- Home

- »

- Animal Health

- »

-

Veterinary API Market Size & Share, Industry Report, 2033GVR Report cover

![Veterinary API Market Size, Share & Trends Report]()

Veterinary API Market (2026 - 2033) Size, Share & Trends Analysis Report By Animal (Production, Companion), By Service (In House, Contract Outsourcing), By Synthesis (Chemical Based API, Biological API, HPAPI), By Therapeutic Category, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-328-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary API Market Summary

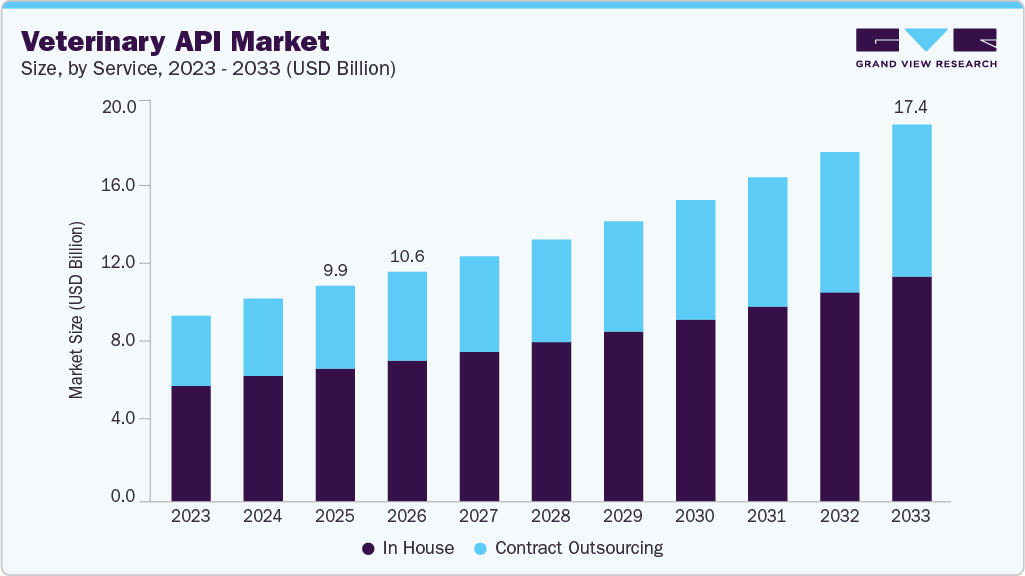

The global veterinary API market size was estimated at USD 9.92 billion in 2025 and is projected to reach USD 17.36 billion by 2033, growing at a CAGR of 7.34% from 2026 to 2033. The market is propelling due to rising investments in outsourcing, R&D of new veterinary products, expanding livestock industry and expenditure on animal health.

Key Market Trends & Insights

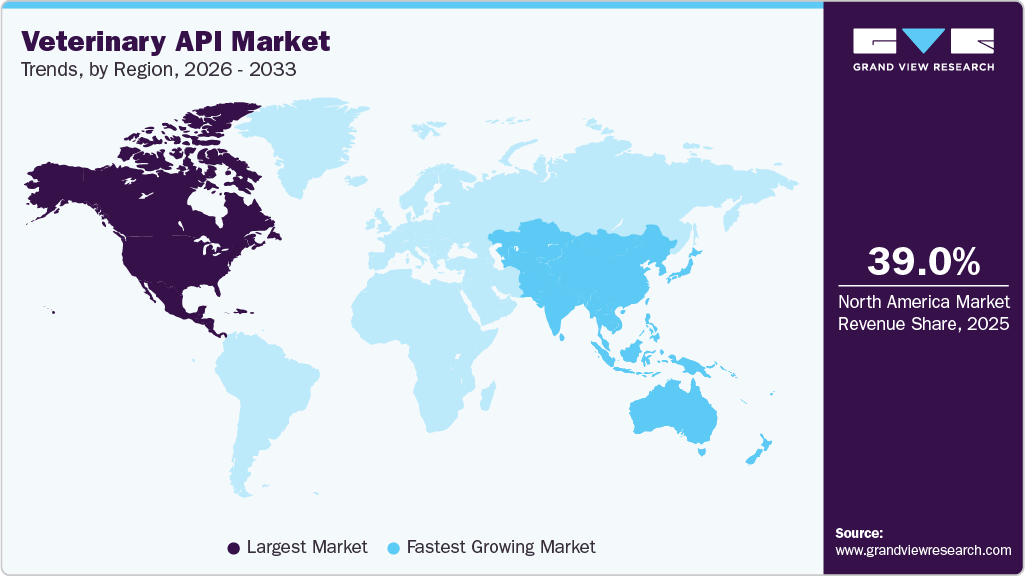

- North America veterinary active pharmaceutical ingredients (API) market held the largest revenue share of 39.04% in 2025.

- U.S. dominated the North America region with largest revenue share in 2025.

- By service, in house segment held the largest share of 61.66% of the market in 2025.

- By synthesis, chemical based API segment held largest in the market in 2025.

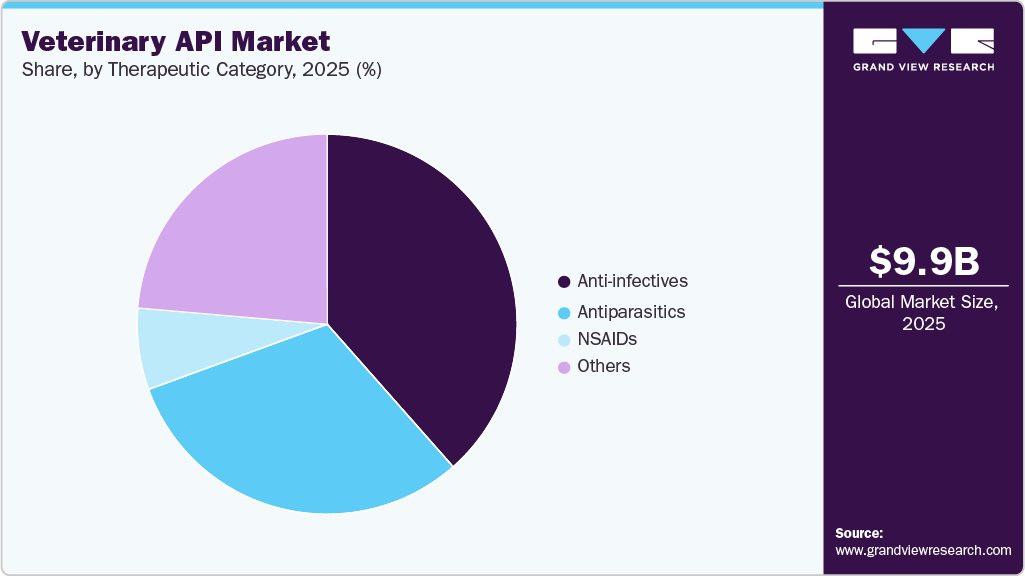

- Based on therapeutic category, anti-infectives segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 9.92 Billion

- 2033 Projected Market Size: USD 17.36 Billion

- CAGR (2026-2033): 7.34%

- North America region: Largest revenue share market in 2025

- Asia Pacific region: Fastest growing in the market

Pharmaceutical companies increasingly outsource animal health API production to specialized contract manufacturing organizations (CMOs) to reduce costs, improve efficiency, and access advanced manufacturing capabilities. This outsourcing enables firms to focus on R&D and marketing of pharmaceuticals. This surges the demand for high-quality APIs having faster production timelines and enhanced scalability. For instance, in November 2024, SeQuent Scientific and Viyash Lifesciences approved a strategic merger, creating a global animal health leader with integrated capabilities, 16 manufacturing facilities, strong R&D, and access to over 150 international markets. This merger is poised to strengthen their global presence, enhance innovation through manufacturing and deliver comprehensive solutions across the animal healthcare industry.In addition, rising investments in research and development by companies to create innovative APIs, including novel medications and biologics are boosting market growth. R&D focuses on efficacy, safety, and regulatory compliance, enabling differentiation in a competitive market. This leads to the development of high-value, specialized APIs, improved animal health outcomes, and enhanced market competitiveness.

The surge in livestock numbers for meat, dairy, and poultry production, combined with increasing pet populations, has propelled the need for animal health medications. Higher populations lead to more disease susceptibility, requiring vaccines, anti-infectives, and supportive drugs. Manufacturers respond by producing larger volumes of APIs and expanding production facilities. The effect is a robust demand pipeline for APIs, stimulating innovation, technological adoption, and strategic collaborations.

Furthermore, increasing veterinary healthcare spending, driven by higher disposable income, growing pet ownership, and livestock industry expansion, raises demand for preventive and therapeutic medications. According to American Pet Products Association report, in 2024, USD 152 billion were spent on pets for food, medicines, vet care products and other services. This surge in spending has driven higher production and consumption of veterinary APIs, encouraging manufacturers to expand operations, adopt advanced technologies, and develop innovative products to meet growing market demand. Higher expenditure encourages investment in quality control, innovation, and regulatory compliance. Thus, rising animal health expenditure directly fuels the expansion and competitiveness of the veterinary API manufacturing market.

Major Livestock Diseases Incidences in India

Disease

Number of Outbreaks

Number of Deaths

Foot & Mouth Disease (FMD)

38

159

Haemorrhagic Septicaemia (HS)

152

54

Black Quarter (BQ)

13

44

Anthrax

17

91

Fascioliasis

1

1

Sheep & Goat Pox

36

234

Blue Tongue

2

38

Contagious Caprine Pleuropneumonia (CCPP)

10

46

Classical Swine Fever

23

239

Salmonellosis

1

985

Ranikhet Disease (NCD)

92

7,688

Chronic Respiratory Disease (CRD)

11

26

Infectious Bursal Disease (IBD)

52

3,817

Rabies

5

12

Babesiosis

17

3

Peste des Petits Ruminants (PPR)

86

695

Brucellosis

8

0

Glanders

17

18

Market Concentration & Characteristics

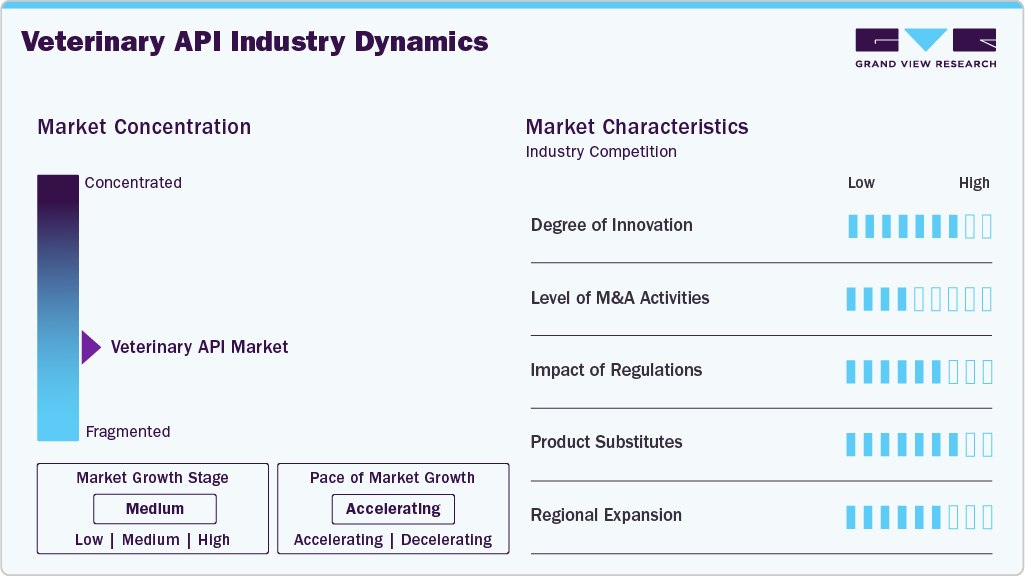

The Veterinary active pharmaceutical ingredients (API) market is moderately concentrated and the pace is accelerating, due to the presence of diverse participants, including large pharmaceutical companies, contract manufacturing organizations (CMOs), and smaller niche players. This diversity contributes to varied expertise, specialization, and product offerings. Large multinational corporations with a global reach hold a significant market share due to their extensive resources, diverse portfolios, and the ability to serve multiple markets. These companies influence market trends and competition. However, only some companies aim to focus on API production excelling in certain therapeutic areas for catering to specific species.

Rapid technological advancements, investments in R&D, and regulatory support and compliance influence the pace of market growth. This acceleration can lead to quicker development and production of APIs. Moreover, the market is witnessing increased innovation in terms of new therapeutic approaches, drug delivery systems, and preventive healthcare solutions. Companies are also expanding their production capacities to meet the rising demand for APIs.

Mergers and acquisitions play a key role in market consolidation, enabling companies to expand product portfolios, access advanced technologies, and enter new geographies. Strategic acquisitions of niche API manufacturers or biotech firms help major players achieve economies of scale, optimize production capabilities, and strengthen their global supply chain presence. For instance, in November 2024, Elanco Animal Health acquired the Speke, UK contract manufacturing facility from insolvent TriRx Speke Ltd., securing a critical farm animal product supply, strengthening its global supply chain.

Strict regulatory standards, including GMP compliance, ISO certifications, and country-specific veterinary drug regulations, significantly influence market operations. Regulatory oversight ensures product safety, quality, and consistency, but increases compliance costs for instance, in September 2025, China tightened veterinary drug rules and in August 2025, U.S. FDA PreCheck initiative, drive domestic production while compelling manufacturers to adopt advanced technologies and robust quality management systems.

The market faces limited substitution, but alternatives like over-the-counter animal health products, herbal remedies, or novel digital veterinary solutions (e.g., sensors, smart collars) can impact demand for traditional APIs. Increasing adoption of biologics and integrated veterinary solutions encourages companies to diversify offerings while maintaining core API production

Companies are expanding regionally to capitalize on rising demand in emerging markets such as Asia Pacific, Latin America, and the Middle East. Strategic investments in manufacturing facilities, partnerships with local firms, and regulatory alignment enable global API manufacturers to meet growing livestock, companion animal, and poultry health needs while strengthening international market presence.

Service Insights

On the basis of service, in house segment dominated the market with largest revenue share of 61.66% in 2025. The segment is driven by major animal health companies producing APIs internally to maintain quality control, ensure supply chain reliability, and protect intellectual property. In-house production enables companies to optimize processes, implement advanced technologies, and meet regulatory standards efficiently. In-house manufacturing helps safeguard the unique aspects of pharmaceutical products, such as novel API compositions or innovative production methods, thus contributing to the high share of the segment.

The contract outsourcing segment is projected to grow at the fastest CAGR from 2026 to 2033. Companies from key markets, such as the U.S., outsource API manufacturing and raw material procurement to countries, such as China and India. In addition, outsourcing allows firms to leverage specialized Contract Development and Manufacturing Organizations (CDMOs) with advanced technologies, regulatory expertise, and efficient supply chains. This outsourcing strategy enables faster product development, reduced capital investment, and access to global markets, making contract manufacturing meet increasing API demand.

Synthesis Insights

On the basis of synthesis, chemical-based API segment dominated with largest revenue share in 2025, driven by its extensive use in livestock and companion animal medications. These APIs offer proven efficacy, stability, and cost-effectiveness for treating diseases, enhancing productivity, and ensuring animal welfare. High demand for antibiotics, antiparasitics, and growth-promoting compounds further fuels growth.

The biological API segment is projected to be the fastest growing segment over the forecast period of 2026 - 2033. The market is driven by increasing demand for vaccines, immunotherapies, and biologics for livestock and companion animals. Rising awareness of disease prevention, stringent regulatory requirements, and advancements in biotechnology encourage the development of safe, effective biological APIs. Manufacturers are investing in innovative production technologies, cell-based platforms, and scalable facilities, enabling faster development and commercialization.

Animal Insights

On the basis of animal, production animals segment held the largest revenue share in 2025, owing to high demand for veterinary drugs to maintain health, productivity, and disease prevention in livestock such as cattle, poultry, and swine. Rising global meat and dairy consumption, coupled with stringent animal health regulations, compels farmers and veterinary service providers to invest in APIs. Vetpharma for instance, specializes in the development, registration, and marketing of APIs for both production and companion animals. APIs are essential in preventing and controlling various diseases that affect animals.

The companion animals segment represents the fastest growing in the market over the forecast period with highest CAGR, driven by increasing pet expenditure & pet humanization, rising raging pet population, innovation in companion animal medicine, and uptake of pet insurance. Demand for preventive care, vaccines, and specialized medications for dogs, cats, and other pets is accelerating. Manufacturers are investing in innovative APIs, advanced formulations, and scalable production to cater to this expanding segment.

Therapeutic Category Insights

On the basis of therapeutic category, anti-infectives constituted the largest revenue segment in 2025. The segment’s dominance can be attributed to factors related to the critical role of anti-infective agents in ensuring the health and well-being of animals. Anti-infectives, including antibiotics, antivirals, and antifungals are crucial for preventing and treating a variety of diseases in animals. Rising incidences of bacterial and viral diseases, coupled with stringent animal health regulations, fuel consistent usage.

The others segment, comprising oncology, diabetes, and other drugs is estimated to be the fastest growing segment in the market, fueled by rising awareness and advanced diagnostic capabilities in veterinary medicine have enabled the detection and treatment of conditions such as cancer and diabetes in animals. Increasing awareness among pet owners and veterinarians, in addition with an aging pet population, led to a higher prevalence of chronic diseases, driving demand for pharmaceuticals, including APIs. These factors are expected to significantly propel growth in the veterinary API market.

Regional Insights

North America dominated the market with largest revenue share of 39.04% in 2025. The market is driven by the presence of leading animal healthcare companies and well-developed veterinary healthcare infrastructure. Major pharmaceutical players such as Zoetis and Elanco, headquartered or significantly operating in the U.S., actively contribute to the development and production of veterinary APIs, further strengthening the region’s market position.

U.S. Veterinary API Market Trends

The Veterinary API Market in the U.S. accounted for the highest market share in the North America market, owing to strong R&D investments, rising pet ownerships and advanced biomanufacturing infrastructure. The country is witnessing innovations in precision fermentation and biotechnology that enhance cost efficiency. For instance, in October 2023, SUANFARMA collaborated with Willow Biosciences utilizing strain optimization to produce large-volume anti-infective APIs more sustainably and economically, strengthening market competitiveness.

The Canada Veterinary API Market is expected to grow at a significant CAGR during the forecast periodpropelled by supported by government-backed life sciences initiatives, a robust biotechnology ecosystem, and growing investments in animal health research. Precision fermentation, sustainable API production, and collaborations between biotech firms and veterinary pharma manufacturers are driving competitiveness.

Europe Veterinary API Market Trends

The Veterinary API market in Europe is expected due to strong regulatory frameworks, a robust pharmaceutical base, and rising demand for high quality animal health solutions. Companies such as EUROAPI in May 2024, expanded through major CMO contracts, such as its USD 152-174 million veterinary product supply deal of 2025-2029, reinforcing Europe’s position as a premium API hub and accelerating growth across hormones, prostaglandins, and complex molecules.

The Veterinary API market in UK is expected to grow significantly over the forecast period. The market is characterized by rising investment in innovation, biosynthesis, and sustainability driven manufacturing, along with the presence of global players and contract manufacturing hubs that enhance competitiveness. Increasing demand for high-quality veterinary APIs further drives domestic and export-oriented production.

The Germany Veterinary API Market held significant share in 2025. The country’s growth is influenced by advanced chemical synthesis capabilities, and robust regulatory standards. The country's focus on animal welfare, rising demand for livestock health solutions, and sustained R&D investments fuel API innovation. Expansion opportunities and EU partnerships further strengthen Germany’s market role.

Asia Pacific Veterinary API Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's growth can be attributed to rising animal health awareness, a large livestock base, higher disposable income, and growing veterinary spending. In addition, the region’s expanding number of veterinary API manufacturing facilities and increasing outsourcing by animal health companies are significantly boosting demand for veterinary pharmaceuticals, including APIs.

The Veterinary API Market in China held the largest revenue share and is witnessing new growth opportunities due its large livestock base, expanding pet ownership, and strong demand for feed additives and veterinary drugs. According to a report of September 2025, the of global demand for global feed additive and veterinary drug demand in China is over 30% thus China is tightening regulatory controls from 2026, enforcing stricter GMP standards for manufacturing of pharmaceuticals. This reform would enhance quality competitiveness, favoring well-capitalized domestic and multinational players.

The market for veterinary API in India is emerging as a competitive hub for veterinary API production, supported by a strong pharmaceutical manufacturing ecosystem, expansion by companies and cost-effective operations. For instance, in September 2025, Sai Life Sciences expanded with dedicated veterinary API facilities, strengthening India’s capabilities in high-value segments. Government support, increasing livestock populations, and global outsourcing trends further position India as a preferred veterinary API supplier.

Latin America Veterinary API Market Trends

The Veterinary API market in Latin America is driven by its expanding livestock sector, growing meat export market, and increasing veterinary healthcare expenditure. Countries like Brazil and Mexico are boosting local production through government support and foreign partnerships. Rising demand for cost-effective animal health products and increasing pharmaceutical investments are enhancing the region’s competitiveness in global veterinary API supply.

Brazil Veterinary API Market is gaining momentum, growing domestic demand, and partnerships with multinational companies. Advances in biomanufacturing, precision fermentation, and contract manufacturing capabilities are enhancing production efficiency and quality.

Middle East & Africa Veterinary API Market Trends

The Veterinary API Market in MEA is expanding due to investments in modern manufacturing facilities, technology adoption, and regulatory improvements which are enhancing local production capabilities. Strategic partnerships with global pharmaceutical companies and government initiatives to improve animal health further drive competitiveness in the region.

South Africa Veterinary API Market held the largest revenue shareand is expanding, fueled by technological advancements in API synthesis, improved regulatory frameworks, and adoption of contract manufacturing are enhancing production efficiency and quality. Some of the key players, such as Aspen Pharmacare and Cape Animal Health, are investing in advanced manufacturing technologies and precision fermentation.

UAE Veterinary API Market is experiencing significant growth due to rising veterinary healthcare spending, and supportive government policies. Major companies, such as Zoetis and Elanco, are utilizing advanced manufacturing technologies and GMP-compliant facilities. Investments in contract manufacturing, and regulatory alignment with international standards are driving efficiency, quality, and competitiveness in the UAE’s veterinary API sector.

Key Veterinary API Company Insights

The veterinary API market is dominated by key players such as Zoetis, Elanco, Merck Animal Health, SUANFARMA, EUROAPI, and Sai Life Sciences. These companies hold significant market share through strong R&D capabilities, advanced manufacturing technologies, global distribution networks, contract manufacturing services, and strategic collaborations, driving innovation and industry growth. Large companies often have diverse portfolios that include APIs for both human and veterinary use. Their global reach allows them to serve a wide range of markets. Alongside major pharmaceutical companies, there are specialized contract manufacturing organizations (CMOs) focusing on the human and animal health sector or exclusively on veterinary API production.

These organizations are engaged in deploying various strategic initiatives to increase their market share. For instance, in March 2025, SeQuent Scientific and Viyash Lifesciences approved a strategic merger, creating a global animal health leader with integrated capabilities, 16 manufacturing facilities, strong R&D, and access to over 150 international markets.

Key Veterinary API Companies:

The following are the leading companies in the veterinary API market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Alivira Animal Health Ltd.

- Ofichem Group

- Chempro Pharma Pvt. Ltd.

- Siflon Drugs

- Qilu Animal Health Products Co., Ltd.

- Vetpharma

- SUANFARMA

- MENADIONA

- Excel Industries Ltd.

Recent Developments

-

In September 2025, Sai Life Sciences opened Unit VI in Bidar, a dedicated veterinary API facility, enhancing production capacity, regulatory compliance, and sustainability while meeting growing global demand for high-quality animal health pharmaceuticals.

-

In August 2025, FDA announced the PreCheck program to enhance U.S. drug manufacturing, increasing regulatory predictability, supporting domestic API production, and reducing reliance on foreign pharmaceutical suppliers to strengthen the national supply chain.

-

In January 2024, Huateng Pharma launched veterinary solutions, Fluralaner and Sarolaner, providing effective anti-parasitic treatments for pets. The company offered lab-to-commercial scale production, showcasing advanced technologies and commitment to animal health innovation.

Veterinary API Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 10.57 billion

Revenue forecast in 2033

USD 17.36 billion

Growth rate

CAGR of 7.34% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, synthesis, animal, therapeutic category, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Thailand, South Korea, Australia, Brazil, Argentina, South Africa, UAE, Saudi Arabia, Kuwait, Qatar, Oman

Key companies profiled

Zoetis, Alivira Animal Health Ltd., Ofichem Group, Chempro Pharma Pvt. Ltd., Siflon Drugs, Qilu Animal Health Products Co., Ltd., Vetpharma, SUANFARMA, MENADIONA, Excel Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary API Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary API market report based on service, synthesis, animal, therapeutic category, and region:

-

Veterinary API Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Companion Animals

-

Production Animals

-

-

Veterinary API Service Outlook (Revenue, USD Million, 2021 - 2033)

-

In House

-

Contract Outsourcing

-

Contract Development

-

Preclinical Development

-

Clinical Development

-

-

Contract Manufacturing

-

-

-

Veterinary API Synthesis Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemical Based API

-

Biological API

-

HPAPI

-

-

Veterinary API Therapeutic Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Antiparasitics

-

Anti-infectives

-

NSAIDs

-

Others

-

-

Veterinary API Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary API market size was estimated at USD 9.92 billion in 2025 and is expected to reach USD 10.57 billion in 2026.

b. The global veterinary API market is expected to grow at a compound annual growth rate (CAGR) of 7.34% from 2026 to 2033 to reach USD 17.36 billion by 2033.

b. By region, North America dominated the market with largest revenue share of 39.04% in 2025. The market is driven by the presence of leading animal healthcare companies and well-developed veterinary healthcare infrastructure. Major pharmaceutical players such as Zoetis and Elanco, headquartered or significantly operating in the U.S., actively contribute to the development and production of veterinary APIs, further strengthening the region’s market position.

b. Some key players operating in the veterinary API market include Zoetis; Alivira Animal Health Limited; Ofichem Group; Chempro Pharma Private Limited; Siflon Drugs; Qilu Animal Health Products Co., Ltd.; Vetpharma; SUANFARMA; MENADIONA; Excel Industries Ltd.

b. Some of the key factors accounting for market growth include growing investments in outsourcing, facility expansion, R&D of new veterinary products and expenditure on animal health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.