- Home

- »

- Next Generation Technologies

- »

-

Vehicle Analytics Market Size, Share & Growth Report, 2030GVR Report cover

![Vehicle Analytics Market Size, Share & Trends Report]()

Vehicle Analytics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Application, By End-use (OEM, Automotive Dealers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-400-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vehicle Analytics Market Size & Trends

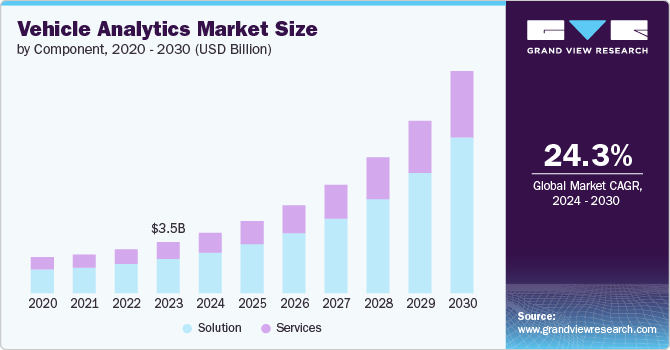

The global vehicle analytics market size was estimated at USD 3.53 billion in 2023 and is expected to grow at a CAGR of 24.3% from 2024 to 2030. Vehicle analytics represents advanced technology designed to monitor vehicles in real-time, offering immediate updates on their status. This technology serves a wide range of stakeholders, from manufacturers and insurance providers to fleet managers, by providing instant access to the vehicle's exact location. Its core function is to oversee, assess, and enhance both vehicle operations and driver habits, thereby contributing to safer driving conditions.

Various factors, such as technological advancements, rising demand for efficiency and cost reduction, growing emphasis on safety and security, and increasing regulatory compliance are primarily driving the growth of the vehicle analytic market growth. Moreover, vehicle analytics is also essential for managing shared vehicle fleets, and the development of self-driving cars.

The application of vehicle analytics technology spans numerous areas such as traffic coordination, preemptive maintenance, insurance models based on usage, among others. The increasing presence and integration of connected vehicles are anticipated to significantly drive the interest and need for vehicle analytics in the forecasted period. Furthermore, new electric vehicles are now outfitted with an array of telematics, IoT technologies, and sensors aimed at increasing their performance, which in turn, escalates the demand for vehicle analytics to process the data these components collect. In response to this growing information pool, vehicle manufacturers, dealership networks, and insurance firms are increasingly turning to analytics solutions to extract actionable insights from vehicle data. These insights are leveraged by manufacturers to refine their services, helping them to secure a competitive edge in the marketplace.

Insurance premiums based on vehicle use, known as Usage-Based Insurance (UBI), directly correlate the cost of the insurance policy with how the vehicle is utilized. Insurers employ analytical tools to gather real-time data on vehicle usage, which then determines the insurance rates. The growing popularity of UBI in developed nations is expected to spur market growth in the projected timeline. The race to pioneer autonomous vehicles is already intense among car manufacturers. Furthermore, the insights gleaned from automotive analytics serve as the foundation for autonomous driving technologies. Therefore, the increased investments by Original Equipment Manufacturers (OEMs) in creating self-driving or fully autonomous vehicles are set to propel the market growth in the forecasted period.

Component Insights

The solution segment led the market in 2023, accounting for over 67.0% share of the global revenue. The vehicle analytics solutions segment is experiencing rapid growth due to a confluence of technological advancements, changing consumer preferences, and evolving industry dynamics. Consumers are increasingly prioritizing vehicle safety, driving the demand for advanced safety features and analytics solutions. Moreover, rising fuel costs and environmental concerns are pushing for more efficient vehicles, and analytics can help optimize fuel consumption.

The services segment is predicted to foresee significant growth in the coming years. The vehicle analytics services segment is experiencing robust growth due to the increasing complexity of vehicles, the exponential rise in data generation, and the demand for improved efficiency and safety. Moreover, the availability of advanced analytics tools, such as AI, machine learning, and data mining, enables service providers to uncover hidden patterns and correlations within vehicle data. Furthermore, the adoption of cloud-based solutions facilitates efficient data storage, processing, and analysis, making analytics services more accessible and cost-effective.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023. The convergence of vehicle analytics and cloud computing is driving significant growth in the automotive industry. This synergy enables the processing, storage, and analysis of vast amounts of vehicle data, leading to innovative solutions and improved operational efficiency. Moreover, cloud-based platforms provide scalability and computing power to extract valuable insights from this data, leading to improved vehicle performance, safety, and user experience.

The on-premises segment is anticipated to exhibit a significant CAGR over the forecast period. Organizations dealing with highly confidential vehicle data, such as autonomous vehicle development or defense applications, often prioritize on-premises solutions for enhanced security. Moreover, industries with stringent data privacy regulations may mandate on-premises deployment to maintain control over data. Furthermore, on-premises setups allow for tailored hardware and software configurations to meet specific needs.

Application Insights

The predictive maintenance segment accounted for the largest market revenue share in 2023. The convergence of vehicle analytics and predictive maintenance is driving substantial growth in the automotive industry. This synergy enables the prevention of equipment failures, optimizing maintenance schedules, and enhancing overall vehicle performance. Moreover, the increasing complexity of vehicles and the rising costs of unplanned downtime are driving the adoption of predictive maintenance solutions. Furthermore, by predicting potential failures, predictive maintenance helps to maximize vehicle availability and utilization.

The usage-based insurance segment is anticipated to exhibit a significant CAGR over the forecast period. The integration of vehicle analytics with usage-based insurance (UBI) is revolutionizing the insurance industry. This synergy enables insurers to offer more personalized and accurate premiums based on driving behavior, vehicle usage patterns, and other relevant factors. Moreover, UBI offers the potential for significant savings for safe drivers, attracting consumers who value transparency and personalization.

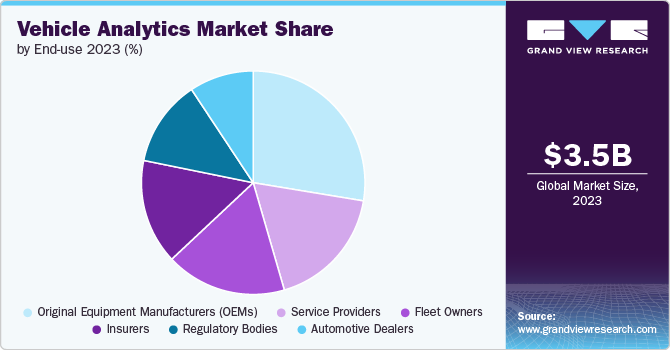

End-use Insights

The Original Equipment Manufacturers (OEMs) segment accounted for the largest market revenue share in 2023. Original Equipment Manufacturers (OEMs) are leveraging vehicle analytics to drive significant transformations in the automotive industry. Moreover, by analyzing vehicle data, OEMs can predict potential failures and schedule maintenance proactively, improving vehicle uptime and reducing costs. By analyzing driving patterns and road conditions, OEMs can develop advanced safety features and systems.

The insurers segment is anticipated to exhibit the highest CAGR over the forecast period. By analyzing driving behavior, vehicle usage patterns, and telematics data, insurers can develop more precise risk profiles for individual drivers. Premiums can be adjusted in real-time based on driving behavior, leading to fairer pricing for policyholders. Offering flexible insurance plans based on driving habits, such as pay-per-mile or pay-how-you-drive models. Thus, it enables insurers to offer more precise, personalized, and cost-effective insurance products.

Regional Insights

North America dominated with a revenue share of over 32.0% in 2023. Proximity to tech hubs such as Silicon Valley has fostered innovation in vehicle analytics market in the region. Moreover, the rapid deployment of 5G networks enables real-time data transmission and analysis. In addition, stringent safety regulations are driving the development of advanced driver assistance systems (ADAS) and autonomous vehicles.

U.S. Vehicle Analytics Market Trends

The U.S. vehicle analytics market is anticipated to exhibit a significant CAGR over the forecast period. The U.S. vehicle analytic market is experiencing robust growth due to a combination of technological advancements, regulatory mandates, consumer preferences, and favorable economic conditions. The market is expected to continue expanding as new applications and business models emerge.

Europe Vehicle Analytics Market Trends

The vehicle analytic market in the European region is expected to witness significant growth over the forecast period. Europe has a history of stringent regulations pertaining to vehicle emissions, safety, and fuel efficiency. Vehicle analytics provides the data necessary to comply with these regulations, driving market growth. Moreover, the region has a strong emphasis on environmental sustainability. Vehicle analytics helps optimize vehicle performance, reducing emissions and fuel consumption, aligning with these goals. Europe boasts a mature automotive industry with a strong focus on innovation. This creates strong grounds for the development and adoption of vehicle analytics solutions.

Asia Pacific Vehicle Analytics Market Trends

The vehicle analytic market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The development of smart cities creates opportunities for vehicle analytics applications in traffic management and urban planning. The increasing population and urbanization in countries such as China and India have led to severe traffic congestion. Vehicle analytics solutions offer potential remedies through traffic management, public transportation optimization, and autonomous vehicle development.

Key Vehicle Analytics Company Insights

Key vehicle analytic companies include Agnik LLC, Cloud Made Ltd., and Genetec Inc. Companies active in the vehicle analytic market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in March 2023, Latitude AI, a subsidiary of Ford, developed advanced automated driving technology, initially focusing on a driver assistance system that allows for hands-free and eyes-off operation in upcoming Ford vehicles. Boasting a team of 550 experts specializing in fields such as machine learning, robotics, software engineering, sensors, systems engineering, and testing procedures, Ford is expanding its portfolio of automated driving technologies. This is aimed at transforming the driving experience for its customers.

Key Vehicle Analytics Companies:

The following are the leading companies in the vehicle analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Agnik LLC

- Cloud Made Ltd.

- Genetec Inc.

- HARMAN International Industries Inc.

- Intelligent Mechatronic Systems

- International Business Machines Corporation

- Microsoft Corporation

- Pivotal Software, Inc.

- SAP SE

- Teletrac Navman

Recent Developments

-

In June 2024, SAP SE, reported that Mahle GmbH, automotive part manufacturer, selected the RISE with SAP solution to move to the cloud. Opting for SAP S/4HANA Cloud, the MAHLE Group is set to transition its comprehensive on-premises SAP infrastructure to the cloud. This move encompasses migrating all Mahle GmbH's ERP operations, including those related to warehousing, finance, analytics, transportation, and material management, to the cloud-based setting.

-

In May 2024, International Business Machines Corporation signed a Memorandum of Understanding with Honda Motor Co., Ltd., to jointly engage in long-term research and development efforts focused on developing advanced computing technologies. These technological advancements are essential for addressing issues related to processing power, energy usage, and the complexity of design-critical components for the development of future software-defined vehicles (SDVs).

-

In February 2024, Nissan Motor Co., Ltd. announced to commercialize its inhouse-developed, autonomous-drive*1 mobility services in Japan. Armed with this insight, Nissan intends to launch services featuring autonomous driving starting in the fiscal year 2027. The company aims to collaborate with external partners including local governments and transportation service providers. Nissan is set to initiate pilot programs in the Minato Mirai region in fiscal 2024, with plans to expand these trials in the subsequent fiscal year. Throughout these pilot programs, the degree of autonomous driving will be incrementally increased as the company evaluates consumer receptivity, with the objective of offering services without the need for a driver.

Vehicle Analytics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.18 billion

Revenue forecast in 2030

USD 15.41 billion

Growth rate

CAGR of 24.3% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Agnik LLC; Cloud Made Ltd.; Genetec Inc.; HARMAN International Industries Inc.; Intelligent Mechatronic Systems; International Business Machines Corporation; Microsoft Corporation; Pivotal Software, Inc.; SAP SE; and Teletrac Navman

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vehicle Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global vehicle analytics market report based on component, deployment, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Predictive Maintenance

-

Traffic Management

-

Safety & Security Management

-

Driver & User Behavior Analysis

-

Dealer Performance Analysis

-

Usage-Based Insurance

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Original Equipment Manufacturers (OEMs)

-

Automotive Dealers

-

Fleet Owners

-

Regulatory Bodies

-

Insurers

-

Service Providers

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global vehicle analytics market size was estimated at USD 3.53 billion in 2023 and is expected to reach USD 4.18 billion in 2024.

b. The global vehicle analytics market is expected to grow at a compound annual growth rate of 24.3% from 2024 to 2030 to reach USD 15.41 billion by 2030.

b. North America dominated the vehicle analytics market with a share of 34.6% in 2023. Proximity to tech hubs like Silicon Valley has fostered innovation in the vehicle analytics market in the region. Moreover, the rapid deployment of 5G networks enables real-time data transmission and analysis. In addition, stringent safety regulations are driving the development of advanced driver assistance systems (ADAS) and autonomous vehicles.

b. Some key players operating in the vehicle analytics market include Agnik LLC; Cloud Made Ltd.; Genetec Inc.; HARMAN International Industries Inc.; Intelligent Mechatronic Systems; International Business Machines Corporation; Microsoft Corporation; Pivotal Software, Inc.; SAP SE; and Teletrac Navman.

b. Vehicle analytics represents advanced technology designed to monitor vehicles in real-time, offering immediate updates on their status. This technology serves a wide range of stakeholders, from manufacturers and insurance providers to fleet managers, by providing instant access to the vehicle's exact location. Its core function is to oversee, assess, and enhance both vehicle operations and driver habits, thereby contributing to safer driving conditions. Various factors, such as technological advancements, rising demand for efficiency and cost reduction, growing emphasis on safety and security, and increasing regulatory compliance are primarily driving the growth of the vehicle analytics market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.