Very Small Aperture Terminal (VSAT) Market Size, Share & Trends Analysis Report By Solution, By Platform, By Frequency, By Network Architecture, By Design, By Application, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-428-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

VSAT Market Size & Trends

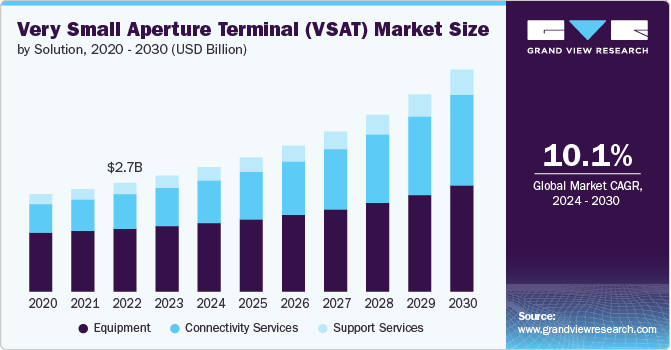

The global very small aperture terminal (VSAT) market size was estimated at USD 2.88 billion in 2023 and is expected to grow at a CAGR of 10.1% from 2024 to 2030. VSAT is a satellite communication (SATCOM) technology using small dish antennas to transmit and receive data through satellite networks. The demand for very small aperture terminal is surging across various industries due to its ability to offer reliable, high-speed communication services to connect remote locations. Moreover, the growing demand for high-throughput satellite services and mobile VSAT solutions is expected to fuel market growth.

The convergence of IoT and M2M communication is anticipated to be a key driver propelling the growth of the very small aperture terminal market. The VSAT system is renowned for its robustness in satellite communication systems. It is crucial as organizations increasingly rely on IoT for automation and real-time data processing, thus stimulating market growth.

The growing demand for stable satellite communication solutions supports the market expansion. Companies heavily depend on VSAT to ensure dependable connectivity, particularly in underserved and rural areas. This ensures productivity and facilitates informed decision-making processes. Such widespread necessity is anticipated to fuel a gradual rise in the VSAT market.

In addition, the growing demand for VSAT systems at remote locations, such as oil and gas rigs, to transfer data and communicate from offshore locations is expected to support the market's growth. For instance, in January 2022, Nelco Ltd. secured a contract worth USD 400 million from Oil and Natural Gas Corporation (ONGC) to provide satellite communication services at offshore locations. The project involves supplying, commissioning, and maintaining ONGC's dedicated VSAT-based network.

However, one of the primary barriers to entry into the very small aperture terminal market is the high initial investment. Deploying VSAT infrastructure may financially burden numerous firms, particularly smaller entities. This financial constraint hampers potential expansion efforts and dampens market adoption rates. Furthermore, regulatory issues represent another significant obstacle in the market landscape. Diverse locations may enforce distinct regulations, thereby complicating the deployment and operation of VSAT systems. The intricate nature of navigating these legal frameworks often entails substantial costs and time investments, leading several organizations to opt against investing in VSAT technology.

Solution Insights

The equipment segment dominated the market in 2023 and accounted for a global revenue share of 56.47%. The segment's dominance can be attributed to the growing focus on digital transformation and the increasing adoption of cloud-based services that create opportunities for VSAT equipment vendors. VSAT systems enable organizations to access cloud resources, deploy software-defined networking (SDN) solutions, and support emerging technologies such as edge computing and 5G networks. The demand for advanced VSAT equipment is anticipated to grow as businesses focus on digitalization to enhance efficiency, flexibility, and competitiveness.

The connectivity services segment is anticipated to register the highest growth over the forecast period. The growth in this market segment can be attributed to the rising demand for VSAT technology that offers faster data transfer speeds for applications requiring real-time communication and large data transmission. Moreover, the expansion of VSAT connectivity services is driven by the globalization of businesses and the need for seamless communication across dispersed locations. VSAT networks provide reliable and secure communication links for multinational corporations, enabling them to connect remote offices, offshore sites, and mobile assets with headquarters and data centers.

Platform Insights

The land VSAT segment dominated the market in 2023. Land VSAT systems' versatility and flexibility make them well-suited for a wide range of applications across various industries. From emergency response and disaster recovery to oil and gas exploration, mining operations, and maritime communications, land VSAT systems provide reliable connectivity in environments where terrestrial infrastructure may be limited or unreliable, thereby dominating the market.

The maritime VSAT segment is expected to grow at the fastest growth rate during the forecast period. The major factor driving the growth is the increasing demand for connectivity at sea. As maritime vessels become increasingly digitized and connected, there is a growing need for reliable, high-speed internet access to support a wide range of applications, including crew welfare, operational efficiency, safety, and regulatory compliance. Maritime VSAT systems offer a solution to these connectivity challenges by providing continuous, global coverage and enabling seamless communication between vessels, shore-based operations, and satellite offices.

Frequency Insights

The Ku-band segment dominated the market in 2023. The dominance of Ku-band VSAT can be attributed to its adaptability and compatibility with a wide range of satellite terminals and antennas. Whether deployed on land, sea, or air, Ku-band VSAT systems can seamlessly integrate into existing networks and infrastructure, facilitating rapid deployment and scalability. Within the Ku-band frequency range, VSAT systems offer ample bandwidth to support diverse data-intensive applications, including broadband internet access, video conferencing, and multimedia streaming. This bandwidth abundance makes Ku-band VSAT an attractive choice for businesses, governments, and consumers seeking high-speed connectivity solutions.

The Ka-band segment is expected to register high growth during the forecast period. Ka-band operates at a higher frequency spectrum than traditional Ku-band, offering a significant advantage: It offers a much larger bandwidth capacity, enabling significantly faster data transfer speeds and increasing demand. This caters to applications requiring real-time communication, high-resolution video streaming, and large data transmission. In addition, as Ka-band technology matures, equipment costs are expected to decrease, making it a more competitive option for a wider range of users.

Network Architecture Insights

The star topology segment dominated the market in 2023. The star topology is a simple yet powerful structure that leads the market due to its ease of deployment and management, especially for large networks. The star topology's scalability allows for seamless network expansion, while the central hub facilitates control, monitoring, and security. Despite the market's growth and emergence of new technologies, the star topology's cost-effectiveness, dedicated data paths, and reliable performance solidify its position as the king of VSAT network architectures.

The mesh topology segment is anticipated to grow significantly through the forecast period. Mesh networks offer redundancy, meaning data can take alternative paths if a terminal fails, enhancing reliability in critical applications. This advantage is particularly attractive for remote deployments where maintaining a central hub might be challenging. However, the increased complexity of managing mesh networks and potentially higher equipment costs compared to star topologies limit their widespread adoption. As technology advances and network management solutions evolve, mesh topology might see a larger market share, especially for applications prioritizing reliability in harsh or remote environments.

Design Insights

The rugged VSAT segment dominated the market in 2023. Rugged VSATs provide robust protection for equipment in platforms and cabinets. They shield against lightning strikes and minimize shock hazards, making them ideal for harsh environments. In contrast, non-rugged VSATs are suitable for commercial applications such as ATMs and televisions, where environmental conditions are less demanding.

The non-rugged VSAT segment is anticipated to grow substantially throughout the forecast period. Non-rugged VSATs are experiencing significant growth, driven by their versatility and reliability in delivering high-speed internet, voice, and data services to remote locations worldwide. Their simpler design and lower cost than their rugged counterparts make them ideal for ATMs, point-of-sale systems, and internet access in semi-urban areas. As industries increasingly rely on seamless communication networks for operations, the demand for non-rugged VSAT systems has surged, with projections indicating sustained expansion fueled by ongoing technological innovations and the imperative for global connectivity.

Vertical Insights

The energy & power segment dominated the market in 2023. VSAT systems are crucial in the energy and power sector, providing a reliable communication backbone for remote and often harsh environments. This technology helps ensure efficient operations and data transmission where traditional infrastructure might be limited. With energy and power operations often located in geographically isolated areas, VSAT technology emerges as the linchpin for seamless connectivity, enabling real-time monitoring, control, and optimization of critical assets and operations. The demand for VSAT systems within this sector continues to escalate, driven by the imperative for uninterrupted communication to ensure operational efficiency, safety, and regulatory compliance.

The telecommunications segment is expected to register high growth during the forecast period. VSAT technology has emerged as a pivotal solution for telecom operators, enabling them to extend their reach into underserved and remote areas where traditional terrestrial infrastructure is inadequate or economically unfeasible. As the demand for broadband connectivity, mobile services, and digital applications continues to escalate globally, the market for VSAT systems in the telecom sector is witnessing significant growth.

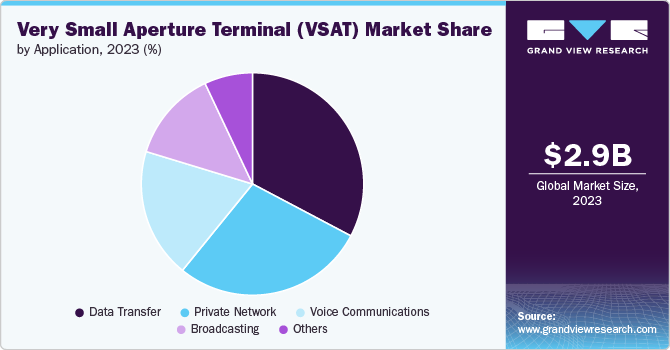

Application Insights

The data transfer segment dominated the market in 2023. The demand for VSAT systems for data transfer applications has witnessed an unprecedented surge, propelled by the exponential growth of digitalization across industries and regions. These applications, leveraging the high-speed and reliable connectivity provided by VSAT technology, facilitate seamless transmission of large volumes of data, ranging from multimedia content to critical operational information, in remote and underserved areas. The segment's growth is expected to propel as organizations increasingly prioritize efficient data exchange for enhanced productivity and decision-making.

The private network segment is expected to grow significantly during the forecast period. This growth is fueled by the imperative for secure, high-speed private communication solutions that cater specifically to the needs of enterprises. VSAT systems offer a compelling proposition by enabling the establishment of dedicated private networks, ensuring reliable connectivity for critical operations across diverse industries. As businesses prioritize data security, reliability, and scalability in their network infrastructure, the versatility and robustness of VSAT systems make them an increasingly preferred choice.

Regional Insights

North America very small aperture terminal market dominated in 2023 and accounted for 31.62% of the global revenue share. The dominance can be attributed to the presence of several leading players in the region, such as Echostar Corporation, L3Harris Technologies, Inc., Intelsat, and Viasat, Inc. Moreover, increasing demand for reliable communication solutions in remote and underserved areas is predicted to fuel market growth.

U.S. Very Small Aperture Terminal (VSAT) Market Trends

Thevery small aperture terminal (VSAT) market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. In recent years, there has been a notable increase in VSAT terminal shipments, driven by the rising demand for high-speed internet connectivity in remote and underserved areas across the U.S.

Europe Very Small Aperture Terminal (VSAT) Market Trends

The very small aperture terminal (VSAT) market in Europe is expected to grow significantly from 2024 to 2030. Managed service offerings and cloud-based VSAT solutions are gaining popularity, providing flexibility, scalability, and cost-effectiveness for European businesses and organizations, thereby fueling market growth.

Asia Pacific Very Small Aperture Terminal (VSAT) Market Trends

The very small aperture terminal (VSAT) market in Asia Pacific is experiencing the highest growth. With a vast geographical expanse and diverse economic landscapes, Asia Pacific presents unique opportunities and challenges for VSAT deployment; beyond the traditional sectors, such as maritime and energy, Asia Pacific showcases increasing adoption of VSAT in areas like agriculture, where satellite-based precision farming solutions are revolutionizing agricultural practices. In addition, the region witnesses a surge in demand for VSAT in disaster response and humanitarian efforts, leveraging satellite communication for rapid deployment of connectivity in crises.

Key Very Small Aperture Terminal (VSAT) Company Insights

Some key companies operating in the market include Echostar Corporation (Hughes Network Systems, LLC.), Gilat Satellite Networks Ltd., Intelsat, and Viasat, Inc.

-

Hughes Network Systems, LLC (Echostar Corporation) is a leading provider of satellite-based broadband solutions and managed network services, catering to both consumer and enterprise markets globally. With a history spanning over four decades, Hughes has established itself as a pioneer in satellite communications technology, specializing in developing and deploying innovative VSAT systems, satellite modems, and network management platforms.

-

Gilat Satellite Networks Ltd. is a leading global provider of satellite-based broadband communication solutions, catering to a wide range of industries and applications. With over three decades of experience, the company specializes in developing innovative VSAT technology, including ground segment equipment, satellite modems, and satellite networks.

L3Harris Technologies, Inc., Orbit Communication Systems Ltd, Thuraya Telecommunications Company, and Singtel are some of the emerging market participants.

-

L3Harris Technologies, Inc. is a global aerospace and defense technology company renowned for its innovative solutions across a broad spectrum of industries. With a rich legacy of over a century, L3Harris specializes in providing advanced communication, surveillance, and reconnaissance systems, as well as electronic warfare, avionics, and space technology solutions.

-

Thuraya Telecommunications Company is a leading provider of mobile satellite communication solutions, offering voice, data, and broadband services to customers across the globe.

Key Very Small Aperture Terminal (VSAT) Companies:

The following are the leading companies in the very small aperture terminal (VSAT) market. These companies collectively hold the largest market share and dictate industry trends.

- Orbit Communication Systems Ltd

- L3Harris Technologies, Inc.

- Gilat Satellite Networks Ltd.

- AsiaSatellite.co

- Cobham Satcom

- Echostar Corporation

- ODN, Inc.

- Singtel

- Thuraya Telecommunications Company

- Viasat Inc.

Recent Developments

-

In May 2024, Eutelsat Group expanded its collaboration with InterSAT, a prominent satellite service provider in Africa, to bolster InterSAT's presence in the Pan-African enterprise and retail sectors. This strategic partnership, spanning multiple years, entails adding Ku-Band capacity over Central and Eastern Africa via Eutelsat's EUTELSAT 70B satellite to InterSAT's existing offerings.

-

In April 2024, Satcom Global and Intelsat strengthened their partnership through a new global agreement. This collaboration expands the reach and capabilities of Satcom Global’s AuraNow VSAT solution, powered by Intelsat's advanced Ku-band network. AuraNow offers businesses unparalleled flexibility and scalability in their satellite communication needs.

-

In September 2023, L3Harris Technologies, Inc. was awarded a five-year contract worth USD 125.1 million from the Defense Logistics Agency to repair parts and supply spares for very small aperture terminal transmission systems the company had built.

Very Small Aperture Terminal (VSAT) Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.09 billion |

|

Revenue forecast in 2030 |

USD 5.52 billion |

|

Growth rate |

CAGR of 10.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, platform, frequency, network architecture, design, application, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Kingdom of Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Orbit Communication Systems Ltd; L3Harris Technologies, Inc.; Gilat Satellite Networks Ltd.; AsiaSatellite.co; Cobham Satcom; Echostar Corporation; ODN, Inc.; Singtel Thuraya Telecommunications Company; Viasat Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Very Small Aperture Terminal (VSAT) Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global very small aperture terminal (VSAT) market report based on solution, platform, frequency, network architecture, design, application, vertical, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Fixed

-

Portable

-

-

Support Services

-

Connectivity Services

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Land VSAT

-

Maritime VSAT

-

Airborne VSAT

-

-

Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

Ku-Band

-

Ka-Band

-

C-Band

-

S-Band

-

Others

-

-

Network Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

Star Topology

-

Mesh Topology

-

Hybrid Topology

-

Point-to-Point Links

-

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Rugged VSAT

-

Non-Rugged VSAT

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Transfer

-

Voice Communications

-

Private Network

-

Broadcasting

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Energy & Power

-

Defense

-

Telecommunications

-

Aviation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global very small aperture terminal market size was estimated at USD 2.88 billion in 2023 and is expected to reach USD 3.09 billion in 2024.

b. The global very small aperture terminal market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 5.52 billion by 2030.

b. North America dominated the very small aperture terminal (VSAT) market with a share of 31.62% in 2023. The dominance can be attributed to the presence of several leading players in the region, such as Echostar Corporation, L3Harris Technologies, Inc., Intelsat, and Viasat, Inc., among others.

b. Some key players operating in the VSAT market include Orbit Communication Systems Ltd; L3Harris Technologies, Inc.; Gilat Satellite Networks Ltd.; AsiaSatellite.co; Cobham Satcom; Echostar Corporation; ODN, Inc.; Singtel Thuraya Telecommunications Company; and Viasat Inc.

b. Key factors that are driving the market growth include the growing need for reliable satellite communication in remote locations and increasing demand for high-throughput satellite services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."