Variable Speed Generator Market Size, Share & Trends Analysis Report By Generator, By Technology (Mechanical, Power Electronics), By Prime Mover, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-353-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Variable Speed Generator Market Trends

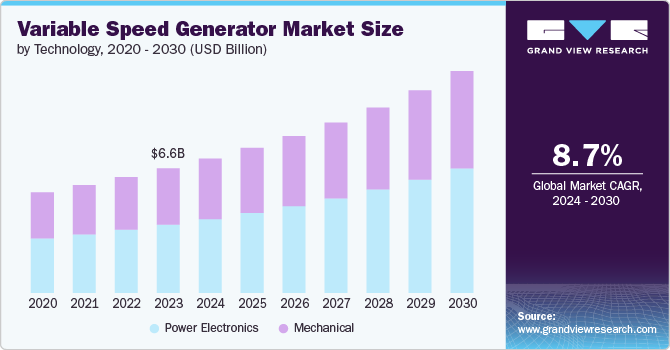

The global variable speed generator market size was estimated at USD 6.65 billion in 2023 and is expected to expand at a CAGR of 8.7% from 2024 to 2030. Increasing energy demands and a growing reliance on imported fossil fuels have driven advancements in the market. This cutting-edge technology is tailored for prime movers with highly variable power requirements. These advanced generators offer a reliable and efficient energy solution by maintaining constant frequency and voltage. This innovation is particularly advantageous for industries with unpredictable and rapidly changing energy needs. The ability to seamlessly adapt to fluctuating power demands ensures operational efficiency and cost savings.

The market is witnessing significant technological advancements. Innovations in power electronics and digital control systems are driving the development of more efficient and adaptable generators. Modern variable speed generators can now seamlessly adjust to fluctuating power demands while maintaining consistent frequency and voltage levels. Additionally, advancements in materials and design are enhancing the durability and performance of these generators, making them more suitable for a wider range of prime movers, from industrial machinery to renewable energy systems.

The rise in renewable energy projects presents substantial new opportunities for the variable speed generator market. As wind and solar power generation inherently involve variable outputs, the need for generators that can efficiently handle these fluctuations is growing. Moreover, the increasing adoption of smart grid technologies is creating a demand for advanced generators that can integrate seamlessly into these systems, offering real-time responses to energy demand changes. Emerging markets, particularly in regions with unstable power supplies, also offer significant growth potential for companies specializing in variable speed generators.

In addition, the regulatory environment for variable speed generators is evolving to support greater energy efficiency and environmental sustainability. Governments worldwide are implementing stricter emissions standards and encouraging the adoption of cleaner technologies. In many regions, incentives and subsidies are available for businesses that invest in energy-efficient equipment, including variable speed generators. However, compliance with these regulations can be challenging, as it often requires significant modifications to existing systems and processes. Staying abreast of regulatory changes and ensuring compliance will be crucial for companies operating in this market.

In spite of the favorable trends, the variable speed generator market faces several restraints. High initial costs and complex installation processes can be barriers to adoption, particularly for small and medium-sized enterprises. Additionally, the technology requires skilled personnel for maintenance and operation, which can be a challenge in regions with limited technical expertise. The reliance on advanced materials and components also makes the supply chain vulnerable to disruptions, potentially affecting the availability and cost of these generators.

Generator Insights

The doubly fed induction generator (DFIG) segment held the largest revenue share of 36.3% in 2023. The segmental growth can be attributed to the rapid technological advancements. DFIGs are designed to operate with variable speed, allowing them to maintain optimal performance despite fluctuations in input power. This capability makes them particularly suitable for renewable energy sources, where power generation can be highly variable. The increasing emphasis on renewable energy sources presents significant growth opportunities for the DFIG segment. Wind power, in particular, benefits greatly from the capabilities of DFIGs, as these generators are designed to handle variable speeds and power outputs typical of wind turbines.

The variable speed self-excited induction generator (SEIG) segment is expected to grow significantly from 2024 to 2030. The segment is witnessing new opportunities due to the growing demand for decentralized power generation and the expansion of microgrid projects. SEIGs are particularly well-suited for renewable energy prime movers, such as small hydro and wind power systems, where the ability to operate independently of a central grid is advantageous. In addition, innovations in control algorithms and power electronics are enabling SEIGs to operate more efficiently under varying load conditions, which in turn is increasing its adoption.

Technology Insights

The power electronics segment held the largest revenue share in 2023. Power electronics-based variable speed generators utilize sophisticated electronic systems to control the speed and output of the generator. These systems include components such as inverters, converters, and digital controllers, which manage the electrical power conversion and regulation. A key advantage of power electronics-based generators is their ability to operate efficiently over a wide range of speeds, making them highly adaptable to varying load conditions and input sources, such as renewable energy sources such as wind and solar power.

The mechanical segment is expected to grow from 2024 to 2030. Mechanical-based variable speed generators rely on mechanical components and systems to regulate the speed and output of the generator. These systems typically involve advanced mechanical designs such as variable pitch blades, gearboxes, and couplings that adjust the generator's speed according to the load and input conditions. Mechanical-based generators are often used in applications where robustness and simplicity are prioritized, such as in industrial machinery and traditional power generation.

Prime Mover Insights

The steam and gas turbine segment dominated the market in 2023 and is predicted to grow significantly from 2024 to 2030. The demand for these generators is primarily driven by the need for reliable and efficient power generation in large-scale industrial and utility applications. These generators are widely used in power plants, industrial facilities, and energy-intensive processes due to their ability to produce large amounts of electricity and their suitability for continuous operation.

The Internal Combustion Engine (ICE) segment is expected to grow at the fastest growth rate from 2024 to 2030. ICE-based generators are crucial for providing backup power during grid outages and emergencies. Hospitals, data centers, commercial buildings, and critical infrastructure rely on these generators for uninterrupted power supply. The increasing frequency of extreme weather events and natural disasters is also boosting the demand for reliable backup power solutions. The shift towards decentralized power generation and the growing adoption of distributed energy resources (DERs) are supporting the demand for ICE-based variable speed generators. These generators are used in microgrids, combined heat and power (CHP) systems, and hybrid renewable energy setups to provide flexibility and stability.

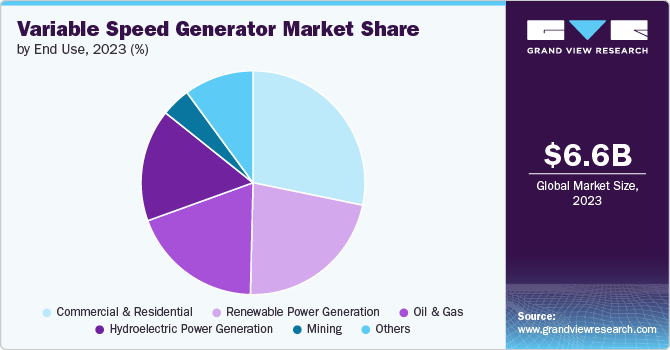

End Use Insights

The commercial & residential segment dominated the market in 2023 and is predicted to grow at the highest CAGR from 2024 to 2030. The demand for variable speed generators (VSGs) in both commercial and residential sectors is witnessing a significant surge, driven by Enhanced Power Quality and Reliability. In commercial use cases, power quality is crucial for the smooth operation of sensitive equipment such as computers, servers, and medical devices. Variable speed generators provide stable voltage and frequency, reducing the risk of power surges or drops that could damage equipment or disrupt operations. Residential users also benefit from this reliability, especially in areas prone to power outages or fluctuations.

The hydroelectric power generation segment is expected to grow substantially from 2024 to 2030. As the global emphasis on renewable energy sources intensifies, hydroelectric power, a major contributor to renewable energy portfolios, is receiving renewed attention. Variable Speed Generators (VSG) play a crucial role in optimizing the efficiency of hydroelectric plants, thereby making renewable energy sources more viable and competitive against fossil fuels. Hence, the hydroelectric power generation sector is increasingly adopting VSGs due to their numerous advantages over traditional fixed-speed generators.

Regional Insights

North America variable speed generator market is witnessing growth owing to the growing demand for reliable backup power solutions and microgrids, particularly in response to the increasing frequency of extreme weather events and grid vulnerabilities. Variable speed generators are essential components in these systems, providing stable and efficient power during outages and enhancing the resilience of local power grids. The need for reliable backup power and resilient microgrid solutions is increasing the demand for variable speed generators in North America.

U.S. Variable Speed Generator Market Trends

The U.S. variable speed generator market is driven by the growing emphasis on alternative energy production, increasing government regulations on energy efficiency, and rapid urbanization and industrialization. This growth is further supported by the increasing demand for efficient power generation in renewable energy sectors such as wind and solar power, which are anticipated to contribute significantly to the country's market growth. Additionally, the robust growth of the wind power sector, with new capacity additions, is expected to present lucrative growth opportunities for variable speed generator manufacturers in the U.S.

Asia Pacific Variable Speed Generator Market Trends

The Asia Pacific variable speed generator market dominated the global market and accounted for 35.4 % in 2023. The regional market is witnessing significant growth in renewable energy projects, particularly in wind and solar power. Countries such as India, Japan, and South Korea are investing heavily in renewable energy infrastructure to reduce their reliance on fossil fuels and meet their carbon reduction goals. Variable speed generators are crucial in these applications as they provide the necessary flexibility and efficiency to integrate intermittent renewable energy sources into the grid. Thus, growth in renewable energy projects is driving the demand for variable speed generators to integrate wind and solar power efficiently.

The variable speed generator market in China is driven by industrial modernization and efficiency initiatives. These initiatives are driving the adoption of VSGs in various Chinese industries. China is focusing on modernizing its industrial sector to improve energy efficiency and reduce emissions. Variable speed generators are being adopted in manufacturing, mining, and other heavy industries to optimize power usage and enhance productivity. The push for smart manufacturing and the adoption of Industry 4.0 technologies are further driving the demand for advanced power solutions like variable speed generators.

Europe Variable Speed Generator Market Trends

The variable speed generator market in Europe is expected to witness growth owing to decarbonization and energy efficiency goals in the region. These goals are pushing the adoption of variable speed generators to enhance overall system efficiency and reduce emissions. Europe is at the forefront of the global decarbonization movement, with stringent regulations and ambitious targets for reducing greenhouse gas emissions. The European Green Deal and various national policies are driving the adoption of energy-efficient technologies, including variable speed generators, in both renewable energy projects and traditional power generation to improve overall system efficiency.

Key Variable Speed Generator Company Insights

Key players operating in the market are focusing on various strategic initiatives, including geographic expansion, new product development, and partnerships & collaborations to achieve a competitive advantage over their competitors.

In March 2023, Cummins Inc. and Danfoss Power Solutions' Editron division signed an MOU to collaborate on developing a hybrid marine solution for the maritime industry. The collaboration aimed to create a set of standard solutions for marine propulsion, focusing on the next generation of variable speed diesel generator sets, energy storage systems, and fuel cells.

Key Variable Speed Generator Companies:

The following are the leading companies in the variable speed generator market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar Inc.

- Aksa Power Generation

- Cummins Inc.

- Mitsubishi Electric Power Products, Inc.

- General Electric Company

- Kirloskar Oil Engines Limited

- ABB Ltd.

- Generac Power Systems

- Innovus Power Inc.

Variable Speed Generator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.18 billion |

|

Revenue forecast in 2030 |

USD 11.86 billion |

|

Growth rate |

CAGR of 8.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Generator, technology, prime mover, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Caterpillar Inc.; Aksa Power Generation; Cooper Corporation Pvt Ltd.; Cummins Inc.; Mitsubishi Electric Power Products, Inc.; General Electric Company; Kirloskar Oil Engines Limited; ABB Ltd.; Generac Power Systems; Innovus Power Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Variable Speed Generator Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global variable speed generator market based on generator, technology, prime mover, end use, and region.

-

Generator Outlook (Revenue, USD Million, 2018 - 2030)

-

Variable Speed Self exited Induction Generator

-

Doubly Fed Induction Generator

-

Permanent Magnet Synchronous Generator

-

Wound Rotor Induction Generator

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical

-

Power Electronics

-

-

Prime Mover Outlook (Revenue, USD Million, 2018 - 2030)

-

Wind Turbine

-

Hydro Turbine

-

Steam and Gas Turbine

-

Internal Combustion Engine

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Renewable Power Generation

-

Hydroelectric Power Generation

-

Oil & Gas

-

Mining

-

Commercial & Residential

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global variable speed generator market size was estimated at USD 6.65 billion in 2023 and is expected to reach USD 7.18 billion in 2024.

b. The global variable speed generator market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 11.86 billion by 2030.

b. Asia Pacific dominated the variable speed generator market with a share of 35.4% in 2022. The growth in renewable energy projects is driving the demand for variable speed generators in Asia Pacific to integrate wind and solar power efficiently.

b. Some key players operating in the variable speed generator market include Caterpillar Inc., Aksa Power Generation, Cooper Corporation Pvt Ltd., Cummins Inc., Mitsubishi Electric Power Products, Inc., General Electric Company, Kirloskar Oil Engines Limited, ABB Ltd., Generac Power Systems, and Innovus Power Inc.

b. Key factors that are driving the variable speed generator market growth include increasing demand for energy efficiency and rising adoption of renewable energy sources.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."