- Home

- »

- Sensors & Controls

- »

-

Vehicles Intelligence Battery Sensor Market Report, 2030GVR Report cover

![Vehicles Intelligence Battery Sensor Market Size, Share & Trends Report]()

Vehicles Intelligence Battery Sensor Market (2024 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Passenger Cars, Commercial Vehicles), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-399-8

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

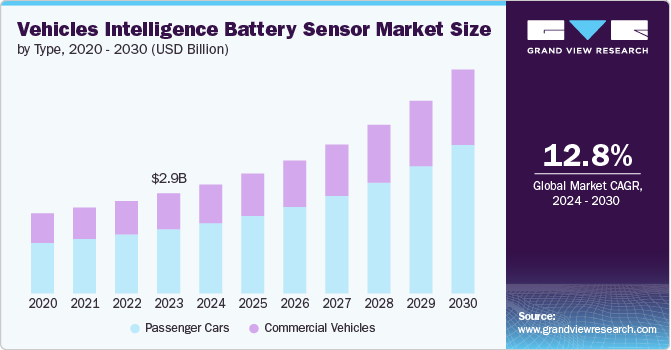

The global vehicles intelligence battery sensor market size was estimated at USD 2.96 billion in 2023 and is expected to grow a CAGR of 12.8% from 2024 to 2030. This growth can be attributed to the rapid electrification of the automotive industry. There is a surge in demand for advanced battery management systems due to increasing market shares of the electric vehicles (EVs) and hybrid vehicles. These intelligent sensors play a crucial role in monitoring battery health, optimizing performance, and extending battery life, which are critical factors for EV adoption.

Additionally, stringent emissions regulations worldwide are pushing automakers to incorporate more sophisticated battery technologies even in conventional internal combustion engine vehicles, further expanding the market for intelligent battery sensors. Technological advancements in sensor accuracy, reliability, and integration capabilities are also fueling market growth. Modern vehicle intelligence battery sensors can provide real-time data on battery status, predict potential issues, and communicate with other vehicle systems for improved overall performance. This integration with vehicle telematics and connected car systems is becoming increasingly important as consumers and manufacturers alike prioritize predictive maintenance and enhanced diagnostics. The ability of these sensors to contribute to improved vehicle safety and efficiency is a key factor driving their adoption across various vehicle types.

The market is also benefiting from the expanding automotive industry in developing countries. With the increasing regional vehicle production, the demand for advanced components like intelligent battery sensors is also increasing. Moreover, rising consumer expectations for longer battery life and improved vehicle range, particularly in EVs, are pushing manufacturers to invest in more sophisticated battery management solutions. This trend is not limited to new vehicles, the aftermarket segment is also seeing growth as owners of older vehicles seek to upgrade their battery management systems.

The market landscape is also being shaped by emerging trends in vehicle design and consumer preferences. As automakers increasingly focus on lightweight materials and compact designs to improve fuel efficiency and EV range, there's a growing need for smaller, more efficient battery sensors that can deliver high performance in limited spaces. Additionally, the rise of autonomous vehicles and advanced driver assistance systems (ADAS) is creating new applications for intelligent battery sensors, as these technologies require consistent and reliable power management. Furthermore, the push towards circular economy principles in the automotive sector is driving interest in battery sensors that can facilitate easier recycling and second-life applications for EV batteries. These evolving market dynamics, coupled with the increasing complexity of vehicle electrical systems, are expected to create new opportunities for innovation and market expansion in the vehicle intelligence battery sensor sector over the forecast period.

Vehicle Type Insights

The passenger car segment held the largest revenue share of 64.2% in 2023 and is expected to maintain its dominance from 2024 to 2030 due to the higher production volumes and increasing demand for these sensors. Consumer preference for advanced features in passenger cars, including sophisticated battery management systems, further boosts adoption.

The rapid growth of electric and hybrid vehicles in this segment necessitates more advanced battery sensors. Stringent emissions regulations for passenger vehicles are compelling manufacturers to implement efficient battery management solutions. The focus on enhancing user experience and vehicle performance in passenger cars is also driving the integration of intelligent battery sensors with other vehicle systems, solidifying the segment's market position.

Technology Insights

The Hall Effect sensor segment's dominant position, captured 52.2% of the market revenue share in 2023 in the market’s technology segment. These sensors offer high reliability and accuracy in measuring current, voltage, and temperature in vehicle battery systems. They provide non-contact measurement capabilities, reducing wear and tear and enhancing longevity. Hall Effect sensors are also cost-effective compared to alternative technologies, making them attractive for mass-market adoption.

The automotive industry's shift towards more sophisticated battery management systems has increased demand for Hall Effect sensors. They excel in providing precise current measurements, which is crucial for optimizing battery performance and extending battery life in both electric and conventional vehicles. Their ability to operate effectively in harsh automotive environments, including extreme temperatures and electromagnetic interference, further solidifies their position.

Hall Effect sensors' compatibility with existing vehicle electrical systems and their compact size make them ideal for integration into various vehicle models. This versatility allows manufacturers to standardize sensor technology across different vehicle lines, streamlining production and reducing costs. Additionally, these sensors support the growing trend of vehicle electrification, as they can accurately monitor high-current systems in electric and hybrid vehicles.

The increasing focus on vehicle safety and performance optimization has also contributed to the Hall Effect sensor segment's dominance. These sensors play a critical role in battery state-of-charge and state-of-health monitoring, which are essential for preventing battery failures and ensuring optimal vehicle performance. Their ability to provide real-time data supports advanced battery management algorithms, enhancing overall vehicle efficiency and reliability.

The MEMS sensor segment is expected to register the fastest CAGR of 13.3% from 2024 to 2030, attributed to the miniaturization advantages, allowing for more compact and efficient battery management systems. They provide high precision in measuring various battery parameters, including temperature and vibration. MEMS sensors are increasingly favored for their low power consumption, which is crucial in electric and hybrid vehicles. Their ability to integrate multiple sensing functions in a single package reduces overall system complexity and cost. The growing demand for advanced driver assistance systems (ADAS) and autonomous vehicles, which require sophisticated sensor technologies, is also fueling the adoption of MEMS sensors in vehicle battery management systems.

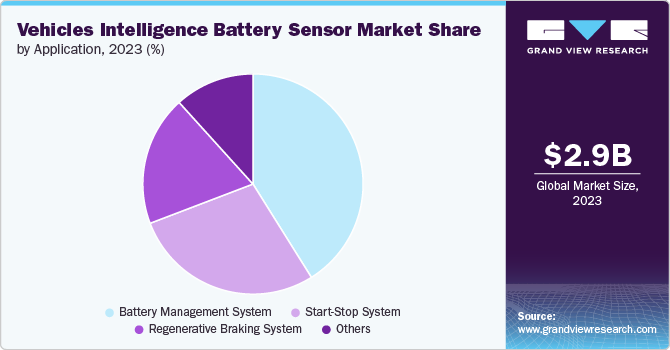

Application Insights

The battery management system segment held the largest revenue share of 41.1% in 2023 and is expected to maintain its dominance from 2024 to 2030, which is mainly attributed to its critical role in optimizing battery performance and longevity. These systems are essential for monitoring and controlling battery parameters, ensuring safe and efficient operation across various vehicle types. The increasing adoption of electric and hybrid vehicles has heightened the importance of advanced battery management systems. Additionally, stringent regulations on vehicle emissions and safety have necessitated more sophisticated battery monitoring solutions. The integration of battery management systems with other vehicle intelligence features for improved overall performance and diagnostics has further solidified this segment's market position.

The battery management system segment's market dominance is also reinforced by the growing complexity of vehicle electrical systems and the increasing energy demands of modern vehicles. As automotive manufacturers incorporate more electronic features and power-hungry components, efficient battery management becomes crucial for maintaining vehicle performance and reliability. The rise of connected car technologies and over-the-air updates has further emphasized the importance of advanced battery management systems, as they enable real-time monitoring and remote diagnostics. Moreover, the trend towards longer warranty periods for vehicle batteries, especially in electric vehicles, has spurred manufacturers to invest in more sophisticated battery management solutions to minimize warranty claims and improve customer satisfaction.

Regional Insights

The North American vehicles intelligence battery sensor market is experiencing growth driven primarily by the rapid adoption of electric and hybrid vehicles in the region. Stringent government regulations aimed at reducing vehicle emissions and improving fuel efficiency are accelerating this transition. The increasing consumer demand for advanced vehicle features and connectivity is also fueling the need for sophisticated battery management systems.

Major automotive manufacturers in North America are investing heavily in electrification technologies, boosting the demand for intelligent battery sensors. The region's strong focus on vehicle safety and performance optimization is leading to increased integration of advanced battery monitoring systems. Additionally, the growing trend of autonomous and semi-autonomous vehicles in North America is creating new applications for intelligent battery sensors. The presence of key market players and robust research and development activities in the region are further contributing to market growth, fostering innovation in battery sensor technologies.

U.S. Vehicles Intelligence Battery Sensor Market Trends

The vehicles intelligence battery sensor market in the U.S. dominates the North American market due to its large automotive manufacturing base and strong consumer demand for advanced vehicles. The country's substantial investments in electric vehicle infrastructure and supportive government policies promoting vehicle electrification contribute significantly to market growth. Additionally, the presence of major tech hubs and automotive research centers in the U.S. fosters innovation in battery sensor technologies.

Asia Pacific Vehicles Intelligence Battery Sensor Market Trends

Asia Pacific led the overall market with a market share of 32.4% in 2023. This market’s growth can be attributed to its robust automotive manufacturing sector, particularly in China, Japan, India, and South Korea. The region's rapid adoption of electric vehicles, especially in China, has significantly boosted demand for advanced battery sensors. The Government initiatives promoting vehicle electrification and emissions reduction have further accelerated market growth.

The presence of major battery and automotive electronics manufacturers provides a strong supply chain advantage. Continuous technological innovation in the automotive and electronics sectors keeps the region at the forefront of the global market. Growing consumer demand for advanced vehicle features, increasing middle-class populations, and rapid urbanization in countries like India and Southeast Asian nations are expanding the market for vehicles with sophisticated battery management systems.

Europe Vehicles Intelligence Battery Sensor Market Trends

The European vehicles intelligence battery sensor market's growth is primarily driven by the region's stringent environmental regulations and ambitious climate goals. The European Union's aggressive targets for reducing carbon emissions have accelerated the transition to electric and hybrid vehicles, boosting demand for advanced battery sensors. European automakers' strong focus on innovation and premium vehicle segments has led to the integration of sophisticated battery management systems across various models.

The region's emphasis on circular economy principles has spurred interest in battery sensors that facilitate recycling and second-life applications. Additionally, Europe's leadership in autonomous driving technology development has created new applications for intelligent battery sensors. The continent's well-established automotive research and development ecosystem, coupled with collaborations between academia and industry, continues to drive advancements in the vehicle intelligence battery sensor market.

Key Vehicles Intelligence Battery Sensor Company Insights

Some key companies operating in the market include Texas Instruments Incorporated, and Robert Bosch GmbH, among others.

- Texas Instruments Incorporated designs and manufactures semiconductors for electronic manufacturers and designers across the globe. The company operates through two business segments, namely Analog and Embedded Processing. The company serves over 100,000 customers operating across various end-use markets, including industrial, automotive, and personal electronics. The company has a global presence, with facilities in over 30 countries. The company is listed on the NASDAQ Stock Market as NASDAQ: TXN.

Integrated Silicon Solution Inc. and Vishay Intertechnology, Inc. are some emerging market companies in the target market.

- Integrated Silicon Solution Inc. (ISSI) designs, develops and sells highly efficient Integrated Circuits (ICs). The company's products include Dynamic Random-Access Memory (DRAM), Static Random-Access Memory (SRAM), and flash memories. The company has categorized the end-use applications it serves under automotive, communications, industrial, medical, and digital consumer. Apart from its headquarters in California, U.S., the company has offices worldwide, including in Europe as well as in the U.S., Taiwan, Singapore, South Korea, Japan, Israel, India, Hong Kong, and mainland China.

Key Vehicles Intelligence Battery Sensor Companies:

The following are the leading companies in the vehicles intelligence battery sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Continental AG

- Texas Instruments Incorporated

- Denso Corporation

- HELLA GmbH & Co. KGaA

- Infineon Technologies AG

- TE Connectivity

- STMicroelectronics

- Johnson Controls Inc.

- NXP Semiconductors

- Vishay Intertechnology, Inc.

- Microchip Technology Inc.

- Hitachi Astemo, Ltd.

- Integrated Silicon Solution Inc.

- AVL

- Amphenol Corporation

Recent Developments

-

In June 2024, Texas Instruments Incorporated and Delta Electronics announced a long-term collaboration to develop next-generation EV onboard charging and power solutions. The partnership will focus on creating smaller, more efficient, and reliable systems using TI's semiconductors, including C2000 real-time MCUs and GaN technology. The initiative aims to enhance EV power density and performance, promoting safer and more affordable electric vehicles.

-

In June 2024, NXP Semiconductors and Vanguard International Semiconductor Corporation (VIS) announced a joint venture named VisionPower Semiconductor Manufacturing Company Pte Ltd (VSMC). This collaboration aims to establish a 300mm semiconductor wafer manufacturing facility in Singapore, focusing on producing 130nm to 40nm mixed-signal, analog instruments, and power management for automotive, industrial, consumer, and mobile markets.

Vehicles Intelligence Battery Sensor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.22 billion

Revenue forecast in 2030

USD 6.62 billion

Growth rate

CAGR of 12.8% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India South Korea Australia Brazil, KSA; UAE; South Africa

Key companies profiled

Robert Bosch GmbH; Continental AG; Texas Instruments Incorporated; DENSO CORPORATION; HELLA GmbH & Co. KGaA; Infineon Technologies AG; TE Connectivity; STMicroelectronics; Johnson Controls Inc.; NXP Semiconductors; Vishay Intertechnology, Inc.; Microchip Technology Inc.; Hitachi Astemo, Ltd.; AVL; Amphenol Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vehicles Intelligence Battery Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global vehicles intelligence battery sensor market report based on vehicle type, technology, application, and region.

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Hall-Effect Sensor

-

MEMS Sensor

-

Optical Sensor

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Battery Management System

-

Start-Stop System

-

Regenerative Braking System

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vehicles intelligence battery sensor market size was estimated at USD 2.96 billion in 2023 and is expected to reach USD 3.22 billion in 2024.

b. The global vehicles intelligence battery sensor market is expected to grow at a compound annual growth rate of 12.8% from 2024 to 2030 to reach USD 6.62 billion by 2030.

b. Asia Pacific dominated the vehicles intelligence battery sensor market with a share of over 32.4% in 2023. This is attributable to the robust automotive manufacturing sector, particularly in China, Japan, India, and South Korea. The region's rapid adoption of electric vehicles, especially in China, has significantly boosted demand for advanced battery sensors. The Government initiatives promoting vehicle electrification and emissions reduction have further accelerated market growth. The presence of major battery and automotive electronics manufacturers provides a strong supply chain advantage.

b. Some key players operating in the vehicles intelligence battery sensor market include Robert Bosch GmbH, Continental AG, Texas Instruments Incorporated, DENSO CORPORATION, HELLA GmbH & Co. KGaA, Infineon Technologies AG, TE Connectivity, STMicroelectronics, Johnson Controls Inc., NXP Semiconductors, Vishay Intertechnology, Inc., Microchip Technology Inc., Hitachi Astemo, Ltd., AVL, and Amphenol Corporation.

b. Key factors driving market growth include the increasing electrification of vehicles, consumer demand for improved vehicle performance and safety, and regulatory mandates and emission standards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.