Veterinary Clinical Trials Market Size, Share & Trends Analysis Report By Animal (Companion Animal, Livestock Animal, Other Animals), By Indication, By Intervention, By Sponsor, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-329-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Veterinary Clinical Trials Market Trends

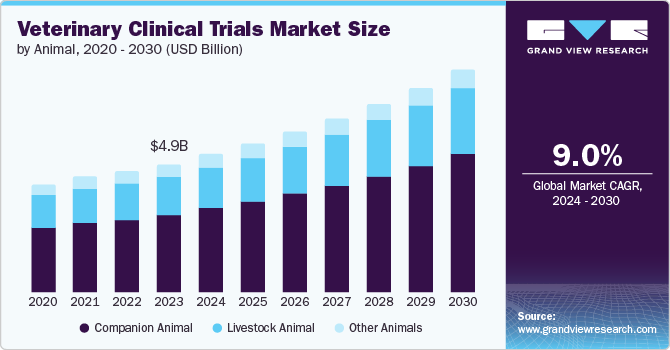

The global veterinary clinical trials market size was estimated at USD 4.94 billion in 2023 and is expected to grow at a CAGR of 9.0% from 2024 to 2030. The market is primarily driven by advancements in veterinary medicine, the rising prevalence of chronic and infectious diseases in animals increased investment from pharmaceutical and biotechnology companies in veterinary research, and increased availability of funding and grants from both public institutions and private organizations.

For instance, on August 20the 23, the University of Nebraska-Lincoln received research and development funding of $248 million from the United States Department of Agriculture's National Institute of Food and Agriculture (USDA-NIFA)for swine-focused research to combat viral diseases, antimicrobial resistance, and enhance farm sustainability. These projects aim to develop management strategies and genetic tests to improve animal health and welfare, potentially impacting the market by advancing vaccine development and disease prevention methods.

Additionally, increasing launch of veterinary clinical trials is also propelling the growth of the veterinary clinical trials market. For instance, in August 2022, Chou2 Pharma, in collaboration with the Pennsylvania School of Veterinary Medicine’s (Penn Vet) Veterinary Clinical Investigations Center (VCIC), initiated clinical trials focusing on cannabigerol (CBG) and cannabidiol (CBD) for dog’s elbow osteoarthritis. This launch of clinical trials marks a significant step in advancing cannabinoid-based treatments for veterinary medicine. This highlights an increasing trend in the market to investigate new therapies for diverse animal health issues, prioritizing safety, effectiveness, and adherence to regulations.

The COVID-19 pandemic has disrupted various sectors, however, development of pharmaceuticals for animal health continues due to the threat posed by diseases with animal origins. While human clinical assays face postponements and cancellations, preclinical and veterinary clinical studies are growing rapidly. European firms, facing import restrictions and transport challenges, are increasingly turning to local sources for animals. Despite logistical hurdles, organizations like ISOQUIMEN and CLINOBS report sustained demand for their veterinary research services, unaffected by the pandemic's disruptions in human clinical trials. Overall, while the pandemic impacts human clinical assays, it presents new opportunities for veterinary clinical trials, driving increased focus and collaboration in the field.

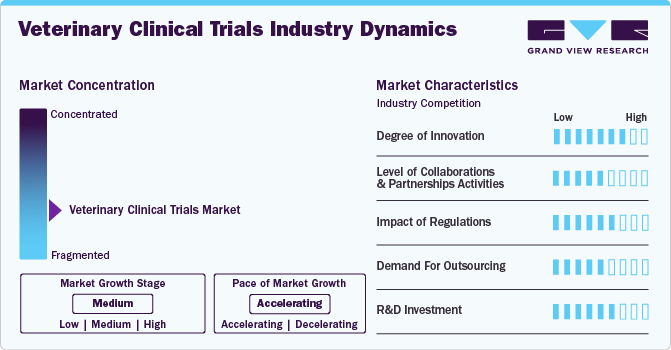

Market Concentration & Characteristics

The veterinary clinical trial market is highly concentrated. The market is at a medium growth stage, and the rate of expansion is accelerating. Rapid developments in veterinary medicine, as well as increased R&D expenditure by leading players, are the key drivers of market growth.

Market concentration is influenced by the pace of technological advancements. Companies that invest in research and development to introduce innovative products with enhanced features, and efficacy can gain a competitive advantage and increase their market share. Conversely, companies that fail to keep up with technological advancements risk losing market share to competitors.

T market exhibits a notable degree of innovation, driven by advancements in technology, methodologies, and therapeutic approaches. This innovation encompasses novel trial designs, such as adaptive and platform trials, as well as the integration of cutting-edge diagnostic tools and biomarkers. Additionally, there's a growing focus on personalized medicine and precision veterinary care, tailoring treatments to individual animals' genetic profiles and disease characteristics. This innovation fosters progress in veterinary medicine, offering new avenues for addressing complex health challenges in animals.

Collaborations and partnerships play a crucial role in driving growth in the veterinary clinical trials market. The level of collaboration and partnership activities has increased significantly in recent years, as stakeholders recognize the benefits of pooling resources, expertise, and networks. Pharmaceutical companies, CROs, academic institutions, and veterinary clinics are increasingly forming strategic alliances to enhance research capabilities, access specialized knowledge, and expedite trial processes. This trend underscores the importance of collaborative efforts in expanding the market and advancing animal healthcare.

Regulations significantly impact the veterinary clinical trials market, ensuring safety, efficacy, and ethical conduct in research. Compliance with regulatory requirements, such as those set by the FDA's Center for Veterinary Medicine (CVM) in the United States and the European Medicines Agency (EMA) in Europe, is essential for market access. Stringent regulatory frameworks influence trial design, documentation, and approval processes, shaping the landscape for pharmaceutical companies, CROs, and academic institutions involved in veterinary research.

The demand for outsourcing veterinary clinical trials is on the rise, due to the growing need for specialized expertise, access to advanced facilities, and a desire to expedite research processes. Pharmaceutical companies, biotech firms, and academic institutions are increasingly turning to contract research organizations (CROs) to conduct these trials efficiently and effectively. This trend underscores the importance of outsourcing in streamlining veterinary research and advancing animal healthcare. Companies like BioAgile Therapeutics are conducting veterinary contract research to develop new medicines and feed additives, adhering to Good Laboratory Practices (GLP) and Good Clinical Practice (GCP) standards.

Rise in veterinary research and development (R&D) spending has driven a notable increase in veterinary clinical trials. With a growing emphasis on developing innovative treatments for animal diseases and improving animal health outcomes, there's been a corresponding surge in funding allocated to veterinary R&D. This increased investment has accelerated frequency of veterinary clinical trials, reflecting a commitment to advancing veterinary medicine and addressing the diverse healthcare needs of animals. Key players like Zoetis and Boehringer Ingelheim International GmbH are heavily investing in R&D sectors to innovate and accelerate development of veterinary medicine. In 2023, Zoetis and Boehringer Ingelheim International GmbH invested USD 614.0 Mn and USD 593.5 Mn in R&D.

Animal Insights

Companion Animal segment is dominating market in 2023 with a market share of 61.39% and is expected to be fastest-growing segment with the highest CAGR of 9.5% over the forecast period owing to a rising incidence of canine cancer, growing investment in veterinary oncology research & development, and a growing number of clinical trials for canine medicines are expected to drive segment growth.

Furthermore, it is subdivided into canine, feline, and equine. The canine segment accounted for the highest revenue share of 49.67% in 2023 due to increased corporate investments in development of canine therapies. The companies are implementing strategies, such as licensing, R&D partnerships, and business growth, to improve their product portfolio in canine oncology.

For instance, in June 2022, Boehringer Ingelheim signed a partnership agreement with CarthroniX to develop small molecule therapies in canine oncology. The partnership between Boehringer Ingelheim and CarthroniX represents a significant advancement for the veterinary clinical trials market, promising to bring cutting-edge cancer treatments to canine patients and setting new benchmarks in veterinary oncology.

Indication Insights

Based on indication, oncology held the largest share of 27.51% in 2023 due to increased incidence of cancer in domestic animals, increase in oncology-focused veterinary clinical trials, and high spending on development of veterinary cancer therapies. Moreover, regulatory bodies, such as the Veterinary Cancer Society, a nonprofit educational group seeking to promote research and collaboration in the field of veterinary oncology, are contributing to segment growth.

Moreover, according to the National Cancer Institute, in 2022, 32 million cats and 65 million dogs live in the U.S. According to preliminary estimates of cancer incidence, roughly 6 million dogs are diagnosed with cancer annually and a comparable number is reported in cats. Similarly, according to the American Veterinary Medical Association, in 2022, one in four dogs was estimated to develop cancer at some stage.

Internal medicine segment is estimated to grow at the highest CAGR of 10.2% over the forecast period. The rise in chronic diseases drives the need for advanced and targeted treatments, inducing more clinical trials in internal medicine. Furthermore, advances in biotechnology, including new drug delivery systems and personalized medicine, are expanding the scope of internal medicine treatments available for pets.

Intervention Insights

Based on intervention, medicines segment held highest share of 53.67% in 2023. Rising prevalence of chronic conditions like arthritis, diabetes, cardiovascular diseases, and cancer in pets is driving segment growth. Studies indicate that approximately 10% of pets will develop diabetes and about 25% of dogs and 20% of cats are diagnosed with arthritis during their lifetime. These increasing prevalence rates necessitate more clinical trials to develop effective medical treatments.

Moreover, the development of new pharmaceuticals for veterinary use has accelerated, driven by advances in biotechnology and a better understanding of animal diseases. Innovations such as targeted therapies and immunotherapies require rigorous clinical trials to establish their efficacy and safety, increasing the number of medicine-focused trials.

Medical device segment is expected to grow at the highest CAGR of 10.0% over the forecast period. Rapid advancements in medical technology, such as minimally invasive surgical instruments, diagnostic imaging equipment, and wearable health monitors, drive the need for clinical trials. These devices require rigorous testing to validate their safety and effectiveness in veterinary applications.

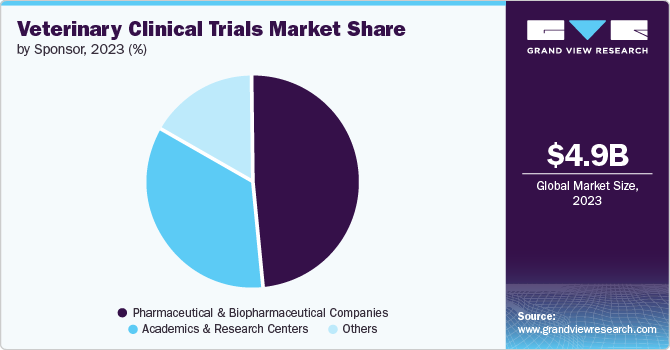

Sponsor Insights

Based on sponsors, pharmaceutical and biopharmaceutical companies segment held the largest share of 53.36% in 2023. Pharmaceutical and biopharmaceutical companies have advanced R&D facilities and laboratories, which are essential for conducting complex veterinary clinical trials. Additionally, these companies are often engaging in strategic partnerships with veterinary clinics, universities, and research institutions, enhancing their research capabilities and expanding their reach in the veterinary market.

Academic and Research centers segment is expected to grow at the highest rate of 9.8% over the forecast period. Academics and research institutions are growing up their investment and funding in the market due to increased funding opportunities, a focus on translational research, advancements in veterinary science, rising demand for veterinary expertise, educational imperatives, public health concerns, and global health initiatives. These factors are driving a significant shift towards more robust and comprehensive veterinary research within academic settings.

Regional Insights

North America veterinary clinical trials market dominated the global market with a revenue share of 33.70% in 2023, owing to the presence of prominent market players, advanced healthcare infrastructure, and high healthcare expenditure. Additionally, North America features advanced healthcare infrastructure, including research institutions, veterinary clinics, and pharmaceutical companies, providing a robust ecosystem for conducting clinical trials. North American companies invest significantly in research and development (R&D) for veterinary products, including conducting clinical trials to bring novel therapies to market. This investment fosters a vibrant clinical research landscape in the region.

U.S. Veterinary Clinical Trials Market Trends

The veterinary clinical trials market of the U.S. is expected to grow at a significant pace over the forecast period.There is growing support from regulatory bodies such as the FDA's Center for Veterinary Medicine (CVM), which oversees the approval of veterinary drugs and biologics. Additionally, increased funding from both private and public sectors is supporting the growth of veterinary clinical trials.

Europe Veterinary Clinical Trials Market Trends

The Europe veterinary clinical trials market is influenced by several trends, driven by advancements in veterinary care, technology, and evolving needs of advanced veterinary medicine. Many pharmaceutical and biotech companies are expanding their presence in Europe, leading to an increase in veterinary clinical trials outsourcing to leverage expertise and resources available in the region. Furthermore, favorable regulatory frameworks in Europe encourage the development and testing of veterinary drugs and therapies, attracting sponsors and expanding clinical trial activity.

The veterinary clinical trials market of Germany is anticipated to grow at a constant growth rate due to the rising number of R&D activities and the influx of new animal products.Germany boasts world-class research institutions, universities, and veterinary clinics equipped with state-of-the-art facilities and expertise. This advanced infrastructure supports the conduct of high-quality veterinary clinical trials.

UK veterinary clinical trials market held the largest share in the European animal health market in 2023. This is presumed to be a consequence of veterinary research activities undertaken across the region, resulting in development of new animal products which play an imperative role in garnering a greater share. These research activities help the market in two ways, by building a knowledge base in the industry to create new products for efficient pet health and by carrying out consistent diagnosis in animals and inspection of raw materials used in the production as a preventive measure against highly prevalent diseases.

Asia Pacific Veterinary Clinical Trials Market Trends

The veterinary clinical trials market of Asia Pacific is expected to exhibit lucrative growth over the forecast period. The Asia-Pacific region has seen a notable increase in veterinary clinical trials over the past decade. This growth is driven by factors such as increasing pet ownership, expanding livestock industries, and growing awareness of animal health and welfare. Clinical trials in the region often focus on areas such as infectious diseases (e.g., avian influenza, foot-and-mouth disease), parasitic infections (e.g., heartworm, tick-borne diseases), and chronic conditions (e.g., cancer, arthritis). Additionally, there's growing interest in trials related to nutrition, behavior, and preventive healthcare.

Japan veterinary clinical trials market is projected to witness considerable growth. With a growing awareness of pet health and wellness, there's an increasing demand for innovative veterinary products and therapies that address issues such as aging-related diseases, obesity, and behavioral disorders. This has led to investments in R&D to develop novel treatment modalities and preventive care solutions for companion animals in Japan.

The veterinary clinical trials market of India is expected to be fueled by theexpansion of veterinary facilities in the country. For instance, in October 2023, The All-India Institute of Veterinary Sciences (AIIVS) offered super-specialty veterinary branches and cutting-edge research facilities in Delhi to revolutionize veterinary education. With a focus on advanced treatments and research in areas such as animal genetics, pathology, and veterinary forensics, AIIVS will address critical gaps in disease detection and treatment, aligning with the One Health initiative to combat zoonotic diseases.

Latin America Veterinary Clinical Trials Market Trends

Latin America veterinary clinical trials market witnesses significant growth. Latin Americais a major player in the global livestock industry, with countries like Brazil and Argentina leading in beef and poultry production. There's a growing demand for veterinary products aimed at improving animal health and productivity, driving the need for clinical trials to assess the effectiveness of these products in production animals. In addition, Latin America boasts diverse ecosystems and animal populations, including unique species of wildlife. This diversity presents opportunities for conducting clinical trials in areas such as conservation medicine, zoo and wildlife medicine, and aquaculture.

Brazil veterinary clinical trials market is growing widely. Brazilis one of the world's largest producers and exporters of livestock products, including beef, poultry, and pork. The country's livestock industry presents opportunities for veterinary clinical trials aimed at improving animal health, productivity, and welfare, addressing challenges such as infectious diseases, parasitic infections, and nutritional deficiencies. Additionally, Brazil is investing in research infrastructure and capacity-building initiatives in veterinary medicine. This includes the establishment of veterinary schools, research institutes, and collaborative partnerships with international organizations and academic institutions, encouraging a favorable environment for veterinary R&D and clinical trials.

Middle East & Africa Veterinary Clinical Trials Market Trends

The veterinary clinical trials market of Middle East and Africa is witnessing significant growth due to advancements in veterinary medicines. Furthermore, outbreaks of diseases such as avian influenza, foot-and-mouth disease, and others in animals have necessitated research into vaccines and treatments, driving the need for clinical trials.

South Africa veterinary clinical trials market is primarily driven by the growing number of veterinary clinics and hospitals. South Africa's agricultural sector is significant, and livestock diseases pose a substantial threat. The need for effective treatments and vaccines to manage and prevent diseases in livestock is spurring veterinary clinical trials.

Key Veterinary Clinical Trials Company Insights

The market is highly competitive, with the presence of many large- and small-scale players. Most companies focus on collaborations, and partnerships to achieve greater market share. The market consists of CROs providing veterinary clinical trials services to pharmaceutical and biopharmaceutical companies.

Key Veterinary Clinical Trials Companies:

The following are the leading companies in the veterinary clinical trials market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratory

- IDEXX Laboratories, Inc.

- Boehringer Ingelheim International GmbH.

- Argenta

- Bioagile Therapeutics Pvt. Ltd.

- Veterinary Research Management

- Merck & Co., Inc.

- Labcorp Drug Development

- OCR - Oncovet Clinical Research

- Vivesto AB

- Vetbiolix

Recent Developments

-

In April 2024, VETBIOLIX's clinical study on VBX-1000 for periodontal disease in dogs showed significant reductions in plasma marker CTX1, alveolar bone defects, and improvements in clinical measures like CAL and PPD. These promising results support VETBIOLIX's plans for further regulatory trials and underscore their commitment to advancing veterinary care.

-

In December 2023, Vivesto AB's Paccal Vet trial for dogs with splenic hemangiosarcoma gained approval for patient recruitment in the U.S., with clinical sites prepared to start after receiving the investigational product in January 2024. The study aims to assess the efficacy of Paccal Vet, a paclitaxel-based treatment, in extending the lifespan of dogs with this aggressive cancer, where traditional treatment options offer limited survival benefits. If successful, the trial may lead to further studies to confirm its effectiveness and safety.

Veterinary Clinical Trials Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.35 billion |

|

Revenue forecast in 2030 |

USD 8.99 billion |

|

Growth rate |

CAGR of 9.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Animal, indication, intervention, sponsor, region. |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Charles River Laboratory; IDEXX Laboratories, Inc.; Boehringer Ingelheim International GmbH.; Argenta; Bioagile Therapeutics Pvt. Ltd.; Veterinary Research Management; Merck & Co., Inc.; Labcorp Drug Development; OCR - Oncovet Clinical Research; Vivesto AB; Vetbiolix |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Veterinary Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary clinical trials market report based on animal type, indication, intervention, sponsor, and region:

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Canine

-

Feline

-

Equine

-

-

Livestock Animal

-

Other Animals

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Internal Medicine

-

Orthopedics

-

Cardiology

-

Neurology

-

Ophthalmology

-

Dermatology

-

Other Indication

-

-

Intervention Outlook (Revenue, USD Million, 2018 - 2030)

-

Medicines

-

Medical Device

-

Others

-

-

Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical And Biopharmaceutical Companies

-

Academics And Research Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global veterinary clinical trials market size was estimated at USD 4.94 billion in 2023 and is expected to reach USD 5.35 billion in 2024.

b. The global veterinary clinical trials market is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 8.99 billion by 2030.

b. North America dominated the veterinary clinical trials market with a share of 33.70% in 2023. The dominant share can be attributed to the presence of prominent market players, advanced healthcare infrastructure, and high healthcare expenditure. Additionally, North America features advanced healthcare infrastructure, including research institutions, veterinary clinics, and pharmaceutical companies, providing a robust ecosystem for conducting clinical trials. North American companies invest significantly in research and development (R&D) for veterinary products, including conducting clinical trials to bring novel therapies to market. This investment fosters a vibrant clinical research landscape in the region.

b. Some key players operating in the veterinary clinical trials market include Charles River Laboratory, IDEXX Laboratories, Inc., Boehringer Ingelheim International GmbH., Argenta, Bioagile Therapeutics Pvt. Ltd., Veterinary Research Management, Merck & Co., Inc., Labcorp Drug Development, OCR - Oncovet Clinical Research, Vivesto AB, Vetbiolix

b. Key factors that are driving the market growth include advancements in veterinary medicine, rising prevalence of chronic and infectious diseases in animals, increased investment from pharmaceutical and biotechnology companies in veterinary research, and increased availability of funding and grants from both public institutions and private organizations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."