Veterinary Equipment And Disposables Market Size, Share & Trends Analysis Report By Product (Equipment & Accessories, Disposables/ Consumables), By Animal Type, By Usage, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-064-2

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global veterinary equipment and disposables market size was estimated at USD 2.83 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. Factors driving the market growth include increasing expenditure on pets, uptake of pet insurance, medicalization rate, prevalence of diseases in animals, technological advancements, and interventional or surgical procedures in animals. In January 2023, Zomedica expanded its relationship with Structured Medical Products, Inc. to commercialize its patented Doppler technology-based vital signs remote monitoring system for veterinary use called VetGuardian. The system is intended to benefit vet practices for ICU and overnight monitoring as well as pre and post-surgical monitoring.

Several factors are driving the demand and uptake of vet equipment & disposables across the globe. Technological advancements in veterinary medicine, including minimally invasive surgeries and advanced monitoring techniques, create demand for specialized equipment like anesthesia machines, telemetry systems, and oxygen concentrators. Moreover, increased awareness about the importance of animal health and preventive care among pet owners and veterinarians drives the adoption of sophisticated equipment for diagnosis, treatment, and monitoring.The expansion of veterinary services, including specialty clinics and emergency care facilities, increases the need for advanced equipment to cater to a wider range of medical procedures.

The expanding applications of veterinary equipment in terms of therapeutic category or animal species is another key factor fueling the market growth. The Large Animal Equine Anesthesia Machine from SHINOVA for example is applicable for use in large animals such as horses and cows weighing up to 1,200 kg. In February 2019, Cornell researchersdeveloped a device to remotely measure the cardiogram and respiration patterns of small animals such as birds, hamsters, fish, and tortoises. Similar R&D initiatives are expected to propel the developments in veterinary equipment.

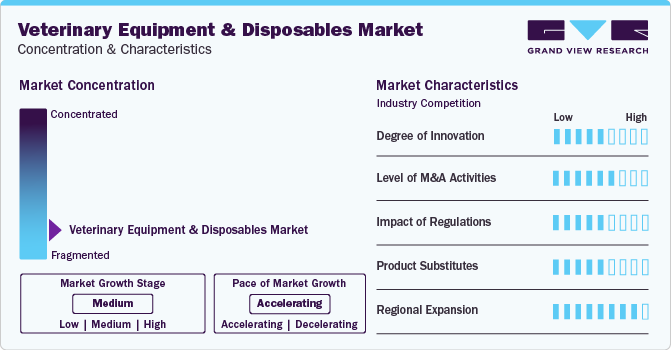

Market Concentration & Characteristics

The veterinary equipment and disposables market exhibits low market concentration, medium growth stage, and an accelerating pace of market growth. A low market concentration is the result of a fragmented market, owing to the presence of several market players. No single company or a few dominant players control a significant portion of the market share. This intensifies the competition among manufacturers and suppliers of veterinary equipment and disposables.

The medium growth stage of the market implies that the products in the market have already passed through their initial phase of introduction and adoption and are currently experiencing steady growth. During this stage, demand for veterinary equipment and disposables is expected to increase at a moderate pace as more veterinary clinics, hospitals, and research institutions adopt advanced equipment and practices.

Despite being in a medium growth stage, the market is experiencing an accelerating pace of growth. This is due to various factors such as increasing pet ownership, rising awareness about animal health and welfare, advancements in veterinary medicine and technology, and expanding veterinary services globally.

The market is characterized by a moderate level of innovation in terms of product development and technological advancements. Companies are continuously investing in R&D to improve existing products and introduce new ones.Bionet America, Inc. for instance, has developed the first wearable and wireless ECG sensor for vet clinics that simplifies ECG, heart rate, and respiratory rate monitoring.

The market experiences a moderate to high level of M&A activity. Companies engage in mergers, acquisitions, or strategic partnerships to expand their product portfolios, enhance their market presence, or gain access to new technologies or distribution channels.

Regulatory factors play a moderate role in shaping market dynamics. While there are regulations governing the manufacturing, distribution, and use of veterinary products, they are not as stringent as in highly regulated industries such as pharmaceuticals.

The threat of product substitutes in the market is moderate and depends on the product category. In terms of telemetry systems for instance, veterinarians can manually monitor vital signs, such as heart rate, respiratory rate, temperature, and blood pressure, using basic tools such as stethoscopes, thermometers, and sphygmomanometers.Smartphone apps and wearable devices equipped with sensors for monitoring vital signs are emerging as potential substitutes for traditional vital signs monitors.

The market experiences high levels of regional expansion, with companies seeking to penetrate new geographic markets to capitalize on growth opportunities. Expansion strategies may involve establishing distribution networks, forming strategic partnerships with local distributors or veterinary clinics, or setting up subsidiaries or production facilities in key regions. In May 2023, Shenzhen melevet Medical Co., Ltd. launched its AM30 veterinary anesthesia machine in Greece via JMCO- its Greek distributor.

Product Insights

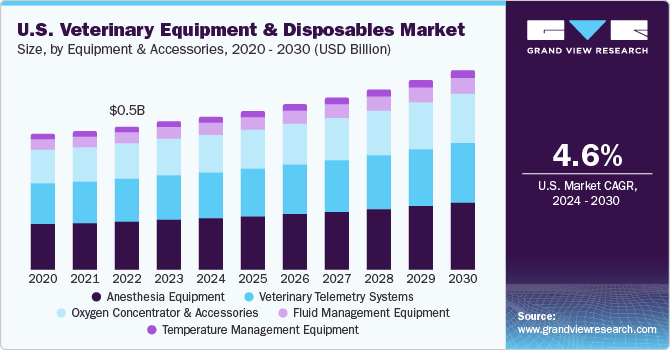

By product, the equipment & accessories segment dominated the market in 2023. Amongst the equipment & accessories category, anesthesia equipment dominated the market in 2023 owing to increasing interventional and surgical procedures in veterinary medicine. Furthermore, initiatives such as product launches by key companies are expected to fuel the segment growth during the forecast period. For instance, in September 2023, Shenzhen melevet Medical Co., Ltd. launched a new veterinary anesthesia machine - AM70.

The disposables/ consumables segment comprising airway management consumables and others is expected to grow the fastest at a rate of 6.6% in the coming years. The segment includes airway management consumables and others.The expansion of veterinary services, including specialty clinics, emergency care centers, and mobile veterinary units, increases the utilization of disposable products for airway management and other procedures.

Animal Type Insights

In 2023, the small animals segment accounted for the largest share of the market by animal type and is also projected to grow the fastest at a CAGR of 6.1%. Small animals, such as dogs, cats, birds, and small mammals, are among the most popular choices for household pets worldwide. The increasing trend of pet ownership, particularly in urban areas, drives the demand for veterinary services and related equipment.

The advancement of veterinary medical technology has led to the development of sophisticated equipment and disposables designed specifically for small animals. This includes advanced anesthesia delivery systems and vital signs monitors. These advancements enhance the quality of care provided to small animals and contribute to the growth of the market segment.There's a growing trend of humanizing companion animals, where pet owners increasingly view their pets as members of the family. This cultural shift leads to higher spending on veterinary care thus propelling the segment growth.

Usage Insights

In terms of usage, the surgical segment held the highest share of about 40% of the market in 2023. Surgeries are performed for various reasons, including spaying/neutering, tumor removal, orthopedic procedures, dental surgeries, and trauma management. The increasing frequency of surgical procedures across different veterinary specialties contributes to the high share of the segment.

The monitoring segment is anticipated to grow at the fastest rate in the near future. This is owing to increasing strategic initiatives such as partnerships, product launches, and regional expansion by market players. In July 2020, Midmark launched a multiparameter monitor for veterinary use for exam, treatment, and surgery usage. In February 2020, Bionet America, Inc. launched the BMVet PRO Series of multiparameter monitors for veterinary use.

End Use Insights

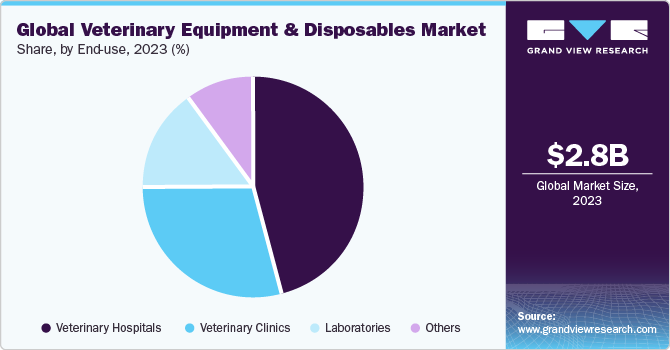

By end use, veterinary hospitals accounted for the largest revenue share of 46% of the market in 2023. Veterinary hospitals serve a larger volume of patients compared to smaller clinics or mobile practices. This higher patient volume translates to increased utilization of equipment and disposables daily. Moreover, hospitals typically offer a comprehensive range of medical services, including preventive care, diagnostics, surgery, dentistry, imaging, emergency care, and specialty services. As such, they require a diverse array of equipment and disposables to support these services effectively.

Mindray Animal Medical for example supplies its lineup of imaging, patient monitoring, and life support solutions to a range of notable veterinary hospitals. These include the Animal Medical Center (AMC) in North America, RVC's Queen Mother Hospital for Animals in the UK, Ghent University Animal Hospital in Belgium, as well as AniCura and IVC Evidensia Group. The others segment comprising home or farm use and research institutes is projected to grow at the highest CAGR from 2024 to 2030.

Regional Insights

North America held the highest share of about 35% of the market by region in 2023. This was followed by Europe due to its well-established veterinary healthcare facilities, increasing number of companion animals, animal healthcare expenditure, and attentiveness to animal illnesses. Asia Pacific region, on the other hand, is estimated to grow at the highest rate of 7.1% in the coming years.

U.S. Veterinary Equipment And Disposables Market Trends

The veterinary equipment & disposables market in the U.S. is attributed to the largest share by country in North America in 2023.This market is driven by factors such as technological innovations, advanced veterinary healthcare infrastructure, and a growing trend toward specialized veterinary care. In January 2023, Avante Animal Health partnered with Nashville Zoo’s HCA Healthcare Veterinary Centerto provide medical equipment including anesthesia machines, infusion pumps, and veterinary monitors for the care of the facility’s 3,000 animals.

Europe Veterinary Equipment And Disposables Market Trends

The Europe veterinary equipment and disposables market is characterized by advancements in veterinary technology and increasing pet ownership. Technological advancements have led to the development of sophisticated veterinary equipment that enhances diagnostic capabilities, surgical procedures, and overall pet healthcare. This drives the demand for newer equipment and disposables. Moreover, Europe has seen a steady rise in pet ownership over the years. This trend has led to increased spending on veterinary care, including equipment and disposables.

The veterinary equipment & disposables market in the UK is attributed to the largest share by country in Europe in 2023.Some key factors propelling the market growth include a high uptake of pet insurance, increasing pet ownership rates, and a high medicalization rate. As per the FEDIAF and internal GVR estimates, there were about 9 million dogs and 7.5 million cats in the UK in 2018. This number is projected to increase to 12.9 million dogs and 13.4 million cats in 2024.

The Spanish veterinary equipment & disposables market is expected to grow at the fastest CAGR in Europe from 2024 to 2030. The market is driven by increasing demand for veterinary care services, an increasing number of veterinarians, and partnerships between market players. As per estimates by the Federation of Veterinarians of Europe, there were about 27,000 veterinarians in Spain in 2018. This number is anticipated to reach 30,000 by 2024 as per internal GVR estimates.

Asia Pacific Veterinary Equipment And Disposables Market Trends

The veterinary equipment and disposables market in Asia Pacific is witnessing rapid growth, driven by factors such as growing pet healthcare expenditure, and rising prevalence of zoonotic diseases. The occurrence of zoonotic diseases is increasing awareness about the importance of veterinary healthcare, leading to higher demand for equipment and disposables for disease diagnosis, prevention, and treatment. Furthermore, as disposable income levels rise in many Asia Pacific countries, pet owners are more willing to spend on veterinary care, including advanced equipment and disposables.

The China veterinary equipment & disposables market accounted for the largest share by country in the Asia Pacific region in 2023. This is owing to the notable presence of local manufacturers & distributors as well as the emergence of new market participants. For instance, in August 2021, Shenzhen melevet Medical Co. Ltd. was founded in Shenzhen, China to serve the animal health market with anesthesia machines, vaporizers, and accessories. The company exports its products globally via a network of distributors.

Latin America Veterinary Equipment And Disposables Market Trends

Latin America veterinary equipment and disposables market is anticipated to grow over the forecast period. Increasing number of veterinary practices, and growing demand for specialty veterinary services are propelling the market growth. As pet owners become more willing to invest in specialized veterinary care, there is a growing demand for specialized equipment and disposables in areas such as dentistry, ophthalmology, and orthopedics. The growth of veterinary clinics and hospitals in Latin America is expected to fuel the demand for veterinary equipment and disposables.

The veterinary equipment & disposables market in Brazil is attributed to the largest share by country in Latin America in 2023.Factors such as a growing pet population, increasing awareness of pet healthcare, and improvements in veterinary infrastructure are driving market growth. Additionally, economic factors, regulatory standards, and technological advancements play significant roles in shaping market dynamics, with rising demand for advanced veterinary equipment to meet the evolving needs of pet owners and veterinary professionals alike.

Middle East & Africa Veterinary Equipment And Disposables Market Trends

The veterinary equipment and disposables market in the Middle East & Africa region is characterized by increasing demand for better veterinary critical care, expansion of veterinary services, and rising awareness on animal health. Expansion of veterinary services in both urban and rural areas increases the demand for equipment and disposables. This includes the establishment of veterinary clinics, hospitals, and diagnostic laboratories.

The South Africa veterinary equipment & disposables market is attributed to the largest share by country in the Middle East & Africa region in 2023. This is due to the expanding pet ownership base, awareness of veterinary healthcare, and increasing strategic initiatives by market players. In September 2018, for example, KahmaVet in South Africa partnered with Suntech to distribute the latter’s veterinary blood pressure monitors across the country.

Key Veterinary Equipment And Disposables Company Insights

Competition in the market is fierce and multifaceted owing to its fragmented nature and the presence of several small to large-sized companies. Moreover, the product segments encompassing multiple categories such as anesthesia equipment, telemetry systems, oxygen concentrators, fluid management equipment, etc. add to the market fragmentation and competition. Competition in the fluid management equipment segment for instance revolves around product reliability, accuracy in fluid delivery, compatibility with various fluids and medications, ease of maintenance, and cost.

Manufacturers differentiate themselves through innovative features such as advanced programming capabilities, wireless connectivity, and integration with electronic medical records.EN-V7P veterinary infusion Pump from Vue Imaging, for example, comes with a touch screen, double CPU, and optional wireless connection to the company’s C7 Central Station. Overall, the competition in the veterinary equipment & disposables market demands continuous innovation, product differentiation, and a keen understanding of veterinarians' evolving needs and preferences. Companies that can effectively balance these factors are positioned to thrive in this competitive landscape.

Key Veterinary Equipment And Disposables Companies:

The following are the leading companies in the veterinary equipment and disposables market. These companies collectively hold the largest market share and dictate industry trends.

- Covetrus

- Medtronic

- B. Braun Vet Care GmbH

- Avante Animal Health

- Shenzhen Mindray Animal Medical Technology Co., LTD.

- Midmark Corporation

- Vetland Medical Sales & Services, LLC

- Masimo

- Dispomed Ltd

- Nonin

Recent Developments

-

In January 2024, SunTech Medical, Inc. launched Vet40- a surgical Vital Signs Monitor for pets thus expanding its portfolio.

-

In April 2022, Dispomed acquired ARVS. This enhanced the company’s capabilities to provide veterinary clinics with suitable medical equipment and technical services.

-

In April 2021, DRE Veterinary- one of the leading providers of surgical, imaging, and radiation oncology equipment in the U.S. changed its name to Avante Animal Health as it became the veterinary division of Avante Health Solutions.

Veterinary Equipment And Disposables Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.96 billion |

|

Revenue forecast in 2030 |

USD 4.17 billion |

|

Growth rate |

CAGR of 5.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

April 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, usage, animal type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Covetrus; Medtronic; B. Braun Vet Care GmbH; Avante Animal Health; Shenzhen Mindray Animal Medical Technology Co., LTD.; Midmark Corporation; Vetland Medical Sales & Services, LLC; Masimo; Dispomed Ltd; Nonin |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Veterinary Equipment And Disposables Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary equipment and disposables market report based on product, animal type, usage, end use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Dogs

-

Cats

-

Other Small Animals

-

-

Large Animals

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment & Accessories

-

Anesthesia Equipment

-

Anesthesia Machines

-

Vaporizers

-

Ventilators

-

Waste Gas Management Systems

-

Anesthesia Accessories

-

-

Veterinary Telemetry Systems

-

Patient Monitors

-

Patient Monitoring Accessories

-

-

Oxygen Concentrator & Accessories

-

Fluid Management Equipment

-

Large-Volume Infusion Pumps

-

Syringe Pumps

-

-

Temperature Management Equipment

-

Patient Warming Systems

-

Fluid Warmers

-

-

-

Disposables/ Consumables

-

Airway Management Consumables

-

Other Consumables

-

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical

-

Diagnostic

-

Monitoring

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary equipment and disposables market size was estimated at USD 2.83 billion in 2023 and is expected to reach USD 2.96 billion in 2024.

b. The global veterinary equipment and disposables market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 4.17 billion by 2030.

b. By region, North America held the highest share of about 35% of the market in 2023. This is attributable to its well-established veterinary healthcare infrastructure, increasing number of companion animals, animal healthcare expenditure, and attentiveness to animal illnesses.

b. Some key players operating in the veterinary equipment and disposables market include Covetrus; Medtronic; B. Braun Vet Care GmbH; Avante Animal Health; Shenzhen Mindray Animal Medical Technology Co., LTD.; Midmark Corporation; Vetland Medical Sales & Services, LLC; Masimo; Dispomed Ltd; and Nonin.

b. Key factors that are driving the veterinary equipment and disposables market growth include increasing expenditure on pets, uptake of pet insurance, medicalization rate, prevalence of diseases in animals, technological advancements, and interventional or surgical procedures in animals.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."