Vaccine Adjuvants Market Size, Share & Trends Analysis Report By Type (Pathogen, Adjuvant Emulsion, Particulate), By Administration (Oral, Intradermal, Intranasal, Intramuscular), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-612-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Vaccine Adjuvants Market Size & Trends

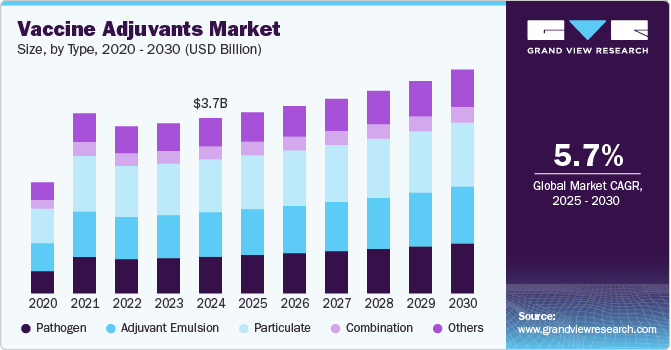

The global vaccine adjuvants market size was estimated at USD 3.81 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2030. The market is driven by the increasing demand for effective vaccines to combat emerging and re-emerging infectious diseases, as well as the rising prevalence of chronic conditions such as cancer. The growing recognition of adjuvants' role in enhancing the efficacy, durability, and breadth of immune responses is propelling their adoption in both prophylactic and therapeutic vaccines. Advancements in immunology and molecular biology have led to the development of next-generation adjuvants, such as saponin-based adjuvants and toll-like receptor (TLR) agonists, which target specific immune pathways, offering improved safety and efficacy profiles. These innovations address the unmet need for vaccines capable of generating strong immune responses with reduced antigen doses, making them cost-effective and scalable.

Additionally, rising investments in vaccine research and development by governments, non-governmental organizations, and pharmaceutical companies are accelerating market growth. Initiatives such as the Coalition for Epidemic Preparedness Innovations (CEPI) and Gavi's support for immunization programs in low- and middle-income countries are fostering innovation and expanding access to vaccines containing advanced adjuvants. Moreover, the ongoing focus on pandemic preparedness, as evidenced by COVID-19 and other outbreaks, has highlighted the need for adjuvant-enhanced vaccines capable of rapid development and deployment. Emerging applications of vaccine adjuvants in oncology and therapeutic areas further broaden the market's potential, driven by a shift towards personalized medicine and precision immunology.

The market also benefits from favorable regulatory support, including expedited approval pathways and funding for critical vaccine technologies. However, challenges such as high costs, stringent regulatory requirements, and the need for robust clinical validation remain significant barriers. Despite these hurdles, the expanding pipeline of adjuvant-based vaccines, coupled with increasing awareness of the importance of immunization in global health, positions the vaccine adjuvants market for sustained growth over the forecast period.

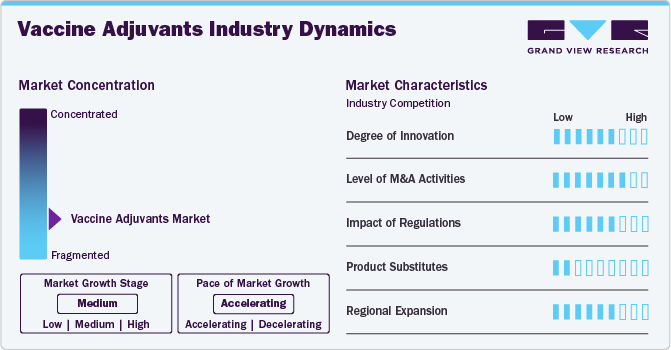

Market Concentration & Characteristics

The vaccine adjuvants market is in a moderate growth stage. The market is witnessing significant innovation, particularly in the development of next-generation adjuvants aimed at enhancing vaccine efficacy, broadening immune responses, and reducing antigen dosages. Advanced adjuvant formulations, such as saponin-based adjuvants (e.g., QS-21) and toll-like receptor (TLR) agonists, are gaining attention, but their widespread adoption is still limited due to cost and technical challenges.

Strategic collaborations and partnerships between pharmaceutical companies, biotech firms, and research institutions are fueling market expansion. These alliances are focused on addressing unmet needs in vaccines for emerging infectious diseases and oncology, with a strong emphasis on improving adjuvant safety profiles and manufacturing scalability.

Regulatory frameworks are pivotal in shaping the market dynamics. Authorities such as the FDA and EMA have established stringent guidelines for adjuvant development, emphasizing safety, immunogenicity, and clinical benefit. These regulatory hurdles often prolong product approval timelines but also ensure robust product evaluation. Incentives such as orphan drug designations and funding for pandemic preparedness are fostering innovation in this space.

The market faces competition from alternative vaccine enhancement technologies, including nucleic acid-based vaccines (mRNA and DNA) and viral vector vaccines, which do not require traditional adjuvants. However, adjuvants remain crucial for conventional and protein-based vaccines, particularly for diseases requiring robust and long-lasting immunity.

Emerging markets, especially in regions such as Asia-Pacific and Latin America, present significant growth opportunities. Increased immunization initiatives, expanding healthcare access, and rising awareness about vaccine-preventable diseases are driving demand. Moreover, government programs and partnerships with international organizations, such as Gavi and WHO, are boosting the adoption of adjuvant-containing vaccines in these regions. The vaccine adjuvants market is poised for steady growth, driven by the need for more effective and durable vaccines across infectious diseases, cancer, and other therapeutic areas.

Type Insights

The particulate segment held the largest market share of 30.1% in 2024. This large share can be attributed to a wide range of products and greater efficiency against diseases. Particulate type includes adjuvants consisting of alum, virosomes, and cytokines. Alum is one of the most used vaccine adjuvants. It consists of aluminum salts and has applications in vaccines such as HPV and hepatitis B. Virosome particles resemble some noninfectious viruses and are used as adjuvants in influenza, hepatitis A, and Epaxal vaccine.

The pathogen-based adjuvants segment is projected to grow at the fastest CAGR of 5.5% over the forecast period, driven by increasing research and development efforts aimed at enhancing vaccine efficacy. Pathogen-derived components, such as Monophosphoryl Lipid A (MPL), have been extensively studied for their ability to elicit robust immune responses. MPL, a detoxified form of lipopolysaccharide derived from Gram-negative bacteria, is often used in combination with other adjuvants to improve immunogenicity.

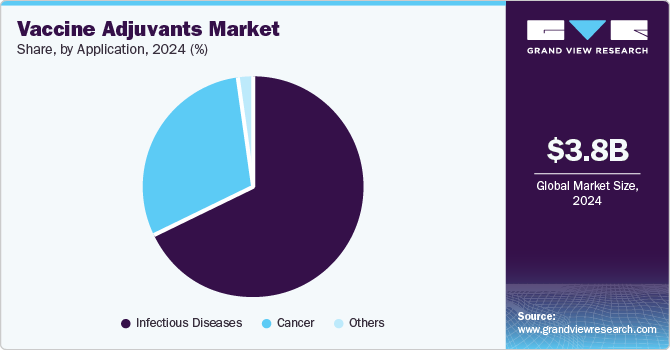

Application Insights

The infectious diseases segment accounted for the largest revenue share of 68.0% in 2024. This large share can be attributed to the gradually growing prevalence of infectious diseases, such as malaria, influenza, hepatitis A, B, & C, and others. Also, strong pipeline products for vaccine adjuvants related to infectious diseases are anticipated to fuel market growth in the coming years. This includes CpG (TLR 9 agonist) vaccine adjuvant from InvivoGen. The product is in phase 3 of the clinical trial and provides CD8 T cell-mediated and Th1-type immunity.

The other segment is expected to grow at the fastest CAGR of 4.5% during the forecast period. Cancer is identified to be the fastest-growing application segment due to its high prevalence and ongoing R&D for targeted therapy for various types of cancers. Moreover, increasing the use of adjuvants, such as Cervarix, is further anticipated to fuel growth.

By Administration Insights

The intramuscular segment held the largest revenue share of 33.8% in 2024, driven by its widespread use in vaccines targeting diseases such as HPV, influenza, meningitis, and others. The intramuscular route is preferred due to its ability to provide robust and systemic immune responses, offering better immune specificity compared to other routes. Additionally, many licensed adjuvants, such as alum salts, are optimized for parenteral delivery and demonstrate high efficacy when administered intramuscularly. However, alum salts are ineffective via the oral or nasal route, which limits their application in non-parenteral vaccine formulations.

The intradermal route is anticipated to be the fastest-growing segment, with a CAGR of 4.5% during the forecast period, owing to its ability to achieve prolonged absorption and sustained immune activation. This route allows for lower doses of vaccines and adjuvants to achieve equivalent or better efficacy, which can reduce costs and improve accessibility. Vaccines delivered intradermal benefit from a higher density of immune cells in the dermis, leading to a more targeted and durable immune response.

Some advanced adjuvants, such as TLR3-Ligand Poly (I: C), are specifically designed to work effectively through intradermal administration. These adjuvants have been shown to induce mucosal antibody responses, providing protection against infections like genital HSV-2. As research progresses, the intradermal route is gaining traction, particularly for next-generation vaccines targeting mucosal immunity and other complex diseases. Additionally, the intranasal route also shows potential, especially for vaccines requiring mucosal immunity, but its adoption is still in the developmental phase due to challenges in achieving stable formulations. Overall, the efficacy of vaccines depends significantly on the route of administration, with innovation in adjuvant formulations driving advancements across different delivery methods.

Regional Insights

North America vaccine adjuvants market dominated in 2024 and held the largest revenue share of 39.4%. Key drivers of regional market growth include advanced healthcare infrastructure, significant investments in vaccine R&D, and robust vaccination programs. The region benefits from government funding and private sector initiatives aimed at developing next-generation adjuvants to enhance vaccine efficacy against complex diseases. Additionally, collaborations between biotech firms and academic institutions, coupled with favorable regulatory policies, drive innovation in this space.

U.S. Vaccine Adjuvants Market Trends

The U.S. market is experiencing steady growth due to the high adoption rate of adjuvant-containing vaccines for infectious diseases and cancer immunotherapies. Government-backed initiatives, such as the Biomedical Advanced Research and Development Authority (BARDA) programs, are accelerating the development of advanced adjuvant systems. For instance, in 2024, BARDA announced funding for multiple partnerships to explore innovative vaccine technologies, including adjuvants designed to combat emerging infectious diseases.

Europe Vaccine Adjuvants Market Trends

Europe vaccine adjuvants market accounted for a significant revenue share in the vaccine adjuvants market in 2024, driven by high vaccination coverage and strong government support for vaccine R&D. Regulatory agencies such as the European Medicines Agency (EMA) are streamlining the approval process for novel adjuvants, focusing on safety and efficacy. The demand for advanced adjuvants is rising in response to the increasing burden of infectious and chronic diseases.

The UK vaccine adjuvants market is witnessing growth driven by investments in innovative vaccine platforms and strategic collaborations. For instance, in 2024, the UK government announced funding for a multi-institutional project to develop new adjuvants targeting flu and respiratory syncytial virus (RSV) vaccines, addressing gaps in immunization for high-risk populations.

The vaccine adjuvants market in Germany is expanding steadily due to government-backed R&D funding and the presence of leading pharmaceutical companies. Initiatives such as the German Center for Infection Research (DZIF) are fostering the development of cutting-edge adjuvant technologies. In 2024, additional funding was allocated to support vaccine innovation projects, particularly those incorporating novel adjuvant formulations.

France vaccine adjuvants market is driven by public-private partnerships and increased focus on oncology vaccine development. In 2024, the French National Research Agency announced grants for projects exploring adjuvant systems in therapeutic cancer vaccines, signaling strong growth potential in this niche segment.

Asia-Pacific Vaccine Adjuvants Market Trends

The Asia-Pacific region is emerging as a lucrative market for vaccine adjuvants, driven by rising healthcare investments, growing immunization initiatives, and an increasing prevalence of vaccine-preventable diseases. The region is also witnessing significant R&D activities, with local players forming collaborations to enhance access to adjuvant vaccines.

Vaccine Adjuvants Market in Japan is growing rapidly, supported by government initiatives to address vaccine innovation. In 2024, Japan launched a national program to develop adjuvant-enhanced vaccines for emerging diseases, supported by collaborations with global organizations.

Latin America Vaccine Adjuvants Market Trends

The Vaccine Adjuvants Market in Latin America is gaining traction due to growing immunization campaigns, government investments, and partnerships with global vaccine manufacturers. Public health initiatives to combat diseases like dengue, Zika, and influenza are driving demand for adjuvant vaccines in this region.

Vaccine Adjuvants Market in Brazil is a key market in the region, benefiting from extensive vaccination programs and government support. In 2024, Brazil’s Ministry of Health partnered with leading vaccine developers to introduce adjuvant vaccines for neglected tropical diseases, aiming to improve disease control outcomes.

Middle East and Africa Vaccine Adjuvants Market Trends

The Vaccine Adjuvants Market in the Middle East and Africa (MEA) is witnessing moderate growth, driven by the high disease burden and increased vaccination efforts. Partnerships with global organizations, such as Gavi and WHO, are improving access to advanced vaccines, including those containing novel adjuvants.

Vaccine Adjuvants Market in Saudi Arabia is a growing market, bolstered by government-led immunization programs and investments in healthcare infrastructure. In 2024, the Ministry of Health announced new initiatives to improve vaccination coverage, focusing on introducing adjuvant vaccines for influenza and pneumococcal diseases.

Key Vaccine Adjuvants Company Insights

Key players in the vaccine adjuvants market are focusing on expanding their footprint in emerging regions, investing in R&D for next-generation adjuvants, and entering strategic collaborations to bolster their market presence. These initiatives aim to address the growing demand for effective vaccines across infectious diseases, oncology, and other therapeutic areas. Market players are actively pursuing partnerships, mergers & acquisitions, and product innovations to strengthen their positions.

Key companies, including GSK plc, CSL Seqirus, Novavax, Inc., and Dynavax Technologies Corporation, continue to dominate the market with their well-established product portfolios and strong global distribution networks. However, the market remains competitive, with regional players and research institutions contributing to the rapid pace of innovation.

The focus on precision immunology and personalized vaccines is expected to redefine the competitive landscape, creating opportunities for both established players and emerging companies to address unmet needs in the vaccine adjuvants market.

Key Vaccine Adjuvants Companies:

The following are the leading companies in the vaccine adjuvants market. These companies collectively hold the largest market share and dictate industry trends.

- GlaxoSmithKline plc.

- Novavax, Inc.

- Adjuvance Technologies, Inc.

- SPI Pharma

- Agenus, Inc.

- CSL Limited

- InvivoGen

- Brenntag Biosector

Recent Developments

-

In February 2024, GSK plc partnered with the Coalition for Epidemic Preparedness Innovations (CEPI) to advance the development of novel adjuvants for pandemic preparedness.

-

In January 2024, Vaxine announced the successful completion of Phase II trials for its Advax adjuvant-based vaccine targeting respiratory syncytial virus (RSV), showcasing its potential to compete with established market leaders.

-

In September 2023, CSL Seqirus collaborated with Dynavax Technologies Corporation to integrate its proprietary CpG 1018 adjuvant into flu vaccines, aiming to enhance immune response and reduce antigen usage.

-

In May 2023, Croda International Plc announced the acquisition of Avanti Polar Lipids, expanding its capabilities in lipid-based adjuvant systems, a key component in mRNA vaccine formulations. The company also strengthened its partnership with the University of Copenhagen to co-develop advanced adjuvant platforms for infectious diseases and oncology applications.

Vaccine Adjuvants Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.94 billion |

|

Revenue forecast in 2030 |

USD 4.86 billion |

|

Growth rate |

CAGR of 4.32% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

December 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, administration, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and MEA |

|

Country scope |

U.S.; Canada; Mexico; UK.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

GlaxoSmithKline plc.; Novavax, Inc.; Adjuvance Technologies, Inc.; SPI Pharma.; Agenus, Inc.; CSL Limited; InvivoGen; and Brenntag Biosector |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Vaccine Adjuvants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vaccine adjuvants market based on type, application, administration, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pathogen

-

Adjuvant emulsion

-

Particulate

-

Combination

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious diseases

-

Cancer

-

Others

-

-

Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Intradermal

-

Intranasal

-

Intramuscular

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Vaccine Adjuvant market size was estimated at USD 3.81 billion in 2024 and is expected to reach USD 3.94 billion in 2025.

b. The Vaccine Adjuvant market is expected to grow at a compound annual growth rate of 4.32% from 2025 to 2030 and is expected to reach USD 4.86 billion by 2030.

b. The infectious diseases segment accounted for the largest revenue share of 67.97% in 2024. This large share can be attributed to the gradually growing prevalence of infectious diseases, such as malaria, influenza, hepatitis A, B, & C, and others.

b. Some key players operating in the Vaccine Adjuvant market include GlaxoSmithKline plc.; Novavax, Inc.; Adjuvance Technologies, Inc.; SPI Pharma.; Agenus, Inc.; CSL Limited; InvivoGen; and Brenntag Biosector.

b. The growth of the Vaccine Adjuvants Market is driven by the increasing demand for effective vaccines to combat emerging and re-emerging infectious diseases, as well as the rising prevalence of chronic conditions such as cancer.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."