- Home

- »

- Drilling & Extraction Equipments

- »

-

Vacuum Pump Market Size, Share & Growth Report, 2030GVR Report cover

![Vacuum Pump Market Size, Share & Trends Report]()

Vacuum Pump Market (2023 - 2030) Size, Share & Trends Analysis Report By Lubrication (Dry, Wet), By Vacuum Level (Low, Medium), By End-use (Semiconductor & Electronics, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-134-3

- Number of Report Pages: 169

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vacuum Pump Market Summary

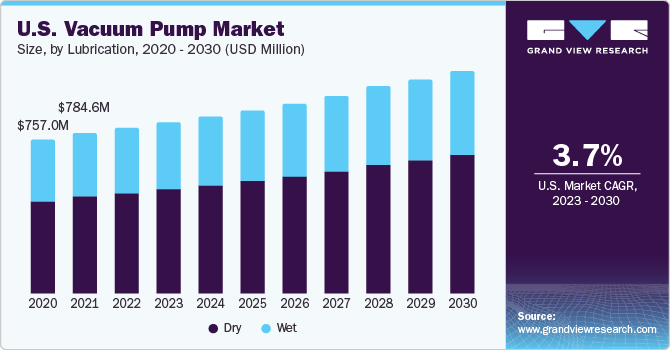

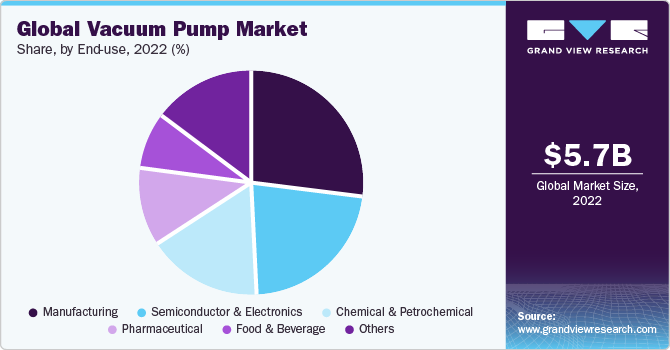

The global vacuum pump market size was estimated at USD 5,728.7 million in 2022 and is projected to reach USD 8.75 billion by 2030, growing at a CAGR of 5.4% from 2023 to 2030. The rising use of vacuum pumps is attributed to technological advancements, rapid automation, stricter industry standards, and the growing complexity of manufacturing processes across diverse sectors.

Key Market Trends & Insights

- Asia Pacific dominated the market in 2022 and accounted for a revenue share of 47.2%.

- By lubrication, the dry lubrication segment led the market and accounted for the largest share of 61.7% of the global revenue in 2022.

- By vacuum level, the high vacuum level segment is expected to witness a CAGR of 6.0% over the forecast period.

- By end use, the manufacturing end-use segment led the market and accounted for the largest share of 27.0% of the global revenue in 2022.

Market Size & Forecast

- 2022 Market Size: USD 5,728.7 Million

- 2030 Projected Market Size: USD 8.75 Billion

- CAGR (2023-2030): 5.4%

- Asia Pacific: Largest market in 2022

The versatility of vacuum pumps makes them indispensable in various applications, contributing to their continued demand and adoption. For instance, vacuum pumps are used in environmental monitoring equipment and analytical instruments like mass spectrometers, supporting research and compliance efforts. Vacuum pumps are used in packaging processes to extend the shelf life of products, particularly in the food industry. Furthermore, vacuum pumps contribute to metallurgical processes, such as vacuum induction melting and sintering, in the production of alloys and advanced materials.In addition, vacuum pumps are fundamental in laboratories and R&D facilities across disciplines, contributing to scientific experiments and material research. These aforementioned factors are expected to drive the product demand in the coming years. According to the Semiconductor Industry Association 2023 report, the U.S. holds the largest share of the semiconductor market at 48%, whereas China holds 7% of the global semiconductor market share in 2022. The U.S. is a hub for semiconductor manufacturing, and vacuum pumps are essential for processes like lithography, deposition, and etching. The semiconductor manufacturing process requires a highly controlled environment with minimal contamination. These factors are anticipated to propel the product demand in the semiconductor industry.

For instance, vacuum pumps help create low-pressure environments for etching processes where material removal is precise to create semiconductor features. Furthermore, vacuum pumps create and maintain the necessary vacuum conditions for these processes, contributing to the precision, reliability, and quality of semiconductor devices. The vacuum pumps used in the semiconductor industry are often designed to meet stringent cleanliness standards and operate in extreme conditions, ensuring the production of high-performance semiconductor components. Moreover, vacuum pumps assist in creating vacuum conditions for ion implantation processes, which involve introducing ions into the semiconductor material for doping.

EVP vacuum pump manufacturers provide vacuum pumps for process applications in semiconductor manufacturing. According to the International Bottled Water Association, in the U.S., bottled water remained the most popular beverage in terms of volume, surpassing all other packaged beverages in 2020. Moreover, according to the Beverage Marketing Corporation 2023 report, the consumption of bottled water in the U.S. increased from 42.1 gallons per capita in 2018 to 46.5 gallons per capita in 2022. The food & beverage industry uses vacuum pumps for packaging, deaeration, and concentration processes, contributing to the growing demand. Thus, the growing beverage industry is anticipated to drive the product demand in the coming years.

Lubrication Insights

The dry lubrication segment led the market and accounted for the largest share of 61.7% of the global revenue in 2022. Dry vacuum pumps eliminate the need for lubricating fluids, reducing the risk of environmental contamination. In addition, dry vacuum pumps are versatile and can be used in various industries, including pharmaceuticals, food & beverage, and manufacturing. The absence of oil-related wear & tear can contribute to a longer service life for dry vacuum pumps. While dry vacuum pumps are gaining traction in certain industries, wet vacuum pumps continue to be favored in scenarios where their specific features align with the needs of the application.

Industries with established processes, a focus on cost-effectiveness, and those requiring robust performance often contribute to the sustained demand for wet vacuum pumps. The wet lubrication segment is expected to witness a CAGR of 5.1% from 2023 to 2030. Wet vacuum pumps often provide a balanced performance across various parameters, making them suitable for a broad spectrum of applications without specialized requirements. Furthermore, wet vacuum pump technology is well-established, and many industries have long-standing processes designed around these pumps, contributing to their continued demand.

Vacuum Level Insights

The high vacuum level segment is expected to witness a CAGR of 6.0% over the forecast period. Industries like optics, electronics, and coatings rely on high-level vacuum pumps for thin-film deposition processes, ensuring uniform and high-quality coatings. Furthermore, certain medical devices, especially those with sensitive electronic components, may require high vacuum levels during manufacturing processes. The low vacuum level segment led the market and accounted for 52.7% of the global market share in 2022. The increasing demand for low vacuum level pumps is driven by various industries, such as semiconductor manufacturing, research, and pharmaceutical, where precise pressure control at lower vacuum levels is crucial for specific processes.

In addition, advancements in technology and the expansion of industries requiring vacuum applications contribute to the growing demand. Medium-level vacuum pumps find applications in industries like pharmaceuticals, food processing, and aerospace. Their demand is increasing due to the rising scope of these industries, where medium vacuum levels are often required for processes, such as distillation, packaging, and composite manufacturing. The need for efficient and reliable vacuum solutions in these sectors contributes to the rising demand for medium-level vacuum pumps.

End-use Insights

The manufacturing end-use segment led the market and accounted for the largest share of 27.0% of the global revenue in 2022. In the manufacturing industry, vacuum pumps play a crucial role in various processes. The product demand in manufacturing is driven by the need for precise control of pressure, efficiency, and reliability in various industrial processes. Advances in manufacturing technologies and increased automation contribute to the continued growth of this demand. Moreover, vacuum pumps are used for sealing and packaging processes to remove air from packaging materials, extending the shelf life of products.

The increasing product demand in the chemical industry reflects the industry's ongoing need for efficient and reliable technologies to enhance process control, productivity, and safety while addressing environmental considerations.Vacuum pumps contribute to maintaining safe working environments by ensuring proper pressure control, which is crucial in chemical manufacturing processes. Furthermore, vacuum pumps are crucial in various chemical processes, such as distillation, drying, and crystallization, where the removal of gases or vapors is essential for maintaining specific conditions.

The semiconductor & electronics end-use segment is anticipated to witness a CAGR of 6.4% over the forecast period. Vacuum pumps are integral to semiconductor fabrication, maintaining controlled environments for processes like thin film deposition and ion implantation. In addition, vacuum pumps are used to maintain the necessary low-pressure conditions for CVD processes, where thin films are deposited onto semiconductor wafers. Moreover, vacuum pumps create vacuum conditions for PVD processes, allowing the deposition of materials onto semiconductor surfaces.

In the pharmaceutical industry, vacuum pumps play a vital role in various processes, contributing to the production of medications and pharmaceutical products. Vacuum pumps are used in drying processes, such as freeze-drying (lyophilization) and spray drying, to remove moisture from pharmaceutical products without exposing them to high temperatures. Furthermore, vacuum pumps are essential in the lyophilization process, which involves freeze-drying pharmaceutical products to enhance stability and extend shelf life.

Regional Insights

Asia Pacific dominated the market in 2022 and accounted for a revenue share of 47.2%. The thriving semiconductor & electronics industry in the region, particularly in countries like China, Japan, South Korea, and Taiwan, has been a significant driver for product demand, given their crucial role in semiconductor manufacturing processes. Moreover, the growth of the pharmaceutical industry in the region contributes to the product demand, especially in applications like medical devices and pharmaceutical manufacturing. The product demand in North America is experiencing notable growth, fueled by a combination of factors. The region's strong industrial base, particularly in sectors like manufacturing, semiconductors, and pharmaceuticals, is driving the product demand in various critical processes.

For instance, in March 2022, the Government of Canada invested approximately USD 240.0 million to expand its presence in photonics and semiconductor manufacturing. In addition, advancements in technology, a growing emphasis on automation, and increased focus on R&D activities contribute to the rising demand. As industries in North America continue to prioritize efficiency, sustainability, and innovation, vacuum pumps play a pivotal role in ensuring precise control, reliability, and performance across a wide range of applications, further propelling their increased adoption in the region. In Europe, product demand is on the rise, driven by diverse industrial applications and technological advancements. One instance is the flourishing automotive sector, where these pumps are crucial for enhancing brake performance and fuel efficiency.

For instance, according to the European Automobile Manufacturers' Association, overall motor vehicle manufacturing accounts for a share of 15.3% of global vehicle production. With the region's commitment to sustainability, there's a growing product demand in renewable energy applications, such as solar panel manufacturing and biogas production. Moreover, the pharmaceutical and chemical industries in Europe extensively use these pumps in processes like distillation, drying, and filtration. As the region continues to prioritize environmental responsibility, vacuum pumps play a key role in processes that improve energy efficiency and reduce environmental impact, contributing to their increasing demand across various European industries.

Key Companies & Market Share Insights

To increase market penetration and meet changing technical demands, key manufacturers use a variety of methods, such as geographical expansions, product launches, and mergers & acquisitions. COVAL, for example, introduced new multistage vacuum pumps with enhanced intelligence and communication in April 2023. It is designed in the same manner as COVAL's vacuum pump ranges, which combine operational power, resilience, modularity, compactness, and communication. Some of the prominent players in the global vacuum pump market include:

-

Atlas Copco

-

Flowserve

-

Becker Pumps

-

Busch Group

-

Ingersoll Rand

-

Ebara Corporation

-

Graham Corporation

-

ULVAC, Inc.

-

GlobalVac & Air

-

Pfeiffer Vacuum GmbH

-

Sulzer Ltd.

-

HCP Pump Manufacturer Co., Ltd.

-

Schlumberger Ltd.

-

ITT INC.

-

HERMETIC-Pumpen GmbH

Vacuum Pump Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.01 billion

Revenue forecast in 2030

USD 8.75 billion

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Lubrication, vacuum level, end-use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Atlas Copco; Flowserve; Becker Pumps; Busch Group; Ingersoll Rand; Ebara Corp.; Graham Corp.; ULVAC, Inc.; GlobalVac & Air; Pfeiffer Vacuum GmbH; Sulzer Ltd.; HCP Pump Manufacturer Co., Ltd.; Schlumberger Ltd.; ITT Inc.; HERMETIC-Pumpen GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

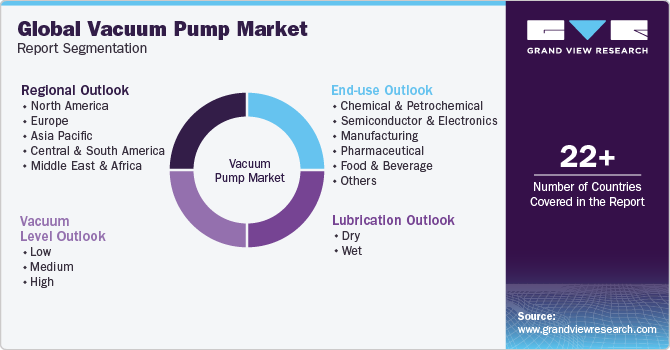

Global Vacuum Pump Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vacuum pump market report on the basis of lubrication, vacuum level, end-use, and region:

-

Lubrication Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Wet

-

-

Vacuum Level Outlook (Revenue, USD Million, 2018 - 2030)

-

Low

-

Medium

-

High

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical & Petrochemical

-

Semiconductor & Electronics

-

Manufacturing

-

Pharmaceutical

-

Food & Beverage

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vacuum pump market size was estimated at USD 5,728.7 million in 2022 and is expected to be USD 6.01 billion in 2023.

b. The global vacuum pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 8.75 billion by 2030.

b. Asia Pacific region dominated the market in 2022 by accounting for a share of 47.2% of the market. The thriving semiconductor & electronics industry in the region, particularly in countries like China, Japan, South Korea, and Taiwan, has been a significant driver for vacuum pump demand, given their crucial role in semiconductor manufacturing processes.

b. Some of the key players operating in the vacuum pump market include Atlas Copco, Flowserve, Becker Pumps, Busch Group, Ingersoll Rand, Ebara Corporation, Graham Corporation, ULVAC, Inc., GlobalVac & Air, Pfeiffer Vacuum GmbH, Sulzer Ltd., HCP PUMP MANUFACTURER CO., LTD., Schlumberger Limited, ITT INC., HERMETIC-Pumpen GmbH.

b. The rising use of vacuum pumps is driven by technological advancements, increased automation, stricter industry standards, and the growing complexity of manufacturing processes across diverse sectors. The versatility of vacuum pumps makes them indispensable in various applications, contributing to their continued demand and adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.