Vehicle Scanner Market Size, Share & Trends Analysis Report By Type (Fixed, Portable), By Structure Type, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-399-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Vehicle Scanner Market Size & Trends

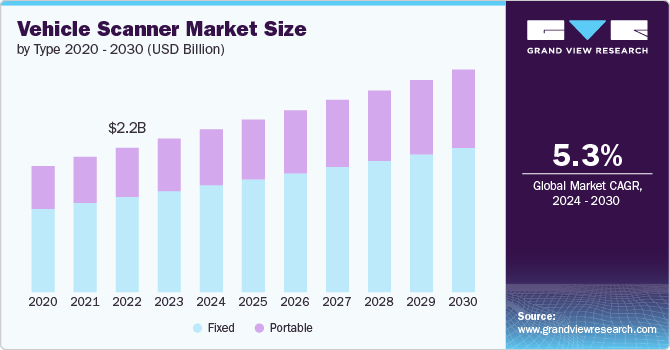

The global vehicle scanner market size was estimated at USD 2.34 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. Increasing concerns about security and the need for effective vehicle inspection systems are propelling the demand for market growth. The rise in terrorist threats and the need for border security have led to the adoption of advanced scanning technologies at various checkpoints. In addition, the growth in international trade and the need for efficient cargo inspection to prevent smuggling and illegal trafficking are further fostering the growth prospective. Urbanization and the consequent increase in vehicular traffic have also necessitated the deployment of vehicle scanners for managing vehicular movement and enhancing security.

Technological advancements are playing a pivotal role in the development and expansion of the market growth. Innovations in imaging technology, such as the development of high - resolution 3D scanning and advanced X - ray imaging systems, have significantly improved the accuracy and efficiency of vehicle inspection. The integration of artificial intelligence (AI) and machine learning (ML) algorithms allows for real - time analysis and threat detection, reducing human error and speeding up the inspection process. Furthermore, advancements in mobile and portable scanning units have made it possible to deploy vehicle scanners in various environments, enhancing their versatility and applicability.

Government investments are crucial in bolstering the market growth. Various governments are allocating substantial budgets to enhance security infrastructure, including the deployment of advanced vehicle scanning systems. Investments are being directed toward modernizing border security, airports, seaports, and critical infrastructure to mitigate potential threats. Public - private partnerships are also being encouraged to leverage private sector expertise and innovation. Grants and funding for research and development in the field of security technologies are further fostering advancements in vehicle scanning solutions.

Manufacturers in the market are focusing on the development of energy - efficient solutions to meet the growing demand for sustainable and cost - effective security systems. Innovations in power management and the use of renewable energy sources are being incorporated into the design of new scanning systems. Energy - efficient vehicle scanners not only reduce operational costs but also minimize the environmental impact, aligning with global sustainability goals. Manufacturers are investing in research and development to create systems that offer high performance while consuming less power, thus providing a competitive edge in the market.

Several key opportunities are emerging in the vehicle scanner industry that can be leveraged for future growth. The increasing adoption of smart city initiatives presents significant opportunities for the deployment of vehicle scanners in urban environments to enhance traffic management and security. The rise of autonomous vehicles also opens new avenues for vehicle scanner technology to be integrated into automated inspection and monitoring systems. Expanding markets in developing regions, where there is a growing focus on enhancing security and infrastructure, offers substantial growth potential. In addition, the continuous advancements in technology and the increasing focus on cybersecurity provide opportunities for the development of more sophisticated and integrated vehicle scanning solutions.

Type Insights

Among the types, the fixed vehicle scanner segment accounted for the largest market share of 65.7% in 2023. Fixed vehicle scanners hold a significant share in the market due to their widespread adoption at critical infrastructure points such as border crossings, military bases, and high - security facilities. These scanners offer reliable and continuous inspection capabilities, ensuring thorough screening of vehicles for contraband, explosives, and other security threats. Their advanced technology and integration with sophisticated software allow for detailed analysis and rapid decision - making. In addition, the durability and robustness of fixed scanners make them ideal for high - traffic areas where constant use is required. As security concerns remain a priority globally, the demand for fixed vehicle scanners is expected to remain strong, maintaining their high market share.

The portable segment is experiencing significant growth due to the increased need for flexible and mobile security solutions. These scanners provide the advantage of mobility, allowing security personnel to conduct inspections at various locations without the need for permanent installations. Their ease of deployment and user - friendly interfaces make them suitable for temporary events, random checkpoints, and locations with limited infrastructure. Advances in technology have also enhanced the accuracy and efficiency of portable scanners, making them a viable alternative to their fixed counterparts. As organizations and governments seek adaptable security measures to respond to evolving threats, the portable vehicle scanner market is poised for continued expansion.

Structure Type

Amongst the structure types, the drive - through segment held the largest market share in 2023.The drive - through vehicle scanner segment has garnered a substantial share due to its efficiency and effectiveness in high - traffic environments. These scanners are designed to inspect vehicles quickly and accurately as they pass through, making them ideal for use at border crossings, ports, and high - security facilities. Their ability to manage a large volume of vehicles without causing significant delays has made them a preferred choice for many organizations. In addition, advancements in technology have enhanced their imaging capabilities, allowing for better detection of contraband and security threats. The combination of speed, reliability, and improved detection has driven the high adoption rate of drive - through vehicle scanners in the market.

The high growth of the UVSS segment is gaining traction over the forecast period owing to the increasing need for enhanced security measures across various sectors. UVSS technology provides a critical layer of security by allowing for the thorough inspection of the underside of vehicles, which is often a vulnerable point for concealed threats. The growth is particularly noticeable in high - risk areas such as government installations, military bases, and critical infrastructure facilities. The rising concerns over terrorism and illegal activities have prompted many organizations to invest in UVSS systems. Furthermore, the development of advanced imaging and detection technologies has improved the accuracy and efficiency of these systems, making them more attractive to potential buyers. As a result, the UVSS vehicle scanner segment is projected to continue its upward trajectory in the coming years.

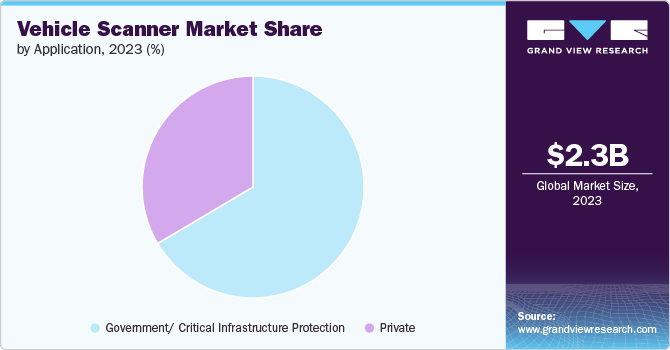

Application Insights

Among the applications, the government/ critical infrastructure protection segment held the largest market share of 66.5% in 2023.The government and critical infrastructure protection segment commands a high share due to the increasing emphasis on national security and public safety. Governments across the globe are investing heavily in advanced scanning technologies to safeguard critical infrastructures such as airports, seaports, military bases, and government buildings. These scanners are essential for detecting potential threats, including explosives, contraband, and unauthorized items. The integration of cutting - edge technologies such as artificial intelligence, machine learning, and real - time data analytics into vehicle scanners enhances their efficiency and accuracy, making them indispensable for security agencies.

The private vehicle scanner segment is anticipated to register significant growth from 2024 to 2030, driven by the rising demand for enhanced security measures in commercial and private facilities. With increasing incidents of theft, smuggling, and terrorism, private enterprises are recognizing the importance of vehicle scanners in safeguarding their assets and ensuring the safety of their personnel. Sectors such as logistics, hospitality, entertainment, and corporate facilities are increasingly adopting vehicle scanners to enhance security protocols. The availability of cost - effective and user - friendly scanning solutions has further accelerated their adoption in the private sector. Moreover, technological advancements that offer high - speed scanning, minimal human intervention, and integration with existing security systems are making vehicle scanners a preferred choice for private entities, propelling the market's robust growth.

Regional Insights

TheNorth America vehicle scanner marketheld the largest global revenue share of 39.75% in 2023. Increasing adoption of advanced security technologies in both public and private sectors is driving the vehicle market in North America. The robust automotive industry in the region is contributing to the market's expansion, with the need for efficient inspection and quality control processes in manufacturing facilities. Government initiatives to enhance homeland security and public safety further bolster the demand for vehicle scanners, fostering the growth of vehicle scanners in the market.

U.S. Vehicle Scanner Market Trends

The vehicle scanner market in the U.S. is experiencing substantial growth due to heightened security concerns and stringent regulatory requirements. The U.S. government's emphasis on strengthening national security and preventing terrorist activities has led to increased investments in advanced vehicle scanning technologies. The expanding logistics and transportation sector, coupled with the need for efficient cargo inspection, is also fuelling the demand for vehicle scanners. Moreover, technological advancements and innovations in scanning systems are enhancing their capabilities and driving their adoption across various industries, including law enforcement, defense, and border security.

Asia Pacific Vehicle Scanner Market Trends

TheAsia Pacific vehicle scanner marketis expected to witness significant growth during the forecast period. The market is witnessing rapid growth, propelled by the expanding automotive industry and rising infrastructure development projects in the region. Countries such as China, India, and Japan are investing heavily in smart city initiatives and modernizing their transportation networks, which is boosting the demand for vehicle scanning systems. The increasing focus on enhancing public safety and security, particularly in high - traffic areas such as airports, seaports, and border crossings, is also driving market growth. In addition, the growing adoption of automated and digital technologies in vehicle inspection processes is contributing to the market's expansion in the Asia Pacific region.

Europe Vehicle Scanner Market Trends

The vehicle scanner market in Europe is characterized by considerable growth, driven by the stringent regulatory environment and the high emphasis on safety and security. European countries are adopting advanced vehicle scanning technologies to combat rising threats such as terrorism, smuggling, and illegal immigration. The region's well - established automotive industry also plays a crucial role in market growth, with manufacturers increasingly incorporating vehicle scanners for quality control and compliance purposes. Furthermore, the implementation of smart transportation systems and the development of modern infrastructure projects are fuelling the demand for vehicle scanning solutions across Europe.

Key Companies & Market Share Insights

Key companies are focusing on various strategic initiatives to gain a competitive edge over their rivals. These initiatives include developing new products, forming partnerships and collaborations, and establishing agreements.

Key Vehicle Scanner Companies:

The following are the leading companies in the vehicle scanner market. These companies collectively hold the largest market share and dictate industry trends.

- SecureOne (Uniscan)

- Omnitec Security Systems LLC

- SecuScan

- Tescon Sicherheitssysteme Schweiz GmbH

- Gatekeep Security Inc.

- SCANLAB

- Leidos

- UVeye Inc.

- Infinite technologies.

Recent Developments

-

In May 2023, UVeye, a manufacturer of automated vehicle inspection systems for the automotive sector, obtained an extra USD 100 million in funding to support significant new sales and production efforts in North America.

-

In December 2022, Vehant Technologies introduced DepScan UVSS, a security device that utilizes stereoscopic vision technology to inspect vehicle undersides. This system creates a point cloud - based 3D model, providing relative depth information.

Vehicle Scanner Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.48 billion |

|

Revenue forecast in 2030 |

USD 3.38 billion |

|

Growth rate |

CAGR of 5.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, structure type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S., Canada, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, Mexico, U.A.E., Saudi Arabia, South Africa |

|

Key companies profiled |

SecureOne (Uniscan), Omnitec Security Systems LLC, SecuScan, Tescon Sicherheitssysteme Schweiz GmbH, Gatekeep Security Inc., SCANLAB, Leidos, UVeye Inc., Infinite technologies, among others |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Vehicle Scanner Market Report Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub - segments from 2018 to 2030. For this study, Grand View Research has segmented the global vehicle scanner market report on the basis of type, structure type, application, and region.

-

Structure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Drive Through

-

UVSS

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Portable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Government/ Critical Infrastructure Protection

-

Private

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vehicle scanner market size was estimated at USD 2.34 billion in 2023 and is expected to reach USD 2.48 billion in 2024.

b. The global vehicle scanner market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030, reaching USD 3.38 billion by 2030.

b. The fixed vehicle scanner segment had the largest market share, 65.7% in 2023. Fixed vehicle scanners hold a significant share due to their widespread adoption at critical infrastructure points such as border crossings, military bases, and high-security facilities.

b. Some of the players in the vehicle scanner market include SecureOne (Uniscan), Omnitec Security Systems LLC, SecuScan, Tescon Sicherheitssysteme Schweiz GmbH, Gatekeep Security Inc., SCANLAB, Leidos, UVeye Inc., and Infinite Technologies.

b. Increasing concerns about security and the need for effective vehicle inspection systems are propelling the demand for the vehicle scanner market. The rise in terrorist threats and the need for border security have led to the adoption of advanced scanning technologies at various checkpoints. Additionally, the growth in international trade and the need for efficient cargo inspection to prevent smuggling and illegal trafficking are further fostering the growth prospective.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."