- Home

- »

- Medical Devices

- »

-

U.S. Zirconia Based Dental Materials Market, Report, 2030GVR Report cover

![U.S. Zirconia Based Dental Materials Market Size, Share & Trends Report]()

U.S. Zirconia Based Dental Materials Market Size, Share & Trends Analysis Report By Product (Zirconia Disc, Zirconia Blocks), By Application (Dental Crowns, Dental Bridges), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-483-7

- Number of Report Pages: 142

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

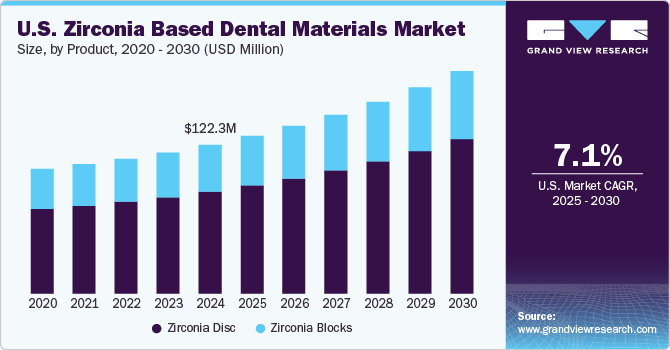

The U.S. zirconia based dental materials market size was estimated at USD 122.3 million in 2024 and is projected to grow at a CAGR of 7.1% from 2025 to 2030. The increasing demand for aesthetic dentistry is one of the factors boosting market growth. According to the American Dental Association (ADA), it is estimated that Americans allocated over USD 140 billion to dental services in 2023. Zirconia, known for its excellent aesthetic properties, including translucency and color matching with natural teeth, has become a preferred material among both dentists & patients.

The shift toward preventive care and cosmetic dentistry practices has continued to play a crucial role in expanding the market. Patients increasingly prioritize their oral health and seek treatments that address their functional issues and enhance their smiles. This trend leads to a rise in procedures such as crowns, bridges, and veneers made from zirconia due to their biocompatibility and aesthetic qualities. According to the American Dental Association (ADA) report, an estimated 5.5 million implants were installed in the U.S. in 2023, marking a 10% increase from the previous year. This trend highlights the increasing demand and accessibility of dental implants in the country. On average, the cost of a single tooth implant in the U.S. is around USD 4,000, though prices can fluctuate based on factors such as case complexity, implant type, crown material, and geographic location.

Zirconia-based dental materials are gaining popularity due to increased awareness and advancements in dental technology that enhance their properties. The ability to produce highly aesthetic restorations that closely mimic natural teeth has made zirconia a preferred material among dentists and patients. As consumers become more informed about these technological advancements through social media, online forums, and professional recommendations, they are more inclined to choose zirconia-based solutions over traditional materials. In a January 2021 summary from the Journal of American DentalAssociation, it was found that dentists predominantly use zirconia for restoring natural teeth (99%) and somewhat less for implants (76%), primarily favoring it for back teeth (98%) over front teeth (61%). The challenges cited include difficulty in replacement and color matching, while its main advantage is seen in its strength and fracture resistance, as 57% of respondents noted.

Moreover, Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) technologies have revolutionized various industries, including dentistry. Integrating CAD/CAM technology in dentistry has led to significant advancements in producing and applying dental materials, especially zirconia-based materials. In February 2022, Planmeca USA, a privately held dental manufacturer, entered the CAD/CAM space with the Planmeca FIT system, enabling dental practices to offer single-visit dentistry. Although intraoral scanning and chairside mills were already available, the introduction of Planmeca's latest system simplified their use.

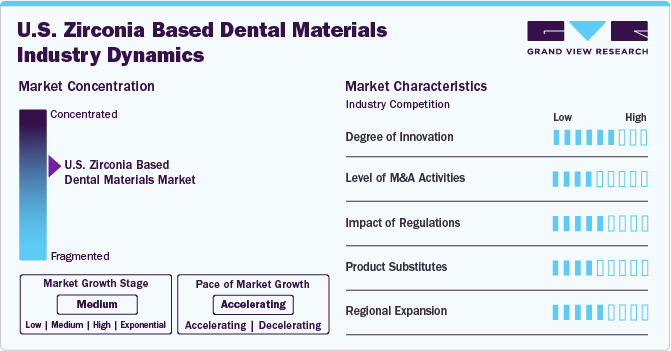

Market Concentration & Characteristics

The market is experiencing significant innovation, with companies introducing advanced materials and digital technologies. These advancements, including CAD/CAM systems and 3D printing, improve the precision, durability, and aesthetic quality of zirconia restorations, enhancing patient outcomes and treatment efficiency. For instance, in March 2024, Amann Girrbach AG introduced a 98 mm portfolio, prompting the phase-out of its 71 mm series, including specific zirconia, sintered metals, and waxes. Moreover, the company announced that it would provide economical options for upgrading Ceramill Motion 1 and adapting the Ceramill Motion 2, Mikro 4X, and Mikro 5X milling machines to the 98 mm blank holder.

Market players, such as Ivoclar Vivadent, Kuraray Noritake Dental, Inc., Argen Corporation, VITA North America, and Dentsply Sirona, are involved in mergers and acquisitions. Through M&A activity, these companies employ vital strategies such as product innovation, strategic collaborations, and geographical expansion to enhance their presence.

The FDA classifies dental materials based on their risk to patients and users. Zirconia-based dental materials are classified as Class II devices, requiring a premarket notification, commonly known as a 510(k) submission. This process necessitates that the product is substantially equivalent to an already marketed device. The FDA’s Center for Devices and Radiological Health (CDRH) oversees this regulatory process, ensuring that all dental materials meet safety and effectiveness standards before marketing.

The threat of substitute products in the market is significant, as alternatives such as lithium disilicate ceramics and metal-ceramic restorations offer comparable aesthetic and functional properties. These substitutes may appeal to dental professionals and patients due to their cost-effectiveness, ease of use, and established clinical performance. In addition, advancements in other materials could further intensify competition, challenging zirconia’s market share.

Market players in the U.S. zirconia-based dental materials sector are expanding their presence by entering new geographical markets, forming strategic partnerships with local distributors, and tailoring their product offerings to align with specific regional healthcare requirements. For instance, in May 2023, VITA North America entered a partnership with BEGO Medical, which employed VITA’s premium YZ SOLUTIONS zirconium material at its Bremer milling center. This collaboration was decided upon after comprehensive evaluations of the product.

Product Insights

The Zirconia disc segment held the largest share of over 68.3% in 2024 due to ongoing product advancements, growing initiatives by key companies, and increasing demand for aesthetic dentistry. Zirconia discs represent a significant segment within the broader category of zirconia-based dental materials, primarily used to fabricate dental restorations such as crowns, bridges, and implant abutments. For instance, in April 2024, Sagemax Bioceramics, a company owned by Ivoclar Vivadent, introduced the NexxZr+ Multi 2.0 disc, the newest entry in their line of zirconia materials. This product is designed to enhance dental restorations by combining aesthetic appeal with lasting durability owing to its innovative composition.

The zirconia blocks segment is expected to grow lucratively during the forecast period. An increase in technological innovations is one of the major factors expected to drive growth over the forecast period. Due to their high strength and fracture toughness, zirconia blocks have become increasingly popular in restorative dentistry, offering a durable alternative to traditional materials like porcelain or metal. In June 2024, Topzir Biotech released its 3D Pro Multilayer zirconia block for dental repairs. It is made from five zirconia types, including 3Y-PSZ, 4Y-PSZ, and 5Y-PSZ, forming a nine-layer block with strength varying from 1,200 to 690 MPa and translucency between 43% and 49%.

Application Insights

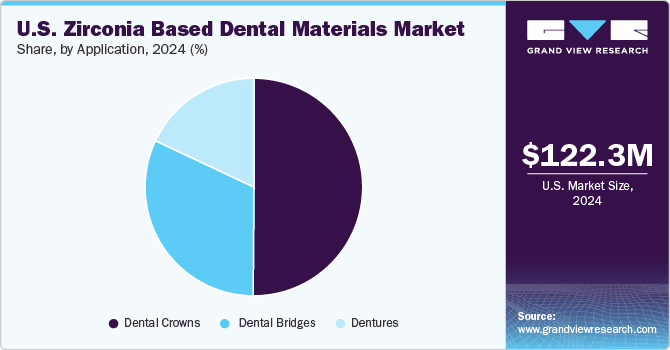

The dental crowns segment held the largest share of over 50.1% in 2024. The increasing awareness of oral health and technological advancements drives segment growth. Crowns are typically placed over a tooth that has been damaged or decayed, providing both functional and aesthetic benefits. In the context of zirconia-based dental materials, crowns made from zirconia are increasingly popular due to their superior mechanical properties and biocompatibility. Zirconia crowns offer a one-stop solution for both anterior and posterior restorations, combining durability with a natural appearance that closely mimics the translucency of natural teeth. In the January 2021 issue of The Journal of the American Dental Association, a report by the ADA Clinical Evaluators Panel revealed that a vast majority of dentists surveyed (98%) utilize zirconia for posterior crowns. In addition, 61% reported using zirconia for anterior crowns.

The dental bridges segment is expected to grow lucratively during the forecast period. The increasing demand for aesthetic dentistry and technological advancements drive segment growth over the forecast period. Dental bridges represent a crucial application within the market, specifically designed to replace missing teeth by bridging the gap between two healthy teeth. These prosthetic devices are anchored to adjacent natural teeth or implants, providing functional and aesthetic benefits. In April 2024, a digital international magazine featured a case study highlighting the revolutionary impact of advanced dental technology on full-arch zirconia implant therapy. Utilizing CBCT imaging, robotic help, digital scanning, and cutting-edge manufacturing with biocompatible materials, this approach has transformed dentistry, providing patients with greater accuracy, comfort, and instant outcomes.

Regional Insights

West region dominated the U.S. zirconia based dental materials market with a share of 30.0% in 2024. The increasing awareness of oral health, product launches, regulatory approvals, and advanced healthcare infrastructure drive the demand for the U.S. market. One such advancement is introducing a new, aesthetically advanced yet strong zirconia CAD/CAM block. In September 2021, Dentsply Sirona, in collaboration with VITA Zahnfabrik, announced the introduction of a new, aesthetically advanced yet strong zirconia CAD/CAM block. The CEREC MTL Zirconia was launched at DS World in Las Vegas, merging high-level aesthetics and ease of processing with the renowned strength of zirconium oxide in a multilayered zirconium oxide block.

California accounted for the largest share of the West region in 2024. Advancements in dental aesthetics have led to innovative techniques for correcting various dental issues. One such technique is crown lengthening, which can significantly improve the appearance of a smile by addressing asymmetry and enhancing overall aesthetics. In March 2023, a dental practice in Los Angeles corrected dental asymmetry through crown lengthening and enhanced aesthetics using porcelain veneers & zirconia crowns. This case study showcases the effective use of anterior implants alongside porcelain veneers to achieve a visually pleasing smile. Achieving the best aesthetic outcome relies on ensuring tissue symmetry, uniform color, and dental restorations' perfect shape and placement.

Key U.S. Zirconia based Dental Materials Company Insights

Some key players operating in the U.S. zirconia-based dental material industry include AIDTE, Ivoclar Vivadent, Kuraray Noritake Dental, Inc., The Argen Corporation, and Dentsply Sirona. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, WhitePeaks Dental Solutions GmbH and Yourcera Biotechnology are some of the emerging players in the market.

Key U.S. Zirconia based Dental Materials Companies:

- Ivoclar Vivadent

- Kuraray Noritake Dental, Inc.

- The Argen Corporation

- Dentsply Sirona

- Amman Girrbag (Capvis AG)

- WhitePeaks Dentals Solutions GmBH

- B&D Dental Technology

- ZirkonZahn

- VITA North America

- Zubler USA

- Dental Direct

- UPCERA/ Upcera Dental America

- Aidite (Qinhuangdao) Technology Co., Ltd.

- Bloomden Bioceramics

- Yourcera Biotechnology

- Huge dental

- VSmileBSM (Hunan Vsmile Biotechnology Co., Ltd.)

View a comprehensive list of companies in the U.S. Zirconia based Dental Materials Market

Recent Developments

-

In February 2024,Huge Dental USA launched an advanced Zirconia block designed for versatile dental solutions, including single crowns to full arch bridges. This block features an innovative 8-layer superimposition and 15-layer gradient system for natural aesthetics, with a translucency of 43%-57% and a strength of 700Mpa-1200Mpa.

-

In January 2024,Ivoclar Vivadent enhanced its IPS e.max ZirCAD Prime and Prime Esthetic zirconia materials with a new ring feature to boost dental laboratory efficiency and streamline production. This innovation capitalizes on proprietary GT technology, ensuring seamless shade and translucency progressions for aesthetically superior dental restorations.

-

In August 2023, Amann Girrbach launched Zolid Bion, a premium zirconia material that elevates aesthetics and maintains the natural appearance of dental restorations without sacrificing safety. Notably, it stands out as the first in its class to enable crown sintering in under 45 minutes.

U.S. Zirconia Based Dental Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 129.5 million

Revenue forecast in 2030

USD 182.8 million

Growth rate

CAGR of 7.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North-east; Mid-west; West, South

Country scope

U.S.

Key companies profiled

Ivoclar Vivadent; Kuraray Noritake Dental, Inc; The Argen Corporation; Dentsply Sirona; Amman Girrbag (Capvis AG); WhitePeaks Dentals Solutions GmBH; B&D Dental Technology; ZirkonZahn; VITA North America; Zubler USA; Dental Direct; UPCERA/ Upcera Dental America; Aidite (Qinhuangdao) Technology Co., Ltd.; Bloomden Bioceramics; Yourcera Biotechnology; Huge dental; VSmileBSM (Hunan Vsmile Biotechnology Co., Ltd.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Zirconia Based Dental Materials Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. zirconia based dental materials market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Zirconia Disc

-

Zirconia Blocks

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Crowns

-

Dental Bridges

-

Dentures

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North-east

-

New York

-

Massachusetts

-

Connecticut

-

Pennsylvania

-

New Jersey

-

-

Mid-west

-

Michigan

-

Illinois

-

Indiana

-

Minnesota

-

Ohio

-

-

West

-

California

-

Washington

-

Arizona

-

Colorado

-

New Mexico

-

-

South

-

Georgia

-

Florida

-

Texas

-

Virginia

-

Alabama

-

-

Frequently Asked Questions About This Report

b. The U.S. zirconia based dental materials size was estimated at USD 122.3 million in 2024 and is expected to reach USD 129.5 million in 2025.

b. The U.S. zirconia based dental materials market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2030 to reach USD 182.8 million by 2030.

b. The Zirconia disc segment held the largest share of over 68.3% in 2024 due to ongoing product advancements, growing initiatives by key companies, and increasing demand for aesthetic dentistry.

b. Some of the key players in the market include Ivoclar Vivadent ; Kuraray Noritake Dental, Inc; The Argen Corporation; Dentsply Sirona; Amman Girrbag (Capvis AG); WhitePeaks Dentals Solutions GmBH; B&D Dental Technology; ZirkonZahn; VITA North America; Zubler USA; Dental Direct; UPCERA/ Upcera Dental America; Aidite (Qinhuangdao) Technology Co., Ltd.; Bloomden Bioceramics; Yourcera Biotechnology; Huge dental; VSmileBSM (Hunan Vsmile Biotechnology Co., Ltd.)

b. The increasing demand for aesthetic dentistry is one of the factors boosting U.S. zirconia based dental materials market growth. Zirconia, known for its excellent aesthetic properties, including translucency and color matching with natural teeth, has become a preferred material among both dentists & patients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."