- Home

- »

- Sensors & Controls

- »

-

UV LED Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![UV LED Market Size, Share, & Trends Report]()

UV LED Market (2024 - 2030) Size, Share, & Trends Analysis Report By Technology (UV-A, UV-B), By Power Output (Less than 1W, 1W -5W), By Application (UV Curing, Medical Light Therapy), By End Use (Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-401-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UV LED Market Summary

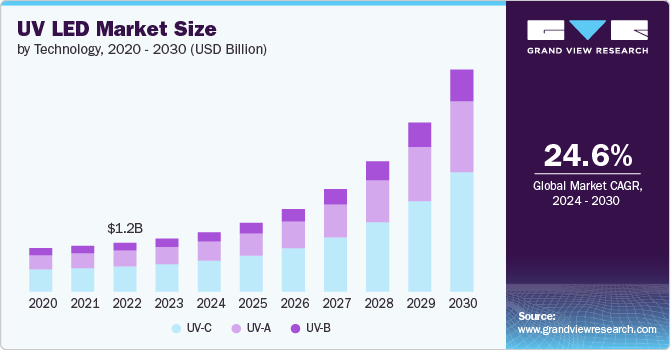

The global UV LED market size was estimated at USD 1.36 billion in 2023 and is projected to reach USD 5.68 billion by 2030, growing at a CAGR of 24.6% from 2024 to 2030. The growth of the market is driven by the rising demand for energy-efficient and environmentally friendly lighting solutions, along with the increasing adoption of UV LEDs in various applications such as disinfection and sterilization.

Key Market Trends & Insights

- The market in Asia Pacific held the major share of 40.1% in 2023.

- The market in the U.S. is expected to grow significantly from 2024 to 2030.

- By technology, the UV-C segment accounted for the largest market share of over 50% in 2023.

- By power output, the 1W -5W segment accounted for the largest market share of more than 42.0% in 2023.

- By application, the UV curing segment accounted for the largest market share of 30.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.36 Billion

- 2030 Projected Market Size: USD 5.68 Billion

- CAGR (2024-2030): 24.6%

- Asia Pacific: Largest market in 2023

The growing awareness of the harmful effects of mercury-based UV lamps has accelerated the shift towards UV LED technology, which is mercury-free and offers longer lifespan and lower energy consumption. Additionally, advancements in UV LED technology, resulting in improved performance and cost-effectiveness, have further fueled market growth.UV LEDs consume significantly less power compared to traditional UV lamps, making them an attractive option for a wide range of applications, including sterilization, medical devices, and water purification. The growing awareness of energy conservation and the need for sustainable technologies further boost the adoption of UV LEDs. For instance, in October 2023, UltraViolet Devices, Inc. (UVDI), a U.S.-based UV disinfection technology producer, announced the global availability of the new UVDI-GO UV LED Surface Sanitizer in healthcare settings. The UVDI-GO has shown over 99.99% effectiveness in deactivating common healthcare-associated microorganisms, from surfaces within 20 seconds. Its rapid action, safe application on surfaces, and portability allow trained healthcare professionals to sanitize surfaces efficiently.

Technological advancements and innovations in UV LED technology are also propelling market growth. Manufacturers are continuously improving the performance, efficiency, and lifespan of UV LEDs, making them more cost-effective and reliable. The development of new materials and improved manufacturing processes has led to the production of UV LEDs with higher power outputs and better thermal management. These advancements enable UV LEDs to be used in more demanding applications, such as industrial curing processes and advanced manufacturing, expanding their market potential. For instance, in May 2023, NICHIA CORPORATION, a Japanese LED manufacturer unveiled a new LED irradiation device for assessing UV sensitivity, including the inactivation of microorganisms. This innovative device is engineered to ensure precise and consistent evaluation of UV sensitivity, factoring in the electrical and thermal properties of the LEDs, the irradiance on the target surface, the distribution of irradiance, exposure duration, beam angle, reflections from adjacent materials, and the sample's temperature.

Furthermore, the increasing regulatory support and stringent government regulations regarding environmental safety are influencing the market positively. Traditional mercury-based UV lamps pose environmental and health hazards due to mercury content. Regulatory bodies worldwide are phasing out these mercury-based lamps, encouraging the adoption of UV LEDs as a safer and more environmentally friendly alternative. This regulatory push is creating new opportunities for UV LED manufacturers and driving market expansion. For example,Canada's SOR/2024-109 Regulations Amending the Products Containing Mercury Regulations aim to reduce mercury exposure risks to the environment and human health by prohibiting the manufacturing and import of most mercury-containing products, with exceptions like pest control products. Effective June 19, 2025, the amendments support Canada's National Strategy for Lamps Containing Mercury by gradually phasing out common mercury-containing lamps. New prohibitions on mercury lamps for general lighting are expected to be implemented in the coming years.

The COVID-19 pandemic highlighted the importance of effective sterilization and disinfection technologies, leading to a surge in demand for UV LED-based solutions. UV LEDs are used for sterilizing medical equipment, air, and surfaces, offering a chemical-free method to eliminate pathogens. This has accelerated the development and deployment of UV LED products in healthcare settings, contributing significantly to market growth.

Technology Insights

The UV-C segment accounted for the largest market share of over 50% in 2023.The ongoing demand for effective sterilization solutions is a significant growth driver. The capability of UV-C light to deactivate viruses, bacteria, and other pathogens without the use of harmful chemicals has made it a preferred choice in healthcare settings, public spaces, and for personal use. For instance, in June 2024,Silanna, a U.S.-based semiconductor company announced the introduction of a new Quad High-Power far-UVC LED, the SF1-3M1FWL1. This high-power LED emits far-UVC light with a peak wavelength of 235nm and comes in a compact package, suitable for various applications. Its effectiveness spans surface disinfection, medical device sterilization, air purification, home appliance sterilization, and liquid chromatography. Being mercury-free, these LEDs provide significant environmental and regulatory benefits, and their durable design minimizes maintenance and replacement costs.

The UV-A segment is anticipated to grow at a significant CAGR over the forecast period owing to the expanding use of UV-A LEDs in curing processes. UV-A LED technology is used extensively in curing adhesives, coatings, and inks due to its efficiency and the rapid curing times it offers compared to traditional methods. This has led to increased adoption in manufacturing and printing industries, which value the improved production speeds and reduced energy consumption provided by UV-A LEDs.

Power Output Insights

The 1W -5W segment accounted for the largest market share of more than 42.0% in 2023.These UV LEDs are particularly favored in industries where precise and effective UV radiation is needed without the extensive power consumption or heat generation associated with higher power LEDs. The applications within this power range include curing of inks, coatings, and adhesives, medical and scientific instruments, and certain disinfection and sterilization processes. The balanced output of 1W - 5W UV LEDs makes them ideal for portable and compact devices, contributing to their popularity in consumer electronics and personal care products as well.

The more than 5W segment is anticipated to grow at the fastest CAGR over the forecast period.UV LEDs with power outputs exceeding 5W are increasingly being used in water and air purification systems. These applications require high-intensity UV light to effectively break down contaminants and microorganisms. The compact size and energy efficiency of UV LEDs make them ideal for integration into residential, commercial, and municipal purification systems. As concerns over water quality and air pollution continue to rise globally, the demand for robust UV purification solutions is expected to grow correspondingly.

Application Insights

The UV curing segment accounted for the largest market share of 30.3% in 2023.Advances in UV LED technology, in particular, have revolutionized the industry by providing energy-efficient and longer-lasting alternatives to traditional mercury lamps. UV LEDs offer numerous benefits, including lower power consumption, minimal heat generation, and enhanced safety due to the absence of mercury. For instance, in September 2023, FUJIFILMa Japanese manufacturer of photographic films, introduced LuXtreme, an advanced LED UV curing system that can retrofit any traditional flexographic press for LED UV curing, significantly improving label production on narrow web presses. LuXtreme supports high-speed operations of up to 200m/min and enhances substrate stability, boosting overall printer productivity. Additionally, the system achieves the same radiant intensity as other similar systems while using 30-60% fewer LED lamps.

The disinfection & sterilization segment is anticipated to grow at the fastest CAGR over the forecast perioddriven by increasing awareness of hygiene and the need to control infections, especially in healthcare and public spaces. Hospitals, laboratories, and even households are investing more in equipment that can ensure a sterile environment, thereby propelling the market forward. Additionally, stringent regulations and guidelines from health organizations worldwide have further necessitated the adoption of reliable disinfection and sterilization solutions.

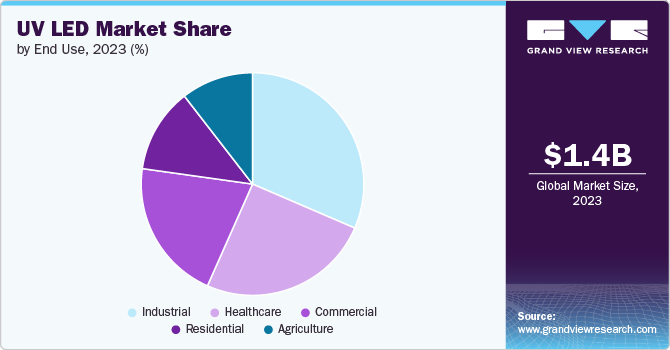

End Use Insights

The industrial segment accounted for the largest market share of 31.5% in 2023. The industrial segment's need for advanced technology and the energy efficiency offered by UV LEDs creates a significant growth. Innovations in UV LED technology continue to expand their application range, enhancing productivity and sustainability across various sectors. As industries prioritize energy efficiency and operational excellence, the UV LED market is poised to witness substantial growth, driven by industrial demand and environmental considerations.

The healthcare segment is anticipated to grow at the fastest CAGR over the forecast period. UV LEDs are increasingly used in disinfection and sterilization processes due to their effectiveness in eliminating harmful microorganisms. This technology's ability to deliver high-intensity ultraviolet light while consuming less energy compared to traditional mercury-based UV lamps makes it an attractive option for healthcare facilities. For instance, in February 2024, Seal Shield, a U.S.-based healthcare technology provider launched Shyld AI autonomous UV-C disinfection system. This cutting-edge technology represents a major leap in disinfection practices, utilizing advanced AI to detect high-risk areas in healthcare facilities and automatically initiate UV-C disinfection of high-touch surfaces when rooms are vacant. Additionally, Shyld AI continuously tracks individuals’ locations and disinfects aerosols and droplets in overhead spaces, even when rooms are occupied, ensuring a high standard of cleanliness and reducing the risk of healthcare-associated infections.

Regional Insights

North America is growing significantly at the highest CAGR of 23.0% from 2024 to 2030. Environmental regulations and the push for eco-friendly solutions are propelling the market in the region. Traditional mercury-based UV lamps pose significant environmental and health risks due to their toxic mercury content. In contrast, UV LEDs are mercury-free and offer a safer, more environmentally friendly alternative. Regulatory bodies in North America are encouraging the shift towards mercury-free technologies, further accelerating the adoption of UV LEDs.

U.S. UV LED Market Trends

The market in the U.S. is expected to grow significantly from 2024 to 2030.Government regulations and initiatives aimed at promoting the use of sustainable and safe technologies further support the growth of the market. Policies that incentivize the adoption of energy-efficient solutions and restrict the use of hazardous materials in lighting systems are encouraging industries to transition to UV LED technology. Additionally, collaborations between key industry players and research institutions are fostering innovation and development, driving the market forward.

Europe UV LED Market Trends

The market in Europe is expected to grow significantly at a CAGR of 22.7% from 2024 to 2030 owing to the increasing demand for UV LEDs in various applications such as healthcare and industrial sectors. UV LEDs are gaining traction in medical sterilization, where their ability to eliminate pathogens effectively makes them invaluable. Additionally, their use in industrial applications for curing and printing processes is expanding as companies seek more efficient and eco-friendly solutions compared to traditional UV lamps.

Asia Pacific UV LED Market Trends

The market in Asia Pacific held the major share of 40.1% in 2023 due to the rapid industrialization and urbanization occurring across many countries in the region. As industries expand and modernize, there is a growing need for efficient, advanced lighting solutions. UV LEDs are increasingly being adopted in sectors such as printing, coatings, and electronics, where their ability to offer precise and rapid curing processes is highly valued.

Key UV LED Company Insights

The key companies in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key UV LED Companies:

The following are the leading companies in the uv led market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Optoelectronic Technology, Inc.

- Crystal IS, Inc.

- EPISTAR Corporation

- Excelitas Noblelight

- LG Innotek

- Lumileds Holding B.V.

- NICHIA CORPORATION

- ams-OSRAM AG

- Phoseon Technology

- Semileds Corporation

- Sensor Electronic Technology, Inc. (SETi)

- Seoul Viosys Co., Ltd.

- STANLEY ELECTRIC CO., LTD.

- Ushio, Inc.

- Violumas

Recent Developments

-

In April 2024, Violumas broadened its high-power UV LED lineup by introducing new VC3X3 COB Module. The M3X3L9 sets are offered various UV-B and UV-C wavelengths and feature the Violumas VC3X3 UV LED COB paired with a fan-cooled heatsink for enhanced performance and stability. By offering the VC3X3 COB as a product, Violumas aims to advance solutions for demanding applications such as spectroscopy, disinfection, and phototherapy.

-

In March 2024, NICHIA CORPORATIONlaunched UV-B (308nm) and UV-A (330nm) LEDs. The company began mass production of new UV-B (308nm) and UV-A (330nm) LEDs in its 434 Series package. The company is committed to advancing UV LED technology to address social challenges, including promoting a mercury-free environment and achieving carbon neutrality.

UV LED Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.52 billion

Revenue forecast in 2030

USD 5.68 billion

Growth Rate

CAGR of 24.6% from 2024 to 2030

Actual data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Technology, power output, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Kingdom of Saudi Arabia, South Africa

Key companies profiled

Advanced Optoelectronic Technology, Inc.; Crystal IS, Inc.; EPISTAR Corporation; Excelitas Noblelight; LG Innotek; Lumileds Holding B.V.; NICHIA CORPORATION; ams-OSRAM AG; Phoseon Technology; Semileds Corporation; Sensor Electronic Technology, Inc. (SETi); Seoul Viosys Co., Ltd.; STANLEY ELECTRIC CO., LTD.; Ushio, Inc.; Violumas

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global UV LED Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UV LED market report based on technology, power output, application, end use, and region.

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

UV-A

-

UV-B

-

UV-C

-

-

Power Output Outlook (Revenue, USD Billion, 2018 - 2030)

-

Less than 1W

-

1W -5W

-

More than 5W

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

UV curing

-

Medical light therapy

-

Disinfection & sterilization

-

Counterfeit detection

-

Optical sensing & instrumentation

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

Agriculture

-

Healthcare

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global UV LED market size was estimated at USD 1.36 billion in 2023 and is expected to reach USD 1.52 billion in 2024.

b. The global UV LED market is expected to grow at a compound annual growth rate of 24.6% from 2024 to 2030 to reach USD 5.68 billion by 2030.

b. The UV-C segment accounted for the largest market share of over 51.0% in 2023. The ongoing demand for effective sterilization solutions is a significant growth driver.

b. Some key players operating in the UV LED market include Advanced Optoelectronic Technology, Inc., Crystal IS, Inc., EPISTAR Corporation, Excelitas Noblelight, LG Innotek, Lumileds Holding B.V., NICHIA CORPORATION, ams-OSRAM AG, Phoseon Technology, Semileds Corporation, Sensor Electronic Technology, Inc. (SETi), Seoul Viosys Co., Ltd., STANLEY ELECTRIC CO., LTD., Ushio, Inc., and Violumas

b. The growth of the market is driven by the rising demand for energy-efficient and environmentally friendly lighting solutions, along with the increasing adoption of UV LEDs in various applications such as disinfection and sterilization.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.