Vector Database Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Technology (Recommendation Systems), By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-387-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Vector Database Market Size & Trends

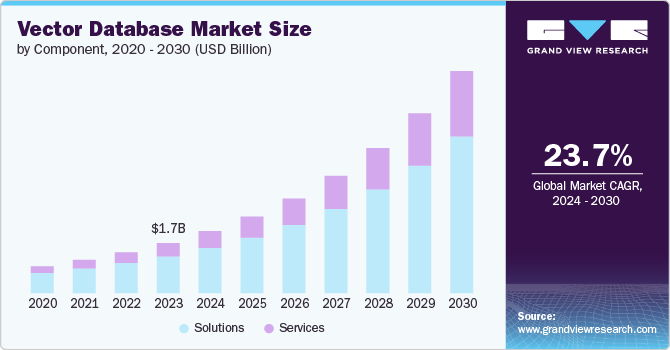

The global vector database market size was estimated at USD 1.66 billion in 2023 and is expected to grow at a CAGR of 23.7% from 2024 to 2030. The growth is attributed to the increasing demand for spatial data analysis across industries, such as transportation, logistics, urban planning, and environmental monitoring. The growth of Geographic Information Systems (GIS) in agriculture, defense, and real estate, alongside advancements in the Internet of Things (IoT) and smart city projects, fuels this demand. In addition, the rising adoption of location-based services and ongoing technological innovations in vector database capabilities enhance performance and scalability, further propelling market growth.

The rising demand for real-time data analytics in applications, such as disaster management, traffic monitoring, and autonomous vehicles, is boosting the market growth. These databases support real-time data processing, enabling timely decision-making. The shift towards cloud computing and the adoption of cloud-based GIS solutions further fuel market growth, offering scalability, flexibility, and cost-effectiveness. Integrating big data analytics with vector databases enhances predictive analytics and data visualization capabilities, providing comprehensive insights. Enhanced data security and compliance features make vector databases suitable for industries with stringent data protection requirements. In addition, the wide usage of mobile mapping systems and drones in sectors, such as agriculture, mining, and construction, drives the need for efficient vector data management solutions.

The expansion of AR and VR applications, reliant on complex spatial data, contributes to the demand for vector databases. Investments in smart infrastructure projects, such as smart grids, transportation, and utilities, emphasize the vital role of vector databases in managing spatial data. The healthcare and life sciences sectors increasingly utilize spatial data for epidemiology, public health monitoring, and medical research, necessitating effective vector data management. The development of user-friendly interfaces and customizable solutions broadens the market reach, making vector databases accessible to users with varying technical expertise. Moreover, the need for effective data sharing and collaboration among organizations and agencies drives the adoption of vector databases, facilitating seamless data exchange and integration.

Component Insights

The solution segment dominated the market by over 73% in 2023. These solutions encompass various functionalities essential for diverse applications, namely vector generation tools for creating and processing data, efficient vector search capabilities, and robust storage & retrieval systems ensuring data integrity and accessibility. Industries, such as transportation, logistics, urban planning, and environmental monitoring, drive demand with their need for advanced spatial data analytics. Continuous technological advancements, including improved algorithms and cloud integration, enhance performance and scalability, while integration with IoT, artificial intelligence (AI), and machine learning (ML) enables data analysis.

The services segment is expected to register a significant growth. Consulting and implementation services are vital in guiding organizations through assessing and deploying suitable vector database solutions, ensuring effective integration into existing IT infrastructures. Training services are essential for educating users on optimal usage, while ongoing support services address technical issues and optimize solution performance. Customization and integration services cater to specific organizational needs, while managed services offer outsourcing options for maintenance and management. Moreover, professional services, including data migration and system upgrades, help maximize the value of vector database investments, supported by advisory services that provide strategic insights for enhancing spatial data management and achieving business goals.

Technology Insights

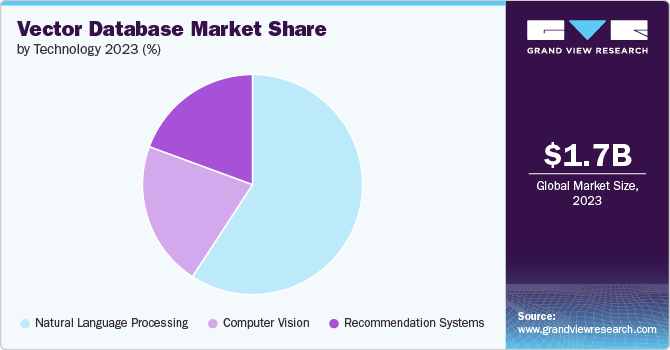

The natural language processing (NLP) segment led the market in 2023, propelled by the increasing demand for efficient textual and semantic analysis. Vector database solutions excel in managing and manipulating vectors representing words, phrases, and documents, which are essential for tasks such as sentiment analysis, language translation, and content recommendation systems within NLP applications. Integration with AI and ML enhances their capability to store and query vector representations efficiently, supporting large-scale training and deployment of NLP models. Advanced indexing and querying capabilities enable vector databases to improve contextual understanding in tasks, such as entity recognition and summarization, essential for industries ranging from healthcare and finance to e-commerce and customer service.

The computer vision segment is witnessing significant growth, driven by the increasing adoption of AI and ML models that rely on vector representations of visual data. Vector database solutions are vital in efficiently storing, retrieving, and manipulating these representations, supporting tasks, such as image recognition, object detection, and video analysis. Real-time processing capabilities provided by vector databases enable quick analysis and interpretation of visual data, which is essential for applications across industries, such as automotive, retail, healthcare, and security. Scalability features accommodate the growing volume of digital images and videos, while integration with IoT devices facilitates centralized management and analysis of data from distributed sensors.

Vertical Insights

The IT & ITeS segment accounted for the largest revenue share in 2023 driven by its extensive use of data-intensive applications. These applications necessitate efficient management and analysis of large datasets, tasks that vector database solutions excel in by offering robust capabilities for storing, querying, and processing complex data structures. Key applications include supporting enterprise IT infrastructure with scalable solutions for managing structured and unstructured data, facilitating application development and testing processes, and enhancing capabilities in cloud computing and big data analytics. As organizations within the IT & ITeS sector continue to prioritize digital transformation initiatives, vector database solutions provide essential infrastructure for managing and analyzing data from advanced technologies, such as AI, ML, and IoT.

The retail & e-commerce segment is expected to register the fastest CAGR from 2024 to 2030. Vector database solutions are essential in enabling personalized customer experiences through advanced data analytics, allowing retailers and e-commerce platforms to efficiently store, analyze, and utilize customer data for personalized recommendations and promotions. These solutions also support optimized inventory management by facilitating real-time tracking, demand forecasting, and supply chain optimization, improving operational efficiency and reducing costs. Integration with computer vision technologies enhances visual search capabilities and product recommendation systems, enhancing the shopping experience. In addition, vector database solutions aid in omni-channel integration, enabling centralized data management across online and offline channels for consistent customer engagement.

Regional Insights

The North America vector database market represented a significant market share of over 38.0% in 2023, driven by its early adoption of advanced technologies across diverse industries, such as IT, healthcare, finance, and retail. The region’s initiative towards technological advancements fuels the demand for data management solutions, such as vector databases. With a strong presence of major tech companies specializing in cloud computing, AI, and big data analytics, North America fosters innovation and investment in technologies that rely on efficient data storage, retrieval, and analysis provided by vector database solutions. The e-commerce and retail sectors in the region also benefit extensively from these solutions, utilizing them to optimize inventory management, enhance customer experiences through personalized recommendations, and improve overall operational efficiency.

U.S. Vector Database Market Trends

The vector database market in the U.S. is poised for substantial growth. These include the increasing adoption of AI and ML technologies across industries, necessitating efficient data management solutions, such as vector databases, for large-scale data storage and analysis. Furthermore, the rise of IoT and sensor data adds to this growth, with vector databases supporting the management of vast amounts of real-time data generated by IoT devices across smart cities, logistics, and healthcare monitoring applications.

Europe Vector Database Market Trends

The Europe vector database market is gaining significant traction, driven by the implementation of smart city initiatives that rely heavily on managing IoT-generated spatial data for applications, such as traffic and waste management. In addition, initiatives promoting cross-border collaboration within the European Union fuel the demand for vector databases to ensure seamless integration and interoperability of spatial data across various sectors, including transportation, agriculture, and urban planning.

Asia Pacific Vector Database Market Trends

The vector database market in Asia Pacific is poised for substantial growth. The region’s rapid expansion in e-commerce and digital payments is leveraging vector databases to manage extensive transactional and customer data, enable personalized marketing, and enhance supply chain efficiency. Smart city initiatives across many Asia Pacific cities also drive the market, utilizing vector databases to optimize urban infrastructure and improve services through data-driven decision-making.

Key Vector Database Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives are vital for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in June 2024, Elasticsearch B.V., the Search AI Company, launched a partner integration package with LangChain, Inc. to simplify importing Elasticsearch B.V.'s vector database and retrieval capabilities into LangChain, Inc. applications. This collaboration empowers developers to leverage common retrieval strategies, enhancing context, relevancy, and accuracy in their application builds.

Key Vector Database Companies:

The following are the leading companies in the vector database market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Cloud

- Elasticsearch B.V.

- Google LLC

- Microsoft

- Milvus.

- MongoDB, Inc.

- Pinecone Systems, Inc.

- Redis Inc.

- SingleStore, Inc.

- Zilliz

Recent Developments

-

In June 2024, Salesforce, Inc. announced the general availability of the Data Cloud Vector Database, designed to help businesses unify and leverage the 90% of customer data trapped in unstructured formats, such as PDFs, emails, and transcripts. This innovation enables businesses to cost-effectively deliver transformative and integrated customer experiences across service, sales, marketing, AI, automation, and analytics

-

In June 2024, Oracle launched HeatWave GenAI, the first in-database large language model, scale-out vector processing, automated in-database vector store, and contextual natural language conversations informed by unstructured content. These capabilities let customers apply generative AI to enterprise data without moving data to a separate vector database or needing AI expertise

-

In April 2024, Vultr partnered with Qdrant, an advanced vector database technology provider, through their Cloud Alliance program to enhance cloud infrastructure and support the growing AI ecosystem. This collaboration combines Qdrant's innovative technology with Vultr's global platform, offering seamless scalability and performance for vector search workloads

Vector Database Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.05 billion |

|

Revenue forecast in 2030 |

USD 7.34 billion |

|

Growth rate |

CAGR of 23.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

Alibaba Cloud; Elasticsearch B.V.; Google LLC; Microsoft; Milvus.; MongoDB, Inc.; Pinecone Systems, Inc.; Redis Inc.; SingleStore, Inc.; Zilliz |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Vector Database Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the vector database market report based on component, technology, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Vector Generation

-

Vector Search

-

Storage & Retrieval Vectors

-

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Natural Language Processing

-

Computer Vision

-

Recommendation Systems

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Retail & E-commerce

-

Healthcare & Life Sciences

-

IT & ITeS

-

Media & Entertainment

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global vector database market size was estimated at USD 1.66 billion in 2023 and is expected to reach USD 2.05 billion in 2024.

b. The global vector database market is expected to grow at a compound annual growth rate of 23.7% from 2024 to 2030 to reach USD 7.34 billion by 2030.

b. North America dominated the market in 2023, accounting for over 38% share of the global revenue, driven by its early adoption of advanced technologies across diverse industries such as IT, healthcare, finance, and retail.

b. Some key players operating in the vector database market include Alibaba Cloud; Elasticsearch B.V.; Google LLC; Microsoft; Milvus.; MongoDB, Inc.; Pinecone Systems, Inc.; Redis Inc.; SingleStore, Inc.; and Zilliz.

b. Key factors driving the vector database market growth include the rise of generative AI and Large Language Models (LLMs) and rising demand for real-time insights and recommendations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."