- Home

- »

- Animal Health

- »

-

Veterinary Molecular Diagnostics Market Size Report, 2030GVR Report cover

![Veterinary Molecular Diagnostics Market Size, Share & Trends Report]()

Veterinary Molecular Diagnostics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Animal Type, By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-324-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

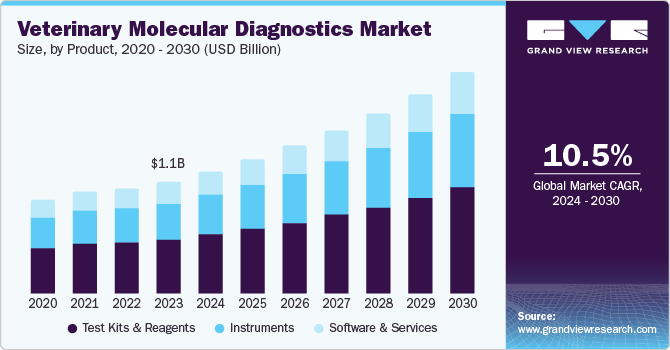

The global veterinary molecular diagnostics market size was estimated at USD 1.12 billion in 2023 and is expected to grow at a CAGR of 10.5% from 2024 to 2030. The market is primarily driven by the rising prevalence of zoonotic animal diseases, technological advancement in veterinary molecular diagnostics, high R&D investment by key players, and growing strategic alliances. For instance, in February 2024, MiDOG Animal Diagnostics LLC expanded its diagnostic capabilities to include several animal species. MiDOG aims to prepare veterinarians with the tools needed to address acute, chronic, and non-responsive infections effectively.

Additionally, the expansion of product lines by key players is propelling growth in the veterinary molecular diagnostics market. These new products address emerging needs in veterinary medicine. For instance, in October 2023, Zoetis launched the Basepaws Breed + Health Dog DNA Test. This innovative test enables pet owners to shift from a reactive to a proactive approach in pet care, thanks to its simple swabbing process and results tailored for mobile devices. This product marks a significant leap forward in empowering pet owners to take a more proactive role in their dogs' health through accessible and user-friendly genetic testing.

Technological advancements such as PCR (Polymerase Chain Reaction), next-generation sequencing (NGS), and microarrays are making diagnostics more accurate, faster, and accessible. Molecular diagnostic techniques, such as Polymerase Chain Reaction (PCR), are increasingly incorporated into veterinary diagnostic testing. These techniques offer high sensitivity and specificity for detecting nucleic acids, enabling the identification of specific pathogens. In October 2022, La Trobe University, Australia, developed a new rapid isothermal PCR test to detect liver fluke within an hour. The test is intended to help prevent the spread of the deadly parasite affecting cows, sheep, and other ruminants.

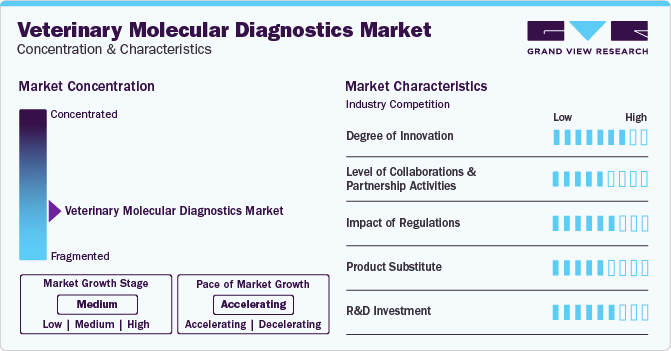

Market Concentration & Characteristics

The veterinary molecular diagnostics market is highly concentrated. The market is at a medium growth stage, and the rate of expansion is accelerating. Rapid developments in veterinary diagnostics, as well as increased R&D expenditure by leading players, are key drivers of market growth. Market concentration is influenced by the pace of technological advancements. Companies that invest in research and development to introduce innovative products with enhanced features and efficacy can gain a competitive advantage and increase their market share. Conversely, companies that fail to keep up with technological advancements risk losing market share to competitors.

The market is witnessing a high degree of innovation, particularly with advancements in technologies like next-generation sequencing (NGS), polymerase chain reaction (PCR), and point-of-care testing devices. These innovations are significantly enhancing diagnostic accuracy and speed, driving market growth by enabling early disease detection and more effective management of animal health. For instance, in March 2024, BIONOTE launched the 'Vcheck M FIV/FeLV' cartridge for on-site diagnosis of Feline Immunodeficiency Virus (FIV) and Feline Leukemia Virus (FeLV) using the M10 automatic analyzer, which simplifies nucleic acid extraction and PCR. The company aims to expand its global market share in veterinary molecular diagnostics with new product launches and an enhanced portfolio.

The market is experiencing an increase in collaboration and partnership activities among key players, including diagnostic companies, research institutions, and veterinary clinics. These strategic alliances are driving innovation and the development of advanced diagnostic tools to enhance the accuracy and accessibility of diagnostic services for animal health. For instance, In January 2024, Alveo Technologies, in collaboration with x-OvO, Royal GD, and Pharmsure, developed an innovative molecular test for avian influenza for rapid, precise detection of multiple strains in poultry. This innovative solution integrates advanced LAMP technology and cloud-enabled analytics to provide real-time, geo-tagged results, enhancing disease surveillance and response capabilities in the poultry industry globally.

Regulatory bodies like the FDA and EMA oversee veterinary molecular diagnostics, ensuring safety and efficacy before products enter the market. While stringent approvals can delay launches and increase costs, they ensure accurate disease detection in animals. Furthermore, compliance drives R&D investment for innovative products, however, barriers can limit entry of smaller players, impacting market diversity. Regulations maintain high standards in the veterinary molecular diagnostics market, supporting its growth and adoption.

Product substitutes in the market include traditional diagnostic methods such as serological testing and microbial culture, as well as point-of-care testing and imaging techniques. These substitutes offer alternatives to molecular diagnostics but may vary in accuracy, speed, and cost-effectiveness. Additionally, imaging techniques such as X-rays, ultrasound, biochemical assays, or point-of-care testing (POCT) devices offer alternatives in certain diagnostic scenarios.

Increase in R&D Investment by key players for development of advanced technologies such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and microarray platforms are driving veterinary molecular diagnostic market. This funding intends to enhance diagnostic accuracy, speed, and the range of detectable pathogens, reflecting a growing commitment to improving animal health outcomes worldwide. The key players in the veterinary molecular diagnostics market, such as IDEXX Laboratories, Thermo Fisher Scientific, QIAGEN, and bioMérieux, are continuously investing in R&D to develop new and advanced molecular diagnostic products and solutions.

Product Insights

The test kits & reagents segment dominated market with a revenue share of over 47 % in 2023. Diagnostic kits and reagents have a wide range of veterinary applications, including the detection of various pathogens and diseases. This broad applicability makes them a crucial component in the market.

The instrument segment is expected to grow at the fastest CAGR of over 10.0% from 2024 to 2030 due to an increase in technological advancements in veterinary molecular diagnostics and the growing launch of innovative molecular diagnostic devices for animals.

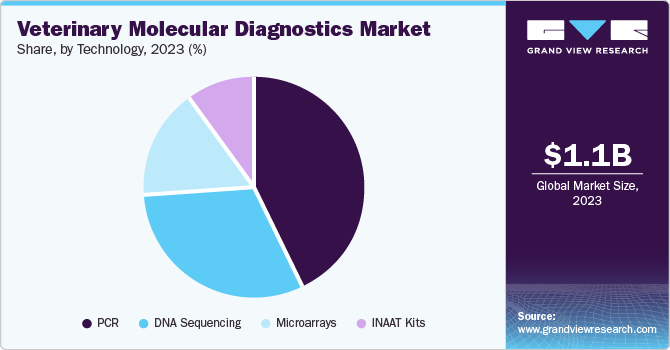

Technology Insights

PCR technology held the largest revenue share of 42.61% in 2023 due to the wide range of applications, advantages over conventional methods high efficacy, and specificity. Many kits and reagents are based on PCR techniques and are widely used in veterinary molecular diagnostics. The integration of PCR with these kits enhances their effectiveness and specificity, further increasing their dominance in the market. Moreover, PCR technology can be integrated with other technologies, such as microarrays and DNA sequencing, to provide even more comprehensive diagnostic capabilities. This integration enhances the effectiveness and specificity of PCR-based tests, further dominating the market.

The DNA sequencing segment is estimated to grow at the highest CAGR of 10.7% from 2024 to 2030. DNA sequencing technology has seen significant advancements in recent years, leading to improved accuracy, speed, and affordability. These advancements have increased its adoption in veterinary molecular diagnostics, driving growth in the segment. The demand for genetic testing in animals is rising due to the growing awareness of genetic diseases and the need for early detection. DNA sequencing is a crucial technology in genetic testing, which contributes to its high growth rate in the market.

Animal Type Insights

The companion animal segment dominated market in 2023. Companion animals, such as dogs and cats, are major drivers due to the increasing pet ownership rates globally. There is a growing demand for early disease detection, genetic screening, and personalized medicine in veterinary care for pets.

Furthermore, it is subdivided into dogs, cats, horses, and other companion animals. The dogs segment accounted for the highest revenue share of 49.4% in 2023. Dogs have a high incidence of genetic disorders, susceptibility to infectious diseases, and a large population worldwide, driving demand for advanced diagnostic tools. Additionally, pet owners increasingly seek personalized healthcare solutions for their dogs, further boosting the adoption of molecular diagnostics in veterinary practices.

Application Insights

The infectious diseases segment held the highest revenue share of 42.4% in 2023. Infectious diseases are highly prevalent in animals, and their diagnosis is crucial for animal health and public health. Moreover, Governments are providing support and funding for research and development in veterinary molecular diagnostics, which is driving the adoption of these tests in veterinary medicine. This support includes initiatives for improving animal health and disease surveillance

The genetics segment is expected to grow at the highest CAGR of 10.7% from 2024 to 2030. Advances in genetic testing technologies, such as DNA sequencing and genotyping, have improved the accuracy and efficiency of genetic testing. This has led to increased adoption in veterinary medicine for identifying genetic disorders and developing targeted treatments. The growing demand for personalized medicine in veterinary medicine, which involves personalizing treatments to an individual animal's genetic profile is also driving the segment’s growth.

End-use Insights

The veterinary hospitals & clinics segment held the largest revenue share of over 51.9% in 2023 and is expected to grow at the highest CAGR of 10.6% from 2024 to 2030. This growth is due to the high demand for rapid, accurate diagnostics in routine care for companion animals. These tests are essential for diagnosing complex health issues that are not easily detectable through conventional methods.

The diagnostic laboratories segment is expected to grow at a significant rate from 2024 to 2030 due to increasing demand for specialized, high-throughput diagnostic services from veterinary clinics and hospitals. Advances in molecular diagnostic technologies, coupled with a growing emphasis on comprehensive disease detection and surveillance, drive the need for sophisticated, centralized testing facilities that can offer more precise and diverse diagnostic capabilities.

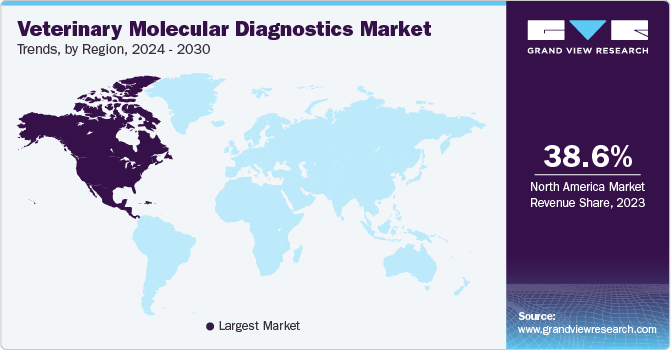

Regional Insights

North America veterinary molecular diagnostics market dominated the global market with revenue share of 38.60% in 2023. The dominant share can be attributed to the advanced healthcare infrastructure, high pet ownership rates, and increasing expenditure on animal health. Similarly, technological advancements and a growing demand for accurate disease detection are expected to boost market demand.

U.S. Veterinary Molecular Diagnostics Market Trends

The veterinary molecular diagnostics market in the U.S. is expected to grow at a significant pace from 2024 to 2030, driven by advancements in technology increasing demand for early disease detection and personalized treatment options in pets, and the presence of a large number of key players in the region. Key trends include the adoption of advanced molecular tests like DNA-based assays and biomarker identification tools, to improve diagnostic accuracy and therapeutic decision-making in veterinary oncology and other specialized areas. For instance, in September 2022, Antech expanded its canine cancer diagnostic capabilities with new molecular tests like SearchLight DNA and OncoK9, enhancing early detection and personalized treatment options. These innovations aim to enhance early detection and tailored treatment approaches, integrating digital cytology, imaging technologies, and molecular diagnostic products to support veterinarians and improve outcomes for dogs with cancer.

Europe Veterinary Molecular Diagnostics Market Trends

The Europe veterinary molecular diagnostics market is influenced by several trends, driven by the rising prevalence of several animal disease outbreaks, advancements in disease surveillance, rising pet ownership rates, and the need for effective diagnostic solutions. There were reported outbreaks of various other infectious animal diseases across Europe, including Avian influenza A, Lumpy skin disease, Rift Valley fever, Aujeszky’s disease, Bluetongue virus, and African swine fever, among others.

The veterinary molecular diagnostics market in Germany is anticipated to grow at a constant growth rate due to rising animal disease outbreaks, increasing demand for accurate and rapid disease diagnosis, and the adoption of veterinary molecular diagnostic products and solutions. For instance, Germany has reported outbreaks of various diseases, such as African Swine Fever (ASF), Avian Influenza, and Bovine Viral Diarrhea (BVD), among others. According to a new report published by the European Food Safety Authority (EFSA) in 2022, Germany reported 1,444 ASF cases in wild boar, with a significant increase in cases in the eastern part of the country. Similarly, Germany reported 144 outbreaks of Avian Influenza in poultry, with a significant increase in cases in the northern part of the country in 2022.

The UK veterinary molecular diagnostics market held the largest share in the European animal health market in 2023. Pets are commonly found in homes everywhere in the UK. Pets are commonly found in homes everywhere, including in the UK. A 2024 article published by Pet Keen stated that the pet population in the UK in 2021 was estimated to be 12.5 million dogs & 12.2 million cats. Due to the COVID-19 pandemic and the isolation that followed, there has been a rise in pet ownership in recent years. In addition, people are adopting new pets for love, company, and fun. Currently, 62% of UK residents are pet owners.

Asia Pacific Veterinary Molecular Diagnostics Market Trends

The veterinary molecular diagnostics market in Asia Pacific is expanding rapidly, driven by factors such as increasing pet adoption rates, rising awareness about zoonotic diseases, and growing expenditure on animal healthcare. For instance, countries like China and India are witnessing a surge in demand for molecular diagnostic tests to ensure early disease detection and management in companion animals and livestock. The adoption of advanced technologies, such as PCR and next-generation sequencing, is also accelerating market growth in the Asia Pacific region.

The Japan veterinary molecular diagnostics market is expanding rapidly, driven by factors such as the country's advanced healthcare infrastructure, high standards of veterinary care, and increasing pet ownership. This growth is supported by innovations in molecular testing technologies, such as PCR and next-generation sequencing, which enable accurate and rapid diagnosis of diseases in animals. Additionally, partnerships between global diagnostic companies and local distributors are enhancing market penetration, ensuring availability of cutting-edge diagnostic solutions across veterinary clinics and research institutions in Japan.

The veterinary molecular diagnostics market in India is witnessing notable growth, driven by increasing adoption of advanced PCR-based techniques for early disease detection in livestock and companion animals, growing supportive government initiatives, and rising demand for improved animal healthcare across the country. For instance, the State Animal Disease Diagnostic Laboratory (SADDL) in Gangtok has successfully standardized PCR for detecting Babesia sp., a protozoal disease in animals, achieving significant milestones with 7.75% prevalence in cattle and 10.12% in canines during 2022 - 23. This advancement reflects growing adoption of molecular diagnostics in India's veterinary sector, enhancing early disease detection and customized treatment for several animal diseases.

Latin America Veterinary Molecular Diagnostics Market Trends

The demand for animal protein is increasing in Latin America, leading to an expansion of the livestock industry. This has resulted in a greater need for accurate and rapid disease diagnosis to ensure animal health and prevent disease outbreaks. Additionally, Latin America has experienced outbreaks of various animal diseases, such as Foot-and-Mouth Disease, Avian Influenza, and Porcine Reproductive and Respiratory Syndrome (PRRS). The need for accurate and rapid diagnosis of these diseases is driving market growth.

The veterinary molecular diagnostics market in Brazil, high mortality rates among beef cattle due to infectious diseases underscore the urgent demand for skilled veterinary professionals proficient in molecular diagnostics. This necessity not only addresses significant financial losses but also supports market growth in one of the world's leading beef-producing nations.

Middle East & Africa Veterinary Molecular Diagnostics Market Trends

The Middle East & Africa veterinary molecular diagnostics market is witnessing significant growth, driven by rising pet adoption rates and increasing awareness about animal health, growing investment in veterinary healthcare infrastructure and the adoption of advanced diagnostic technologies are also expected to boost market growth. For instance, countries like South Africa and the UAE are leading the adoption with increased spending on veterinary services and diagnostic tools, reflecting the region's evolving healthcare landscape.

The Saudi Arabian market is experiencing significant growth due to the rapid expansion of poultry production in line with the Saudi Vision 2030 initiative. This strategic plan by the Saudi Ministry of Environment, Water and Agriculture (MEWA) aims to significantly increase local poultry production, reducing dependence on oil and diversifying the economy. In 2020, Saudi Arabia produced 900,000 MT of chicken meat, meeting 60% of its domestic consumption needs. The country's poultry production is projected to reach 1.55 million metric tons annually. This expansion in poultry production is driving the Saudi Arabian veterinary molecular diagnostics market. As the poultry industry grows, there is an increasing demand for advanced diagnostic tools to ensure animal health and productivity. The focus on improving veterinary diagnostics aligns with the broader goals of enhancing food security and supporting sustainable agricultural practices.

Key Veterinary Molecular Diagnostics Company Insights

Major players in the market are actively engaged in competitive and moderately fragmented market dynamics. These companies emphasize R&D along with introducing new products to enhance their market presence. Furthermore, they are frequently collaborating with veterinary clinics, research institutions, and academic organizations to boost R&D efforts and expand the availability of diagnostic products in veterinary healthcare. They are also expanding globally to tap into emerging markets and influence the increasing awareness of veterinary diagnostics.

Key Veterinary Molecular Diagnostics Companies:

The following are the leading companies in the veterinary molecular diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- IDEXX

- Antech Diagnostics, Inc. (Mars Inc.)

- Thermo Fisher Scientific Inc.

- Neogen Corporation

- Gold Standard Diagnostics (Eurofins Technologies)

- Bio-Rad Laboratories, Inc

- Ring Biotechnology Co Ltd.

- QIAGEN N.V.

- BIONOTE

Recent Developments

-

In February 2024, MiDOG Animal Diagnostics introduced an advanced All-in-One Diagnostic Test capable of rapidly detecting bacterial and fungal infections, including antibiotic resistance, across a wide range of animal species. This innovation aims to enhance veterinary care by replacing traditional testing methods with efficient molecular-based diagnostics, supporting comprehensive treatment strategies for diverse animals, from pets to exotic species.

-

In January 2024, Royal GD and PathoSense entered into an exclusive partnership for PathoSense's veterinary diagnostic assay in the Dutch market. PathoSense utilizes nanopore sequencing to detect a wide range of viruses and bacteria in animal samples, offering comprehensive pathogen identification without prior selection.

-

In July 2023, Alveo Technologies collaborated with Germany's Fraunhofer Institute for Cell Therapy and Immunology IZI to create molecular diagnostic tests for veterinary applications. Using Alveo's be.well platform, which features rapid, handheld LAMP technology, Fraunhofer IZI will develop novel assays. This collaboration aims to expand diagnostic capabilities and streamline testing processes closer to the point of need in veterinary care.

Veterinary Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.23 billion

Revenue Forecast in 2030

USD 2.23 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, animal type, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Zoetis; IDEXX; Antech Diagnostics, Inc. (Mars Inc.); Thermo Fisher Scientific Inc.; Neogen Corporation; Gold Standard Diagnostics (Eurofins Technologies); Bio-Rad Laboratories, Inc; Ring Biotechnology Co Ltd.; QIAGEN N.V.; BIONOTE.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary molecular diagnostics Market report based on product, animal type, technology, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Test Kits & Reagents

-

Software & Services

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Dogs

-

Cats

-

Horses

-

Other Companion Animals

-

-

Production Animals

-

Cattle

-

Poultry

-

Swine

-

Other Production Animals

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR

-

DNA Sequencing

-

Microarrays

-

INAAT Kits

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Metabolic Disease

-

Genetics

-

Other Application

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Diagnostic Laboratories

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global veterinary molecular diagnostic market is expected to witness a significant growth owing to the increasing companion animal population around the globe and advancements in veterinary molecular diagnostics.

b. The global veterinary molecular diagnostic market is expected to register a substantial growth rate in the next five years. The increasing prevalence of animal diseases and expenditure on animal care is expected to augment the market growth.

b. North America is expected to show high growth due to rising demand for animal-based proteins, government & private funding, the incidence of zoonotic diseases, and pet ownership in the region.

b. Some key players operating in the veterinary molecular diagnostic market include Idexx Laboratories Inc., Neogen Corporation, Thermo Fischer Scientific Inc., VCA Inc., HealthGene Corporation, Abaxis Inc., and Biomedica Medizinprodukte GmbH.

b. Key factors driving the veterinary molecular diagnostic market growth include increasing zoonotic diseases, technological advancements, awareness, and sensitivity towards zoonoses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.