- Home

- »

- Homecare & Decor

- »

-

Vacation Rental Market Size, Share, Industry Report, 2033GVR Report cover

![Vacation Rental Market Size, Share & Trends Report]()

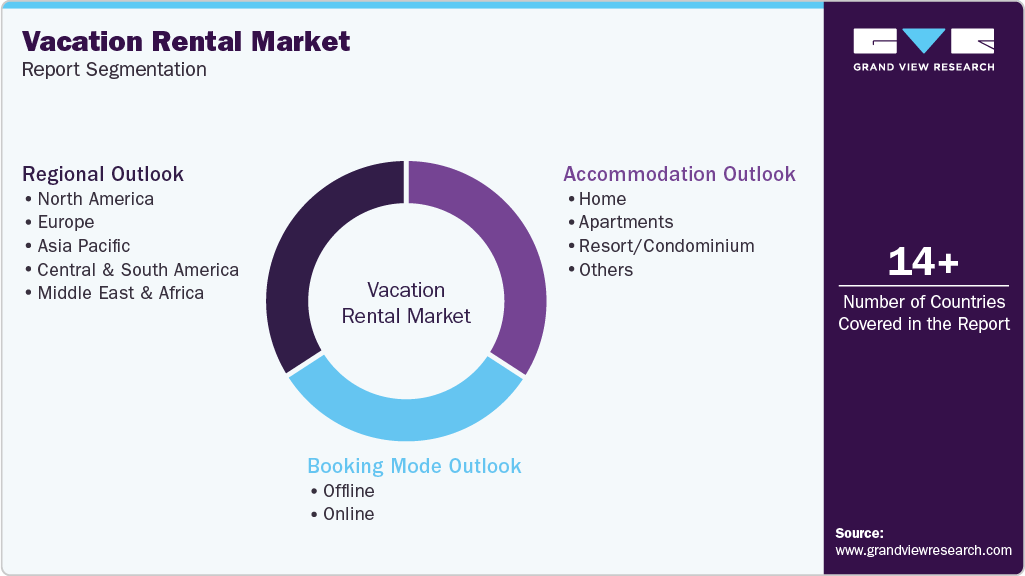

Vacation Rental Market (2026 - 2033) Size, Share & Trends Analysis Report By Accommodation (Home, Apartments, Resort/Condominium), By Booking Mode (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-532-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vacation Rental Market Summary

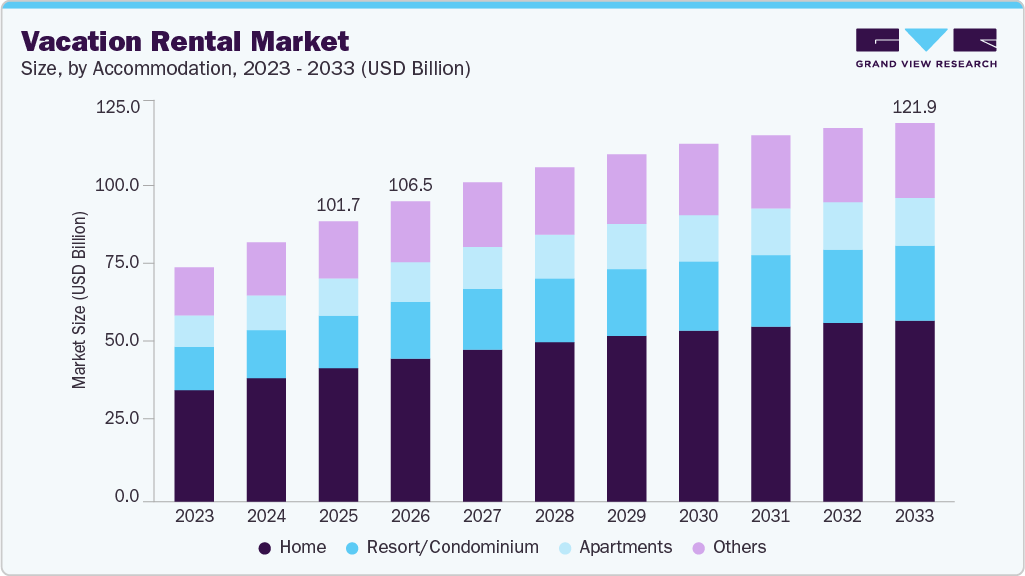

The global vacation rental market size was estimated at USD 101.69 billion in 2025 and is projected to reach USD 121.94 billion by 2033, growing at a CAGR of 3.7% from 2026 to 2033. The rising expenditure on travel, vacations, and accommodation among millennials is driving market growth.

Key Market Trends & Insights

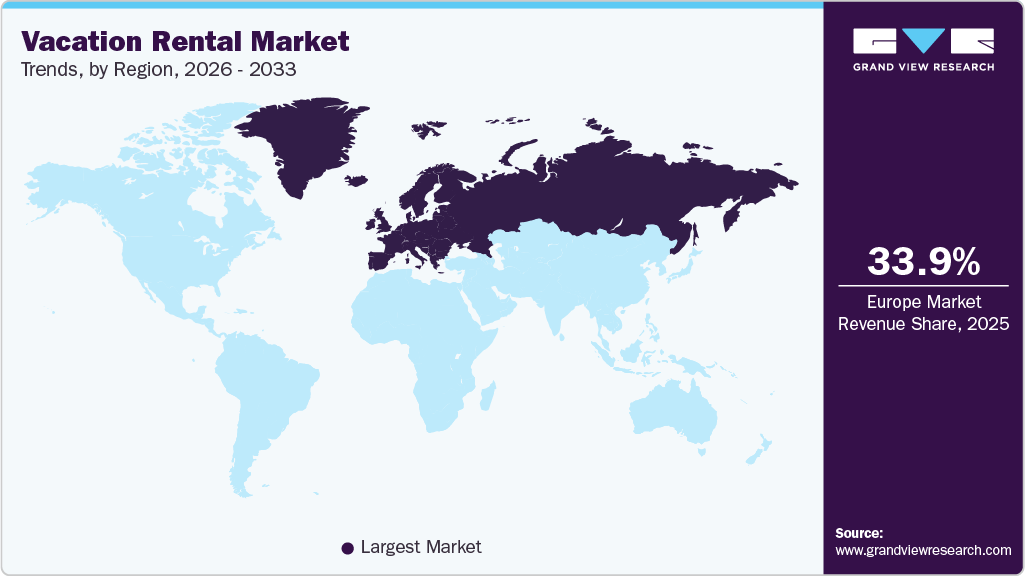

- By region, Europe led the vacation rental industry and accounted for a share of 33.89% in 2025.

- By accommodation, home accommodation led the vacation rental industry and accounted for a share of 47.68% in 2025.

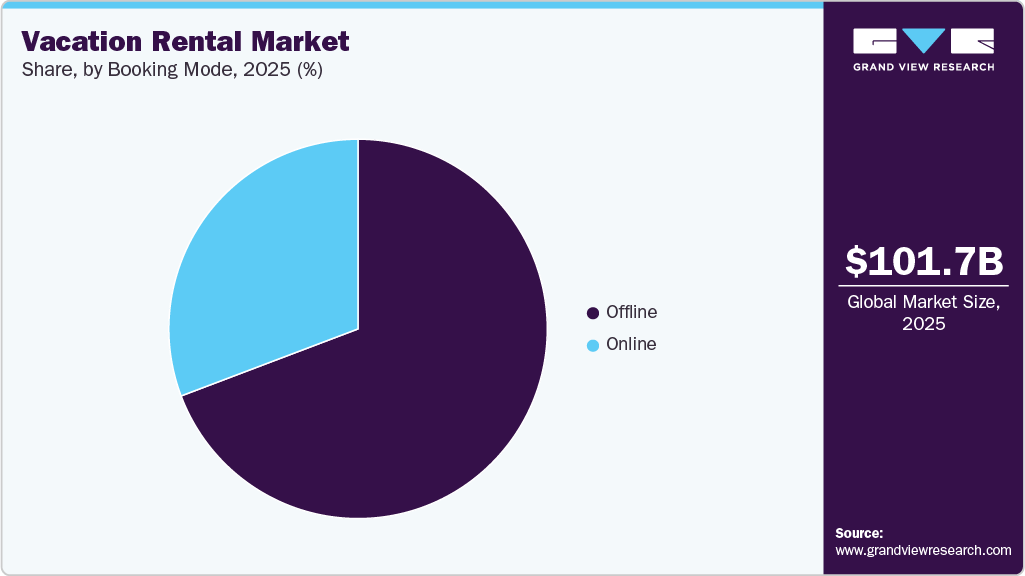

- By booking mode, offline led the vacation rental industry and accounted for a share of 69.25% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 101.69 billion

- 2033 Projected Market Size: USD 121.94 billion

- CAGR (2026-2033): 3.7%

- Europe: Largest market in 2025

According to Copyrise, 200,000 million global tourists are millennials, and they spend around USD 180 billion on travel every year. In addition to demographic tailwinds, the market is benefiting from the rapid digitalization of booking channels and the growing preference for experiential travel over traditional hotel stays. Vacation rentals offer greater flexibility, privacy, and value for money, factors that resonate strongly with younger travelers as well as families and remote workers. The expansion of online travel platforms, improved payment infrastructure, and the integration of AI-driven pricing and property management tools are further streamlining operations for hosts and enhancing the end user booking experience.Travelers are more inclined toward vacation rental properties than hotels, as these properties are affordable, offer a higher level of comfort & privacy, and are child and pet friendly. Low cost as compared to hotel accommodation with similar amenities drives the consumer’s inclination toward such properties.

According to 2025 data, more than 35% of travelers now favor vacation rentals over traditional hotels, primarily because of their affordability, home-like amenities, enhanced privacy, and opportunities to experience local culture. In specific destinations such as Nuevo Vallarta, nearly 40% of visitors are choosing apartments or condominiums over hotel rooms, reflecting a noticeable shift in accommodation preferences toward more spacious, flexible lodging options.

The normalization of remote and hybrid work models has significantly strengthened demand in short-term rental markets, particularly for mid-term and extended stays of 30 days or more. Digital nomads, freelancers, and corporate employees working flexibly are increasingly choosing fully furnished apartments and homes over hotels, as they offer better workspace setups, reliable high-speed internet, kitchen facilities, and greater cost efficiency for longer durations. This shift has prompted hosts in short-term rental markets to upgrade properties with work-friendly amenities such as dedicated desks and ergonomic seating, positioning vacation rentals as an attractive solution for location-independent professionals seeking both productivity and lifestyle flexibility.

Evolving traveler preferences are significantly reshaping the holiday rental market, as guests increasingly prioritize personalized and authentic experiences over standardized hotel stays. Younger travelers are seeking accommodation that reflects local culture, provides distinctive design elements, and offers immersive community connections. As a result, demand is rising for unique and themed properties, including eco-friendly homes, luxury villas, boutique-style apartments, and culturally immersive stays, positioning holiday rentals as experience-driven alternatives rather than places to stay.

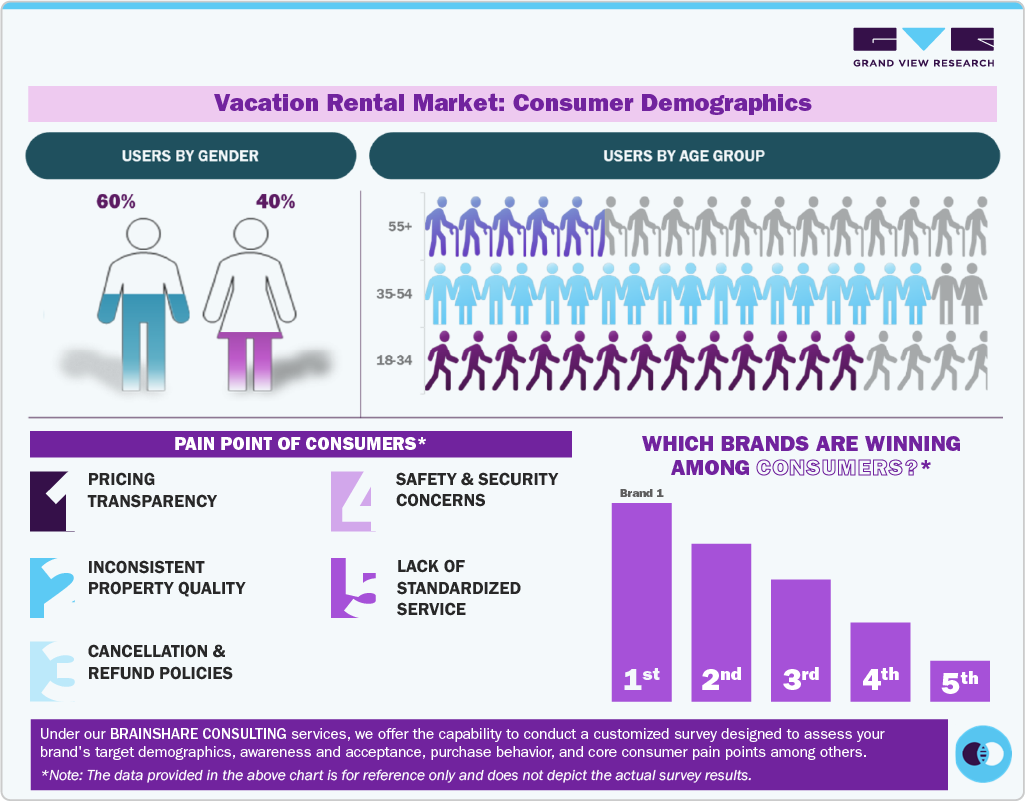

Consumer Insights

Higher satisfaction levels and the growing demand for comfort-oriented stays increasingly shape consumer preferences in the vacation rental industry. 2025 surveys indicate that 82% of vacation rental guests report high satisfaction, compared to 68% of hotel guests, highlighting a clear advantage for rental accommodations. Travelers particularly value spacious layouts, enhanced privacy, and access to full kitchens, features that are especially important for families, group travelers, and those planning more extended trips. These benefits make vacation rentals more appealing than traditional hotels, particularly for extended stays and leisure-focused travel.

In addition, shifting travel behavior in the post-pandemic era has strengthened demand within the holiday rental market, with a notable rise in bookings for two weeks or more. Apartments and condos are gaining popularity among remote workers and families seeking flexibility, autonomy, and cost-effective options for larger groups. Consumers are drawn to vacation rentals for their ability to offer local, immersive experience alongside home-like comforts, such as multiple bedrooms, terraces, and fully equipped kitchens. This combination of flexibility, affordability, and experiential value continues to drive preference toward vacation rentals over conventional hotel stays.

Accommodation Insights

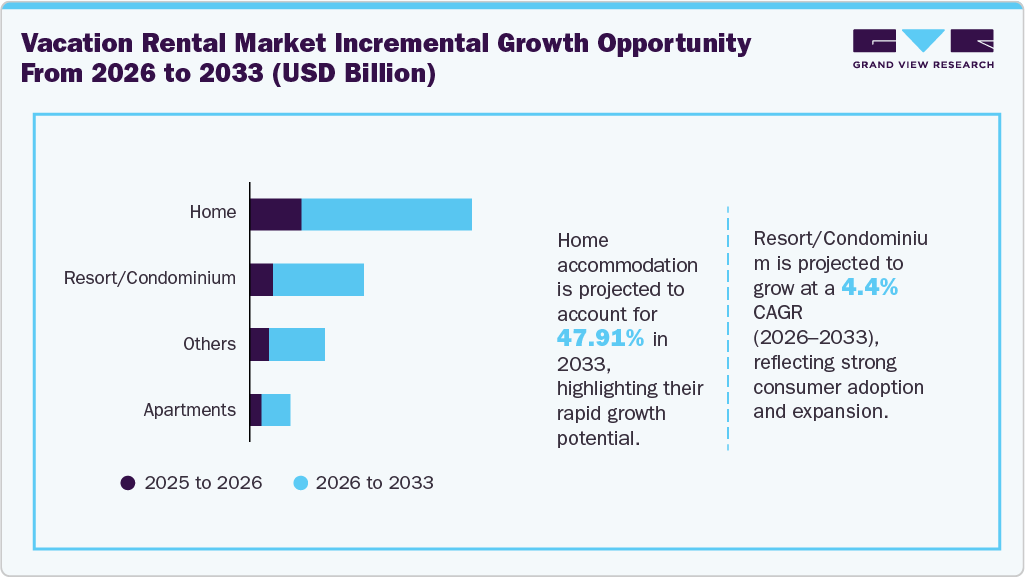

Home accommodation held the largest revenue share of the vacation rental industry in 2025, accounting for a share of 47.68%. Opting for a lavish home or villa as accommodation instead of a luxurious 5-star hotel presents a cost-effective alternative for holiday stays, which can be a significant expense during any trip. Homes offer a budget-friendly option, particularly advantageous for group bookings. Recognizing the growing demand for home vacation rentals, hotel companies have been strategically entering this market segment.

For instance,in January 2025, Hilton Hotels & Resorts announced a partnership with Evermore Orlando Resort, a vacation rental resort offering hundreds of homes within a single expansive property. The development combines the space and flexibility of vacation rentals with resort-style amenities, including a 24-hour front desk and on-site dining.

Resort/Condominium is anticipated to witness a CAGR of 4.4% from 2026 to 2033. The resort and condominium accommodation in the market is driven by travelers seeking the luxury and amenities typically associated with resorts, combined with the space, privacy, and home-like comforts of a condominium. These properties often offer a range of upscale features such as swimming pools, fitness centers, and concierge services, appealing to those looking for a more upscale and hassle-free vacation experience. Moreover, the ability to accommodate larger groups or families in a single unit, often with kitchen facilities and multiple bedrooms, adds to their attractiveness.

Booking Mode Insights

Bookings through offline mode held the largest revenue share of 69.25% in the vacation rental industry in 2025. The widespread availability of offline channels and their well-established and extensive networks across the globe are key factors boosting segment growth. Generation X and baby boomers comprise the major share of tourists in the market. Individuals in these generations are most likely to book their tours through travel agencies and other offline channels that provide convenient and easy services.

Bookings through online mode are anticipated to witness a CAGR of 4.4% from 2026 to 2033. The market has seen substantial growth, significantly propelled by the popularity of online platforms such as Vrbo, HomeAway, Airbnb, and Booking.com. Booking vacation rentals has become more convenient post-pandemic, with the proliferation of online booking sites that offer a wide range of options worldwide.

Regional Insights

North America Vacation Rental Market Trends

The North American vacation rental industry held a global revenue share of 23.36% in 2025. The market in North America is driven by a combination of factors, including the increasing demand for unique and personalized travel experiences, the growth of digital platforms like Airbnb and Vrbo, and the shift in traveler preferences towards home-like amenities and flexible accommodation options. Economic factors such as rising disposable incomes and the proliferation of remote work have also contributed to this trend, enabling more frequent and extended travel.

U.S. Vacation Rental Market Trends

The vacation rental industry in the U.S. is anticipated to witness a CAGR of 2.9% from 2026 to 2033. The U.S. market is primarily driven by increasing consumer preference for unique, personalized travel experiences and the growing demand for accommodations that can cater to larger groups or families, often at a lower cost than traditional hotels. Additionally, the widespread adoption of digital booking platforms, expanding inventory across suburban and leisure destinations, and rising remote work flexibility are further supporting steady demand and repeat bookings nationwide.

Furthermore, continued platform innovation, dynamic pricing capabilities, and professional property management services are improving host profitability and guest satisfaction. Growth in drive-to destinations, short-term leisure trips, and event-driven travel demand is also reinforcing occupancy levels, positioning the U.S. market for stable, long-term expansion across diverse traveler segments.

Europe Vacation Rental Market Trends

The vacation rental industry in Europe held a revenue share of 33.89% in the global vacation rental industry in 2025. Rising travel connectivity and rapid penetration of high-speed internet have made even the most remote places in Europe more accessible to travelers. This is driving the urge to explore new, exotic, and exciting locations across the region, fueling the market. Germany, France, the UK, Italy, and Spain are the largest markets in the region, with cities like London, Paris, Rome, Moscow, Madrid, Saint Petersburg, Barcelona, Lisbon, Milano, and Batumi having the highest number of vacation rentals. Travelers across the region are looking for more convenient options to book and manage trips and accommodation, and this has driven the preference for online and mobile reservations.

The vacation rental industry in the UK is anticipated to witness a CAGR of 3.7% from 2026 to 2033. Sustainability is becoming a major influencing factor in the UK market, as eco-conscious travelers increasingly prefer holiday rentals that align with their environmental values. Guests are actively seeking properties powered by renewable energy, equipped with low-impact amenities, and offering locally sourced products to reduce their carbon footprint. In the evolving vacation market, accommodations that promote green certifications, waste reduction practices, and sustainable design often attract premium bookings and stronger brand loyalty, as responsible travel continues to shape consumer decision-making.

The vacation rental industry in France is anticipated to witness a CAGR of 4.1% from 2026 to 2033. Demand across France remains strong, with steady occupancy levels supported by both domestic and international travelers seeking diverse experiences. Scenic and resort regions such as the Alps, the French Riviera, and countryside destinations are seeing quite resilient bookings, as travelers increasingly prioritize experiential, nature-oriented stays. In the evolving vacation property market, year-round tourism, event-driven travel, and flexible booking trends are helping maintain stable occupancy rates, even amid rising supply and regulatory adjustments.

Asia Pacific Vacation Rental Market Trends

The Asia Pacific vacation rental industry is anticipated to witness a CAGR of 4.9% from 2026 to 2033. Short-term rental markets across the Asia Pacific are witnessing substantial expansion, driven by rising middle-class travel demand, higher disposable incomes, and the widespread adoption of mobile and online booking platforms. As travel becomes more accessible and digitally driven, short-term rental markets are benefiting from growing demand for flexible, cost-effective accommodation options across Southeast Asia, East Asia, and other emerging regional destinations.

At the same time, evolving traveler expectations are reshaping short-term rental markets in the region. Guests increasingly seek vacation rentals that provide unique experiences, authentic local flavor, and home-like comforts rather than standardized hotel stays. From private villas in Bali and Phuket to modern city apartments in Kuala Lumpur and Tokyo, travelers are prioritizing space, privacy, and immersive cultural experiences, positioning the holiday rental segment as an integral part of the Asia Pacific’s broader tourism ecosystem.

The vacation rental industry in China held a revenue share of 44.20% of the Asia Pacific market. Technology plays a central role in shaping China’s vacation rental landscape, as digital platforms, mobile payment systems, and app-based booking services make short-term rentals more accessible and convenient for travelers. The widespread adoption of super-app ecosystems and online travel agencies has streamlined property discovery, booking, and customer support, thereby strengthening consumer trust in the segment. Additionally, rising domestic tourism, increasing disposable incomes, and a growing preference for flexible, experience-driven stays continue to drive expansion within China’s evolving vacation property market.

The vacation rental industry in Japan is anticipated to witness a CAGR of 4.0% from 2026 to 2033. Japan’s market benefits from a wide variety of destinations that cater to different traveler preferences. Major cities such as Tokyo, Osaka, and Kyoto attract visitors seeking cultural landmarks and urban experiences. At the same time, regions like Hokkaido and Okinawa appeal to those looking for nature, beaches, and seasonal attractions. Traditional townhouses, countryside homes, and modern apartments offer travelers distinctive accommodation options, supporting demand for immersive, locally authentic stays across both metropolitan and rural areas.

The vacation rental industry in Australia is anticipated to witness a CAGR of 5.6% from 2026 to 2033. Australia's beautiful coastline and scenic regions make it an attractive destination for vacation rentals. Coastal areas, beachside towns, and regions with natural attractions like the Great Barrier Reef, Whitsundays, Blue Mountains, and the Yarra Valley are popular spots for vacation rental properties

Central & South America Vacation Rental Market Trends

The vacation rental industry in Central & South America held a share of 5.64% of the global vacation rental industry in 2025. Urban and leisure destinations are the primary growth engines of the market, with cities like Rio de Janeiro, Buenos Aires, Cancún, Tulum, and Mexico City consistently ranking among the most searched holiday rental markets. These destinations combine strong international tourism appeal, vibrant cultural attractions, beaches, nightlife, and expanding digital nomad communities, driving high demand for short-term rentals. Urban centers attract business and cultural travelers seeking centrally located apartments, while coastal leisure hotspots draw families and long-stay tourists looking for private villas and beachfront properties. Improved air connectivity, social media exposure, and platform-based booking convenience further strengthen occupancy levels and average daily rates in these high-demand cities.

Middle East & Africa Vacation Rental Market Trends

The vacation rental industry in Middle East & Africa is anticipated to witness a CAGR of 4.3% from 2026 to 2033. Tourism growth is a key driver of short-term rental market demand across the Middle East, supported by rising leisure travel and substantial government investment in luxury and lifestyle tourism. Destinations such as Dubai and Riyadh attract year-round visitors through high-profile events, international exhibitions, shopping festivals, sporting tournaments, and expanding cultural attractions. Large-scale developments, premium hospitality infrastructure, and diversified entertainment offerings are positioning these cities as global tourism hubs. As a result, travelers increasingly prefer flexible accommodation options such as apartments and villas, boosting occupancy rates and average daily rental rates in the vacation market.

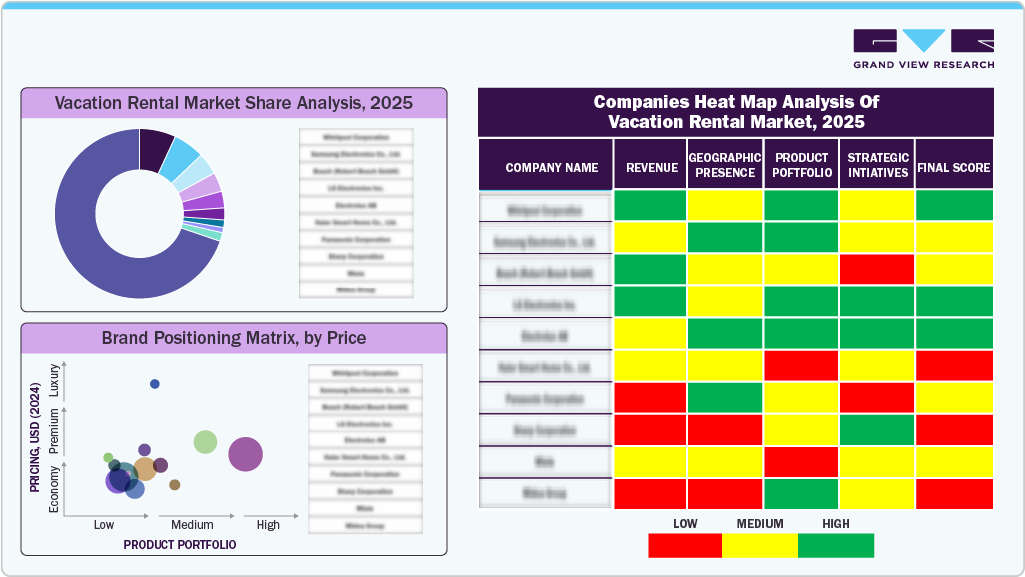

Key Vacation Rental Company Insights

The global vacation rental industry is characterized by the presence of a few well-established players, such as Airbnb Inc., Booking Holdings Inc., Expedia Group Inc., Hotelplan Holding AG, MakeMyTrip Pvt. Ltd., NOVASOL AS, and Oravel Stays Pvt. Ltd. The market players face intense competition from each other, as some of them are among the top manufacturers with diverse product portfolios for the products. These companies have a large customer base due to the presence of established and vast service providers to reach out to both regional and international consumers.

Key Vacation Rental Companies:

The following key companies have been profiled for this study on the vacation rental market.

- 9flats.com Pte Ltd.

- Airbnb Inc.

- Booking Holdings Inc.

- Expedia Group Inc.

- Hotelplan Holding AG

- MakeMyTrip Pvt. Ltd.

- NOVASOL AS

- Oravel Stays Pvt. Ltd.

- TripAdvisor Inc.

- Wyndham Destinations Inc.

Recent Developments

-

In July 2025, OYO Rooms announced the expansion of its European vacation rental brand DanCenter across India’s leisure and tourism hubs, adding about 50 premium homes in the April–June quarter and planning to increase its portfolio to roughly 250 luxury vacation homes by the end of FY 26.

-

In April 2025, Stayterra was launched as a new premier vacation rental management collection in the U.S., backed by investment firm Garnett Station Partners and led by hospitality veteran Mary Lynn Clark as CEO. The company brings together leading local brands, starting with Prime Vacations, which manages over 1,000 properties across popular Florida destinations like Anna Maria Island and Siesta Key, under one network to deliver elevated, personalized guest experiences and professional property management services for owners.

Vacation Rental Market Report Scope

Report Attribute

Details

Market size in 2026

USD 106.45 billion

Revenue Forecast in 2033

USD 121.94 billion

Growth rate (Revenue)

CAGR of 3.7% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation, booking mode, region

Region Covered

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Covered

U.S.; Canada; UK; Germany; France; UK; China; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

9flats.com Pte Ltd.; Airbnb Inc.; Booking Holdings Inc.; Expedia Group Inc.; Hotelplan Holding AG; MakeMyTrip Pvt. Ltd.; NOVASOL AS; Oravel Stays Pvt. Ltd.; TripAdvisor Inc.; Wyndham Destinations Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vacation Rental Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global vacation rental market report based on accommodation, booking mode, and region.

-

Accommodation Outlook (Revenue, USD Billion, 2021 - 2033)

-

Home

-

Apartments

-

Resort/Condominium

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global vacation rental market size was estimated at USD 101.69 billion in 2025 and is expected to reach USD 106.47 billion in 2026.

b. Some key players operating in the vacation rental market include 9flats.com Pte Ltd., Airbnb Inc., Booking Holdings Inc., Expedia Group Inc., Hotelplan Holding AG, MakeMyTrip Pvt. Ltd., NOVASOL AS, Oravel Stays Pvt. Ltd., TripAdvisor Inc. and Wyndham Destinations Inc.

b. Key factors that are driving the vacation rental market growth include comfort, low cost, more privacy, kids, and the pet-friendly nature of the accommodation coupled with rising expenditure on travel, vacations, and accommodation among millennials.

b. The global vacation rental market is expected to grow at a compound annual growth rate of 3.7% from 2026 to 2033 to reach USD 121.94 billion by 2033.

b. Europe dominated the vacation rental market with a share of 33.89% in 2025. This is attributable to the presence of big tour operators and online tour operators already catching up with the growing trend of glamping and rising expenditure for booking accommodation in resorts and condominiums.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.