Utility Poles Market Size, Share & Trends Analysis Report By Product (Transmission & Distribution, Light Pole), By Application, By Size (6-15m, 15-24m), By End-use (New Installations, Replacement), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-303-4

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Utility Poles Market Size & Trends

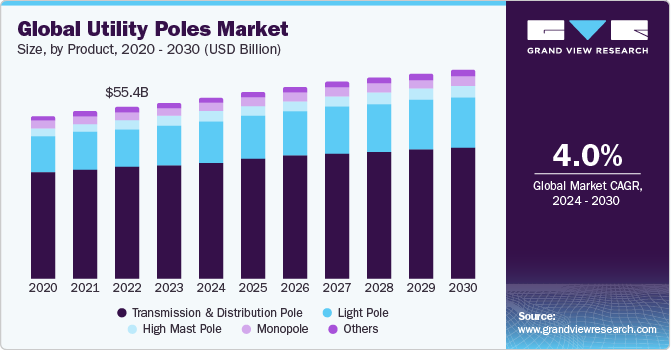

The global utility poles market size was estimated at USD 57.65 billion in 2023 and is expected to grow at a CAGR of 4.0% from 2024 to 2030. The market growth is driven by multiple factors such as rising electricity consumption, the increasing demand for efficient energy distribution and the subsequent construction of power transmission and distribution networks. The proliferation of smartphones, internet connectivity, and data-intensive applications has additionally contributed to the market growth by increasing the demand for efficient communication networks.

The shift toward smart grid technologies is driving the market owing to their ability to enable real-time monitoring of power usage, early detection of faults or damage, and optimization of maintenance schedules. These technologies enable real-time monitoring of power usage, early detection of faults or damage, and optimization of maintenance schedules, leading to improved reliability and efficiency in energy transmission and distribution, which in turn is expected to present lucrative growth opportunities for the market.

Furthermore, the adoption of sustainable practices is becoming more crucial in considering environmental concerns and the demand for eco-friendly solutions. Utility pole manufacturers are responding to this growing trend of implementing sustainable practices by increasingly adopting eco-friendly materials and production processes to reduce the environmental impact of their products and operations. In addition, governments are taking initiatives to implement sustainable practices in the utility poles market by promoting the use of environment-friendly materials and production methods.

In February 2024, The American Composites Manufacturers Association (ACMA) successfully finalized the Utility Pole Product Category Rule (PCR) in collaboration with industry stakeholders. The PCR sets new standards for environmental transparency and performance evaluation within the utility pole manufacturing sector. This achievement marks a noteworthy achievement in the advancement of sustainable infrastructure solutions.

Moreover, the market is witnessing innovation in design and construction techniques. Manufacturers are developing modular and prefabricated pole systems that offer advantages such as ease of installation, reduced maintenance requirements, and improved aesthetics. In addition, manufacturers are increasingly focused on designing utility poles that can withstand extreme weather events and natural disasters, enhancing their resilience and minimizing service disruptions in adverse conditions. This, in turn, is expected to fuel the growth of the utility poles market in the coming years.

Companies operating in the market have adopted various strategies to enhance their market presence and meet the growing demand for utility poles. Many companies are focusing on developing innovative utility pole designs that offer improved strength, durability, and cost-effectiveness. In addition, companies are exploring new geographical markets to tap into emerging opportunities and increase their market share. This may involve strategic partnerships, acquisitions, or setting up manufacturing facilities in key regions to better serve local demand. For instance, in January 2024, Nippon Steel Corporation acquired a 20% interest in Elk Valley Resources, the steelmaking coal business partnership sold by Teck Resources Limited. The acquisition was aimed at securing stable procurement of high-quality steelmaking coal, which is vital for decarbonizing the manufacturing process of steel. Such strategies by key companies are expected to fuel market growth in the coming years.

Market Concentration & Characteristics

The degree of innovation in the market is anticipated to be high owing to technological advancements and changing industry demands. Key players in the market have been focusing on developing new materials, designs, and manufacturing processes to enhance the performance, durability, and sustainability of utility poles. These innovations aim to address challenges such as environmental impact, maintenance costs, and safety concerns associated with traditional utility pole materials like wood. In addition, technology trends such as the adoption of advanced composite materials and the integration of Internet of Things (IoT) devices and sensors into utility poles which enables connectivity and data exchange between various components of electrical grid are expected to boost the market expansion.

The level of merger & acquisition activities in the market is moderate to high. Companies are leveraging mergers and acquisitions to strengthen their operations, enhance profitability, streamline their business processes, and to gain a competitive edge. For instance, in September 2022, Bell Lumber & Pole acquired the assets of The Oeser Company, a utility pole manufacturer and supplier based in Bellingham in the U.S. state of Washington. The company was looking forward to leveraging the asset acquisition to further expand its presence in the Pacific Northwest U.S.

The impact of regulations on the market is high. Regulatory bodies set strict safety standards for utility poles, covering design, construction, and maintenance to ensure public safety and grid reliability. Compliances are mandatory for suppliers and utilities to prevent accidents and meet regulatory requirements. For instance, The National Safety Council (NSC) is calling on road agency officials, utility companies and organizations, the US Congress, and state legislatures to implement a methodical approach for detecting potentially dangerous utility pole setups. They urge taking preventive and corrective measures for both new and existing risky utility pole installations.

The competition from product substitutes in the market is low. The market is experiencing a shift toward sustainable solutions, with greater adoption of composite utility poles and smart grid technologies. Composite utility poles, made from materials like fiberglass-reinforced polymer, offer superior strength, durability, and resistance to environmental factors. These poles are a viable substitute for traditional wooden poles, providing a longer lifespan and reduced maintenance costs.

Product Insights

The transmission & distribution pole segment dominated the market with the largest revenue share of 63.6% in 2023. This dominance is attributed to the global push toward upgrading aging infrastructure to meet modern efficiency and reliability standards. Many countries are focusing on refurbishing and replacing old transmission and distribution lines, which inherently require the installation of new poles. The expansion of electrical grids to accommodate growing populations and the increasing demand for electricity, particularly in developing regions, is spurring the demand for both transmission and distribution poles.

The light pole segment is expected to record the fastest CAGR of 5.1% from 2024 to 2030. The increasing emphasis on energy efficiency and sustainability has led to the widespread adoption of LED lighting, prompting utilities to upgrade their infrastructure with modern light poles. In addition, urbanization and infrastructural development projects worldwide require the installation of new lighting systems, boosting the demand for light poles. Moreover, advancements in materials and manufacturing processes have made light poles more durable, cost-effective, and aesthetically pleasing, further stimulating market growth.

Application Insights

The electricity distribution segment dominated the market with the largest revenue share in 2023. Factors such as the expansion of urban areas and the development of rural electrification projects amplify this demand. In addition, the growing integration of renewable energy sources such as wind and solar power into the grid necessitates the installation of additional utility poles to support the existing transmission and distribution infrastructure. Moreover, advancements in technology, such as smart grid systems and electric vehicle charging stations, require a robust network of utility poles for efficient operation.

The lighting segment is anticipated to witness the fastest growth from 2024 to 2030. The integration of lighting applications into utility poles is increasingly driven by the expansion of cities and modernization initiatives. The consecutive rise in demand for smart infrastructure is prompting utilities to seek multifunctional solutions for utility poles. Lighting applications provide improved visibility and security, aiding pedestrian and vehicular traffic flow, especially in densely populated areas Moreover, the rise of the Internet of Things (IoT) and growing smart city initiatives further drive attention to the potential use of utility poles for a range of innovative lighting applications, such as remote monitoring, data collection, and adaptive lighting.

Size Insights

Based on size, the 6m to 15m segment dominated the market with the largest revenue share in 2023. The increasing demand for renewable energy sources, such as wind and solar power, drives the need for transmission and distribution infrastructure, including utility poles within this size range. Furthermore, stringent regulations regarding the safety and reliability of power distribution networks prompt utilities to invest in newer, more robust utility poles within this size range to replace aging infrastructure. Technological advancements, including the development of lightweight yet durable materials, also contribute to the growth of this segment by offering cost-effective and sustainable solutions.

The 15m to 24m segment is anticipated to record a significant CAGR from 2024 to 2030. Technological advancements in materials such as composites and treated wood are enabling the construction of taller poles that offer improved strength, durability, and resistance to environmental factors. In addition, stringent regulations regarding the safety and reliability of power distribution infrastructure are driving utilities to invest in taller utility poles capable of withstanding extreme weather conditions and minimizing downtime, which is further driving the segmental growth.

End-use Insights

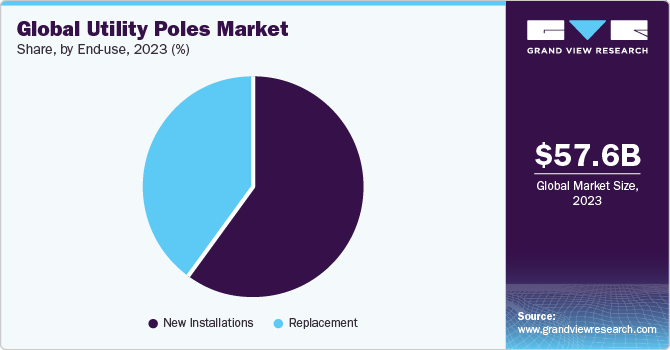

Based on end-use, the new installations segment dominated the market with the largest revenue share in 2023 and is expected to dominate the market from 2024 to 2030. The growth is attributed to the growing focus of utilities on the modernization and expansion of electricity transmission and distribution networks. Increasing urbanization and industrialization are putting increased pressure on existing electricity infrastructure, driving the demand for new structures. Moreover, the replacement of aging utility poles with newer, more durable materials such as composites or steel is contributing to market growth.

The replacement segment is expected to grow at the fastest CAGR from 2024 to 2030, owing to the aging infrastructure and the need for modernization. In addition, technological advancements in materials and construction methods are encouraging utilities to replace older poles with more efficient and cost-effective alternatives. This drive for replacement ensures the reliability and safety of power distribution networks, stimulating continuous growth in the utility poles market.

Regional Insights

The North America utility poles market accounted for a significant market share of over 21% in 2023. The market growth is driven by several factors that are crucial for the development and expansion of infrastructure across the region. The increasing demand for electricity due to urbanization and industrial growth is the major driver; as cities expand and industries grow, the need for an efficient and reliable power distribution network becomes imperative, leading to a higher demand for utility poles.

U.S. Utility Poles Market Trends

The utility poles market in the U.S. is expected to grow at a significant CAGR of 2.1% from 2024 to 2030. The U.S. market is driven by the drive toward electrification and the increasing demand for electricity, spurred by the electric vehicle revolution and the electrification of heating.

Canada utility poles market is expected to grow at a significant CAGR of 3.2% from 2024 to 2030. The country’s commitment to enhancing its electricity infrastructure to support its growing economy and population is driving the market growth in Canada.

Europe Utility Poles Market Trends

The utility poles market in Europe is anticipated to grow at a CAGR of over 2.8% from 2024 to 2030. Europe's emphasis on eco-friendly solutions is driving the adoption of utility poles made from sustainable materials such as composite wood or recycled steel.

The UK utility poles market is expected to grow at a CAGR of 2.2% from 2024 to 2030. Technological advancements and the deployment of smart grid systems are replacing outdated infrastructure with modern, more efficient utility poles, which is driving the market expansion.

The utility poles market in Germany is expected to grow at a CAGR of 1.7% from 2024 to 2030. Germany's ambitious plan to shift to renewable energy sources such as wind and solar necessitates grid expansion. This translates to a rising demand for new utility poles to support additional power lines, further fueling the market growth in Germany.

France utility poles market is projected to grow at a CAGR of over 3.3% from 2024 to 2030. The market is being driven by the increasing demand for online education and digital literacy, with mobile devices such as tablets and smartphones playing a key role in the growth of online education.

Asia Pacific Utility Poles Market Trends

The Asia Pacific utility poles market dominated the market with a revenue share of 44.54% in 2023 and grow at a significant CAGR of 4.9% from 2024 to 2030. The market is being primarily driven by rapid urbanization, industrialization, and the expansion of utility infrastructure across the region. As countries in the Asia Pacific region experience significant population growth and economic development, there is an increasing demand for electricity, telecommunication, and other utility services, which fuels the demand for utility poles.

China utility poles market is projected to grow at a CAGR of over 4.2% from 2024 to 2030. The rapid urbanization and industrialization across the country are fueling the demand for electricity transmission and distribution infrastructure.

The utility poles market in Japan is expected to grow at a CAGR of 4.8% from 2024 to 2030. This can be attributed to Japan's ongoing urbanization and construction activities, which are fueling the demand for utility poles for expanding and upgrading electrical grids to meet the rising energy needs of urban areas.

India utility poles market is expected to grow at a CAGR of 7% from 2024 to 2030. The market in India is primarily driven by the country's ambitious infrastructure development plans, rapid urbanization, and the increasing demand for electricity transmission and distribution networks.

South America Utility Poles Market Trends

The utility poles market in South America is anticipated to grow at a CAGR of over 4.7% from 2024 to 2030. The rapid urbanization and industrialization across the region are propelling the demand for electricity and telecommunication infrastructure, thereby increasing the need for utility poles.

Brazil utility poles market is expected to grow at 3.8% from 2024 to 2030. Government initiatives aimed at rural electrification are stimulating the demand for utility poles, providing a significant boost to the market growth in Brazil.

Middle East And Africa (MEA) Utility Poles Market Trends

The utility poles market in the Middle East and Africa (MEA) region is expected to grow at a significant CAGR of 4.9% from 2024 to 2030. The primary driver is the ongoing effort to expand and modernize electricity infrastructure across the MEA region. As countries focus on industrialization and urbanization to foster economic growth, there is an increasing need to develop and upgrade the existing electricity networks to support burgeoning urban populations and industrial demands, which in turn is expected to fuel market growth.

Saudi Arabia utility poles market is expected to show a significant CAGR of over 3.3% from 2024 to 2030. Saudi Arabia's commitment to sustainable energy and the integration of renewable energy sources into the national grid is a significant market driver. The country's shift toward solar and wind energy requires an expansion of the existing power grid infrastructure, which, in turn, drives the demand for utility poles to connect new renewable energy installations among consumers and industries.

Key Utility Poles Company Insights

Some of the key players operating in the market include Tata Power, Nov Inc, SAE Towers, Nippon Steel Corporation, KEC International Ltd.

-

Tata Steel's diverse product portfolio caters to multiple market segments. The company offers a wide range of steel products, including hot and cold rolled coils and sheets, galvanized sheets, tubes, wires, and construction rebars for various applications in the automotive, construction, consumer goods, and engineering industries, demonstrating the company's versatility in meeting global steel demands.

-

NOV Inc. (formerly known as National Oilwell Varco) provides equipment and components used in oil & gas drilling and production operations, oilfield services, and supply chain integration services to the upstream oil & gas industry. The company is committed to innovation and technological advancement. The company invests aggressively in research and development to improve the performance and durability of its products. The company’s commitment to sustainability and innovation is evident in its efforts to improve the environmental footprint of its products.

New Forests Company, Lishu Steel Co. Ltd, and Omega Company are some of the emerging market participants in the utility poles market.

-

New Forests Company specializes in the manufacturing and supply of transmission poles across East and Southern Africa. The company’s customer base includes national electricity utilities, government agencies, municipalities, and turnkey operators.

-

Lishu Steel Co.Ltd’s product portfolio showcases a diverse range of utility poles crafted from various materials, including steel, concrete, and innovative composite materials, thereby ensuring that the company can meet the specific needs of its global clientele, providing solutions that cater to different environmental conditions, load requirements, and aesthetic preferences.

Key Utility Poles Companies:

The following are the leading companies in the utility poles market. These companies collectively hold the largest market share and dictate industry trends.

- Al-Babtain Power & Telecom

- American Timber and Steel

- Bell Lumber & Pole

- Energya Steel-KSA

- Europoles Middle East LLC

- Frank R. Close & Son, Inc.

- NATIONAL COMPANY FOR GALVANIZING AND STEEL POLES (GALVANCO)

- George Scott (Geo Stott)

- HAS Engineering LLC

- Hidada

- Metrosmart International Trading & Contracting W.L.L.

- New Forests Company

- NOV Inc.

- Omega Company for Luminaries, Poles & Galvanizing

- ORBIX INTERNATIONAL LLC

- R&B Timber Group

- Stella-Jones

- Techno Pole Industries LLC

- Valmont Industries, Inc.

- SAE Towers

- Skipper Limited

- Nanjing Daji Tower Manufacturing Co., Ltd.

- KEC International Inc.

- Lishu Steel Co., Ltd

- Nippon Steel Corporation

- Qingdao Mingzhu Steel Structure Co., Ltd.

- Jiangsu Guohua Tube Tower Manufacturer Co. Ltd.

- Tata Steel

- Kalpataru Projects International Ltd.

- Jyoti Structures Limited

- Sabre Industries, Inc.

- Foresite Group LLC

- Nanjing Tuopeng Construction Technology Co., Ltd

Recent Developments

-

In February 2024, Bell Lumber & Pole acquired a pole peeling facility and wood concentration yard located in Newport in the U.S. state of Maine from Prentiss & Carlisle, a forest resource management and timberland services company. The company’s customers in the Northeast region would enjoy even more direct access to local pole fiber as a result of the deal.

-

In February 2024, Skipper Limited received a contract worth USD 88.55 million (INR 7.37 billion) for the design, supply, and construction of a 765 kV Transmission Line Project for Power Grid Corporation of India Limited.

-

In January 2023, Nippon Steel Corporation collaborated with Mitsubishi Corporation and ExxonMobil Asia Pacific Pte. Ltd. to jointly study Carbon Capture and Storage (CCS) and establish potential CCS value chains in Asia Pacific.

Utility Poles Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 60.12 billion |

|

Revenue forecast in 2030 |

USD 75.88 billion |

|

Growth Rate |

CAGR of 4.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024- 2030 |

|

Quantitative units |

Volume in thousand units; revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Australia; Japan; Brazil; Colombia; Chile; Peru; Saudi Arabia; Qatar; U.A.E.; Ethiopia; Kenya; Uganda; Tanzania; Ghana; Nigeria and Cote d’Ivoire (Ivory Coast) |

|

Key companies profiled |

Al-Babtain Power & Telecom; American Timber and Steel; Bell Lumber & Pole; Energya Steel-KSA; Europoles Middle East LLC; Frank R. Close & Son; Inc.; NATIONAL COMPANY FOR GALVANIZING AND STEEL POLES (GALVANCO); George Scott (Geo Stott); HAS Engineering LLC; Hidada; Metrosmart International Trading & Contracting W.L.L.; New Forests Company; NOV Inc.; Omega Company for Luminaries; Poles & Galvanizing; ORBIX INTERNATIONAL LLC; R&B Timber Group; Stella-Jones; Techno Pole Industries LLC; Valmont Industries, Inc.; SAE Towers; Skipper Limited; Nanjing Daji Tower Manufacturing Co., Ltd.; KEC International Inc.; Lishu Steel Co., Ltd; Nippon Steel Corporation; Qingdao Mingzhu Steel Structure Co., Ltd.; Jiangsu Guohua Tube Tower Manufacturer Co. Ltd.; Tata Steel; Kalpataru Projects International Ltd.; Jyoti Structures Limited; Sabre Industries, Inc.; Foresite Group LLC; Nanjing Tuopeng Construction Technology Co., Ltd |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Utility Poles Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global utility poles market report on the basis of product, application, size, end-use, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Transmission & Distribution Pole

-

Steel

-

Concrete

-

Wood

-

Composite

-

-

Light Pole

-

High Mast Pole

-

Monopole

-

Others

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Electricity Transmission

-

Electricity Distribution

-

Lighting

-

Telecommunication

-

Others

-

-

Size Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Less than 6m

-

6m to 15m

-

15m to 24m

-

Above 24m

-

-

End-use Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

New Installations

-

Replacement

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

South America

-

Brazil

-

Colombia

-

Chile

-

Peru

-

-

Middle East & Africa

-

GCC Countries

-

Saudi Arabia

-

Qatar

-

UAE

-

-

Africa

-

Ethiopia

-

Kenya

-

Uganda

-

Tanzania

-

Ghana

-

Nigeria

-

Cote d’Ivoire (Ivory Coast)

-

-

-

Frequently Asked Questions About This Report

b. Based on application, the electricity distribution segment dominated the market in 2023 due to the expansion of urban areas and the development of rural electrification projects amplify this demand.

b. The key players in this industry are Tata Power, Nov Inc., SAE Towers, Nippon Steel Corporation, KEC International Ltd., Stella Jones, New Forests Company, Lishu Steel Co. Ltd., Omega Company, R&B Timber Group, and others.

b. Key factors driving the utility poles market growth include an rapid expansion of urban area & the concentration of population in cities, favorable government initiatives & related infrastructure development, and aging infrastructure & grid modernization

b. The global utility poles market size was estimated at USD 57.65 billion in 2023 and is expected to reach USD 60.121 billion in 2024.

b. The global utility poles market is expected to grow at a compound annual growth rate of 4.0% from 2024 to 2030 to reach USD 75.88 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."