- Home

- »

- Sensors & Controls

- »

-

U.S. Motor Vehicle Sensors Market Size Report, 2030GVR Report cover

![U.S. Motor Vehicle Sensors Market Size, Share & Trends Report]()

U.S. Motor Vehicle Sensors Market Size, Share & Trends Analysis Report By Sensor (Temperature Sensors, Pressure Sensors, NOx Sensors), By Application (Engine & Drivetrain, Safety & Security), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-331-7

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

U.S. Motor Vehicle Sensors Market Trends

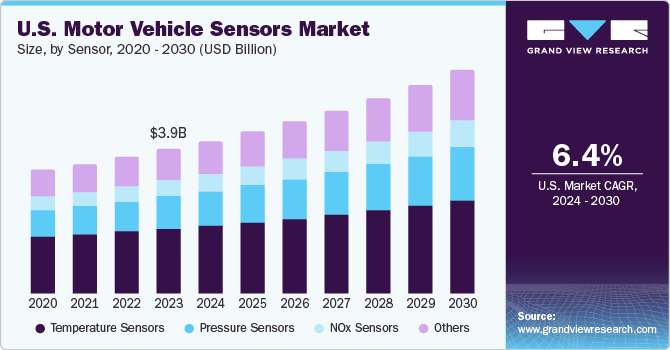

The U.S. motor vehicle sensor market size was valued at USD 3.88 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030 owing to the increased demand for Advanced Driver Assistance Systems (ADAS). ADAS technologies are designed to enhance vehicle safety and driving comfort. They include lane departure warning, adaptive cruise control, automatic emergency braking, and parking assistance. The growing consumer awareness of the safety benefits provided by ADAS is a major driver for the motor vehicle sensors market. Moreover, regulatory bodies have mandated the inclusion of certain ADAS features in new vehicles. The National Highway Traffic Safety Administration (NHTSA) in the U.S. has been pushing for the adoption of automatic emergency braking systems in all new cars.

The shift towards electric vehicles (EVs) and autonomous vehicles (AVs) is another significant factor driving the motor vehicle sensors market. EVs require a variety of sensors to monitor battery performance, manage energy consumption, and ensure safety. In addition, AVs, which rely heavily on sensors for navigation, obstacle detection, and decision-making, have contributed to market growth. These vehicles use a combination of cameras, radar, lidar, and ultrasonic sensors to perceive their environment and operate safely. The development and deployment of AVs are expected to drive substantial demand for advanced sensors in the coming years.

Furthermore, governments and regulatory bodies have implemented stringent safety and emissions regulations to reduce road accidents and environmental impact. In the U.S., the Environmental Protection Agency (EPA) and the NHTSA have set targets for reducing vehicle emissions and improving fuel efficiency. These regulations necessitate the use of advanced sensors to monitor and control various vehicle parameters. For example, pressure sensors are used in exhaust systems to monitor emissions and ensure compliance with environmental standards. Similarly, temperature sensors are employed to optimize engine performance and reduce fuel consumption. The need to meet these regulatory requirements has driven the increased adoption of motor vehicle sensors.

Sensor Insights

The temperature sensors segment accounted for the dominant share of 45.2% in 2023. This growth can be attributed to the advancements in sensor technology, such as the development of microelectromechanical systems (MEMS) and infrared temperature sensors. These innovations enhance the accuracy, reliability, and cost-effectiveness of temperature sensors. In addition, modern consumers have increasingly demanded vehicles that offer superior performance. Temperature sensors achieve superior performance by ensuring that engines, transmissions, and other critical systems operate within optimal temperature ranges. This enhances vehicle performance and extends the lifespan of various components.

NOx sensors are expected to register the fastest CAGR during the forecast period owing to the increased adoption of Selective Catalytic Reduction (SCR) systems in vehicles. CR systems use NOx sensors to monitor and reduce nitrogen oxide emissions by converting them into harmless nitrogen and water. This technology has become more prevalent in both commercial and passenger vehicles, driving the demand for NOx sensors. Additionally, the surge in the production of commercial and passenger vehicles has also contributed to the growth of the NOx sensors market. Additionally, automakers have applied NOx sensors as a component of engine management solution that regulates the operation of the engine for optimum performance with minimum pollutant levels.

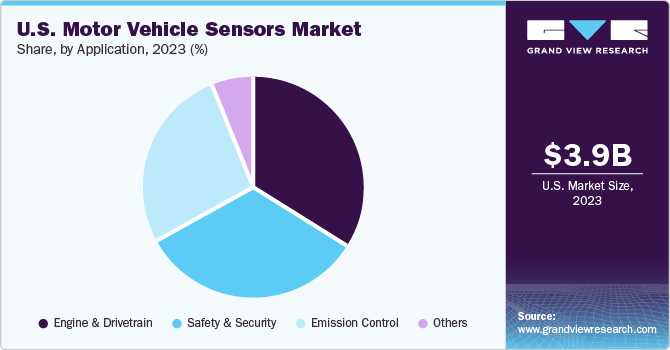

Application Insights

The engine & drivetrain segment secured the propellant share of the market in 2023 owing to technological advancements in engine management systems. Modern engines have become increasingly complex, requiring advanced sensors to monitor and optimize performance. Sensors such as oxygen sensors, temperature sensors, and pressure sensors are crucial for managing fuel injection, ignition timing, and emission control. These specialized sensors are applied in various electric and hybrid vehicles to monitor battery health, electric motor performance, and energy management systems.

The safety & security segment is expected to register the fastest CAGR of 8.2% during the forecast period. It can be attributed to the rise in vehicle theft rates which drove the adoption of advanced security sensors. These sensors, including motion, glass break, shock/impact, and tilt sensors, are essential for detecting unauthorized access and preventing theft. The growing concern over vehicle security has pushed manufacturers to integrate more sophisticated sensor technologies. In addition, the integration of safety and security sensors with ADAS has been crucial for the development of semi-autonomous and fully autonomous vehicles. ADAS technologies, such as automatic emergency braking and blind-spot detection, rely heavily on sensors to provide real-time data and enhance vehicle safety.

Key U.S. Motor Vehicle Sensors Company Insights

The U.S. motor vehicle market features market players such as Robert Bosch GmbH, Continental AG, and more. These companies have increasingly focused on R&D efforts to diversify their product portfolios in the market. They have undertaken several organic approaches such as strategic collaborations, acquisitions, and mergers.

-

Bosch, a multinational engineering technology company. It is a supplier of technology, and services associated with automotive components, power tools, home appliances, and building technology. In the automotive sector, Bosch majorly focuses on innovations in the areas of engine management, safety systems, and driver assistance technologies. In recent years, the company developed hydrogen fuel cell technology.

-

Hitachi Ltd, operates in many sectors including IT, energy, mobility, and smart life solutions. In recent years Hitachi focused on digital innovation, IoT, and AI to enhance its products and services.Hitachi has been collaborating with various partners to develop smart city solutions and has been actively involved in sustainability initiatives, including the development of energy-efficient technologies and circular economy solutions.

Key U.S. Motor Vehicle Sensors Companies:

- Continental AG

- DENSO CORPORATION

- Aptiv

- Robert Bosch GmbH

- Hitachi, Ltd.

- Sensata Technologies, Inc.

- Autoliv

- Eaton

- Valeo

Recent Developments

-

In January 2024, Robert Bosch GmbH introduced the vehicle computer capable of handling both infotainment and advanced driver assistance system functionalities on a single system-on-chip along with Qualcomm Technologies, Inc. The collaboration aimed at developing highly integrated solutions that are shaping the future of software-defined vehicles.

U.S, Motor Vehicle Sensor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.10 billion

Revenue forecast in 2030

USD 5.96 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sensor, application

Key companies profiled

Continental AG; DENSO CORPORATION; Aptiv; Robert Bosch GmbH; Hitachi, Ltd.; Sensata Technologies, Inc.; Autoliv; Eaton; Valeo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Motor Vehicle Sensors Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. motor vehicle sensor market report based on sensor and application:

-

Sensor Outlook (Revenue, USD Million, 2018 - 2030)

-

Temperature Sensors

-

Pressure Sensors

-

NOx Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Engine & Drivetrain

-

Safety & Security

-

Emission Control

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."