- Home

- »

- Animal Health

- »

-

Veterinary Artificial Insemination Market Size Report, 2030GVR Report cover

![Veterinary Artificial Insemination Market Size, Share & Trends Report]()

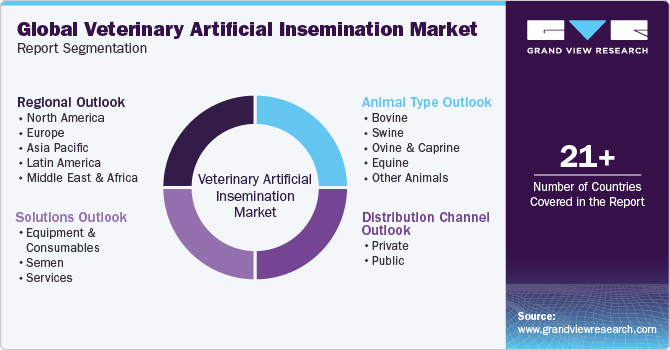

Veterinary Artificial Insemination Market (2025 - 2030) Size, Share & Trends Analysis Report By Solutions (Equipment & Consumables, Semen, Services), By Animal Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-570-0

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Artificial Insemination Market Summary

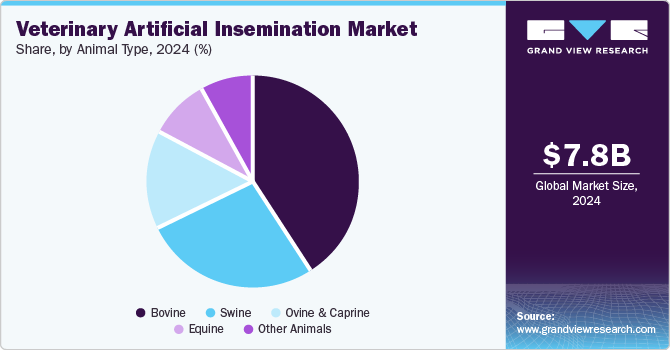

The global veterinary artificial insemination market size was estimated at USD 7,784.0 million in 2024 and is projected to reach USD 11,329.6 million by 2030, growing at a CAGR of 6.8% from 2025 to 2030. Growing demand to improve animal efficiency and productivity, consumption of meat, milk, & dairy products, need for sustainable food production, supportive initiatives by industry stakeholders, and adoption of sexed semen are some of the key drivers of this market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, services accounted for a revenue of USD 3,407.1 million in 2024.

- Semen is the most lucrative solutions segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 7,784.0 Million

- 2030 Projected Market Size: USD 11,329.6 Million

- CAGR (2025-2030): 6.8%

- North America: Largest market in 2024

In January 2024, the National Dairy Development Board’s subsidiary brand Mother Dairy, India, imported 40,000 doses of bull semen from Brazil to boost milk production via artificial insemination of Indian native breeds such as Gir and Kankrej.

The increasing adoption of artificial insemination services is a key market driver. Veterinary AI service providers offer expertise in performing AI procedures for various animal species, including cattle, horses, pigs, dogs, cats, and others. These professionals are skilled in semen collection, processing, and insemination techniques, ensuring the proper timing and accurate placement of semen to optimize conception rates. Artificial insemination service providers often offer comprehensive reproductive management programs that encompass the entire breeding process. This may include estrus synchronization, reproductive health assessment, fertility testing, ultrasound examinations, and artificial insemination. They help animal owners and breeders optimize reproductive performance, maximize conception rates, and minimize the risk of reproductive disorders.

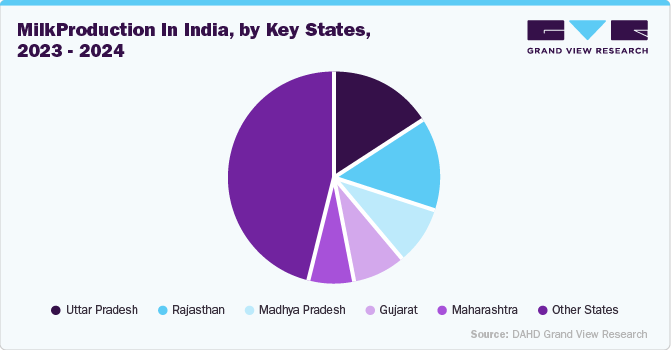

The increasing demand for dairy products is a key driver of the veterinary AI market. As India's population grows and dietary preferences shift toward higher protein consumption, there is a rising need for enhanced livestock productivity. Bovine AI plays a crucial role in meeting this demand by improving genetic traits, increasing milk yield, and enhancing quality. For instance, according to an article published by The Hindu, in November 2024, The country's milk output increased by 3.78% in 2023-2024 compared to 2022-2023 predictions. Uttar Pradesh leads the nation in milk production, accounting for 16.21% of total milk output. Furthermore, the study estimates that the country produced 239.30 million tons of milk in 2023-2024, representing a compound annual growth of 5.62% over the previous ten years, according to Union Minister Rajiv Ranjan Singh. The total quantity of milk produced in 2022-2023 was 230.58 million tonnes. India is first in the world in terms of milk output.

Another crucial driving factor for the market is the launch of innovative technologies to aid the livestock sector. For example, in March 2024, the Press Information Bureau of India (PIB), the Indian government launched Bharat Pashudhan Livestock Data Stack, a digital database for real-time tracking and monitoring of livestock animals in the country using a unique ID number. Through this system, farmers can access and upload veterinary information related to artificial inseminations, vaccinations, new animal registration, ownership change, animal disease diagnostic and treatment data, milk output recording, etc. The PIB further said that as of March 2024, 1.6 million entries per day are being added to this data stack.

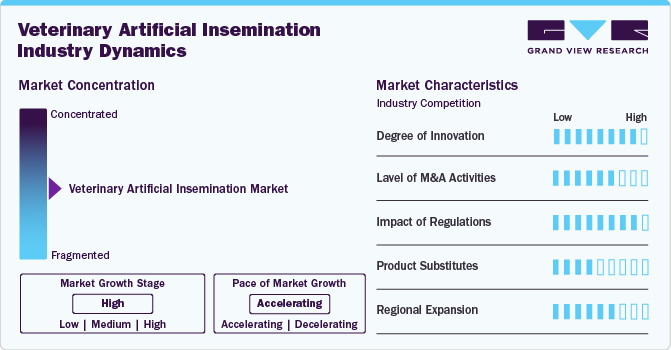

Market Concentration & Characteristics

The veterinary artificial insemination market exhibits a low market concentration, indicating a diverse landscape with numerous players involved in semen production, processing & distribution, insemination equipment manufacturing, and service provision. This diversity fosters competition and innovation, offering consumers a wide range of choices and driving continuous improvement in products and services.

In terms of the growth stage, the market is positioned at a medium level, characterized by steady but substantial expansion. Factors such as increasing demand for superior livestock genetics, advancements in reproductive technologies, and rising awareness about the benefits of artificial insemination contribute to this moderate growth trajectory. While the market is not in its infancy, there remains ample room for further development and penetration into new markets and segments.

The pace of growth within the market is accelerating, spurred by various factors including technological advancements, government support, and evolving customer preferences. This rapid expansion is evident in the increasing adoption of artificial insemination techniques by farmers, the proliferation of specialized equipment and services, and the continual innovation aimed at improving breeding outcomes and efficiency. As demand for high-quality genetics and sustainable livestock production continues to rise, the market is poised for further acceleration in the coming years.

The market demonstrates a moderate degree of innovation, characterized by ongoing technological advancements, collaboration between market players, and supportive initiatives. For instance, in October 2022, Genus extended its partnership with Tropic - an Agri-biotech company for applying the latter’s Gene Editing induced Gene Silencing (GEiGS) technology in bovine and swine genetics. The market sees a steady stream of improvements aimed at optimizing reproductive processes, enhancing genetic diversity, and addressing emerging challenges in animal breeding.

Within the market, there exists a moderate level of mergers and acquisitions activity, indicative of ongoing consolidation and strategic partnerships among industry players. For example, in January 2025, IMV Technologies acquired Conception Ro-Main Inc., a Quebec-based leader in AI-driven swine production technology, to strengthen its farm animal division. The deal, expected to close in Q1 2025, will bring Ro-Main's advanced IoT and AI solutions into IMV’s global portfolio, supporting innovation in sustainable pig farming.

The market experiences a moderate impact of regulations, with governmental oversight primarily focused on ensuring the safety, efficacy, and ethical use of reproductive technologies. While regulations exist to safeguard animal welfare and genetic diversity, they generally allow for flexibility in business operations and innovation within the industry. Compliance with regulatory standards is important for market participants, still, the regulatory environment is not overly restrictive, allowing for the adoption of new technologies and practices that contribute to market growth and advancement.

While alternative reproductive technologies exist, such as natural mating or embryo transfer, artificial insemination offers distinct benefits, including precise genetic selection, disease control, and increased breeding efficiency. Furthermore, the comprehensive nature of artificial insemination services, which often include genetic counseling, semen analysis, and reproductive management, further distinguishes them from alternative options. As a result, artificial insemination products & services maintain a unique position within the market, with limited viable substitutes offering comparable expertise and results.

In March 2023, URUS launched the Dairy Genetics Multiplication Program in African countries such as Kenya, Uganda, and Tanzania. This is expected to fuel AI adoption by small scale producers, build dependable network of AI technicians, and develop partnerships with local stakeholders. Similar initiatives by key market players leads to a high level of regional expansion activities in the market.

Solutions Insights

The services segment dominated the market with a share of 41.91% in 2024. These include AI service execution, reproduction management, semen evaluation & analysis, genetic consultations, and training & education. The semen segment, on the other hand, is anticipated to grow the fastest CAGR of 6.987.0% during the forecast period.

The semen segment is further bifurcated into normal or conventional semen and sexed semen. Normal semen accounted for the largest share in 2024, while sexed semen is projected to grow at the highest CAGR during the forecast period. This is due to the increasing adoption of sexed semen and supportive government policies. For instance, in July 2024, The Indian government imported 40,000 doses of purebred Gir bull semen from Brazil under its Genetic Improvement Programme to enhance Gir cow milk productivity, which could rise 5-8 times. Managed by NDDB with an INR 6 crore (USD 0.69 Mn) budget, the initiative aims to counter declining Gir populations and improve India’s milk output. A tender for 2.5 lakh more semen doses is also planned. Additionally, the government, as well as private players, have taken the initiative to produce sex-sorted semen indigenously, with records from DAHD putting the total production by the government as well as private players in 2023-2024 at more than 8 million doses.

Distribution Channel Insights

The private segment accounted for the largest revenue share of the market in 2024 and is projected to grow the fastest over the forecast period.This is due to a growing network of private companies and organizations involved in the distribution and supply of artificial insemination products and services to veterinary clinics, breeders, and livestock owners. These entities play a crucial role in making AI technology and genetic materials accessible to end-users.

The public segment also held a notable share of the market in 2024. Initiatives by publicly managed semen collection or distribution centers and veterinary facilities, such as government veterinary clinics or hospitals, contribute to the segment share. These facilities may offer AI services to farmers, livestock owners, and pet owners at subsidized rates or as part of government-sponsored animal health programs. National Dairy Development Board in India, for instance, is a statutory body of the Indian government that offers AI solutions to farmers in the country.

Animal Type Insights

In 2024, the bovine segment accounted for the largest share of the market by animal type. This dominance can be mainly attributed to two factors, the population and the contribution to the milk production. Additionally, government policies and NGO-led breed improvement programs have focused primarily on cows to enhance dairy profitability and rural livelihoods.

The swine segment is estimated to grow the fastest at a CAGR of 7.3% from 2025 to 2030. This is owing to widespread adoption of AI in cattle and pig breeding across key markets, initiatives by key companies, increasing advancements in bovine and swine genetics, and the need to produce sustainable animals. For instance, a company in Denmark— DanBred offers superior bovine genetics through DanBred AI. It also offers the GenePro solution for tracking the semen and genetic progress of the herd for better accountability and ROI. In August 2023, Urus Group— a leading market player in the genetics sector acquired Leachman Cattle of Colorado. This is expected to elevate URUS into a leadership role in the beef sector across North America and the globe.

Regional Insights

North America veterinary artificial insemination market held the largest share of 31.65% of the market in 2024. This is owing to the well-equipped animal husbandry industry, growing awareness and adoption of AI for breeding livestock, and the presence of key companies such as STgenetics. The company is U.S.-based and one of the leading players in the sexed semen market. The Sex Sorted Semen produced by the company offers an average of 93.0% female purity for various breeds of cattle and buffaloes.

U.S. Veterinary Artificial Insemination Market Trends

The veterinary artificial insemination market in the U.S. attributed to the largest share by country in North America in 2024.This market is driven by factors such as a strong infrastructure, significant investments in research and development, the growing trend of precision breeding and the increasing adoption of genomic selection methods. As per the National Association of Animal Breeders about 69 million units of bovine semen were sold in the U.S. via domestic sales, export sales, custom collection, and imported units combined.

Europe Veterinary Artificial Insemination Market Trends

The veterinary artificial insemination market in Europe is characterized by a robust infrastructure, advanced technological capabilities, and a strong emphasis on animal welfare and breeding standards. Semen production and distribution are well-established, with a wide range of genetic resources available for various livestock species. Insemination equipment and services are also highly developed, with a focus on precision breeding techniques and the use of advanced reproductive technologies contributing to the market growth.

The UK veterinary artificial insemination market attributed to the second largest share by country in Europe in 2024. While artificial insemination is widely practiced, there is a growing emphasis on ethical and sustainable breeding practices, with a focus on minimizing the potential negative impacts on animals and the environment. The growing number of market participants is another key driver for the market. For example, in August 2020, Cogent and AB Europe partnered to launch sexed semen services for ovine farmers in the U.K.

Asia Pacific Veterinary Artificial Insemination Market Trends

The veterinary artificial insemination market in Asia Pacific is witnessing rapid growth, driven by factors such as increasing demand for high-quality livestock genetics, rising awareness about the benefits of AI in animal breeding, and government initiatives to modernize the agricultural sector. Semen production and distribution networks are expanding to meet the growing demand from farmers, particularly in countries with large livestock populations such as China and India. Insemination equipment and services are also evolving, with a focus on affordability, accessibility, and customized solutions tailored to local breeding practices and environmental conditions.

The veterinary artificial insemination market in India is expected to grow at the fastest CAGR across the APAC region from 2025 to 2030. This is fueled by increasing demand for improved livestock productivity, supportive government initiatives, high population of cattle, and rising awareness among end users. The Indian government has implemented various initiatives to enhance the bovine artificial insemination (AI) market, including the Rashtriya Gokul Mission and the National Artificial Insemination Programme (NAIP). Under NAIP, AI services are provided free of cost across 605 districts. In 2023-2024, India produced over 10 million doses of sex-sorted semen, with five government-run semen stations in Uttarakhand, Gujarat, Uttar Pradesh, Madhya Pradesh, and Tamil Nadu contributing 4.95 million doses. Additional production by dairy cooperatives, NGOs, and private stations added 4.97 million doses. To boost AI adoption, the government offers a subsidy of INR 750 (USD 8.9) or 50% of the cost of sorted semen upon pregnancy confirmation. These efforts are significantly improving AI penetration among dairy farmers.

Latin America Veterinary Artificial Insemination Market Trends

Latin America Veterinary Artificial Insemination Market is estimated to grow at the highest CAGR of 7.7% from 2025 to 2030. Large cattle inventory, a thriving dairy industry, supportive government initiatives, and growing awareness about the benefits of artificially inseminating livestock are propelling the market growth. Various Latin American nations have put in place government initiatives and programs to support animal breeding, genetic advancement, and disease prevention, creating an ideal atmosphere for the growth of the veterinary AI market.

The Argentina veterinary artificial insemination market is projected to grow at a notable rate from 2025 to 2030. According to the Argentine Chamber of Biotechnology of Reproduction and Artificial Insemination, an estimated 8.2 million doses of bovine semen were sold in the country in 2023. About 4.7 million were attributed to the beef sector, while 3.5 million were accounted for by the dairy sector. Increasing demand for animal protein is anticipated to propel the market's growth in the near future.

Middle East & Africa Veterinary Artificial Insemination Market Trends

The veterinary artificial insemination market in the Middle East & Africa region is characterized by a growing demand for improved livestock genetics, driven by factors such as population growth, urbanization, and changing dietary preferences. Semen production and distribution networks are developing, albeit at a slower pace compared to other regions, with a focus on enhancing genetic diversity and resilience in local livestock breeds. Insemination equipment and services are gradually gaining traction, supported by government initiatives to modernize the agricultural sector and improve food security.

The South Africa veterinary artificial insemination market held the largest share by country in Middle East & Africa region in 2024. This is due to increasing demand for improved livestock genetics, advancements in reproductive technologies, and a growing focus on enhancing agricultural productivity. In May 2021, for instance, Sexing Technologies partnered with RAMSEM in South Africa to establish a semen sorting lab to produce fresh and frozen sex-sorted semen from cattle, sheep, and goats.

Key Veterinary Artificial Insemination Company Insights

The market is characterized by intense competition and is fragmented in nature. Several large, medium, and small players are implementing strategic initiatives to boost their market share. Genus for instance is a major player in the animal genetics industry. It offers a wide range of reproductive solutions, including AI services and products for dairy and beef cattle as well as swine.

Key players vie for market share through innovative product offerings, technological advancements, and superior service provision. Companies engage in continuous research and development to enhance semen quality, optimize insemination processes, and cater to diverse animal breeding needs. Additionally, competition intensifies as providers strive to offer comprehensive solutions, including training programs, genetic counseling, and reproductive health monitoring. Pricing strategies, distribution networks, and customer relationships also play crucial roles in shaping competitive dynamics within this specialized sector, where efficiency, reliability, and customer satisfaction are paramount.

Key Veterinary Artificial Insemination Companies:

The following are the leading companies in the veterinary artificial insemination market. These companies collectively hold the largest market share and dictate industry trends.

- Genus

- URUS Group LP

- CRV

- SEMEX

- IMV Technologies

- Select Sires Inc.

- Swine Genetics International

- Shipley Swine Genetics

- Stallion AI Services Ltd

- STgenetics

Recent Developments

-

In March 2025, The India government launched a sex-sorted semen scheme to increase female calf births to 90%, ensuring a steady population of high-yielding cows in Rajasthan, India. The state has procured 1 lakh doses of sex-sorted semen to be produced within Rajasthan in collaboration with NDDB.

-

In January 2025, IMV Technologies announced that Conception Ro-Main Inc., a Canadian leader in high-tech swine production solutions, will join its Farm Animal business. The acquisition, expected to close in Q1 2025, will strengthen IMV’s global portfolio with Ro-Main’s AI-powered technologies and IoT solutions, enhancing innovation in sustainable pig farming.

-

In February 2024, HKScan Sweden partnered with PIC to develop its Hampshire pig breed by gaining access to PIC’s expertise and cutting-edge technology.

-

In January 2023, BullWise— a breeding organization in Ireland and CRV partnered to distribute CRV genetic solutions in Ireland & Northern Ireland, offering farmers access to quality semen from top bulls. With this, BullWIse became a key distributor for CRV in the region.

Veterinary Artificial Insemination Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.16 billion

Revenue forecast in 2030

USD 11.33 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, animal type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Genus; URUS Group LP; CRV; SEMEX; IMV Technologies; Select Sires Inc.; Swine Genetics International; Shipley Swine Genetics; Stallion AI Services Ltd; STgenetics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Artificial Insemination Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Veterinary Artificial Insemination market report based on solutions, animal type, distribution channel, and region:

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment & Consumables

-

Semen

-

Normal

-

Sexed

-

-

Services

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Swine

-

Ovine & Caprine

-

Equine

-

Other Animals

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.