- Home

- »

- Animal Health

- »

-

Veterinary ECG Systems Market Size, Industry Report, 2030GVR Report cover

![Veterinary ECG Systems Market Size, Share & Trends Report]()

Veterinary ECG Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Modality (Handheld, Benchtop), By Technology, By Usage (Resting ECG, Holter ECG), By Animal, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-500-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary ECG Systems Market Summary

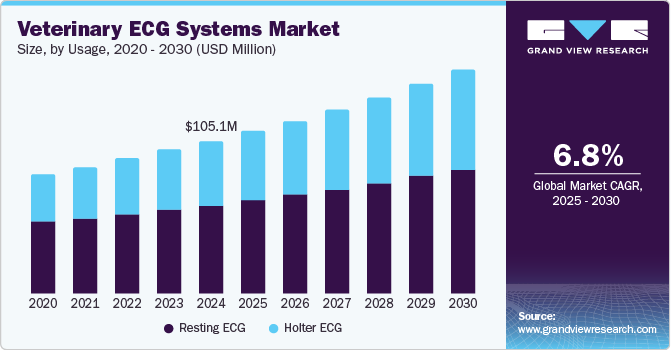

The global veterinary ECG systems market size was estimated at USD 105.05 million in 2024 and is expected to reach USD 154.76 million by 2030, growing at a CAGR of 6.76% from 2025 to 2030. Some key factors driving the market growth are the increasing prevalence of arrhythmia and other cardiac complications, evolving R&D initiatives, growing awareness initiatives, and the emerging role of continuous medical education (CME).

Key Market Trends & Insights

- The North America veterinary ECG systems market held a 36.42% share of the global market in 2024.

- The veterinary ECG systems market in the U.S. is witnessing lucrative growth.

- By product, the ECG systems segment held a significant share of around 79% in 2024.

- By aminal, the small animals segment led the market with a share of 61.46% in 2024.

- By modality, the benchtop segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 105.05 Million

- 2030 Projected Market Size: USD 154.76 Million

- CAGR (2025-2030): 6.76%

- North America: Largest market in 2024

One of the most dynamic driving factors for this industry is growing R&D initiatives to explore using these systems for measuring heart rate (HR) in animals like donkeys, wildlife, new breed horses, etc. Researchers worldwide are involved in standardizing vital sign parameters for various species and testing novel forms of existing technologies for use in veterinary medicine.For instance, in June 2023, veterinarians and researchers at Twycross Zoo, UK, in collaboration with the World Primate Centre, initiated an investigation of heart disease in apes like chimpanzees. As a part of an international research project, the team utilizes advanced diagnostic tools, including electrocardiograms (ECGs) and ultrasound, to monitor heart health and identify potential issues early. The adoption of technology is crucial as it provides valuable insights into the cardiovascular conditions of the apes, enabling timely interventions. This initiative enhances the welfare of the zoo's primates and contributes to broader research on heart disease in wildlife animals.

An August 2023 study in Veterinary Sciences also determined electrocardiographic reference values for clinically healthy Lusitano horses. The study categorized horses into three age groups and evaluated their ECG parameters, providing crucial data for veterinary cardiology. The findings highlighted the significance of ECG in monitoring equine heart health, enabling veterinarians to detect abnormalities early and ensuring appropriate care. Establishing these reference values across species is essential for improving diagnostic accuracy and treatment outcomes across veterinary practice, underscoring the importance of adopting this technology in veterinary settings.

Another crucial market dynamic is the emerging role of CME in veterinary practice. CME assists healthcare professionals in keeping up-to-date with the latest practices in the field. In recent years, a trend of case-study-based CME has been emerging in veterinary practice. For instance, in April 2023, Improve Veterinary Practice, a leading knowledge hub, discussed the role of electrocardiographs (ECGs) in veterinary nursing, emphasizing their importance in diagnosing and managing arrhythmias. Proper attachment of leads is crucial for obtaining accurate readings, with recommended patient positioning to enhance trace quality. The interpretation process includes assessing heart rate and the P-QRS relationship, which helps identify potential cardiac issues. The article further presented two case studies to illustrate practical applications: a cat with ventricular premature complexes leading to hypertrophic cardiomyopathy and another with a dog suffering from myxomatous mitral valve disease progressing to atrial fibrillation.

These examples highlight the critical role of ECGs in monitoring heart health and guiding treatment decisions in veterinary practice. Such materials featuring case studies are valuable for CME for veterinarians as they provide real-world scenarios that enhance clinical reasoning and decision-making skills. By analyzing specific cases, veterinarians can learn practical applications of these diagnostic tools to improve their ability to identify and manage cardiac conditions in animals effectively.

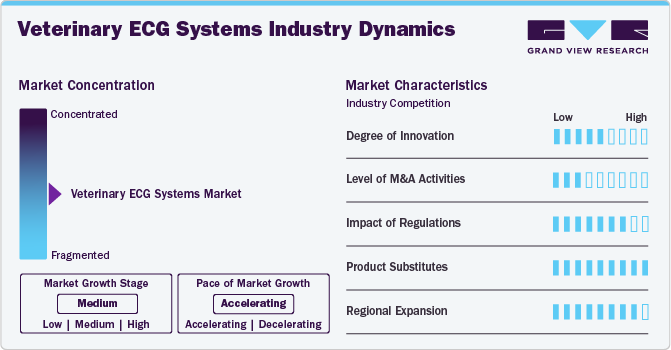

Market Concentration & Characteristics

The degree of innovation in this market is estimated to be moderate to high owing to growing research studies and breakthroughs in using this crucial diagnostic tool across multiple animal species. In the near future, such initiatives will help develop unique and species-specific diagnostic protocols, ultimately proving to be conducive to animal care.

The industry is experiencing a low level of M&A activities. Manufacturers in this industry are expanding their operational efficiencies to capture market share and expand market access.

The impact of regulations is anticipated to be moderate, considering the growing efforts from across the globe to train veterinarians in the effective and efficient utilization of crucial diagnostic tools like ECG systems. Various organizations worldwide are focusing on publishing guidance documents on the importance of ECG systems in veterinary, efficient ways to interpret veterinary ECG, etc. These practices will help standardize a diagnostic protocol throughout the world.

The industry has a moderate number of product substitutes. Market players are attempting to stand out in the competition by launching innovative products. For example, Bionet America recently launched a unique wearable system called VEMO. This device can be used in dogs & cats for quick measurement and prolonged holter monitoring of the pet's heart rhythm. Apart from this, in many regions, human ECG systems are being refurbished for veterinary use, ultimately increasing market competition. The industry is experiencing a moderate-to-high impact of regional expansion.

Product Insights

The ECG systems segment held a significant share of around 79% in 2024 and is projected to witness the fastest CAGR over the forecast period of 2025 - 2030. This can be attributed to it being a primary diagnostic tool for measuring the HR of animals to detect arrhythmia. Furthermore, industry participants are developing innovative ECG systems to revolutionize the veterinary cardiac diagnostic sector. For example, Bionet America Inc. is one of the pioneers in developing VEMO, a wearable ECG system for dogs and cats.

Modality Insights

The benchtop segment held the largest market share in 2024 because of its high adoption in the veterinary sector. These devices are the traditional and most widely used for measurement. These systems are designed for comprehensive monitoring, providing accurate and real-time data essential for diagnosing animal cardiac conditions. Their user-friendly interfaces and advanced features make them ideal for veterinary hospitals and clinics, where precise monitoring is critical.

The handheld segment is anticipated to grow at the fastest CAGR of 7.14% over the forecast period. These devices are portable and can measure ECG at remote locations. They also prove to be helpful if the veterinarian intends to monitor HR for prolonged periods. This segment is experiencing considerable product innovation.

Technology Insights

The digital segment held the largest share in 2024 and is projected to witness the fastest CAGR over the forecast period. This can be attributed to its ability to provide real-time, accurate readings through wireless or wired transmission. This innovation enhances convenience and efficiency in veterinary practices, allowing for better patient monitoring and data management. Integrating standalone or built-in transmitters, such as those from Dextronix and Sound Vet, facilitates seamless connectivity and improves diagnostic capabilities. As a result, the veterinary digital technology market is expected to grow significantly, driven by increasing demand for advanced monitoring solutions and enhanced animal healthcare outcomes.

Usage Insights

The resting ECG segment dominated the market in 2024 owing to its widespread application in diagnosing arrhythmias and other cardiac conditions in various animals, including pets and livestock. This modality is favored for its ease of use and effectiveness in clinical settings, allowing veterinarians to obtain rapid and accurate heart health assessments.

The Holter ECG segment is anticipated to grow at the fastest CAGR from 2025 to 2030 due to its ability to provide continuous, long-term cardiac activity monitoring. This is essential for diagnosing intermittent arrhythmias that may not be captured during resting/standard ECG tests. This technology allows veterinarians to collect comprehensive data over extended periods, enhancing diagnostic accuracy and patient management.

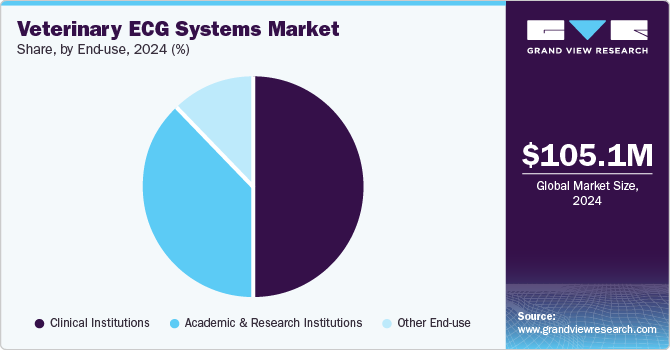

End-use Insights

The clinical Institutions segment led the veterinary ECG systems industry in 2024 in terms of revenue share. This is owing to their established infrastructure and high investment in advanced diagnostic tools. The increasing prevalence of heart diseases in pets and livestock and a growing focus on pet health monitoring drive demand for ECG systems in these settings, ensuring comprehensive care and accurate diagnoses.

Academic & Research Institutions is expected to witness the fastest CAGR over the forecast period. This can be attributed to their need for advanced diagnostic tools for animal health studies. These institutions focus on research and education in veterinary medicine, which fosters innovation and adoption of new technologies, leading to increased demand for sophisticated ECG systems. In addition, increased funding for research projects allows these institutions to invest in cutting-edge technologies, accelerating advancements in veterinary cardiology. The emphasis on animal welfare and health research also contributes to the rising demand for effective ECG systems in academic settings.

Animal Insights

The small animals segment led the market with a share of 61.46% in 2024. Small animals, such as dogs, cats, rabbits, etc., typically have a higher incidence of cardiac issues that require monitoring, and their smaller size allows for easier handling and placement of leads. Additionally, technological advancements have made ECG systems more accessible and user-friendly for these species. In contrast, large animals often present challenges in monitoring due to their size and the complexity of their cardiac physiology, making routine ECG less practical.

The large animal segment is anticipated to grow most over the forecast period. This can be attributed to increasing research and development into standardizing diagnostic protocols for large animals like horses, cattle, pigs, and donkeys. Furthermore, researchers are also expanding their research beyond these animals into wildlife animals like apes, lions, etc. In addition, improvements in technology, including portable and wearable devices, allow for easier monitoring in field settings, making it more feasible for veterinarians to assess the heart health of large animals.

Regional Insights

The North America veterinary ECG systems market held a 36.42% share of the global market in 2024. The dominance can be attributed to regulatory and animal welfare organizations focusing on timely ECG and other vital signs monitoring. For instance, a September 2023 article by the American Veterinary Medical Association (AVMA) identified 11 crucial technologies that can disrupt the veterinary sector. One of the technologies the article focused on was the rise of quantified health or wearable devices in veterinary medicine, highlighting their potential to enhance animal care through continuous monitoring of vital parameters, including ECG readings. These devices are collars or attachments, allow for real-time data collection on health metrics and behaviors, and facilitate individualized care for pets. As technology improves, the accuracy and reliability of these wearables are expected to increase, making them valuable tools for veterinarians. However, challenges remain regarding regulatory oversight and the need for integration with veterinary practice management systems to ensure effective use in clinical settings.

U.S. Veterinary ECG Systems Market Trends

The veterinary ECG systems market in the U.S. is witnessing lucrative growth owing to the emergence of innovative product launches coupled with attempts by manufacturers to highlight their USP and capture the market share. For instance, VEMO, one of the first wearable ECG systems specifically designed for dogs and cats, was launched recently. The manufacturing company, Bionet America Inc., to boost demand and sales, started a promotional scheme for customers in the U.S., which lasted till the end of December 2024.

Europe Veterinary ECG Systems Market Trends

The Europe veterinary ECG systems market growth can be attributed to rapidly advancing diagnostic protocols of veterinary ECG measurement due to back-to-back CME. For instance, in September 2024, veterinarians at DiploVet, Germany, published a case study of an 11-year-old Beauceron dog that was suffering from anorexia, vomiting, and extrasystoles on ECG. Radiographic findings suggested splenic torsion, characterized by an enlarged spleen with a reverse C-shape and mild abdominal displacement. An abdominal ultrasound confirmed the diagnosis, revealing a hypoechoic spleen with no blood flow, leading to surgical removal of the spleen. ECG played a crucial role in identifying extrasystoles, which indicated potential cardiac issues related to splenic torsion. Continuous monitoring of ECG during the preoperative and postoperative periods is essential for detecting arrhythmias and ensuring the animal's cardiovascular stability throughout treatment.

The veterinary ECG systems market in the UK is experiencing lucrative growth due to increasing efforts to conduct CME sessions to enhance the efficiency and accuracy of veterinarians in the country. For instance, in May 2024, Northern Ireland Veterinary Specialists (CVS UK Ltd.) conducted a CME webinar on reviewing the generation of the normal ECG, followed by some case studies and arrhythmias that can be seen in practice commonly. The seminar aimed to identify rhythms like ventricular rhythms and supraventricular rhythms, discussing how they are generated and can be managed more efficiently.

The veterinary ECG systems market in Italy is driven by the primary factor strengthening the country's market growth, which includes the efforts to diversify the use of ECG systems for preventive diagnosis of cardiac complications. For instance, a December 2022 article from Open Veterinary Journal investigated the feasibility and established normal electrocardiographic (ECG) values for healthy Chianina breeds of cows using a standard base-apex ECG examination. The study found that all participant animals exhibited sinus rhythm without arrhythmias, with heart rates ranging from 48 to 94 bpm. Significant correlations were observed between heart rate, body weight, and other clinical variables. This research has the potential to act as valuable reference data for ECG parameters in Chianina cows, enhancing the understanding of cardiac health monitoring in this breed.

Asia Pacific Veterinary ECG Systems Market Trends

Asia Pacific veterinary ECG systems market is anticipated to witness a significant CAGR of 7.62 over the forecast period. This can be attributed to the growing penetration of ECG measurement in the region's dominant livestock - the Cattle. For instance, a July 2022 study published in InTech Open explored electrocardiography (ECG) as a non-invasive diagnostic tool for assessing cardiac function and identifying diseases in cattle. It detailed the anatomy of the bovine heart and the efficient methodologies for conducting ECG examinations. Furthermore, the researchers formulated guidelines for interpreting ECG results related to various cardiac conditions, including arrhythmias and electrolyte imbalances.

The veterinary ECG systems market in India is primarily driven by increasing attempts at penetrating veterinary care in remote regions of the country. For instance, in May 2024, Kerala Veterinary and Animal Sciences University (KVASU) and the Animal Husbandry Department arranged a medical camp focusing on diagnosing and treating heart diseases in dogs. The camp aimed to raise awareness about canine heart health and provided free health check-ups, including ECG measurements and consultations, to pet owners. This initiative highlights the importance of early detection and treatment of heart conditions in dogs to improve their quality of life.

Latin America Veterinary ECG Systems Market Trends

The veterinary ECG systems market in Latin America is influenced by the rising demand for advanced veterinary care and the growing livestock industry, necessitating better animal health monitoring. Increased investment in veterinary education and training enhances practitioners' skills, leading to greater adoption of diagnostic technologies. Additionally, the expansion of pet insurance and a focus on preventive care encourage veterinary practices to incorporate systems into their services.

The veterinary ECG systems market in Brazil is expected to exhibit steady growth during the forecast period. Veterinary experts and researchers from the country are researching and developing diagnostic parameters for various animal species. For instance, a February 2023 MDPI research study provided a comprehensive analysis of the cardiac health of Pega breed donkeys using electrocardiography and echocardiography. The study aimed to establish baseline parameters that can prove useful for future assessments, particularly about the impact of physical exertion on heart health. These researchers from Brazil aimed to enhance the understanding of cardiac function in donkeys and contribute to better management practices focused on animal welfare.

MEA Veterinary ECG Systems Market Trends

The veterinary ECG systems market in the Middle East and Africa is driven by increasing pet ownership and growing animal health and welfare awareness. In addition, advancements in veterinary technology and the rising prevalence of cardiovascular diseases in animals are prompting veterinary clinics to adopt more sophisticated diagnostic tools. Government initiatives to improve animal healthcare infrastructure and expand veterinary services in rural areas also contribute to market growth.

The veterinary ECG systems market in Saudi Arabia is driven by researchers attempting to discover novel applications of existing ECG systems for new animal species, boosting the penetration of ECG systems. For instance, in September 2024, research from Saudi Arabia evaluated donkeys' heart response and locomotor parameters during exercise using the Equimetre fitness tracker. The study aimed to assess the reliability of wearable devices for heart rate and ECG readings and to measure heart rate and cardiac troponin levels in donkeys. They inferred that Equimetre and standard ECG measurements are both capable & feasible for monitoring heart activity in donkeys. However, no significant differences in heart response or locomotor parameters were found between trained racing donkeys and those used for regular riding, warranting further research.

Key Veterinary ECG Systems Company Insights

The market is fragmented owing to the presence of multiple manufacturers as well as the off-label use of products for ECG measurement in animals. This is expected to intensify the competition in the coming years. Furthermore, industry scientists are adopting various research studies and strategic initiatives, such as partnerships, sales & marketing activities, and awareness initiatives. However, their primary focus seems to be on product and geographical expansion and offering innovative products to customers to strengthen their market presence.

Key Veterinary ECG Systems Companies:

The following are the leading companies in the veterinary ECG systems market. These companies collectively hold the largest market share and dictate industry trends.

- Dextronix Inc.

- Idexx

- Contec Medical Systems Co. Ltd.

- SoundVet (Mars Inc.)

- Bionet America Inc.

- Eickemeyer Veterinary Equipment Ltd.

- Narang Medical Limited

- Shenzhen Comen Medical Instruments Co., Ltd.

- Aspel SA

- Dawei Medical (Jiangsu) Co. Ltd.

- iWorx Systems Inc.

- Alba Medical

- VectraCor

- New Gen Medical Systems

Recent Developments

-

In August 2024, a veterinary doctor from Australia, Dr. Chloe Buiting, experimented with measuring the heart rate of a lion using an Apple smartwatch. She placed the watch on the lion's tongue to successfully measure its heart rate.

-

In June 2024, the Lalari government veterinary polyclinic became the only veterinary clinic in the Haroli region of Himachal Pradesh, India, to have advanced diagnostic equipment.

-

In November 2023, Antech Diagnostics launched a new veterinary diagnostic reference laboratory in the UK

Veterinary ECG Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 111.60 million

Revenue Forecast in 2030

USD 154.76 million

Growth Rate

CAGR of 6.76% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, modality, technology, usage, animal, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

US; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dextronix Inc.; Idexx; Contec Medical Systems Co. Ltd.; SoundVet (Mars Inc.); Bionet America Inc.; Eickemeyer Veterinary Equipment Ltd.; Narang Medical Limited; Shenzhen Comen Medical Instruments Co., Ltd.; Aspel SA; Dawei Medical (Jiangsu) Co. Ltd.; iWorx Systems Inc.; Alba Medical; VectraCor; New Gen Medical Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary ECG Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary ECG systems market report based on product, modality, technology, usage, animal, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

ECG Systems

-

Accessories & Consumables

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Benchtop

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital

-

Analog

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Resting ECG

-

Holter ECG

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Large Animals

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Institutions

-

Academic & Research Institutions

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary ECG systems market size was valued at USD 105.05 million in 2024 and is expected to reach USD 111.60 million in 2025.

b. The global veterinary ECG systems market is projected to grow at a compound annual growth rate (CAGR) of 6.76% from 2025 to 2030 to reach USD 154.76 million by 2030.

b. North America veterinary ECG systems market held the largest share of 36.42% of the global market in 2024. The dominance can be attributed to regulatory and animal welfare organizations putting a focus on importance of timely ECG and other vital signs monitoring. For instance, a September 2023 article published by American Veterinary Medical Association (AVMA), identified 11 crucial technologies that have the capability to disrupt the veterinary sector. One of technologies that the article focused on was the rise of quantified health or wearable devices in veterinary medicine, highlighting their potential to enhance animal care through continuous monitoring of vital parameters, including ECG readings.

b. Some key players operating in the veterinary ECG systems market include Dextronix Inc., Idexx, Contec Medical Systems Co. Ltd., SoundVet (Mars Inc.), Bionet America Inc., Eickemeyer Veterinary Equipment Ltd., Narang Medical Limited, Shenzhen Comen Medical Instruments Co., Ltd., Aspel SA, Dawei Medical (Jiangsu) Co. Ltd., iWorx Systems Inc., Alba Medical, VectraCor, and New Gen Medical Systems.

b. Some of the key factors driving the market growth are increasing prevalence of arrhythmia and other cardiac complications, evolving R&D initiatives, growing awareness initiatives, and emerging role of continuous medical education (CME).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.