- Home

- »

- Animal Health

- »

-

Veterinary Anesthesia Equipment Market Size Report, 2030GVR Report cover

![Veterinary Anesthesia Equipment Market Size, Share & Trends Report]()

Veterinary Anesthesia Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Complete Anesthesia Machines, Ventilators), By Animal Type (Large, Small), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-636-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Anesthesia Equipment Market Summary

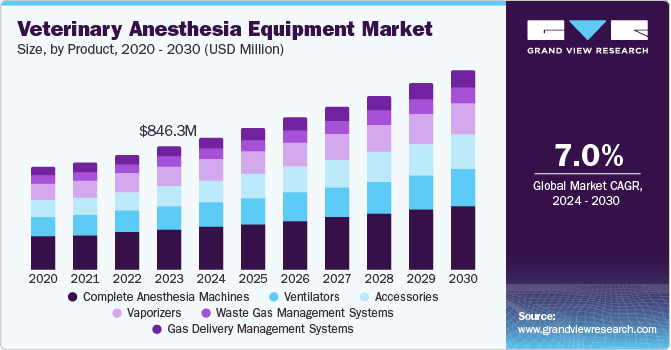

The global veterinary anesthesia equipment market size was valued at USD 846.3 million in 2023 and is expected to reach USD 1.36 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. This growth is primarily driven by the increasing adoption of pets, leading to a higher demand for veterinary care.

Key Market Trends & Insights

- North American veterinary anesthesia equipment market dominated the market in 2023.

- The U.S. dominated the North American veterinary anesthesia equipment market in 2023.

- By product, the complete anesthesia machines segment accounted for a share of 32.7% in 2023.

- By modality, the portable modality segment accounted for the largest market revenue share in 2023.

- By animal size, the small animal segment dominated in 2023.

Market Size & Forecast

- 2023 Market Size: USD 846.3 Million

- 2030 Projected Market Size: USD 1.36 Billion

- CAGR (2024-2030): 7.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The rise in the incidence rate of chronic diseases and accidents in animals is contributing to the escalated demand for anesthesia equipment during treatment. Furthermore, the growth in disposable income is influencing pet owners to seek advanced veterinary care, thereby significantly propelling the market forward. The surge in pet ownership has driven significant growth in the market. Countries such as China, Brazil, the U.S., and the European Union collectively have over half a billion dogs and cats, with 8 million animals entering rescue shelters in the U.S. annually. This increase in pet ownership has led to a rise in animal treatment issues, including neoplasia and other severe diseases such as animal cancer. Recent data from the American Veterinary Medical Association (AVMA) indicates that approximately 25% of dogs develop neoplasia, and there has been a notable increase in lymphoma cancers in cats. Consequently, a growing demand for enhanced treatment, such as anesthesia, is significantly expanding the market.

The market is experiencing substantial growth due to increasing urbanization, rising disposable incomes, and evolving lifestyle choices in developed and developing countries. These dynamics are driving a surge in demand for advanced veterinary services and pet equipment, presenting a substantial opportunity for industry players to increase their market share by leveraging advanced technologies to enhance the pet treatment process and deliver better outcomes.

Product Insights

The complete anesthesia machines product segment accounted for a share of 32.7% in 2023. This dominance can be attributed to the comprehensive nature of these machines, which are typically equipped with all the necessary components for administering anesthesia to animals. Veterinary professionals often prefer these machines due to their efficiency and reliability in delivering controlled and safe anesthesia. Additionally, the rising awareness about animal health has led to the expansion of veterinary practices such as dentistry, surgery, and emergency care that require complex procedures and assistance of anesthesia thus making it another major factor for the segment's growth.

The accessories product segment is anticipated to witness the fastest growth, with a CAGR of 8.0% from 2024 to 2030. This growth is attributed to the expanding e-commerce landscape, which offers various anesthesia accessories at competitive prices. Additionally, strict adherence to regulatory standards for safety and the growing emphasis on animal welfare, leading to increased demand for pain and discomfort minimization during treatment, are contributing factors to this significant growth.

Modality Insights

The portable modality segment accounted for the largest market revenue share in 2023. This growth is driven by increasing demand for mobile veterinary services, including at-home care and on-site surgical services for animals in emergency situations. These factors create opportunities for the industry to expand market share through technological advancements that make procedures more user-friendly, compact, and efficient. Additionally, cost-effective measures are increasing product usage and significantly growing this segment.

The standalone modality segment is expected to grow significantly from 2024 to 2030. This growth can be attributed to advancements in anesthesia technology, including monitoring capabilities, improved safety features, and vaporization techniques, leading to better treatment outcomes. Moreover, the rising disposable income in both developing and developed countries is leading pet owners to invest more in their pets' health, thereby expanding veterinary practices and increasing demand for anesthesia products, significantly growing this segment.

Animal Size Insights

The small animal segment dominated in 2023. This growth is primarily attributed to factors such as rising pet ownership, increased spending on veterinary services with the integration of safety features in treatments, heightened awareness of animal rights, growing demand for specialized veterinary practices, improved training and development of veterinary professionals, and the accessibility of required equipment through online shops.

The large animal segment is expected to grow fastest over the forecast period. This growth is driven by factors including population growth in large animals such as livestock, which raises concerns about global animal welfare and leads to increased regulations and technological innovation. Furthermore, the growing awareness through education and research on anesthesia in large animal species is also a contributing factor to the segment's growth.

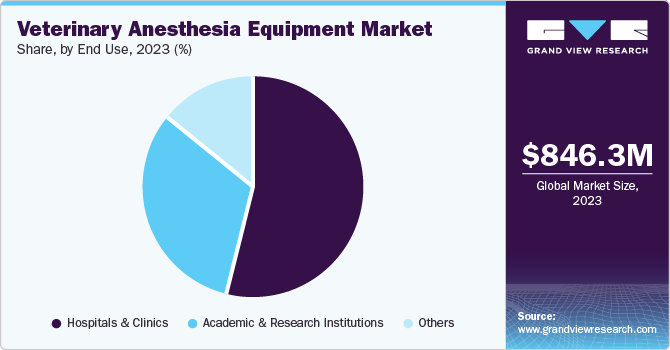

End Use Insights

The hospital & clinic segment dominated the market in 2023. The driving forces for the growth of the market are the rising innovations in technology, such as non-invasive monitoring systems, sophisticated delivery systems, advanced anesthetic agents, and other innovations which has enhanced the anesthesia administration in hospitals & clinics, the surge in the demand for specialty veterinary services such as orthopedic surgery, cardiology, and oncology which require a high level of skill set to follow and manage the procedure, and improving anesthesia techniques to reduce pain and discomfort are a growing the market significantly.

The academic and research Institutions segment is anticipated to witness the fastest growth from 2024 to 2030. This can be attributed to the increasing focus on research and development in the field of veterinary medicine. Academic and research institutions often require anesthesia equipment for various research purposes, including the development and testing of new anesthesia drugs and techniques. The growth in this segment also reflects the increasing investment in veterinary research and the growing collaboration between academia and industry.

Regional Insights

North American veterinary anesthesia equipment market dominated the market in 2023. The driving forces for the growth of the market are the government initiatives to improve animal health standards, increasing demand for emergency veterinary services due to illness and accidents, increasing technological advancement in the regional market, and increasing pet ownership.

U.S. Veterinary Anesthesia Equipment Market Trends

The U.S. dominated the North American veterinary anesthesia equipment market in 2023 due to the high demand for pet surgical services coupled with advanced animal healthcare facilities. The growth in the region is also propelled by the increasing pet adoption rates and the rising expenditure on animal health by pet owners. Moreover, the presence of key market players in the U.S., along with the introduction of innovative and technologically advanced anesthesia equipment, has further bolstered the market growth.

Canada’s veterinary anesthesia equipment market is expected to witness steady growth in the coming years. Canada’s strong emphasis on animal welfare and stringent regulations for animal surgeries necessitates the use of advanced anesthesia equipment. The presence of well-established veterinary hospitals and clinics, along with growing investments in animal health research, further drives the demand for such equipment.

Europe Veterinary Anesthesia Equipment Market Trends

Europe's veterinary anesthesia equipment market was identified as a lucrative region in 2023. Europe has a strong culture of pet ownership and animal welfare, which drives the demand for advanced veterinary services and equipment. Secondly, Europe is home to some of the world’s leading veterinary research institutions and universities, which contributes to the demand for anesthesia equipment for research and educational purposes.

The UK veterinary anesthesia equipment market is expected to grow rapidly in the coming years due toowners’ awareness of animal health, supportive legislation and regulatory environments, the expansion of veterinary practices across different areas, and improved economic returns that can be devoted to animal health.

Asia Pacific Veterinary Anesthesia Equipment Market Trends

Asia Pacific veterinary anesthesia equipment market is anticipated to witness the fastest growth from 2024 to 2030. Factors driving this growth include increased investment in research and development, expansion of veterinary establishments, improved veterinary infrastructure, and a rise in conditions such as skin allergies, diabetes, and various cancers. These factors are contributing to a higher demand for advanced treatments, particularly non-invasive surgeries and other procedures necessitating anesthesia, thereby significantly expanding the market in the region.

China's veterinary anesthesia equipment market held a substantial market share in 2023 owing to increased awareness about animal health, which led to the expansion of veterinary clinics and hospitals. Increasing pet ownership, continuous technological advancement in the regional market, and an increasing focus on improving animal health care standards are also growing the demand for the products and growing the market significantly in the country.

Key Veterinary Anesthesia Equipment Company Insights

Some of the key companies in Veterinary Anesthesia Equipment include Kent Scientific Corporations, B. Braun SE, VETLAND MEDICAL SALES & SERVICES, Avante Animal Health, and many others companies, Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Veterinary Anesthesia Equipment Companies:

The following are the leading companies in the veterinary anesthesia equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Midmark India Pvt Ltd.

- Dispomed ltd

- B. Braun SE

- Kent Scientific Corporation.

- ICU Medical, Inc.

- VETLAND MEDICAL SALES & SERVICES.

- Supera Anesthesia Innovations.

- Avante Animal Health

- RWD Life Science Co., LTD

Recent Developments

-

In April 2024, Mars Veterinary Health, in collaboration with its UK veterinary group Linnaeus and Waltham Petcare Science Institute, unveiled a pioneering partnership with SageTech Veterinary to trial an advanced anesthetic gas capture system aimed at mitigating the release of harmful greenhouse gases into the atmosphere.

-

In August 2023, Dispomed launched its latest innovative veterinary anesthesia equipment, Multiflex, which enhances safety with a recessed flush valve and quick-close pop-off valve. Additionally, it is user-friendly with a quick-connect fresh gas outlet for easy switching between breathing circuits. Moreover, its high-quality component build will require the lowest maintenance level possible.

Veterinary Anesthesia Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 905.0 million

Revenue Forecast in 2030

USD 1.36 billion

Growth Rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Modality, Animal, End Use, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, Kuwait, South Africa

Key companies profiled

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Midmark India Pvt Ltd.; Dispomed ltd; B. Braun SE; Kent Scientific Corporation.; ICU Medical, Inc.; VETLAND MEDICAL SALES & SERVICES.; Supera Anesthesia Innovations.; RWD Life Science Co., LTD; Avante Animal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Anesthesia Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary anesthesia equipment report based on product, animal, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Complete Anesthesia Machines

-

Ventilators

-

Vaporizers

-

Waste Gas Management Systems

-

Gas Delivery Management Systems

-

Accessories

-

-

Modality Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone

-

Portable

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Large

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.