Veterinary Imaging Market Size, Share & Trends Analysis Report By Product (X-ray, Ultrasound), By Solutions (Equipment, PACS), By Animal Type, By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-020-0

- Number of Report Pages: 183

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Veterinary Imaging Market Size & Trends

The global veterinary imaging market size was estimated at USD 1.8 billion in 2023 and is expected to grow at a CAGR of 7.01% from 2024 to 2030. The market is primarily being driven by increasing prevalence of zoonotic diseases, rising number of pet owners, growing adoption of pet insurance, and rapid technological advancements in veterinary imaging.

One such rapidly advancing technology is Artificial Intelligence (AI), especially incorporated into veterinary radiology and its respective software. It enables automated evaluation of various veterinary radiological parameters and directly uploads x-rays to servers securely. Implementing such AI-based strategies is a progressive step in veterinary practices. For instance, In April 2024, MiReye Imaging launched its unique product line of veterinary X-ray machines that use AI for the diagnosis of diseases in animals.

Furthermore, the rising incidence of zoonotic diseases has increased the demand for effective diagnostic solutions, which is expected to drive market growth. According to 2024 data by WHO, out of the total infectious diseases that occur in the world, 60% are reported to be of zoonotic origin. Moreover, in a 2024 publication, WHO states that in the last 30 years, out of the 30 new pathogens detected among humans, 75% were of animal origin. This compels veterinary professionals to perform in-depth diagnostic evaluations of animals to curb the spread of these zoonotic diseases from animals to humans.

The emergence of COVID-19 had an impact on the entire healthcare sector, including veterinary medicine. The COVID-19 pandemic slightly halted the growth of the veterinary imaging industry since several non-essential surgeries were restricted across the globe during the pandemic. Furthermore, strict restrictions on the transportation of individuals and goods led to a restricted patient influx in veterinary centers. Similarly, the shortage of skilled veterinarians, combined with suspended/postponed elective surgeries, significantly disrupted the activities of veterinary facilities, having a slightly negative impact on market providers.

The growing trend of pet humanization and the rising adoption of pet insurance in various countries have increased pet insurance enrollment rates globally. For instance, in a 2023 report by the North American Pet Health Insurance Association (NAPHIA), there are over 5.36 million insured pets in North America, and this number is expected to grow exponentially at a CAGR of 2.17%. Out of these insured pets, dogs account for the highest share of 80.1%, followed by cats with 19.9%. The overall number of pets insured in the U.S. increased from 3.1 million in 2020 to 4.8 million in 2022.

Moreover, diagnostic imaging procedures can prove to be costly for pet owners. For example, an X-ray can approximately cost the pet owner from USD 75 to USD 500 for dogs and USD 100 to USD 500 for cats. A comprehensive pet insurance plan can cover every diagnostic imaging test, such as CT, MRI, ultrasound, and radiography. Due to the recently evolving AI technology in veterinary diagnostics, insurance companies are expanding their coverage. For instance, the Embrace pet insurance plan, a part of the NSM Insurance Group, covers AI-based diagnostic imaging procedures for animals in the U.S. Increasing pet insurance adoption, coupled with expanding coverage for AI-based diagnostic imaging procedures, is expected to drive market growth. Accessibility of imaging procedures is expected to improve because they are covered by insurance.

Industry Dynamics

The market exhibits a high concentration. The market growth stage is high, at an accelerating pace. One major factor driving the market growth is the rapid technological advancements in veterinary imaging. Continuous advancements in veterinary imaging technologies, such as the development of AI-based imaging solutions, improved accuracy, ease of use, and integration of digital platforms for image analysis, are propelling market growth.

Market concentration is influenced by the pace of technological advancements. Companies that invest in research and development to introduce innovative products with enhanced features, accuracy, and ease of use can gain a competitive advantage and increase their market share. Conversely, companies that fail to keep up with technological advancements risk losing market share to competitors.

The market is witnessing a high degree of innovation driven by advancements in technology and a growing focus on improving pet healthcare. Manufacturers are continuously developing new devices with enhanced features such as improved accuracy, superior image quality, faster processing, reduced radiation exposure, and integration of artificial intelligence (AI) and machine learning algorithms. For example, in April 2024, MiREYE Imaging launched its Veterinary X-ray machines product line in the U.S. The devices use AI in X-ray diagnostic imaging to provide data.

Key players in the veterinary imaging market are expanding regionally; for instance, in November 2023, Hallmarq Veterinary Imaging opened a new manufacturing site in Chicago, U.S. This trend reflects a strategic shift towards targeting specific geographical markets to capitalize on unique opportunities and increase market share.

Product Insights

Based on product type, the X-ray segment accounted for the highest revenue share of 37.54% in 2023. This can be attributed to an increased focus on animal health innovation, need for diagnostics, increased pet adoption, and a rise in adoption of radiography in veterinary orthopedics, dentistry, and several other indications. Radiography is one of the most common diagnostic tests covered by pet insurance. Thus, rising adoption of pet insurance and increased awareness of the various diagnostic & treatment options available for pets are some of the factors driving the market growth.

However, the video endoscopy segment is expected to be the fastest-growing segment with the fastest CAGR of 8.04% over the forecast period owing to increasing use of veterinary video endoscopy as a less invasive substitute for surgical operations. For instance, a flexible fiberoptic endoscope is used at Point Grey Veterinary Hospital in Vancouver, Canada, to perform endoscopy on organs such as the gastrointestinal tract, trachea, and colon without the need for surgery. To examine the upper airways, place feeding tubes, remove items from the stomach, and perform gastrointestinal exams & biopsies, video endoscopy is frequently employed.

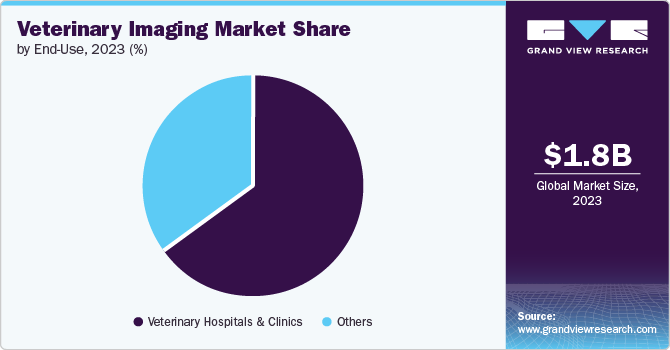

End Use Insights

Based on end use, the veterinary clinics & hospitals segment held the largest share of 64.86% in 2023 and is expected to grow at the fastest CAGR of 7.06% during the forecast period. This is because these healthcare settings enable faster diagnosis, allowing patients to receive treatment as soon as possible. Moreover, veterinary hospitals offer a wide range of diagnostic imaging options, which is a high-impact driver of this market.

Moreover, many veterinary diagnostic laboratories provide 90% coverage for pet diagnostic tests and procedures related to any accident, disease, or injury. Furthermore, the demand for high-quality veterinary equipment and diagnostic tools is expanding as a result of modern lifestyle changes and rising spending on animal healthcare.

Animal Type Insights

Based on animal type, small animals held the largest share of 69.38% in 2023, and the segment is estimated to grow at the fastest CAGR over the forecast period. Among small animals, dogs are the primary species for which veterinary diagnostic imaging technology is utilized. The uptake of these technologies is being driven by an increase in the number of pet (especially dog) owners, growth in the overall pet population, higher healthcare costs, and improvements in pet insurance coverage. Besides, the segment is expected to witness the fastest growth over the forecast period due to a rise in painful and inflammatory disorders in animals and an increase in product launches specifically for small animals.

Solutions Insights

Based on solutions, the equipment segment accounted for the largest revenue share of 55.65% in 2023. Imaging equipment, such as MRI, CT, ultrasound, and X-rays, are now readily available to veterinarians due to their wide penetration and applicability. Due to accessibility, low cost, and wide availability, radiography is expected to continue to be a mainstay in the veterinary industry. MRI and CT scans are frequently used for whole-body imaging, which has dramatically increased in recent years. These tools are used to image several animal species, including reptiles, whose small body masses make them difficult to identify with conventional X-rays.

The PACS segment is projected to grow at the fastest rate of 8.04% during the forecast period. The adoption of PACS in the market is driven by the need for advanced diagnostic capabilities, improved efficiency, enhanced communication, and the overall digitalization of veterinary practices to meet the evolving needs of pet owners and their furry companions. Veterinary practices are increasingly transitioning from traditional film-based imaging to digital imaging technologies. PACS provides a centralized digital platform for storing and managing these images, eliminating the need for physical film storage and making images easily accessible from multiple locations.

Application Insights

Based on application, the orthopedics & traumatology segment held the largest share of 37.70% in 2023. The increasing launches of advanced veterinary imaging systems specifically designed for orthopedic imaging are expected to drive segment growth. For instance, in January 2023, ESAOTE SPA launched Magnifico Vet MRI system for use in veterinary healthcare settings for several clinical applications including orthopedics. The oncology segment is expected to grow at the fastest rate of 9.41% over the forecast period owing to rising R&D in the field of oncology as well as the high prevalence of cancer among the veterinary population. In addition, the industry players are investing capital to create efficient oncological diagnostic and treatment modalities. For example, University of Glasgow in February 2024 invested to launch a new cancer treatment facility for small animals.

Regional Insights

North America veterinary imaging marketdominated globally in 2023 in terms of revenue share of 40.84%. North America, particularly the U.S. and Canada, has one of the highest rates of pet ownership globally. This large pet population drives the demand for veterinary healthcare services, including diagnostic imaging. Furthermore, an increase in strategic advancements and initiatives undertaken by key players in the form of product launches, acquisitions, mergers, and alliances is expected to boost the North America market. For instance, in January 2023, JPI Healthcare launched an innovative veterinary imaging solution that integrates an exclusive combination of computed tomography, fluoroscopy, and digital X-ray, which will be useful in the veterinary field. The veterinarians can now access new imaging techniques with the help of the company's DeteCT Vet CT and DynaVue Duo in the same configuration as digital X-ray, video, and thermal scanning systems at an extremely affordable cost.

U.S. Veterinary Imaging Market Trends

The veterinary imaging market in the U.S. is expected to grow at a significant pace over the forecast period, owing to an increase in the incidence of orthopedic diseases among animals as well as a rise in pet obesity in the country. According to an article published in March 2021 by the Morris Animal Foundation, osteoarthritis affects approximately 14 million adult dogs in the U.S. Although the exact number of cats affected is unknown, 90% of cats over the age of 12 have osteoarthritis, as observed on X-ray images. This represents a sizable number of animals suffering from such conditions.

Europe Veterinary Imaging Market Trends

The veterinary imaging marketin Europe is driven by the rising prevalence of chronic diseases in pets, which necessitates adequate diagnostic imaging and the growth in the number of pet owners. For instance, there is a high prevalence of obesity, osteoarthritis, and mobility issues among the pet population. Excess body fat and weight put more strain on joints, causing arthritis to worsen and making movement difficult. As a result, it is projected that the prevalence of joint inflammatory illnesses will increase along with a rise in obesity, which has been identified as the most prevalent nutritional health issue in dogs. In addition, the expanding use of digital ultrasonography and radiography is anticipated to significantly boost the regional market for veterinary imaging.

Germany veterinary imaging market is anticipated to grow at a significant rate over the forecast period, as Germany is the leading country in Europe, with the largest population of both cats and dogs. According to FEDIAF estimates, in 2023, Germany had approximately 15.2 million cats and 10.6 million dogs. The growing pet ownership is, thus, a key factor driving the companion animal diagnostic imaging market in the country. From 2010 to 2022, the population of pet dogs in Germany has doubled to around 10.6 million, while cats continue to be the most popular pets, with approximately 15.2 million population in 2023. The percentage of German households with pets has remained relatively stable, with around 45% of households owning pets.

The veterinary imaging market in the UK is anticipated to grow significantly over the forecast period. According to an article published by Pet Keen in June 2023, there are 34 million pets in the UK, with dogs & cats accounting for the highest proportion. With the growing pet adoption rate, the prevalence of illnesses and the burden of osteoarthritis in dogs is growing in the country. According to an article published by the Royal Veterinary College, London, osteoarthritis affects between 2.5% and 6.6% of dogs of all breeds & ages and affects up to 20% of dogs older than one year in the country. Canine osteoarthritis is a significant problem for veterinarians, owners, and breeders in the UK, in addition to its effects on canine well-being. These factors are expected to contribute to the country's market growth.

Asia Pacific Veterinary Imaging Market Trends

The Asia Pacific veterinary imaging market is expected to exhibit lucrative growth over the forecast period. This can be attributed to the increasing adoption of pet animals, growing health concerns, increasing vigilance about animal health, rising livestock population, and increasing prevalence of animal diseases. Furthermore, rising healthcare expenditure on animal health and veterinary services is contributing to market growth.

The veterinary imaging market in Japan is anticipated to grow at a healthy rate over the forecast period. Key factors driving the market are technological developments in veterinary sector, innovations in the diagnostic field, and favorable government initiatives to increase the adoption of veterinary healthcare practices. Furthermore, the upward shift in medical expenditure is a key contributing growth factor in the market. A survey conducted by the Japan Pet Food Association in 2020 found a 15% increase in cat and dog ownership compared to the year 2019. There were almost 8.49 million dogs and 9.64 million cats as pets in Japan as of October 2020. Furthermore, the introduction of innovative veterinary imaging products in the country has significantly boosted the veterinary imaging market. For instance, in February 2021, FUJIFILM Medical Systems introduced its VXR Veterinary X-Ray Room, designed specifically for veterinarians seeking high-quality, low-dose X-rays. With advanced digital radiography technology, the system enhances diagnostic efficiency for pets while ensuring the safety of both patients & staff.

Latin America Veterinary Imaging Market Trends

The veterinary imaging market in Latin America is expected to grow at a significant rate due to lower awareness regarding point-of-care imaging systems in the region. There is a rise in pet ownership across Latin America, driven by rising disposable income, urbanization, and changing lifestyles. Furthermore, pet owners in Latin America are becoming more aware of the importance of preventive healthcare and early diagnosis for their pets. This has led to an increased demand for advanced veterinary imaging technologies to encourage the diagnosis and treatment of various medical conditions. In addition, the expansion of veterinary clinics, hospitals, and diagnostic centers across Latin America increased access to veterinary services, including imaging, for pet owners. This expansion is driven by growing investments in the veterinary healthcare sector and the establishment of partnerships with international veterinary companies. The Latin American market includes Brazil, Mexico, & Argentina.

The Brazil veterinary imaging market is experiencing significant growth due to a rise in pet ownership across the country, driven by an increasing number of middle-class households and a growing urban population. The Pet Brazil Institute (IPB) indicated a rise in the pet population from 132 million in 2013 to 150 million in 2021. However, the Brazilian Association of the Pet Products Industry (ABINPET) reports an even higher number, with pets totaling 168 million in the country. This suggests that there are nearly two pets per household in Brazil. As more Brazilians welcome pets into their families, the demand for veterinary services, including diagnostic imaging, would increase.

Middle East & Africa Veterinary Imaging Market Trends

The market for veterinary imaging in MEA is anticipated to expand steadily over the projected period due to the growing animal disease outbreak and rising need for effective diagnostic solutions. In addition, the market is anticipated to grow as a result of rising demand for advanced imaging services and insurance, as well as increased awareness of animal diseases. Moreover, the need for improved diagnostics and advanced imaging solutions increases as the number of zoonotic diseases in animals and their transmission to humans rises.

South Africa veterinary imaging market is anticipated to increase in the coming years. In recent years, there has been a considerable increase in the number of incidents of zoonotic diseases. Hence, the need to treat diseases has increased significantly as a result of the rise in cases, which is going to promote the growth of the market. For example, in July 2022, a WHO article stated that epidemics brought on by zoonotic infections, such as the monkeypox virus, which first infected animals before switching to people, represent a significant threat in Africa. In the last ten years, there have been 63% more zoonotic outbreaks in the area. Veterinary imaging technologies, such as radiography, ultrasonography, and MRI, are essential tools for diagnosing zoonotic diseases in animals. These imaging modalities help veterinarians identify lesions, tumors, and abnormalities, which may indicate the presence of infectious agents, facilitating early detection & control of zoonotic diseases.

Key Veterinary Imaging Company Insights

The market is highly competitive, with the presence of many large- and small-scale players. Most companies focus on R&D efforts, mergers, acquisitions, collaborations, and partnerships to achieve greater market share. In addition, industry players are expanding into other countries with their AI technologies to enhance their market reach. For instance, in January 2024, SK Telecom Co., a South Korean company, introduced its AI pet diagnostic assistant service-X Caliber-in the U.S. by partnering with Vetology.

Key Veterinary Imaging Companies:

The following are the leading companies in the veterinary imaging market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories, Inc.

- ESAOTE SPA

- Mars, Inc.

- GE HealthCare

- Midmark Corporation

- FUJIFILM Holdings America Corporation

- Hallmarq Veterinary Imaging

- Canon Medical Systems Corporation

- Shenzhen Mindray Animal Medical Technology Co., Ltd.

- IMV Imaging

Recent Developments

-

In April 2024, Asteris partnered with VetlinkPRO, intending to combine imaging technology with its practice management system

-

In June 2023, ESAOTE SPA launched the MyLab X90VET ultrasound system with patented Augmented Insight technology for precise and accurate diagnostic imaging.

Veterinary Imaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.0 billion |

|

Revenue forecast in 2030 |

USD 2.9 billion |

|

Growth Rate |

CAGR of 7.01% from 2024 to 2030 |

|

Actual data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, animal type, solutions, application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Netherlands, Poland, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

IDEXX Laboratories, Inc., ESAOTE SPA, Mars, Inc., GE HealthCare, Midmark Corporation, FUJIFILM Holdings America Corporation, Hallmarq Veterinary Imaging, Canon Medical Systems Corporation, Shenzhen Mindray Animal Medical Technology Co., Ltd., IMV ing |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Veterinary Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary imaging market report based on product, animal type, solutions, application, end use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

X-ray

-

Ultrasound

-

MRI

-

CT Imaging

-

Video Endoscopy

-

-

Solutions Outlook (Revenue, USD Million; 2018 - 2030)

-

Equipment

-

Accessories/ Consumables

-

PACS

-

-

Animal Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Small Animals

-

Large Animals

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Orthopedics And Traumatology

-

Oncology

-

Cardiology

-

Neurology

-

Respiratory

-

Dental Application

-

Other

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

Sweden

-

Norway

-

Denmark

-

Poland

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global veterinary imaging market size was estimated at USD 1.8 billion in 2023 and is expected to reach USD 2.0 billion in 2024.

b. Some key players operating in the global veterinary imaging market include IDEXX Laboratories, Inc., ESAOTE SPA, SOUND, General Electric Company, Universal Medical Systems, Inc., FUJIFILM Holdings America Corporation, Hallmarq Veterinary Imaging Ltd., VetZ GmbH, Shenzhen Mindray Animal Medical Technology Co., LTD., Heska Corporation.

b. The global veterinary imaging market is expected to grow at a compound annual growth rate (CAGR) of 7.01% from 2024 to 2030 to reach USD 2.9 billion by 2030.

b. North American region registered the highest market revenue share of about 40.8% in 2023 owing to growing pet ownership, implementing strategic initiatives by the key manufacturers, and the increasing disease burden in animals.

b. The key factors driving the market growth include the rising need for timely diagnosis of chronic conditions, increased adoption of imaging technologies in veterinary orthopedics, dentistry, and several other indications, and increased pet adoption & ownership rates.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."