- Home

- »

- Consumer F&B

- »

-

Vegan Popsicles Market Size, Share & Growth Report, 2030GVR Report cover

![Vegan Popsicles Market Size, Share & Trends Report]()

Vegan Popsicles Market (2025 - 2030) Size, Share & Trends Analysis Report By Flavor (Fruit, Exotic & Tropical), By Distribution Channel (Supermarkets & Hypermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-471-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vegan Popsicles Market Size & Trends

The global vegan popsicles market size was estimated at USD 84.1 million in 2024 and is projected to grow at a CAGR of 16.1% from 2025 to 2030. One of the most significant drivers of the market is the increasing consumer focus on health and wellness. Over the past decade, consumers have become more aware of the adverse health effects associated with high consumption of processed sugars, artificial preservatives, and dairy. In particular, dairy products have been linked to issues such as lactose intolerance, inflammation, and cholesterol problems. According to the National Institutes of Health (NIH), approximately 68% of the global population experiences lactose malabsorption, with the number being even higher in Asia, Africa, and parts of Latin America.

The surge in veganism and plant-based diets is largely fueled by this shift toward healthier lifestyles. Vegan popsicles, often made from natural ingredients such as fruit purees, plant-based milk, and organic sweeteners, cater to health-conscious consumers looking for refreshing treats without compromising on nutritional value. Unlike traditional dairy-based ice creams, vegan popsicles tend to have lower calorie counts, less saturated fat, and more vitamins and minerals, making them a popular choice for individuals aiming to maintain a balanced diet. Moreover, the growing awareness of the ecological impact of dairy farming, including greenhouse gas emissions, water usage, and deforestation, has led many consumers to seek plant-based alternatives, resulting in the increasing adoption of vegan products, including vegan popsicles.

Product innovation is another vital driver in the market. Manufacturers are constantly seeking new ways to enhance the taste, texture, and nutritional profile of vegan popsicles to attract a wider audience. A significant trend in product development is the use of diverse plant-based ingredients such as coconut milk, almond milk, and oat milk to replicate the creamy texture traditionally associated with dairy products. These plant-based alternatives offer unique flavor profiles and nutritional benefits, such as being rich in healthy fats, vitamins, and antioxidants. In addition, manufacturers are experimenting with exotic fruit flavors, herbs, and spices to create gourmet popsicles that cater to more adventurous palates. For instance, brands are launching products infused with ingredients such as lavender, ginger, and turmeric, which not only add unique flavors but are also associated with various health benefits such as improved digestion and reduced inflammation. The use of superfoods like acai, spirulina, and matcha in vegan popsicles is also on the rise, as these ingredients are touted for their antioxidant and energy-boosting properties.

Product development is further bolstered by advancements in freezing technology. Many companies are using advanced methods like flash freezing to lock in the natural flavors and nutritional content of their ingredients. This results in a higher-quality product with a better texture and taste compared to traditional freezing methods, giving vegan popsicles an edge over their conventional counterparts. Furthermore, the expanding availability of vegan popsicles across various distribution channels has played a significant role in market growth. Initially, plant-based products, including vegan popsicles, were primarily available in specialty health food stores. However, as demand has surged, these products have become widely available in mainstream supermarkets, hypermarkets, convenience stores, and online platforms.

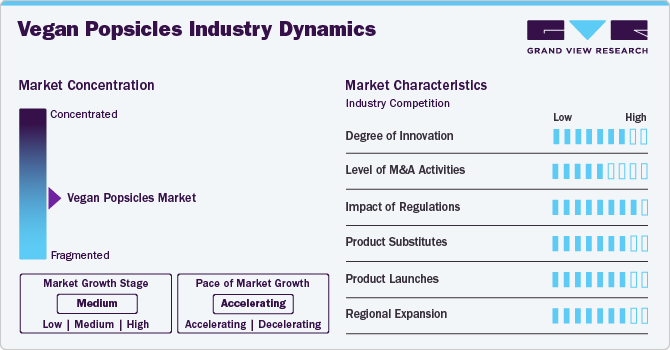

Market Concentration & Characteristics

The market is witnessing significant innovation, particularly in flavor development, functional ingredients, and sustainable packaging. Brands are experimenting with plant-based superfoods, probiotics, and natural sweeteners while also adopting eco-friendly packaging materials. Innovations such as allergen-free and low-sugar options are catering to diverse dietary preferences, further expanding the consumer base and driving market growth.

Mergers and acquisitions in the market are steadily rising as larger food companies acquire smaller, niche vegan brands to expand their plant-based portfolios. Key players aim to strengthen their foothold in the rapidly growing vegan frozen dessert sector. These acquisitions often lead to expanded distribution networks and greater R&D resources for scaling product innovation and market reach.

Regulations surrounding labeling, allergen disclosure, and plant-based certifications play a crucial role in the market. Stricter regulations on product ingredients and health claims require manufacturers to ensure transparency and compliance. In addition, government incentives promoting plant-based and eco-friendly products, especially in regions like Europe and North America, positively influence market growth and consumer trust.

In the frozen dessert space, substitutes for vegan popsicles include traditional dairy-based popsicles, sorbets, and other plant-based frozen desserts like vegan ice creams. However, vegan popsicles offer distinct advantages such as lower calorie counts, cleaner labels, and allergen-free benefits, making them a competitive alternative to these substitutes, especially among health-conscious and environmentally aware consumers.

Product launches in the market are frequent, with brands introducing new flavors, textures, and functional ingredients. Companies are focusing on exotic and superfood-infused flavors, as well as low-sugar and organic options. Seasonal offerings and collaborations with influencers or chefs are also popular strategies to attract consumers and generate excitement around new product introductions.

The market is expanding rapidly across regions like Asia Pacific and Europe, driven by rising health awareness and plant-based food trends. North America remains a dominant market due to established distribution networks and a strong consumer base for vegan products. Global brands are increasingly entering emerging markets with localized flavors and targeted marketing strategies to capture regional demand.

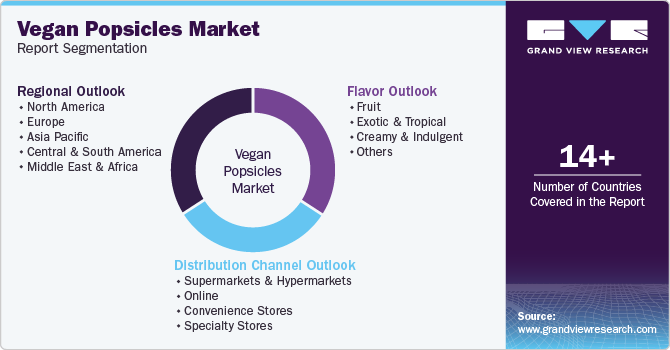

Flavor Insights

Fruit flavor held a revenue share of 47.3% in 2023 due to a combination of factors, including consumer preferences, health consciousness, and the availability of natural, clean ingredients. Consumers increasingly gravitate towards products that are perceived as healthy and natural, and fruit-flavored popsicles perfectly align with these preferences. Made with real fruit juices or purees, these popsicles are often seen as healthier options compared to indulgent or exotic flavors, which may include added sugars, fats, or artificial flavorings. Moreover, fruit-flavored vegan popsicles are the association of fruits with clean eating and nutrition, resulting in their increased usage. Fruits are naturally rich in vitamins, antioxidants, and fiber, which resonate with health-conscious consumers. In a market where people are increasingly focused on wellness, low-calorie, and nutrient-dense options, fruit-flavored vegan popsicles offer an appealing alternative.

Exotic & tropical-flavored vegan popsicle is expected to grow at a CAGR of 16.1% from 2024 to 2030, driven by the growing consumer demand for unique, bold, and adventurous flavor profiles. As the global food industry witnesses a shift toward experiential eating, consumers are increasingly seeking out new and exciting tastes. This trend is evident in the growing popularity of exotic flavors like passionfruit, dragon fruit, lychee, and guava, which offer distinct taste experiences compared to the more conventional fruit options. The demand for exotic vegan popsicles is also fueled by the influence of globalization and the cross-cultural exchange of culinary trends. As people become more exposed to different cultures and cuisines, particularly through travel and media, they are more open to trying tropical and exotic flavors.

Distribution Channel Insights

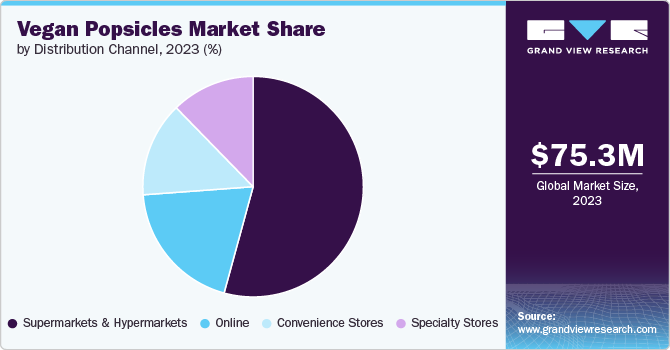

Sales through supermarkets & hypermarkets accounted for a revenue share of 54.3% of the market in 2023. Several factors contribute to this dominance, primarily the widespread accessibility, convenience, and product variety these stores offer. Supermarkets and hypermarkets are often the first point of contact for consumers when purchasing frozen products, including popsicles. They offer a one-stop shopping experience where consumers can purchase all their grocery needs, including vegan popsicles, in a single visit. The large market share of supermarkets and hypermarkets can also be attributed to their ability to offer a wide variety of brands and flavors, from mainstream brands to niche vegan options. In addition, supermarkets typically have large, dedicated freezer sections where vegan popsicles are prominently displayed, making them more accessible and visible to consumers. Store layouts and product placement strategies further enhance the likelihood of impulse purchases, which is particularly important in the frozen dessert category.

Sales through online channels are expected to grow at a CAGR of 16.1% from 2024 to 2030. This growth is primarily driven by the increasing adoption of e-commerce, the convenience of online shopping, and the expanding availability of vegan products on digital platforms. Online channels offer several advantages for both consumers and manufacturers. For consumers, online platforms provide access to a broader range of products and flavors that may not be available in physical stores. This is particularly important for vegan popsicles, as some exotic or niche flavors may be harder to find in supermarkets. In addition, e-commerce platforms like Amazon Fresh, Instacart, and specialty vegan retailers allow consumers to compare prices, read reviews, and discover new products with ease.

Regional Insights

The North America vegan popsicles market accounted for a revenue share of 44.6% in 2023 owing to several key factors, including the high level of health awareness, the established plant-based food industry, and the region’s strong distribution network. The U.S. and Canada are at the forefront of the plant-based food revolution, with a large and growing number of consumers adopting vegan or flexitarian diets. The North American market benefits from a well-developed food infrastructure that supports the widespread distribution and availability of vegan popsicles in supermarkets, hypermarkets, and specialty stores. Moreover, the high level of health consciousness in the region drives demand for vegan popsicles as consumers seek out dairy-free, low-calorie, and natural ingredient options. The increasing prevalence of lactose intolerance and dairy allergies among North American consumers has also led to a growing preference for dairy-free alternatives, further bolstering the demand for vegan popsicles in the region.

Asia Pacific Vegan Popsicles Market Trends

Asia Pacific vegan popsicles market is expected to grow at a CAGR of 16.3% from 2024 to 2030, driven by factors such as increasing health awareness, a rising vegan population, and growing disposable incomes. Countries like China, Japan, and India are witnessing a surge in demand for plant-based foods, including frozen desserts, as consumers become more health-conscious and environmentally aware. The rapid urbanization and changing dietary preferences in the region are also contributing to the growth of the market. Moreover, the increasing adoption of plant-based diets, particularly among younger consumers, is further driving the market growth.

Key Vegan Popsicles Company Insights

Key players operating in the market are GoodPop, Chloe’s, Solero, RITE BITE GROUP, Outshine, Ruby Rocket, Edy’s, Popsicle, MOKIPOPS, and Fudgy Pop. The market participants are constantly working towards new product launches, partnerships, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

Key Vegan Popsicle Companies:

The following are the leading companies in the vegan popsicles market. These companies collectively hold the largest market share and dictate industry trends.

- GoodPop

- Chloe’s

- Solero

- RITE BITE GROUP

- Outshine

- Ruby Rocket

- Edy’s

- Popsicle

- MOKIPOPS

- Fudgy Pop

Recent Developments

-

In May 2023, House of Pops, a popular vegan popsicle brand in Dubai, is quickly gaining traction with its vibrant, colorful flavors. Its stands are strategically located in malls, beaches, and luxury resorts, and it is explaining its availability on Emirates flights, broadening its reach across the Middle East.

-

In March 2023, Fudgy Pop, a new women-owned brand, introduced the first vegan and gluten-free fudge pops to the U.S. market, offering a nostalgic twist on the classic childhood dessert. Created by SorBabes founders Nicole Cardone and Deborah Gorman, these pops are indulgent yet made with clean, simple ingredients, including Guittard chocolate. Available in three flavors-Fudgin’ Fudgy (classic chocolate), Berry Fudgy (with strawberry puree), and Minty Fudgy (peppermint-chocolate)-each pop offers a rich, melt-in-your-mouth experience without dairy or gluten.

Vegan Popsicles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 94.8 million

Revenue forecast in 2030

USD 199.5 million

Growth Rate

CAGR of 16.1% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

GoodPop, Chloe’s, Solero, RITE BITE GROUP, Outshine, Ruby Rocket, Edy’s, Popsicle, MOKIPOPS, Fudgy Pop

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Popsicles Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vegan popsicles market report based on flavor, distribution channel, and region.

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit

-

Exotic & Tropical

-

Creamy & Indulgent

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Online

-

Convenience Stores

-

Specialty Stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Vegan popsicles, often made from natural ingredients such as fruit purees, plant-based milk, and organic sweeteners, cater to health-conscious consumers looking for refreshing treats without compromising on nutritional value, owing to which its consumption is increasing among consumers across the globe.

b. The global vegan popsicles market size was estimated at USD 75.3 million in 2023 and is expected to reach USD 84.1 million in 2024.

b. The global vegan popsicles market is expected to grow at a compounded growth rate of 15.5% from 2024 to 2030 to reach USD 199.5 million by 2030.

b. Fruit-flavored vegan popsicles dominated the market, with a share of 47.3% in 2023. Consumers increasingly gravitate towards products that are perceived as healthy and natural, and fruit-flavored popsicles perfectly align with these preferences.

b. Some key players operating in vegan popsicles market include GoodPop, Chloe’s, Solero, RITE BITE GROUP, Outshine, Ruby Rocket, Edy’s, Popsicle, MOKIPOPS, Fudgy Pop.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.