- Home

- »

- Consumer F&B

- »

-

Vegan Tuna Market Size, Share And Trends Report, 2030GVR Report cover

![Vegan Tuna Market Size, Share & Trends Report]()

Vegan Tuna Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Frozen, Canned), By End-user (Household, Foodservice), By Distribution Channel (Online, Supermarkets/ Hypermarkets), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-473-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vegan Tuna Market Summary

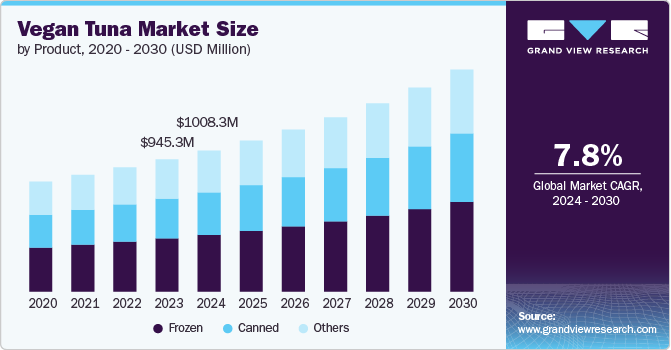

The global vegan tuna market size was estimated at USD 945.3 million in 2023 and is projected to reach USD 1.59 billion in 2030, growing at a CAGR of 7.8% from 2024 to 2030. One of the most significant factors driving the market is the increasing consumer preference for plant-based diets.

Key Market Trends & Insights

- North America vegan tuna market accounted for a revenue share of 40.2% in 2023.

- The vegan tuna market in Asia Pacific is expected to grow with a CAGR of 8.4% from 2024 to 2030.

- By product, the frozen segment held a revenue share of 40.2% in 2023.

- By end-user, the households segment held a revenue share of 60.5% in 2023.

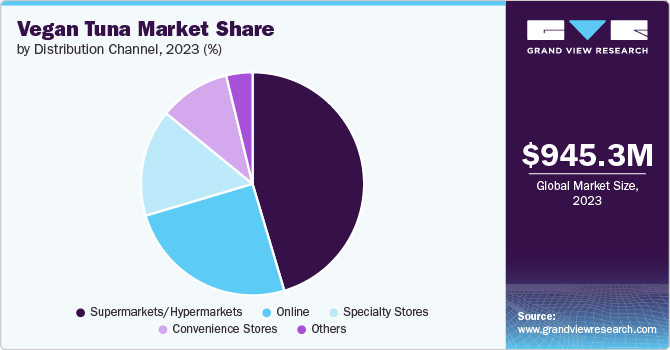

- By distribution channel, supermarkets/hypermarkets segment accounted for a revenue share of 45.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 945.3 Million

- 2030 Projected Market Size: USD 1.59 Billion

- CAGR (2024-2030): 7.8%

- North America: Largest market in 2023

Concerns about health, ethics, and ecological sustainability influence this shift. As more people adopt vegetarian, vegan, or flexitarian diets, the demand for plant-based protein alternatives has skyrocketed. Vegan tuna is emerging as a popular substitute for conventional tuna due to its ability to mimic the taste, texture, and nutritional profile of real seafood.

Studies show that plant-based diets are gaining momentum globally, especially in developed markets. A significant portion of this demographic shift is driven by millennials and Gen Z, who are particularly concerned about animal welfare, sustainability, and health. Additionally, flexitarians-consumers who occasionally consume meat but are looking to reduce their intake-represent a large and growing consumer base. This widespread shift has laid the foundation for the rise of vegan tuna and other plant-based seafood alternatives. Moreover, overfishing is a critical issue affecting marine ecosystems, and it has heightened consumer awareness of the environmental consequences of seafood consumption. Tuna is one of the most overfished species in the world, with several species classified as endangered. This has driven consumers to seek alternatives that are both ethical and sustainable. Plant-based tuna, being free of any impact on marine biodiversity, appeals to environmentally conscious consumers who want to mitigate the negative effects of overfishing.

Health-conscious consumers are another key driver of the market. Many individuals are shifting away from traditional seafood due to concerns over mercury levels, pollutants, and microplastics found in ocean-caught fish. Tuna, in particular, is known for having high mercury content, which can be harmful to human health, especially when consumed in large quantities. Vegan tuna, made from plant-based ingredients such as legumes, soy, or pea protein, eliminates these risks while still offering a protein-rich alternative. Vegan tuna products often contain high levels of plant-based proteins, fiber, omega-3 fatty acids (derived from algae), and essential nutrients without the cholesterol and saturated fat found in animal-based seafood. This makes it an appealing option for health-conscious individuals who are looking to maintain a balanced diet while reducing their intake of animal products. Additionally, plant-based tuna does not contain any harmful additives like antibiotics or hormones, which are commonly used in farmed fish.

Another major driver of the market is the wave of product innovations and technological advancements within the plant-based food industry. Companies are using cutting-edge food science to create plant-based tuna products that closely mimic the texture, flavor, and mouthfeel of traditional tuna. This is being achieved through the use of new ingredients, protein extrusion technologies, and flavor enhancers that replicate the umami taste of seafood. Several prominent companies are at the forefront of this innovation. Good Catch Foods, for example, uses a proprietary blend of six different legumes, including chickpeas, peas, lentils, and soy, to create a realistic tuna texture.

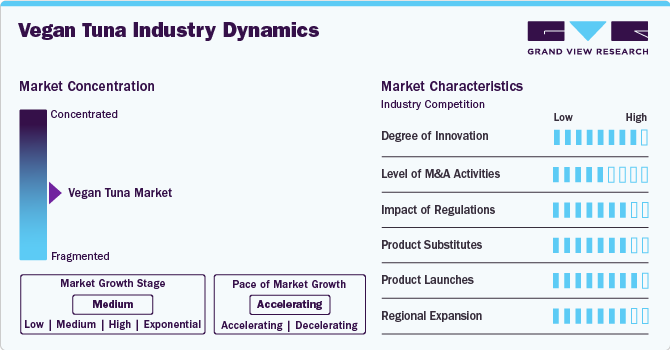

Market Concentration & Characteristics

The vegan tuna market has seen significant innovation, especially in improving texture and flavor to mimic real tuna. Companies are leveraging plant-based proteins like soy, peas, and legumes to create products that closely replicate the mouthfeel of traditional tuna. Innovation in processing technologies, like extrusion, has improved product quality, while advancements in sustainable packaging and clean-label ingredients are further driving innovation in this space.

The market has witnessed growing mergers and acquisition activities as larger food companies seek to expand their plant-based portfolios. Strategic partnerships, like Bumble Bee Foods' alliance with Good Catch, exemplify the trend of traditional seafood companies investing in plant-based alternatives. These collaborations enable greater distribution reach, product development, and brand expansion, reflecting a robust consolidation trend within the plant-based seafood market.

Regulations around labeling, food safety, and plant-based product claims are increasingly impacting the market. Regulatory bodies like the FDA and EFSA enforce strict guidelines to ensure products meet safety standards and transparent labeling practices, particularly regarding allergens and nutritional claims. In some regions, governments are promoting plant-based diets, which indirectly supports the market, while labeling restrictions on terms like “tuna” have also surfaced, influencing product marketing.

Vegan tuna faces competition from other plant-based seafood alternatives such as vegan salmon, shrimp, and crab. In addition, traditional plant-based protein sources like tofu, seitan, and tempeh act as substitutes for consumers seeking high-protein, non-meat options. While these substitutes do not directly replicate tuna, they offer versatility in plant-based diets, potentially reducing demand for vegan tuna in certain consumer segments.

The market has seen numerous product launches by various brands. These products are introduced in various forms, including frozen, canned, and pre-seasoned varieties, catering to different consumer needs. Many new launches emphasize clean ingredients, sustainability, and culinary versatility, as brands aim to attract health-conscious and eco-conscious consumers. Frequent product releases signal the growing dynamism of this market.

Region expansion is a key growth strategy in the market, particularly in Asia-Pacific and Europe. North American brands are expanding into these regions, where demand for plant-based foods is rising rapidly. The Asia-Pacific market is witnessing a surge in plant-based seafood consumption due to sustainability concerns and dietary shifts, while European markets, driven by environmental policies and consumer demand, are also growing hotspots for vegan tuna.

Product Insights

Frozen vegan tuna held a revenue share of 40.2% in 2023. One of the primary reasons for this dominance is the ability of frozen products to retain the texture, flavor, and nutritional value of the ingredients for a longer period than canned or fresh alternatives. This preservation of quality makes frozen vegan tuna a more appealing option for both consumers and retailers. Frozen vegan tuna products can closely mimic the texture of real tuna, especially in applications like sushi, poke bowls, and salads, which rely on fresh-tasting ingredients.

The ability of frozen products to replicate the sensory experience of fresh fish plays a crucial role in their widespread acceptance among vegan and flexitarian consumers. The advancement of freezing technology, such as individual quick freezing (IQF), has improved the quality of frozen vegan tuna, helping it to better compete with traditional seafood products.

Canned vegan tuna is expected to grow at a CAGR of 8.3% from 2024 to 2030 due to its convenience, affordability, and increasing consumer demand for shelf-stable, ready-to-eat products. Canned products are often considered more practical for consumers with busy lifestyles, as they require minimal preparation and can be stored for extended periods without refrigeration. This makes canned vegan tuna a convenient option for quick meals or snacks.

Another driver of this growth is the growing demand for plant-based protein sources that can be easily incorporated into meals. Canned vegan tuna offers a versatile, pre-cooked solution that can be used in a wide range of dishes, from sandwiches to casseroles, making it an appealing choice for consumers who are new to plant-based diets. Additionally, canned vegan tuna is often more affordable than fresh or frozen alternatives, which makes it accessible to a broader range of consumers.

End-user Insights

The use of vegan tuna in households held a revenue share of 60.5% in 2023 due to the increasing adoption of plant-based diets at the consumer level, driven by health, environmental, and ethical concerns. Vegan tuna is primarily purchased by individuals or families who prepare meals at home, making households the largest end-user segment. As veganism and flexitarianism become more mainstream, more consumers are experimenting with plant-based alternatives to traditional seafood in their home kitchens.

The growing awareness of the health benefits of plant-based diets, including lower cholesterol and reduced risk of heart disease, is encouraging consumers to incorporate vegan products into their daily meals. Vegan tuna, as a source of plant-based protein, appeals to health-conscious consumers who are seeking alternatives to animal-based protein. Additionally, as plant-based food options have expanded in retail stores, consumers have greater access to products like vegan tuna, which can be easily incorporated into homemade dishes.

The use of vegan tuna in food service is expected to grow at a CAGR of 7.5% from 2024 to 2030. This growth is largely driven by the increasing inclusion of plant-based options in restaurant menus, fast-food chains, and cafes. The rising demand for vegan and vegetarian options among diners has prompted the foodservice industry to adapt by incorporating plant-based alternatives, including vegan tuna, into a variety of dishes.

Vegan tuna is particularly well-suited for sushi restaurants, poke bowl chains, and other establishments that traditionally serve seafood. As plant-based seafood becomes more widely accepted, many restaurants are experimenting with vegan tuna as a way to attract health-conscious, environmentally aware customers. This trend is supported by the growing consumer demand for sustainable and ethical dining options.

Distribution Channel Insights

Sales through supermarkets/hypermarkets accounted for a revenue share of 45.4% of the market in 2023 due to their broad consumer reach, diverse product offerings, and convenience. These retail outlets cater to a wide demographic, offering easy access to vegan products as part of their regular grocery shopping routine. Supermarkets are often the primary destination for consumers looking for plant-based alternatives, as they offer a wide range of vegan products across different categories.

In addition, the expansion of plant-based food sections within supermarkets has played a key role in driving sales. Retail giants such as Walmart, Kroger, and Whole Foods have invested heavily in their plant-based product lines, offering vegan tuna alongside other plant-based seafood options. This has increased the visibility of vegan products and made it easier for consumers to discover and purchase vegan tuna.

Sales through online channels is expected to grow at a CAGR of 8.5% from 2024 to 2030, driven by the rise of e-commerce and changing consumer shopping habits. The growth of online retail platforms like Amazon, Instacart, and company-owned websites has made it easier for consumers to access vegan products, including vegan tuna. The convenience of home delivery, coupled with the wide range of products available online, has contributed to the increasing popularity of this channel. The COVID-19 pandemic accelerated the shift to online shopping, with many consumers preferring the safety and convenience of having groceries delivered to their homes. Even as brick-and-mortar stores have reopened, the trend toward online shopping continues to grow, particularly among younger, tech-savvy consumers who prioritize convenience.

Regional Insights

North America vegan tuna market accounted for a revenue share of 40.2% in 2023 due to the high levels of consumer awareness regarding plant-based diets and sustainability. The region is home to a large population of vegans, vegetarians, and flexitarians, particularly in the United States and Canada, where plant-based eating is a well-established trend. The strong presence of established plant-based food companies in North America has also contributed to the region’s dominance. Companies invest heavily in product development and marketing, driving consumer awareness and increasing the availability of vegan tuna across various retail and foodservice channels. Furthermore, North American consumers are generally more willing to try new, innovative products, particularly those that align with their values of sustainability and animal welfare.

Asia Pacific Vegan Tuna Market Trends

The vegan tuna market in Asia Pacific is expected to grow with a CAGR of 8.4% from 2024 to 2030, driven by increasing awareness of plant-based diets, rising disposable incomes, and changing dietary habits. The region is witnessing rapid urbanization, and as middle-class populations expand in countries like China, Japan, and Australia, consumer preferences are shifting toward healthier and more sustainable food choices. The growing concerns over environmental sustainability and overfishing in the region are driving demand for plant-based seafood alternatives like vegan tuna. Asia-Pacific is one of the largest consumers of seafood globally, and as concerns over depleted fish stocks and the impact of commercial fishing practices grow, consumers are increasingly turning to plant-based alternatives. Vegan tuna offers a sustainable solution that allows consumers to enjoy the flavors and textures of traditional seafood without contributing to overfishing or environmental degradation.

Key Vegan Tuna Company Insights

Key players operating in the market are Thai Union, Good Catch, Ocean Hugger Foods, Inc., Atlantic Natural Foods, Garden Gourmet Vuna, and Sophie’s Kitchen. The market participants are constantly working towards new product launches, partnerships and M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

Key Vegan Tuna Companies:

The following are the leading companies in the vegan tuna market. These companies collectively hold the largest market share and dictate industry trends.

- Thai Union

- Good Catch

- Ocean Hugger Foods, Inc.

- Atlantic Natural Foods

- Garden Gourmet Vuna

- Sophie’s Kitchen

- OmniTuna

- Hooked

- Vgarden Ltd.

- Endori

Recent Developments

-

In September 2023, The German plant-based food company Endori introduced a new vegan tuna product named Thuna, which is crafted from pea protein.

-

In February 2023, John West, the leading canned fish brand in the Netherlands, announced the launch of two new vegan 'tuna' products: Vegan Fish-Free Tuna with Tomato and Basil and Vegan Fish-Free Tuna with a Dash of Oil. These vegan options are available in 1,400 stores across the Netherlands, made from soy protein and wheat. Offered in pouches with either a tomato and basil flavor or a brine and oil variant, this new range caters to the growing consumer interest in diverse, flexitarian diets.

-

In January 2023, Vgarden Ltd., a developer and manufacturer of plant-based alternatives, launched an innovative vegan canned tuna product. This 100% plant-based offering replicates the look, texture, and taste of traditional canned tuna, addressing concerns about overfishing and the declining populations of wild tuna.

Vegan Tuna Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1008.3 million

Revenue forecast in 2030

USD 1.59 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

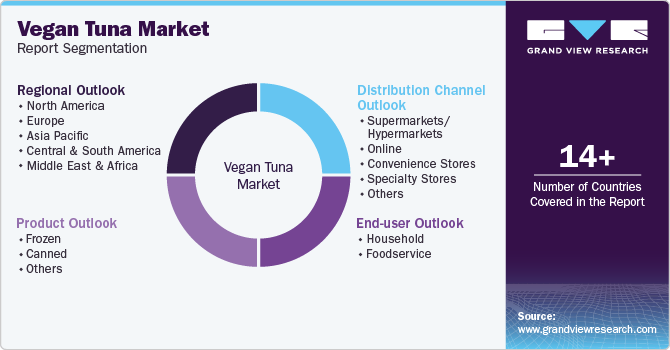

Segments covered

Product, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK;. Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Thai Union; Good Catch; Ocean Hugger Foods, Inc.; Atlantic Natural Foods; Garden Gourmet Vuna; Sophie’s Kitchen; OmniTuna; Hooked; Vgarden Ltd.; Endori

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Tuna Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vegan tuna market report based on product, end-user, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen

-

Canned

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Foodservice

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Online

-

Convenience Stores

-

Specialty Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The vegan tuna market size was estimated at USD 945.3 million in 2023 and is expected to reach USD 1,008.3 million in 2024.

b. The vegan tuna market is expected to grow at a compounded growth rate of 7.8% from 2024 to 2030 to reach USD 1.59 billion by 2030.

b. Frozen vegan tuna dominated the vegan tuna market with a share of 40.2% in 2023.One of the primary reasons for this dominance is the ability of frozen products to retain the texture, flavor, and nutritional value of the ingredients for a longer period compared to canned or fresh alternatives.

b. Some key players operating in vegan tuna market include Thai Union, Good Catch, Ocean Hugger Foods, Inc., Atlantic Natural Foods, Garden Gourmet Vuna, Sophie’s Kitchen, OmniTuna, Hooked , Vgarden Ltd. and Endori.

b. One of the most significant factors driving the vegan tuna market is the increasing consumer preference for plant-based diets. This shift is influenced by concerns about health, ethics, and environmental sustainability. As more people adopt vegetarian, vegan, or flexitarian diets, the demand for plant-based protein alternatives has skyrocketed.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.