- Home

- »

- Electronic & Electrical

- »

-

Ventilation Fan Market Size & Share, Industry Report, 2030GVR Report cover

![Ventilation Fan Market Size, Share & Trends Report]()

Ventilation Fan Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Axial, Centrifugal), By Raw Material, By Application (Industrial, Commercial, Residential), By Deployment, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-868-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ventilation Fan Market Size & Trends

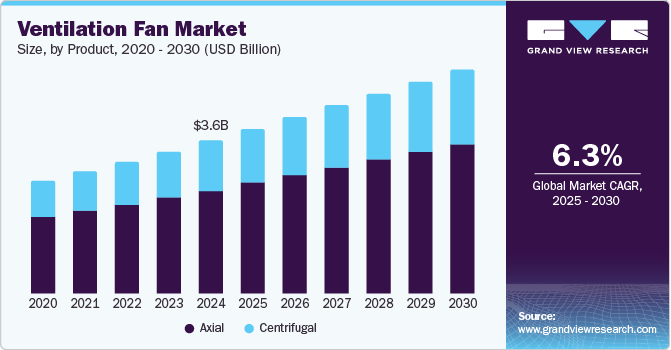

The global ventilation fan market size was valued at USD 3.57 billion in 2024 and is expected to grow at a CAGR of 6.3% from 2025 to 2030. This growth is attributed to increasing awareness regarding indoor air quality, urbanization trends, and the rising demand for energy-efficient solutions in residential and commercial buildings. As more people recognize the health benefits of proper ventilation, the market is expected to expand, driven by consumer demand and regulatory standards.

Pollutants emitted within a space majorly impact the health and comfort of the building occupants. Ventilation fans help maintain good indoor air quality by diluting and removing such pollutants. These fans are crucial in mitigating risks by facilitating air circulation and removing contaminants such as mold, bacteria, and volatile organic compounds (VOCs). For instance, in densely populated urban areas with increasingly compact housing, the demand for effective ventilation solutions has surged as residents seek to improve their living environments.

Urbanization also significantly contributes to the expansion of the ventilation fan industry. The need for efficient air circulation becomes paramount as cities expand and more people move into smaller living spaces with continuous population growth. Modern apartments often lack sufficient windows or open spaces for natural ventilation, increasing the reliance on ventilation fans to ensure a healthy atmosphere. This trend can be seen in metropolitan areas where new housing developments prioritize energy efficiency and indoor air quality, leading to a surge in sales of advanced ventilation systems.

Furthermore, regulatory frameworks aimed at improving building standards are influencing ventilation fan industry dynamics. Many governments are implementing stricter guidelines regarding indoor air quality and energy efficiency in construction practices. This regulatory push is expected to encourage builders and homeowners to invest in ventilation solutions that comply with these standards. For instance, in North America, adherence to Passive House standards has led to increased installation of ventilation fans in new constructions, reflecting a broader commitment to sustainable living environments and further driving the ventilation fans industry.

Product Insights

The axial segment dominated the ventilation fan industry with the largest revenue share of 67.6% in 2024 due to the ability of this category of fans to efficiently move large volumes of air, making them ideal for various applications in both residential and industrial settings. Their design allows for high airflow rates while maintaining low energy consumption, which is increasingly important as industries seek to reduce operational costs and comply with environmental regulations. For instance, in the pharmaceutical sector, axial fans are essential for ensuring adequate ventilation and maintaining air quality in facilities that handle sensitive materials, thereby preventing contamination and ensuring compliance with health standards.

The centrifugal segment is expected to grow at the highest CAGR over the forecast period due to increasing industrialization and the demand for efficient air movement solutions across various sectors. Centrifugal fans are particularly valued for their ability to generate high pressure and move air through ducts, making them essential in applications such as HVAC systems, power generation, and manufacturing processes. The rise in construction activities and the expansion of industries have further driven this demand, as these sectors require reliable ventilation systems to maintain air quality and operational efficiency. Centrifugal fans are critical in the chemical manufacturing industry for controlling emissions and ensuring compliance with environmental regulations, leading to increased investments in advanced blower technologies.

Raw Material Insights

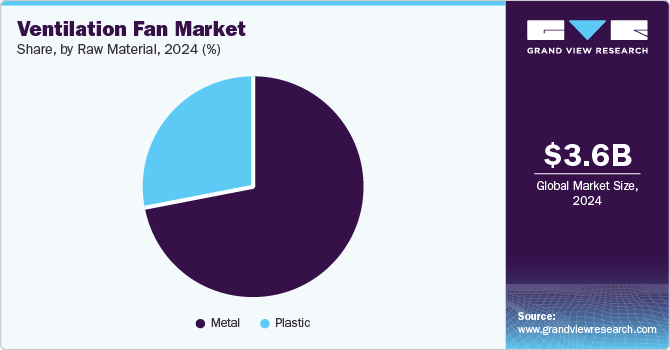

The metal segment dominated the ventilation fan industry with the largest revenue share in 2024 due to its superior durability and performance. Metal fans, typically made from materials such as steel or aluminum, offer significant strength and resistance to wear. These fans are ideal for heavy-duty applications in industrial environments. Their ability to withstand harsh conditions and high temperatures ensures a longer lifespan. In industrial settings like steel plants, metal ventilation fans are essential for managing heat and fume extraction, ensuring safety and compliance with health regulations. Moreover, the efficiency of metal blades in moving larger volumes of air contributes to better overall air circulation, further increasing their dominance in the ventilation fan industry.

The plastic segment is expected to grow at the highest CAGR over the forecast period due to its cost-effectiveness and lightweight properties. Plastic fans are less expensive than their metal counterparts, making them an attractive option for budget-conscious consumers and businesses looking to optimize operational costs. The lightweight nature of plastic facilitates easier installation and reduces shipping costs, enhancing its appeal in residential and commercial applications. In modern households, plastic ventilation fans are increasingly preferred in kitchen and bath areas as they operate quietly and efficiently, contributing to improved indoor air quality without significant energy consumption.

Application Insights

The industrial segment held the largest revenue share in 2024, driven by the necessity for adequate ventilation to ensure controlled temperature, safety of workers, and elimination of harmful contaminants from industrial environments. As industries expand and modernize, reliable ventilation systems become critical to ensure that these spaces comply with health and safety regulations. For instance, ventilation fans are essential in compact apartments for removing stale air from kitchens and bathrooms to prevent mold growth and improve overall air quality.

The residential segment is expected to grow at the fastest CAGR over the forecast period, owing to increasing consumer awareness about indoor air quality and health. People recognize the importance of proper ventilation in reducing indoor pollutants, allergens, and moisture. This trend is particularly pronounced in urban areas where smaller living spaces often lack adequate natural airflow. For instance, in compact apartments, ventilation fans are essential for removing stale air from kitchens and bathrooms, thereby preventing mold growth and improving overall air quality. In addition, the rise in health-related issues linked to poor indoor air quality has prompted homeowners to invest in ventilation systems that enhance comfort and well-being.

Deployment Insights

The wall-mounted segment dominated the ventilation fan industry in 2024 due to its space-saving design and efficiency in air circulation. Wall-mounted fans are particularly advantageous in environments with limited floor space, such as warehouses, workshops, and residential areas. By being installed high on walls, they free up valuable floor area, reducing clutter and potential tripping hazards while still providing effective airflow. Furthermore, their ability to direct airflow precisely where needed enhances ventilation effectiveness, making them a preferred choice for commercial and residential applications.

The ceiling-mounted segment is expected to grow at the fastest CAGR over the forecast period due to the rising demand for space-saving cooling solutions in urban environments. With more people living in high-rise buildings and compact apartments with limited floor space, ceiling-mounted fans are ideal for effective air circulation without occupying valuable ground areas. In addition, technological advancements have led to the introduction of smart ceiling fans that offer energy efficiency, remote control, and various other features that appeal to consumers looking for modern and convenient solutions.

Regional Insights

The North America ventilation fan market dominated with the largest revenue share of 35.0% in 2024 due to a combination of stringent regulatory standards and heightened awareness of indoor air quality (IAQ). For instance, ventilation fans are essential for maintaining energy efficiency while providing adequate airflow in newly constructed homes that adhere to Passive House standards. The region's robust building codes, such as the Energy Star program and the Indoor Air Quality Act, encouraged the adoption of efficient ventilation systems to ensure safe and healthy environments in residential, commercial, and industrial settings.

U.S. Ventilation Fan Market Trends

The U.S. ventilation fan market dominated North America in 2024, driven by growing public awareness regarding the health risks associated with poor indoor air quality, including respiratory illnesses and allergies. Innovations in fan design, such as energy-efficient motors and smart controls, offer enhanced performance and operational efficiency, making modern ventilation fans more attractive to consumers. Consumers have a growing preference for smart home technologies, including advanced ventilation systems that can be controlled remotely for improved air quality management. Increased awareness regarding the impact of climate change has driven the demand for sustainable building practices in the U.S., including the installation of efficient ventilation systems that help regulate indoor environments effectively.

Asia Pacific Ventilation Fan Market Trends

The Asia Pacific ventilation fan market is expected to grow at the highest CAGR over the forecast period owing to the increasing middle-class population in emerging economies, such as India and China, which have evolved manufacturing hubs as a result of easy access to human labor and growing demand from manufacturing, service, and government sectors. The high-tech and smart construction trend further propels this growth, as modern buildings often require advanced ventilation systems to ensure optimal air circulation. The increase in residential and commercial investments and the trend of smaller apartments in major urban areas are among the key factors accelerating the growth of the ventilation fan market.

The China ventilation fan market dominated Asia Pacific in 2024 with the largest revenue share, driven by rapid urbanization and substantial investments in infrastructure development. The country's ongoing urban expansion has significantly increased residential and commercial construction projects, necessitating effective ventilation systems to ensure indoor air quality and comfort. For instance, China's 14th Five-Year Plan emphasizes massive investments in infrastructure, targeting approximately USD 4.2 trillion for projects that include transportation and urban development, which inherently require advanced ventilation solutions. As more cities grow and modernize, the need for reliable ventilation systems becomes critical, positioning China as a leader in the Asia Pacific ventilation fan market.

Europe Ventilation Fan Market Trends

Europe ventilation fan market is expected to grow significantly over the forecast period due to increasing implementation of stringent regulations by the government, aimed at improving energy efficiency and indoor air quality. Changing policies and regulations are compelling manufacturers to innovate and offer compliant ventilation solutions. The rise in sustainable construction practices and green building certifications, such as BREEAM and LEED, is expected to drive the demand for advanced ventilation systems that meet eco-friendly standards. The demand for ventilation systems is expected to surge in the coming years with continuous innovations, such as the inclusion of smart controls and IoT integration in fan technology, to enhance the functionality and efficiency of ventilation systems.

Key Ventilation Fan Company Insights

Some of the key players in the ventilation fan market are Andrews Sykes Group PLC, Crompton Greaves Consumer Electricals Limited., Delta Electronics, Inc., Fuji Electric Co., Ltd., Havells India Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Rexnord Electronic & Control Ltd, Surya Roshni Ltd., Systemair AB, Volution Group plc, Wonder Fibromats Ltd., and others. These companies employ various strategies to maintain a competitive edge, focusing on the development of energy-efficient products that meet the demand for sustainable solutions. They integrate advanced technologies, such as IoT-enabled systems, to enhance functionality and user experience.

-

Panasonic Corporation specializes in providing innovative ventilation solutions that prioritize energy efficiency and indoor air quality. The company has established a production base in Mexico to manufacture ceiling-mounted ventilation fans tailored for the North American market, aiming to enhance sales and reduce lead times.

-

Delta Electronics, Inc. delivers high-performance ventilation solutions that emphasize energy efficiency and smart technology integration. The company is known for its innovative designs, which incorporate IoT capabilities and enable users to remotely monitor and control air quality.

Key Ventilation Fan Companies:

The following are the leading companies in the ventilation fan market. These companies collectively hold the largest market share and dictate industry trends.

- Andrews Sykes Group PLC

- Crompton Greaves Consumer Electricals Limited.

- Delta Electronics, Inc.

- Fuji Electric Co., Ltd.

- Havells India Ltd.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Rexnord Electronic & Control Ltd

- Surya Roshni Ltd.

- Systemair AB

- Volution Group plc

- Wonder Fibromats Ltd.

Recent Developments

-

In April 2024, Panasonic Corporation launched eight enhanced models of its WhisperGreen Select ventilation fans, designed to improve indoor air quality and meet the demand for smart living environments. These new models have Dual Sensor Technology, which includes Smart Action Motion and Condensation Sensors for environmental conditions based on automatic activation. The fans have a Wi-Fi Plug-n-Play system that allows users to control and monitor them remotely via voice commands or mobile apps.

Ventilation Fan Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.85 billion

Revenue forecast in 2030

USD 5.23 billion

Growth Rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Raw Material, Application, Deployment, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Andrews Sykes Group PLC; Crompton Greaves Consumer Electricals Limited.; Delta Electronics, Inc.; Fuji Electric Co., Ltd.; Havells India Ltd.; Mitsubishi Electric Corporation; Panasonic Corporation; Rexnord Electronic & Control Ltd; Surya Roshni Ltd.; Systemair AB; Volution Group plc, Wonder Fibromats Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ventilation Fan Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ventilation fan market report based on product, raw material, application, deployment, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Axial

-

Centrifugal

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Plastic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Wall-mounted

-

Ceiling-mounted

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.