- Home

- »

- Automotive & Transportation

- »

-

Vehicle Access Control Market Size, Industry Report, 2030GVR Report cover

![Vehicle Access Control Market Size, Share & Trends Report]()

Vehicle Access Control Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Biometric, Non-biometric, RFID), By Application (Tollways, Commercial Buildings), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-660-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vehicle Access Control Market Size & Trends

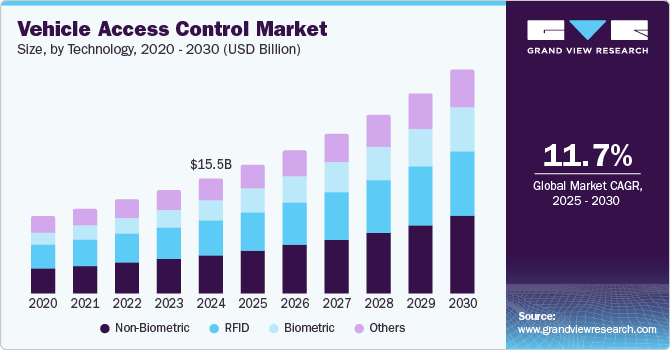

The global vehicle access control market size was valued at USD 15.53 billion in 2024 and is expected to expand at a CAGR of 11.7% from 2025 to 2030. Increasing concerns over vehicle security and the rising incidence of vehicle thefts have led to a higher demand for advanced access control systems. Technological advancements, such as biometric authentication and keyless entry systems, are enhancing the security and convenience of these systems, further fueling market growth. Additionally, the expanding automotive industry and stringent government regulations regarding vehicle safety are driving the adoption of sophisticated access control technologies. The growing trend of connected cars and the integration of Internet of Things (IoT) solutions are also contributing to the market's expansion, providing enhanced features and functionalities for vehicle access control.

The need for advanced safety features that can control any unauthorized access to a vehicle is growing. At the same time, the security requirements at the entry gates of commercial and residential buildings are also growing. Research & development centers, power plants, and nuclear power zones, among other establishments, are vital for a nation's economy. Such establishments often house confidential information; hence, they must be protected from any unauthorized vehicular entry. These are the major factors that are driving the demand for advanced vehicle access control systems.

Vehicle access control systems can also be installed across tollways, in addition to commercial and residential buildings. Their traffic management capabilities can help reduce traffic congestion on the tollways. Moreover, technological advances are helping to increase the acceptability of vehicle access control systems by enabling various combinations of non-biometric and biometric systems. The growing acceptability of these systems bodes well for market growth over the forecast period.

Technology Insights

Non-biometrics dominated the market, with the largest revenue share of 33.6% in 2024. Non-biometric vehicle access control systems offer the basic safety and security features, such as keyless entry, intrusion alarm, and stolen car assists, among others, that can help owners in accessing, protecting, and tracking their automobiles easily. These systems are common among low-end and mid-end cars as well as premium cars owing to the ease of implementation and use associated with them. However, non-biometric vehicle access control systems cannot be considered as highly reliable systems, particularly because there have been several instances where thieves have managed to bypass non-biometric vehicle access control systems.

Biometrics is expected to grow at the fastest CAGR of 13.3% over the forecast period. The rapid growth can be attributed to the increasing adoption of biometrics-based access control systems in automobiles. Biometric systems can thwart vehicle theft attempts and ensure easy access to the owner of the automobile. Biometric systems can also be configured to offer a personalized experience to the users, thereby adding to their popularity. As a result, the adoption of biometrics-based vehicle access control systems, particularly in premium cars, is anticipated to grow over the forecast period.

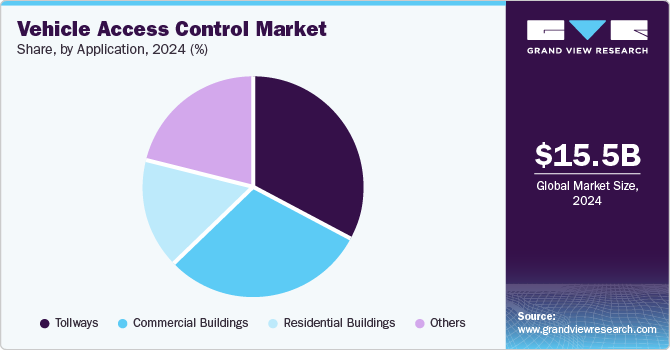

Application Insights

Toll ways dominated the market with the largest revenue share in 2024 due to the widespread implementation of toll collection systems, which rely heavily on access control technologies to ensure smooth and efficient operations. These systems, including electronic toll collection (ETC) and automatic number plate recognition (ANPR), have become essential for managing traffic flow, reducing congestion, and enhancing revenue collection. The increasing number of vehicles on the road and the expansion of toll road networks have further driven the demand for advanced access control solutions in toll ways.

The commercial buildings segment is expected to grow at the fastest CAGR over the forecast period. The increasing adoption of advanced vehicle access control systems in commercial spaces such as office complexes, shopping malls, hotels, and parking facilities. The need for enhanced security, efficient access management, and seamless user experiences is driving the demand for sophisticated access control solutions in these buildings. Moreover, the integration of technologies such as IoT, AI, and biometrics in commercial buildings is revolutionizing access control, providing higher security levels, and improving operational efficiency. As businesses continue to prioritize safety and convenience, the commercial buildings segment is expected to see significant advancements and widespread adoption of these innovative solutions.

Regional Insights

North America vehicle access control industry dominated the global market with the largest revenue share of 33.5% in 2024. The region's advanced automotive sector, strong focus on vehicle security, and widespread adoption of innovative technologies are propelling market growth. The integration of IoT, AI, and biometric systems has significantly enhanced the efficiency and security of vehicle access control solutions in North America. Additionally, stringent government regulations regarding vehicle safety and security have further driven the demand for these advanced systems. Major automotive manufacturers and technology companies in the region have also contributed to the market's growth and leadership position.

U.S. Vehicle Access Control Market Trends

The U.S. vehicle access control industry is expected to grow significantly over the forecast period. The rising incidents of vehicle thefts and stringent government regulations regarding safety and security are driving the adoption of advanced access control systems. Additionally, major automotive manufacturers and tech companies in the U.S. further fuel the innovation and implementation of cutting-edge vehicle access control technologies.

Europe Vehicle Access Control Market Trends

Europe vehicle access control industry held a considerable share in 2024 owing to the region's strong focus on reducing carbon emissions and promoting sustainable development. European countries are investing heavily in advanced access control systems that offer enhanced security and efficiency. The integration of IoT, AI, and biometric technologies in vehicles is a key driver, as it aligns with the region's commitment to technological innovation and environmental sustainability.

Asia Pacific Vehicle Access Control Market Trends

Asia Pacific vehicle access control industry is expected to grow at the fastest CAGR of 14.6% over the forecast period. The region is experiencing rapid growth driven by the expanding automotive industry and increasing urbanization. Countries such as China, Japan, and South Korea are at the forefront of adopting advanced technologies to improve vehicle security and enhance user experience. Government initiatives to modernize infrastructure and improve safety standards are also contributing to the market's growth. The region's high demand for connected and autonomous vehicles further accelerates the adoption of sophisticated vehicle access control systems.

Key Vehicle Access Control Company Insights

Some key companies in the vehicle access control market include Continental AG, Robert Bosch GmbH, AVERY DENNISON CORPORATION, STMicroelectronics, Valeo, and others.

-

Continental AG specializes in developing cutting-edge access control systems, including biometric sensors and keyless entry technologies. Their innovative solutions enhance vehicle security and user convenience, catering to both passenger cars and commercial vehicles.

-

Robert Bosch GmbH is another key player, providing a wide array of access control solutions such as biometric sensors, keyless entry systems, and remote access technologies. Bosch's offerings are designed to improve vehicle security, reduce the risk of unauthorized access, and provide seamless user experience.

Key Vehicle Access Control Companies:

The following are the leading companies in the vehicle access control market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- Robert Bosch GmbH

- AVERY DENNISON CORPORATION

- STMicroelectronics

- Valeo

- HELLA GmbH & Co. KGaA

- Lear Corp

- NXP Semiconductors

- ALPS ALPINE CO., LTD.

- OMRON Corporation

Recent Developments

-

In February 2024, VicOne unveiled its xNexus next-generation Vehicle Security Operations Center (VSOC) platform, designed to enhance automotive cybersecurity.

-

In January 2024, Continental introduced the "Face Authentication Display," a groundbreaking two-stage access control system utilizing biometric recognition technology. This innovative system, featuring discreet camera integration on the B-pillar and behind the driver display, enables secure vehicle access and digital payments.

Vehicle Access Control Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.26 billion

Revenue forecast in 2030

USD 30.07 billion

Growth Rate

CAGR of 11.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Continental AG; Robert Bosch GmbH; AVERY DENNISON CORPORATION; STMicroelectronics; Valeo; HELLA GmbH & Co. KGaA; Lear Corp.; NXP Semiconductors

ALPS ALPINE CO., LTD.; OMRON Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vehicle Access Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vehicle access control market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Biometric

-

Non-Biometric

-

RFID

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Tollways

-

Commercial Buildings

-

Residential Buildings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.