- Home

- »

- Medical Devices

- »

-

Varicose Veins Treatment Market Size & Share Report, 2030GVR Report cover

![Varicose Veins Treatment Market Size, Share & Trends Report]()

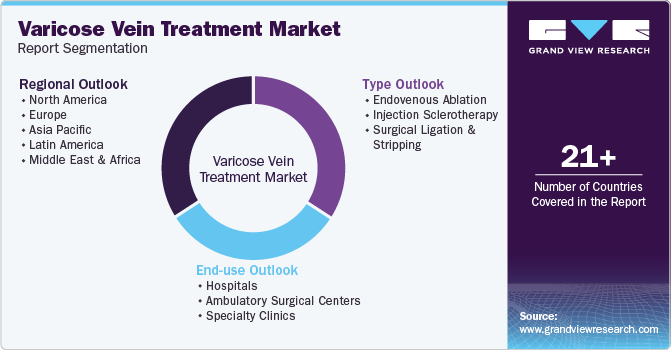

Varicose Veins Treatment Market Size, Share & Trends Analysis Report By Type (Endovenous Ablation, Injection Sclerotherapy), By End-use (Specialty Clinics, Ambulatory Surgical Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-963-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2020 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Varicose Veins Treatment Market Size

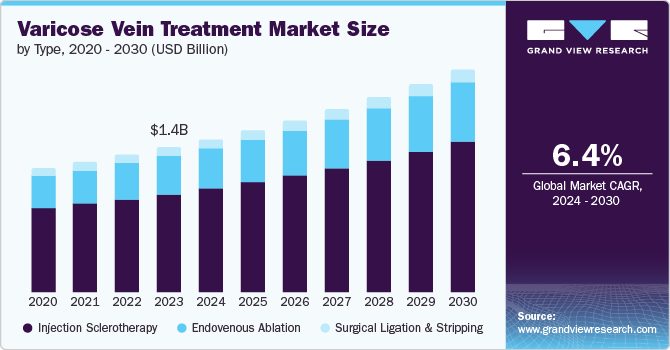

The global varicose veins treatment market size was estimated at USD 1.35 billion in 2023, and is projected to grow at a CAGR of 6.4% from 2024 to 2030.The varicose vein treatment market has experienced substantial growth on a global scale. This growth can be attributed to the increasing prevalence of varicose veins, the growing demand for more effective treatment options, heightened awareness of the condition, and the rising healthcare expenditure.

The global prevalence of varicose veins is rising due to increasing sedentary lifestyles. As a result, advanced treatment methods such as endovenous ablation and ultrasound-guided injection sclerotherapy are becoming more popular compared to traditional surgery. These procedures offer several benefits, such as reduced pain, fewer complications, and faster recovery. To address the treatment of varicose veins, manufacturers are developing innovative procedures that minimize complications.

Furthermore, technological advancements in varicose vein treatment have led to greater adoption of minimally invasive procedures, which are also a significant driving force in the market for varicose veins. For instance, in June 2024, to create a state-of-the-art center of excellence for minimally invasive laser, Swift Day Surgery partnered with Reem Hospital in Abu Dhabi. This center was expected to offer advanced laser proctology services to citizens and expatriates in Abu Dhabi and nearby areas.

In addition, the market is poised for substantial expansion owing to the increasing geriatric population. According to the World Population Prospects 2019, the global count of individuals aged 65 and older reached 703 million, expected to double to 1.5 billion by 2050. It is important to highlight that varicose veins are more prevalent among older adults and women.

Varicose veins can be unattractive from an aesthetic standpoint. However, they only become troublesome if they result in pain, aching, swelling, or significant discomfort. In more severe instances, they may even rupture and give rise to ulcers. Fortunately, the treatment options for this condition have advanced in recent years. Many private healthcare providers now offer enhanced minimally invasive techniques. For instance, ambulatory phlebectomy involves removing varicose veins through small skin punctures. A local anesthetic is applied, and the vein is extracted using a thin metal hook. The procedure, which takes 30 minutes to an hour, typically causes minimal discomfort with temporary bruising or swelling, and any scarring is usually faint within a year. It is sometimes performed alongside an ablation.

Type Insights

Injection sclerotherapy dominated the market and accounted for a share of 68.5% in 2023.This is attributed to the rising prevalence of varicose veins due to aging populations and sedentary lifestyles, increasing demand for minimally invasive procedures, advancements in sclerosing agents, improved patient outcomes, and growing awareness about aesthetic benefits and treatment options.

The endovenous ablation segment is expected to grow at the fastest CAGR over the forecast period. The growth is attributed to the growing numbers of individuals affected by varicose veins, attributed to lifestyle shifts, an aging population, obesity, and extended periods of standing or sitting. Moreover, heightened awareness of venous disorders is prompting increased diagnoses and treatment rates, further driving demand for these minimally invasive procedures. According to the MDPI Journal, varicose veins, affecting 10% to 30% of the global population, are characterized by bulging, swollen blood vessels typically found on the legs and feet. These veins, which can also appear in other areas of the body, are identified by their blue or dark purple color and often have a visibly lumpy or swollen appearance. Varicose veins represent one of the most common peripheral vascular conditions worldwide.

Vein ligation and stripping surgery carries certain risks, including the possibility of scarring and the recurrence of varicose veins. In addition, if the deep vein system is harmed during the procedure, it could exacerbate issues with blood flow in the veins. Nerve damage may result in numbness lasting for several months. Due to these concerns, varicose vein stripping is often replaced by endovenous laser or radiofrequency ablation.

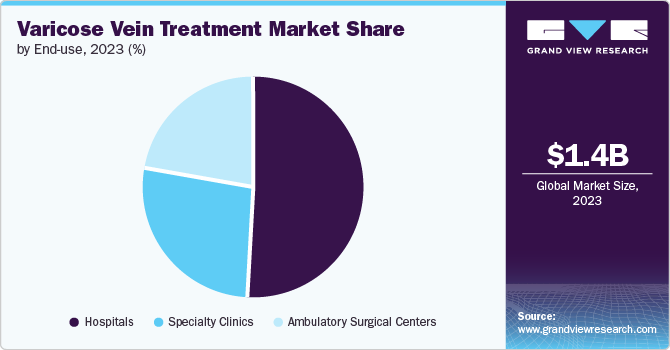

End-use Insights

In 2023, the hospital segment dominated the market, this trend is expected to continue during the forecast period of 2024-2030. A comprehensive approach involving multiple medical specialties, including vascular surgery, interventional radiology, dermatology, and cardiology, may be required for the treatment of varicose veins. Due to their diverse range of medical departments and specialists, hospitals are well-equipped to offer coordinated care for individuals with varicose veins. Hospitals are at the forefront of identifying innovative ways to enhance healthcare delivery.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR over the forecast period. Due to several driving factors, ambulatory surgical centers (ASCs) play a significant role in the varicose veins treatment market. These include the rising prevalence of varicose veins globally, driven by factors such as lifestyle changes, aging populations, and increasing rates of obesity. ASCs offer advantages such as convenience, cost-effectiveness, and efficiency in providing minimally invasive procedures such as endovenous ablation. In addition, growing patient preference for outpatient settings and advancements in technology and techniques that support safe and effective treatments in ASCs further boost their prominence in the varicose veins treatment market. For instance, in January 2024, Baptist Health and Compass Surgical Partners partnered to establish Horizon Surgery Center, a network of Ambulatory Surgical Centers in Northeast Florida. They plan to open multiple facilities by renovating existing Baptist sites and acquiring new ones. The first Horizon Surgery Center will provide orthopedic, neurosurgery, plastic, and general surgery services.

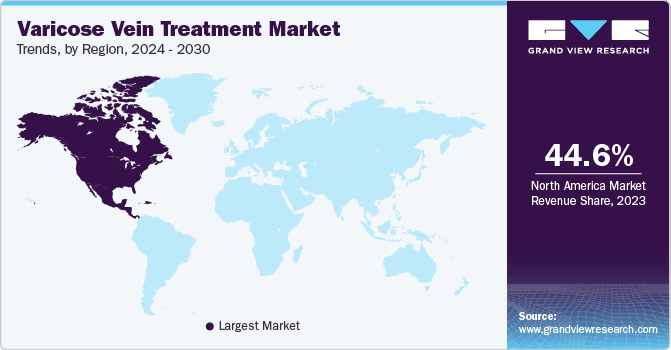

Regional Insights

In 2023, North America dominated the varicose veins treatment market with 44.6% revenue share. This can be attributed to the region's substantial patient population, known for their keen aesthetic awareness. The evident outcomes and safety associated with cosmetic procedures have instilled confidence in individuals, motivating them to opt for such treatments. For instance, over 40 million people in the U.S. suffer from varicose veins, with nearly 50% having a family history of the condition. If both parents have varicose veins, there's a 90% likelihood of developing the disease; with one parent affected, the risk is 60% for daughters and 25% for sons. The condition is more prevalent in women (55%) than men (45%), and it was estimated that 41% of women and 50% of the overall population over 50 have varicose veins.

U.S. Varicose Veins Treatment Market Trends

The varicose veins treatment market in the U.S. dominated the market with a share of 89.1% in 2023 due to the increasing prevalence of varicose veins, the presence of a well-established healthcare system, and the accessibility of advanced medicals.

Asia Pacific Varicose Veins Treatment Market Trends

The Asia Pacific region held a substantial market share in the global market in 2023 and is anticipated to be the fastest-growing region, with a compounded annual growth rate of 7.8%. This growth can be attributed to various factors such as the rising prevalence of varicose veins, increased government spending on healthcare, a significant elderly population, higher disposable income, and a growing awareness of related procedures. According to a WTW survey, healthcare benefit cost increases in the Asia-Pacific (APAC) region were projected to remain around 9.9% in 2024, similar to 2023's forecast. The Global Medical Trends Survey indicated that 59% of Asia Pacific insurers expected higher increases over the next three years. In 2022, medical care costs in region rose by 7.2%, with the 2023 projection being lower than the global average of 10.7%, but both Asia Pacific and global forecasts for 2024 were aligned at 9.9%.

China possesses significant potential to contribute to the varicose vein treatments market due to its sizable elderly population, and the government is actively increasing awareness campaigns for these treatments. For instance, the United Nations projected that in 2050, there would be 366 million older Chinese adults, surpassing the current U.S. population of 331 million. By then, the proportion of Chinese adults aged 65 and older was expected to rise from 12% to 26%. This rapid aging, due to declines in fertility and mortality, raised concerns about the health and well-being of older adults in China and posed significant challenges for the healthcare system.

Key Varicose Veins Treatment Company Insights

Key strategies for major players to enhance their market position include product launches, mergers and acquisitions, and investments in R&D for portfolio expansion. In the global market for varicose veins treatment, there exists a competitive landscape where numerous players strive to gain a significant market share. These participants include manufacturers, healthcare providers, research institutions, and other stakeholders involved in the development, production, and distribution of varicose veins treatment solutions.

Key Varicose Veins Treatment Companies:

The following are the leading companies in the varicose veins treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Lumenis Be Ltd.

- AngioDynamics

- Sciton

- Quanta System

- intros Medical Laser GmbH

- Alma lasers

- Dornier MedTech

- Theraclion

Recent Developments

-

In June 2024, Doctors have begun using a new stent by Koninklijke Philips N.V.called the Duo. The FDA approves this stent to help patients with chronic vein problems (CVI) that cause blood flow blockage.

-

In January 2024, to distribute VVT Medical’s ScleroSafe platform for treating varicose veins in the U.S., VVT Med Ltd. (VVT Medical) completed the strategic distribution partnership with Methapharm Inc.

-

In June 2023, Theraclion obtained approval from the U.S. FDA to initiate a new crucial clinical study to evaluate the effectiveness of Sonovein in treating primary insufficiency of great saphenous veins.

Varicose Veins Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.43 billion

Revenue forecast in 2030

USD 2.08 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2020 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia, South Korea; Thailand; Brazil; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Lumenis Be Ltd.; AngioDynamics; Sciton; Quanta System; intros Medical Laser GmbH; Alma lasers; Dornier MedTech; Theraclion

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Varicose Veins Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020-2030.For this study, Grand View Research has segmented the global varicose veins treatment market into type, end-use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Endovenous Ablation

-

Endovenous Laser Therapy

-

Radiofrequency Ablation

-

-

Injection Sclerotherapy

-

Surgical Ligation & Stripping

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."