Vegetable Oil Market Size, Share & Trends Analysis Report By Type (Palm Oil, Soybean Oil), By Application, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-333-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Vegetable Oil Market Size & Trends

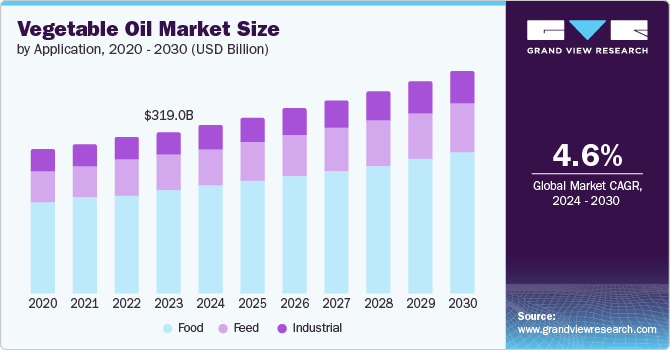

The global vegetable oil market size was valued at USD 319.03 billion in 2023 and is anticipated to grow at a CAGR of 4.6% from 2024 to 2030. The increasing global population, rising disposable incomes, and changing dietary preferences are driving the market. As the world's population continues to grow, the demand for food, including vegetable oils, rises correspondingly. This is particularly evident in developing regions where population growth is most pronounced. Higher disposable incomes, especially in emerging economies, allow consumers to diversify their diets, incorporating more processed and convenience foods that often contain vegetable oils. Additionally, there is a growing trend toward healthier eating habits, with many consumers opting for oils perceived as healthier alternatives to animal fats.

Moreover, the market is influenced by the expansion of the biofuel industry. Vegetable oils, such as soybean and palm oil, are critical feedstock for biodiesel production. Government policies promoting renewable energy sources and sustainability are boosting the demand for vegetable oils in biofuel production. This trend is particularly strong in regions like North America and Europe, where regulatory frameworks encourage the use of biofuels to reduce greenhouse gas emissions. Furthermore, advancements in agricultural practices and biotechnology are enhancing crop yields, making vegetable oil production more efficient and cost-effective, thus supporting market growth.

Additionally, the increasing awareness and concern for environmental sustainability and ethical sourcing are shaping the vegetable oil market. Consumers and companies alike are becoming more conscious of the environmental impact of their food choices, leading to a demand for sustainably produced oils. This is driving the adoption of certification programs such as the Roundtable on Sustainable Palm Oil (RSPO), which promotes sustainable palm oil production practices. Companies are also investing in traceability and transparency within their supply chains to meet consumer demand for responsibly sourced products. Consequently, these factors are collectively propelling the growth and evolution of the vegetable oil market.

Product Insights

The palm oil segment accounted for a revenue share of 34.27% of the global market in 2023. Palm oil's versatility enhances its dominance in the market. It is a crucial ingredient in a wide range of products, from food items like margarine, ice cream, and baked goods to non-food products such as cosmetics, detergents, and biofuels. Its semi-solid nature at room temperature, oxidative stability, and long shelf life make it particularly valuable in food processing and preservation. The demand for these diverse applications drives the continuous growth and prominence of palm oil in the market.

Soybean oil is anticipated to grow at a CAGR of 5.9% from 2024 to 2030. Soybean oil is perceived as a healthier alternative to other vegetable oils, as it is low in saturated fats and rich in unsaturated fats, including omega-3 fatty acids. The growing emphasis on health and wellness, along with increasing consumer awareness of the nutritional benefits of soybean oil, has further fueled its rapid growth in the market.

Application Insights

Vegetable oil application in food accounted for a revenue share of 63.43% of the global market in 2023. Vegetable oils are rich in essential fatty acids and vitamins, which are crucial for maintaining health. They provide a major source of dietary fats necessary for energy production and the absorption of fat-soluble vitamins like A, D, E, and K. The health benefits associated with certain vegetable oils, such as olive oil's high monounsaturated fat content and omega-3 fatty acids in canola oil, have driven their demand in the food sector. This nutritional value underscores their popularity and extensive use in everyday diets around the world.

Vegetable oil application in the industrial sector is anticipated to grow at a CAGR of 4.9% from 2024 to 2030. It is the fastest-growing application in the market primarily due to the increasing demand for biofuels and lubricants. As the world seeks sustainable alternatives to fossil fuels, vegetable oils have emerged as a critical feedstock for biodiesel production. Governments and organizations worldwide are implementing policies and incentives to promote renewable energy sources, driving the growth of the biodiesel industry. The environmental benefits of biodiesel, such as lower greenhouse gas emissions and biodegradability, make vegetable oils an attractive choice for fuel production, thereby boosting their industrial application.

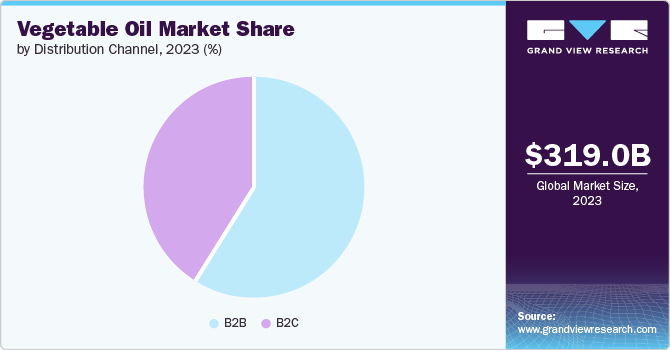

Distribution Channel Insights

Sales through B2B distribution channels accounted for a revenue share of 58.55% of the global market in 2023. B2B transactions inherently cater to large-scale buyers such as food manufacturers, restaurants, and industrial users. These entities require vegetable oil in substantial quantities to meet their production and operational needs, making bulk purchasing through B2B channels more cost-effective and logistically feasible. By sourcing directly from manufacturers or wholesalers, these businesses can negotiate better prices, secure a consistent supply, and reduce transaction costs, which is essential for maintaining competitive pricing in their respective markets.

Sales through the B2C distribution channel are anticipated to grow at a CAGR of 5.4% from 2024 to 2030. The proliferation of e-commerce platforms has revolutionized how consumers purchase vegetable oils. Online retail provides a convenient and efficient shopping experience, offering a wide range of products that can be delivered directly to consumers' doorsteps. The digital marketplace allows for easy comparison of brands, prices, and reviews, empowering consumers to make informed choices. This convenience and accessibility contribute significantly to the growth of B2C channels, as consumers prefer the hassle-free experience of online shopping over traditional brick-and-mortar stores.

Regional Insights

The vegetable market in North America is expected to grow at a CAGR of 3.1% from 2024 to 2030. With a growing emphasis on health and wellness, consumers are shifting towards vegetable oils that are perceived as healthier alternatives to animal fats and trans fats. Oils such as olive oil, canola oil, and avocado oil are particularly popular due to their high content of monounsaturated and polyunsaturated fats, which are considered beneficial for heart health. Additionally, the trend towards plant-based and vegan diets is further propelling the demand for vegetable oils, as these diets often require vegetable oil as a primary ingredient in cooking and food preparation.

U.S. Vegetable Oil Market Trends

The vegetable market in the U.S. held a share of over 87.08% of the North American market in 2023. Economic factors, such as the expansion of agricultural production and advancements in extraction and processing technologies, are playing a crucial role in driving the market in the U.S. Improved agricultural practices and genetic modifications have led to higher yields of oilseed crops, ensuring a steady supply of raw materials. Additionally, technological advancements in extraction methods have enhanced the efficiency and quality of oil production, making vegetable oils more accessible and affordable for consumers and industries alike.

Asia Pacific Vegetable Oil Market Trends

The Asia Pacific vegetable market held a share of over 56.67% of the global market in 2023. The increasing demand for food products, fueled by population growth and rising incomes in countries such as China, India, and Indonesia is driving the market in this region. As people in these nations attain higher income levels, their dietary preferences shift toward more processed and packaged foods, which often contain vegetable oils. Additionally, the expanding urban population and the proliferation of modern retail formats are making these products more accessible to a larger segment of the population.

Middle East & Africa Vegetable Oil Market

The vegetable market in the Middle East and Africa is expected to grow at a CAGR of 4.3% from 2024 to 2030. The biofuel industry also significantly influences the vegetable oil market in Europe. Policies promoting renewable energy sources and reducing greenhouse gas emissions have led to increased production of biodiesel, which often uses vegetable oils like rapeseed oil as feedstock. This demand for biofuels is driven by both environmental regulations and the push towards sustainable energy alternatives, creating a substantial market for vegetable oils.

Key Vegetable Oil Company Insights

The market is highly competitive, with a range of companies offering various forms. Many big players are increasing their focus on new form launches, partnerships, and expansion into new markets to compete effectively.

Key Vegetable Oil Companies:

The following are the leading companies in the vegetable oil market. These companies collectively hold the largest market share and dictate industry trends.

- Archer Daniels Midland Company

- Sime Darby Plantation Berhad

- Bunge Limited

- Olam International Limited

- Cargill Incorporated

- Golden Agri-Resources

- Kuala Lumpur Kepong Berhad

- Fuji Oil Holding Inc.

- Wilmar International Limited

- PT Astra Agro Lestari Tbk

Recent Developments

-

In February 2024, Cargill launched its Gemini Pureit sunflower oil brand in four southern states of India: Andhra Pradesh, Telangana, Karnataka, and Tamil Nadu.

-

In July 2022, Eni, the Italian energy giant, started producing vegetable oil for biorefining in Kenya. They have established an oilseed collection and pressing facility, called an agri-hub, in Makueni, Kenya, with an initial production capacity of 15,000 tons.

Vegetable Oil Market Report Scope

|

Report Attribute |

Details |

|

Market form value in 2024 |

USD 332.74 billion |

|

Revenue forecast in 2030 |

USD 436.12 billion |

|

Growth rate |

CAGR of 4.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; France; Spain; Italy; France; China; India; Japan; Australia; South Korea; Brazil; South Africa; Saudi Arabia |

|

Key companies profiled |

Archer Daniels Midland Company; Sime Darby Plantation Berhad; Bunge Limited; Olam International Limited; Cargill Incorporated; Golden Agri-Resources; Kuala Lumpur Kepong Berhad; Fuji Oil Holding Inc.; Wilmar International Limited; PT Astra Agro Lestari Tbk |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Vegetable Oil Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vegetable oil market report based on type, application, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Palm Oil

-

Soybean Oil

-

Rapeseed Oil

-

Sunflower Oil

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food

-

Feed

-

Industrial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

B2B

-

B2C

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."