Veterinary MRI Market Size, Share & Trends Analysis Report By Solutions (MRI Scanner, Software & Services, Accessories/ Consumables), By Type (Small, Large), By End-use (Veterinary Hospitals, Veterinary Clinics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-028-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Veterinary MRI Market Size & Trends

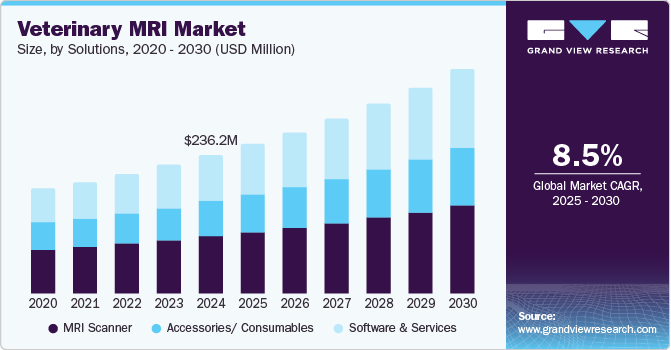

The global veterinary MRI market size was estimated at USD 236.2 million in 2024 and is expected to grow at a CAGR of 8.5% from 2025 to 2030. Growth is primarily driven by the increasing humanization of pets, advancements in imaging technology, and rising adoption of pet insurance. Companies are introducing dedicated veterinary MRI systems to improve the accessibility and affordability of diagnostic imaging. For instance, Time Medical Systems, based in Hong Kong, offers a range of veterinary MRI scanners, such as Panion Premier, Panion Pro, Panion, and Panion+, designed to provide cost-effective diagnostic solutions for pets.

The COVID-19 pandemic significantly impacted the market due to supply chain challenges and reduced demand. However, it also raised awareness about animal health, increased veterinary visits, and heightened concerns over zoonotic diseases. As a result, the overall market impact remained neutral. Veterinary MRI sales are expected to grow in the coming years. For instance, Hallmarq Veterinary Imaging reported a key milestone in March 2022 with the completion of 300,000 animal scans using its MRI and CT machines, reflecting this continued demand.

Technological advancements play a significant role in driving market growth. Companies actively engage in R&D, product development, and upgrades to address the challenges in the veterinary MRI industry and strengthen their market positions. For instance, in November 2022, Hallmarq Veterinary Imaging introduced a zero-helium small animal MRI machine to overcome helium shortage, rising costs, and sustainability concerns. This system eliminates the need for helium or extra power for cooling and uses vacuum technology and a conduction-based cooling system instead.

The growing population of companion animals is another key factor driving the veterinary MRI market. According to the American Veterinary Medical Association (AVMA), the pet dog population in the U.S. has steadily increased from 52.9 million in 1996 to 89.7 million in 2024. However, this growth was briefly interrupted in 2023 when the population declined to 80.1 million from 88.3 million in 2022 before rebounding in 2024. In comparison, the pet cat population has remained relatively stable, rising from 59.8 million in 1996 to 73.8 million in 2024, with its highest recorded level of 81.7 million in 2006.

Solutions Insights

On the basis of solutions, the MRI scanner segment dominated the veterinary MRI industry, with a 41.3% share in 2024. MRI scanners are widely used in veterinary diagnostics due to their ability to provide detailed imaging of soft tissues, aiding in the diagnosis of neurological, musculoskeletal, and oncological conditions in animals. The segment growth is driven by the increasing adoption of advanced imaging technologies in veterinary clinics and hospitals, along with rising pet ownership and demand for better diagnostic solutions. In addition, ongoing technological advancements in MRI systems, such as high-resolution imaging and improved efficiency, contribute to their growing preference for veterinary applications.

The software and services segment is expected to grow at the fastest CAGR of 9.2% over the forecast period. This growth can be attributed to the increasing integration of AI-driven diagnostic tools, the rising demand for cloud-based imaging solutions, and the need for efficient data management in veterinary practices. Advancements in imaging software enhance diagnostic accuracy, streamline workflows, and improve overall operational efficiency. In addition, the growing emphasis on telemedicine and remote consultations in veterinary care further supports the expansion of this segment.

Type Insights

On the basis of type, small animals held the largest share of 70.9% in 2024, and the segment is estimated to grow at the fastest CAGR over the forecast period. Among small animals, dogs are the primary species for which veterinary diagnostic imaging technology such as MRI is utilized. The adoption of these technologies is being driven by a rise in pet ownership, a growing pet population, increasing animal healthcare costs, and improvements in pet insurance coverage. In addition, the segment is expected to witness the fastest growth over the forecast period due to a rise in painful and inflammatory disorders in animals and an increase in product launches specifically for small animals. Among small animals, cats are expected to experience the fastest growth, driven by the growing focus on feline healthcare and advancements in imaging solutions tailored for this species.

Large animals held a notable market share in 2024, driven by the growing adoption of veterinary MRI technology in livestock and equine healthcare. The demand for advanced diagnostic tools is increasing due to the rising prevalence of musculoskeletal disorders, reproductive health concerns, and the need for efficient disease management in cattle and horses. In addition, advancements in portable imaging solutions support wider adoption in field settings, further contributing to segment growth.

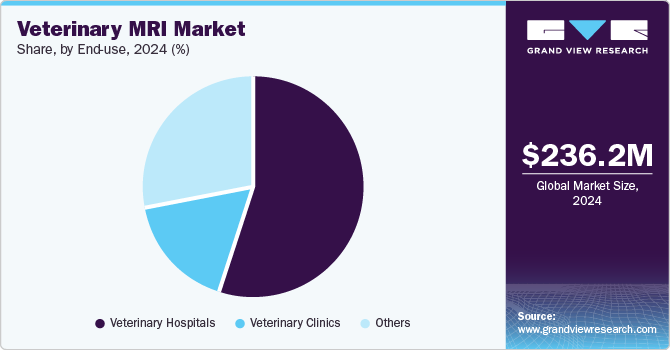

End-use Insights

On the basis of end use, the veterinary hospitals segment held the largest share of 55.1% in 2024. This is because these facilities offer comprehensive diagnostic and treatment services, driving the demand for advanced MRI technology. The presence of specialized veterinary professionals, increasing pet ownership, and rising expenditure on animal healthcare further support segment growth. In addition, veterinary hospitals are well-equipped with imaging modalities, such as MRI, ensuring accurate diagnosis and effective treatment planning.

The veterinary clinics segment is expected to grow at the fastest rate over the forecast period due to the growing number of pet owners seeking specialized care for their animals. These clinics offer accessible diagnostic services, such as MRI technology, at a more affordable price point compared to veterinary hospitals. The increasing trend of preventative care and early detection of health issues in pets contributes to the demand for veterinary MRI in these settings.

Regional Insights

The North America veterinary MRI market dominated globally in 2024, accounting for 50.9% of the total revenue share. Driven by high pet ownership rates in the U.S. and Canada, the demand for advanced veterinary healthcare services, such as MRI diagnostics, continues to rise. In addition, strategic initiatives such as product launches, acquisitions, mergers, and alliances undertaken by key industry players have further strengthened the market.

The growing prevalence of neurological disorders and musculoskeletal conditions in companion animals has increased the need for accurate diagnostic imaging, reinforcing the adoption of MRI systems. Advancements in AI-driven imaging solutions also enhance diagnostic capabilities and efficiency in veterinary practices. Furthermore, collaborations between veterinary clinics and imaging technology providers are expanding access to MRI services, supporting continued market growth in the region.

U.S. Veterinary MRI Market Trends

U.S. veterinary MRI market dominated the North America veterinary MRI industry with a revenue share of 84.6% in 2024, owing to the high adoption of advanced veterinary MRI technology, a well-established healthcare infrastructure, and a large pet population. According to an article published in March 2021 by the Morris Animal Foundation, osteoarthritis affects approximately 14 million adult dogs in the U.S. Although the exact number of cats affected is unknown, 90% of cats over the age of 12 have osteoarthritis, as observed on X-ray images. This represents a sizable number of animals suffering from such conditions. In addition, increasing awareness about animal healthcare and the rising demand for accurate diagnostics in veterinary practices further drive the market growth.

Europe Veterinary MRI Market Trends

Europe veterinary MRI market held a significant revenue share, attributable to the rising prevalence of chronic diseases in pets, which drives the need for advanced diagnostic imaging, and the growing number of pet owners across the region. Conditions such as obesity, osteoarthritis, and mobility issues are increasingly observed among companion animals. Excess body fat and weight strain joints, exacerbating arthritis and limiting movement. This trend is expected to contribute to a higher incidence of joint inflammatory disorders, with obesity recognized as one of the most common nutritional health concerns in dogs.

In addition, the growing adoption of digital imaging technologies, such as MRI solutions, improves diagnostic accuracy and efficiency in veterinary practices. Collaborations between veterinary clinics and imaging technology providers are further strengthening access to advanced imaging services, supporting the growth of the veterinary MRI market in Europe.

The UK veterinary MRI market dominated the region with a revenue share of 21.4% in 2024, owing to advanced healthcare infrastructure, a growing number of veterinary hospitals and clinics, and increasing demand for diagnostic imaging services. In addition, the rising awareness of animal health and the growing adoption of cutting-edge technologies for more accurate diagnoses contribute to market growth.

According to an article published by Pet Keen in June 2023, there are 34 million pets in the UK, with dogs & cats accounting for the highest proportion. With the growing adoption rate, the prevalence of illnesses and the burden of osteoarthritis in dogs is growing in the country. According to an article published by the Royal Veterinary College, London, osteoarthritis affects between 2.5% and 6.6% of dogs of all breeds & ages and affects up to 20% of dogs older than 1 year in the country. Along with its effects on canine well-being, canine osteoarthritis is a significant problem for veterinarians, owners, and breeders in the UK. These factors are expected to contribute to the country's market growth.

Asia Pacific Veterinary MRI Market Trends

The Asia Pacific veterinary MRI market is expected to exhibit lucrative growth over the forecast period. This can be attributed to the increasing adoption of pet animals & their humanization, growing health concerns, increasing vigilance about animal health, rising livestock population, and increasing prevalence of animal diseases. Furthermore, rising healthcare expenditure on animal health and veterinary services contributes to the growth of Asia Pacific veterinary MRI industry.

The veterinary MRI market in Japan is expanding due to advancements in veterinary imaging, ongoing innovations in diagnostic technologies, and supportive government initiatives promoting veterinary healthcare. In addition, rising medical expenditure on pet care further drives market growth. A 2020 survey by the Japan Pet Food Association indicated a 15% increase in cat and dog ownership compared to 2019, with approximately 8.49 million dogs and 9.64 million cats in Japan as of October 2020. This trend reflects the growing need for advanced veterinary diagnostics in the country, supporting the continued adoption of MRI technology in veterinary practices.

Middle East & Africa Veterinary MRI Market Trends

The Middle East & Africa veterinary MRI market is experiencing notable growth as more people become aware of advanced imaging for animal healthcare. The expansion of veterinary facilities, better access to imaging technology, and partnerships between clinics and imaging providers are driving this trend.

Moreover, advancements in MRI technology, along with efforts to make it affordable and accessible, are shaping the market. Countries with expanding veterinary services, such as South Africa, the United Arab Emirates, and Saudi Arabia, are gradually adopting MRI, supported by training programs and educational initiatives for veterinary professionals. The ongoing advancements in imaging technology are expected to support regional market expansion further.

Key Veterinary MRI Company Insights

Some of the key companies operating in the veterinary MRI industry are Siemens; Esaote SPA; and General Electric Company. These companies are growing their market presence by launching new products, collaborations, and adopting various other strategies.

-

Esaote SPA is a leading provider of veterinary MRI systems, specializing in dedicated MRI solutions for animal healthcare. The company's Vet-MR series, designed specifically for companion animals, offers high-resolution imaging while ensuring ease of use in veterinary practices. Esaote’s focus on cost-effective and efficient MRI technologies has strengthened its position in the veterinary MRI market, enabling clinics and hospitals to enhance their diagnostic capabilities and improve patient outcomes.

-

General Electric Company (GE Healthcare) is a prominent player in the veterinary MRI market, offering advanced imaging solutions tailored for animal healthcare. The company’s high-performance MRI systems provide detailed anatomical imaging, aiding in the diagnosis of neurological, musculoskeletal, and soft tissue conditions in animals. GE Healthcare's focus on technological advancements, such as AI-driven imaging enhancements and high-field MRI systems, supports improved diagnostic precision in veterinary practices. Its commitment to innovative imaging solutions continues to drive the veterinary MRI market, expanding access to cutting-edge diagnostic tools for veterinarians worldwide.

Key Veterinary MRI Companies:

The following are the leading companies in the veterinary MRI market. These companies collectively hold the largest market share and dictate industry trends.

- Esaote SPA

- General Electric Company

- Siemens

- Hallmarq Veterinary Imaging

- Shenzhen Anke High-tech Co., Ltd.

- Time Medical Holding

- IDEXX Laboratories, Inc.

- Shenzhen Basda Medical Apparatus Co., Ltd

- Willows Veterinary Centre and Referral Service

- North West Radiology

Recent Developments

-

In January 2023, Esaote North America introduced the Magnifico Vet MRI system, which is designed to enhance diagnostic efficiency in veterinary hospitals. This system provides quick and accurate imaging, supporting veterinarians in making timely clinical decisions.

-

In November 2022, the Hallmarq Veterinary Imaging company introduced the Zero-Helium (ZHM) Small Animal 1.5T MRI system. This system features a cooling mechanism based on conduction, which removes the need for helium, providing a more sustainable imaging solution for veterinary practices.

Veterinary MRI Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 254.3 million |

|

Revenue forecast in 2030 |

USD 381.5 million |

|

Growth rate |

CAGR of 8.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Solutions, type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Esaote SPA; General Electric Company; Siemens; Hallmarq Veterinary Imaging; Shenzhen Anke High-tech Co., Ltd.; Time Medical Holding; IDEXX Laboratories, Inc.; Shenzhen Basda Medical Apparatus Co., Ltd; Willows Veterinary Centre and Referral Service; North West Radiology. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Veterinary MRI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary MRI market report based on solutions, type, end-use, and region:

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

MRI Scanner

-

Software & Services

-

Accessories/ Consumables

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Dogs

-

Cats

-

Others

-

-

Large Animals

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

- Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

- Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary MRI market size was estimated at USD 236.16 million in 2024 and is expected to reach USD 254.3 million in 2025.

b. The global veterinary MRI market is expected to grow at a compound annual growth rate of 8.45% from 2025 to 2030 to reach USD 381.5 million by 2030.

b. North America dominated the veterinary MRI market with a share of over 50% in 2024. This is attributable to advanced veterinary healthcare facilities, the growing humanizations of pets, and rising pet expenditures.

b. Some key players operating in the veterinary MRI market include Esaote SPA; General Electric Company; Siemens; Hallmarq Veterinary Imaging; Shenzhen Anke High-tech Co., Ltd.; Time Medical Systems; IDEXX Laboratories, Inc.; Shenzhen Basda Medical Apparatus Co., Ltd; Willows Veterinary Centre and Referral Service; North West MRI

b. Key factors that are driving the market growth include increasing pet humanization, technological advancements, initiatives by key companies, and adoption of pet insurance

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."