- Home

- »

- Medical Devices

- »

-

Vagus Nerve Stimulation Market Size & Share Report, 2030GVR Report cover

![Vagus Nerve Stimulation Market Size, Share & Trends Report]()

Vagus Nerve Stimulation Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Implantable, External), By Application (Depression, Epilepsy, Migraine), By Biomaterial (Metallic, Ceramics), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-004-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vagus Nerve Stimulation Market Summary

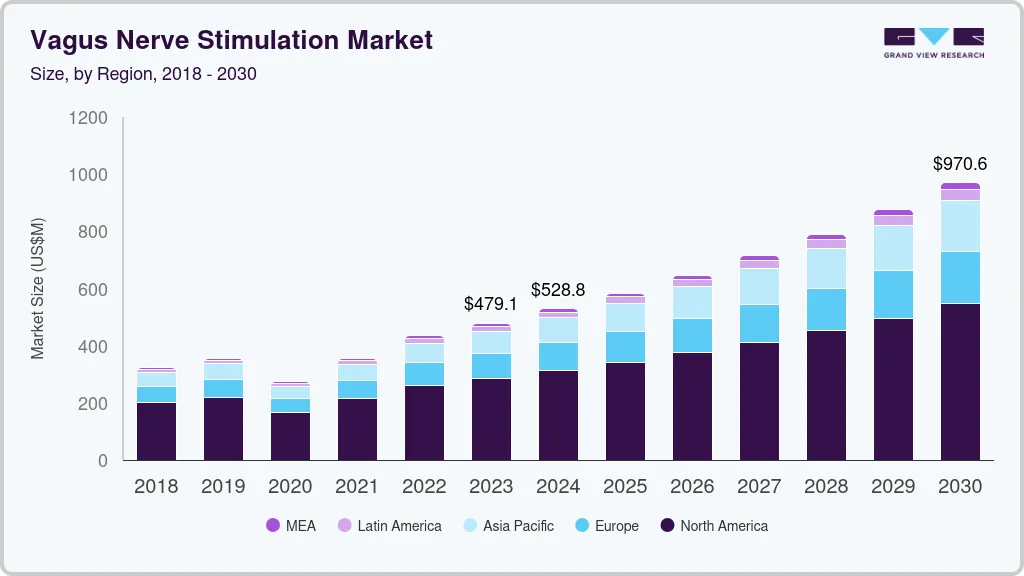

The global vagus nerve stimulation market size was estimated at USD 434.40 million in 2022 and is projected to reach USD 970.6 million by 2030, growing at a CAGR of 10.61% from 2023 to 2030. Some of the key factors driving the market growth include the rising geriatric population, the introduction of technologically advanced products, escalating product demand as an add-on therapy, an increasing incidence of chronic diseases such as migraine and epilepsy, and the presence of highly unmet medical needs in these disease segments.

Key Market Trends & Insights

- North America dominated the vagus nerve stimulation market with a share of 59.92% in 2022.

- By product, the implantable VNS device segment dominated the market with a revenue share of over 59.0% in 2022.

- By biomaterial, the metallic biomaterials segment dominated the market with a revenue share of over 49.0% in 2022.

- By application, the epilepsy segment is dominating the market as of 2022 with a 58.25% revenue share.

Market Size & Forecast

- 2022 Market Size: USD 434.40 Million

- 2030 Projected Market Size: USD 970.6 Million

- CAGR (2024-2030): 10.61%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Also, the rising prevalence of neurological and lifestyle-related disorders, external funding for R&D, and demand for minimally invasive surgeries are other factors propelling the vagus nerve stimulation (VNS) industry growth. Vagus nerve stimulation devices are used for the treatment of chronic conditions, such as epilepsy and depression, which involves stimulation of the vagus nerve with electrical impulses. VNS consists of two major components: a vagus pacemaker and an electrode.Epilepsy is a chronic disease, and most epileptic patients use medications and dietary restrictions to control their seizures. However, in about 30% of the cases, medications fail to curb the seizures, thereby driving patients to resort to treatment via a VNS device. The use of a VNS device reduces the occurrence of epileptic seizures by 50%. The high efficacy exhibited by these devices in treating epilepsy, as well as their application in the treatment of diseases such as chronic depression, are major factors expected to drive the market over the next 6 years.

The outbreak of COVID-19 in 2020 negatively impacted the market for vagus nerve stimulation by directly affecting demand & production, creating a disruption in the supply chain and increasing the financial burden on firms. To reduce the spread of the coronavirus, brain surgeries were frequently postponed or even canceled in this timeframe. In worst-affected nations such as the U.S., Russia, India, Brazil, France, the UK, Italy, and Spain, neurosurgical operations fell by 55%.

Manufacturers have found it difficult to serve their surgeon customers since some hospitals have restricted access to their facilities or changed access regulations. As a result, they saw a decrease in procedural volumes in 2020, which is expected to stifle market growth. However, globally increased activities in tele-consultancy for follow-ups and routine check-ups to address the symptoms of epilepsy patients during the pandemic are playing a key role in improving market growth. Thus, such trends are expected to have a significant impact on the adoption of VNS devices in the upcoming years.

Moreover, patients who recovered from COVID-19 have subsequently shown neurologic symptoms, which is expected to create a favorable environment for market growth in the near future. For instance, as per a Lancet study, 1 in 3 COVID-19 patients who recovered have shown neurological and mental health disorders such as strokes, depression, cognitive and memory problems, anxiety, and migraine headaches.

Additionally, according to a comprehensive analysis of federal health data by researchers at Washington University School of Medicine, the post-COVID brain is associated with movement disorders, from tremors and involuntary muscle contractions to epileptic seizures, hearing and vision abnormalities, and balance and coordination difficulties, as well as other symptoms. Such instances will surge the demand for VNS devices during the forecast period.

The increasing prevalence of neurological disorders such as epilepsy, depression, and migraine, as well as the rising adoption of minimally invasive neurosurgical procedures, are the key growth drivers for the global market for vagus nerve stimulation. According to the WHO, neurological diseases contribute 6.3% to the global disease burden and are one of the major causes of mortality worldwide, resulting in 13.2% of deaths in developed countries and 16.8% in low- and middle-income countries.

High mortality and disease burden create a clinical urgency for the incorporation of long-term solutions such as vagus nerve stimulators. According to the WHO in 2019, over 50 million people in the world have epilepsy. Although epilepsy can be controlled using medications, VNS therapy can be used as an add-on treatment to control seizures.

Similarly, according to the American Academy of Neurology, migraine is a common neurologic illness characterized by irregular attacks of moderate-to-severe headaches and accompanying symptoms, such as nausea, vomiting, and sensitivity to light & sound. In addition, the high prevalence of depression owing to lifestyle habits, such as stress due to work pressure, and the increasing incidence of treatment-resistant depression worldwide are some of the major factors driving the market growth.

According to WHO estimates, approximately 30% of all patients are resistant to treatment. VNS therapy is considered to be the most effective treatment for patients suffering from depression who do not respond to the standard treatment procedure. Thus, the increasing prevalence of chronic conditions, such as epilepsy and migraine, is expected to contribute to the market growth during the forecast period.

Furthermore, technological advancements in vagus nerve stimulators are anticipated to create growth opportunities in this market. These technological improvements include robot-assisted implantation, improved designs, and small-sized implantable VNS devices. Owing to these advancements, VNS devices are showing fewer adverse effects and improved efficacy & symptomatic relief in patients suffering from epilepsy & depression, as compared to the traditional methods.

Moreover, the FDA has approved an implantable VNS for the treatment of epilepsy and depression. Additionally, a new non-invasive VNS device that does not require surgical implantation has been approved in Europe to treat epilepsy, depression, and pain. For instance, in March 2020, LivaNova received the CE Mark approval for its VNS Therapy System - Symmetry - for difficult-to-treat depression. Such technological advancements are expected to boost the vagus nerve stimulation market growth during the forecast period.

The U.S. dominated the North American vagus nerve stimulation market with a revenue share of 88.27% in 2022. This dominance can be attributed to factors such as the high prevalence of chronic diseases such as migraine & epilepsy, a rise in awareness about treatments, the availability of highly skilled physicians, and the presence of well-established healthcare facilities. As per Mental Health America, one in five adults suffers from at least one mental condition.

In addition, an estimated 14. 8 million U.S. adults aged 18 or older had at least one major depressive episode with severe impairment in 2020. This number represented 6.0% of all U.S. adults. Moreover, as per the American Headache Society, migraine is one of the major causes of disability in the U.S. and the third most prevalent disorder in the world. Also, as per the Migraine Research Foundation in 2019, migraine affects nearly 39 million Americans and about 1 billion people worldwide.

Furthermore, the presence of well-defined regulatory guidelines and reimbursement coverage available for VNS devices by Medicare are contributing to the growth of the market. CMS will cover FDA-approved VNS devices for treatment-resistant depression (TRD) through Coverage with Evidence Development (CED). Hence, CMS offers favorable healthcare insurance policies for various neurological procedures, which may increase the number of patients opting for such services.

Furthermore, severe adverse effects and drug interactions owing to drug absorption by non-targeted sites are anticipated to boost the need for a targeted therapy approach, propelling the demand for VNS devices. These drugs can offer significant improvements in motor function; however, they may lead to adverse effects, particularly when the disease progresses.

For instance, constant administration of Anti-epileptic drugs (AEDs ) such as sodium valproate, carbamazepine, lamotrigine, levetiracetam, and topiramate may result in long-term complications such as hallucinations, dyskinesia, neurotoxic effects, and severe metabolic changes. Thus, adverse effects such as these drive the clinical need to incorporate alternatives based on targeted therapy approaches, including vagus nerve stimulators; thus, boosting the market growth during the forecast period.

Product Insights

In 2022, the implantable VNS device segment dominated the market with a revenue share of over 59.0%, owing to an increase in the number of patients suffering from different types of headaches, depression, and epilepsy. The implanted VNS devices are specialized to act directly on the pain spot and they alter nerve activity by sending electrical stimulation to a particular nerve, thereby making it a more effective way of treating the disease. Based on the product, the vagus nerve stimulation market is segmented into implantable and external VNS devices.

An implantable VNS device is helpful for those who have not responded to anti-seizure drugs and intensive depression treatments, such as antidepressant medications, psychotherapy, and electroconvulsive therapy (ECT). Furthermore, the introduction of new and innovative products by key market players is fueling the demand and adoption of VNS devices in the global market. For instance, in August 2021, the FDA approved the MicroTransponder Vivistim Paired VNS System, a drug rehabilitation system intended to treat moderate to severe upper extremity motor deficits due to chronic ischemic stroke.

However, the external VNS device segment is expected to expand at the highest CAGR of 11.9% from 2023 to 2030. This is attributed to the increasing number of patients with chronic disorders, the rising demand for non-invasive therapy, and the cost-effectiveness of the device. The introduction of new devices by market players and the shift of patient preference towards non-invasive devices are factors projected to fuel the demand for these devices and drive market growth during the forecast period.

Implantable VNS devices are often associated with adverse events encompassing both the surgical procedure and the electrical stimulation itself. Therefore, non-invasive VNS (nVNS) devices were developed with the aim to address the shortcomings associated with their invasive counterparts. A few of the non-invasive vagus nerve stimulators that are currently available for commercial use are gammaCore Sapphire by electroCore, and Parasym device by Parasym Ltd.

Biomaterial Insights

In 2022, the metallic biomaterials segment dominated the market with a revenue share of over 49.0%, owing to advancements and growth in the R&D for vagus nerve stimulation therapies. The segment is also expected to maintain its position through 2030. Metallic biomaterials are most used in medical devices such as implantable devices, due to their thermal conductivity & mechanical properties. 316L stainless steel, titanium-based alloys, gold, tantalum, silver, platinum, and cobalt-chromium alloys are some of the metals used for coating electrical implantable devices due to their anti-inflammatory properties.

Based on biomaterial, the market is segmented into polymeric, metallic, and ceramic biomaterials. The polymeric segment is expected to advance at the highest growth rate of 11.6% from 2023 to 2030, owing to its flexibility benefits. The prevalence of stress and depression is constantly increasing globally. Polymers can be shaped into support structures, including electro-spun matrices, nerve conduits, and scaffolds, and are capable of regenerating damaged neural tissues.

Polymers are used in medical implantable devices, and they offer a wide range of shapes and mechanical characteristics, such as biocompatibility and bioactivity. Such factors are expected to drive segment growth during the forecast period.

Application Insights

The epilepsy segment is dominating the market as of 2022 with a 58.25% revenue share, owing to the increasing number of regulatory approvals and the high prevalence of epilepsy worldwide. For instance, as per WHO, in high-income countries, about 49 out of 100,000 people are diagnosed annually with epilepsy, whereas 139 people are diagnosed in low- and middle-income countries. Similarly, approximately 100,000 to 120,000 children are hospitalized each year in the U.S. for epilepsy-related conditions. This is expected to drive segment growth in the coming years.

Moreover, rising awareness levels about epilepsy treatment, coupled with strategic alliances, are anticipated to stimulate market growth. The awareness initiatives by epilepsy networks have led to an increase in demand for better diagnosis and effective treatment of the disease. For instance, in 2009, the Epilepsy Association of Nova Scotia and the Anita Kaufmann Foundation together announced March 26 as the “Purple Day” internationally to increase worldwide awareness about epilepsy. Based on application, the vagus nerve stimulation market is segmented into epilepsy, depression, and migraine.

The depression segment is expected to advance at the highest compound annual growth rate from 2023 to 2030. The prevalence of stress and depression is constantly increasing globally. According to the National Institute of Mental Health (NIHM), over 2.7 million American adults suffer from the burden of difficult-to-treat depression. In addition, as per the WHO, more than 300 million adults are suffering from depression globally and approximately one-third of patients with major depressive disorder (MDD) have treatment-resistant depression (TRD).

Vagus nerve stimulators have been proven to play an important role in providing therapeutic solutions for difficult-to-treat depression; therefore, a rise in the prevalence of such diseases is expected to drive the segment growth during the forecast period. In addition, product launches with advanced technology are enhancing the quality of therapy. For instance, in 2017, electroCore launched the first non-invasive vagus nerve stimulation therapy product called gammaCore. Such developments are further likely to bolster segment growth.

End-use Insights

In the end-use segment, hospitals dominated the overall vagus nerve stimulation market with a share of 51.77% in 2022. The growth can mainly be attributed to the increase in the number of VNS surgeries performed in hospitals and a surge in the prevalence of neurological disorders. Furthermore, the availability of technologically advanced devices, coupled with favorable reimbursement policies, is expected to drive the hospitals segment further during the forecast period. For instance, Medtronic offers comprehensive services to secure and maintain coverage as well as payment for various DBS devices.

Furthermore, hospitals are currently advancing in terms of technology, and advanced devices are being extensively used in hospitals to provide better treatment. These devices are not just simplifying treatment procedures, but are also helping provide better, faster, and more accurate results. Mostly, all neurological disorders, including epilepsy, are diagnosed and treated by professional neurologists, who are available in specialty hospitals, using advanced equipment.

On the other hand, the Ambulatory Surgical Centers (ASC) segment is expected to expand at the highest CAGR from 2023 to 2030. This is due to the lower cost of procedures as compared to hospitals, convenient access to patient care, reduced waiting time, and low infection rate compared to neurology clinics and hospitals. Furthermore, according to a study conducted by Advancing Surgical Care, 92% of patients were satisfied with the medical care and service provided in the ASCs, thus, boosting segment growth.

In addition, most of the neurosurgeries can now be performed at ASCs, as surgical procedures undertaken here are advanced and less invasive. Thus, the growth of the segment can majorly be attributed to shorter procedure time and ongoing advancements in minimally invasive surgical techniques.

Regional Insights

North America dominated the vagus nerve stimulation market with a share of 59.92% in 2022, owing to the increase in government funding and initiatives for raising awareness about epilepsy and difficult-to-treat depression in the region. Also, rapid technological advancements, the presence of key manufacturers in the region, an increase in R&D investments, and a rise in the number of government funding and initiatives are among the key factors expected to create significant growth opportunities in the market.

For instance, according to the Centers for Medicare & Medicaid Services (CMS), health spending in the U.S. is expected to grow at 5.5% every year from 2018 to 2027 and is estimated to reach USD 6 trillion by 2027. In addition, high disposable income in developed economies and the availability of skilled professionals are some of the factors responsible for the large share of the North American region in the market.

On the other hand, Asia Pacific is expected to significantly expand at 11.6% CAGR from 2023 to 2030. This is attributed to the rising prevalence of neurodegenerative disorders in the region, coupled with unmet demand for effective and long-term solutions. Rising awareness about neurological disease treatment options and improvements in the clinical development framework of emerging economies is expected to drive market growth in this region.

Moreover, the presence of high-growth opportunities in developing countries such as Japan, China, and India is likely to contribute to market growth. Furthermore, the establishment of organizations such as the Asia-Pacific Centre for Neuromodulation (APCN), which has been founded for conducting research and promoting awareness about the associated benefits of vagus nerve stimulation, is anticipated to boost regional growth.

Key Companies & Market Share Insights

Key players operating in the industry are increasingly focusing on product launches, technological advancements, and other growth strategies, such as mergers & acquisitions, to strengthen their foothold in the market. For instance, in March 2020, LivaNova received the CE Mark approval for their VNS Therapy System - Symmetry - for difficult-to-treat depression.

Various clinical trials are being undertaken by market players in association with research institutes to explore and expand the applications of VNS devices. However, the proven effectiveness of VNS in epilepsy and treatment-resistant depression (TRD), along with higher penetration of these devices for epilepsy treatment in developed countries, is expected to create significant opportunities for market players.

Emerging players such as electroCore, MicroTransponder, Inc., and Parasym are considered innovators in the market for vagus nerve stimulation. Products offered by these companies have a good price-performance proposition, competitive functionality, and are technologically advanced. These players focus on product commercialization as well as fundraising activities to support R&D growth. For instance, in November 2017, electroCore completed its Series B Funding round with over USD 70 million, for the commercialization of gammaCore and further clinical development of nVNS.Some of the key players in the global vagus nerve stimulation market are as follows:

-

LivaNova LLC (formerly Cyberonics)

-

electroCore

-

Cerebral Rx

-

MicroTransponder, Inc.

-

Parasym

Vagus Nerve Stimulation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 479.11 million

Revenue forecast in 2030

USD 970.6 million

Growth rate

CAGR of 10.61% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, biomaterial, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

LivaNova LLC; electroCore; MicroTransponder, Inc.; Parasym; Cerebral Rx

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vagus Nerve Stimulation Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vagus nerve stimulation market report based on product, application, biomaterial, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implantable VNS Device

-

External VNS Device

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Epilepsy

-

Depression

-

Migraine

-

-

Biomaterial Outlook (Revenue, USD Million, 2018 - 2030)

-

Metallic

-

Ceramics

-

Polymeric

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Neurology Clinics

-

Ambulatory Surgical Centers

-

Research Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vagus nerve stimulation market size was estimated at USD 434.40 million in 2022 and is expected to reach USD 479.11 million in 2023.

b. The global vagus nerve stimulation market is expected to grow at a compound annual growth rate of 10.61% from 2023 to 2030 to reach USD 970.60 million by 2030.

b. North America dominated the VNS market with a share of 59.92% in 2022. This is attributable to the increase in government funding and initiatives for raising awareness about difficult to treat depression & epilepsy. Furthermore, the presence of major competitors, availability of sophisticated healthcare infrastructure, and skilled professionals are also responsible for the market growth in this region.

b. Some key players operating in the vagus nerve stimulation market include electroCore, Cerebral Rx, LivaNova LLC, MicroTransponder, Inc., and NERVANA LLC among others.

b. Key factors that are driving the VNS market growth include growing incidence of neurological disorders such as epilepsy, depression, and migraine as well as the rising adoption of minimally invasive neurosurgical procedures. Furthermore, an increasing number of approvals and new product launches are expected to further drive the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.