- Home

- »

- Automotive & Transportation

- »

-

Utility Trucks Market Size & Share, Industry Report, 2030GVR Report cover

![Utility Trucks Market Size, Share & Trends Report]()

Utility Trucks Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Garbage Truck, Fire Truck, Dump Truck, Sweeper Truck), By Engine (ICE, Electric), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-961-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Utility Trucks Market Size & Trends

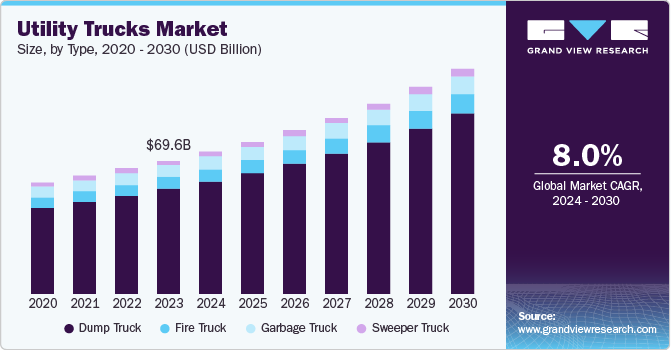

The global utility trucks market size was valued at USD 69.63 billion in 2023 and is projected to grow at a CAGR of 8.0% from 2024 to 2030. Increasing municipal corporation budget allocations and the growing need for sustainable infrastructure are boosting the adoption of utility trucks. Moreover, regions with extensive construction and mining activities are increasing demand for dump trucks. In addition, due to the rising cases of fire incidents, various governments have started implementing stringent regulations concerning fire safety and rescue operations, increasing the demand for fire trucks.

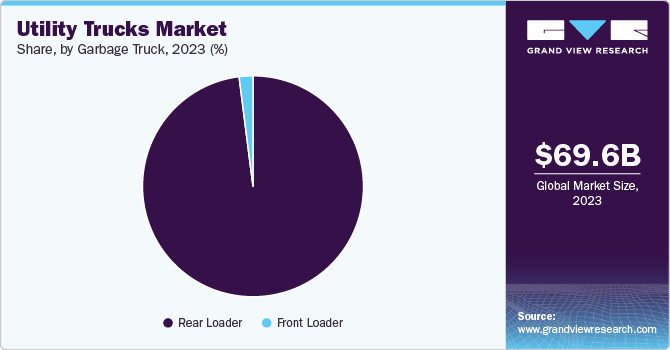

A rising focus on waste management techniques owing to the increasing solid waste disposal rate is proliferating the demand for garbage trucks. According to the Global Waste Management Outlook 2024 report by the United Nations Environment Programme (UNEP) published jointly with the International Solid Waste Association (ISWA), municipal solid waste generation is expected to grow from 2.1 billion tonnes in 2023 to 3.8 billion tonnes by 2050. This has forced various governments across the globe to frame stringent regulations regarding solid waste management and disposal, which has increased municipal budgets.

Increasing urbanization and global population are propelling the demand for utility trucks. However, considering the net zero carbon emission goal, the popularity and high adoption of electric utility trucks are expected. Urban area expansion & increasing volume of waste generated have propelled demand for garbage trucks. Stringent regulations for waste management have made developed and developing economies adopt waste collection methods where garbage trucks are used.

Type Insights

The dump truck segment dominated the market and accounted for a revenue share of 78.9% in 2023 due to increasing mining & excavation activities, use of dump trucks to move harvested crops in agriculture, waste management processes adopted by governments worldwide, and economic growth resulting increase in industrial activities. Also, new housing, commercial, and government-supported infrastructure development projects drive the demand for dump trucks in earthmoving and construction activities. For instance, the Infrastructure Investment and Jobs Act of the U.S. aimed to invest 1.2 trillion USD in infrastructure redevelopment to rebuild roads & bridges, change lead pipes, improve public transportation, and resolve drinking water contamination and more, propelling the demand for dump trucks.

The fire truck segment is expected to grow significantly from 2024 to 2030. As urban areas expand and populations grow, the demand for effective emergency response services increases. This urbanization leads to higher risks of fires due to densely packed buildings, industrial activities, and increased human activity. Consequently, municipalities are investing more in fire safety infrastructure, which includes acquiring advanced fire trucks equipped with modern technology. Also, Government regulations regarding fire safety standards play a crucial role in shaping the demand for fire trucks. Many countries have stringent laws requiring municipalities to maintain specific levels of firefighting capability, increasing the demand for procuring and maintaining fire trucks.

Engine Insights

The ICE (Diesel/Gasoline/CNG/Hybrid) segment dominated the market and accounted for the largest revenue share in 2023. This is owing to the heavy-duty applications of these trucks, which require a high torque ratio. Since diesel and gasoline-powered engines offer higher torque than compressed natural gas (CNG) and hybrid engines, the current fleet of utility trucks is mostly fuel-powered. However, continuous technological advancements, stringent emission standards for heavy-duty trucks, and an increasing focus on electrically powered vehicles are expected to hinder the growth of diesel and gasoline-powered vehicles.

The electric segment is expected to grow at the fastest CAGR during the forecast period. Due to increasing environmental concerns such as global warming & greenhouse gas emissions, Governments worldwide are imposing stricter emission standards, making electric vehicles a more attractive option for fleet operators. Moreover, many countries offer tax breaks, subsidies, and other incentives to promote the adoption of electric vehicles. Also, electric trucks have lower fuel & maintenance costs than diesel-engine trucks, leading to long-term savings and making them attractive for different purposes.

Regional Insights

North America utility trucks market held a significant market share in 2023 due to infrastructure development, waste management needs, government initiatives, and a growing emphasis on disaster response. Various industries such as mining, construction, and waste management in the region increase the demand for utility trucks. Heavy investments from the government in businesses and infrastructure development drive market growth.

U.S. Utility Trucks Market Trends

The U.S. utility trucks market held a significant market share in North America in 2023 Innovations in utility truck designs have significantly transformed the market, attracting buyers seeking modern and efficient vehicles. Advances in fuel efficiency technologies reduce operating costs and minimize environmental impact, appealing to businesses focused on sustainability and cost-effectiveness. Introducing electric and hybrid models marks a pivotal shift towards greener alternatives, offering reduced emissions and compliance with stringent environmental regulations. Enhanced safety features, such as advanced driver assistance systems (ADAS), collision avoidance, and automated braking, ensure higher safety standards, reducing accidents and improving overall operational safety.

Europe Utility Trucks Market Trends

Europe utility trucks market is expected to grow at a significant CAGR during the forecast period due to economic growth and infrastructure development, technological advancements. The region is witnessing a shift towards electric and alternative fuel-powered vehicles, driven by stringent emission norms. Net zero carbon emission goals by United Nations members and Europe’s Focus on environmental sustainability & advanced technologies increase the demand for electric and alternative fuel-powered vehicles.

UK utility trucks market held a substantial market share in 2023 owing to the demand for waste management and municipal utility trucks. The government's emphasis on recycling and waste reduction drives the segment's investment. Companies increasingly focus on developing electric and hybrid utility trucks to meet environmental regulations.

The utility truck market in Germany is expected to grow significantly due to the presence of the world's leading truck manufacturers, including Volkswagen Group, MAN, and others. Moreover, technological advancements in fuel efficiency, electrification, and autonomous driving drive market growth.

Asia Pacific Utility Trucks Market Trends

The Asia Pacific utility trucks market held the largest revenue share of 37.1% in 2023. This growth is attributed to increasing urbanization and industrialization across countries like China, India, and Southeast Asian nations, which have led to increased demand for utility trucks. As the urban area grows, the need for waste collection processes and disposal processes increases. Governments invest in public health through waste collection, recycling, and disposal processes. Moreover, Countries like China, India, and Southeast Asia have seen rapid industrialization and urbanization. This economic boom has increased demand for utility trucks across various sectors such as construction, logistics, agriculture, and mining.

The India utility truck market is expected to grow significantly due to a growing economy and infrastructure development. The government’s massive investment in roads, highways, ports, and airports is driving the need for construction equipment and heavy-duty trucks. Moreover, increasing urbanization in the country is driving the demand for better infrastructure, including waste management, further propelling the demand for garbage trucks.

Key Utility Trucks Company Insights

Some of the key companies in the utility trucks market include Daimler Truck AG., Ford Motor Company, General Motors, FCA US LLC., ISUZU MOTORS LIMITED, Mack Trucks, and others. Organizations are focusing on innovative food maker offerings with multiple functionalities to increase the consumer base. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Mack Trucks specializes in designing, building, and delivering medium- and heavy-duty trucks, as well as proprietary engines and transmissions. Recently Mack Truck launched an electric truck named Mack MD Electric.

-

ISUZU MOTORS LIMITED produces reliable trucks for various applications, from heavy to light duty. It offers three-way dump trucks designed for construction and transportation. These trucks can unload their cargo by tilting the cargo box in three directions: rearward, to the left, or to the right.

Key Utility Trucks Companies:

The following are the leading companies in the utility trucks market. These companies collectively hold the largest market share and dictate industry trends.

- Daimler Truck AG.

- Ford Motor Company

- General Motors

- FCA US LLC.

- TOYOTA MOTOR CORPORATION.

- ISUZU MOTORS LIMITED

- NISSAN USA

- Volkswagen Group

- Mack Trucks

- NAVISTAR, INC.

Recent Developments

-

In March 2023, Mack Trucks introduced its second battery-electric vehicle, the MD Electric, following the LR Electric refuse truck. The MD Electric, available in Class 6 and Class 7 ratings, offers a maximum payload of 19,400 pounds and features lithium-nickel-manganese-cobalt oxide batteries for higher energy density. It can be charged using both AC and DC power sources, with a range of up to 230 miles. Mack Trucks aims for 35% of its vehicles to be electric by 2030.

-

In May 2023, Daimler Truck AG, Mitsubishi Fuso Truck and Bus Corporation, Hino, and TOYOTA MOTOR CORPORATION signed a Memorandum of Understanding to accelerate the development of advanced technologies and merge Mitsubishi Fuso and Hino. This collaboration aims to achieve carbon neutrality and enhance the commercial vehicle business globally. The new entity will focus on developing CASE (Connected, Autonomous, Shared, and Electric) technologies and hydrogen solutions.

Utility Trucks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 74.28 billion

Revenue forecast in 2030

USD 117.68 billion

Growth Rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, engine, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Daimler Truck AG.; Ford Motor Company; General Motors; FCA US LLC.; TOYOTA MOTOR CORPORATION; ISUZU MOTORS LIMITED; NISSAN USA; Volkswagen Group; Mack Trucks.; NAVISTAR, INC.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Utility Trucks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global utility trucks market report based on type, engine, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Garbage Truck

-

Front Loader

-

Rear Loader

-

Side Loader

-

-

Fire Truck

-

Dump Truck

-

Sweeper Truck

-

Street Sweeper

-

Parking Lot Sweeper

-

-

-

Engine Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE (Diesel/Gasoline/CNG/Hybrid)

-

Electric

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabi

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.