- Home

- »

- Consumer F&B

- »

-

Used Cooking Oil Market Size & Share, Industry Report 2030GVR Report cover

![Used Cooking Oil Market Size, Share & Trends Report]()

Used Cooking Oil Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Biodiesel Production, Animal Feed, Oleochemicals, Personal Care & Cosmetics, Others), By Source, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-490-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Used Cooking Oil Market Summary

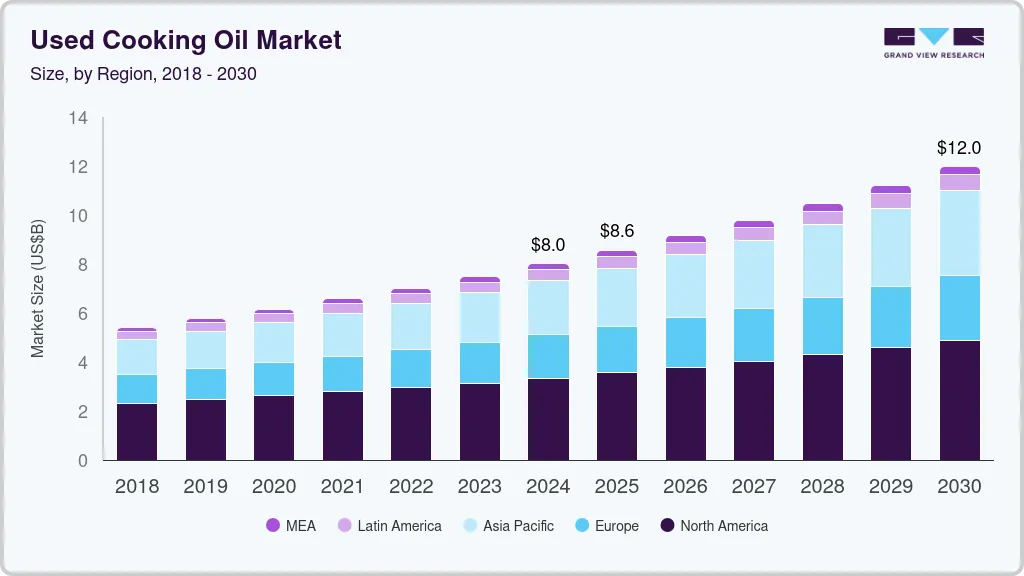

The global used cooking oil market size was estimated at USD 8.00 billion in 2024 and is projected to reach USD 11.98 billion by 2030, growing at a CAGR of 7.0% from 2025 to 2030. The growth of this market is primarily driven by increasing awareness regarding the value of waste cooking oil, a significant increase in biofuel production, and an inclination toward the use of renewable energy sources.

Key Market Trends & Insights

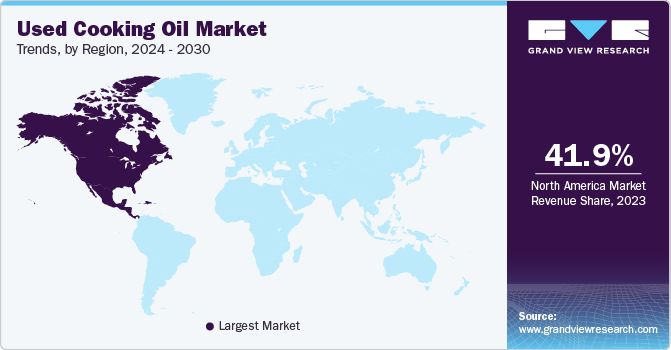

- North America dominated the global used cooking oil industry with revenue share of 41.7% in 2024.

- The U.S. held the largest revenue share of the regional industry in 2024.

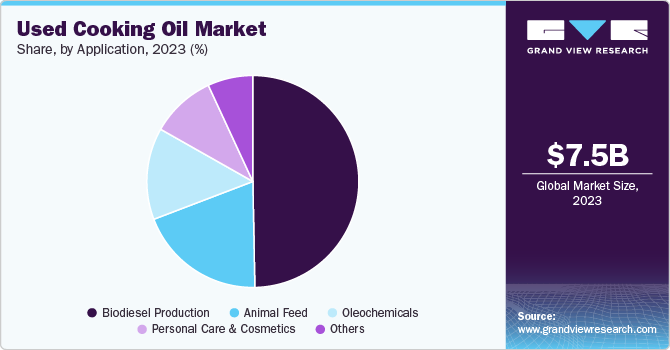

- Based on application, biodiesel production segment dominated the market with largest revenue share of 50.0% in 2024.

- Based on source, the food service segment held the largest revenue share of the used cooking oil industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.00 Billion

- 2030 Projected Market Size: USD 11.98 Billion

- CAGR (2025-2030): 7.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing concerns associated with petroleum diesel, such as emissions, focus on reducing the environmental impact of energy solutions, and rising demand for used cooking oil (UCO) for biodiesel production is expected to generate substantial growth.

The cost of raw materials has a major impact on the cost of goods produced. Used cooking oil is considered to be a low-cost feedstock for biofuel production. The Net Energy Ratio (NER) for biodiesel produced from UCO is typically around 5.49, indicating that for every unit of fossil energy consumed during the production process, UCO biodiesel produces 5.49 units. This NER is significantly higher than palm oil-based biodiesel and conventional diesel, making UCO a more energy-efficient and sustainable alternative.

Used cooking oil or waste cooking oil is collected by multiple companies, food processing businesses, and organizations engaged in recycling. It is primarily collected from restaurants, food processing factories, households, and large manufacturing facilities. Increasing investments in this industry are expected to develop lucrative growth opportunities. For instance, in February 2025, RIGEL CAPITAL, a business management consultant and key investor in emerging Eastern markets, announced an investment of USD 3.0 million in noovoleum, which offers UCOllect Solution, a technology-driven offering equipped with AI and proprietary technology.

Collaborations initiated by large enterprises that facilitate easier collection of used cooking oil from restaurants and households are expected to this market's growth. In addition, innovation in the industry, primarily related to UCO collection, is expected to create lucrative growth opportunities. For instance, in November 2024, Darling Ingredients Inc., one of the key companies in the ingredients industry, announced it had developed DarLinQ. This technology solution features advanced sonar and Bluetooth capabilities to facilitate continuous oil-level monitoring of UCO storage containers through automated equipment to improve operational efficiency and security.

The increasing number of restaurants, cafes, and food stores contributes to generation of higher volume of waste cooking oil for recycling. Growing consumer inclination toward dining outdoors, increasing food tourism in multiple countries, and rising market penetration of food delivery apps contribute to the growth in cooking oil waste, particularly in urbanized areas. In addition, many establishments are adopting sustainable practices by partnering with waste management companies to recycle their used cooking oil, thus creating a steady supply for biodiesel producers. Technological advancements in waste recycling processes have also bolstered market growth.

Application Insights

Based on applications, biodiesel production segment dominated the global used cooking oil market with largest revenue share of 50.0% in 2024. One of the primary drivers is the increasing demand for renewable energy sources. As global awareness of climate change and environmental sustainability rises, there is a significant push towards reducing greenhouse gas emissions. Biodiesel produced from used cooking oil is recognized as a cleaner alternative to traditional fossil fuels, contributing to this shift. It emits lower levels of carbon dioxide and particulate matter when burned, making it an attractive option for countries aiming to meet their carbon reduction targets and transition to greener energy solutions.

The cost-effectiveness of used cooking oil compared to virgin oils is another crucial factor propelling its use in biodiesel production. As a result, many producers are increasingly turning to UCO as a primary feedstock for biodiesel production, thus driving market growth. Technological advancements in waste recycling processes have also contributed significantly to the growth of the used cooking oil industry in biodiesel production. Enhanced processing techniques allow for better extraction and purification of oil, increasing yield and product quality while reducing operational costs.

Source Insights

The food service segment held the largest revenue share of the used cooking oil industry in 2024. This market is mainly driven by large amounts of waste cooking oil from food service businesses such as quick service restaurants, local food vendors, dine-in theme-based restaurants, luxury hotels, and cloud kitchens. According to the U.S. Bureau of Labor Statistics, in 2024, there were nearly 724,335 private industry food services and drinking places in the U.S. Changing lifestyles, significant growth in the number of customers ordering food from outside, and rising disposable income levels are expected to develop growth for this segment.

Moreover, the growing consumer interest in sustainability has prompted many food service establishments to adopt eco-friendly practices. Restaurants are now more aware of their environmental impact and are actively seeking ways to reduce waste. This includes recycling used cooking oil, which helps in waste management and provides an additional revenue stream by selling it to biodiesel producers. Such initiatives are supported by government policies promoting renewable energy sources and sustainability, further driving the demand for UCO from the food service sector.

Government regulations and incentives to promote sustainable practices within the food service industry have been instrumental. Many countries have implemented policies requiring restaurants to responsibly dispose of their used cooking oil responsibly, often mandating recycling programs. These regulations facilitate better waste management and encourage establishments to engage with collection services that can process their used cooking oil into biodiesel or other products.

Household segment is expected to experience significant growth over the forecast period. Growth of this segment is mainly driven by aspects such as increasing awareness regarding waste cooking oil recycling, a growing number of organizations engaged in used cooking oil collections, and innovation-based technology solutions that facilitate easier collection from households.

Regional Insights

North America dominated the global used cooking oil industry with revenue share of 41.7% in 2024. This market is mainly driven by multiple companies engaged in waste cooking oil recycling businesses, growing awareness regarding benefits associated with used oil recycling, increasing collaborations among food service businesses and ingredient companies, and advanced biofuel production technologies available in the North American market. The region is home to multiple food service chains and food processing brands that utilize large amounts of cooking oils. The availability of advanced technologies and increasing inclination among consumers towards sustainably aware brands also influence the growth of this market.

U.S. Used Cooking Oil Market Trends

The U.S. held the largest revenue share of the regional industry in 2024. This market is primarily driven by the generation of large volumes of used cooking oil by food service businesses, manufacturing and processing factories operating in the food processing industry, and a significant increase in the collection of used cooking oil facilitated by technology advancements and improved awareness. The presence of multiple companies operating to convert waste materials into useful ingredients also contributes to the growing opportunities experienced by this market.

Europe Used Cooking Oil Market Trends

Europe was identified as one of the key regions of global used cooking oil industry in 2024. This market is mainly influenced by factors such as the growth experienced by the food services industry, which leads to the generation of large volumes of used cooking oil, increasing awareness regarding sustainability in the region, and the growing focus of multiple sectors to embrace environment-friendly initiatives. Growing biofuel production in the area and efforts to become carbon neutral by 2050 are expected to support further market growth.

Asia Pacific Used Cooking Oil Market Trends

Asia Pacific used cooking oil market is expected to experience fastest CAGR over the forecast period. The presence of highly populated countries such as China and India in the region, the growing food service and food delivery industry, and traditional cooking preferences, which include the use of cooking oils in multiple cuisines, are expected to drive the growth of this market. Emerging businesses focused on collecting and recycling used cooking oils are also likely to drive growth in this market.

China dominated the regional cooking oil industry with the largest revenue share in 2024. The growth of this market is mainly driven by the significance of cooking oils in culinary preferences observed across the country. Traditional Chinese cooking has a strong connection with the use of oils for taste, texture, and desired culinary experience. These aspects lead to a growing generation of used cooking oil. The availability of advanced recycling technologies in China facilitates the growth of this market.

Key Used Cooking Oil Company Insights

Some of the key companies in the used cooking oil industry include Baker Commodities Inc., Arrow Oils Ltd, Mahoney Environmental, Darling Ingredients Inc., Olleco and others. Major players adopt strategies such as innovation, technology advancements, collaborations and others.

-

Mahoney Environmental specializes in turning used cooking oil and other wastes into useful materials and products. It controls whole recycling process from equipment, collections and product. Its solutions include used cooking oil recycling, restaurant grease trap cleaning, and more.

-

Darling Ingredients Inc., repurposes and recycles variety of materials sourced from the animal agriculture and food industries, to turn them into numerous ingredients. Its solutions are based in segment including feed, food and fuel. These solutions feature ingredients for animal feed, human health and low-emission energy solutions.

Key Used Cooking Oil Companies:

The following are the leading companies in the used cooking oil market. These companies collectively hold the largest market share and dictate industry trends.

- Baker Commodities Inc.

- Arrow Oils Ltd.

- Olleco

- Waste Oil Recyclers

- GRAND NATURAL INC.

- GREASECYCLE

- Brocklesby

- Oz Oils Pty. Ltd.

- Darling Ingredients Inc.

- Argent Energy

- Greenergy

- Mahoney Environmental

- noovoleum

Recent Developments

-

In December 2024, Darling Ingredients Inc., a global company operating in sustainable products and renewable energy solutions, announced that it had successfully delivered its first batch of sustainable aviation fuel (SAF) produced by Diamond Green Diesel (DGD) to Avfuel Corporation. The neat SAF is made with ingredients such as animal used cooking oil, distiller's corn oil and others.

Used Cooking Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.56 billion

Revenue forecast in 2030

USD 11.98 billion

Growth Rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, source, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, and South Africa

Key companies profiled

Baker Commodities Inc.; Arrow Oils Ltd.; Olleco; Waste Oil Recyclers; GRAND NATURAL INC.; GREASECYCLE; Brocklesby; Oz Oils Pty. Ltd.; Darling Ingredients Inc.; Argent Energy; Greenergy; Mahoney Environmental; noovoleum

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Used Cooking Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global used cooking oil market report based on application, source, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biodiesel Production

-

Animal feed

-

Oleochemicals

-

Personal Care & Cosmetics

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Household

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global used cooking oil market size was valued at USD 8.00 billion in 2024.

b. The global used cooking oil market is projected to grow at a compound annual growth rate (CAGR) of 7.0% from 2025 to 2030.

b. Based on applications, biodiesel production segment dominated the global used cooking oil market with largest revenue share of 50.0% in 2024. One of the primary drivers is the increasing demand for renewable energy sources. As global awareness of climate change and environmental sustainability rises, there is a significant push towards reducing greenhouse gas emissions. Biodiesel produced from used cooking oil is recognized as a cleaner alternative to traditional fossil fuels, contributing to this shift. It emits lower levels of carbon dioxide and particulate matter when burned, making it an attractive option for countries aiming to meet their carbon reduction targets and transition to greener energy solutions.

b. Some prominent players in the used cooking oil market include Baker Commodities Inc.; Arrow Oils Ltd.; Olleco; Waste Oil Recyclers; GRAND NATURAL INC.; GREASECYCLE; Brocklesby; Oz Oils Pty. Ltd.; Darling Ingredients Inc.; Argent Energy; Greenergy; Mahoney Environmental; noovoleum

b. The growth of this market is primarily driven by increasing awareness regarding the value of waste cooking oil, a significant increase in biofuel production, and an inclination toward the use of renewable energy sources. Growing concerns associated with petroleum diesel, such as emissions, focus on reducing the environmental impact of energy solutions, and rising demand for used cooking oil (UCO) for biodiesel production is expected to generate substantial growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.