- Home

- »

- HVAC & Construction

- »

-

U.S. Wires And Cables Market Size, Industry Report, 2030GVR Report cover

![U.S. Wires And Cables Market Size, Share & Trends Report]()

U.S. Wires And Cables Market (2025 - 2030) Size, Share & Trends Analysis Report By Cable Type, (Copper Cables, Fiber Optic Cables), By Application (Telecom, Industrial, Building & Construction, Power Utilities, Military, Commercial, Space), And Segment Forecasts

- Report ID: GVR-4-68040-221-0

- Number of Report Pages: 117

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wires & Cables Market Size & Trends

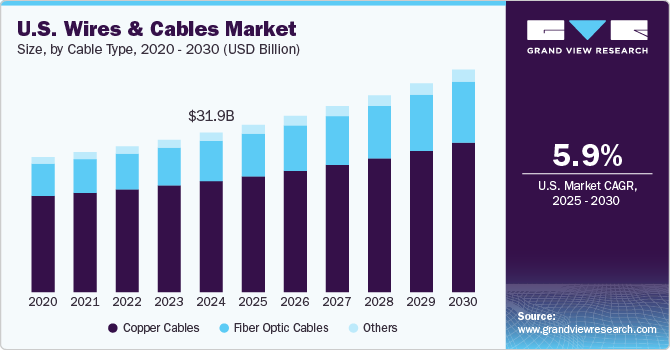

The U.S. wires and cables market size was valued at USD 31.93 billion in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2030. Renewable energy sources such as solar and wind power are gaining popularity, necessitating the use of specialized cables designed for efficient long-distance electricity transmission from remote installations to high-demand urban areas. These cables are engineered to minimize energy losses and ensure reliable power delivery in support of a sustainable and widespread adoption of clean energy.

Emerging technologies such as 5G and the Internet of Things are spurring a need for faster and more reliable data transmission, consequently driving demand for enhanced types of cables. A significant rise in copper cables is expected to drive the market growth over the forecast period. Copper cables are extensively used in residential and commercial building wiring, particularly in electrical systems. The growth of the construction industry, fueled by factors such as population growth, urbanization, and economic development, is a significant driver for the demand for copper cables in the U.S. wires and cables market. As the construction sector continues to thrive, the need for reliable and efficient copper cables to power buildings and infrastructure is expected to rise, further contributing to the overall growth of the industry.

Several prominent companies operating in the U.S. market, including Siemon, Hitachi, Ltd., Belden, Inc., and MaxLinear, have strengthened their strategies to maintain a competitive edge. These companies are poised to pursue a combination of organic and inorganic growth initiatives to reinforce their market positioning within the regional landscape. For instance, In February 2024, MaxLinear launched a new toolset Product Design Kit (PDK) designed to improve performance and speed up the development of high-performance cables. This PDK serves as a cost-effective and time-efficient tool for cable manufacturers seeking to rapidly integrate Keystone into their AECs, thereby gaining a competitive edge over rival solutions in terms of both power consumption and cable reach.

Cable Type Insights

Copper cables led the market and accounted for a revenue share of 69.64% in 2024. Copper is a favorable choice in power cables due to its superior conductivity and reliability, and it is widely used in deployment across various sectors, including transmission, distribution, and renewable energy projects in the U.S. The demand and need for energy are on the rise, and with power grids being upgraded, copper becomes even more essential for the nation's electrical system-this increased demand and modernization establish copper's role as a vital part of the infrastructure. Copper building wire is a fundamental component in residential, commercial, and industrial construction projects, serving as the backbone for electrical systems. With ongoing construction activity and renovations, there's a continuous demand for copper building wire, especially in applications requiring high conductivity and durability.

The fiber optic cables segment is expected to show significant CAGR growth of 7.4% over the forecast period. Fiber optic cables stand out in the market due to their superior bandwidth capabilities, which are crucial for high-speed internet, data center connectivity, and cloud computing demands. With the ability to transmit larger data volumes over longer distances, they excel in supporting high-speed and high-capacity communication channels. Advancements in fiber optic technology are significantly cutting down manufacturing and installation costs, lowering initial investment barriers, and promoting wider adoption. Innovations such as single-mode fiber and improved manufacturing techniques continue to enhance the efficiency and capabilities of fiber optic cables. Furthermore, the scalability of fiber optic networks allows for seamless expansion to accommodate future technological advancements and increasing data demands. Moreover, the growing awareness of the benefits of fiber optics is further fueling their adoption across various sectors.

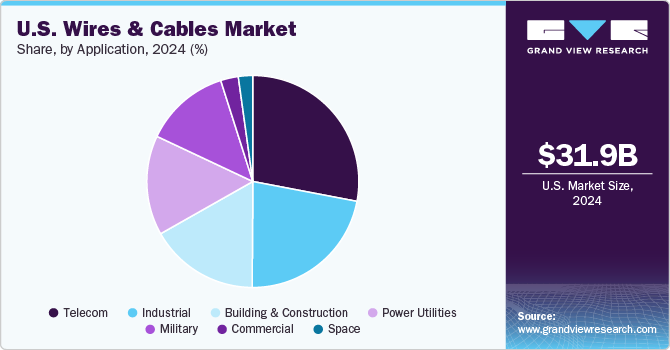

Application Insights

The industrial segment held the largest market share of around 27.98% in 2024. Wires and cables are essential components in various industries across the U.S., powering critical infrastructure such as national power plants and enabling automation on assembly lines. They act as the primary foundation, ensuring seamless operations across diverse sectors. These indispensable components ensure the seamless operation of diverse processes across sectors, supporting electricity transmission in power plants and control systems in manufacturing facilities. In industrial environments, high-voltage cables carry electricity efficiently, while control cables manage and monitor machinery and environmental conditions. The industrial sector, including energy and mining, is experiencing a rise in demand for specialized cables due to expansion and modernization efforts. Industries invest in upgrading infrastructure and machinery; necessitating ruggedized electrical cabling solutions to withstand harsh operating conditions. For instance, in January 2024, Amphenol Corporation acquired TPC Wire & Cable, bolstering its industrial solutions portfolio. This strategic move enhances Amphenol's harsh environment interconnect capabilities and expands its global reach in high-tech industrial markets.

The space applications are expected to grow at the highest CAGR, over 7.7%, during the forecast period. In space exploration, wires and cables are critical for spacecraft systems, including communication, power distribution, data transmission, and instrumentation. The rigorous demands of space environments require cables that can withstand extreme temperatures, vacuum conditions, radiation exposure, and mechanical stress. As the U.S. continues to invest in space exploration missions, including satellite launches, space probes, and manned missions to the Moon and beyond, there's a growing demand for advanced wires and cables that meet the stringent requirements of space applications.

Key U.S. Wires And Cables Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

-

Amphenol is a global provider of high-technology interconnect, sensor, and antenna solutions, playing a crucial role in the electronics revolution across various sectors, including automotive, aerospace, defense, and telecommunications. The company specializes in designing and manufacturing a wide range of products, particularly focusing on connectors and interconnect systems. Amphenol's offerings in wires and cables include high-speed interconnects, coaxial cables, power cables, and specialty cables. Additionally, they provide value-added cable assemblies and harnesses that enhance the functionality and reliability of electronic systems.

-

Alpha Wire, established in 1922, has evolved from a supplier of wire strengtheners for the millinery industry to a prominent manufacturer of wires and cables for various sectors. The company offers a comprehensive range of products, including cables, heat-shrink tubing, and wire management solutions, catering to industries such as Industrial Automation, Medical, Aerospace & Defense, and Consumer Electronics. Notably, Alpha Wire is recognized for its innovative EcoWire, the first zero-halogen hook-up wire, and its leadership in flexible automation cabling. The company emphasizes purpose-driven connectivity solutions tailored to meet specific customer needs, providing options for small put-ups and short minimum runs

Key U.S. Wires And Cables Companies:

- A.E. Petsche

- Alpha Wire

- Amphenol Corporation

- Apar Industries Ltd

- Belden Inc.

- Carlisle Interconnect Technologies

- Collins Aerospace

- Encore Wire Corporation

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Glenair, Inc

Recent Developments

-

In February 2024, Belden Inc. launched products for faster speeds, better connectivity and more power for mission-critical environments. In essence, the organization has designed indoor/outdoor (I/O) plenum (CMP) stadium cables apt for aerial and outdoor, below-grade conduit applications.

-

In May 2024, Hitachi Energy, a segment of Hitachi Ltd., partnered with Pattern Energy, a renewable energy company, to support the SunZia Transmission Project. The project connects the 3,515-megawatt SunZia Wind project in New Mexico to Arizona and Western states, marking one of the largest HVDC-connected wind energy projects in the U.S. The agreement involves service solutions for the HVDC link, using Hitachi Energy's HVDC Light technology to boost renewable energy availability to homes and businesses in the region upon completion in 2025.

U.S. Wires And Cables Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.51 billion

Revenue forecast in 2030

USD 44.54 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Cable type, application

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; South Korea; Brazil

Key companies profiled

A.E. Petsche; Alpha Wire; Amphenol Corporation; Apar Industries Ltd; Belden Inc.; Carlisle Interconnect Technologies; Collins Aerospace; Encore Wire Corporation; Fujikura Ltd.; Furukawa Electric Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wires And Cables Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. wires and cables market report based on cable type, and application:

-

Cable Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Copper Cables

-

Fiber Optic Cables

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Telecom

-

Industrial

-

Building & Construction

-

Power Utilities

-

Military

-

Commercial

-

Space

-

Frequently Asked Questions About This Report

b. The global U.S. wires and cables market size was estimated at USD 31.93 billion in 2024 and is expected to reach USD 33.52 billion in 2025.

b. The global U.S. wires and cables market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 44.54 billion by 2030.

b. The copper cables segment dominated the U.S. wires and cables market with a share of 69.64% in 2024. The demand and need for energy are on the rise, and with power grids being upgraded, copper becomes even more essential for the nation's electrical system—this increased demand and modernization establish copper's role as a vital part of the infrastructure.

b. Some key players operating in the U.S. wires and cables market include Belden, Inc.; Encore Wire Corporation; Fujikura Ltd.; Furukawa Electric Co., Ltd.; LEONI; LS Cable & System Ltd.; Prysmian Group; Hitachi, Ltd.; Nexans; Siemon; Southwire Company, LLC; MaxLinear

b. Key factors that are driving the market growth include the trend for smart cables and notable investments in high-capacity transmission lines

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.