- Home

- »

- Consumer F&B

- »

-

Vegan Chocolate Confectionery Market, Industry Report 2030GVR Report cover

![Vegan Chocolate Confectionery Market Size, Share & Trends Report]()

Vegan Chocolate Confectionery Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Molded Bars, Boxed, Chips & Bites, Truffles & Cups), By Type (Dark, Milk, White), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-436-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vegan Chocolate Confectionery Market Summary

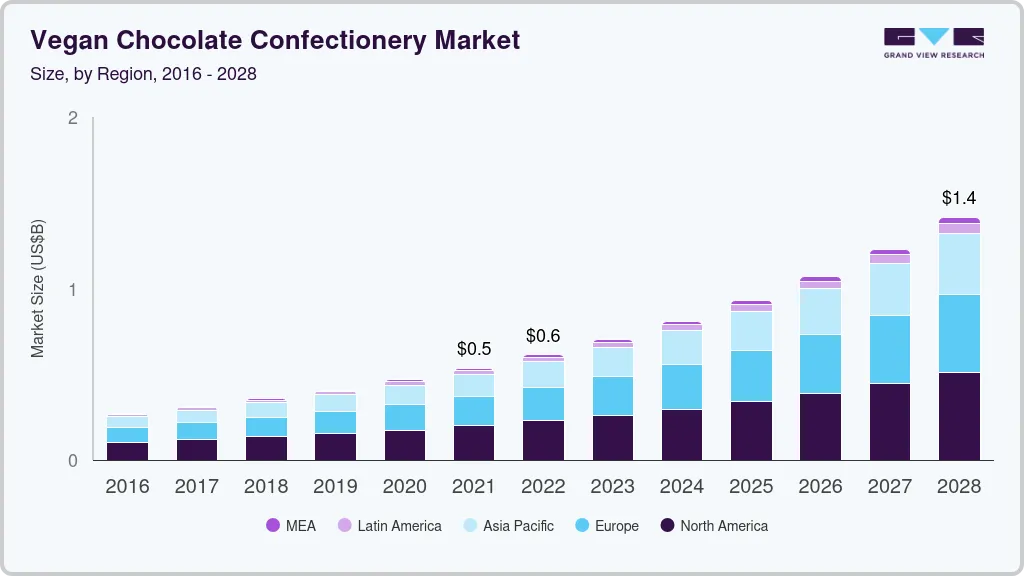

The global vegan chocolate confectionery market size was estimated at 809.7 million in 2024 and is projected to reach USD 1,871.1 million by 2030, growing at a CAGR of 15.0% from 2025 to 2030. The increasing vegan population worldwide and the rising prevalence of lactose intolerance among individuals have created notable growth avenues for manufacturers of vegan chocolate items such as bars, truffles, and chocolate chips.

Key Market Trends & Insights

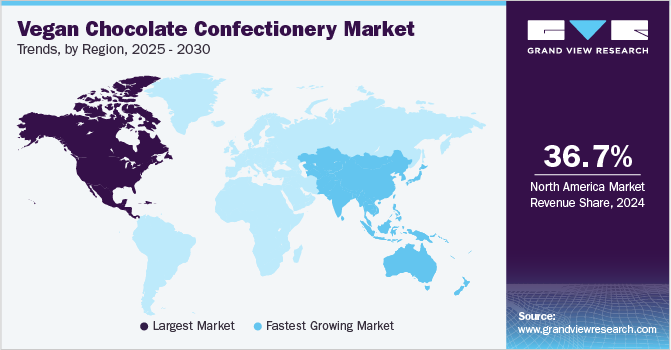

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, the U.S. accounted for a dominant revenue share in the North American in 2024.

- By product, the molded bars segment accounted for the largest revenue share of 42.3% in 2024.

- By type, the milk chocolate segment dominated the market in 2024.

Market Size & Forecast

- 2025 Market Size: USD 809.7 Million

- 2030 Projected Market Size: USD 1,871.1 Million

- CAGR (2025-2030): 15.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Vegan chocolates are often perceived as a healthier alternative to dairy-based chocolates, as they are free from dairy, which has been known to cause digestive issues in some individuals. Furthermore, companies are utilizing omnichannel strategies to improve the visibility of vegan products, creating substantial awareness among consumers regarding this market.With the rising disposable income levels of consumers and the increasing pace of urbanization globally, consumers have started adhering to health- and wellness-based lifestyle practices. A notable aspect of this lifestyle is the consumption of organic and minimally processed ingredients. Vegan chocolate items tend to be made with fewer artificial additives, preservatives, and refined sugars, making them a viable option for this demographic. Many consumers, especially health-conscious individuals, prefer products that have a cleaner label, with natural ingredients and minimal processing. Vegan chocolate is also aligned with various dietary preferences and lifestyles, including plant-based, gluten-free, and low-sugar diets. The growing adoption of low-carb and sugar-free diets has prompted the creation of healthier vegan chocolate options using alternative sweeteners such as stevia or coconut sugar.

Increasing awareness regarding animal cruelty and exploitation that are part of dairy farming activities has compelled many consumers to move towards vegan offerings. According to a report by People for the Ethical Treatment of Animals (PETA), higher milk production in cattle is achieved through techniques such as milking regimens, artificial insemination, and drugs, all of which prove to be harmful to cattle health. Moreover, according to the U.S. Department of Agriculture (USDA), more than 16% of cows used for producing milk suffer from mastitis, which is the inflammation of the udders and is a major cause of fatality in adult cows in the dairy sector. The vegan industry is constantly creating awareness about these issues to encourage consumers to shift to plant-based alternatives. As a result, consumers are increasingly avoiding animal-derived products in the food industry to support cruelty-free options, aiding the expansion of the vegan chocolate confectionery industry.

Earlier, vegan chocolates lacked the creamy texture and rich taste that conventional dairy-based chocolates are known for. However, with technological advancements and improved ingredient quality, such as the incorporation of plant-based milk options (almond, oat, and coconut), vegan chocolates have become more comparable to dairy chocolates in terms of taste and texture, boosting their appeal among a broader audience. With intensifying competition in this market due to the emergence of several regional and local companies, brands are encouraged to increase the frequency and quality of their offerings. For instance, in January 2025, Galaxy, a brand of Mars Incorporated, introduced the Hazelnut Praline vegan chocolate bar across supermarkets in the UK. The gluten-free offering has received certification from The Vegan Society and joins other flavors by the brand in this range, which include Classic, Crumbled Cookie, Salted Caramel, Caramelized Hazelnut, and Smooth Mint, among others.

Product Insights

The molded bars segment accounted for the largest revenue share of 42.3% in the global vegan chocolate confectionery market in 2024. Chocolate bars are the most widely consumed form of chocolate confectionery globally, and this trend extends to their vegan variants. Consumers are increasingly seeking quick, convenient, and healthier snack options that are easy to carry, and vegan chocolate bars cater to this need. Moreover, their widespread availability and recognizable form make them a preferred choice for consumers visiting retail stores, with brands showcasing the nutritive value of these products through high-quality packaging. Companies are collaborating to launch more nutritious and appealing products and boost their positioning in the global market. For instance, in December 2023, Lindt announced its partnership with ChoViva, which manufactures cocoa-free chocolate, to launch the limited edition Soft & Creamy Hazelnut chocolate bar. The product’s inner layer contains cocoa-free chocolate by ChoViva, with the outer layer made from Lindt’s normal dairy-free chocolate.

The chips & bites segment is expected to advance at the fastest CAGR in the global market from 2025 to 2030. These products' high convenience and portability have made them a popular choice among vegan consumers. Moreover, they are considered an easy-to-portion snack compared to traditional chocolate bars. Consumers who want to control their portion sizes generally find these products appealing, especially those who are mindful of their calorie intake or are looking for a quick, smaller snack. They are also considered essential ingredients in many baking recipes, such as cookies, brownies, cakes, and muffins. With the increasing number of individuals adopting vegan and plant-based diets, the demand for vegan chocolate chips in the baking segment has expanded. The segment expansion has been further strengthened by the popularity of home baking, which has encouraged vegan consumers to purchase these products in higher volumes and use them in their preparations.

Type Insights

The milk chocolate segment accounted for a leading revenue share in the vegan chocolate confectionery industry in 2024. The product is made using plant-based alternatives, such as almonds, oats, or coconut milk, and does not contain any dairy ingredients. A significant portion of consumers prefer vegan milk chocolate because it is lactose-free and dairy-free, addressing concerns of those with lactose intolerance, milk allergies, or sensitivities. Manufacturers are introducing constant innovations in this market with new flavor combinations and premium formulations. These confectionery products are available in a variety of flavors, including salted caramel, hazelnut, and fruit-infused versions, among others. Such diverse options cater to changing consumer preferences, making vegan milk chocolate a popular choice for consumers.

The dark chocolate segment is anticipated to grow at the fastest CAGR in the global market during the forecast period. The various health benefits associated with this type of chocolate have resulted in substantial product sales. Dark chocolate, particularly in varieties with a higher cocoa content, is known for its antioxidant properties, which reduce inflammation, improve heart health, and support overall wellness. Growing awareness among consumers regarding the negative health impacts of excessive sugar consumption has led them to seek alternatives with fewer added sugars and more natural ingredients. Companies are accordingly launching products in different forms, such as bars, truffles, and cups, to address customer requirements. In April 2023, Nestlé announced the launch of the Nestlé Toll House Dark Chocolate Plant Based Morsels and Nestlé Toll House Semi-Sweet Plant Based Morsels. The plant-based products, part of the company’s Toll House brand, have been made available in 255-gram bags, and their launch forms a part of the company’s strategy to explore other varieties of vegan chocolate.

Distribution Channel Insights

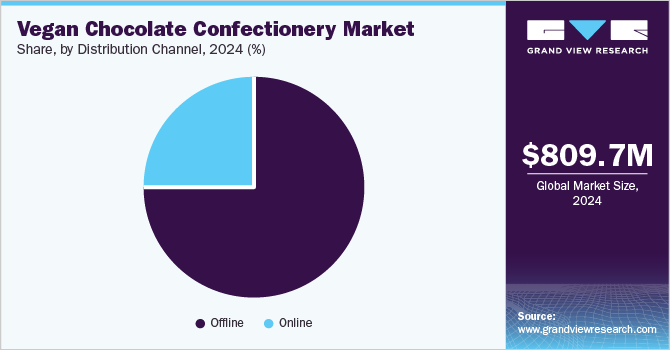

The offline segment accounted for the largest revenue share in the global market for vegan chocolate confectionery in 2024. The rising demand for vegan and plant-based products has resulted in supermarkets and grocery chains increasing the space dedicated to plant-based food items, including vegan chocolate products. Major retailers, such as Whole Foods, Walmart, and Target, have started stocking a wider range of vegan chocolate options in their snack aisles and health food sections. This increased availability makes it easier for consumers to find and purchase vegan chocolate while shopping for other items. Moreover, brands often conduct in-store marketing campaigns, product sampling, and offering discounts to increase the visibility of their products. Such promotions can stimulate impulse purchases and introduce new customers to vegan chocolates.

On the other hand, the online segment is expected to witness the fastest growth in the vegan chocolate confectionery industry from 2025 to 2030. The increasing Internet penetration globally and rising use of smartphones have led to strong sales of vegan confectionery items through online platforms. These platforms provide benefits such as the availability of a wider range of products and attractive discounts to aid brands in boosting visitor traffic to their websites. Moreover, detailed product descriptions, transparency regarding sourcing of ingredients, and the presence of articles and blogs highlighting various ways to incorporate these items in different preparations further enable brands to generate sales.

Regional Insights

The North America vegan chocolate confectionery market accounted for a leading global revenue share of 36.7% in 2024. The steadily growing vegan population in regional economies and the demand for premium-quality and low-sugar confectionery items among consumers has aided market growth. Vegan chocolate is being perceived as a healthier option to conventional chocolates due to the absence of dairy ingredients, which appeals to those who are lactose intolerant, have dairy allergies, or are looking to reduce their overall sugar or fat intake. Moreover, several notable manufacturers of vegan chocolate items in economies such as the U.S. and Canada have led to increased competition in this industry, compelling manufacturers to launch innovative and more nutritional products.

U.S. Vegan Chocolate Confectionery Market Trends

The U.S. accounted for a dominant revenue share in the North American market for vegan chocolate confectionery in 2024. The fast-growing vegan movement in the economy and the promotion of plant-based food products by several notable celebrities and athletes have resulted in the transition of a substantial population toward a vegan lifestyle. This is expected to drive improved sales of vegan chocolate confectioneries in the coming years. The U.S. has a large and steadily expanding population of vegan consumers, with a poll by Gallup published in August 2023 stating that 4% of respondents stated that they followed a vegetarian diet, while 1% claimed to be vegan. A wider range of consumers in the country, including flexitarians, are also increasingly moving toward plant-based diet options. Vegan chocolate confectionery has benefitted from this trend, as many consumers seek alternatives to traditional dairy-based chocolate.

Europe Vegan Chocolate Confectionery Market Trends

Europe accounted for a substantial revenue share in the global market for vegan chocolate confectionery in 2024. Veganism has become an increasingly popular lifestyle among European consumers; for instance, as per a survey by Veganz published in 2022, approximately 3.1% of Germany’s population, equating to around 1.7 million people, identified as vegans. A growing proportion of the regional population prioritizes health and wellness, leading to increased demand for vegan chocolates that are healthier alternatives to traditional dairy-based options. The UK also has seen a rapid growth in its vegan population, according to research conducted by Finder. The data states that around 4.7% of the adult population, amounting to 2.5 million people, followed a plant-based diet in 2024. This represented an increase of 1.1 million people in the vegan demographic between 2023 and 2024, highlighting the positive impact of various campaigns promoting this lifestyle. These factors are expected to shape industry expansion in the economy positively.

Asia Pacific Vegan Chocolate Confectionery Market Trends

The Asia Pacific vegan chocolate confectionery industry is expected to grow at the highest CAGR from 2025 to 2030. The steadily growing regional population and the expanding younger and working professional demographics have led to improved awareness regarding alternative diet patterns, including vegan, keto, and paleo. According to a report by Veganising it, the region leads globally in terms of vegan population with 9%, showcasing the popularity of this diet in economies such as Japan, China, and Australia. Furthermore, the rising prevalence of lactose intolerance aids regional market expansion, with an article by World Population Review stating that this condition affects 70-100% of the East Asian population. Consequently, consumers are demanding food products that provide high nutritional value while avoiding the harms of dairy-based items, making vegan chocolate a notable presence in the plant-based sections of retail and grocery outlets.

China accounted for a leading revenue share in the Asia Pacific market in 2024. Increasing health and wellness concerns among individuals in the economy, coupled with rising awareness regarding animal cruelty in food production, have compelled many Chinese consumers to shift to plant-based diets. As a result, retail stores have significantly increased the availability of vegan products such as beverages, desserts, and confectioneries to cater to this expanding demographic. Moreover, the growing popularity of social media platforms and the presence of several Chinese influencers promoting the benefits of alternative diet patterns have also created a positive perception regarding vegan food items. Several notable international chocolate brands have introduced dairy-free versions of their products in this market to generate sales through the vegan population, while a number of local brands have also emerged in recent years. This has led to increased competition in the market and provided consumers with several choices across both premium and affordable segments.

Key Vegan Chocolate Confectionery Company Insights

Some major companies involved in the global vegan chocolate confectionery industry include Theo Chocolate, Alter Eco, and Mondelēz International, among others.

-

Alter Eco is a sustainability-focused food company headquartered in the U.S., specializing in organic and fair-trade products. The company is known for its chocolate-based offerings, including chocolate bars, truffles, and granola and quinoa products. Alter Eco's chocolate bars are categorized into dark chocolate, vegan, paleo, keto, and gluten-free. Notable vegan chocolate variants include Classic Blackout, Super Blackout, Almond Blackout, Raspberry Blackout, Quinoa Crunch, and Sea Salt.

-

Mondelēz International is a multinational confectionery, food, and beverage company headquartered in Chicago, Illinois. The company is known for a range of brands across categories, such as baked snacks, chocolate, biscuits, beverages, and candy and gum. Under the chocolate segment, notable brands include 5 Star, Alpen Gold, Cadbury, Daim, Hu, Lacta, Milka, and Toblerone. In recent years, Mondelez has expanded to plant-based products, with Cadbury's Plant Bars being launched in the UK in 2021 and expanding to Canada in 2022. Mondelez further acquired Hu Master Holdings in 2021, which develops vegan chocolate options such as Vanilla Crunch Dark Chocolate, Hazelnut Butter Dark Chocolate, and Salty Dark Chocolate.

Key Vegan Chocolate Confectionery Companies:

The following are the leading companies in the vegan chocolate confectionery market. These companies collectively hold the largest market share and dictate industry trends.

- Taza Chocolate

- Alter Eco Foods

- Endangered Species Chocolate

- Equal Exchange

- ENDORFIN FOODS

- Chocoladefabriken Lindt & Sprüngli AG

- Mondelēz International

- Goodio

- No Whey Chocolate

- Montezuma's Chocolate

- RAAKA CHOCOLATE LTD.

- EVOLVED CHOCOLATE

- Theo Chocolate, Inc.

- Rococo Chocolates London Limited

Recent Developments

-

In April 2024, Lindt’s brand LINDOR announced the launch of Lindt LINDOR Dark Chocolate OatMilk Truffles and Lindt LINDOR Non-Dairy OatMilk Truffles, which are plant-based variants of their truffle offerings. The products are part of Lindt’s expanding plant-based product range, following the introduction of Lindt CLASSIC RECIPE Non-Dairy OatMilk Bars in 2022. The new products have been made available through retail stores across the U.S. and the company’s online platform, www.lindtusa.com.

-

In February 2024, Trek One Capital announced that it had acquired Alter Eco Foods, which develops and sells organic dark chocolate bars, truffles, quinoa, and granola. The company markets these products in Canada, the U.S., New Zealand, and Australia, with the primary sales channel being the organic/natural retail outlet. Alter Eco sources its raw materials from farms that leverage regenerative farming, sustainable agriculture, fair trade practices, and agroforestry, with all of the company's products having organic certification. The acquisition is expected to enable Alter Eco to accelerate its growth by leveraging Trek One's operational and financial capabilities.

Vegan Chocolate Confectionery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 930.3 million

Revenue forecast in 2030

USD 1,871.1 million

Growth rate

CAGR of 15.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Belgium; Switzerland; Russia; Netherlands; China; Japan; South Korea; Australia; Brazil; South Africa; Saudi Arabia; Israel

Key companies profiled

Taza Chocolate; Alter Eco Foods; Endangered Species Chocolate; Equal Exchange; ENDORFIN FOODS; Chocoladefabriken Lindt & Sprüngli AG; Mondelēz International; Goodio; No Whey Chocolate; Montezuma's Chocolate; RAAKA CHOCOLATE LTD.; EVOLVED CHOCOLATE; Theo Chocolate, Inc.; Rococo Chocolates London Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Chocolate Confectionery Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vegan chocolate confectionery market report based on product, type, distribution channel, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Boxed

-

Molded Bars

-

Chips & Bites

-

Truffles & Cups

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Dark

-

Milk

-

White

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Sweden

-

Denmark

-

Belgium

-

Switzerland

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

South Korea

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

Saudi Arabia

-

Israel

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.