints. Canine dysplasia of the elbow & hips and arthritis are among common conditions. Several factors contribute to orthopedic problems in animals, including aging, poor diet, and obesity. Recent studies have shown a rise in obesity among animals such as dogs and horses. For instance, an NCBI study in 2023 on horses revealed a 45% obesity rate.

Stem cell therapy has recently gained popularity and generated significant interest in research & clinical settings. In veterinary medicine, stem cell therapy has been studied as a potential treatment option for various health complications such as dermatological, orthopedic, dental, etc. The use of stem cells in these diseases is still in its infancy, but the potential for stem cell therapy in veterinary medicine is extensive. For instance, StemcellX, a UK-based company, currently has two stem-cell products in the pipeline for application in dogs and horses. The veterinary orthopedic medicines market is growing due to increase in prevalence of Osteoarthritis (OA) and other Degenerative Joint Diseases (DJD) among various animals like dogs, cats, & horses, among others. According to estimates from a 2022 study in Frontiers of Veterinary Sciences, OA is the most common musculoskeletal disorder in dogs, and about 1 in 4 dogs suffer from it. Another research study from the Veterinary Ireland Journal stated that approximately 40% of all cats suffer from OA. Estimates provided by the American Animal Hospital Association (AAHA) reveal that 40% to 92% of cats experience joint pain due to OA or other DJD. Furthermore, the studies suggest possible underdiagnosis of these conditions in these animals. Figures provided by Zoetis indicate that out of the total diagnosed cases of canine OA in the US, only 33% are treated.

Furthermore, University of Illinois data suggests that athletic horses are at a high risk of developing OA that causes lameness. It is estimated that over 50% of horses older than 15 years suffer from OA, and in horses over 30 years of age, this number increases to more than 80% to 90%. OA affects the performance and wellbeing of athletic horses. For early diagnosis, it is important to understand causal & developmental pathways and prescribe the right treatment. Moreover, several pet owners are opting for pet insurance to manage the health expenses of their pets. According to a February 2024 article in USA Today, 26% of surveyed Americans stated they spend between USD 51 & USD 100 a month on their dogs. The same number of people (26%) spend from USD 101 to USD 250 monthly on dog care. Ownership of a dog can cost up to USD 5,000 in some cases. About 66% of the respondents said they had to cut down on their personal expenses to meet the rising costs of owning a pet. Others have taken out loans or asked for financial assistance to pay for the care of animals.

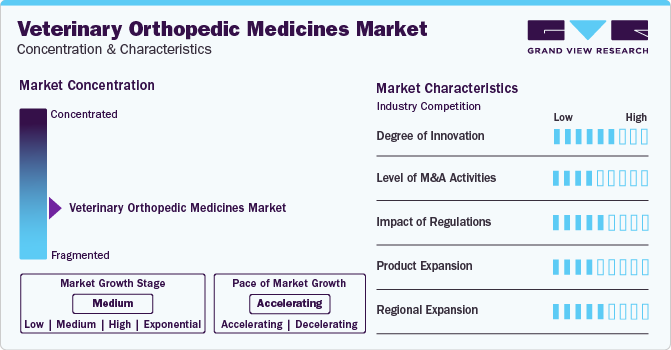

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of the market growth is accelerating.

The market is characterized by its strong focus on innovation, mainly in areas such as Platelet-rich Plasma (PRP) therapy. This is driven by various factors, including the rise of regenerative medicine in the veterinary field and the growing adoption of viscosupplementation products for treating musculoskeletal disorders in animals like cats, horses, and dogs. For instance, in April 2024, VetStem, Inc. launched PrecisePRP Canine, an off-the-shelf PRP product designed for intra-articular administration in dogs. This freeze-dried PRP does not require blood draw or centrifugation and offers consistent dosage & reduced safety risks through FDA-approved quality testing.

The market is also characterized by increased Merger & Acquisition (M&A) activity by the leading players and the emergence of specialist companies. These specialist companies focus on developing & launching dynamic products and M&A activities. For instance, in March 2023, VetStem, Inc. acquired three new GMP manufacturing and R&D facilities in the San Diego Biopharma corridor to accommodate its rapid growth.

The market is also subject to increasing regulatory scrutiny. Stem Cell-based Products (SCPs) are on the rise in veterinary medicine. As these products are used for regeneration, repair, or replacement of damaged areas and can sometimes be fatal for the animal, SCPs are subject to intense regulatory scrutiny. Leading regulatory authorities globally, like the U.S. FDA and the European Medicines Agency, ensure these products are safe for use in veterinary medicine. These regulatory bodies provide manufacturers of SCPs or other Animal Cells, Tissues, and Cell- & Tissue-Based Products (ACTPs) with recommendations on aspects of manufacturing unique to ACTPs and how to meet CGMP requirements.

The market is characterized by a moderate level of product expansion. Existing product lines are expanded by introducing new strengths, dosage forms, or formulations to cater to different animal species, sizes, or treatment requirements. Manufacturers are developing combination products that combine two or more active ingredients or therapies to provide enhanced efficacy or convenience in treating orthopedic conditions. For instance, in June 2023, Bimeda Biologicals launched Stimulator 5 + PMH combination vaccine indicated against major Bovine Respiratory Diseases (BRD) in cattle, including Infectious Bovine Rhinotracheitis (IBR), Bovine Respiratory Syncytial Virus (BRSV), Bovine Viral Diarrhea, and Parainfluenza-3 (PI3).

It is a dynamic factor in this market. Veterinary medical facilities are expanding to accommodate the growing demand, equipped with state-of-the-art technology and expertise to enhance the distribution of novel products. For instance, in November 2023, Bimeda inaugurated a state-of-the-art sterile injectable manufacturing facility in Shijiazhuang, China.

Product Insights

Pharmaceuticals dominated the veterinary orthopedic medicines market with a share of 46.5% in 2023. This high percentage can be attributed to the fact that pharmaceuticals are the first line of treatment for any musculoskeletal disorder in animals. They are available in various dosage forms like tablets, chewable tablets, powders, liquids, creams/ointments, etc., and therefore can be used as per convenience on varied species. Several emerging companies are developing generic versions of pharmaceutical products such as NSAIDs and steroids to ensure widespread availability for animal owners. For instance, in April 2023, the FDA approved Bimasone Injectable Solution, a generic corticosteroid injectable of flumethasone, manufactured by Bimeda Animal Health. This drug is used to treat dogs, cats, & horses suffering from various musculoskeletal conditions.

The viscosupplements segment is expected to register the fastest CAGR of 9.5% over the forecast period. Viscosupplements, such as hyaluronic acid & polyacrylamide hydrogel, improve joint function by lubricating, lowering friction, and stabilizing the joint structure. Their main purpose is to reduce pain, ease lameness, and minimize joint degeneration to manage & enhance the orthopedic health of equine athletes. These hyaluronic acid-based products are administered directly into the joints (intra-articular), mainly in animals like dogs & horses, to improve joint functioning.

Animal Type Insights

Canine dominated the veterinary orthopedic medicines market with a share of 46.1% in 2023. This can be attributed to the growing prominence of dog adoption globally. As per data published by HealthforAnimals, dogs are the most commonly adopted pet in the world, and it is estimated that 1 in 3 households across the globe owns a dog. Brazil has the highest pet dog population, a staggering 54.2 million. Families from the U.S., China, & Europe contribute to half a billion of the total dogs & cats. Furthermore, a research article published in the Journal of Small Animal Practice (JSAP) in 2023 suggested that musculoskeletal disorders like OA and DJD affect approximately 200,000 dogs annually.

The other animal type segment is expected to register the fastest CAGR of 9.7% over the forecast period. In animals like swine and cattle, NSAIDs & steroids are most widely used for the treatment of orthopedic conditions. However, research is underway for applying biologics treatment in these species. In cats, despite the high prevalence of orthopedic conditions like OA, i.e., more than 50%, the adoption of treatment is very low. However, this is expected to change with the evolving industry landscape and the growing popularity of cats. Expenditure on cat health is anticipated to increase, leading to a rising focus on treating OA that will boost the demand for orthopedic medications.

Application Insights

Osteoarthritis dominated the application segment, with a share of 60.4% in 2023. This can be attributed to the fact that OA is the most common musculoskeletal disorder in animals. This disease is debilitating and causes inflammation of the joints. It is often extremely painful and leads to lameness as well as postural & behavioral changes in animals like dogs, cats, horses, & cattle, among others. A study examining dairy farms across England & Wales stated that prevalence of lameness in cattle is at around 36.8%. Arthritis and joint pain are some of the leading causes of this lameness.

The others application segment is expected to register the fastest CAGR over the forecast period. The others segment includes muscle strains, ligament tears, intervertebral disc syndrome, and trauma. To address these problems, veterinarians must employ various specialized interventions, including physical therapy, surgical procedures, and customized therapeutic measures. This section highlights the necessity for comprehensive strategies for successfully managing numerous diseases impacting the musculoskeletal condition of dogs and horses.

Route Of Administration Insights

The injectable route segment accounted for the largest market share of 59.5% in 2023 and is expected to witness the highest CAGR of 8.9% in the forecast period. This is due to the wide availability of products administered through this route. Injectable medication has a higher absorption rate and leads to a faster onset of action in the animal's body, making it the most convenient method. In addition, the demand for injectable medications to treat orthopedic conditions holistically is increasing, with intra-articular injections specifically targeting joint issues and Intramuscular (IM) injections being particularly beneficial for alleviating pain, employing biologic drugs, anti-inflammatory drugs, & antibiotic therapy.

The IM segment under the injectable route is estimated to grow at the highest CAGR during the forecast period. IM administration is an effective form of medication delivery in veterinary orthopedic medicines. It is particularly beneficial for drug delivery of pain management drugs, anti-inflammatory drugs, muscle relaxation drugs, antibiotic therapy, and nutritional support.

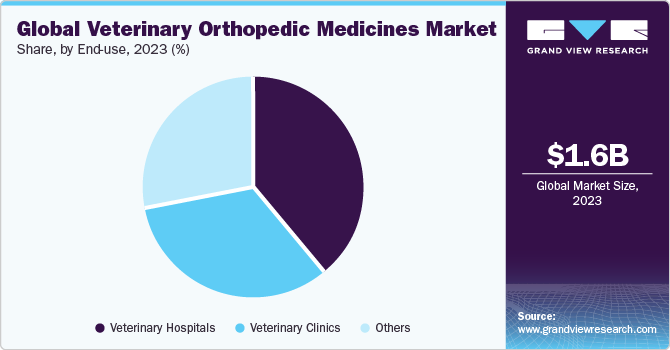

End Use Insights

The veterinary hospitals segment accounted for the largest market share in 2023. This can be attributed to the growing patient footfall in these hospitals. Moreover, biologics & viscosupplements need specific tools and skilled personnel to perform procedures. In addition, veterinarians prescribe medications based on each patient’s distinctive treatment plan, and hospitals stock these medications so pet owners can get them easily.

The veterinary clinics segment is anticipated to witness a substantial growth due to higher accessibility for animal owners. According to an NCBI article published in May 2022, key veterinary clinical services include diagnosing and treating common orthopedic conditions, such as arthritis, fractures, & soft tissue injuries in small animals like dogs & cats. Furthermore, large veterinary hospitals are only present at specific locations central to all. But, for most individuals, visiting a local veterinary clinic is more beneficial for basic needs such as medication procurement and routine animal check-ups.

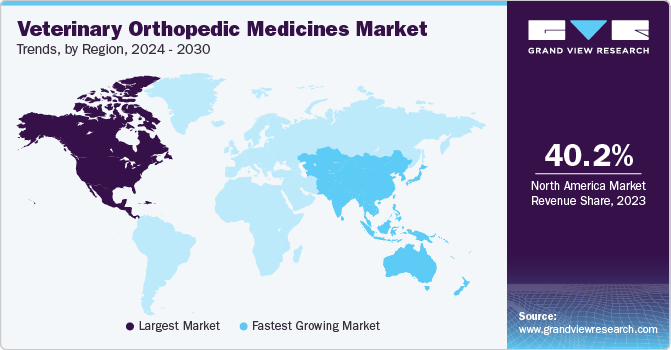

Regional Insights

The North America veterinary orthopedic medicines market accounted for the largest market share of 40.2% in 2023. This high share can be attributed to developed veterinary care infrastructure, high pet adoption, and the presence of major market players like Zoetis & Elanco Animal Health in the U.S. According to Humane Society International, the U.S. accounts for around 85 million pet owner families. Furthermore, the U.S. accounts for 65.1 million pet dogs and 46.5 million pet cats. Moreover, Humane Canada stated that in 2021, around 20,974 Dogs and 60,677 Cats were taken into shelters. Out of which, 44% of dogs and 62% of cats have been adopted back into homes.

U.S. Veterinary Orthopedic Medicines Market Trends

The veterinary orthopedic medicines market in the U.S. is anticipated to witness significant growth of 7.8% CAGR over the forecast period due to the rising prevalence of OA and other degenerative joint diseases. According to an article published by Morris Animal Foundation, in October 2023, OA affected around 14 million adult dogs in the U.S., making it a major health problem for dog owners. Although exact percentages for cats are still unknown, X-rays show that 90% of cats older than 12 have osteoarthritis. Moreover, initiatives like product approval and launching new products play a significant role in driving growth within the veterinary orthopedic medicines market. For instance, in May 2023, Zoetis Inc. reported that the U.S. FDA approved Librela (bedinvetmab injectable), the first anti-NGF monoclonal antibody medication for canine OA pain, for treating pain associated with OA in dogs.

Europe Veterinary Orthopedic Medicines Market Trends

The veterinary orthopedic medicines market in Europe was identified as a lucrative region in veterinary orthopedic medicines market. Europe held the second-largest share of the veterinary orthopedic medicines market in 2023. The increasing number of pets across Europe and growing pet humanization trends drive the demand for advanced veterinary orthopedic services. Pets are increasingly considered as family members, leading to higher spending on their healthcare needs, including orthopedic care. Pet owners are becoming more aware of the available treatment options for their pets, including orthopedic procedures.

The veterinary orthopedic medicines market in the UK is anticipated to witness significant growth over the forecast period due to factors such as rising consumer awareness of pet insurance and the need to purchase dog & cat insurance. The top veterinary charity in the UK, PDSA, provides free or extremely inexpensive medical care to animals in need. PDSA is a charity organization that runs pet hospitals, which treat over 800 cases requiring emergency surgery every month. Key players are engaging in strategic initiatives like product launches, collaborations, and acquisitions to make their market presence more prominent, impelling market growth. In September 2022, Jurox, a privately held animal health company specializing in veterinary medications for companion and livestock animals, was acquired by Zoetis. Such factors drive growth in the region.

The veterinary orthopedic medicines market in Germany is expected to grow over the forecast period. Germany has a large population of horses, with a significant percentage involved in activities like sports, racing, and leisure riding. Increased activity increases orthopedic injuries and illnesses in equines. German veterinarians adhere to high standards of care, ensuring that equine orthopedic conditions are diagnosed accurately and treated effectively. This commitment to quality care contributes to the overall growth of the orthopedic medicine market.

Asia Pacific Veterinary Orthopedic Medicines Market Trends

The veterinary orthopedic medicines market in Asia Pacific is anticipated to witness the highest CAGR over the forecast period. With a growing middle-class population and increased disposable income, pet owners in the Asia Pacific region are becoming more aware of the importance of maintaining their pet's health & wellbeing. For instance, the Elanco Animal Health survey for 2022 states that pet ownership in China is estimated to jump from 19% of households in 2020 to 40% of households by 2030. As more people welcome pets into their families, the need for specialized medical care, including orthopedic treatments, increases.

The China veterinary orthopedic medicines market is expected to grow at a substantial rate over the forecast period due to obesity in pets, leading to various orthopedic issues, including joint pain, arthritis, and ligament injuries. According to a research, there is a rising number of young animals worldwide that are becoming obese, with 21% of dogs being overweight by the age of 6 months. Up to 59% of dogs and 52% of cats were obese. It was found that pet owners (54% of dog owners and 50% of cat owners) were overfeeding their animals without monitoring the amount of food. This is a significant factor driving the market in China.

The veterinary orthopedic medicines market in Japan is expected to grow over the forecast period. This can be attributed to the presence of veterinary hospitals, which serve as crucial centers for providing medical care to animals, including orthopedic procedures. For instance, OrthoPets animal clinic in Japan focuses on arthritis, complex bone fractures, joint malalignments, orthopedic joint operations, and regenerative medicine. Moreover, veterinary hospitals often collaborate with other healthcare providers, including specialists in orthopedic medicine. This collaborative network enhances the availability and accessibility of orthopedic services, boosting market growth.

Latin America Veterinary Orthopedic Medicines Market Trends

The veterinary orthopedic medicines market in Latin America exhibits lack of awareness among pet owners about the importance of managing pet obesity, which is a significant problem. Furthermore, increased government funding has contributed to the market growth in countries like Brazil. Factors such as untapped opportunities, economic development, and rising awareness levels can contribute to rapid market growth of the region.

The Brazil veterinary orthopedic medicines market may attract international pharmaceutical companies seeking to expand their product portfolios and tap into the growing demand for advanced veterinary care in the country, driving growth. The increasing occurrence of orthopedic diseases in athletic bulls is likely to fuel the veterinary orthopedic medicines market as owners and breeders seek ways to ensure the health & performance of their animals.

Middle East And Africa Veterinary Orthopedic Medicines Market Trends

South Africa, Saudi Arabia, Kuwait, and the United Arab Emirates are part of the MEA region. Due to growing awareness and a high incidence of conditions like hip dysplasia, degenerative disc disease, torn cruciate ligaments, fractures, arthritis, & others, the veterinary orthopedic medicines market in this region is expected to grow during the forecast period.

The veterinary orthopedic medicines market in the UAE is expected to grow due to the availability of pet insurance and a growing number of wellness initiatives. An increasing number of pet owners value providing their animals with comprehensive healthcare. An appealing incentive is the availability of insurance policies and wellness programs that cover treatment for obesity, joint discomfort, & other conditions. In addition, the establishment of specialized veterinary clinics and hospitals offering orthopedic services, such as surgery and rehabilitation, has been on the rise in Dubai, UAE, contributing to the adoption of orthopedic medicines & therapies.

Key Veterinary Orthopedic Medicines Company Insights

Some of the key players operating in the market are Zoetis Inc; Boehringer Ingelheim; Elanco Animal Health, Inc.; and Merck Animal Health (Merck & Co. Inc). Industry leaders like Zoetis, Inc.; Boehringer Ingelheim; Elanco Animal Health; American Regent, Inc.; Merck Animal Health (Merck & Co. Inc); and Vetoquinol S.A. are investing significantly in the R&D of novel medicines for musculoskeletal complications prevalent in various animals. Companies like Ardent Animal Health, LLC; VetStem, Inc.; and MEDREGO LLC are focusing on developing specialized biologics like stem cells, PRP, and other biologics to effectively combat orthopedic conditions in animals.

-

Zoetis is one of the leading veterinary product companies in the world. It discovers, develops, manufactures, and commercializes vaccines, medicines, diagnostics, & other technologies for the treatment of various diseases in companion animals, as well as livestock animals. It has a widespread network in over 45 countries.

-

Elanco Animal Health has operated in the veterinary industry for over 65 years. It is a subsidiary of the pharmaceutical products giant Elli Lilly & Company. The company is among the top four global veterinary product manufacturers, with over 200 brands and a presence in over 90 countries.

Hyalogic, Bioiberica S.A.U, and Contipro A.S. are some of the emerging market participants in the veterinary orthopedic medicines market.

-

Hyalogic is a company that specializes in and focuses on manufacturing products made from high-molecular-weight hyaluronic acid, which has hydrating and lubricating properties. Its product portfolio includes skin care, personal care, joint care, etc., for humans and specialized joint care products for animals.

Key Veterinary Orthopedic Medicines Companies:

The following are the leading companies in the veterinary orthopedic medicines market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis Inc.

- Boehringer Ingelheim

- Elanco Animal Health

- American Regent, Inc.

- Merck Animal Health (Merck & Co. Inc)

- Vetoquinol S.A.

- Ceva Sante Animale

- Virbac

- Biogenesis Bago

- Ardent Animal Health, LLC

- Bioiberica S.A.U

- PetVivo Holdings, Inc. (Spryng)

- Contipro A.S.

- VetStem, Inc.

- Enso Discoveries

- Contura Vet US

- T-Cyte Therepeutics

- MEDREGO LLC

- Bimeda U.S.

- Hyalogic

- Hester Biosciences

Recent Developments

-

In April 2024, VetStem, Inc. launched PrecisePRP Canine, an off-the-shelf PRP product designed for intra-articular administration in dogs. This freeze-dried PRP requires no blood draw or centrifugation, offering consistent dosage and reduced safety risks through FDA-approved quality testing.

-

In April 2024,Felix Pharmaceuticals Pvt. Ltd. received FDA approval for ANADA (Carprofen), which is used for treating pain & inflammation caused by OA and managing pain that results from orthopedic & soft tissue surgeries in dogs.

-

In December 2023, PetVivo Holdings partnered with Covetrus North America to distribute Spryng with OsteoCushion technology, an injectable veterinary medical device for managing joint pain in animals. Covetrus was expected to begin marketing and promoting the product across the U.S. from January 1, 2024, providing PetVivo broader market exposure in the U.S. animal health sector.

-

In October 2023, Athersys, Inc. entered a licensing agreement with Ardent Animal Health, LLC, granting Ardent exclusive rights to use Athersys’ MAPC technology for nonhuman mammal applications in the U.S., with milestone payments & royalties included.

-

In October 2022, Zoetis Inc. announced the acquisition of Jurox, an Australia-based company that develops, manufactures, & markets a wide range of veterinary medicines for treating livestock and companion animals.

-

On April 21, 2022, Boehringer Ingelheim received approval in Europe for RenuTend, a product to improve healing of tendon and suspensory ligament injuries in horses. Complements the equine stem cell product Arti-Cell FORTE, which treats recurrent lameness associated with non-septic joint inflammation in horses.

Veterinary Orthopedic Medicines Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.74 billion |

|

Revenue Forecast in 2030 |

USD 2.87 billion |

|

Growth rate |

CAGR of 8.6% from 2024 to 2030 |

|

Actual estimates/historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, animal type, application, route of administration, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Zoetis Inc.; Boehringer Ingelheim; Elanco Animal Health; American Regent, Inc.; Merck Animal Health (Merck & Co. Inc); Vetoquinol S.A.; Ceva Sante Animale; Virbac; Biogenesis Bago; Ardent Animal Health LLC; Bioiberica S.A.U; PetVivo Holdings, Inc. (Spryng); Contipro A.S.; VetStem, Inc.; Enso Discoveries; Contura Vet US; T-Cyte Therepeutics; MEDREGO LLC; Bimeda U.S.; Hyalogic; Hester Biosciences |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Veterinary Orthopedic Medicines Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunitiesin each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the veterinary orthopedic medicines market report based on product, animal type, application, route of administration, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Stem Cells

-

Platelet-Rich Plasma (PRP)

-

Other Biologics

-

-

Viscosupplements

-

Pharmaceuticals

-

Steroids

-

NSAIDS

-

Others

-

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Equine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Osteoarthritis

-

Degenerative Joint Disease

-

Other Applications

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Intra-muscular

-

Intra-articular

-

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary orthopedic medicine market size was estimated at USD 1.62 billion in 2023 and is expected to reach USD 1.74 billion in 2024.

b. The global veterinary orthopedic medicine market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 2.87 billion by 2030.

b. North America dominated the veterinary orthopedic medicine market with a share of 40.26% in 2023. The market growth can be attributed to rising prevalence of orthopedic conditions, increasing pet ownership, growing geriatric pet population, and presence of key market players like Zoetis & Elanco Animal Health.

b. The veterinary orthopedic medicine market in the U.S is estimated to be USD 0.60 billion in 2023.

b. The key factors driving the market are rising prevalence of orthopedic disorders in animals, the growing uptake of pet insurance, an increase in the aging animal population, and advancements in veterinary orthopedic medicine.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."