- Home

- »

- Animal Health

- »

-

Veterinary Orthobiologics Market Size & Share Report, 2030GVR Report cover

![Veterinary Orthobiologics Market Size, Share & Trends Report]()

Veterinary Orthobiologics Market (2024 - 2030) Size, Share & Trends Analysis Report By Mode of Delivery (Intra-muscular/Intra-lesional, Intra-articular), By Product, By Animal, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-369-5

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Orthobiologics Market Trends

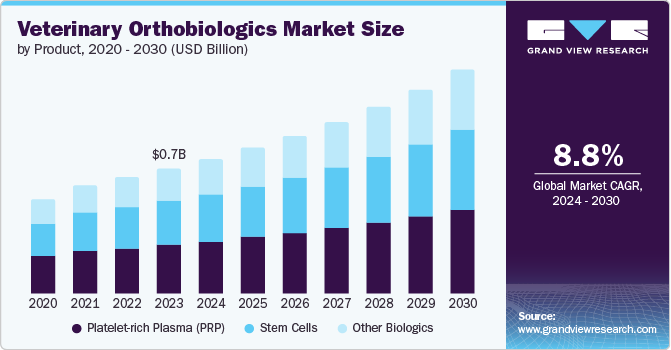

The global veterinary orthobiologics market size was estimated at USD 690.00 million in 2023 and is anticipated to grow at a CAGR of 8.82% from 2024 to 2030. Key factors expected to drive the market growth include advances in veterinary regenerative medicine, rising prevalence of orthopedic complications in animals, global rise in animal athletic events, innovative product launches, and an increasing number of clinical trials. The market has been experiencing continuous advancements in the recent past and is expected to continue to do so in the forecast period. Novel treatments for veterinary injuries and diseases have been made possible by advancements in orthobiologics.

While treatments like autologous bone marrow mononuclear cell fraction and bone marrow aspirate concentrate offer alternative treatment options to traditional stem-cell and platelet-rich plasma (PRP) therapy, extracellular vesicle-based approaches provide an "off-the-shelf" solution. Alpha-2 macroglobulin and liquid amnion allograft are also being investigated for their possible advantages in treating tendon and ligament injuries. These developments could transform how equine injuries are treated and lead to better results, providing the market with a lucrative growth opportunity. These advancements range from pipeline products to developing biological therapies for species other than dogs, horses, and cats.

For example, Akston Biosciences is developing a protein-based therapeutic vaccine for chronic pain in dogs. This product aims to mitigate pain caused by complications like osteoarthritis (OA) and inflammation by decreasing the risen nerve growth factors (NGF). Moreover, a May 2024 study published in the Journal of Population Therapeutics and Clinical Pharmacology explored the therapeutic effects of PRP alone and ozone therapy in rabbits with hamstring injuries. It concluded that PRP, combined with ozone therapy, had very beneficial effects on repairing the injured hamstring of the rabbits. Such and many other instances pave the way for using novel products and promote penetration of existing therapies into treating complications in various other species.

Furthermore, industry participants engage in multi-sectoral research collaborations to explore using novel materials for developing regenerative medicine products across human and veterinary medicine. For instance, in May 2024, multiple leading universities like Utrecht University (Faculties of Medicine and Veterinary), Eindhoven University of Technology, Hubrecht Institute, and Maastricht University formed a Drive-RM research collaboration with a funding of over Euro 37.5 Mn (USD 40.2 Mn). This collaboration aims to research and develop regenerative medicine solutions for therapeutic use in humans and animals for diseases like musculoskeletal, renal, and cardiovascular diseases. Another crucial factor driving the market growth is continuous new product launches by various companies.

For instance, in April 2024, the U.S. FDA approved PrecisePRP, a PRP therapy manufactured by VetStem Inc., for addressing issues related to OA and other musculoskeletal injuries in dogs. This intra-articular injection is the world's first animal cells, tissues, and cell- and tissue-based product or ACTP. In addition, in April 2023, Hilltop Bio launched Strydaflex, which uses the company’s proprietary combination of natural cytokines, growth factors, and exosomes to promote healthy joint health in horses. These product launches will help drive market growth by granting veterinarians and animal owners various treatment alternatives and allowing them to choose the best therapy for their animals.

Market Concentration & Characteristics

The degree of innovation in the market is estimated to be very high. Product manufacturers are continuously working on researching novel therapeutics and launching products for use in animals. For example, in October 2023, Zoetis commercially launched the world’s first monoclonal antibody (mAb), Librela, for treating OA in dogs.

The market has a moderate level of mergers and acquisitions. Industry players are boosting their R&D capabilities by acquiring other companies. For instance, in September 2023, Zoetis completed the acquisition of Adivo, a German company specializing in biotechnology solutions.This acquisition was made to enhance the former’s competencies in research and development of biologics.

The regulatory impact in this market is expected to be very high. These biological products are subject to intense scrutiny by the authorities amidst the growing misleading practices by some industry players. In May 2024, the U.S. FDA issued a warning to veterinary PRP and Stem-cell products manufacturer, Safari Stem Cells for conducting marketing and distribution practices for unapproved animal drugs and claiming their application in multiple disease treatments. Such practices contribute to heavy scrutiny of veterinary products in the overall market. The authorities are expected to further tighten the regulatory control over product approvals to avoid such malpractices.

In the current scenario, a few companies like Zoetis, Boehringer Ingelheim, VetStem Inc., Dechra, Enso Discoveries, etc. are dominant, in terms of veterinary orthobiologics products. However, the market is changing rapidly with the emergence of new substitute products that are attempting to employ alternative and more efficient technologies other than stem cells and PRP to treat orthopedic conditions in animals. This complex scenario, despite the current moderate impact, is expected to increase the influence of substitute products in the future.

A moderate level of regional expansion can be seen in the industry. Companies are expanding their operations overseas by engaging in collaboration activities with domestic players. For instance, in August 2022, Medrego LLC, a UK-based veterinary orthobiologics manufacturer, collaborated with Exceed Equine to expand into the U.S. market and develop guidelines for horses undergoing stem-cell treatments

Product Insights

The PRP segment accounted for the largest share of 39.2% in 2023. This dominance can be attributed to the fact that in animals platelets are vital in multiple processes, such as immune response, angiogenesis, and tissue repair. PRP is used to promote the healing process in blood clotting as it contains proteins & growth factors that speed up the healing of the tendons & ligaments by speeding up the growth of new tissues. In addition, PRP can treat conditions like OA, muscle strains, and soft tissue injuries. Therefore, the adoption of PRP therapy is increasing in veterinary practices due to its easy accessibility among animal owners and lower price than other products like stem cells and monoclonal antibodies (mAb).

The other product segment is anticipated to grow at the fastest CAGR of 9.6% over the forecast period. This segment is further categorized into mABs, collagen/elastin-based products, autologous serum, bone graft, regenerative matrix, and immune-modulating proteins that show high promise in combating orthopedic complications in animals. Product approvals from authorities are increasing as veterinarians are venturing into exploring newer & more effective solutions for treating debilitating orthopedic conditions among animals. For instance, Solensia & Librela are used for treating OA in cats and dogs and were launched by Zoetis as recently as 2022 & 2023, respectively. Such products are expected to increasingly gain traction in the market, driving the segment growth.

Animal Insights

The canine segment dominated the market with a revenue share of 46.1% in 2023. This can be attributed to the high adoption, rising rates of sports-related injuries in dogs, and prevalence of OA in dogs (40%) and lameness in 1 in 5 dogs (Zoetis, 2024 data). Common causes of OA include being overweight, lack of physical activity, genetic predisposition, joint infection, and injury. These factors are anticipated to drive the demand for orthobiologics in dogs, and the fact that dogs are becoming more active in sports demonstrates the need for specialized orthopedic care and effective orthopedic treatments. These factors are expected to facilitate segment growth over the forecast period.

The other segment is expected to showcase lucrative growth over the forecast period. The other animal type segment includes feline, swine, cattle, etc. At present, the adoption of orthobiologics is comparatively lower in these animals. However, the dominant growth rate of this segment can be attributed to the involvement of industry professionals in introducing innovative products, especially for feline orthopedic conditions (E.g., the launch of Solensia in 2022). In addition, the volume of research studies is increasing to expand the use of orthobiologics in animals like cattle, swine, and rabbits, providing an added boost to the segment.

Application Insights

The OA segment dominated the market with a share of over 60% in 2023 because of the high prevalence of OA and the rise in contributing factors to OA in dogs, cats, and horses. Osteoarthritis is becoming one of the most prevalent conditions in animals. The main causative factors for OA can be obesity, breed, lack of exercise & proper diet, and genetic predisposition. For example, in horses older than 15 years, the prevalence of OA is estimated to be more than 50%, and in horses older than 30 years, it escalates to 80%-90%, according to the 2023 study published in NIH journal. In addition, new developments in regenerative treatment options are aiding veterinarians in managing OA. These factors are collectively expected to propel segment growth.

The other application segment is expected to grow with the highest CAGR from 2024 to 2030. This segment includes ligament tears, muscle strains, trauma, intervertebral disc syndrome, and lameness. The key to minimizing the occurrence of complex orthopedic conditions like OA and degenerative joint disease (DJD) is treating their early symptoms. All the conditions mentioned in this segment are generally some of the initial symptoms of complex orthopedic conditions. Therefore, recognizing the importance of preventive and timely treatment of these underlying conditions, veterinarians are shifting towards preventive use of orthobiologics, driving the market growth over the forecast period.

Mode of Delivery Insights

The intra-articular delivery mode segment dominated the market in 2023. This dominance can be attributed to its demand as it can be directly delivered into the joint to ensure faster action and increase drug bioavailability. In veterinary medicine, intra-articular administration of orthobiologics is an established process for managing joint pain and lameness. It is utilized for animals with OA or perioperatively, such as in animals undergoing arthroscopy or arthrotomy. Major orthopedic biologics, such as PRP and stem cells, are administered to promote tissue healing and repair cartilage damage. These factors are expected to drive segment growth over the forecast period.

The other modes segment is estimated to grow at the highest CAGR from 2024 to 2030. This segment includes subcutaneous, intravenous, peri tendonous/ligamentous, etc. The high growth rate of this segment is due to the increasing product launches that use these delivery modes. For example, recently launched Librela and Solensia are delivered through subcutaneous mode. Furthermore, therapies like stem cells and PRP are also being administered intravenously and peri tendonous/ligamentous to attain two goals: rapid action of the drugs and site-specific action of the drugs, respectively, driving the segment growth.

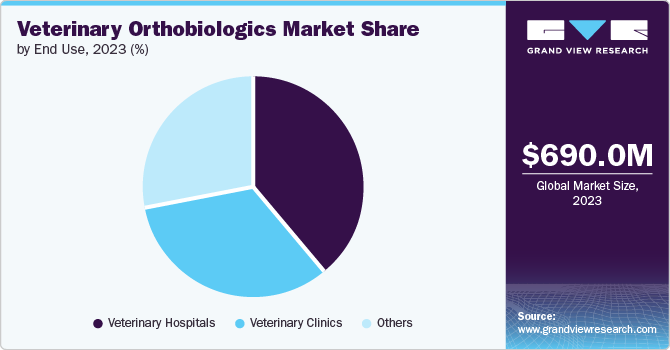

End Use Insights

The veterinary hospitals segment dominated the veterinary orthobiologics market in terms of share in 2023. This is explained by the increasing number of patients receiving treatment for orthopedic medical conditions in animals at these hospitals. To administer orthobiologics at the necessary location, specific equipment, and skilled staff are essential. Overall, the availability of therapies at the hospital pharmacy in a single location, skilled personnel, and specialized equipment are advantageous to animal owners. It becomes convenient for them to acquire the prescribed drugs from a single hospital setting, consult with leading veterinarians, and perform all the necessary tests.

The veterinary clinics segment is expected to grow at the highest CAGR from 2024 to 2030. This can be attributed to the high accessibility of this end user to pet owners seeking orthopedic care for their animals. Hospitals lack the location penetration that clinics possess. These clinics are easily accessible for animal parents when the animal needs periodic treatment for orthopedic conditions.

Regional Insights

The veterinary orthobiologics market in North America accounted for the largest share of 43.23% in 2023. This dominance can be due to the contribution of multiple factors like high pet adoption rate, higher animal health awareness among owners, rising spending on animal health, and the presence of major market players, such as Zoetis, VetStem Inc., Enso Discoveries, and Ardent Animal Health.

U.S. Veterinary Orthobiologics Market Trends

The U.S. veterinary orthobiologics market is expected to witness considerable growth in the coming years. Continuous and ongoing research into innovative orthobiologics, increasing regulatory approvals, thorough regulatory scrutiny, and a supportive environment for veterinary clinical trials are the driving factors for the domestic market.

Europe Veterinary Orthobiologics Market Trends

The veterinary orthobiologics market in Europe is attributed to the region's increasing population of overweight pets. Overweight dogs and cats are more likely to experience comorbid conditions like metabolic dysregulations and joint disorders that increase the chances of further complications like lameness, trauma, and injuries. For example, according to May 2024 data published by UK Pet Food, it is estimated that over 40% of the cats & dogs in the UK are overweight. Furthermore, in Sweden, approximately 30% of the local dog breeds are estimated to be overweight, according to a 2021 study from Acta Veterinaria Scandinavica Journal. Obesity increases the pet’s chances of developing orthopedic complications, simultaneously increasing the demand for orthobiologics drugs.

The Germany veterinary orthobiologics market ranked first for the largest equine population in European Union, with 4.48 million heads in 2023, according to FAO. Due to the large horse population in Germany, a significant portion of them are involved in various activities like sports, racing, and riding. Higher physical activity boosts the probability of orthopedic injuries and diseases in them. German veterinarians follow high standards of care to ensure that equine orthopedic complications are diagnosed and treated promptly. This commitment to quality care contributes to the overall growth of the domestic market.

Asia Pacific Veterinary Orthobiologics Market Trends

The veterinary orthobiologics market in Asia Pacific (APAC) is expected to grow at the highest CAGR of over 10.09% from 2024 to 2030. This high growth is primarily due to increasing ingenuity in R&D activities in major countries like Japan, China, and India. For instance, in December 2023, researchers at Osaka Metropolitan University of Japan developed a novel technique for extracting stem cells from an animal’s urine sample. Traditionally, stem cells are extracted through sources like animals' bone marrow aspirate, blood plasma, fat tissue, etc. This new method will ensure that the extraction process is non-invasive and pain-free for the pet. Such initiatives are anticipated to enhance veterinary regenerative R&D across the region, driving market growth.

The India veterinary orthobiologics market is expected to grow at a CAGR of 11.8% over the forecast period. In recent years, apart from the growing pet adoption rate in India, equestrian sports have grown in popularity. For example, in the 2023 Asian Games, the Indian equestrian contingent grabbed three gold medals after a gap of over 41 years. This popularity is expected to rise further in the future and prompt veterinarians to maintain a higher quality of care for equine athletes, as this sport's success depends on the horses' physical well-being. All these factors are expected to boost the demand for equine orthobiologics in the country, driving market growth. Furthermore, the rising incidence of arthritis in dogs and other animals is expected to significantly impact market growth in India.

Latin America Veterinary Orthobiologics Market Trends

The veterinary orthobiologics market in Latin America is expected to witness considerable growth driven by rising pet expenditure. According to 2023 survey data by Euromonitor, the average spending of Latin Americans on their pets exceeds the global average by 22%. This indicates that pet owners in the region are very actively spending money on things like food, toys, and healthcare, boosting the demand for veterinary medicines for various conditions like cardiovascular and orthopedic conditions.

The Brazil veterinary orthobiologics market is expected to rise due to a huge boost to the pet population in the country. According to 2023 data by the Brazilian Association of Pet Products, in 2022, the pet population in the country totaled around 168 million with a growth rate of almost 34%, i.e., nearly two pets in each of 90 million households in Brazil. This popularity indicates the increasing demand for appropriate therapeutic care for pets.

Middle East & Africa Veterinary Orthobiologics Market Trends

The veterinary orthobiologics market in Middle East & Africa will grow due to rising awareness and a high incidence of conditions like hip dysplasia, degenerative disc disease, torn cruciate ligaments, fractures, arthritis, & others. The need for veterinary orthopedic medications and care is rising as these conditions become more common in animals. Due to these circumstances, the region's need for efficient management of the aforementioned chronic diseases has increased. The lack of therapeutic options in this area is causing a rise in urgency. The market growth is driven by consumers' growing interest in healthier lifestyles for their pets.

The South Africa veterinary orthobiologics market is likely to grow significantly in the coming years, mainly due to the increasing popularity of stem cell therapy in the country. One of the primary reasons for stem cell therapy's popularity is its ability to provide long-term treatment and improve the quality of life for animals suffering from orthopedic disorders. Moreover, there is a growing need for innovative medicines like stem cell therapy as pet owners look for advanced methods to treat their pets. For example, Blue Hills Veterinary Hospital offers stem cell-based regenerative treatment. This is only the second clinic in South Africa that currently provides stem cell therapy.

Key Veterinary Orthobiologics Company Insights

The market is subject to a very high degree of innovation with researchers delving into exploring novel treatments for orthopedic complications in animals. Some of the main initiatives undertaken by industry players and researchers are patent applications, clinical trials, partnerships & collaborations, and novel product launches.

Key Veterinary Orthobiologics Companies:

The following are the leading companies in the veterinary orthobiologics market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Boehringer Ingelheim

- Ardent Animal Health LLC

- Enso Discoveries

- VetStem Inc.

- Medrego LLC

- T-Cyte Therapeutics

- Arthrex Inc.

- Hilltop Bio

- Enovis

- Movora

- Dechra Pharmaceuticals Inc.

Recent Developments

-

In May 2024, VetStem Inc. filed a Patent Cooperation Treaty (PCT) patent application for its proprietary PRP therapy for dogs & horses, PrecisePRP

-

In April 2024, researchers at Lousiana State University (LSU) invented a new type of syringe for injecting stem cells into humans and animals that minimizes the chances of contamination of the sample by limiting the number of times the cells are handled before the procedure. The inventors have filed for a patent for this device

-

In March 2024, Theradeptive Technologies initiated clinical trials for an innovative surgical graft, OsteoAdapt, for humans & animals that uses the body’s proteins to assist in re-growing the bones at the injection site. The company plans to launch the product by the end of the year 2024

-

In October 2023, Athersys, Inc. entered a licensing agreement with Ardent Animal Health, LLC, granting Ardent exclusive rights to use Athersys’ MAPC technology for nonhuman mammal applications in the U.S. The partnership aimed to advance stem cell therapies for joint diseases and other unmet needs in animal health

-

In January 2023, Hilltop Bio launched Regenaflex K-9, a stem-cell therapy for dogs, which is administered into their muscles. This product uses a proprietary combination of essential growth factors, exosomes, and cytokines that have the ability to accelerate the healing process in ligaments, tendons, muscles, and bones

Veterinary Orthobiologics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 0.74 billion

Revenue forecast in 2030

USD 1.24 billion

Growth rate

CAGR of 8.82% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, application, mode of delivery, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zoetis; Boehringer Ingelheim; Ardent Animal Health LLC; Enso Discoveries; VetStem Inc.; Medrego LLC; T-Cyte Therapeutics; Arthrex Inc.; Hilltop Bio; Enovis; Movora; Dechra Pharmaceuticals Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Orthobiologics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary orthobiologics market report based on product, animal, application, mode of delivery, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Stem Cells

-

Platelet-rich Plasma (PRP)

-

Other Biologics

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Equine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Osteoarthritis

-

Degenerative Joint Disease

-

Other Applications

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

Intra-muscular/Intra-lesional

-

Intra-articular

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary orthobiologics market size was estimated at USD 690.00 million in 2023 and is expected to reach USD 0.74 billion in 2024.

b. The global veterinary orthobiologics market is expected to grow at a compound annual growth rate of 8.82% from 2024 to 2030 to reach USD 1.24 billion by 2030.

b. Based on product, the platelet-rich plasma (PRP) segment accounted for the largest revenue share of 39.2% in 2023. This dominance can be attributed to the fact that in animals platelets are vital in multiple processes, such as immune response, angiogenesis, and tissue repair. PRP is employed to promote the healing process in blood clotting as it contains proteins & growth factors that speed up the healing of the tendons & ligaments by speeding up the growth of new tissues.

b. Some key players operating in the veterinary orthobiologics market include Zoetis, Boehringer Ingelheim, Ardent Animal Health Llc, Enso Discoveries, VetStem Inc., Medrego Llc, T-Cyte Therapeutics , Arthrex Inc., Hilltop Bio, Enovis, Movora, and Dechra Pharmaceuticals Inc.

b. Key factors that are driving the market growth include advances in veterinary regenerative medicine, rising prevalence of orthopedic complications in animals, global rise in animal athletic events, rising innovative product launches, and increasing number of clinical trials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.