Uterine Manipulation Devices Market Size, Share & Trends Analysis Report By Application (Total Laparoscopy Hysterectomy, Laparoscopic Supracervical Hysterectomy), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-302-7

- Number of Report Pages: 165

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Uterine Manipulation Devices Market Trends

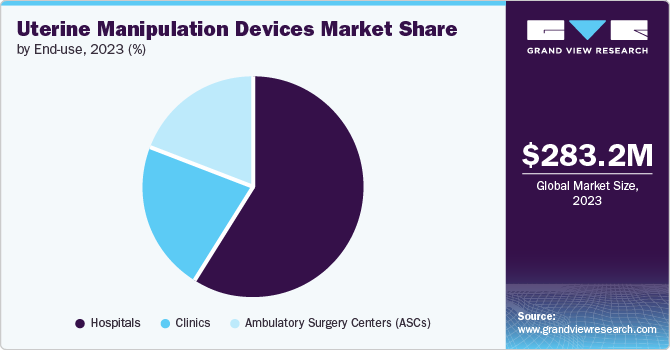

The global uterine manipulation devices market size was valued at USD 283.23 million in 2023 and is projected to grow at a CAGR of 5.93% from 2024 to 2030. The growth can be attributed to the growing adoption of minimally invasive procedures and rising technological advancements. Moreover, the growing prevalence of gynecological disorders such as cervical cancer, ovarian cysts, uterine fibroids, and endometriosis, among others, is anticipated to drive market growth. According to the data published by the WHO in March 2023, around 190 million or 10% of reproductive-age females and girls are affected by endometriosis across the globe.

Moreover, the growing adoption of minimally invasive procedures is anticipated to drive the market growth in the coming years. Minimally invasive procedures have numerous benefits over traditional open surgery, including less blood loss, decreased recovery time, and fewer complications. Due to these benefits, the demand for minimally invasive procedures among healthcare professionals and patients is rapidly growing. Numerous hysteroscopic procedures, such as laparoscopic hysterectomy and laparoscopic supracervical hysterectomy, are minimally invasive, and uterine manipulators are widely used during these procedures. Thus, the rising adoption of minimally invasive procedures is anticipated to drive the demand for uterine manipulation devices.

Furthermore, the increasing adoption of technologically advanced devices for hysteroscopy procedures is anticipated to propel the growth of the uterine manipulation devices market. Major industry players and stakeholders, such as research groups, focus on R&D to develop novel products. They are aiming to introduce technologically advanced solutions to the market. For instance, in June 2023, researchers from the Biomechanics and Ergonomics research group partnered with the General University Hospital of Castelló and the Fisabio Foundation to develop an innovative, atraumatic uterine manipulator that can be used in minimally invasive gynecological surgery. This device will be utilized in robotic/laparoscopic abdominal hysterectomies. Such developments are anticipated to support the market growth over the forecast period.

Moreover, the increasing number of studies on gynecological disorders and the evaluation of treatment devices, such as uterine manipulation devices, is expected to drive market growth in the coming years. For example, a study published by MDPI in April 2024 assessed a robotic uterine manipulation system, including a reusable and tiltable-tip uterine manipulator, for laparoscopic gynecologic surgery. The study found that the prototype of the uterine manipulator robot provides surgeons with cost-effective option, familiarity, sterilization, and a wide control range of the device without the need for a Remote Center of Motion (RCM) mechanism, which can cause incisions or fissures in the vulva. This growing focus on such studies is expected to spur innovation in the market.

Industry Dynamics

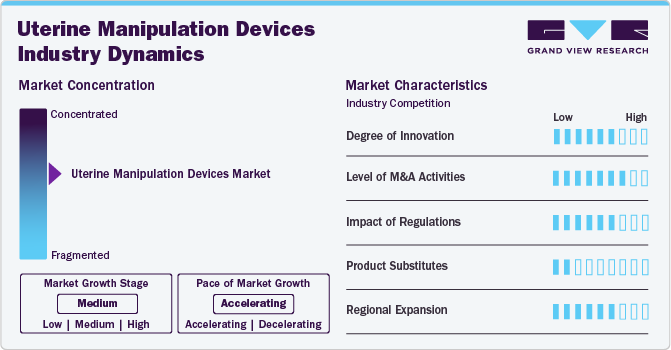

The market growth stage is moderate, and the pace of growth is accelerating. The uterine manipulation devices market is characterized by a high degree of growth due to rising developments of novel uterine manipulation devices and the growing prevalence of gynecological disorders.

The market is experiencing high levels of innovation due to the increasing number of clinical trials for various uterine manipulation devices used in treating gynecological disorders such as endometrial cancer and cervical cancer. For example, in January 2022, a multicenter, prospective, randomized phase III study commenced to assess whether patients undergoing minimally invasive surgery for early-stage uterine cancer have cancer cells in the fluid obtained during surgery when a uterine manipulator is used, compared to patients without a uterine manipulator. Such clinical intervention studies focused on uterine manipulation devices are expected to propel market growth in the coming years.

Regulatory bodies such as the FDA and other agencies such as Health Canada and the European Union, among others, set quality and safety standards for medical equipment, including uterine manipulation devices. The regulatory authorities are involved in regulating clinical trials and marketing authorizations for devices used in hysteroscopy, including uterine manipulators.

The industry is expected to witness high mergers & acquisitions activities. Several major companies, such as CooperSurgical Inc. and Laborie, are focusing on acquiring smaller players to strengthen their position in the industry. For instance, in March 2021, CooperSurgical Inc., a division of CooperCompanies, acquired a private medical device manufacturer, Safe Obstetric Systems. It includes the acquisition of devices like Fetal Pillow that can be used during delivery and gynecological procedures

The market for uterine manipulation devices is fragmented. This fragmentation can be attributed to numerous small, medium, and large-sized manufacturers offering different uterine manipulation devices. For instance, KARL STORZ SE & Co. KG offers uterine manipulators such as the KECKSTEIN and SCHÄR Manipulator. In addition, CONMED Corporation provides VCare uterine manipulators to help in various procedures such as salpingectomy, hysterectomy, oophorectomy, and myomectomy. The companies operating in the market often compete based on price, product differentiation, and applications.

Industry manufacturers focus on growing their presence in multiple nations. To increase the reach of their products across different regions, manufacturers are opening subsidiaries. For instance, in November 2021, Richard Wolf GmbH, a key industry player, opened subsidiaries in Spain and Vietnam to consolidate in Asia and Europe.

Application Insights

Total Laparoscopic Hysterectomy (TLH) dominated the market with a revenue share of 38.33% in 2023. The increasing number of hysterectomy surgeries performed worldwide, and the various benefits of TLH are expected to drive the segment's growth in the upcoming year. For example, an article published by the National Women's Health Network in November 2022 reported that approximately 600,000 hysterectomies are performed annually in the U.S. Some advantages of TLH over abdominal hysterectomies include less pain, minimal scarring, reduced blood loss, and fewer postoperative complications. Thus, due to these aforementioned benefits the demand for TLH is anticipated to increase in the coming years. In addition, numerous industry participants offer uterine manipulators for TLH. For instance, CooperSurgical Inc offers RUMI II System Uterine Manipulator for faster TLH

Laparoscopic Supracervical Hysterectomy (LSH) is expected to grow with the fastest compounded annual growth rate during the forecast period. This growth can be attributed to its numerous benefits, such as shorter hospital stays, reduced discomfort during the recovery period, and the preservation of certain pelvic functions due to retention of the cervix.

End-use Insights

The hospital segment dominated the market with a revenue share of 59.37% in 2023 due to the increasing number of hospitals and growing efforts to enhance awareness about gynecological and laparoscopic procedures. Many hospitals are taking steps to raise awareness among patients and healthcare experts about gynecological diseases and treatment approaches. For example, in June 2020, World Laparoscopy Hospital showcased a laparoscopic uterine manipulator and posted an article highlighting the benefits and complications associated with its use. Such initiatives are anticipated to drive the segment growth due to increasing understanding about the treatment approaches among patients and healthcare providers.

Ambulatory surgery centers are projected to show the fastest CAGR during the forecast period. There is a rising trend towards ambulatory surgery centers due to various benefits such as shorter procedure times, lower prices, and same-day discharge compared to hospitals, which is expected to drive the growth of this segment. In addition, the increasing adoption of minimally invasive surgeries is likely to support further the growth of this segment over the forecast period.

Regional Insights

North America uterine manipulation devices market dominated the global industry with a revenue share of 38.10% in 2023. This was driven by the increasing prevalence of uterine disorders and the growing demand for minimally invasive surgical procedures. The American Cancer Society reported in January 2024 that around 67,880 new cases of uterine cancer are expected in the U.S. in 2024. Furthermore, the organization estimated that approximately 13,250 women will die in 2024 due to uterine cancer. As a result, the regional market is expected to be driven by many individuals suffering from gynecological disorders.

U.S. Uterine Manipulation Devices Market Trends

The uterine manipulation devices market in the U.S. is expected to dominate the North American market over the forecast period. The presence of key players such as CooperSurgical Inc., CONMED Corporation, Utah Medical Products, Inc., and Laborie is anticipated to support the market growth. Moreover, the rising demand for minimally invasive surgical procedures across the country is anticipated to fuel the country's market in the coming years.

Europe Uterine Manipulation Devices Market Trends

The uterine manipulation devices market in Europe is anticipated to witness significant growth in the coming years. This growth can be attributed to the rising prevalence of gynecological diseases, such as cervical cancer, ovarian cysts, and uterine fibroids, coupled with the rising number of surgical procedures across the globe. According to the data published by the ICO/IARC Information Centre on HPV and Cancer in March 2023, every year, 3,152 females in Italy are diagnosed with cervical cancer, and 1,011 die from cervical cancer; thus, the presence of a large patient population is anticipated to drive the market growth. In addition, the rising demand for laparoscopic procedures is also expected to propel the regional market growth as uterine manipulators are widely used in several laparoscopic procedures, such as laparoscopic hysterectomy and other laparoscopic gynecological procedures.

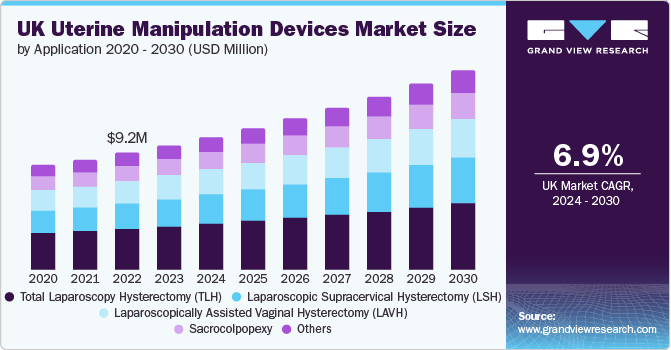

UK uterine manipulation devices market is expected to grow moderately over the forecast period. The rising number of individuals suffering from gynecological and uterine conditions such as uterine fibroids and endometrial cancer is anticipated to boost the country’s market growth. According to the data published by the World Cancer Research Fund International in June 2024, about 10,440 cases of endometrial cancer were reported in the UK in 2022, with around 2,695 associated deaths in the same year.

The uterine manipulation devices market in France is projected to grow in the coming years due to the growing number of hysterectomies being performed across the country and the increasing incidence of gynecological disorders. For example, data from the ICO/IARC Information Centre on HPV and Cancer in March 2023 revealed that approximately 3,379 women in France are diagnosed with cervical cancer each year, leading to 1,452 deaths.

Germany uterine manipulation devices market is witnessing steady growth owing to the presence of major manufacturers such as B. Braun Medical Ltd., KARL STORZ SE & Co. KG, Richard Wolf GmbH, and Bissinger Medizintechnik among others.

Asia Pacific Uterine Manipulation Devices Market Trends

The uterine manipulation devices market in Asia Pacific is expected to experience significant growth over the forecast period due to several key factors. These include the rising prevalence of gynecological disorders and increased adoption of minimally invasive surgical procedures in countries such as Japan, China, and India. Moreover, the growing use of robotic-assisted surgery, which needs specialized devices for uterine manipulation, is also expected to drive the growth of the regional market over the forecast period.

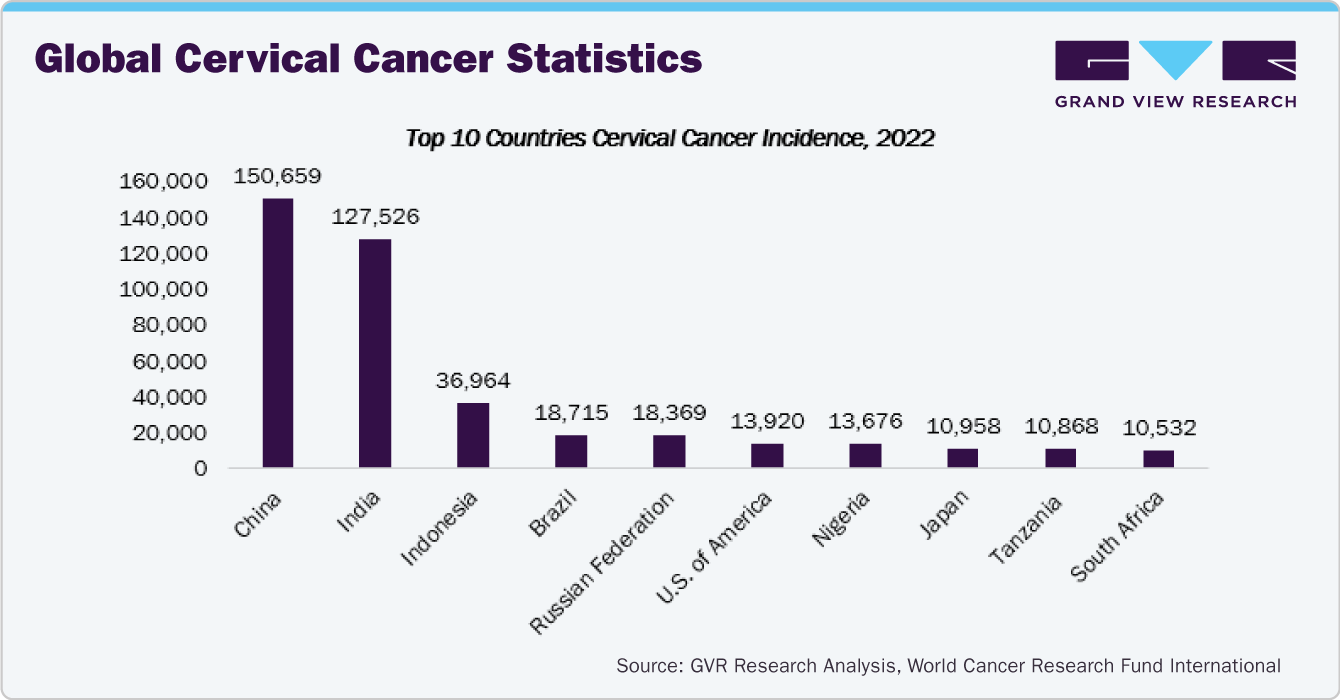

China uterine manipulation devices market is expected to grow over the forecast period owing to increasing awareness about their advantages, surging cases of cervical cancer, and growing demand for them. For instance, a study published in Frontiers in March 2024 reported a significant 169.80% increase in the incidence of cervical cancer cases in China from 1990 to 2019.

The uterine manipulation devices market in Japan is expected to grow over the forecast period owing to increasing demand for minimally invasive surgical procedures, growing awareness about the advantages of uterine manipulation devices, technological advancements, and rising prevalence of gynecological conditions such as cervical cancer, endometriosis, and uterine fibroids. According to the study published by the John Wiley & Sons, Inc. in July 2023, around 6.55 million individuals are likely to have uterine fibroids in Japan

Latin America Uterine Manipulation Devices Market Trends

The uterine manipulation devices market in Latin America is expected to grow fastest in the coming years due to the rising prevalence of gynecological disorders and increasing initiatives to provide awareness of endometriosis across the countries like Brazil and Argentina. Moreover, the advancements in the healthcare system and the availability of skilled physicians are also expected to drive the regional market's growth over the forecast period.

Brazil uterine manipulation devices market is expected to grow significantly over the forecast period owing to the increasing number of patients suffering from uterine fibroids and cervical cancer. According to the data published by the ICO/IARC Information Centre on HPV and Cancer in 2023, approximately 17,743 females are diagnosed with cervical cancer each year, and 9,168 die from the condition in Brazil.

Middle East & Africa Uterine Manipulation Devices Market Trends

The uterine manipulation devices market in the Middle East and Africa is projected to experience significant growth in the coming years. This growth is driven by increasing healthcare spending and the rising incidence of gynecological diseases such as endometriosis, fibroids, and cervical cancer. For example, in South Africa, the budget for total health expenditure estimates is anticipated to increase from USD 3,179.07 million in FY 2023 - 24 to USD 3,456.54 million in FY 2025 - 26, according to the Estimates of National Expenditure 2023.

Kuwait uterine manipulation devices market is expected to grow over the forecast period due to the country's increasing focus on healthcare, the growing prevalence of gynecologic disorders, and rising healthcare spending. The country allocated around USD 8.9 billion for healthcare expenditures in FY 2021 - 2022, which was around 12.93% higher than the allotted budget for FY 2020 - 2021.

Uterine manipulation devices are used in the treatment of cervical cancer. According to the data published by the World Cancer Research Fund International in June 2024, cervical cancer is the 4th most common cancer among women across the globe. There were over 662,301 new cases of cervical cancer in 2022. Furthermore, several studies are being conducted by the industry stakeholders to evaluate the safety and efficacy of uterine manipulation devices in the treatment of cervical cancer. For instance, the study published by Elsevier Inc. in September 2020 assessed the safety and effectiveness of a novel uterine manipulation device during minimally invasive radical hysterectomy MIS-RH used for treating early-stage cervical cancer patients. This study concluded that the innovative U-traction device permits reproducible and easy uterine manipulation during MIS-RH. Such innovative developments in the industry and growing cervical cancer incidences are anticipated to fuel market growth in the coming years.

Key Uterine Manipulation Devices Company Insights

Conkin Surgical Instrument Ltd., CooperSurgical Inc., B. Braun SE, KARL STORZ SE & Co. KG, CONMED Corporation, Richard Wolf GmbH, Utah Medical Products, Inc., Purple Surgical, Laborie, and LSI Solutions, Inc. are some of the major players in the uterine manipulation devices market. These manufacturers provide different types of uterine manipulators, such as intrauterine manipulators and vaginal manipulators. Companies operating in the industry are expanding their presence in numerous countries and acquiring smaller players to bolster their presence in the market. In addition, the manufacturers are focusing on collaborations & partnerships to gain a competitive edge in the rapidly growing market.

Key Uterine Manipulation Devices Companies:

The following are the leading companies in the uterine manipulation devices market. These companies collectively hold the largest market share and dictate industry trends.

- Conkin Surgical Instrument Ltd.

- CooperSurgical Inc.

- B. Braun SE

- KARL STORZ SE & Co. KG

- CONMED Corporation

- Richard Wolf GmbH

- Utah Medical Products, Inc.

- Purple Surgical

- Laborie

- LSI Solutions, Inc.

- Uterine Manipulation Devices

Recent Developments

-

In May 2024, Dr. Lutfi Kirdar Kartal Training and Research Hospital sponsored an interventional study to compare SecuFix and VCare Uterine Manipulators in Total Laparoscopic Hysterectomy. Around 10 participants aged between 35 and 65 were enrolled in this study.

-

In January 2023, Universita di Verona sponsored the clinical trial to study the oncologic outcomes of not using versus using the uterine manipulator in treating uterine-confined endometrial Carcinoma. Around 1,030 individuals are enrolled in this trial. This interventional study is estimated to be completed in December 2031.

-

In November 2023, CooperCompanies, a key industry player, acquired select Cook Medical assets concentrated primarily on the Doppler monitoring, obstetrics, and gynecology surgery markets.

Uterine Manipulation Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 298.56 million |

|

Revenue forecast in 2030 |

USD 421.79 million |

|

Growth Rate |

CAGR of 5.93% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis |

|

Segments covered |

Application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; Mexico UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Conkin Surgical Instrument Ltd.; CooperSurgical Inc.; B. Braun SE; KARL STORZ SE & Co. KG; CONMED Corporation; Richard Wolf GmbH; Utah Medical Products, Inc.; Purple Surgical; Laborie; LSI Solutions, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Uterine Manipulation Devices Market Report Segmentation

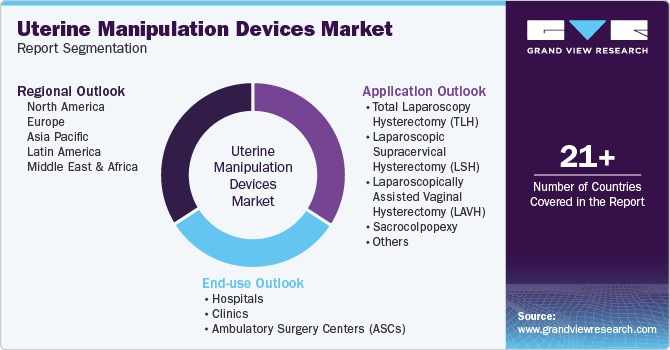

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the uterine manipulation devices market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Total Laparoscopy Hysterectomy (TLH)

-

Laparoscopic Supracervical Hysterectomy (LSH)

-

Laparoscopically Assisted Vaginal Hysterectomy (LAVH)

-

Sacrocolpopexy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgery Centers (ASCs)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global uterine manipulation devices market size was estimated at USD 283.23 million in 2023 and is expected to reach USD 298.56 million in 2024.

b. The global uterine manipulation devices market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 421.79 million by 2030.

b. North America dominated the uterine manipulation devices market with a share of 38.10% in 2023. This is attributable to the presence of the key market players and various awareness initiatives by the government and non-government organizations.

b. Some of the key players operating in the uterine manipulation devices market include Conkin Surgical Instrument Ltd., CooperSurgical Inc., B. Braun SE, KARL STORZ SE & Co. KG, CONMED Corporation, Richard Wolf GmbH, Utah Medical Products, Inc., Purple Surgical, Laborie, and LSI Solutions, Inc.

b. Key factors that are driving the uterine manipulation devices market growth include the rising prevalence of diseases related to female reproductive organs, such as cervical cancer and uterine fibroids, an increase in the adoption of minimally invasive or noninvasive procedures, and technological advancements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."