Veterinary Antimicrobial Susceptibility Testing Market Size, Share & Trends Analysis Report By Animal Type (Production, Companion), By Product (Accessories & Consumables, Automated AST Instruments), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-330-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2031 - 2030

- Industry: Healthcare

Market Size & Trends

The global veterinary antimicrobial susceptibility testing market size was estimated at USD 1.02 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The market is primarily driven by factors like rising regulatory & training initiatives among leading veterinary organizations, the growing potential of Artificial Intelligence (AI) in AST, the rising livestock population, and growing Antimicrobial Resistance (AMR) among animals.

Antimicrobial Susceptibility Testing (AST) is a very beneficial tool used by veterinary professionals to select the appropriate treatment agent for animal diseases. This testing helps determine the bacterial pathogens associated with animal disease and the antimicrobial drug that will be most effective in treating the disease without any AMR.

Leading veterinary organizations worldwide are engaging in efforts to enhance veterinary AST by releasing reference resources for veterinary professionals to assist them in determining the candidates for testing. For instance, in January 2024, the American Veterinary Medical Association (AVMA) released over six documents on animal antimicrobial susceptibility testing. These documents are aimed at assisting veterinary professionals in selecting antimicrobial therapy and predicting outcomes for a range of antimicrobial agents in bacterial infections.

These documents contain guidelines to determine the sensitivity and resistance of specific pathogens among a wide selection of antimicrobial agents. This will help the veterinary professionals make a swift yet informed decision on the type of antimicrobials required in different types of animals like dogs, cats, cattle, poultry, pigs, and others. AVMA also offers antimicrobial stewardship, a program that promotes multiple objectives like optimal use of antimicrobials to improve patient outcomes and reduce AMR & infection spread due to multi-drug resistant organisms.

Furthermore, in October 2023, the Food and Agriculture Organization of the United Nations conducted training sessions for veterinary laboratory analysts in Mongolia. These sessions spanned 21 Mongolian provinces and were aimed at creating a competent workforce for detecting antibiotic residues and antimicrobial resistance across the country. Over 50 veterinary laboratory analysts underwent this training. Such programs promote thorough penetration of antimicrobial susceptibility testing and effective use of necessary antimicrobials.

Such initiatives contribute to improved antimicrobial susceptibility testing practices, which foster informed decision-making and antimicrobial stewardship. These initiatives advocate the effective use of antimicrobial agents and help combat AMR.

Globally, the rise in livestock population is promoting market growth for veterinary antimicrobial susceptibility testing. According to a December 2023 data release by the Press Information Bureau of India (PIB), the livestock population in the country is estimated to be at around 1,387 million heads and growing at a rate of about 13% per year. Also, as per the January 2024 USDA report, the U.S. cattle population is estimated to be at around 87.2 million heads. The rise in the population of livestock animals like cattle, poultry, swine, and others leads to higher chances of transmission of bacterial infections, which can be harmful to animal and human lives. This transmission increases the importance appropriate use of antimicrobial drugs.

However, overuse of these drugs may lead to the development of AMR in these disease-causing agents. Demand for healthy and high-quality animal products like dairy and meat is increasing, and consumers are preferring products with comparatively few to no antibiotics. These developments accelerate the need for swift but accurate AST to guide veterinary professionals in selecting useful treatments and implementing antimicrobial stewardship programs. Such developments are the driving force of the market.

Market Concentration & Characteristics

Companies offering veterinary antimicrobial susceptibility testing products like disks & plates, culture media, and AST instruments are branching out into novel areas to exploit developing markets and increase their clientele. Industry participants are enhancing product accessibility and industry penetration by creating a comprehensive distributor network and opening manufacturing facilities worldwide. For instance, in September 2022, Thermo Fisher Scientific invested over USD 160 million in establishing a new manufacturing facility in Chelmsford, Massachusetts, U.S.

AST product manufacturers are innovating their products to lower the possibility of substitution. This involves launching innovative products, implementing innovative ways of promotion, or launching specialized equipment designed to address particular ocular conditions to maintain their industry share and drive demand for their products. For instance, bioMérieux, a French company, in March 2022, received USFDA regulatory clearance for Vitek Ms Prime MALDI-TOF mass spectrometry identification system. This product will reduce microbial identification time to a few minutes.

The veterinary antimicrobial susceptibility testing industry is becoming competitive due to mergers and acquisitions. Strategic expansion of product portfolios and strengthening of R&D capabilities are some of the reasons behind this strategy. In May 2022, bioMérieux, a French company, completed the acquisition of Specific Diagnostics. This acquisition aimed to enhance the company’s product portfolio by combining expertise from the acquired company across domains like human and animal testing.

To introduce products using innovative testing methods that address unmet needs in veterinary antimicrobial susceptibility testing, manufacturers are making investments in research and development. These investments aim to improve testing outcomes and ensure thorough testing across species, activities like developing innovative testing techniques and sophisticated testing tools. For instance, in September 2022, Thermo Fisher Scientific became a founding sponsor of The Pennsylvania Biotechnology Center’s (PABC) life science innovation incubator, B+Labs.

Compliance with regulatory frameworks that ensure the safety, effectiveness, and quality of products used in testing for antimicrobial susceptibility is crucial in shaping the veterinary antimicrobial susceptibility testing industry. Industry penetration and product approval depend on compliance with country-wise regulations for these diagnostic testing products. Leading authorities are developing guidance documents to assist veterinary professionals in maintaining swift and accurate testing standards.

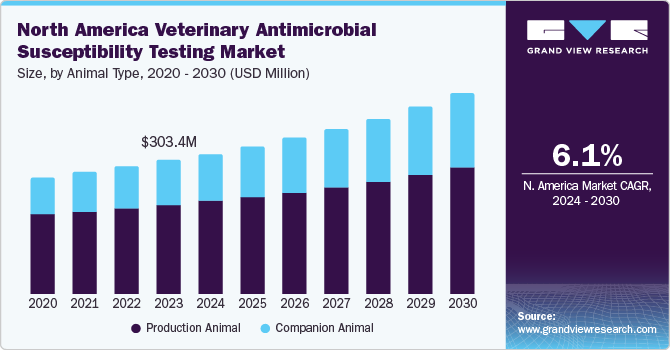

Animal Type Insights

The production animal segment held the highest revenue share of over 66.7% in 2023, owing to rising consumption of animal products and usage of antibiotics in food animals. As per December 2023 data by USFDA, a 4% rise in sales and distribution of antimicrobial drugs approved for application in food-producing animals was seen for 2021-2022 compared to 2015. To fulfill the growing demand for the production animal byproducts such as meat and dairy, proper disease management and antimicrobial stewardship is needed. This further lead to a rise in demand for testing products for antimicrobial susceptibility, thereby driving the market.

The companion animal segment is estimated to grow with the highest CAGR from 2024 to 2030, owing to a rise in antimicrobial resistance (AMR) among them. For instance, a study published by the Journal of Infection & Public Health in December 2023, the AMR of E-coli isolates were 29% in dogs and 47% in cats. Moreover, the rise in pet adoption globally leads to increased veterinary care expenditure. This rise in expenditure entails spending on pharmaceuticals, diagnostic services, etc. All these factors contribute towards higher chances of a rise in AMR among these companion animals, which promotes an increase in AST among them to select the best possible antimicrobial agent for treatment without the possibility of AMR.

End-use Insights

The veterinary reference laboratories segment held the highest revenue share of 58.14% in 2023. This growth can be attributed to a maximum number of AST samples being tested in these facilities. These laboratories employ the latest diagnostic kits, culture media & advanced AST devices available for use in companion and production animals for activities like government programs, research collaborations, etc. AST provides essential information to the veterinarian for selecting the most appropriate antimicrobial agent for a specific disease. This will lead to the overall lucrative growth of the segment.

The veterinary research institutes segment is expected to dominate the market at significant CAGR from 2024 to 2030. Rising spending on veterinary care, as well as rising AMR among both companions as well as production animals, are the factors fueling the segment’s growth. These institutions play a major role in using and developing AST products. Identifying, deploying, and developing novel diagnostic techniques and procedures for research and monitoring applications of emerging and existing diseases in animals and reducing the over-usage of antibiotics are the main functions of these institutes.

Product Insights

The automated AST instruments segment held the highest market share in 2023. This growth can be diluted by the rising adoption of these instruments in various veterinary laboratories and their higher cost than other products. Also, these devices are subject to technological advancements like improvement in turnaround time and identification time, fueling growth. Furthermore, these instruments are increasingly penetrating newer markets, increasing product availability and penetration. This can be highlighted by the fact that bioMérieux, in their 2022 - 2023 investor presentation reported a 5% revenue growth due to AST instruments between 2017 - 2022.

Regional Insights

The veterinary antimicrobial susceptibility testing market in North America held the significant share in 2023. The region is driven by the fact that veterinary testing is well-structured and well-established in this region, and the majority of global market leaders are present in this region.

U.S. Veterinary Antimicrobial Susceptibility Testing Market Trends

The U.S. veterinary antimicrobial susceptibility testing industry is flourishing. The driving factors include stringent regulatory control of FDA & USDA over AST in livestock for food safety, animal owners in the country adopting advanced diagnostic testing technologies for their production or companion animals, and livestock owners across the country. Moreover, there is high adoption of intensive production techniques for effective disease management in the region, contributing to country growth.

Asia Pacific Veterinary Antimicrobial Susceptibility Testing Market Trends

The veterinary antimicrobial susceptibility testing market in Asia Pacific held the revenue share of 34.51% in 2023. This can be attributed to the fact that this region is home to the world's highest amount of livestock population. The region fulfills the world's demand for milk and animal-based protein. Governments are actively involved in ensuring the region maintains its dominance over livestock production, propelling the region's market growth. Moreover, a boost in pet adoption, increasing pet health expenditure, and a rise in the usage of antibiotics in animals are the factors driving the market in Asia Pacific countries, such as India and China.

The India veterinary antimicrobial susceptibility testing market held the largest share in 2023. The country houses around 32% of the total global cattle population. Apart from cattle, the presence of other livestock like pigs, cattle, sheep, and others opens up numerous risk factors for AMR among this population. Hence, this ensures mass adoption of AST products and services across the country, boosting the market.

The veterinary antimicrobial susceptibility testing market in China follows India in terms of revenue share in the veterinary AST and cattle population. China is estimated to hold around 11% of the total cattle population of the world. The market growth can be attributed to the country’s decision to join the European Committee on Antimicrobial Susceptibility Testing (EUCAST). This organization is a body that provides standard methods and guidance for antimicrobial susceptibility testing.

Europe Veterinary Antimicrobial Susceptibility Testing Market Trends

Europe veterinary antimicrobial susceptibility testing market is expanding steadily and is quite dynamic. The region is home to the largest standardization and guidance body, EUCAST which performs antimicrobial susceptibility testing. This provides first preference to the region’s AST guidance documents and novel methods, boosting the market growth. Furthermore, EU regulations on antimicrobial use in food animals require extensive testing, propelling the market growth.

The veterinary antimicrobial susceptibility testing market in Germany is characterized by rapid expansion and innovation. The country is emphasizing sustainable veterinary practices, which drives demand for AST to ensure conditional antibiotic use to avoid AMR. Also, the country has a strong research and development ecosystem to foster the creation of advanced testing products.

France veterinary antimicrobial susceptibility testing market is anticipated to grow at a significant CAGR from 2024 to 2030. This is driven by collaborative practices and innovation in the country. Adopting innovative diagnostic testing products drives the market by boosting the efficiency and accuracy of antimicrobial susceptibility testing in the country. Collaborative activities between the government, veterinary associations, and industry players to modify antimicrobial use drive market growth.

The veterinary antimicrobial susceptibility testing market in Italy is set to grow quickly from 2024 to 2030. This can be attributed to the fact that the country has drastically decreased veterinary antibiotic use. According to a December 2023 publication in pig333.com, a 57.5% decrease in veterinary antibiotics can be seen in Italy since 2011. A drop in veterinary antibiotic use indicates the presence of proper AST penetration in the country.

Latin America Veterinary Antimicrobial Susceptibility Testing Market Trends

Latin American region is one of the top dominating region in terms of livestock production. The region is one of the top beef producing regions in the world. This high production volume requires a thorough AS testing protocols and products to ensure the quality of the end-product, hence driving the market for the region.

Brazil veterinary antimicrobial susceptibility testing market is expected to reach significant growth during forecast period due to its dependence on livestock production animals. A large livestock population increases demand for AST products like culture media, test kits, and AST instruments. Additionally, the country’s Ministry of Agriculture (MAPA) is actively involved in scraping outdated regulations and introducing new guidelines to limit AMR among the animals in the country.

Key Veterinary Antimicrobial Susceptibility Testing Company Insights

Some key players operating in the market include Becton, Dickinson, and Company, Thermo Fisher Scientific, Bio-Rad Laboratories, and Danaher Corporation.

Market participants in the veterinary antimicrobial susceptibility testing market are taking part in various initiatives to improve the range of products they offer and enhance their market share. These activities encompass strategic partnerships or collaborations for exclusive distribution rights, product portfolio diversification through acquisitions, recognitions from leading industry organizations, and the launch of innovative products. Furthermore, businesses are concentrating on developing testing methods that address particular demands in this industry. Together, these initiatives assist in boosting the market of veterinary antimicrobial susceptibility testing and meet the changing needs of veterinarian professionals and animal owners.

Key Veterinary Antimicrobial Susceptibility Testing Companies:

The following are the leading companies in the veterinary antimicrobial susceptibility testing market. These companies collectively hold the largest market share and dictate industry trends.

- BioMérieux SA

- Becton, Dickinson and Company

- Synbiosis

- Thermo Fisher Scientific

- Bruker Corporation

- Danaher Corporation (Beckman Coulter Inc.)

- Condalab

- Bioguard Corporation

- Liofilchem S.r.l.

- HiMedia Laboratories

- Bio-Rad Laboratories

Recent Developments

-

In July 2023, bioMérieux received nine IMV ServiceTrak clinical laboratory awards for the segments Immunoassay, ID/AST, and Blood Culture excellence.

-

In June 2023, Bio-Rad Laboratories, Inc. launched ID-Check Speciation Solution, which is useful in identifying the animal species origin of meat sample has originated, in food, feed and environmental samples.

-

In August 2022, Becton, Dickinson and Company and Accelerate Diagnostics, Inc. signed a commercial collaboration agreement for distribution of Accelerate’s antibiotic resistance and susceptibility product portfolio.

-

In November 2022, Bioguard Corporation received accreditation for ISO 17025, for its animal health diagnostic centre.

-

In June 2021, bioMérieux signed distribution agreement with Specific Diagnostics for distribution of their products in Europe known as REVEAL Rapid AST system in Europe.

Veterinary Antimicrobial Susceptibility Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.07 billion |

|

Revenue forecast in 2030 |

USD 1.50 billion |

|

Growth rate |

CAGR of 5.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Animal type, product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

BioMérieux SA; Becton, Dickinson and Company; Synbiosis; Thermo Fisher Scientific; Bruker Corporation; Danaher Corporation (Beckman Coulter Inc.); Condalab, Bioguard Corporation; Liofilchem S.r.l.; HiMedia Laboratories; Bio-Rad Laboratories |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Veterinary Antimicrobial Susceptibility Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary antimicrobial susceptibility testing market report based on animal type, product, end-use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animal

-

Cattle

-

Poultry

-

Pigs

-

Others (Sheep, Goats, Veal)

-

-

Companion Animal

-

Dogs

-

Cats

-

Horses

-

Others (Birds, Fish, Turtles)

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disks & Plates

-

Culture Media

-

Accessories & Consumables

-

Automated AST Instruments

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Reference Lab

-

Vet Research Institutes

-

Others (Vet Hospitals, Pet Clinics, Point of Care Testing)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global veterinary Antimicrobial Susceptibility Testing market size was estimated at USD 1.02 billion in 2023 and is expected to reach USD 1.07 billion in 2024.

b. The global veterinary antimicrobial susceptibility testing market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 1.50 billion by 2030.

b. Asia Pacific held the largest market share of over 34.51% in the veterinary antimicrobial susceptibility testing market owing to the fact that this region is home to highest amount of livestock population in the world. The region fulfills the world’s demand for milk as well as animal-based protein. Governments are actively involved in ensuring the region maintains its dominance over the livestock production and hence propelling the market growth in this region. Moreover, boost to pet adoption, increasing pet health expenditure, and rise in usage of antibiotics in animals are the factors driving the market in Asia Pacific countries, such as India and China.

b. Some key players operating in the veterinary antimicrobial susceptibility testing market are BioMérieux SA, Becton, Dickinson and Company, Synbiosis, Thermo Fisher Scientific, Bruker Corporation, Danaher Corporation (Beckman Coulter Inc.), Condalab, Bioguard Corporation, Liofilchem S.r.l., HiMedia Laboratories, Bio-Rad Laboratories.

b. Key factors that are driving the veterinary antimicrobial susceptibility testing market growth include rising regulatory & training initiatives among leading veterinary organizations, growing potential of Artificial Intelligence (AI) in AST, rising livestock population and growing antimicrobial resistance (AMR) among animals

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."