Veterinary Glucose Monitoring Devices Market Size, Share & Trends Analysis Report By Product (Glucose Meters, Consumables), By Animal Type (Dogs, Cats), By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-263-6

- Number of Report Pages: 157

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global veterinary glucose monitoring devices market size was estimated at USD 714.8 million in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030. The market growth is primarily driven by the rising prevalence of diabetes in animals coupled with increasing pet adoption, rapid technological advancements, and a shift towards homecare monitoring. Diabetes is becoming more common in pets, particularly in cats and dogs. Factors such as obesity, aging populations, and genetic predisposition contribute to rising prevalence of diabetes in animals, which is expected to increase demand for glucose monitoring devices for proper management. For instance, according to PetMD, in April 2022, 1 out of every 300 dogs and 230 cats developed diabetes during their lifetime.

The COVID-19 pandemic has had a significant impact on various sectors, including the veterinary glucose monitoring devices industry. With lockdowns and restrictions on movement, many pet owners turned to online platforms to purchase essential pet supplies such as food, medications, and grooming products. COVID-19 pandemic has further boosted the demand for pet diabetic products, including glucose monitors and insulin delivery pens, through increased sales via online channels like e-commerce websites. This shift towards online purchasing has facilitated access to essential pet care products, driving market growth. Like many other industries, the veterinary glucose monitoring devices industry faced challenges in supply chain and logistics due to disruptions caused by the pandemic. Delays in shipping and shortages of certain products were common, impacting the overall customer experience and potentially leading to shifts in consumer loyalty.

Veterinary professionals are conducting educational campaigns to raise awareness among pet owners about the signs, risks, and management of diabetes in animals. In addition, companies have introduced innovative glucose-monitoring devices tailored for pets, offering accurate and convenient solutions for monitoring blood glucose levels. These efforts aim to help pet owners and veterinarians understand and deal with diabetes in animals better. Furthermore, companies in the market are introducing new products, engaging in strategic acquisitions, and focusing on research and development to advance diabetes management for pets. These efforts collectively increase awareness, promote early diagnosis, and improve the quality of life for pets with diabetes.

For instance, Merck Animal Health, Purina, and Zoetis collaborated through the Diabetes Pet Care Alliance program in August 2019, aiming to aid veterinarians in screening, educating owners, and initiating treatment for pet diabetes. This initiative, timed with Pet Diabetes Month in November, provided veterinarians with tools and resources to raise awareness and increase screenings. Clients whose pets were diagnosed during the program received free kits to kickstart management, including glucose monitoring systems, specialized diets, and insulin. The program, active since 2014, saw significant growth each year, facilitating screenings and diagnoses for thousands of pets while offering education and support to pet owners.

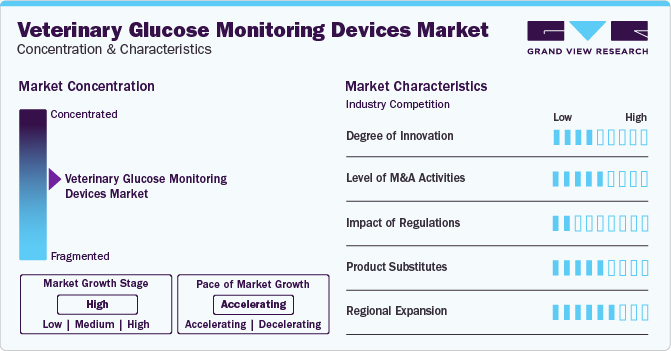

Market Concentration & Characteristics

The veterinary glucose monitoring devices industry exhibits a high market concentration. The market growth stage is high, and the pace of the market growth is accelerating. A major factor propelling market growth is the rapid technological advancements. Continuous advancements in veterinary glucose monitoring technologies, such as the development of minimally invasive devices, improved accuracy, ease of use, and integration of digital platforms for data tracking and analysis, are propelling market growth.

Market concentration is influenced by the pace of technological advancements. Companies that invest in research and development to introduce innovative products with enhanced features, accuracy, and ease of use can gain a competitive advantage and increase their market share. Conversely, companies that fail to keep up with technological advancements risk losing market share to competitors.

The global veterinary glucose monitoring devices industry is witnessing a high degree of innovation driven by advancements in technology and a growing focus on improving pet healthcare. Manufacturers continuously develop new devices with enhanced features such as improved accuracy, ease of use, and real-time data tracking capabilities. For instance, in February 2023, Zoetis launched the AlphaTrak 3 blood glucose monitoring system for diabetic cats and dogs in the U.S., featuring a new mobile app for data collection and sharing between pet owners and veterinarians.

Key players in the veterinary glucose monitoring devices industry are expanding regionally. For instance, in 2023, ALR Technologies SG Ltd. plans to launch their GluCurve Pet CGM in Canada and anticipate significant market penetration. This trend reflects a strategic shift towards targeting specific geographical markets to capitalize on unique opportunities and increase market share.

Product Insights

Based on products, glucose meters segment held the largest revenue share of 33.06% in 2023. This can be attributed to the several advantages offered by glucose meters. Traditional methods of blood glucose monitoring in pets often involve frequent trips to the veterinarian, which can be stressful for both pet and owner. Glucometers enable non-invasive and stress-free monitoring at home, promoting better compliance with the monitoring regimen. Pet glucometers play a crucial role in diabetes management for pets, offering convenience, accuracy, and improved outcomes for both pets and their owners.

Continuous glucose monitors (CGMs) segment is anticipated to grow at the fastest CAGR of over 8.2% over a forecast period. CGMs provide continuous and real-time monitoring of glucose levels in pets, offering a more comprehensive understanding of their daily glucose fluctuations. This continuous monitoring capability is particularly beneficial for pets with diabetes, as it allows for timely adjustments to treatment plans. CGMs offer a non-invasive and user-friendly way to monitor glucose levels in different animals.

Animal Type Insights

The dogs segment held the highest market share in 2023. Dogs are the most widely adopted pets in the world and have a very high adoption rate. The American Pet Products Association’s National Pet Owners Survey indicates that 69.0 million American households have dogs. In addition, the increasing prevalence of diabetes in dogs highlights the importance of glucose monitoring devices in effectively managing this chronic condition and ensuring the well-being of canine companions. For instance, prevalence of diabetes in dogs has been on the rise, with a 79% increase since 2006, as per State of Pet Health Report 2016 published by Banfield Pet Hospital.

The cats segment growth is anticipated to grow at the fastest CAGR during the forecast period. This segment is positively impacted by the increasing number of cat owners worldwide. The growing prevalence of diabetes in the cat population is a significant driver for the increased use of glucose monitoring devices. Cats are three times more prone to develop diabetes compared to dogs, with more than half of them being obese, which further increases their risk of diabetes.

Distribution Channel Insights

The online stores segment held the largest revenue share of 38.76% in 2023 and is anticipated to grow at the fastest CAGR during the forecast period. Pet owners find it more convenient to browse and purchase veterinary glucose monitoring devices online rather than visiting physical stores. They can shop anytime, from the comfort of their homes, and have the products delivered directly to their doorstep. Online stores provide access to a broader range of veterinary glucose monitoring devices compared to brick-and-mortar stores. This allows pet owners to find products that best suit their pets' needs, including specific features, brands, and price points.

The offline distribution channel segment is expected to grow lucratively during the forecast period. Consumers are increasingly shifting towards online shopping for convenience, price comparison, and a broader product range. This shift affects demand in offline channels, as more people prefer to purchase such devices online. Veterinary practices are adopting digital platforms for communication and sales. This digital transformation allows veterinarians to recommend products directly to clients through online channels, reducing the need for offline distribution. These factors contribute to lower demand for veterinary glucose monitoring devices in offline distribution channels.

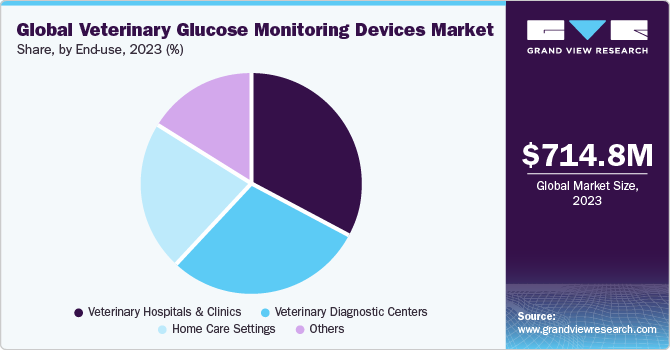

End-use Insights

The veterinary hospitals & clinics segment held the largest revenue share of 33.55% in 2023. These facilities offer comprehensive veterinary services, including diagnostic testing and specialized care, making them primary destinations for pet owners with diabetic pets. Furthermore, veterinary hospitals and clinics frequently collaborate with other healthcare providers and industry stakeholders, including pharmaceutical companies and medical device manufacturers, to stay updated on the latest advancements in diabetes management and access cutting-edge technologies, including glucose monitoring devices. This collaborative approach enhances the quality of care provided to diabetic pets and fosters innovation in the field of veterinary diagnostics.

The home care settings segment is anticipated to grow at the fastest CAGR over the forecast period. Home care settings help minimize stress and anxiety in pets, particularly cats, which can affect blood glucose measurements. Stress-induced hyperglycemia commonly occurs during veterinary clinic visits, potentially leading to inaccurate readings and incorrect insulin dosing. Similarly, technological advancements in glucose monitoring devices have made at-home monitoring more accurate, reliable, and user-friendly.

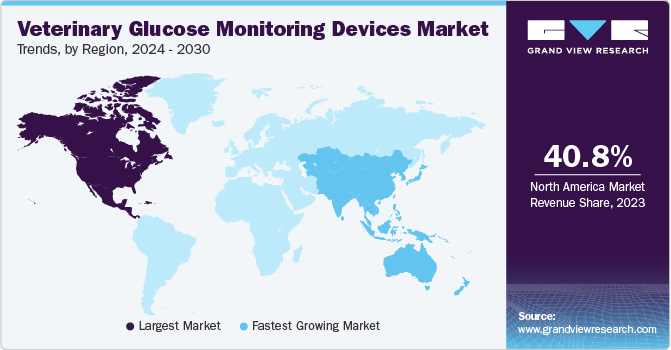

Regional Insights

The veterinary glucose monitoring devices market in North America dominated the market and accounted for the largest revenue share of 40.79% in 2023. North America, particularly the U.S. and Canada, has one of the highest rates of pet ownership globally. This large pet population drives the demand for veterinary healthcare services, including diagnostic devices like glucose monitors. Similarly, in North America, pet insurance coverage is relatively common compared to other regions. This comprehensive insurance coverage encourages pet owners to seek regular veterinary care, including diagnostics such as glucose monitoring, as they are more likely to afford these services.

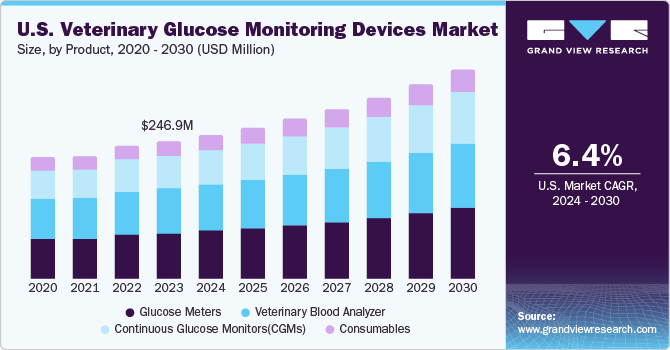

U.S. Veterinary Glucose Monitoring Devices Market Trends

Veterinary glucose monitoring devices market in the U.S. is fueled by various factors, primarily the rising prevalence of pet obesity and diabetes,advances in veterinary diagnostics and technology, and growing emphasis on preventive healthcare.The number of dogs and cats developing diabetes mellitus is estimated to be significantly higher in recent years, which is expected to drive demand for the U.S. veterinary glucose monitoring devices industry. For instance, according to an article published in PetMD in April 2022, 1 in every 300 dogs and 1 in 230 cats develop diabetes during their lifetime. Similarly, in 2021, Med Trust report stated that 3 out of 500 dogs and 6 out of 500 cats are prone to diabetes. In addition, Merck Animal Health reported in 2015 that the prevalence of diabetes among pets has tripled in the past 30 years.

Europe Veterinary Glucose Monitoring Devices Market Trends

Veterinary glucose monitoring devices market in Europe holds a significant share of the market owing to increasing collaboration between key market players to expand distribution network in European region. For instance, in December 2022, ALR Technologies SG Ltd, signed a co-branded distribution deal with Covetrus, Inc., a leading animal-health technology and services provider, for ALRT's GluCurve Pet CGM, first continuous glucose monitoring system for diabetic cats and dogs directly sold to veterinarians. By offering unique and innovative products like GluCurve Pet CGM through a co-branded distribution agreement, ALR Technologies SG Ltd and Covetrus gain a competitive edge in the regional market.

Germany veterinary glucose monitoring devices market is anticipated to grow at the fastest CAGR over forecast period, owing to rising number of R&D activities and influx of new pet care products. Country witnessed peak growth in pet ownership and adoption rates during COVID-19 pandemic, as people were spending more time indoors due to quarantine protocols and movement restrictions. Country's known breeds of dogs, such as German shepherds, are at major risk of developing diabetes mellitus at older age. This factor increased awareness among pet parents about having routine healthcare check-ups for their at-risk companions. Country majorly contributes to market with several major players, such as Zoetis which holds significant market shares.

Veterinary glucose monitoring devices market in the UK is experiencing a rise in pet obesity. Obesity in pets can lead to various health issues, including diabetes. As prevalence of obesity increases, so does incidence of diabetes in pets, driving need for glucose monitoring to manage this condition effectively. According to an article published in UK Associated Newspapers Ltd. in January 2022, nearly half of the country’s feline pets are obese, with an estimated 54,500 cats suffering from diabetes. Royal Veterinary College, UK, has suggested that pet owners enroll their diabetic-risk cats in its new dietary trial plans that provide participating animals, and their owners benefits of free diabetes diagnosis, cat diet foods for whole year, at-home use glucose monitoring supplies, and other diabetic care products.

Asia Pacific Veterinary Glucose Monitoring Devices Market Trends

Veterinary glucose monitoring devices market in Asia Pacific is expected to witness high growth due to factors such as growing pet population, increasing expenditure on pets, pet humanization, and initiatives by key market participants. According to Dr. Jamie Gallagher, veterinary surgeon at Society for Prevention of Cruelty to Animals in Hong Kong and South China Morning Post, diabetes is second most prevalent endocrine condition in cats, affecting around 1 in 200 cats (or 0.5%) and 1 in 500 dogs. A standard approach for managing diabetes includes regular testing for blood sugar, insulin injections, and lifestyle changes. Growing awareness about pet diabetes and its management is expected to propel regional market during forecast period.

Japan veterinary glucose monitoring devices market is anticipated to register significant growth due to aging pets, increasing prevalence of chronic conditions, and humanization of pets. As per an annual survey conducted by Japan Pet Food Association, there were over 18 million pet dogs and cats in the country in October 2020. In 2020, average life expectancy of dogs was estimated at 14 years to 15 years and that of cats was estimated at 15 years to 16 years. This makes pet population more susceptible to chronic diseases, such as diabetes, leading to greater demand for insulin & glucose monitoring products. Similar factors are expected to fuel market in country over forecast period.

Latin America Veterinary Glucose Monitoring Devices Market Trends

Veterinary glucose monitoring devices market in Latin America is witnessing an expansion of veterinary clinics and hospitals, particularly in urban areas. This growth in infrastructure improves access to veterinary services, including diabetes diagnosis and management, thereby boosting the demand for glucose monitoring devices. Furthermore, Latin American veterinary practices are increasingly adopting advanced medical technologies to enhance diagnostic and treatment capabilities. The availability of sophisticated glucose monitoring devices specifically designed for veterinary use aligns with this trend, driving market growth.

Brazil veterinary glucose monitoring devices market has witnessed a steady rise in pet ownership, particularly dogs and cats, as more households are welcoming pets as companions. With this increase in pet ownership, there is growing demand for veterinary services and products, including glucose monitoring devices, to ensure health and well-being of these animals. Similar to global trends, Brazil has observed a surge in lifestyle-related diseases among pets, such as diabetes. Changes in pet diets, decreased physical activity, and obesity contribute to prevalence of diabetes in animals. As a result, there is a greater need for reliable glucose monitoring devices to facilitate early detection, monitoring, and management of diabetes in pets.

Middle East & Africa Veterinary Glucose Monitoring Devices Market Trends

Veterinary glucose monitoring devices market in the Middle East and Africa are expected to grow due to an increasing prevalence of diabetes in pets, advancements in pet healthcare technology, growing pet population, rising awareness about pet health, and availability of innovative glucose monitoring devices. These major factors collectively contribute to expansion of market for veterinary glucose monitoring devices in Middle East and Africa region.

South Africa veterinary glucose monitoring devices market is expected to grow notably at a rate of over 9.0% over the forecast period. This is owing to significant population of pet dogs in the country, growing awareness about pet health, and improving diagnostic rates. The presence of leading market players and initiatives undertaken by them are expected to supplement market growth. Zoetis South Africa, for instance, sells the company’s flagship AlphaTRAK Blood glucose monitoring system, calibrated and validated for use in cats and dogs. As per the company, annual screenings at the vet or home screenings can help detect changes in insulin or glucose levels, thus supporting proper management of diabetes in pets. A diabetes plan comprising diet, insulin injections, exercise, and blood glucose monitoring can enable diabetic pets to lead an everyday life.

Key Veterinary Glucose Monitoring Devices Company Insights

The market is highly competitive, with the presence of many large- and small-scale players. Most companies focus on R&D efforts, mergers, acquisitions, collaborations, and partnerships to achieve greater market share. In addition, key players are investing in promotional campaigns to boost awareness regarding diabetes management in pets, aiming to enhance market penetration and educate pet owners about the importance of regular glucose monitoring for their animals. Moreover, advancements in technology have led to the development of user-friendly and efficient devices with features like easy-to-read displays, wireless connectivity for data transfer, and enhanced accuracy in glucose measurements, which are part of strategic initiatives adopted by key players to meet evolving market needs.

Key Veterinary Glucose Monitoring Devices Companies:

The following are the leading companies in the veterinary glucose monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- IDEXX

- Trividia Health, Inc.

- Allison Medical, Inc.

- UltiMed, Inc.

- ACON Laboratories Inc.

- i-SENS, Inc.

- TaiDoc Technology Corporation

- MED TRUST

- AccuBioTech Co., Ltd

- Teco Diagnostics

Recent Developments

-

In August 2023, ALR Technologies SG Ltd. plans to launch GluCurve Pet CGM in Canada through direct sales to veterinarian clinics starting Q3 2023 via GluCurve.ca, utilizing inventory from a recent purchase order.

-

In February 2023, Zoetis launched AlphaTrak 3 blood glucose monitoring system for diabetic cats and dogs in U.S., featuring a new mobile app for seamless data sharing between pet owners and vets.

Veterinary Glucose Monitoring Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 755.9 million |

|

Revenue forecast in 2030 |

USD 1.17 billion |

|

Growth rate |

CAGR of 7.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product type, animal type, end-use, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Zoetis; IDEXX; Trividia Health, Inc.; Allison Medical, Inc.; UltiMed, Inc.; ACON Laboratories Inc.; i-SENS, Inc.; TaiDoc Technology Corporation; MED TRUST; AccuBioTech Co., Ltd; Teco Diagnostics |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Veterinary Glucose Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary glucose monitoring devices market report based on product, animal type, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Glucose Meters

-

Continuous Glucose Monitors (CGMs)

-

Veterinary Blood Analyzer

-

Consumables

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Horses

-

Other Animals

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Home Care Settings

-

Veterinary Diagnostic Centers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Stores

-

Offline Stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary glucose monitoring devices market size was estimated at USD 714.8 million in 2023 and is expected to reach USD 755.9 million in 2024.

b. The global veterinary glucose monitoring devices market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 1.17 billion by 2030.

b. North America dominated the veterinary glucose monitoring devices market with a share of 40.79% in 2023. North America has a highly developed veterinary healthcare infrastructure with numerous clinics, hospitals, and specialty centers equipped with advanced diagnostic and treatment capabilities. This advanced infrastructure enables veterinarians to diagnose and manage conditions like diabetes in animals more effectively, leading to a higher demand for glucose monitoring devices.

b. Some key players operating in the veterinary glucose monitoring devices market include Zoetis, IDEXX, Trividia Health, Inc., Allison Medical, Inc., UltiMed, Inc., ACON Laboratories Inc., i-SENS, Inc., TaiDoc Technology Corporation, MED TRUST, AccuBioTech Co., Ltd, Teco Diagnostics

b. Key factors that are driving the market growth include growing pet ownership and humanization, rising incidence of diabetes in animals, increased focus on preventive healthcare, advancements in technology, and rising awareness and education about effective diabetes management in animals.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."