- Home

- »

- Automotive & Transportation

- »

-

Vehicle Anti-theft System Market Size & Share Report, 2030GVR Report cover

![Vehicle Anti-theft System Market Size, Share & Trends Report]()

Vehicle Anti-theft System Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Vehicle Type (Passenger Cars, Commercial Vehicles), By Sales Channel, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-397-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vehicle Anti-theft System Market Trends

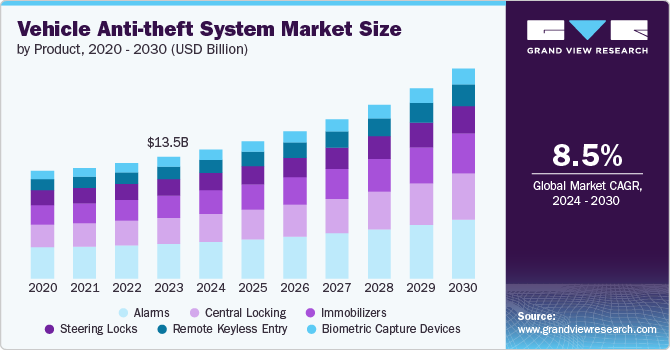

The global vehicle anti-theft system market size was estimated at USD 13.53 billion in 2023 and is expected to grow at a CAGR of 8.5% from 2024 to 2030. Increased safety regulations owing to the rising vehicle theft incidents and increasing production and sales of automobiles, particularly in emerging economies, are major factors behind the market growth. The growing technological advancements and rising adoption of smart technologies, including GPS and biometric systems, are further contributing to the growth of the vehicle anti-system market. Furthermore, growing awareness among consumers regarding vehicle safety and anti-theft solutions is also boosting the market’s growth.

With advancing technology, the automotive industry is increasingly adopting access control systems that focus on both security and convenience. Technologies such as biometric recognition, Artificial Intelligence (AI), and Machine Learning (ML) enhance the effectiveness of anti-theft systems by providing accurate location tracking, biometric authentication for access control, and predictive analytics to prevent potential theft incidents. For instance, AI algorithms analyze user behavior patterns, driving habits, and access attempts to detect anomalies and potential security risks. ML allows the anti-theft systems to continuously enhance its capability to distinguish between authorized users and potential intruders as it evolves.

Furthermore, there is a growing demand for vehicle tracking systems, particularly in commercial and fleet management applications. These systems utilize GPS technology to track vehicle location, monitor movement, and provide real-time alerts in case of unauthorized use or theft. The integration of telematics with tracking systems further enhances operational efficiency and security. In addition, vehicle GPS tracking systems increase fleet productivity, control unsafe driving risks, and ensure quick theft recovery, which in turn propels the market’s growth.

Owing to stringent government regulations, several manufacturers are moving towards offering integrated anti-theft solutions that combine security features with other vehicle functionalities. These integrated systems may include remote engine immobilization, alarm systems, tamper detection, and smartphone connectivity for remote monitoring and control. For instance, National Highway Traffic Safety Administration (NHTSA) regulations mandate vehicle manufacturers to label major vehicle components and replacement parts to aid authorities in recovering and tracing stolen items. The regulations also promote the installation of passive anti-theft devices, such as immobilizer systems, as standard equipment in vehicles. This trend aims to provide comprehensive protection while enhancing user convenience and ease of integration with existing vehicle systems.

The high initial cost associated with implementing advanced security technologies is a major restraining factor that could hamper the growth of the market. In addition, compatibility issues with existing vehicle architectures and retrofitting older vehicles with modern anti-theft technologies pose challenges. Moreover, with vehicles becoming increasingly interconnected and dependent on electronic systems, they face heightened cybersecurity threats and potential hacker attacks. Vulnerabilities in vehicle anti-theft systems can be exploited by hackers to gain unauthorized access to vehicles, compromise valuable data, or remotely manipulate vehicle functions. Thus, concerns regarding privacy and data security related to connected car technologies could hinder market growth as consumers and businesses prioritize safeguarding sensitive information.

Product Insights

The alarms segment dominated and accounted for a 28.8% share of global revenue in 2023. Alarms are one of the primary components of the vehicle anti-theft systems, typically featuring sensors that trigger audible and sometimes visual alerts when unauthorized entry or tampering is detected. These alarms serve as a deterrent to potential thieves and alert vehicle owners or nearby individuals to attempted theft. Upon detection of a breach, the alarm system activates flashing lights, initiates a loud audible alarm, and often activates a starter disable feature or vehicle shutdown to immobilize the vehicle. Thus, owing to several benefits, the demand for and adoption of alarm systems is growing in the market.

The immobilizers segment is projected to witness significant growth from 2024 to 2030. There is a significant increase in the adoption of immobilizer systems across various vehicle types. An immobilizer is an electronic security device installed in vehicles to prevent the engine from starting unless the correct key or key fob is present. This highly effective anti-theft system has significantly reduced car theft rates, offering reassurance to vehicle owners and contributing to enhanced public safety and reduced insurance costs. Thus, automotive immobilizer technology has emerged as a critical component in preventing vehicle theft and bolstering overall security measures.

Vehicle Type Insights

The passenger cars segment dominated the market in 2023. Increasing production and sales of passenger cars, such as SUVs, luxury cars, and sedans, are driving the segment's growth. Passenger car owners are increasingly opting for vehicles equipped with advanced anti-theft systems, including alarms, immobilizers, and tracking devices, to protect their investments and belongings. Thus, vehicle manufacturers are constantly innovating and integrating advanced technologies to offer comprehensive and effective solutions that meet the evolving needs of passenger car owners worldwide, thereby fueling the segment's growth.

The commercial vehicles segment is projected to witness significant growth from 2024 to 2030. This segment includes trucks, buses, and other heavy-duty vehicles, which presents unique challenges and requirements when it comes to anti-theft systems. These vehicles often carry valuable cargo, making them attractive targets for theft and necessitating robust security measures. Thus, the increasing adoption of anti-theft systems, such as immobilizer systems and alarms in commercial vehicles to prevent the vehicle from starting unless a specific key or code is provided and to prevent valuable cargo, can be attributed to the segment's growth.

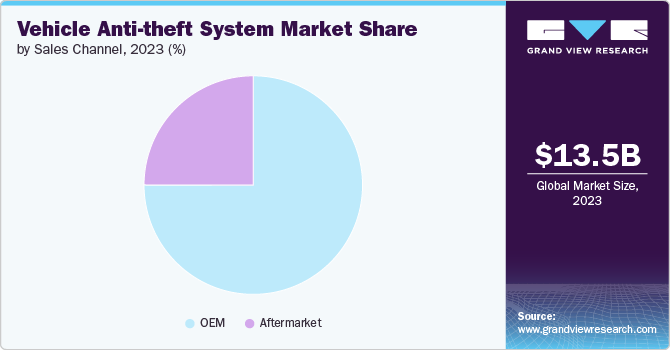

Sales Channel Insights

The OEM segment dominated the market in 2023. As consumer priorities shift towards heightened safety and security standards, original equipment manufacturers (OEMs) in the automotive industry are responding by integrating advanced anti-theft systems into their vehicles. This shift allows OEMs to comply with evolving regulatory requirements and cater to the discerning preferences of modern car buyers. As a result, the market is experiencing a consistent increase in demand, highlighting the influential role of OEMs in shaping the future of vehicle security.

The aftermarket segment is projected to witness significant growth from 2024 to 2030. The growth of the segment is driven by several factors, including the surge in passenger car sales and the increasing demand for retrofitting existing vehicles with advanced security solutions. Moreover, the aftermarket channel allows for greater flexibility and customization, enabling consumers to select from a wide range of anti-theft systems and tailor them to their specific needs. This level of personalization is particularly appealing to owners of older vehicles who seek to enhance the security features of their existing rides, thereby boosting the segment growth.

Regional Insights

The vehicle anti-theft system market in North America is expected to witness steady growth from 2024 to 2030. Stringent government regulations mandating robust vehicle security features drive market growth in the region as manufacturers prioritize compliance and consumer safety. In addition, the presence of major automotive manufacturers, coupled with rising consumer awareness about vehicle security, is also boosting the market’s growth in the region.

U.S. Vehicle Anti-theft System Market Trends

The vehicle anti-theft system market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. Increasing incidences of vehicle theft across the country are encouraging both consumers and fleet operators to adopt advanced security solutions. For instance, according to NHTSA, in 2023, over one million vehicles were stolen in the U.S., a 25% increase in vehicle theft compared to previous years.

Asia Pacific Vehicle Anti-theft System Market Trends

The Asia Pacific region dominated the vehicle anti-theft system market in 2023 and accounted for a 36.46% share of the global revenue. The expanding automotive sector in countries such as China, Japan, and India, driven by increasing vehicle production and sales, can be attributed to the market growth. In addition, the electrification of vehicles, particularly in small passenger cars, along with the increasing popularity of autonomous vehicles, is expected to further drive the demand for advanced anti-theft solutions in the region.

Europe Vehicle Anti-theft System Market Trends

The vehicle anti-theft system market in Europe is expected to register a moderate CAGR from 2024 to 2030. The market growth in the region can be attributed to rising consumer awareness about the benefits of anti-theft systems and the availability of integrated solutions. The integration of connected car technologies, such as telematics and remote monitoring capabilities, is also expanding the functionalities of anti-theft systems, making them more attractive to vehicle owners in Europe.

Key Vehicle Anti-theft System Company Insights

Key players operating in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Vehicle Anti-theft System Companies:

The following are the leading companies in the vehicle anti-theft system market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- Author LLC

- Viper

- OnStar Corporation

- Pandora Car Alarm Systems Ltd.

- Meta System S.p.A.

- Valeo S.A.

- ZF Friedrichshafen AG

Recent Developments

-

In April 2024, Continental AG introduced innovative smart device-based access solution known as CoSmA. This access system that transforms mobile devices such as smartwatches or smartphones into vehicle keys. This technology ensures a seamless and user-friendly experience that aligns perfectly with the digital era.

-

In May 2024, BMW, a luxury vehicles manufacturer launched the first-ever BMW i5 in India and it will be available as BMW i5 M60 xDrive, an exclusive BMW M Performance model. BMW's safety features encompass six airbags, dynamic stability control with cornering brake control, attentiveness assistance, side-impact protection, and many innovative features.

Vehicle Anti-theft System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.33 billion

Revenue forecast in 2030

USD 23.38 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, vehicle type, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE, South Africa

Key companies profiled

Continental AG; Denso Corporation; Robert Bosch GmbH; Author LLC; Viper; OnStar Corporation; Pandora Car Alarm Systems Ltd.; Meta System S.p.A.; Valeo S.A.; ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vehicle Anti-theft System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vehicle anti-theft system market report based on product, vehicle type, sales channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Steering Locks

-

Alarms

-

Biometric Capture Devices

-

Immobilizers

-

Remote Keyless Entry

-

Central Locking

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vehicle anti-theft system market size was estimated at USD 13.53 billion in 2023 and is expected to reach USD 14.33 billion in 2024.

b. The global vehicle anti-theft system market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030, reaching USD 23.38 billion by 2030.

b. The alarms segment dominated the market in 2023 and accounted for more than 28.8% of global revenue. Alarms are one of the primary components of vehicle anti-theft systems, typically featuring sensors that trigger audible and sometimes visual alerts when unauthorized entry or tampering is detected.

b. Some of the players operating in the vehicle anti-theft system market include Continental AG, Denso Corporation, Robert Bosch GmbH, Author LLC, Viper, OnStar Corporation, Pandora Car Alarm Systems Ltd., Meta System S.p.A., Valeo S.A., and ZF Friedrichshafen AG.

b. Increased safety regulations owing to the rising vehicle theft incidents and increasing production and sales of automobiles, particularly in emerging economies, are major factors behind the growth of the vehicle anti-theft system market. The growing technological advancements and rising adoption of smart technologies, including GPS and biometric systems, are further contributing to the growth of the vehicle anti-system market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.