- Home

- »

- Animal Health

- »

-

Veterinary Dental Equipment Market Size, Share Report 2030GVR Report cover

![Veterinary Dental Equipment Market Size, Share & Trends Report]()

Veterinary Dental Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Equipment, Consumables, Adjuvants), By Animal (Large, Small), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-705-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Dental Equipment Market Trends

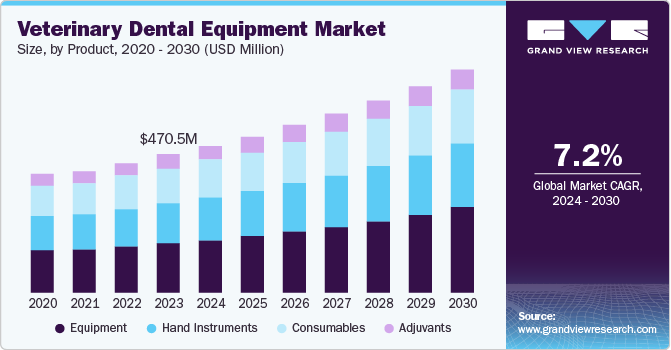

The global veterinary dental equipment market size was valued at USD 470.5 million in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. The increased pet ownership and awareness of veterinary dental health have increased the demand for veterinary dental equipment. Additionally, the growing emphasis on preventive dental care for animals is anticipated to drive market growth. Advances in dental technology, including accurate imaging and efficient therapeutic tools increase diagnostic capabilities and treatment outcomes. Furthermore, the positive impact of oral health on the overall welfare of animals, and the expansion of veterinary practices and clinics are driving the demand for advanced dental equipment.

Demographic and economic trends influence the veterinary dental equipment market. The rising disposable income in emerging markets drives spending on pet health and dental care. As the urbanization landscape enlarges, pet owners desire high-quality veterinary care comprising specialty dental services, and an increased demand for advanced dental equipment. This economic shift is notable, especially in the Asia Pacific, where increasing pet ownership drives demand for premium pet healthcare products and services with the rise in consumer spending.

Another significant driver is the ongoing professionalization and specialization in veterinary. As veterinary medicine continues to evolve, there is a growing trend towards specialization, with more veterinary professionals focusing on animal dentistry. This specialization requires adopting advanced dental technologies and equipment with high-quality care. Additionally, education and training programs add to the competency of veterinary professionals in dental care, further boosting the demand for sophisticated dental equipment as they adopt new techniques and technologies to enhance patient outcomes.

Product Insights

Equipment dominated the market and accounted for a share of 35.7% in 2023 attributed to increased awareness among pet owners of oral health and its impact on overall animal welfare. In addition, digital imaging, less complex surgical instruments, and technological advances have increased diagnostic capabilities and treatment outcomes, encouraging veterinarians to invest in modern equipment. Furthermore, the increasing incidences of dental diseases in pets have led veterinary clinics to expand their services, creating the need for specialized dental equipment.

Hand instruments are expected to register a steady CAGR during the forecast period driven by the growing investment in dental training, and enhancing veterinary professionals' skills. The focus on preventative pet care and routine dental care has also increased the demand for precision hand tools. Furthermore, high-quality and effective veterinary care is helping to grow the acceptance of these tools.

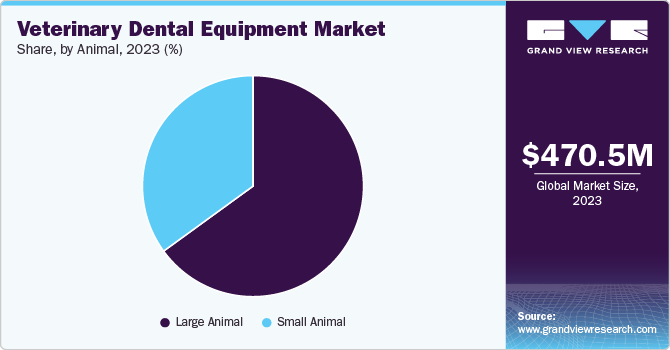

Animal Insights

The large animal segment dominated the market in 2023 primarily due to increasing oral health awareness among livestock and the equine population, which emphasizes preventive care. Additionally, advances in livestock dental technology for dental implants are anticipated to drive market growth. Furthermore, increasing investments in agricultural practices and livestock management have increased the demand for specialized veterinary services for large animals.

The small animal segment is projected to grow at a CAGR of 8.9% over the forecast period due to the increasing availability of pets and growing awareness of the importance of dental health for dogs, cats, and so on. Additionally, the current advancements in veterinary dental technology make the equipment more effective and user-friendly. Furthermore, the growth of new preventive and cosmetically oriented small animal dental procedures exhibits significant effect on the increased usage of specialized dental instruments in this category.

Distribution Insights

The hospitals & clinics segment dominated the market in 2023 due to their role as primary centers for advanced and comprehensive veterinary care, including specialized dental procedures. Additionally, increased investments in state-of-the-art dental equipment and facilities in these institutions have enhanced their capability to offer high-quality dental treatments. Furthermore, the growing trend of specialized veterinary hospitals focusing on dental care has driven greater demand for sophisticated dental equipment in these clinics.

The e-commerce segment is projected to grow at a CAGR of 8.9% over the forecast period owing to the rise in online shopping preference of veterinarians and hospitals to access dental equipment. Additionally, easy digital channels, combined with the ability to compare prices and access a wide variety of products are anticipated to drive this trend. Furthermore, advances in e-commerce technology and improved logistics facilitate the distribution and availability of specialized veterinary dental equipment, fuel the segment growth.

Regional Insights

North America veterinary dental equipment dominated the market with a revenue share of 36.5% in 2023 due to advanced healthcare, the latest veterinary technologies, and the increasing adoption of cutting-edge veterinary technology. Additionally, investment in veterinary research and development has created a demand for sophisticated dental equipment alongwith specialized veterinary clinics. Furthermore, awareness of medical care and spending on advanced equipment is anticipated to drive market growth in North America.

U.S. Veterinary Dental Equipment Market Trends

The U.S. veterinary dental equipment market dominated North America with a significant revenue share in 2023 as it is a pioneer in veterinary healthcare and has a visibly higher number of sophisticated veterinary practices in the industry. The healthcare industry's investment in the research and development of new technology has seen the introduction of sophisticated dental technologies hence the increased demand. Furthermore, there is a large and increasing population of pets in the U. S., combined with an increased awareness of the need for pet care especially as far as oral health is concerned, this supports the large market share of this segment.

Europe Veterinary Dental Equipment Market Trends

Europe veterinary dental equipment market accounted for a significant share in 2023. This is due to increased investments in veterinary infrastructure and the adoption of advanced dental technologies across the region. Additionally, pet health and preventive care expertise is anticipated to increase demand for sophisticated dental appliances. Furthermore, Europe's strong regulatory environment and supportive policies for veterinary care have facilitated the expansion and advancement of dental equipment offerings.

The UK veterinary dental equipment market is expected to grow high in the coming years due to increased pet availability and increased focus on pet health and preventive care. Additionally, advances in dental technology and increased investment in the veterinary sector drive the adoption of sophisticated equipment. Furthermore, the increasing public awareness of the importance of oral health for pets and supportive veterinary programs contribute to the market growth.

Asia Pacific Veterinary Dental Equipment Market Trends

Asia Pacific veterinary dental equipment market is anticipated to witness significant growth. This is attributed to the increasing awareness among pet owners about oral health and its impact on overall animal welfare. Additionally, increased disposable income across the region has enabled pet owners to invest more in their pet’s health and well-being. Furthermore, advances in veterinary dentistry techniques and equipment, and the increasing number of veterinary clinics specialized in dental care, further expand the market growth.

Key Veterinary Dental Equipment Company Insights

Some key companies in the global veterinarydental equipment market include Mars, Incorporated, Midmark Corporation, Patterson Companies, Inc, Planmeca Oy, and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Midmark Corporation is a supplier of medical and veterinary equipment, specializing in solutions that improve the efficiency and effectiveness of the healthcare environment. In the case of veterinary equipment, Midmark offers a variety of advanced dental programs, including quality dental and imaging solutions. designed to support dental care for animals.

-

Patterson Companies, Inc. is a distributor of health products and services, specializing in dental and veterinary health. In veterinary dental equipment, Patterson offers a comprehensive range of advanced products, such as imaging systems and accessories designed to support dental procedures and enhance the diagnostic capacity of veterinary services.

Key Veterinary Dental Equipment Companies:

The following are the leading companies in the veterinary dental equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Mars, Incorporated

- Midmark Corporation

- Patterson Companies, Inc

- Planmeca Oy

- iM3 AUS

- Jorgensen Laboratories

- Dentsply Sirona

- 3M

- Henry Schein, Inc

- MAI ANIMAL HEALTH

Recent Developments

-

In May 2024, Mars, Incorporated announced plans to acquire Cerba Veterinary Partners and Antagene from Cerba HealthCare, strengthening its position in the veterinary diagnostics and genetics sectors. The acquisition expands Mars' veterinary services and capabilities by integrating Cerba Vet’s network of veterinary diagnostics laboratories and Antagene’s expertise in genetic testing. This reflects Mars' commitment to enhancing pet health and advancing personalized veterinary care.

-

In January 2024, Midmark Corp. unveiled its redesigned Midmark Mobile Dental Delivery System, which features a compact design and integrated tools that enhance veterinary workflow and space efficiency. Key improvements include a fully enclosed system for easier cleaning, a quieter oil-less compressor, and various ergonomic features such as swivel handpieces and LED indicators. This next-generation system, developed based on extensive research with veterinary professionals improves efficiency and maintenance while providing a high level of support.

Veterinary Dental Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 499.8 million

Revenue forecast in 2030

USD 756.8 million

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, distribution, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Mars Incorporated; Midmark Corporation ; Patterson Companies, Inc; Planmeca Oy; iM3 AUS; Jorgensen Laboratories; Dentsply Sirona; 3M; Henry Schein; Inc; MAI ANIMAL HEALTH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

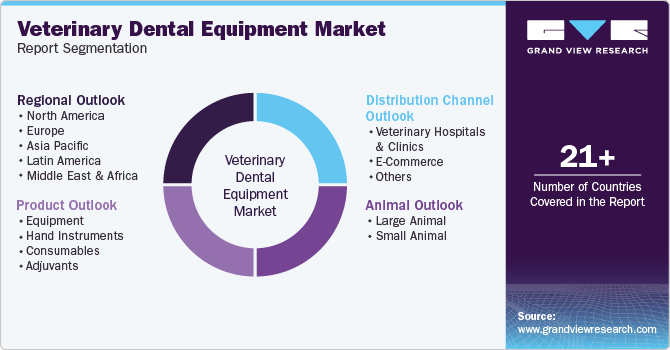

Global Veterinary Dental Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinarydental equipment market report based on product, animal, distribution, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Dental X-Ray Systems

-

Electrosurgical Units

-

Dental Stations

-

Dental Lasers

-

Powered Units

-

-

Hand Instruments

-

Dental Elevators

-

Dental Probes

-

Extraction Forceps

-

Curettes and Scalers

-

Retractors

-

Dental Luxators

-

Others

-

-

Consumables

-

Dental Supplies

-

Prophy Products

-

Others

-

-

Adjuvants

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Animal

-

Small Animal

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.