- Home

- »

- Animal Health

- »

-

Veterinary Care Market Size, Share & Trends Report, 2030GVR Report cover

![Veterinary Care Market Size, Share & Trends Report]()

Veterinary Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Animal Type (Companion, Production), By Type of Care (Primary, Critical), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-512-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Care Market Summary

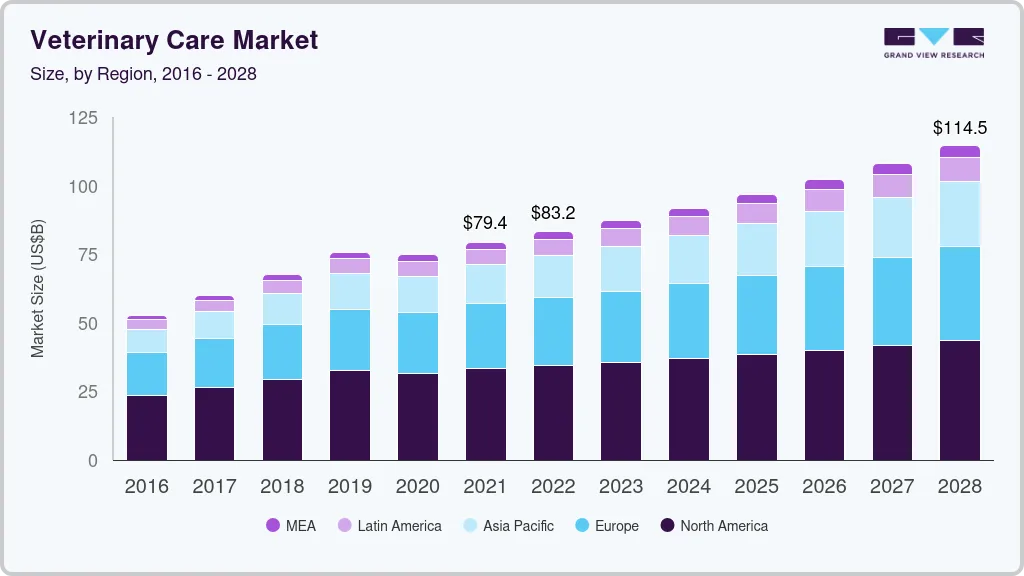

The global veterinary care market size was estimated at USD 87.3 billion in 2023 and is projected to reach USD 149.3 billion by 2030, growing at a CAGR of 8.0% from 2024 to 2030. The rising incidence of chronic diseases in pets and animals drives the need for improved veterinary care, fueling market demand.

Key Market Trends & Insights

- North America veterinary care market accounted for the dominant revenue share of 41.8%.

- The veterinary care market in the U.S. dominated the North American region in 2023.

- By animal, the production animal type segment dominated the market and accounted for a share of 58.15% in 2023

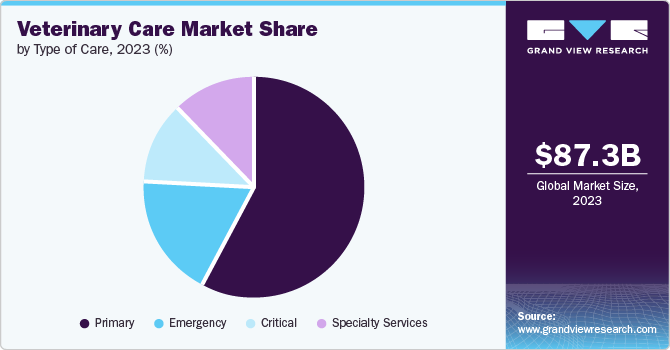

- By type of care, the primary care segment led the market with a revenue share of 58.10% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 87.3 Billion

- 2030 Projected Market Size: USD 149.3 Billion

- CAGR (2024-2030): 8.0%

- North America: Largest market in 2023

Moreover, government initiatives promoting better veterinary care are expected to accelerate market growth. A notable example is the U.S. Department of Agriculture’s Veterinary Services Grant Program, which provides funding for educational, extension, and training programs to enhance veterinary services.

The global market is experiencing significant growth, driven by several key factors. One of the primary drivers is the adoption of the One Health initiative. This collaborative approach brings together human, animal, and environmental health experts to address complex health issues at the human-animal-environment interface. The One Health initiative’s efforts to monitor and prevent zoonotic diseases have also contributed to the market’s growth, leading to improved animal healthcare standards and increased demand globally.

Governments worldwide have also launched initiatives to address specific animal health issues. For instance, India’s National Animal Disease Control Programme (NADCP) was launched in 2021 to eradicate Foot and Mouth Disease and Brucellosis. This program has increased the demand for veterinary care services in the country by requiring the implementation of disease surveillance, control, and vaccination measures. Similar government-led initiatives in other countries have also contributed to the growth of the global market by promoting the importance of animal health and the need for comprehensive veterinary services.

Growing awareness of animal welfare and increasing pet adoption in developed countries have driven market expansion. Pet owners seek high-quality veterinary care for their companion animals, boosting the demand for services and products.

Animal Type Insights

The production animal type segment dominated the market and accounted for a share of 58.15% in 2023. This is mainly due to the importance of livestock in rural areas, where farming and livestock are the primary sources of income. Rural communities rely heavily on the sale of by-products, such as milk, meat, and eggs, from their livestock, making veterinary care essential for maintaining the health and productivity of these animals.

The companion animals segment is projected to grow at the fastest CAGR of 8.4% over the forecast period. Increasing adoption of pets as companions presents a significant growth opportunity for the market. This shift in consumer behavior highlights the importance of understanding the factors influencing pet ownership, livestock production, and the demand for veterinary services across various animal categories.

Type of Care Insights

The primary care segment led the market with a revenue share of 58.10% in 2023. This is attributed to the rising pet ownership, heightened awareness about animal health, and growing recognition of the importance of preventive care in maintaining the overall well-being of pets and livestock. The affordability and convenience of primary care services, including routine check-ups, vaccinations, and wellness checks, have also played a significant role in the segment’s dominance. As a result, pet owners are increasingly seeking regular veterinary check-ups to ensure their companion animals receive the necessary care and attention.

The critical care segment is expected to witness the fastest CAGR of 8.2% over the forecast period. This is attributed to the rising prevalence of chronic and complex diseases in pets and livestock. Pet owners and livestock producers seek advanced care, including intensive monitoring, diagnostics, and specialized treatments. The availability of sophisticated equipment, specialized facilities, and board-certified specialists has contributed to increased adoption. Furthermore, growing awareness of the importance of timely and comprehensive care has fueled demand for critical care services, propelling the segment’s growth.

Regional Insights

North America veterinary care market accounted for the dominant revenue share of 41.8% of the global revenue in 2023 owing to supportive government initiatives promoting better veterinary care. The study highlights emerging markets with significant growth potential for veterinary care providers and manufacturers. Notably, the U.S. government’s initiatives, such as the Veterinary Services Grant Program and Livestock Veterinary Innovation, aim to improve access to veterinary care for farmers and ranchers, further driving regional market growth.

U.S. Veterinary Care Market Trends

The veterinary care market in the U.S. dominated the North American region in 2023, aided by the increasing adoption of advanced technologies, such as telemedicine and wearable devices, which enable remote monitoring and early detection of health issues in pets. The COVID-19 pandemic has accelerated the adoption of these technologies, as pet owners seek convenient and accessible veterinary services while maintaining social distancing measures.

Europe Veterinary Care Market Trends

The Europe veterinary care market accounted for the second-largest share in 2023. Market growth is driven by the increasing initiatives by governments and animal welfare associations to promote better veterinary care. Moreover, rising demand for advanced diagnostic and treatment options for pets and livestock is aiding market growth further. Several pet owners in Europe are willing to spend on high-quality veterinary services to ensure the well-being of their animals.

The veterinary care market in the UK is projected to grow lucratively due to the increasing pet population. Animal shelters and rescue organizations reported a rise in foster applications and adoptions during the COVID-19 lockdowns, reflecting a growing concern about zoonotic diseases and the need for better biosecurity measures in livestock production.

The Germany veterinary care market is projected to grow significantly over the forecast period, driven by the growing demand for specialized services, such as oncology, cardiology, and neurology. German pet owners are increasingly willing to invest in advanced treatments for their animals, driven by a focus on preventive care and early disease detection. As a result, veterinarians in Germany are emphasizing the importance of regular check-ups and vaccination programs to maintain the overall health of pets and livestock.

Asia Pacific Veterinary Care Market Trends

The veterinary care market in Asia Pacific is anticipated to witness the fastest CAGR of 10.5% over the forecast period. The growing middle-class population and increasing disposable income drive market growth in the region. As a result, pet owners are becoming more willing to invest in high-quality veterinary services for their animals. The rising awareness about animal welfare and the need for better veterinary care is also a key driver, with various animal welfare organizations in the region launching awareness campaigns and educational programs to promote responsible pet ownership and animal welfare.

The China veterinary care market is expected to flourish from 2024 to 2030, driven by the country's rising demand for pet insurance. As pet owners in China seek to cover the costs of veterinary care for their animals, the market is set to experience significant growth. Furthermore, the growing concern about food safety and the need for better animal health management in livestock production are key drivers, as the Chinese government has implemented initiatives, such as the Animal Husbandry Law, to promote animal health and welfare.

The veterinary care market in India is forecasted to grow substantially, fueled by the rising demand for specialized care for exotic pets, such as reptiles and birds. As more Indian pet owners opt for these unique animals, there is a growing need for specialized veterinary services to cater to their specific needs. The increasing awareness about animal welfare and the importance of proper veterinary care is also a key driver, with animal welfare organizations in India launching awareness campaigns and educational programs to promote responsible pet ownership and animal welfare.

Key Veterinary Care Company Insights

Some key companies in the veterinary care market include Zoetis Inc.; Merck & Co., Inc.; Ceva Santé Animale S.A.; Boehringer Ingelheim International GmbH; and Elanco Animal Health Inc. The market is characterized by the presence of multiple players, including established brands, emerging startups, and specialty providers. Key market participants focus on technological advancements, mergers and acquisitions, collaborations, and partnerships to gain a larger market share.

-

Merck & Co., Inc., an American multinational pharmaceutical company, is one of the leading players in the market. The company offers a wide range of animal health products and services, including vaccines, pharmaceuticals, and services for veterinarians, farmers, and pet owners

-

Ceva Santé Animale S.A. is another key player in the market. The French multinational veterinary pharmaceutical company is known for its innovative solutions in animal health, specifically in the companion animal, poultry, and ruminant sectors. Ceva’s strong focus on R&D, combined with its global presence and comprehensive product range, has contributed to its success in the market

Key Veterinary Care Companies:

The following are the leading companies in the veterinary care market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis Inc.

- Merck & Co., Inc.

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Inc.

- IDEXX Laboratories, Inc.

- Ceva Santé Animale S.A.

- Dechra Pharmaceuticals PLC

- Virbac S.A.

- Vetoquinol S.A.

- Phibro Animal Health Corp.

Recent Developments

-

In June 2024, Merck Animal Health launched and made available the NOBIVAC NXT Rabies portfolio in Canada, a first-of-its-kind vaccine line using RNA-particle technology to protect cats and dogs from rabies. The vaccines are adjuvant and preservative-free, providing optimal safety and protection against the deadly disease

-

In January 2022, The Vets secured USD 40 million in seed funding to revolutionize pet care by providing premium at-home veterinary services and promoting a healthy work environment for veterinarians. The company aimed to expand to 25 cities by the end of 2022, addressing the growing issue of burnout among veterinarians

Veterinary Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 94.1 billion

Revenue Forecast in 2030

USD 149.3 billion

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, type of care, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zoetis Inc.; Merck & Co., Inc.; Boehringer Ingelheim International GmbH; Elanco Animal Health Inc.; IDEXX Laboratories, Inc.; Ceva Santé Animale S.A.; Dechra Pharmaceuticals PLC; Virbac S.A.; Vetoquinol S.A.; Phibro Animal Health Corp.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Care Market Report Segmentaton

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary care market report based on animal type, type of care, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Dogs

-

Cats

-

Equine

-

Others

-

-

Production Animal

-

-

Type of Care Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Primary

-

Emergency

-

Critical

-

Specialty Services

-

-

Production Animal

-

Primary

-

Emergency

-

Critical

-

Specialty Services

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary care market is expected to grow at a compound annual growth rate of 8.0% from 2024 to 2030 to reach USD 149.3 billion by 2028.

b. North America dominated the veterinary care market with a share of 41.8% in 2023. The rising incidence of canine disorders is one of the key factors responsible for the largest market share of the region.

b. Some key players operating in the veterinary care market include MSD Animal Health, Ceva, Zoetis, Boehringer Ingelheim GmbH, Elanco, IDEXX, Heska, etc.

b. Increasing cases of chronic diseases in pets and livestock animals are fueling the demand for better veterinary care. Many awareness programs are being conducted around the world regarding better veterinary care, thus propelling the demand.

b. The global veterinary care market size was estimated at USD 87.3 billion in 2023 and is expected to reach USD 94.1 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.