- Home

- »

- Animal Health

- »

-

Veterinary Infusion Pumps Market Size & Share Report, 2030GVR Report cover

![Veterinary Infusion Pumps Market Size, Share & Trends Report]()

Veterinary Infusion Pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type, By Animal Type (Companion, Livestock), By Route of Administration, By Application, By End-use, By Region And Segment Forecasts

- Report ID: GVR-4-68040-153-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Infusion Pumps Market Trends

The global veterinary infusion pumps market size was estimated at USD 266.34 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.36% from 2024 to 2030. The key drivers contributing to the market's growth include an upsurge in hospitalizations for surgical interventions coupled with favorable insurance policies, which is anticipated to boost product demand. In addition, the growing trend for enteral feeding for effective disease management is estimated to fortify the market demand. Moreover, continuous technological advancements in infusion pumps, rising veterinary health expenditure coupled with high awareness among pet owners for precise drug dosing, R&D activities, and prevalence of diseases are a few other aspects driving the market growth.

Moreover, rapidly developing healthcare infrastructure owing to the high prevalence of veterinary ailments requiring surgical interventions among developed regions is expected to bolster the market growth potential. Further, the American Pet Products Association (APPA) estimates that U.S. pet care spending will increase from USD 90.5 billion in 2018 to USD 123.6 billion in 2021. Thus, an upsurge in pet care spending among high and middle-income countries contributes to overall market growth potential.

The COVID-19 pandemic affected the demand for veterinary infusion pumps, particularly in 2020. This adverse effect was primarily owing to movement restrictions among several nations, disruptions in the supply chain led to temporary shortages, operational hurdles, the rise of input costs, and delayed deliveries limited the overall market growth. For instance, as per the American Veterinary Medical Association report, the COVID-19 pandemic caused considerable challenges to veterinary procedures, which decreased the number of non-urgent cases and impeded market expansion. However, in 2021, the surge in the adoption of telemedicine and remote consultations in the veterinary field to minimize the risk of infections sustained market revenue growth.

Ongoing technological advancements in veterinary infusion pumps to enhance functionality, precision, safety, and efficiency are estimated to propel market penetration over the forecast period. The incorporation of numerous advancements such as microprocessor control for precise dosing, touchscreen interfaces for user-friendliness, wireless connectivity for remote monitoring, and smart alarms for safety are a few aspects anticipated to boost product adoption. Several industry participants are proactively involved in the development and manufacturing of technologically advanced infusion pumps, which will spur the market growth potential. For instance, in May 2022, Hawkmed introduced the HK-T100VET touchscreen veterinary infusion pump with an enhanced user-friendly interface, performance, and smart features for precise drug delivery. Thus, the introduction of smart veterinary infusion pumps can drive the market revenue growth potential over the forecast period.

Several initiatives by prominent industry players and government agencies are anticipated to boost market expansion. Notable instances include Merck Animal Health's collaboration with The Street Dog Coalition to offer complimentary veterinary services to homeless pets and the animal welfare action plan by the United Kingdom Government are some of the major initiatives aid to drive industry growth. Furthermore, expanding availability of cost-effective insurance policies for companion animals covering long-term treatments in developed nations is estimated to drive market growth potential.

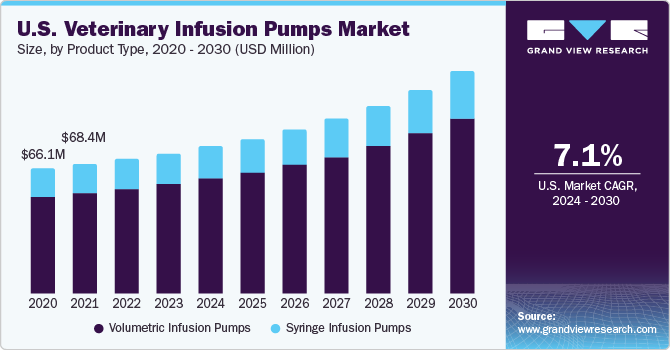

Product Type Insights

Based on product type, the market is categorized into syringe infusion pumps and volumetric infusion pump segments. The volumetric infusion pumps segment dominated the market in 2023 with a share of over 77.00%. This dominance can be attributed to the growing usage of large-volume infusion pumps for numerous benefits, including delivering fluids during animal blood transfusions, parenteral nutrition administration, and emergency conditions. In addition, continuous technological advancements and integration of advanced features for long-term treatments are expected to stimulate segmental growth. Moreover, volumetric infusion pumps offer ergonomic and compact design as well as they are integrated with wireless connectivity for real-time monitoring for effective treatment with better animal care are a few aspects driving segmental demand over the forecast period.

The syringe infusion pumps segment is projected to witness substantial growth in the foreseeable future. The segment demand is primarily attributed to the growing usage of syringe infusion pumps for precise anesthesia administration and drug administration with narrow therapeutic ranges.

Animal Type Insights

Based on animal type, the companion animals segment held the largest market share of over 90% in 2023. The segment growth is due to the significant rise in pet adoption brought on by changing lifestyles, favorable reimbursement coverage, increasing awareness and adoption of advanced veterinary care, and out-of-pocket expenditure among developing economies. For instance, the APPA National Pet Owners Survey estimated that in 2023, around 66% of households own a pet in the U.S. and over 53% in the UK. Thus, increasing pet population in developed regions leads to a risk of several diseases among companion animals, thereby accelerating market demand. Furthermore, an upsurge in pet care spending and heightened awareness among pet owners and veterinarians regarding infusion therapy for critical care are other factors driving segmental demand.

The livestock animals segment held a considerable revenue share in 2023 and is estimated to witness a similar trend over the forecast timeline. The high segment growth potential is owing to increasing awareness regarding infusion therapy for better animal care. Further, the growing adoption of infusion pumps among homecare settings for long-term care broadens overall segmental revenue growth potential over the forecast period.

Route of Administration Insights

In terms of route of administration, the intravenous segment held the largest market share of approximately 90% in 2023. The subcutaneous segment is anticipated to grow at the fastest CAGR of 8.82% over the forecast period. The intravenous route offers several advantages, such as direct delivery to the bloodstream, dosage control, and better immune response, making it a widely adopted route of administration in the veterinary infusion pump sector. Moreover, advancements in infusion technology and the integration of several features, including precise drug dosing, wireless connectivity, and relay mode for continuous infusion, among others, propel segmental growth.

The subcutaneous route segment has gained popularity in recent years due to applications such as drug delivery precision and enhanced patient comfort. The rise in awareness regarding advanced infusion pumps and alternative routes of administration, such as subcutaneous routes among healthcare professionals is anticipated to bolster segmental demand in the foreseeable future.

End-use Insights

In terms of end-use, the veterinary hospitals & clinics segment held the majority share of the market at 48.21% in 2023. Expanding veterinary hospitals and clinics coupled with an increasing number of veterinarians across the globe is anticipated to spur the market demand. The growing advancements in veterinary healthcare infrastructure and integration of advanced equipment, including infusion pumps among clinical settings, will positively influence the market demand. The rising preference for advanced infusion pumps among veterinarians is owing to several benefits such as precise drug dosing, multi-channel dosing, and integration of several modes to enhance effectiveness and patient outcomes.

The home care segment is predicted to witness unprecedented growth over the projected period. This high growth potential is primarily attributed to the upsurge in long-term care, along with increasing awareness regarding infusion therapy for effective nutrition and fluid management for better results. In addition, increasing pet care spending, especially on pet insurance in high-income countries will spur market growth. For instance, the APPA National Pet Owners Survey stated that U.S. pet owners spent more than USD 136.8 million on pet care in 2022. Thus, rising pet care spending coupled with high product awareness is expected to drive market revenue growth in the forthcoming years.

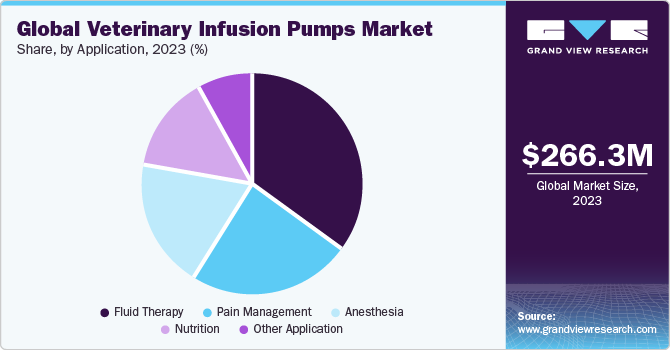

Application Insights

In terms of application, the fluid therapy segment held the largest market share of over 34.00% in 2023. The growing adoption of infusion pumps for fluid therapy in veterinary medicine to provide precise control over the administration of fluids and medications is enhancing patient care and thereby driving segmental demand. The rising demand for multi-channel infusion pumps that allow for the simultaneous administration of multiple fluids or medications in complex treatment conditions strengthen the market demand. Furthermore, numerous pharmaceutical and biotech companies are proactively involved in R&D activities and clinical trials for novel drug innovations that require continuous fluid therapy to animals for checking effectivity and bioavailability, which can positively influence segment growth potential.

The nutrition segment is projected to grow at the fastest CAGR of 7.79% over the forecast period. The segment growth is attributed to the growing preference for enteral nutrition in pet care, where nutrients are directly delivered into the gastrointestinal tract through infusion pumps. Moreover, nutrition plays a significant role in preventive veterinary care, and veterinary infusion pumps can be used to administer nutritional solutions that assist in maintaining optimal health and prevent certain diseases. Thus, the aforementioned factors propel segment growth.

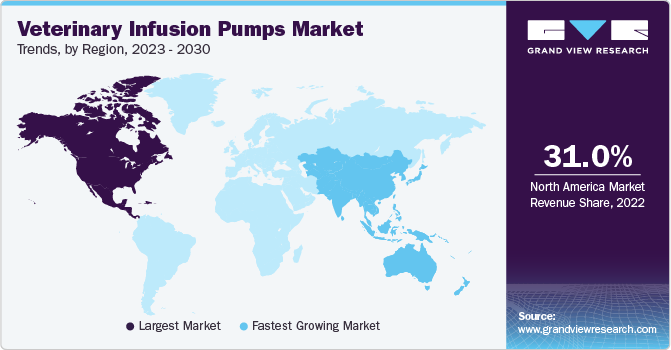

Regional Insights

Based on region, North America dominated the market with a share of more than 31.00% in 2023. The regional growth is owing to factors such as the strong presence of major industry players, increasing prevalence of several chronic diseases, and technological advancements. Key companies, including HESKA Corporation, Grady Medical Systems, and Avante Health Solutions, are headquartered in the U.S., thus contributing to the regional share. Moreover, a strong foothold in R&D activities and clinical trials in the region by several life science companies and research institutes is projected to accelerate product demand in the region. Further, heightened product awareness and high pet care spending are a few other factors propelling the North America market over the forecast period.

Asia Pacific region is expected to grow the fastest at over 8% over the forecast period. The regional growth is attributed to the evolving healthcare infrastructure, strong presence of local players, and awareness of animal health and fluid management.

Key Companies & Market Share Insights

Several prominent companies, B. Braun Melsungen AG, Shenzhen Mindray Animal Medical Technology Co., LTD., Eitan Medical Ltd., and HESKA Corporation, compete for market share in the global market. These companies have established themselves as key players through their wide product portfolios, strong distribution networks, and research and development capabilities. Market players also engage in strategic partnerships, collaborations, and acquisitions to strengthen their market position and enhance their product offerings. These partnerships allow companies to leverage each other's strengths, access new markets, and expand their product portfolios. For instance, in June 2023, Mars Incorporated acquired HESKA Corporation, a prominent player in veterinary diagnostics and specialty solutions, including veterinary infusion pumps. Through this acquisition, Mars Inc. broadened its product offerings in Petcare’s science and diagnostics division as well as enhanced operational capabilities in the significant market worldwide.

Key Veterinary Infusion Pumps Companies:

- B. Braun Melsungen AG

- Shenzhen Mindray Animal Medical Technology Co., LTD.

- Avante Health Solutions

- Burtons Medical Equipment

- Digicare Biomedical Technology Inc.

- Eitan Medical Ltd.

- Grady Medical Systems

- HESKA Corporation

- Leading Edge Veterinary Equipment

- Millpledge Veterinary

Veterinary Infusion Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 279.29 million

Revenue forecast in 2030

USD 427.79 million

Growth rate

CAGR of 7.36% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, animal type, end-use, route of administration, application, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Turkey

Key companies profiled

B. Braun Melsungen AG; Shenzhen Mindray Animal Medical Technology Co., LTD.; Avante Health Solutions; Burtons Medical Equipments; Digicare Biomedical Technology Inc.; Eitan Medical Ltd.; Grady Medical Systems; HESKA Corporation; Leading Edge Veterinary Equipment; Millpledge Veterinary

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Infusion Pumps Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary infusion pumps market report based on product type, animal type, route of administration, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Volumetric Infusion Pumps

-

Syringe Infusion Pumps

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Livestock Animals

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous (IV)

-

Subcutaneous

-

Epidural Infusion

-

Other Route of Administration

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fluid Therapy

-

Anesthesia

-

Pain Management

-

Nutrition

-

Other Application

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Home Care

-

Research & Academic Institutions

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Turkey

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary infusion pumps market size was estimated at USD 266.34 million in 2023 and is expected to reach USD 279.29 million in 2024.

b. The global veterinary infusion pumps market is expected to grow at a compound annual growth rate of 7.36% from 2024 to 2030 to reach USD 427.79 million by 2030

b. North America dominated the veterinary infusion pumps market with a share of over 31% in 2023. This is attributable to factors such as the strong presence of major industry players, favorable reimbursement coverage, increasing prevalence of chronic diseases, and technological advancements.

b. Some key players operating in the telemedicine market include B. Braun Melsungen AG, Shenzhen Mindray Animal Medical Technology Co., LTD., Avante Health Solutions, Burtons Medical Equipments, Digicare Biomedical Technology Inc., Eitan Medical Ltd., Grady Medical Systems, HESKA Corporation, Leading Edge Veterinary Equipment, and Millpledge Veterinary

b. Key factors that are driving the market growth include an upsurge in hospitalizations for surgical interventions coupled with favorable insurance policies, and trend for enteral feeding for effective disease management

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.